Bitcoin Gradually Becomes a Strategic Asset: How to Promote Its Adoption Amid Great Power Competition?

TechFlow Selected TechFlow Selected

Bitcoin Gradually Becomes a Strategic Asset: How to Promote Its Adoption Amid Great Power Competition?

Once some influential countries adopt Bitcoin, others will follow, creating a bandwagon effect.

Author: ASXN

Translation: TechFlow

When Trump spoke to the audience at the 2024 Bitcoin Nashville Conference, he laid out his vision of transforming the United States into a global cryptocurrency leader. At the end of his speech, he made a striking promise: he pledged never to sell the U.S. government’s existing inventory of 213,000 BTC. He described this massive reserve as the cornerstone of a national strategic Bitcoin reserve.

While this initial statement might be challenged today by the Silk Road auction, it leads us to an idea as old as Bitcoin itself—the game theory of inter-national Bitcoin adoption.

Game theory is a mathematical framework used to understand strategic interactions and serves as a useful tool for analyzing how nations view Bitcoin adoption. Generally, it helps us make better decisions under uncertainty or incomplete information. In the specific context of inter-national Bitcoin adoption, studying game theory helps us understand how countries think about innovation, taxation, adoption, regulation, and other key variables.

A nation's Bitcoin adoption strategy is best understood through two core concepts in game theory—First Mover Advantage and Payoff Matrix.

First Mover Advantage

Countries that adopt Bitcoin early will enjoy significant advantages (if BTC succeeds). These benefits may include becoming hubs for innovation and investment, attracting crypto businesses, and setting global standards for digital currency regulation. However, early adopters also face higher risks, including uncharted regulatory territory and potential economic instability. The earlier a country "moves," the higher both the risks and rewards.

