From Earning Over $15 Million to Losing It All: The Rise and Fall of an NFT Whale

TechFlow Selected TechFlow Selected

From Earning Over $15 Million to Losing It All: The Rise and Fall of an NFT Whale

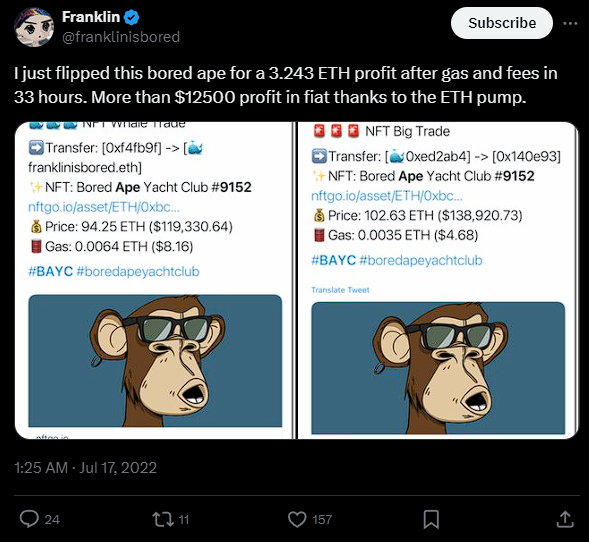

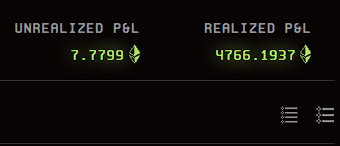

Franklin made over $15 million trading NFTs, but his subsequent trades cost him everything.

Author: Pix, Web3 Researcher

Translation: Felix, PANews

The man in the image below is named Franklin. He made over $15 million trading NFTs, but subsequent trades cost him everything (even his sanity?). Here's his little-known story of rise and fall.

Franklin first learned about NFTs through NBA TopShot. But flipping "basketball video clips" didn't go well for him.

He didn’t make any money, but that didn’t stop him.

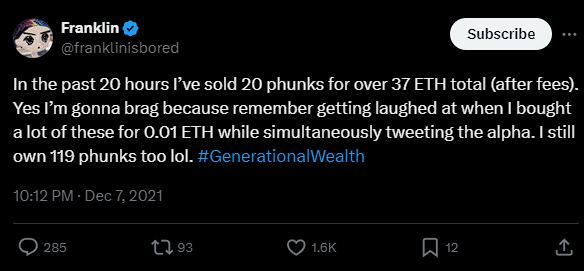

When BAYC launched, Franklin minted some. Seeing his NFTs triple in price, he became obsessed. Over the next two years, he dove deep into heavy trading.

