TVL Surpasses $200 Million: How Pell Network Unlocks the Trillion-Dollar BTCFi Market by Building an AVS Network on Bitcoin Restaking?

TechFlow Selected TechFlow Selected

TVL Surpasses $200 Million: How Pell Network Unlocks the Trillion-Dollar BTCFi Market by Building an AVS Network on Bitcoin Restaking?

Pell Network aims to build the first general-purpose security network based on Bitcoin restaking, enabling AVSs across the industry to share Bitcoin's robust security foundation.

Written by: TechFlow

2024 has become a year of explosive momentum for Bitcoin. On the macro level, not only was BTC ETF approval achieved, but application-layer innovations such as inscriptions, Memes, and Layer 2 solutions have flourished, giving Bitcoin an entirely new ecosystem profile:

Bitcoin holders are no longer limited to simply holding (HODLing); they can now actively participate in on-chain DeFi activities such as staking and lending. BTCFi is widely regarded as one of the most promising sectors in this market cycle. Therefore, how to better leverage Bitcoin’s foundational infrastructure to unlock trillions of dollars worth of dormant BTC assets within the ecosystem has become a critical challenge for BTCFi’s development.

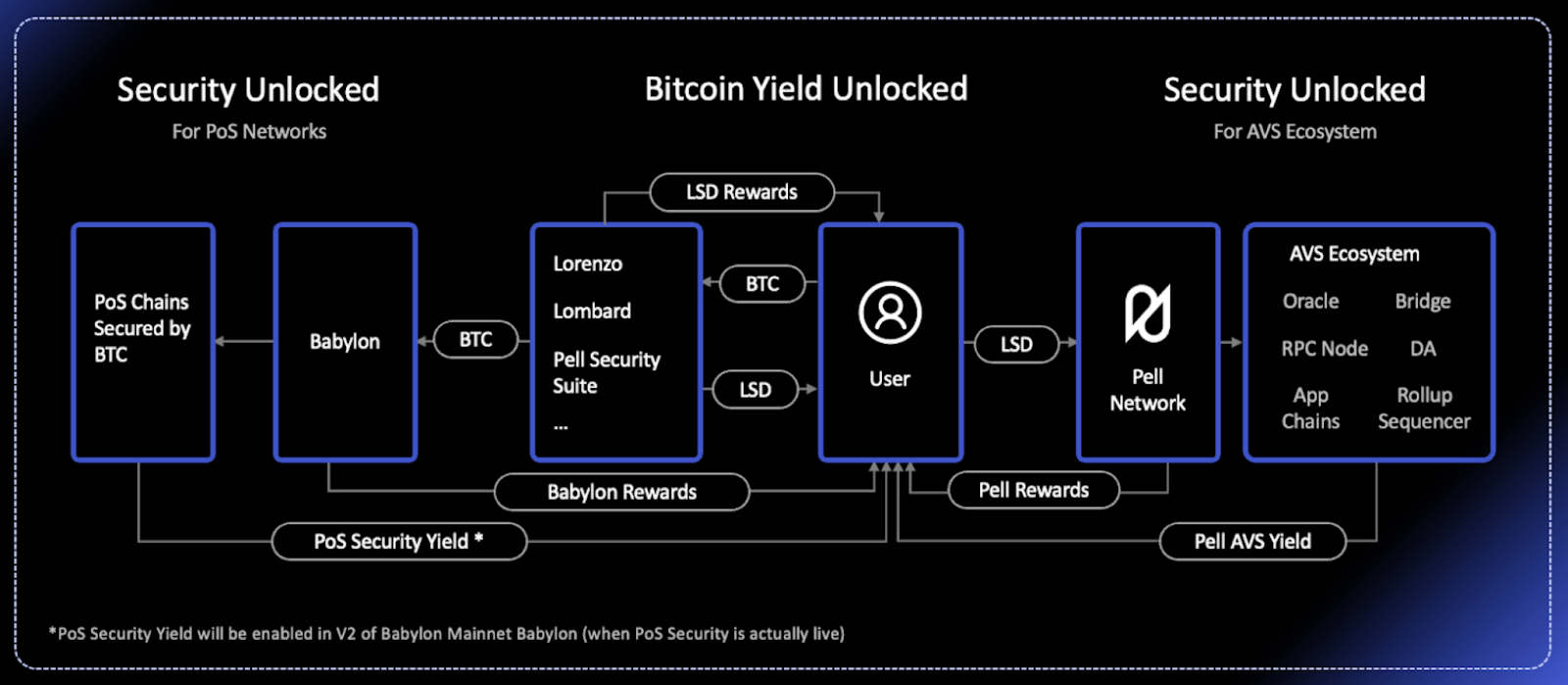

In this context, Pell Network emerges at just the right time: as the first general-purpose security network built on Bitcoin restaking, Pell Network aims to enable all Active Validation Services (AVS) to share Bitcoin’s robust security foundation, serving as a powerful catalyst for BTCFi’s growth.

