Layer3 in the Attention Economy: How Will $21.2M in Funding Drive Full-Chain Identity Transformation?

TechFlow Selected TechFlow Selected

Layer3 in the Attention Economy: How Will $21.2M in Funding Drive Full-Chain Identity Transformation?

Layer3 is not just a platform, but an experience of a completely new token economic model, showcasing the fusion of GameFi and a novel attention economy.

Author: Shisi Jun

Recently, a funding round co-led by ParaFi and Greenfield Capital caught my attention. At first glance, I thought it was just another task platform, but the fact that it raised $250K in 2021, $370K in 2022, and then jumped to $15M in 2024 made me wonder—what exactly is Layer3 building, and why is it gaining such momentum?

1. Overview

We’ve witnessed an explosive growth of on-chain communities, where tokens serve as the most powerful tool—they provide shared purpose, goals, and interests.

However, when token prices drop, these communities often collapse.

In other words, during periods of inflated value, it becomes difficult to distinguish whether participants are driven by genuine interest or mere speculation. As a result, they gradually drift away from the community.

At the core of Web3 projects lies the challenge of capturing user attention in an increasingly fragmented environment. Relying solely on internal marketing efforts is often ineffective. In today’s airdrop-driven culture, platforms like Layer3—note, not referring to a Layer-3 blockchain, but an application built on public chains—are emerging as aggregators and distributors of attention. By establishing cross-chain identity infrastructure, Layer3 enables both users and project teams to access the resources they need.

It not only offers new users an engaging way to enter the Web3 ecosystem but also encourages existing users to explore new protocols and applications.

Therefore, Layer3 is more than just a platform—it represents a new model of token economics, blending GameFi with a novel attention economy. Through a triad strategy—attention economy, cross-chain identity, and token distribution protocol—it aims to unlock trillions in market value.

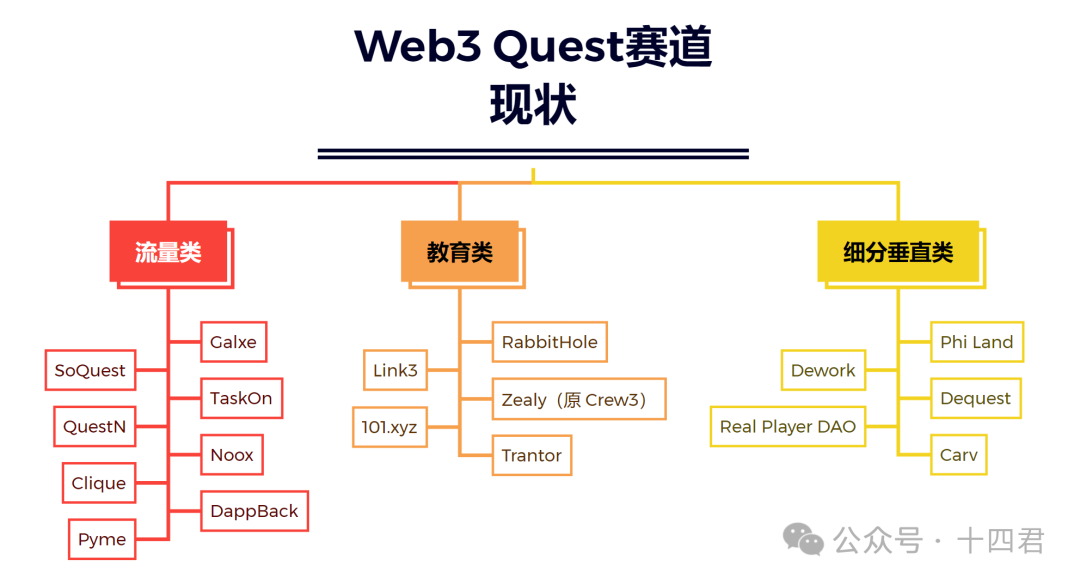

2. Current State of the Web3 Task Platform Landscape

The marketing needs of Web3 projects have driven rapid development in task platforms, which can be categorized into three types: traffic-focused (e.g., Galxe, SoQuest, TaskOn), education-focused (e.g., Layer3, RabbitHole), and vertical-specific platforms (e.g., Phi Land, Dework). More examples are listed in the table below.

