How far has the liquid staking sector in Cosmos developed?

TechFlow Selected TechFlow Selected

How far has the liquid staking sector in Cosmos developed?

As more DeFi dApps launch their products in the coming months, opportunities to deploy LSD will only expand.

Written by: Opa

Translated by: TechFlow

The Wave of Liquidity

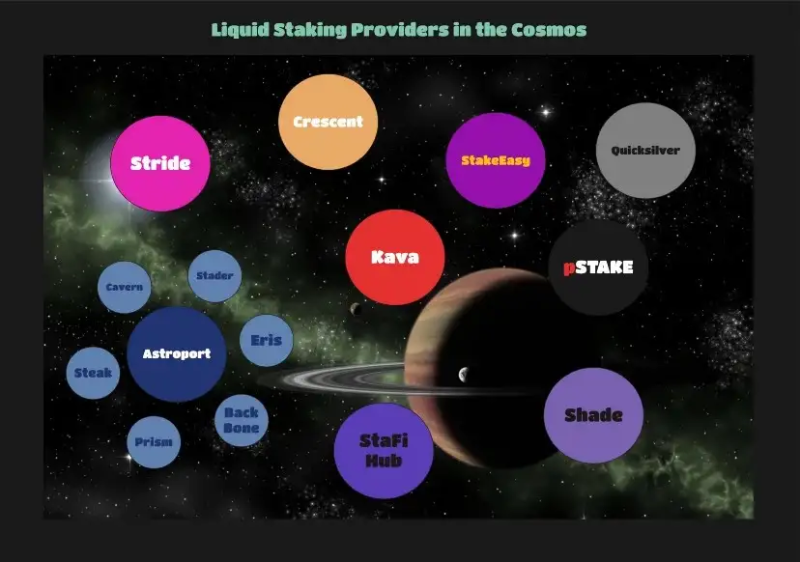

During 2022, I introduced liquid staking protocols in Cosmos, starting from Prism derivatives in January to last month's novel and multifaceted token model of StakeEasy. The pace of innovation has not slowed down—2023 has already seen many exciting announcements and protocol launches, including: pSTAKE, Shade, Stride, BackBone Labs, and Quicksilver.

The purpose of this article is to provide an up-to-date overview of most of the liquid staking derivatives (LSDs) currently available in Cosmos. More importantly, I want to examine the dashboard to see how much these dApps, protocols, and blockchains are being used.

LSDs in Cosmos

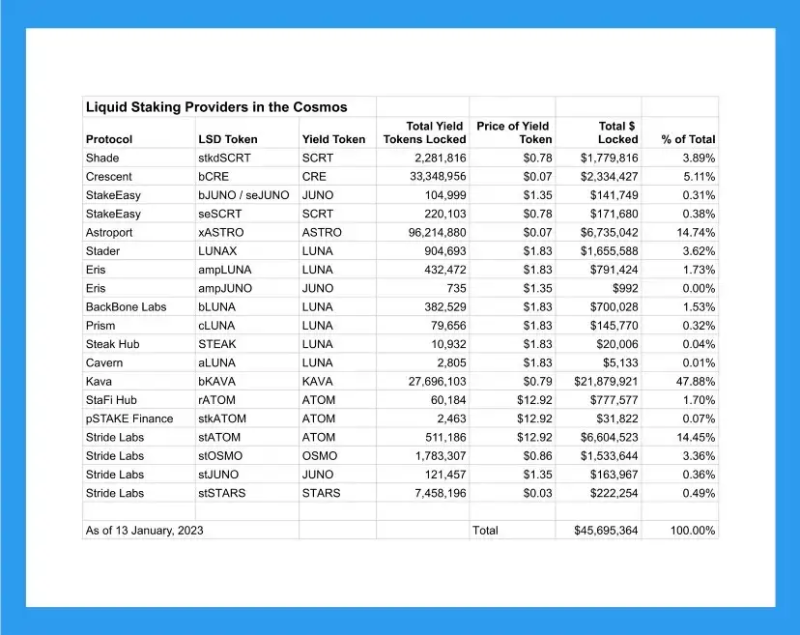

Take a look at the image below for an overview of protocols offering liquid staking in Cosmos, along with the names of all circulating tokens. As you can see, this space has become increasingly crowded.