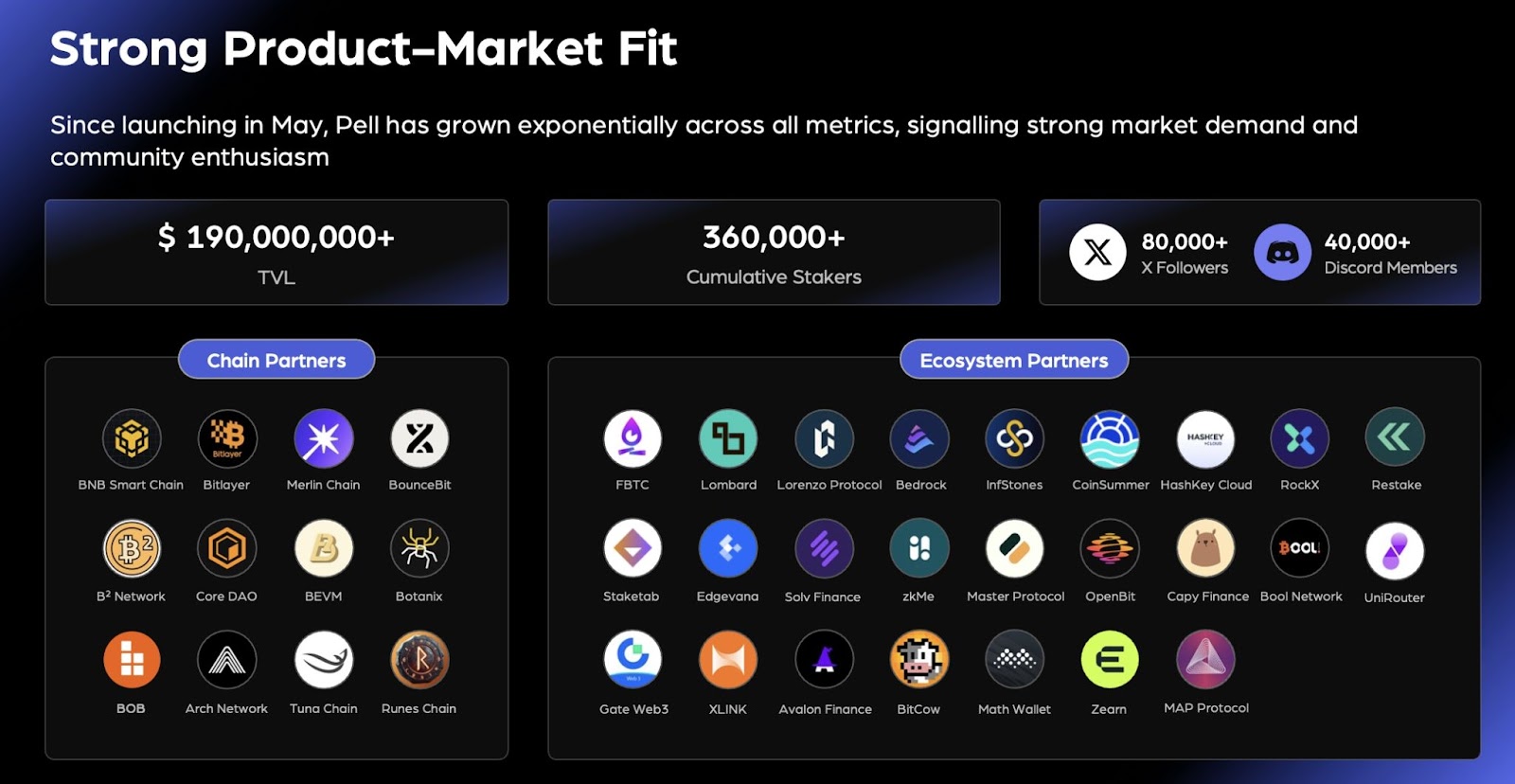

Since its pre-launch announcement, Pell Network has delivered impressive results: its Total Value Locked (TVL) surpassed $200 million within just three weeks, with over 410,000 unique addresses participating. The project has reportedly raised several million dollars in funding.

These strong growth metrics not only reflect significant market enthusiasm for BTCFi but also fuel deeper community interest in exploring Pell Network. With upcoming initiatives such as the BNB Chain Campaigns, Bitlayer Carnival, and the approaching testnet launch, Pell Network is poised to attract even broader community participation in the near future.

Beyond the numbers, this article examines the driving forces behind Pell Network’s growth by analyzing the vast potential of BTCFi, the importance and necessity of AVS sharing Bitcoin’s security foundation, and the operational logic of Pell Network—offering insights into both the project and the future trajectory of the Bitcoin ecosystem.

Bitcoin’s Enhanced EigenLayer: Pell Builds an AVS Network via Bitcoin Restaking

Simply put, if you understand EigenLayer, you’ll easily grasp the core principles of Pell Network.

We know that Ethereum’s transition from PoW to PoS ushered in the era of staking. EigenLayer is a restaking protocol built on Ethereum, allowing ETH already staked on the network to be restaked to enhance overall network security. Active Validation Services (AVS) can leverage these restaked assets to inherit Ethereum’s security guarantees.

AVS aims to provide Web3 trust assurances for any computation. Often, AVS can be thought of as “middleware,” existing in various forms such as data availability layers, shared sequencers, or oracle networks. EigenLayer enables AVS to deliver superior services to dApps in DeFi, gaming, and other fields, fostering ecosystem growth. Meanwhile, participants who stake earn additional rewards. This process reduces startup costs for new blockchain protocols, strengthens network resilience against attacks, and improves capital efficiency.