[Overview of projects across categories]

Traffic platforms drive user acquisition through tasks, educational platforms deepen users’ understanding of crypto projects, while niche platforms focus on specific domains. Overall market enthusiasm has cooled, with second-tier platforms experiencing slower growth amid competition from top players and challenges around homogenization. Increasing user engagement and combating bot activity remain key hurdles. Monetization models are still underdeveloped; future competition will center on innovation and user conversion.

Platforms must evolve into long-term traffic reservoirs, improve user experience, and build unique monetization strategies. A critical path forward lies in reuniting communities through aligned incentives, thereby consolidating value.

Most Web3 airdrops represent a blend of future incentives and community participation, leveraging token scarcity to increase perceived value. However, building value purely on future consumption isn't sufficient for sustainable project growth.

As Thomson pointed out, one of the internet’s key issues is abundance—there’s a new kind of power in making sense of this abundance, indexing it, and finding needles in haystacks. That power currently resides with Google.

Likewise, Web3 is also an abundant world—but until now, no one has effectively aggregated this abundance within the Web3 ocean. Today’s communities struggle to identify or reward their most active members, leading to wasted contributions.

Interestingly, amidst ongoing evolution, some have begun recognizing the importance of attention—attention as soulbound to tokens, using participation records to aggregate high-quality Web3 resources so individuals and projects can discover each other through shared traits.

More broadly, how do we build a new economic model around attention and create social graphs based on attention resources—this vision promises higher value for every participant.

Why does this matter?

Because creators in Web3 need to know who their content resonates with. Let’s now examine how Layer3 envisions the future:

3. How Layer3 Works

3.1 For End Users (C-side)

Web3’s core value has always been: returning data and value sovereignty to individuals.

As a cross-chain identity infrastructure platform, Layer3 embodies this vision—maximizing the commercial value of data while ensuring it originates from real individuals and returns value back to them.

For ordinary users, the main concerns are:

-

How to find high-value projects suited to me?

-

How can I generate continuous income from my personal data?

These are essential conditions for the platform to sustainably generate value. Let's briefly explore how Layer3 addresses them.

Layer3’s task system is designed with depth and breadth:

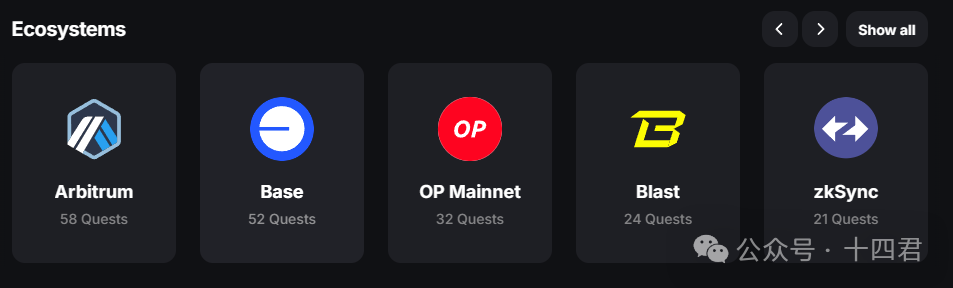

Breadth: Layer3 organizes tasks by ecosystem—each major ecosystem forms a category, with multiple tasks within each.

Depth: Within each category, tasks follow a gamified progression system. Tasks of varying difficulty offer different XP and rewards. Each completed task mints a chain-linked NFT called a CUBE, recording the user’s journey and data.

For users,

We can quickly subscribe to all projects we care about. By tracking project热度 and overall task completion rates, we gain insights into a project’s potential, enabling quick identification of high-potential opportunities.

Earlier, we mentioned minting a CUBE upon completing a task—this serves as your on-chain identity and opens revenue streams. When developers or projects access your CUBE data, they pay a fee, part of which flows back to the ecosystem. Earnings depend on your platform activity—the more active you are, the greater your rewards, creating a “the harder you work, the luckier you get” wealth-building mechanism.

Finally, there’s multiplicative benefit: via Layer3’s ecosystem, completing tasks earns CUBEs, which factor into Layer3’s airdrop eligibility. Additionally, many high-potential projects yet to launch airdrops are already featured on Layer3. Early participation increases chances of receiving larger allocations later—enabling one action to yield multiple rewards.