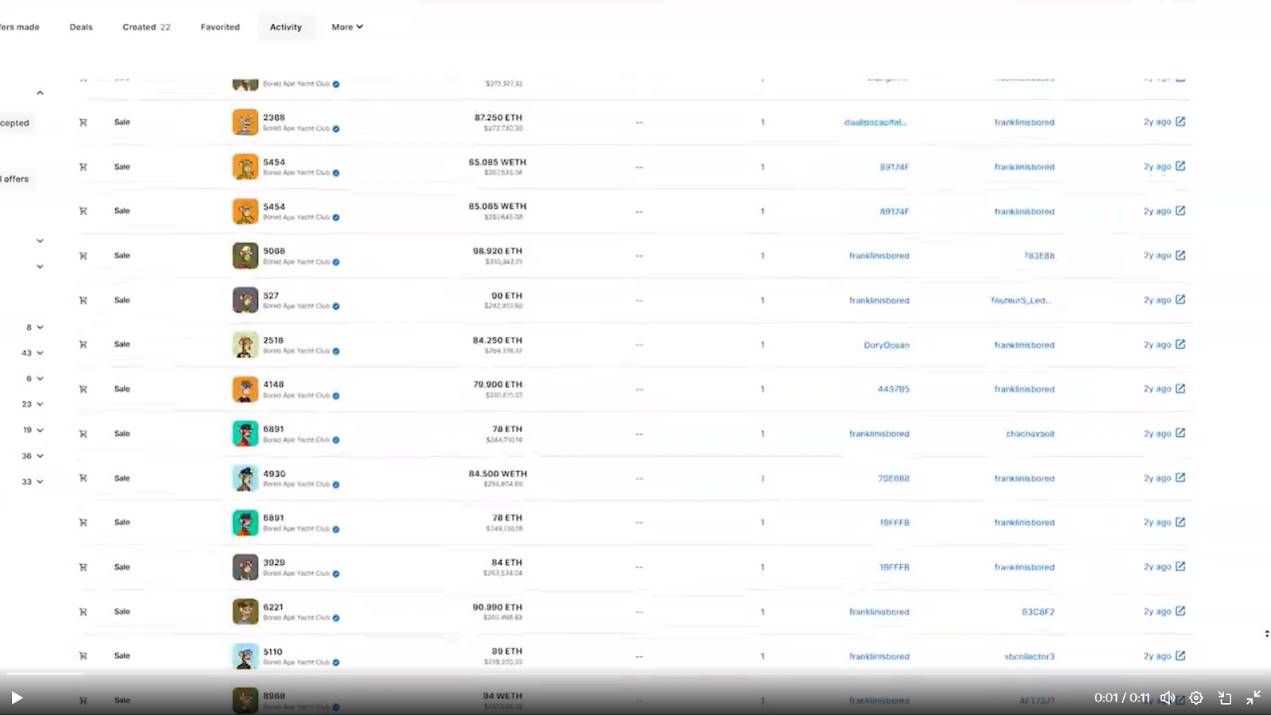

The image below shows just BAYC flips, but things didn’t stop there.

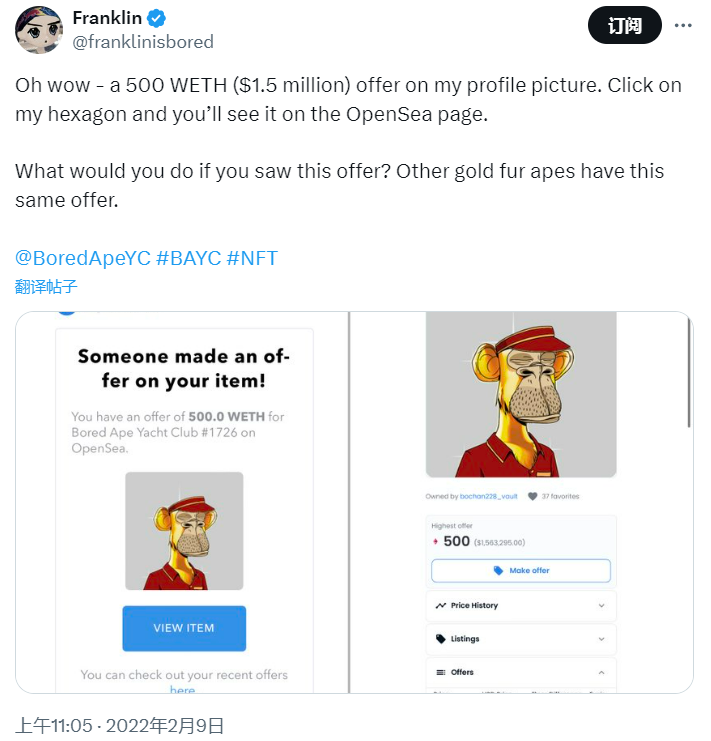

In February 2022, Franklin received an offer of $1.5 million for his iconic Golden Ape.

He originally paid only $12,000 (cost), which would have given him a 125x return with ease.

But he rejected the deal (slipped finger?).

Then things got even crazier.