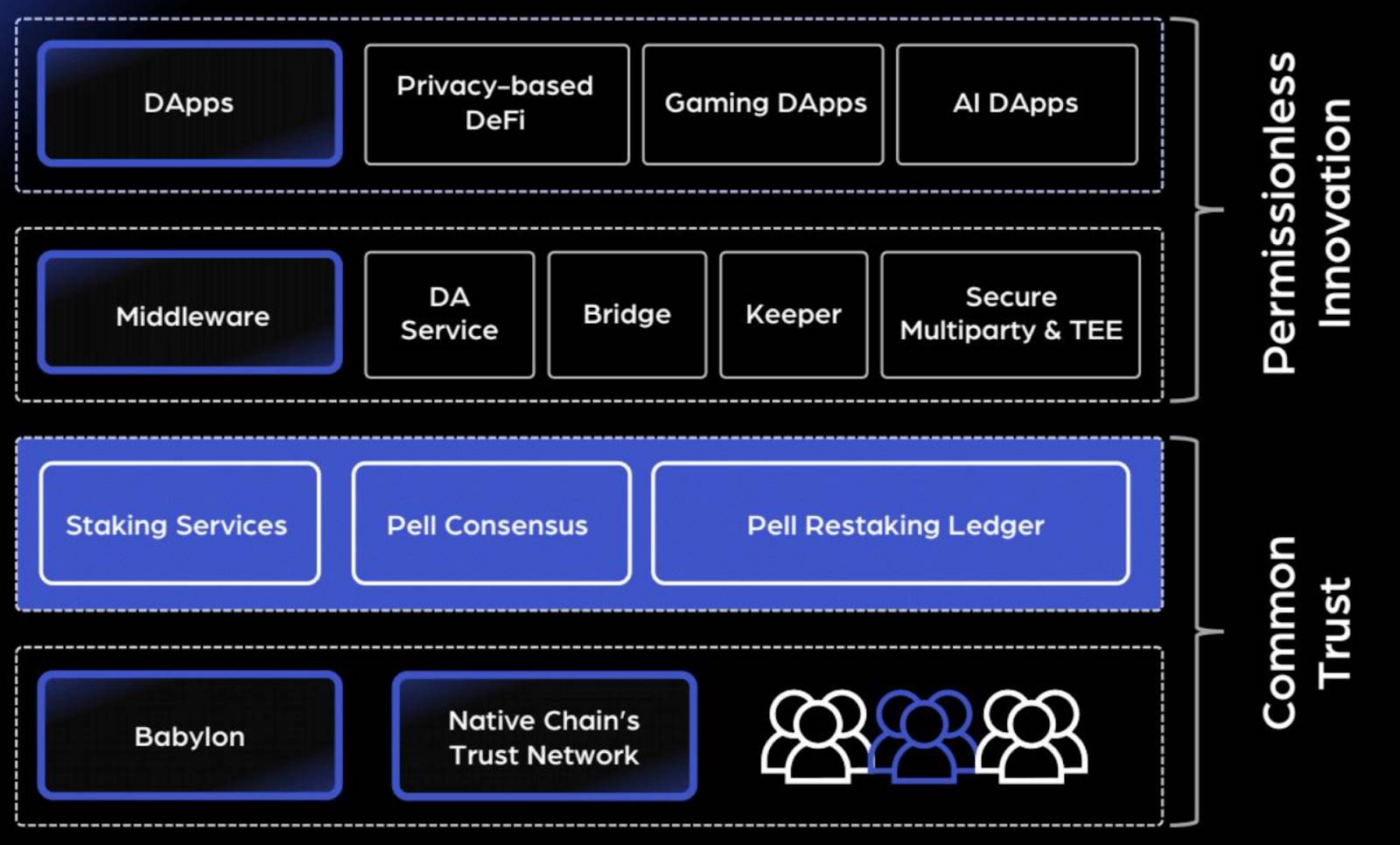

In Pell Network, users stake BTC assets, which then provide the strongest possible security based on Bitcoin. dApps requiring AVS services gain access to higher-quality infrastructure, enabling them to build more innovative and user-friendly products. All participants—including AVS providers, node operators, the Pell protocol, and BTC stakers—earn rewards.

Unlike EigenLayer, which focuses primarily on the Ethereum ecosystem, Pell Network aims to build a cross-chain AVS network, extending Bitcoin’s unparalleled security across the entire industry.

The essence of this cross-chain vision is breaking down silos between blockchains. Using technologies like cross-chain atomic communication and ZK-Rollups, Pell Network builds a universal relay network that consolidates BTC and its LSD liquidity tokens scattered across various Layer 2s onto a unified Pell ledger. This resolves issues of fragmented BTC liquidity and isolated ecosystems, enabling a decentralized governance model for AVS services. As a result, Bitcoin can now participate in securing and generating yield from a wide range of decentralized applications.

In other words, as the Bitcoin restaking sector evolves, BTC enters a recursive “matryoshka” structure. Regardless of how many layers are added, users always retain a “receipt” tied to their principal. Beyond native BTC, Pell Network offers a “final destination” for all such receipts—accepting them universally to consolidate fragmented liquidity and lay a solid foundation for a BTC-backed universal security layer.

Pell Network supports multiple asset staking options:

-

Native restaking: Validators can restake their BTC by pointing their withdrawal credentials to the Pell Network contract.

-

LSD restaking: Deposit LSD tokens into the Pell Network smart contract.

-

BTC LP restaking: Validators stake a liquidity pair containing BTC.

-

LSD LP restaking: Validators stake a liquidity pair containing a liquid-staked BTC token.

Currently, Pell Network supports BNB Smart Chain, Bitlayer, MerlinChain, B² Network, BOB, Core DAO, BEVM, and has partnered with protocols including Lorenzo Protocol, Solv Finance, FBTC, and MapProtocol—revealing the early contours of its cross-chain footprint.

As aggregated liquidity becomes a powerful force, Pell Network channels these restaked assets toward building a cross-chain AVS network.

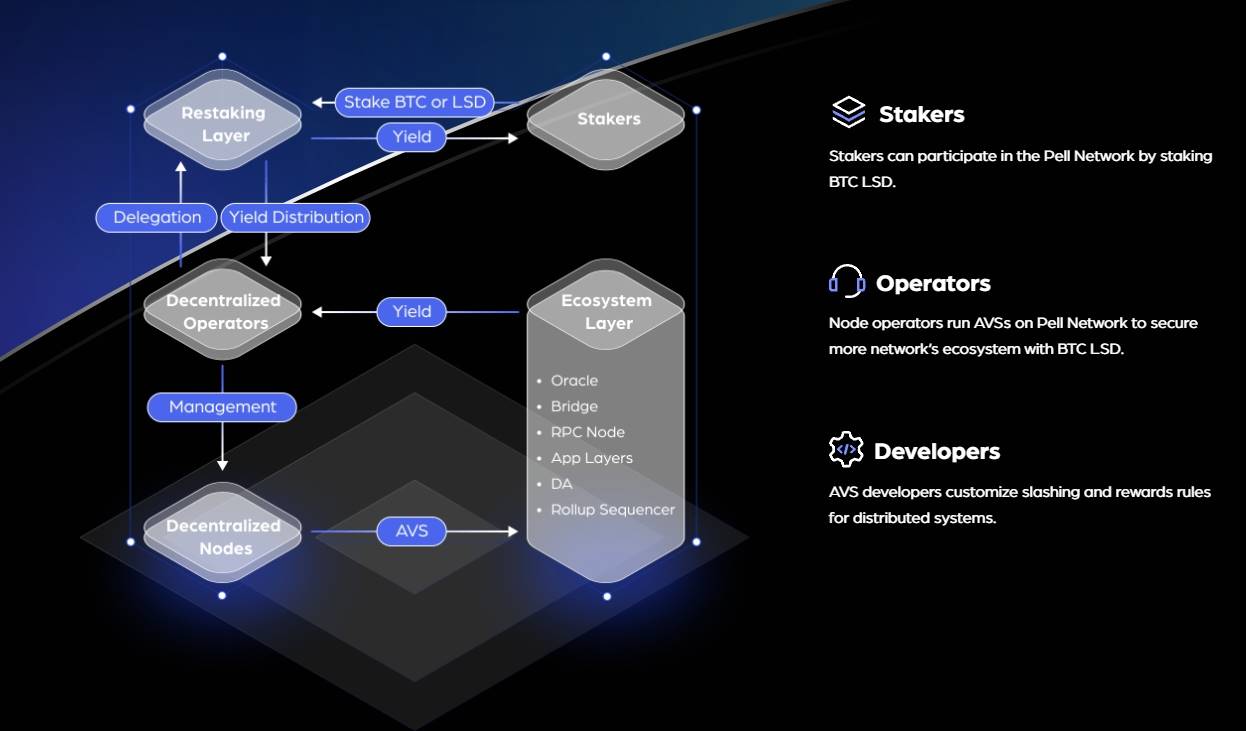

Specifically, Pell Network’s ecosystem consists of three main roles: stakers, operators, and developers.