3.2 For Project Teams (B-side)

In Web2, targeted advertising relies on users’ historical behavior data, enabling personalized ad delivery.

Simply put, this is powered by credential data and big data analytics—one of the most important applications of digital credentials.

Web3 is no exception.

Moreover, blockchain’s traceability and immutability make it even more suitable for creating and tracking credential data. On-chain credentials include, for example, a lending history without liquidation events, or liquidity provision records in an LP pool.

Such behavioral credentials significantly aid project operations and promotion.

Project Galaxy team noted: "Digital credentials are crucial due to their high-frequency use cases. Protocol developers can use credentials to calculate credit scores, identify target audiences, and reward contributors. As Web3 and DAOs grow, participant behavior data will explode. Project Galaxy will provide the necessary infrastructure to help new participants establish vital digital credentials."

So how does Layer3 collect on-chain credentials? And how does it empower project teams? We’ll explore this from several angles.

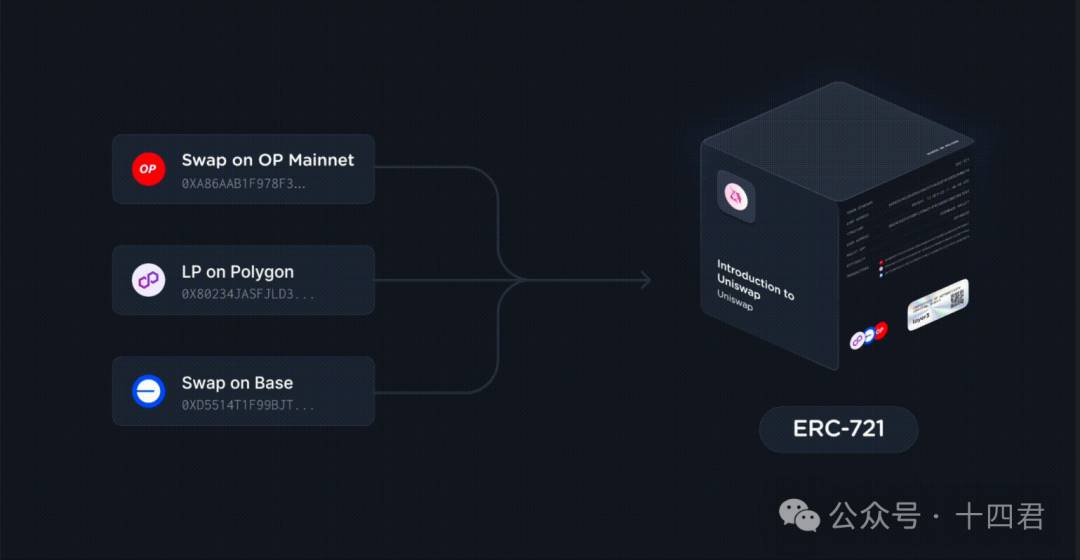

1. CUBE Credentials

On-chain credential data resembles real-world resumes—recording individual actions. On Layer3, user profiles are stored as CUBEs in ERC-721 token format.

Each CUBE contains information about tasks completed across various apps, chains, and ecosystems. These credentials help explorers unlock new opportunities and allow protocols to identify high-quality users.

For users, minting CUBEs unlocks rewards within Layer3’s attention economy—tokens and dynamic task rewards. This incentivizes active participation, generating more credential data.

These cross-chain CUBE data sets are, in fact, attention assets.

Why? Because every on-chain participant has unique interests. If project teams can effectively identify and access these attention resources, they can deliver targeted promotions and incentive campaigns—expanding market share and strengthening their position.

Layer3 builds this resource into foundational infrastructure—any organization in need can access these attention assets by creating open identities, incentives, and interface networks owned by participants.

2. More Integrated Tools

Any project integrating with Layer3 can seamlessly embed its experience into their native website with just two lines of code.

Furthermore, anyone can paste a link onto blogs, technical guides, or internal docs to embed tasks or Streaks—no additional coding required!

This is an ultra-low-cost promotion method for small teams. By interoperating with Layer3’s vibrant ecosystem—and leveraging attractive rewards, social features, and partnerships—they can directly attract users to their own platforms.

