Ethereum's Old Dreams and New Realities: Growing Institutionalization of Buyers, Lowering Expectations for Price Volatility

TechFlow Selected TechFlow Selected

Ethereum's Old Dreams and New Realities: Growing Institutionalization of Buyers, Lowering Expectations for Price Volatility

The approval of ETH ETFs will most obviously benefit real-world asset (RWA) and decentralized finance (DeFi) protocols.

Authors: @c0xswain, @0xkinnif, 0xlaiyuen & @0xZhouYeMen

Translation: TechFlow

Over the past decade, Ethereum's continuous development has given rise to numerous use cases for ETH and diverse perspectives on its value. Crypto investors who have experienced ETH price rallies may view it as "ultrasound money." Technological purists might see it as a trust-minimized global computer. Newcomers could regard it as "digital oil" powering a decentralized, open-source app store.

The investment case for Ethereum: What is Ethereum’s investment value?

Ethereum’s value lies in its flexibility and ability to support applications more complex than simple value transfers. Ethereum hosts the largest and most active community of software contributors who implement upgrades to enhance platform functionality. These developers are not only focused on maintaining the platform’s ongoing relevance but also committed to building a system capable of adapting and scaling—laying a solid foundation for today’s and tomorrow’s assets and activities. Currently, the most prominent applications on Ethereum include stablecoins (payment tokens pegged to the U.S. dollar), decentralized finance (rebuilding traditional financial services like lending on blockchain), and tokenization (issuing financial assets on-chain).

When applications run on Ethereum, the ether token serves as the currency required to transact within the Ethereum ecosystem. Ether is consumed when paying transaction fees and removed from circulation, potentially reducing ether supply as platform usage grows. Therefore, investing in ether expresses a belief that more applications will be built on Ethereum’s open, permissionless programming infrastructure, aiming to attract more users and revenue while expanding ether’s role as a medium of exchange.

Source: iShares

We believe that for Ethereum adoption to continue growing, sustained recognition from new market participants—with unique perspectives on ETH’s value—is essential. The marginal buyer of ETH may not share the same ideological inclinations as crypto natives, and we should embrace this reality. As we enter a post-ETF era marked by increasing institutional adoption, we expect applications built on Ethereum with institutional appeal to benefit most from increased traffic, fees, and ultimately price appreciation.

Approval of ETH ETFs will have a long-term impact on investor perceptions of legitimacy regarding the Ethereum ecosystem and the applications built upon it. The most obvious beneficiaries will be real-world asset (RWA) and decentralized finance (DeFi) protocols.

RWA

The RWA space is broad, covering asset classes such as real estate, bonds, equities, and even luxury goods. Numerous protocols are currently involved in tokenizing Treasury yields and private credit. Many other tokenization use cases exist, though the long-term viability of some protocols remains questionable due to several factors:

-

Regulatory hurdles;

-

Concerns over KYC controls;

-

Institutional trust in proprietary products launched by major banks;

-

Lack of integration with existing traditional financial infrastructure.

There appears to be divergence in how institutions will execute their RWA strategies. On one hand, institutions are pursuing private blockchain approaches; on the other, they aim to integrate with existing solutions. J.P. Morgan’s Onyx is a private blockchain based on Avalanche Evergreen subnet, while BlackRock’s BUIDL fund is a tokenized USD yield fund issued on Ethereum. Although many crypto natives believed the debate between private and public blockchains was settled during the 2018 cycle, genuine institutional adoption today may reignite this discussion.

Cobie on institutional adoption

Source: Cobie

For private/consortium blockchains, interoperability could become key to enabling asset movement across platforms—similar to interbank transfers. Infrastructure connecting blockchain assets, such as trustless oracles and bridges (LINK, ZRO, AXL), may capture some value accumulation. Conversely, institutions leveraging existing infrastructure may choose to tokenize high-value assets on Ethereum due to its security budget and credible neutrality.

DeFi: Financialization of Everything

DeFi kicked off the bull market in 2020, as many envisioned a future where finance would flourish without intermediaries. Its permissionless and decentralized nature allows anyone to interact with protocols—borrowing and lending on money markets, swapping assets on decentralized exchanges (DEXs), and forming decentralized autonomous organizations (DAOs) to vote on proposals and conduct transactions.

This emerging industry has unlocked numerous opportunities beyond what traditional markets offer. Beyond DAOs and DEXs, fascinating game-theoretic experiments such as the Curve Wars and OlympusDAO (3,3) attracted many participants dreaming of the possibilities offered by new decentralized frontiers.