Stakers can either directly stake their assets to Pell Network and run nodes themselves or delegate to agents. Delegated agents operate the validation nodes and charge fees; both stakers and agents earn rewards, while those failing their duties face penalties. Operators manage and run AVS networks using BTC LSD to strengthen security. Developers focus on designing and tuning slashing and reward mechanisms for decentralized systems to ensure secure and orderly operation.

To maximize the use of staked assets in supporting AVS and further alleviate concerns about whether expected revenues can cover operator costs or whether operators have sufficient computing resources, Pell Network introduces another clever design: a layered AVS architecture.

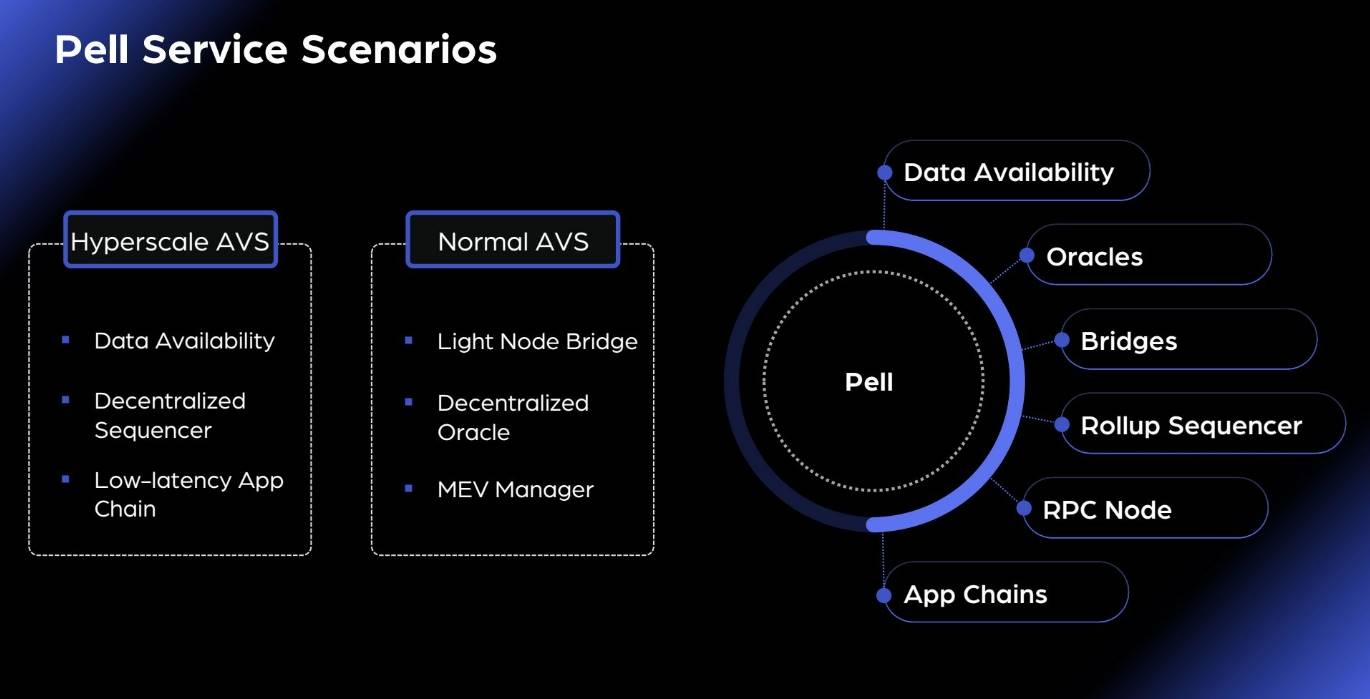

Specifically, Pell Network categorizes AVS into two types:

Large-scale AVS: The total computational workload is evenly distributed across all participating operator nodes. For example, in a large-scale data availability protocol, data is split into N chunks, each sized at 2/N of the original, making total storage cost comparable to storing data on just two nodes. This way, individual node processing demands remain low, yet the system achieves high throughput by aggregating performance across multiple nodes—while achieving greater decentralization.

Lightweight AVS: Designed for tasks that are frequently repeated but extremely low-cost—such as verifying information via light clients or validating zero-knowledge proofs. These require minimal computation and infrastructure, making them ideal for deployment on Pell Network.

Thanks to this tiered design, AVS can be tailored according to their capabilities and needs, ensuring even solo validators can achieve substantial economic returns. Wider participation also helps mitigate centralization risks. So far, Pell Network has successfully attracted cooperation intentions from over seven well-known node operators. With the testnet launch approaching, more node operators and AVS are expected to register and join.

Thus, Pell Network’s vision and solution for unlocking Bitcoin’s formidable security to establish a cross-chain consensus layer come clearly into view. From product architecture to multi-party benefits, Pell’s sophisticated design gives it a unique position in both restaking and security sharing—advantages deeply rooted in its profound understanding of the broader ecosystem landscape.

Truly Sharing Bitcoin’s Strongest Security Foundation: Pell’s Uniqueness and Necessity

It’s widely known that security is the most fundamental requirement for ecosystem establishment and prosperity. Yet building a robust security foundation is far from easy for most projects and practitioners:

Some projects attempt to build entirely new trust networks, but recreating consensus mechanisms fragments trust further and achieving meaningful decentralization is costly and time-consuming. Others choose to build atop mature L1 or L2 blockchains to inherit their security, but this comes with trade-offs—high development costs, reduced flexibility, and loss of autonomy due to compliance with host chain governance rules.