Layer3 also integrates a full suite of tools needed for tasks. For instance, if you need to perform an official task on Chain A but your assets are idle on Chain B, you can use Layer3’s integrated cross-chain bridge to move assets. Notably, cross-chain operations themselves count as beginner-level tasks on Layer3—making it a training ground that helps onboard newcomers and turn them into experienced users.

What remains for project teams are informed, discerning users—more cautious, yet more committed and active.

3.3 Summary

Layer3 is neither purely ToC nor ToB—it acts as a bridge connecting both sides, offering a warm and efficient platform where users and projects can meet, understand each other, and find the right "match."

Layer3 has a beautiful flywheel: new protocols bring new users, and new users attract more protocols—forming the foundation of crypto marketing solutions.

Even when initiatives or airdrops occur outside Layer3’s infrastructure, contributors still curate and incentivize them for user exploration—providing a global entry point for every ecosystem.

4. Layer3’s Token Economics

4.1 Why Is Token Economics So Important?

The development of any Web3 project hinges on one fundamental relationship—supply and demand.

Tokens form the base layer, so token economic design is critical—it shapes both short-term and long-term supply-demand dynamics. A well-designed token economy ensures long-term token value and establishes a foundation for sustained value creation.

For an in-depth discussion on tokenomics theory and function, see: *Understanding Token Economics* (see appendix)

4.2 Exploring Layer3’s Token Economic Model

As the first platform to build cross-chain identity infrastructure rooted in the attention economy, I’d like to analyze its economic model from two perspectives:

-

How does Layer3’s economic model ensure long-term sustainability?

-

How does its economic model deliver tangible benefits to users?

As an infrastructure platform aggregating attention resources, sustainability depends on delivering value to both end users and project teams—ensuring users earn while projects receive high-quality traffic.

Below is my summary of Layer3’s economic model:

We’ll examine the economic model across three dimensions: token supply, utility, and distribution.

There are multiple frameworks for analyzing token models. For further reading, see: *Token Economics: Analyzing Token Models of Mainstream Web3 Projects* (see appendix)

1. Token Supply

[Tip: current market cap and circulating supply are estimates]

It should be emphasized that Layer3 adopts a deflationary economic model.

As previously mentioned, token value is influenced by supply and demand. To prevent a token from becoming a worthless "air coin," three factors are crucial—but the most important is the burn mechanism: continuously reducing supply leads to deflation; increasing supply leads to inflation.

This is determined at the protocol level. Layer3’s burn mechanism operates on two levels:

From the user perspective:

-

Under Layer3’s design, user behavior is tied to burning mechanisms—users can burn L3 tokens to gain privileges within the ecosystem. For example:

-

Early access to newly listed project tasks, securing advantageous timing.

-

Discounts and preferential rates on task-related or transaction fees.

-

Burning L3 tokens to obtain exclusive NFTs.

-

These designs incentivize users to burn tokens. In this model, users gain benefits while the platform maintains deflationary pressure.

From the community perspective:

-

Compared to retail users, the community plays a larger role in ecosystem regulation. In financial markets, token value doesn’t rely solely on scarcity—it also requires good liquidity, whose essence is trading. So how does the model balance liquidity and scarcity?

-

Maintaining scarcity is straightforward—similar to the user side, community actions require burning L3 tokens. These actions include launching tasks, deploying incentives, and accessing CUBE credentials. Additionally, submitting governance proposals and voting also require burning L3 tokens.

-

And liquidity? It’s simple too—the essence of liquidity is buying and selling. Since user actions are tied to burning, community actions are tied to both burning and purchasing. The model mandates that certain community activities require buying and burning L3 tokens.

-

Purchasing naturally implies a seller side. Notably, aside from the community, only users, issuers, and investors hold large token amounts—but issuers and investors face vesting schedules. Thus, currently circulating tokens are mostly held by users. This makes users the primary source of sell-side volume, opening new income possibilities.

Layer3’s dual burn mechanisms maintain a deflationary model from both circulation and holdings perspectives, creating positive price feedback loops.

A high-value ecosystem attracts users, while burn mechanisms counteract inflationary pressure from linear time-based unlocks. A stable economy supports long-term project development.

Moreover, deflationary burns involve value transfer—from projects and communities to users—creating tangible user earnings and a new form of economic value.

2. Token Utility

Token utility reflects token value—does it have real use cases? Can it attract more participants? This defines the demand side.