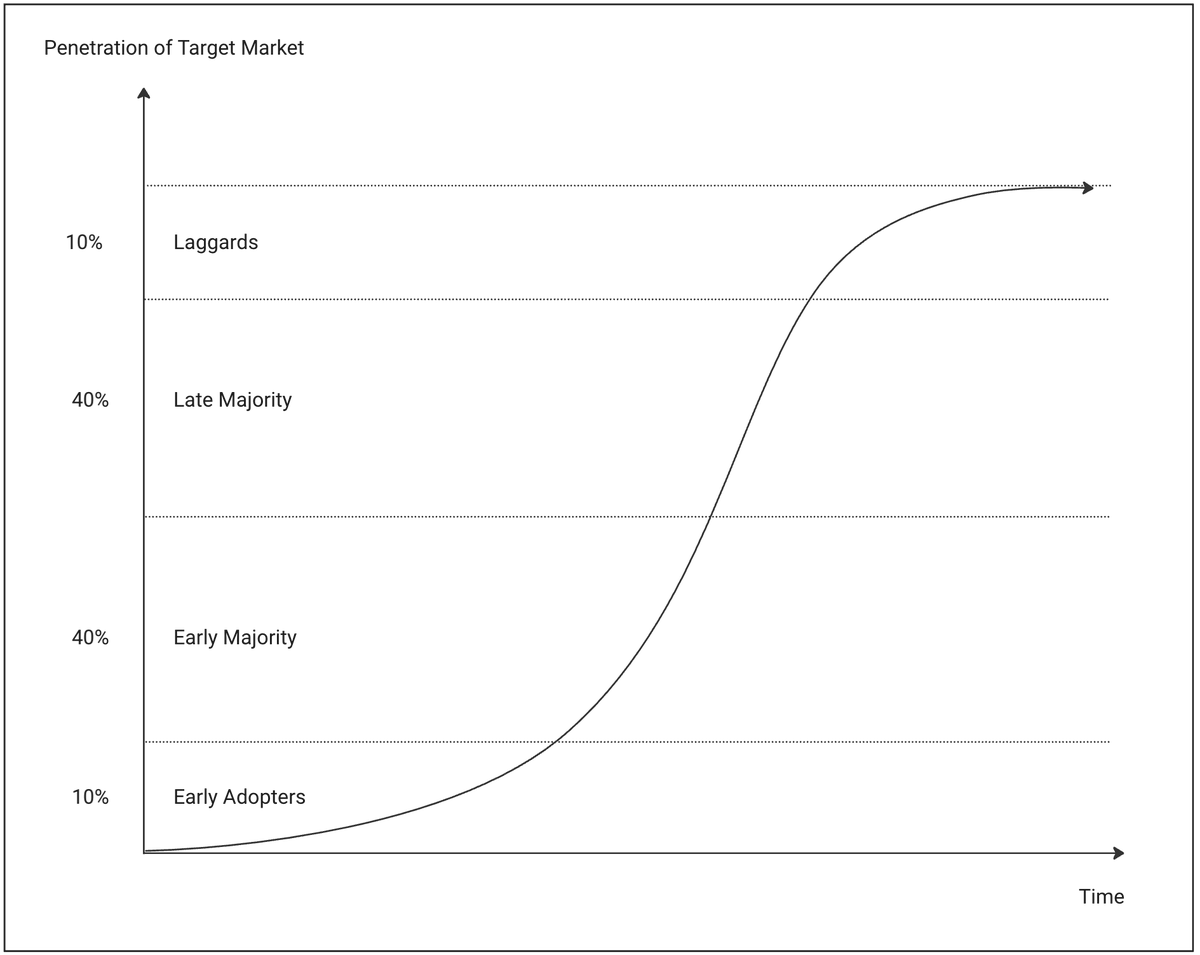

Once several influential countries adopt Bitcoin, others will follow suit to avoid being left behind—this creates a bandwagon effect. This effect is driven by the returns from adoption and the risks of non-adoption. At this point, the Bitcoin adoption cycle enters the steepest part of the S-curve.

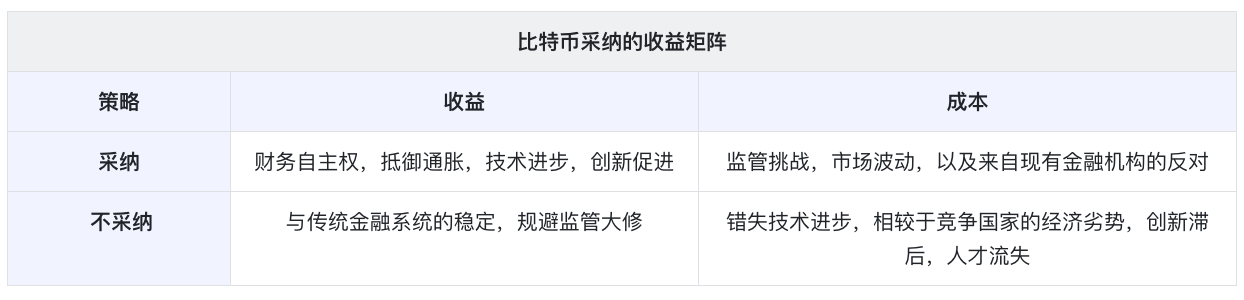

Payoff Matrix

In game theory, a payoff matrix helps illustrate the potential outcomes of different strategies. For Bitcoin adoption, each country evaluates the costs and benefits of adopting versus not adopting and chooses the optimal strategy. Clearly, considering the cost-benefit trade-off, the dominant strategy is adoption.

In game theory, a best response function refers to the strategy that provides the highest payoff for a player (country), given the strategies chosen by other players. For a country considering Bitcoin adoption, the best response function is the optimal strategy based on the anticipated actions of other countries and the resulting economic and geopolitical dynamics. The logic goes roughly like this—Country 1 evaluates the cost-benefit trade-off and decides to adopt. Country 1 realizes all other countries will also choose to adopt, so Country 1 concludes that since everyone will adopt, they should accelerate adoption to avoid losing competitive advantage.

Slowly, then all at once. (TechFlow note: Originates from the famous writer and economist Ernest Hemingway, often used to describe a gradual change process that ultimately results in sudden, dramatic outcomes.)

Practical Applications of Adoption Game Theory

To better visualize the game theory of adoption, let's examine several examples—El Salvador, U.S. states, and MicroStrategy. These cases highlight how adoption game theory operates at national, regional, and corporate levels.

In 2021, El Salvador became the first country to announce BTC as a reserve asset and legal tender. Since then, the government has accumulated 5,825 BTC, with a market value of $394 million.

In May 2024, Wisconsin became the first U.S. state to announce a BTC purchase. They disclosed in filings with the SEC that they had bought $160 million worth of BTC ETFs for their pension fund. While this isn't a huge amount relative to a $132 billion pension fund, it signals an understanding of Bitcoin as a savings technology and recognition of first-mover advantage.