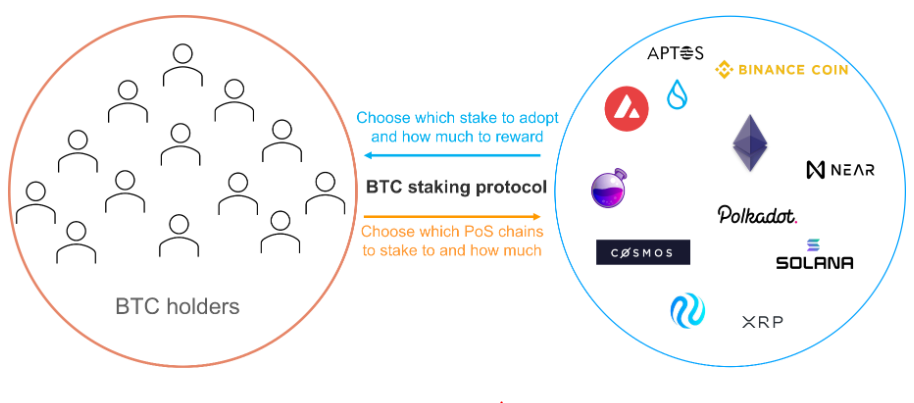

As the pioneer of the crypto industry, Bitcoin boasts the strongest security: a mature and stable consensus mechanism, the broadest global adoption, and an asset base exceeding $1.3 trillion. Its extensive decentralization further raises the cost for attackers attempting to control the network. If more projects could share Bitcoin’s unbreakable security foundation, developers could focus on innovation and feature expansion, accelerating the growth of the entire on-chain ecosystem.

So, how do we unlock the immense value of this “strongest security”? Facing this question, Ethereum—often seen as the “second safest” chain—offers inspiration through EigenLayer’s concept of empowering AVS. However, successful models should be adapted, not copied—a principle especially relevant when building a Bitcoin-native version of EigenLayer:

On one hand, EigenLayer’s design is inherently optimized for the Ethereum ecosystem. Supporting non-Ethereum systems introduces challenges around cross-chain staking, slashing, and governance.

On the other hand, since the goal is to share Bitcoin’s strongest security, using BTC itself as the staking asset is the most natural choice. This enhances credibility among Bitcoin believers. Moreover, BTC is significantly less volatile than most PoS assets, greatly reducing the risk that sharp price drops could make PoS chains vulnerable to attacks—making BTC-based shared security solutions more attractive.

However, a critical issue remains: Bitcoin’s PoW consensus does not natively support staking rewards. Previous attempts to generate yield from BTC relied on wrapped tokens, CeDeFi, or cross-chain bridges—all involving trust assumptions. WBTC requires trusting a centralized custodian; sidechain BTC often depends on a multisig committee—none truly share Bitcoin’s security foundation.

The turning point came with Babylon: Babylon uses staked BTC to help secure PoS chains and validate transactions, while PoS chains provide security rewards to Babylon and BTC holders. This innovation enables native, risk-free PoS-like yields for BTC, providing a stronger foundation for BTC-backed shared security solutions. Yet, one major gap remains for supporting large-scale AVS:

Babylon primarily serves PoS chains, especially within the Cosmos ecosystem, because Bitcoin timestamping relies on IBC to relay messages between Babylon and Cosmos chains—limiting its applicability. Lightweight AVS cannot fully utilize Babylon for security, so it cannot serve as a universal AVS solution.

Babylon made non-stakable BTC stakable—achieving the crucial leap from 0 to 1. But how do we enable the entire industry to share Bitcoin’s formidable security and drive BTCFi from 1 to 10—or even 100? Pell Network aims to build the first universal security network based on Bitcoin restaking, empowering all AVS across the industry to leverage Bitcoin’s unmatched security. Based on this solid foundation, users, AVS, the Bitcoin ecosystem, and the broader industry will all benefit.

AVS Builds Ecosystem Infrastructure, Fueling the BTCFi Summer Surge

A healthy ecosystem creates value not only by benefiting all participants but also by accumulating long-term momentum for the industry. Pell Network’s universal security network, built on Bitcoin restaking, exemplifies this principle.

For users, the appeal of joining Pell Network lies not only in earning points but in actively contributing to the construction of the industry’s security foundation—an involvement that unlocks additional earning potential.

First, by participating in staking on Pell Network, users earn point rewards. These points recognize user participation and will be closely linked to future token airdrops, offering additional value.

Second, stakers collectively form a powerful security layer that empowers AVS to deliver higher-quality services, enabling dApps to operate more securely and efficiently. Revenue generated from upper-layer applications is then funneled back to stakers via predefined mechanisms. A breakout dApp could bring substantial hidden rewards to users, and as dApp user bases and transaction volumes grow, staker earnings increase accordingly.

For AVS providers, Pell Network offers a low-barrier, robust security foundation, freeing developers to focus on business logic rather than underlying security architecture.

More importantly, Pell Network achieves cross-chain interoperability at the architectural and technical levels. AVS built once can be deployed across multiple chains—making Pell Network fertile ground for new AVS and delivering better infrastructure to the cross-chain ecosystem.

For example, Pell Network can rapidly build economically secure oracle networks. Developers no longer need to build standalone AVS layers but can instead focus on data processing and delivery. Powered by Pell’s security infrastructure, oracle networks can operate more efficiently and reliably, ensuring data accuracy and timeliness.

Or, leveraging Pell Network’s restaking mechanism and community strength, a high-efficiency, low-cost large-scale data availability layer can be constructed, providing robust data support for diverse dApps and ensuring data accessibility and integrity.

Additionally, using Pell Network’s message-passing mechanism, building lightweight cross-chain bridges becomes much easier. Stakers can verify cross-chain signatures off-chain. If a discrepancy is challenged and proven, validators in Pell Network are slashed in a slow mode (non-optimistic), effectively safeguarding the security and reliability of cross-chain operations.

Other potential AVS use cases include ultra-low-latency appchains, privacy-preserving DeFi protocols, blockchain games, Web3 AI applications, and RWA platforms. Through these applications, Pell Network aims to deliver more diverse and efficient services to the blockchain ecosystem, accelerating innovation and growth.