My greatest concern regarding Layer3’s economic model is value accrual—a key indicator of model quality, as it directly ties to user earnings.

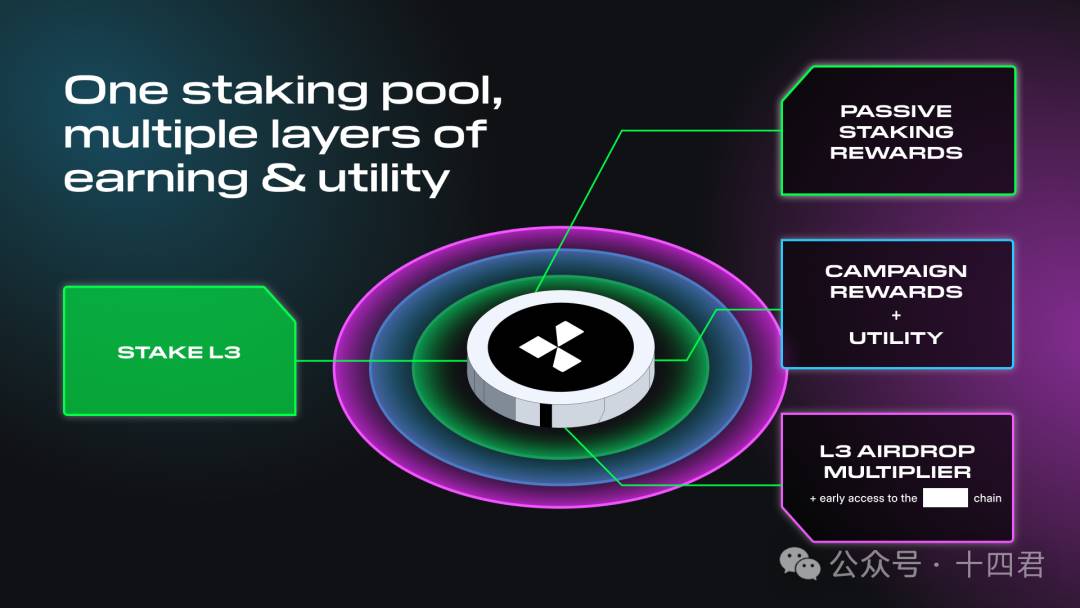

L3’s utility philosophy centers on aligning token value with network growth and user engagement. To achieve this, Layer3 introduces an innovative staking model called tiered staking.

Key design aspects include:

-

Passive rewards calculated based on staked amount + staking duration.

-

Active participation boosts reward multipliers, enhancing community stickiness and preventing large holders from being passive.

Regarding point one, under L3’s model, users can perform liquid staking, providing LP for the ecosystem and earning passive LP rewards. User trustworthiness is also factored in, creating a mutually beneficial relationship. Rewards aren’t based solely on stake size—duration is a key multiplier. Long-term committed users earn more than short-term farmers.

Point two is, in my view, the most interesting aspect. Most platforms base rewards solely on stake size, occasionally considering time. While this retains long-term users, it doesn’t guarantee quality or rich behavioral data.

In L3’s model, activity level directly impacts earnings—so a large but inactive holder earns less than a smaller but highly active one.

This encourages users to actively participate in platform activities to earn doubled rewards and airdrop benefits—an innovative way to boost user quality and retention.