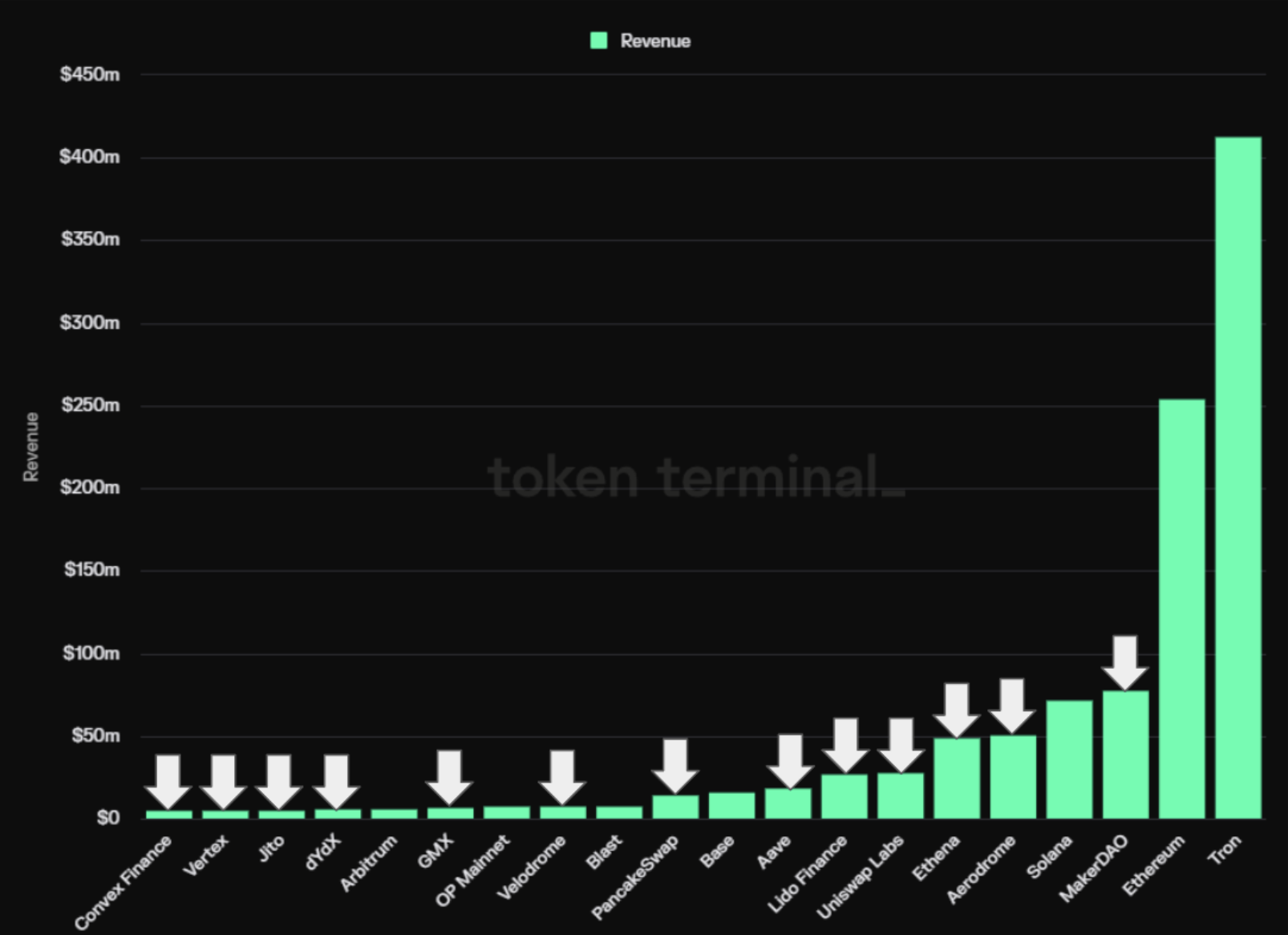

Top 20 crypto projects by revenue over the past 90 days

Source: DeFi projects labeled on Token Terminal

As a sector, DeFi has also drawn fundamental investors seeking revenue-generating assets. Among the top 20 crypto projects by revenue, DeFi claims 13 spots—second only to L1s and L2s.