The novel AVS services emerging from Pell Network will fill long-standing infrastructure gaps in the Bitcoin ecosystem, further advancing BTCFi’s development.

For the Bitcoin ecosystem, Pell Network’s cross-chain interoperability marks a major breakthrough. Seamless connectivity with other blockchain networks allows BTC to flow more efficiently across chains, expanding beyond single-chain use cases and enabling wider applications throughout the blockchain ecosystem for optimal asset allocation and utilization.

Moreover, the AVS network built by Pell Network genuinely shares Bitcoin’s security foundation. This enhanced security boosts user confidence in the Bitcoin ecosystem and creates a favorable environment for Layer 2 solutions and dApp development. Developers can concentrate on product innovation and UX improvements, and better products attract more users—creating a virtuous cycle that drives ecosystem growth.

Beyond Bitcoin, the cross-chain nature of AVS brings clear benefits to developers across other ecosystems. A security layer backed by Bitcoin is stronger than any other. By enabling universal access to Bitcoin’s security, Pell Network provides developers industry-wide with a more reliable and efficient environment. They can focus on product innovation and user experience, launching high-quality products faster and accelerating market responsiveness.

With the widespread adoption of AVS services, the on-chain ecosystem is set for unprecedented prosperity. Developers can build innovative applications on a powerful security foundation, enriching blockchain diversity and attracting more users and capital—fueling rapid maturation of the entire ecosystem.

$300 Billion Growth Potential: How to Participate in Pell Network?

As an enhanced version of EigenLayer for Bitcoin, Pell Network holds immense growth potential. First, in terms of asset scale: Ethereum’s market cap is around $400 billion, while Bitcoin’s exceeds $1.5 trillion—highlighting Bitcoin’s greater potential for ecosystem expansion.

Further analysis shows that ETHFi currently stands at approximately $80 billion. Applying a similar ratio, BTCFi could reach $300 billion. This massive projected market size not only underscores BTCFi’s vast potential but also suggests that Pell Network, as a key driver of BTCFi growth, occupies a space rich with opportunity and expansive market reach.

Notably, while EigenLayer focuses mainly on Ethereum, Pell Network offers universality and cross-chain advantages—enabling support for a broader range of applications. This wider service scope gives Pell Network stronger momentum in future development. Consequently, many community members believe holding Pell Network positions offers strong return potential.

So how can one effectively accumulate Pell Network positions?

First and foremost: don’t miss out on points.

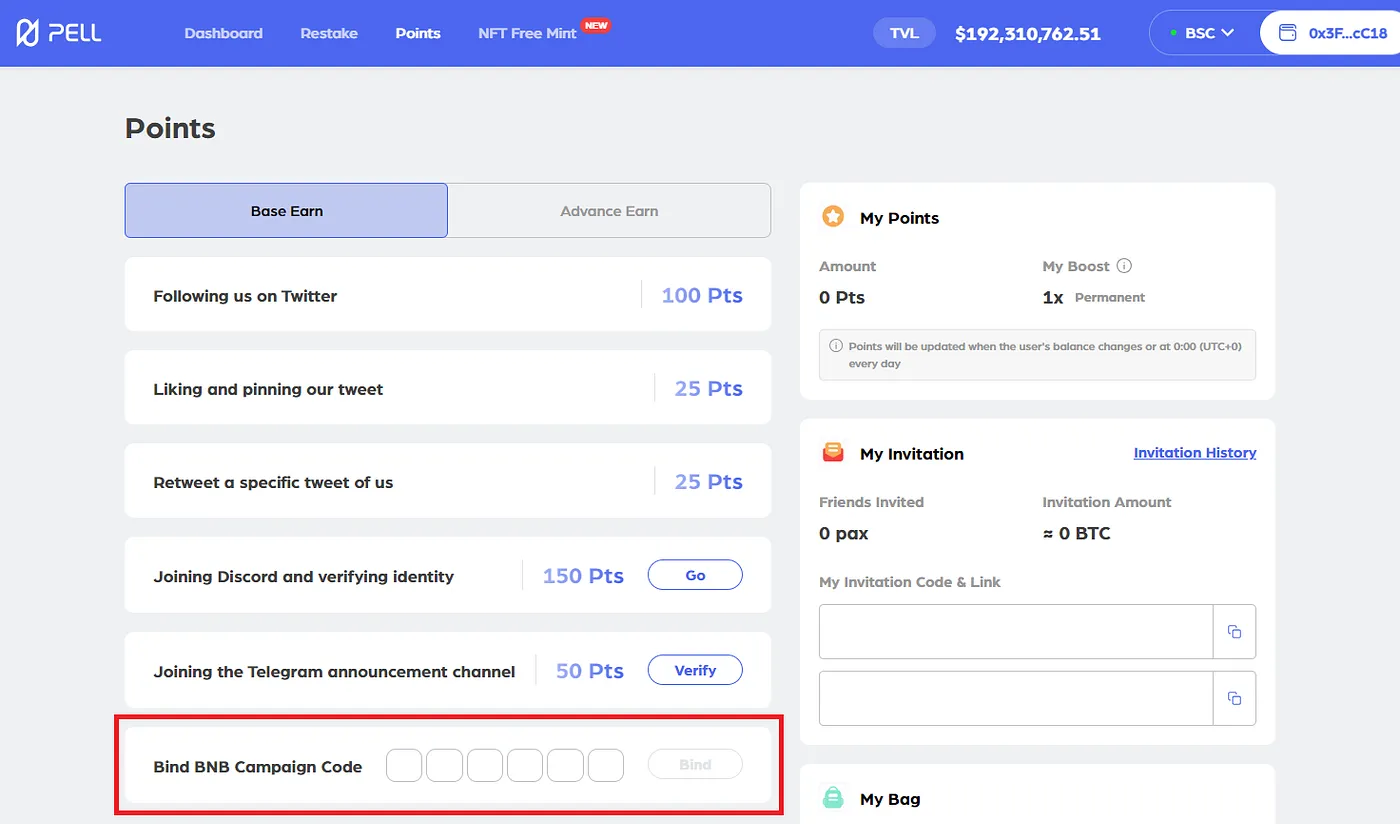

With the token not yet launched, Pell Network’s ecosystem rewards are currently distributed as points. The Pell Points Program targets $10 billion in TVL. Users earn base points by completing tasks such as following Pell on Twitter, joining Discord and Telegram, making an initial deposit over 0.001 BTC, or staking over 0.01 BTC continuously for 14 days. Additional point bonuses are available for participating in the Bitlayer Mining Festival, staking through partner projects, or inviting friends.