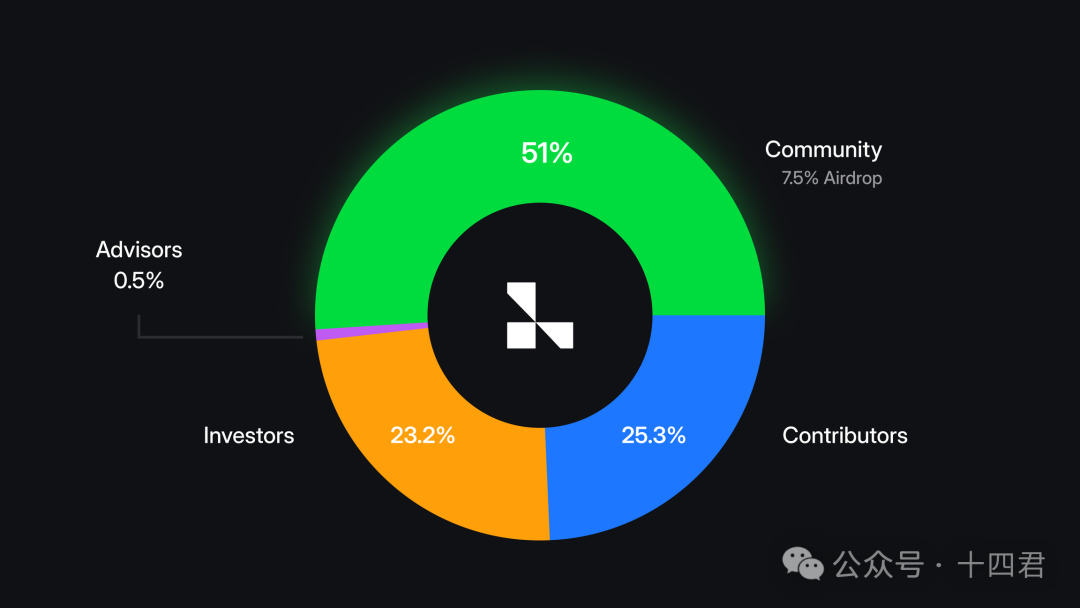

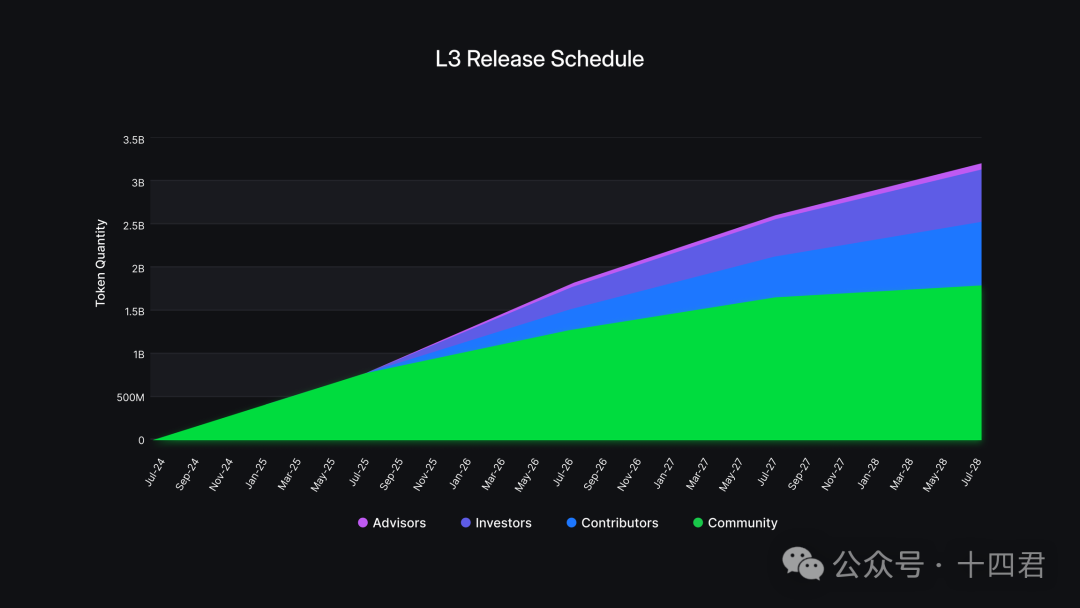

3. Token Distribution

Token distribution reflects fairness and the team’s confidence in long-term success. Key considerations include: holder composition and allocation ratios, and release schedules.

Layer3’s token allocation balances interests among community members, core contributors, investors, and advisors, ensuring fairness and long-term viability. Lock-up periods and gradual release mechanisms prevent market volatility and strengthen stakeholder confidence in long-term success. Overall, this structure supports sustainable development while balancing competing interests.

For detailed distribution breakdown, read: *Distribution of Layer3 Foundation* (see appendix)

Notably, after cliff periods, vesting occurs daily rather than monthly or quarterly.

Large unlocks after long waits may trigger prisoner’s dilemma behavior—holders rushing to sell for optimal pricing.

Daily vesting allows gradual trading, eliminating panic dumps.