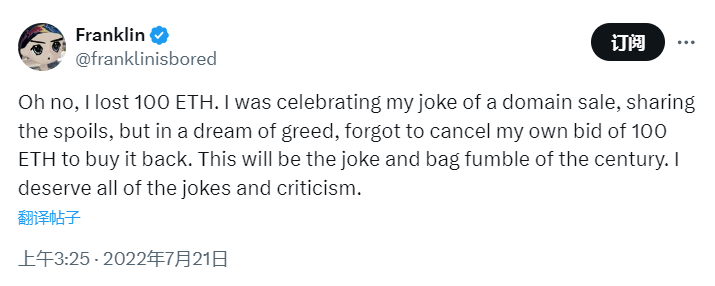

Franklin once lost 100 ETH ($150,000), which seemed insignificant to him (see below).

He frequently made mistakes on NFT trades, losing 10–20 ETH at a time.

How could he afford so many losses?

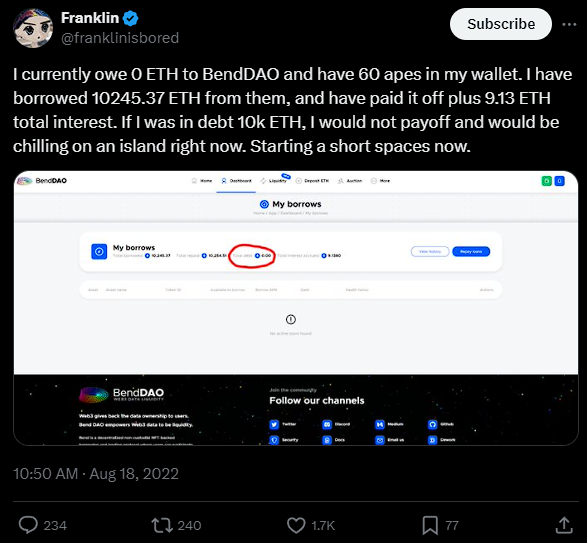

Franklin was addicted and started using leverage.

He borrowed over 10,000 ETH from BendDAO.

At first, he repaid on time (airdrop gains were good).

But then the bear market hit…

If only NFT prices had simply crashed.

Franklin suffered setbacks elsewhere too:

-

Lost $1.4 million in crypto casinos

-

Lost $4.2 million in private investments

These blows forced him to sell all his apes and exit the space…

But Franklin quickly returned.

He used the money he had left to restart NFT trading.

Seeing limited returns, he decided it was time for a change…

In February this year, Franklin sold his Golden Ape for $675,000.

He occasionally traded whatever was trending at the time.

But soon, things began to spiral out of control…

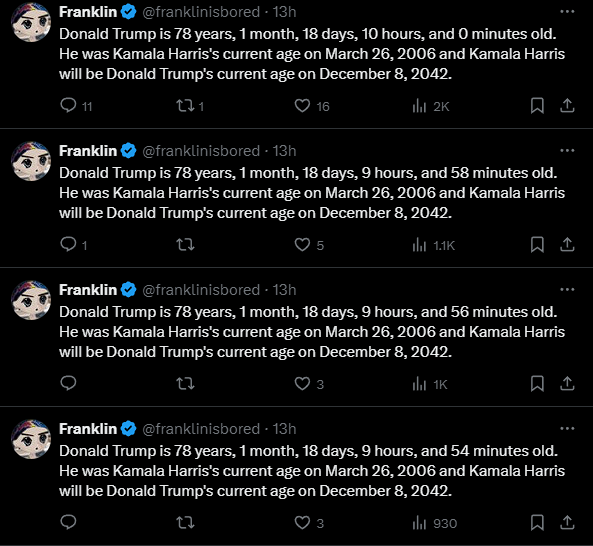

Instead of posting NFT trades, he began publishing a video every five minutes.

Then it evolved into sending controversial/link-bait tweets.

All of this was to earn a bit of ETH in return from Fantasy Top.

Franklin is intelligent (his profession is aerospace engineer).

Yet his story perfectly illustrates why one should never use leverage.

If the next NFT bull market arrives, can he make a comeback?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News