Number of LSDs

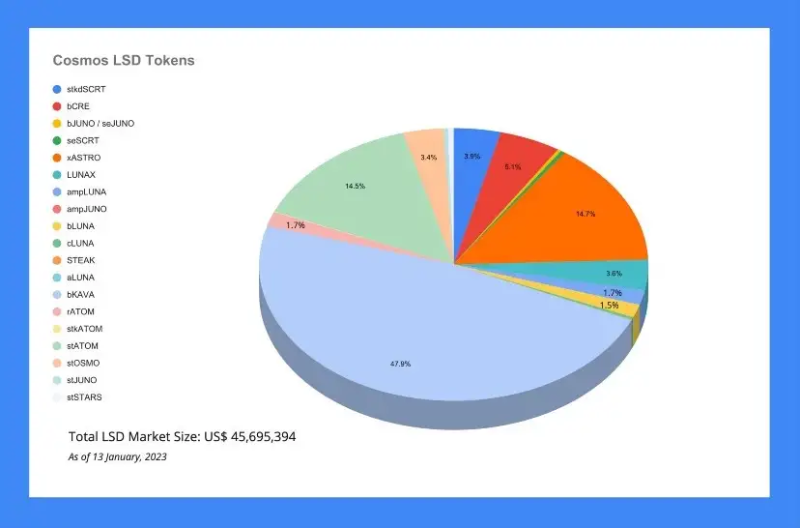

As LSD tokens gain popularity and more Cosmos participants take advantage of their economic benefits, both the number of LSD tokens and their associated value are steadily rising. The chart and table below summarize the current state of the LSD market in Cosmos.

New Features and Opportunities

Outstanding development teams from the Cosmos Hub and other blockchains across the ecosystem have built several exciting new technologies. In addition to launching these advanced features, DeFi in Cosmos is rapidly evolving, and many profitable opportunities are gradually emerging.

Governance

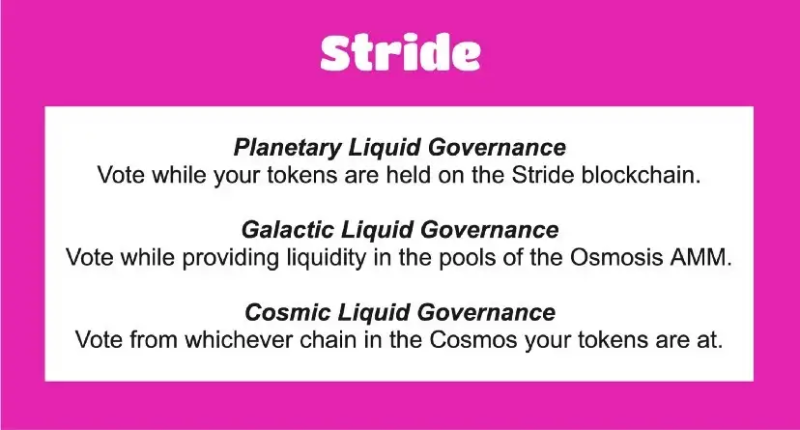

Typically, when you deploy your tokens in DeFi, you forfeit the ability to participate in governance voting. However, blockchains like Stride and Quicksilver will use interchain accounts to solve this issue, enabling users who stake their assets with liquid staking providers to still participate in governance.

A perfect example of this functionality is the Stride team, which recently announced its updated roadmap and a phased rollout of its liquidity governance program (see image below).

Quicksilver will launch its initial suite of qAssets this month alongside STARS from Stargaze, followed by JUNO from Juno Network, and OSMO from Osmosis.