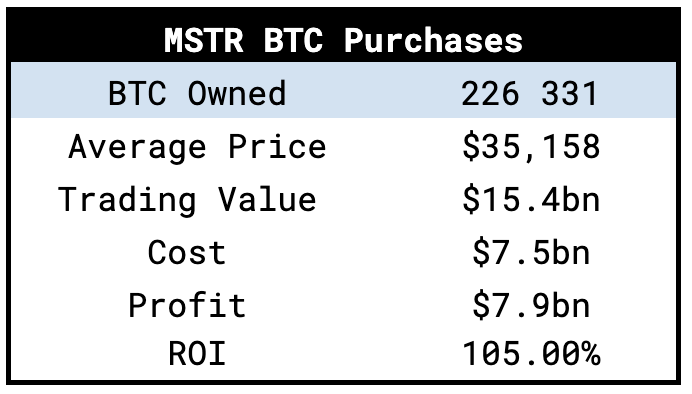

MicroStrategy may be the quintessential example of first-mover advantage. At the end of 2020, Michael Saylor announced a plan to buy BTC and has since accumulated 226,000 BTC—more than 1% of the total supply. Although this move was unpopular at the time, Saylor’s foresight and patience created immense value for himself and shareholders.

What Does the Future Hold for Adoption Game Theory?

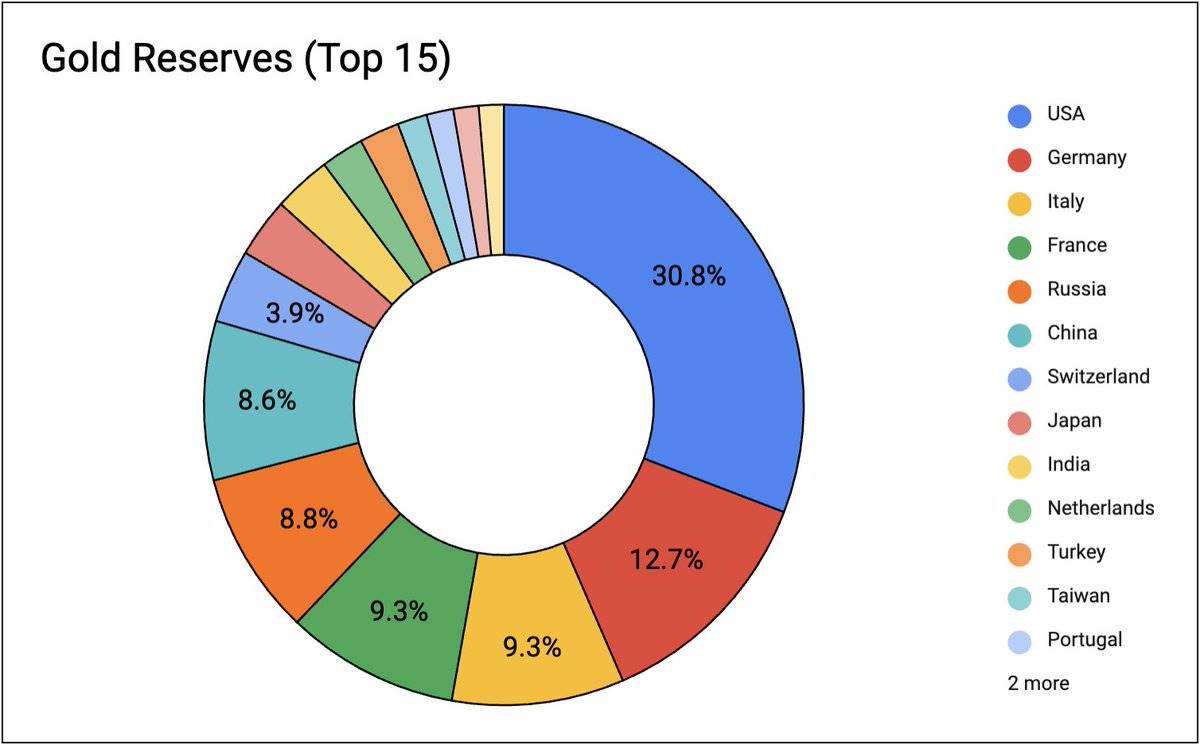

At the 2024 Bitcoin Nashville Conference, Bitcoin advocate and presidential candidate Robert F. Kennedy Jr. proposed an even more aggressive Bitcoin adoption plan. He plans to buy 550 BTC daily until the U.S. holdings reach 4 million BTC (19% of Bitcoin’s total supply), matching the proportion of gold reserves the U.S. holds globally.

Even if Trump’s ideas presented at the Bitcoin Nashville Conference may or may not come to pass, the simple fact that he publicly acknowledged Bitcoin and its properties is a victory in itself—we have already seen early signs of this.

Expanding our view to broader cryptocurrency adoption game theory, we find another example in the dominant strategy of dollar-denominated stablecoin adoption and the consolidation of dollar hegemony. There are 180 fiat currencies worldwide, most of which perform worse than Bitcoin. By promoting the adoption of dollar-pegged stablecoins in economies where local currencies fail, they take a crucial step toward securing global dollar dominance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News