During the recent Bitlayer Head Miner Festival, Pell Network—acting as a partner—offered $3.75 million in rewards to participants, including 30,000 Pell Points and 1.5x permanent point cards, sparking broad community engagement.

As part of standard marketing strategy, these points will be linked to future token airdrops and represent various ecosystem rights. Before token launch, accumulating more points equates to holding more token-equivalent positions.

Additionally, two major incentive campaigns are currently underway, offering users rich rewards.

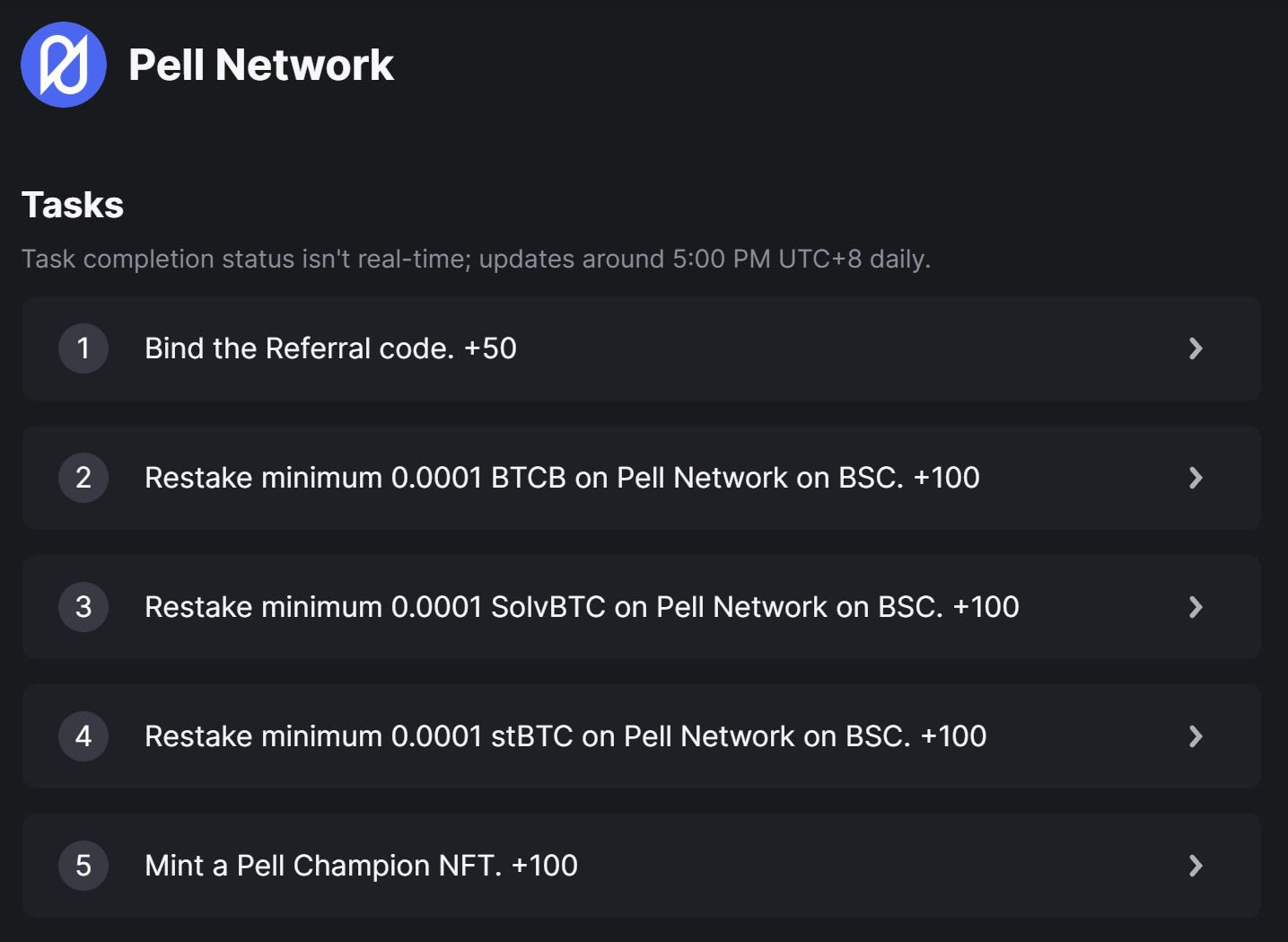

The first is the “TRAIN LIKE A CHAMPION” campaign, co-hosted by Pell Network, BNB Chain, and over 15 top-tier projects in its ecosystem:

Celebrating the opening of the 2024 Summer Olympics, the event runs from July 24 to August 14. Participants connect their wallets, mint AI NFTs, and complete project tasks to earn points. The top 5,000 point earners will share a $250,000 prize pool, and users with over 500 points can enter a lucky draw worth $100,000. Over 10,000 users have already joined.

Specifically, participants must join the Pell Network Discord #bnb-code channel and enter the command "!bnb" to get the event code, then input the code on the Pell page to complete registration.

After registering the referral code, participants earn event points and mint a Pell Champion NFT by restaking at least 0.0001 BTCB (BounceBit), 0.0001 solvBTC (SolvBTC), and 0.0001 stBTC (Lorenzo) on Pell.

Click here for full details on the BNB Chain Campaigns

The second major event is the Yield Carnival, jointly hosted by Pell Network, Bitlayer, and Bedrock. Running from July 25 to August 25, users can participate in two ways.

Option 1: Go to Bedrock’s Minting page, select the Bitlayer chain, and mint uniBTC using WBTC/BTC, then stake uniBTC with Pell.

Option 2: Visit Pell's Stake page, select Bitlayer chain, and stake WBTC/BTC directly with Pell Network. Pell will collaborate with Bedrock to mint an equivalent amount of uniBTC and deposit it into Pell’s restaking vault. After Babylon launches, Bedrock will stake the BTC on Babylon to earn Babylon staking rewards for users.