After these first three, ATOM from the Cosmos Hub will follow. The team has announced plans to create liquidity pools for qAssets on Osmosis.

Liquid Staking Module (LSM)

One of the most anticipated features is the Liquid Staking Module (LSM). This will allow users to transfer their delegation to liquid staking providers without first unbonding.

I expect that allowing liquid staking providers to mint LSDs against already-locked governance tokens will significantly increase product adoption and participation in Cosmos DeFi.

Note that liquid staking providers do not currently offer this feature. Many protocols have announced they will immediately adopt it once the Liquid Staking Module (LSM) is released by the Cosmos Hub.

Liquidity Pool Incentives

All protocols are actively building partnerships with exchanges around Cosmos to create new DeFi opportunities. For example, Stride and Shade jointly announced new liquidity pools for derivative tokens upon the launch of ShadeSwap, including:

- stATOM — ATOM

- stOSMO — OSMO

- stJUNO — JUNO

- stATOM — stOSMO

- SHD — stATOM

- stkdSCRT — sSCRT.

Moreover, some of these pools will receive dual incentives.

Protocols also offer external incentives to reward participants deploying their LSDs in DeFi across platforms such as Osmosis, Astroport, Crescent, KavaSwap, SiennaSwap, rDEX, and Loop AMM. Liquid staking providers offering rewards include:

- StakeEasy — SEASY

- Stride — STRD

- Crescent — CRE

- Kava — KAVA

- StaFi Hub — FIS

- Astroport — ASTRO.

For instance, StakeEasy sets a high bar for liquidity pool rewards, partnering with Loop AMM on the Juno network to offer triple rewards in LOOP, SEASY, and bJUNO tokens. Additionally, StakeEasy’s LSD will hold a prominent position on the brand-new Wynd DEX (also on the Juno network).

Lending

Liquid staked tokens will also be accepted as collateral by lending dApps. For example, SiennaLend accepts seSCRT as collateral, with more collateral types being integrated across lending protocols throughout Cosmos.

Airdrops

Finally, these protocols are also airdropping their tokens. Stride has already begun its airdrop campaign, and others have announced upcoming airdrops of their governance tokens, including StakeEasy and Quicksilver.

For example, the Quicksilver team announced an ongoing airdrop, where QCK tokens will be distributed to builders on new blockchains. The team also announced a participation rewards program, where users can earn additional QCK tokens based on their validator selection. The goal here is to promote decentralization and incentivize delegations to validators with lower voting power but higher performance levels.

Rapid Growth

Growth in liquid staking within Cosmos has reached a frenzied pace. Surprisingly, one of the earliest blockchains to offer LSDs in the Cosmos ecosystem—Terra back in 2021—still maintains an impressive set of options. Another contender claiming to be the first to offer LSDs in Cosmos is pSTAKE. Their original product predates IBC and was developed as an EVM-based solution. They have just launched their latest product—a brand-new stkATOM, now fully IBC and interchain account compatible.

Kava blockchain’s LSD—bKAVA—is a relatively late entrant but one of the fastest-rising projects, having launched less than three months ago. The blockchain offers enhanced yield rewards for participants in its yield and boost programs.

Imminent Economic Expansion

As more DeFi dApps launch their products over the coming months, opportunities to deploy LSDs will only expand. Not only is the number of staked tokens continuously increasing, but the overall dollar-equivalent value of staked assets is also rising due to new LSD offerings. This is particularly impressive given the depressed token prices during this bear market.

The continual rise in usage will also lead to increased daily trading volumes in Cosmos DeFi. This is a welcome development, as standard staking and LP APRs across the ecosystem have been steadily declining.

Finally, the positive impact of growing fee revenue will be crucial for the economic health of the ecosystem. Moreover, assuming protocols remain true to their decentralization promises, the steady growth of staked assets will greatly help secure the blockchain's security.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News