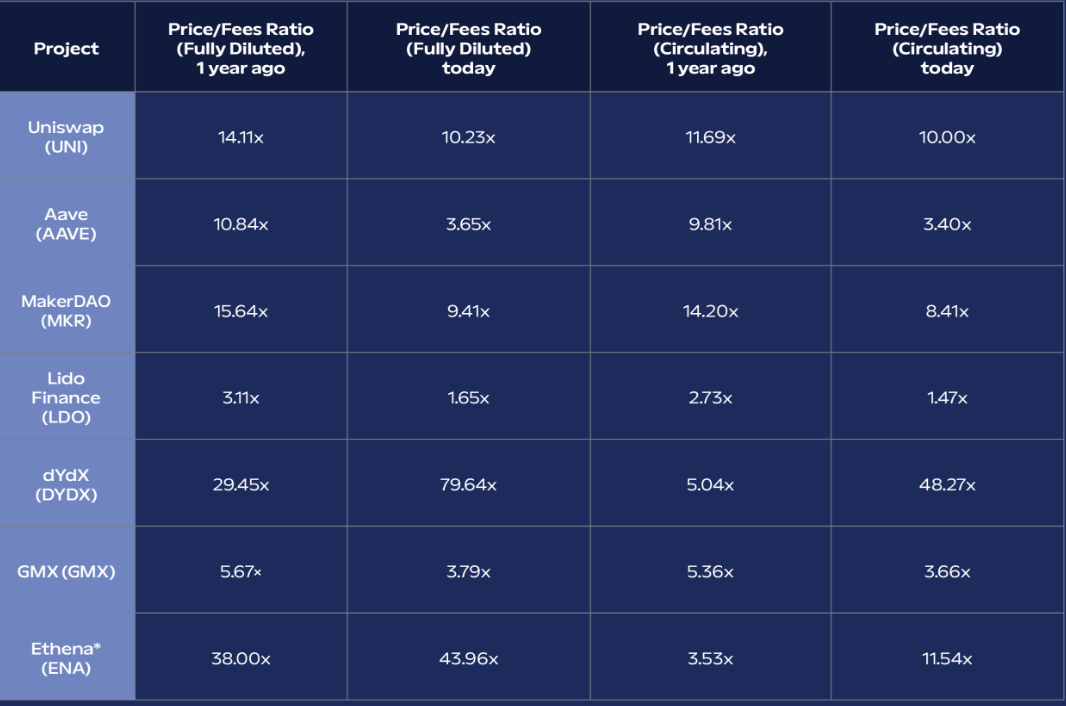

P/F ratios of selected DeFi protocols

Source: Token Terminal

Funds looking to allocate capital beyond ETH into other crypto assets may prefer time-tested products and mature DeFi applications with relatively strong fundamentals, rather than newer protocols with low float and high fully diluted valuations (FDV). In terms of price-to-fees ratio (the multiple the market is willing to pay per $1 of fees), many DeFi protocols are trading at significant discounts compared to when ETH traded around $1,850 a year ago. While fees can be influenced by asset prices, the broader message is clear: these protocols with proven product-market fit are trading at notable discounts in today’s more favorable environment. Given the wider context of increasing institutional participation, this appears to be an attractive investment opportunity.

Moreover, sufficient time has passed for supply distribution among market participants, reducing risks associated with large structural sellers. Established DeFi protocols like MKR, LDO, and AAVE may appeal to capital allocators focused on fundamentals, while perpetual decentralized exchanges (perp DEXs) such as DYDX and GMX could see potential growth if on-chain trading volume rebounds.

A New Reality

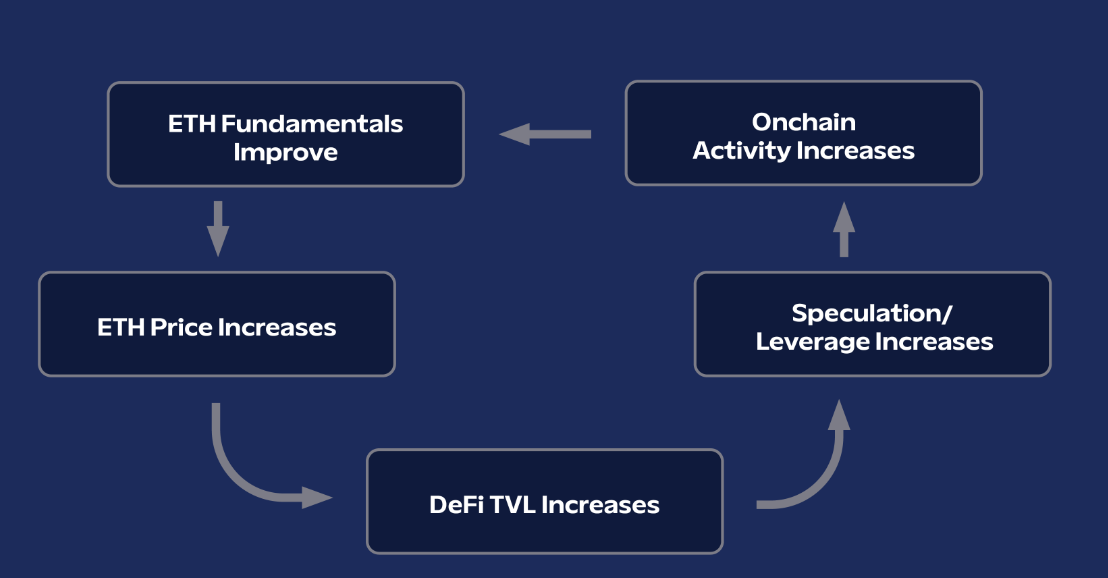

Institutional capital inflows via ETH ETFs could spark a resurgence in blockchain activity, amplified by Ethereum’s economic effects and the inherent leverage within its ecosystem. However, it’s important to note that passive buyers of ETH ETFs won’t rotate into altcoins the way BTC ETF buyers might. While this could temper investor expectations, we believe ETH’s reflexive characteristics give it greater upside potential per dollar invested in the ETF compared to BTC.

Ethereum's Trickle Down Economics

Regardless of whether ETH ETF inflows lead to unexpected upside, crypto investors should recognize that market dynamics are evolving as the buyer base becomes increasingly institutional. In the post-ETF era, we should expect ETH to exhibit lower volatility as the asset matures—but while embracing this new reality, we must not forget to revisit old dreams.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News