Participants can earn multiple rewards including Bitlayer points, Bedrock Diamonds, Pell Points, and future Babylon staking yields. Additionally, social media giveaways will be held during the event—users are encouraged to follow Pell’s official Twitter for updates.

Click here for full details on the Yield Carnival

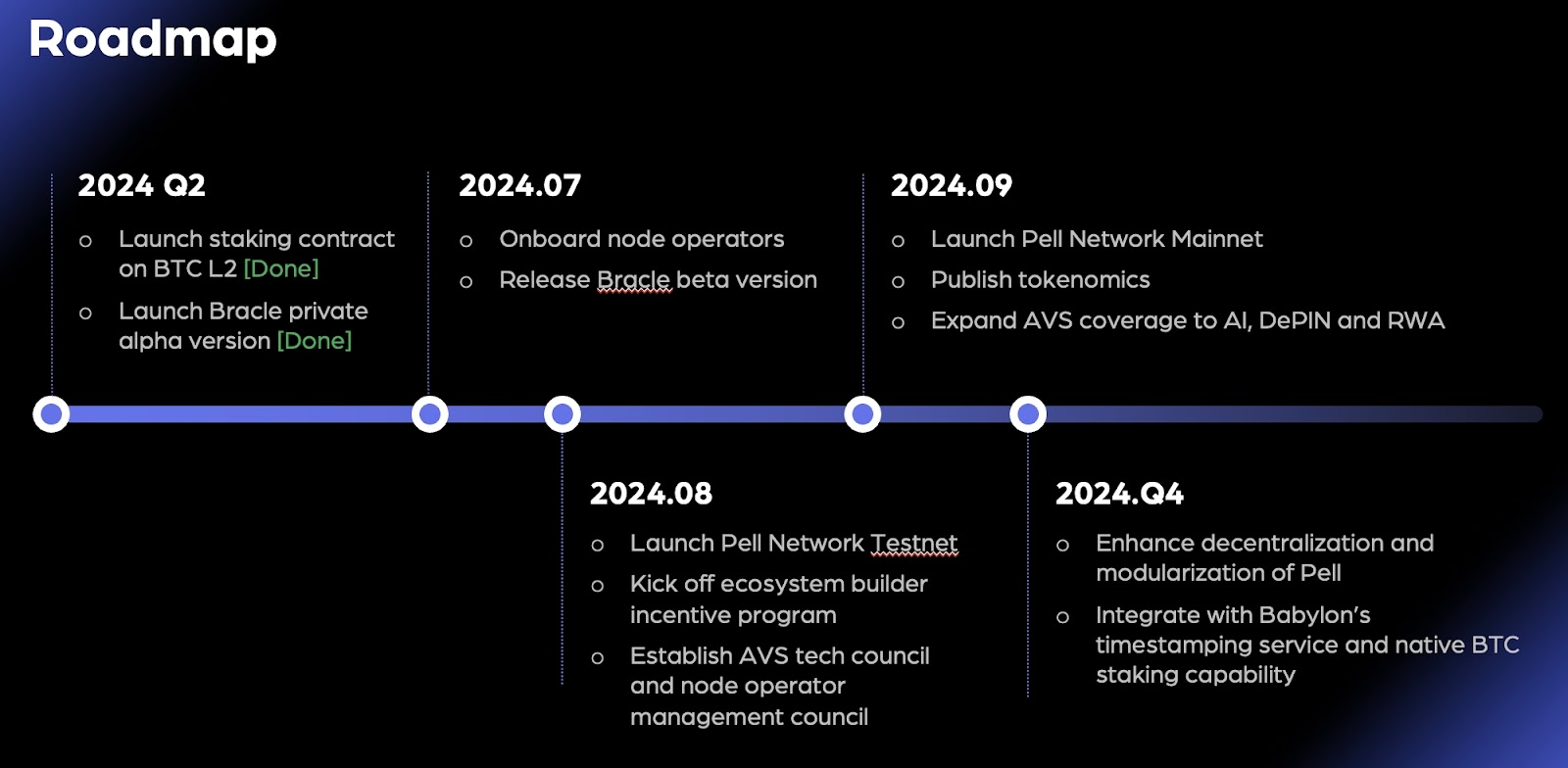

These concurrent events aim to provide diverse earning opportunities through a vibrant ecosystem, encouraging users to explore its mechanics. Notably, according to Pell Network’s official roadmap, the testnet will launch in early August. At that time, AVS registration will open, accompanied by incentive programs to encourage mass participation. This will allow Pell Network to test and refine its applications and services.

Beyond the testnet, Pell Network continues to advance key milestones systematically.

In August, Pell Network will launch an Ecosystem Builder Incentive Program to attract more developers, and establish an AVS Technical Committee and Node Operator Management Committee to accelerate AVS network deployment.

In September, focus will shift to mainnet launch and the release of the tokenomics model, expanding AVS coverage into AI, DePIN, and RWA domains.

In Q4 2024, Pell Network will work to enhance decentralization and modularity, integrating with Babylon’s timestamping service and native BTC staking functionality.

Conclusion

For years, BTCFi users have held vast amounts of Bitcoin, yet due to the lack of efficient utilization tools like those on Ethereum, most BTC assets remain idle in cold wallets—leading to a broad consensus that the BTCFi sector remains underdeveloped.

Given this, if Bitcoin’s foundational infrastructure can be better leveraged to generate yield while ensuring asset security, BTCFi could experience explosive growth—potentially surpassing Ethereum’s historical peak.

Targeting this trillion-dollar market, Pell Network’s solution doesn’t focus on building a single product but on creating a decentralized free market for trust. It offers diversified权益 options and restaking mechanisms to enhance Bitcoin’s economic and security utility, while supporting both lightweight and large-scale decentralized components. This delivers cost-effective infrastructure and security solutions for the Bitcoin ecosystem, driving exponential growth. Meanwhile, the broader industry gains access to Bitcoin’s security foundation via Pell’s AVS network, unlocking new possibilities for on-chain innovation.

Although Pell Network’s mainnet has not yet launched and its future performance remains to be seen, its pre-launch achievement of over $190 million TVL and 360,000 unique addresses already signals strong market positioning. With ongoing testnet activities, multi-chain expansion, and campaigns like the BNB Chain Campaigns, we look forward to more exciting developments from Pell Network in the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News