4.3 Holistic Review

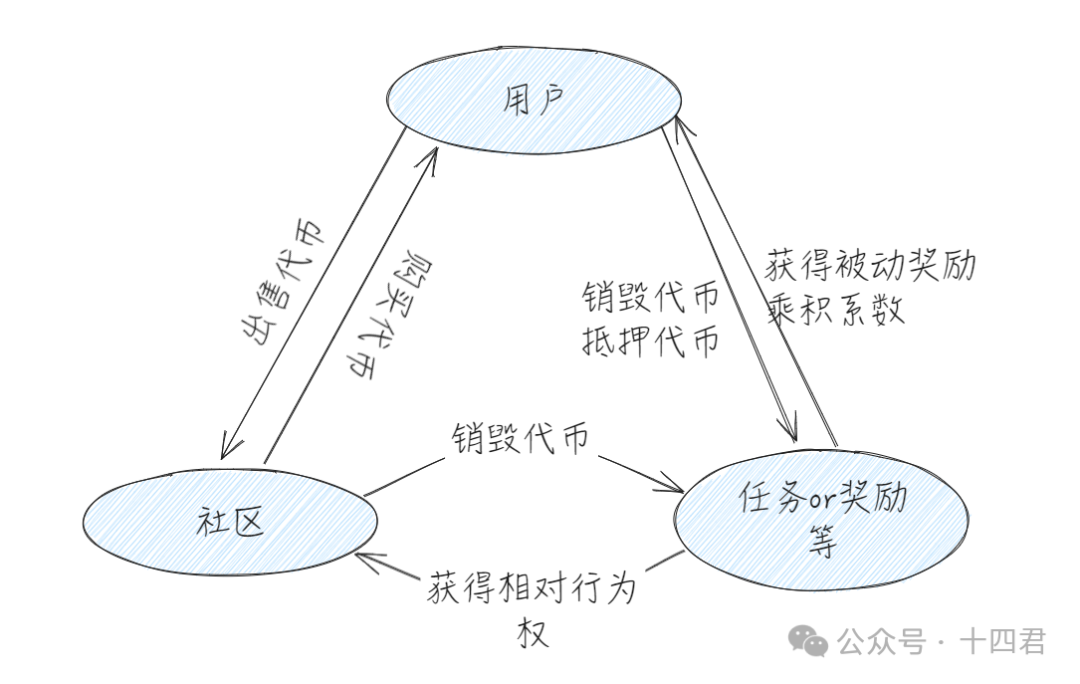

Let’s step back and examine the entire economic flow. Layer3’s model resembles a stable triangular framework with three core pillars:

-

Users, communities, and institutions form a buy-sell market, giving tokens inherent value through circulation.

-

A pure buy-sell model lacks resilience against market risks—especially inflationary pressure from linear unlocks flooding the market. To counter this, the model links tasks, rewards, and burn mechanisms, using community activity to absorb excess supply.

-

The platform’s core lies in user traffic and quality. A sound economic model must therefore support full-cycle incentives—from acquisition to activation. This is achieved through the formula: Rewards = Passive Income + (Other Rewards × Multiplier).

Analyzing the model reveals that L3’s token economy must possess three key elements: a rational staking mechanism, diverse use cases, and steadily growing passive yields.

It’s worth noting that token economics is vital—but a good model cannot rely solely on the project itself, or else the token becomes a useless "air coin." Beyond being self-sustaining within its ecosystem, a strong token model must adapt to external market risks amid the fast evolution of Web3 projects. The relationship between project and economic model isn’t parasitic—it’s symbiotic and co-evolutionary.

5. Conclusion

The Web3 task platform space continues to evolve with dynamic innovations worth exploring. As frontline tools driving project growth, they efficiently foster ecosystem prosperity, provide users with information gateways, and—most importantly—deliver real benefits and engagement.

Achieving Web3 growth is never instantaneous. Projects can choose to grow alongside task platforms while acquiring traffic. Monitoring platform growth metrics helps projects make smarter decisions and lay a solid foundation for healthy user expansion.

As fragmentation grows and competition for user attention intensifies, project acquisition methods remain limited—mostly relying on joint campaigns. These often offer attractive rewards, sometimes cost-free, lacking sustainable growth drivers. Moreover, attracted users vary widely in quality and cannot be effectively segmented.

Only by building the right bridge between keys and locks—helping both sides find their perfect match—can we unlock unprecedented growth and value creation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News