The Power of Aggregation: How Layer3 is Bringing Cryptocurrency to the Masses

TechFlow Selected TechFlow Selected

The Power of Aggregation: How Layer3 is Bringing Cryptocurrency to the Masses

Layer3 can capture value while disrupting the historical relationship between advertising networks and products.

Author: JOEL JOHN AND SIDDHARTH

In March 2022, I first wrote about aggregation theory in the context of crypto. Since then, I’ve observed up close how aggregators have performed within several investment portfolios.

- Hashflow has processed over $18 billion in trading volume.

- Gem was acquired by OpenSea.

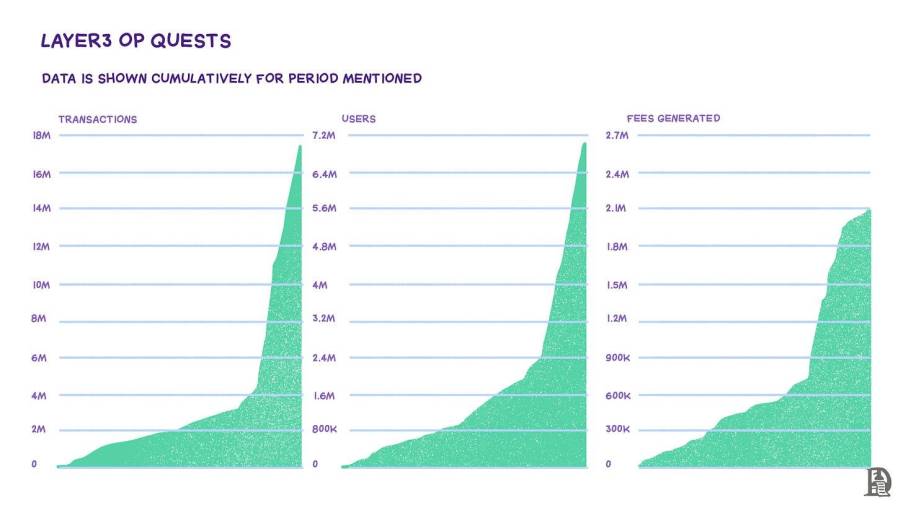

- Layer3 has scaled to 4.5 million wallets.

Layer3 is particularly special because it was my final deal at LedgerPrime before the FTX collapse. I’d like to claim this was due to exceptional foresight, but in reality, it was somewhat random. Still, in hindsight, it’s worth revisiting aggregation theory and exploring the patterns founders can leverage to scale their ventures.

In today’s story, we’re excited to partner with Layer3. They generously opened up their internal datasets and gave us access to speak with VCs and their top users. Over the past few weeks, we’ve studied how a company can become an attention magnet, much like Google in the early 2000s. In this article, I’ll first challenge some of the views I presented in 2022, then explain what differentiates successful aggregators as they build scale.

We often assume consumer apps in crypto can’t scale. Yet as a product, Layer3 has 4.5 million wallets and has completed 100 million tasks—driving nearly 120 million on-chain operations in the process. Scale is here; these stories just haven’t been widely told or studied.

Today’s article walks you through the inner workings behind such results.

The Power of Aggregation

Before the internet, the hardest part of building any product or service was reaching customers. If you made a consumer good, you could only sell it through physical stores—limiting your reach. The internet’s key advantage was its ability to aggregate global demand.

This aggregation gave rise to many household names we know today: Google, Netflix, Amazon, and Meta—all follow some (if not all) aspects of aggregation theory.

There are three key elements in any supply chain:

- Suppliers: The side of the network seeking distribution—e.g., advertisers on Google and Meta, retailers on Amazon, content creators on Netflix

- Distributors: The channel through which suppliers reach end consumers

- Consumers: The demand side—the ultimate buyers of products or services

Aggregation theory refers to consolidating supply, distribution, and demand to improve processes, reduce costs, and increase efficiency. Aggregators have three key traits:

- Direct relationship with consumers: Platforms directly own consumer time and attention. For example, users visit Amazon to buy goods or Netflix to consume content.

- Zero marginal cost to serve new users: As more users join, platforms incur no incremental cost. Spotify or Netflix can distribute content to 100 or 1 million users without added cost (excluding infrastructure).

- Network effects: Users come to the platform, making suppliers more willing to list there, increasing supply and attracting even more users. For example, users shop on Amazon, attracting manufacturers to sell there, whose diverse offerings attract more users.

Not all aggregators exhibit every trait. Amazon, for instance, incurs marginal costs per new user served.

Ultimately, aggregators capture immense value by improving efficiency and user experience across both sides of the market.

Now, let’s shift focus to crypto and examine emerging aggregators. Their supply chain looks like this:

- Suppliers: In crypto, suppliers are Layer 1 or Layer 2 blockchains and dApps with native tokens. The former seek allocation of blockspace; the latter offer products to consumers. All pursue efficient distribution to acquire users.

- Distributors: Any channel with a direct relationship to consumers—wallets, exchanges, and emerging models we’ll discuss below.

- Consumers: Developers, institutions, or retail users needing blockspace or on-chain applications.

Supply is increasingly fragmented—with hundreds of L1/L2 chains and thousands of dApps. Many have raised tens of millions in venture funding and hold treasuries worth hundreds of millions. These assets will be used for distribution, as every project competes for audience.

In a 2019 panel, Chamath Palihapitiya noted that for every dollar raised, $0.40 went to Google, Facebook, or Amazon. We believe this will repeat in crypto—except most teams will distribute native tokens instead of cash. Another way to view TAM is the value of native tokens in protocol treasuries.

As of June 2024, the top 20 blockchain ecosystems collectively hold over $25 billion in tokens earmarked for users and stakeholders. This figure is expected to grow as thousands more projects launch their tokens in coming years.

As token valuations rise, they will become primary incentive tools across the internet.

We also believe only a few apps will emerge as dominant channels for this spending.

Today’s article focuses on one company at the heart of these dynamics. During our research, multiple top users described Layer3 as “Google for crypto.” They bookmark its page to discover new products or simply find the right links to apps they use regularly. In other words, the product has crossed the chasm from needing retention to becoming habitual—something few startups achieve today.

Behind these behavioral patterns lies solid business fundamentals. To understand them, we need to go back to early 2022.

Wild Times

Before the collapses of Luna, 3AC, and FTX, the industry believed it had crossed the chasm. Buying stadium naming rights was seen as a path to mainstream adoption. But user acquisition remained fragmented.

Despite public interest, most projects couldn’t run ads directly on Twitter or Google. Product discovery still relied heavily on organic chatter among Twitter users.

The emergence of ownership via tokens introduced a new dynamic. In crypto, tokens effectively became customer acquisition cost (CAC). As the industry evolved, tokens were used in various ways to acquire users—initially via ICOs, then airdrops, and later liquidity mining. But these methods proved inefficient.

New distribution channels like Layer3 emerged, aiming to distribute tokens more efficiently to attract users. This is where “task platforms” came in. Their value proposition was simple: instead of paying for ads, brands would reward users directly.

Early adopters looking for new products simply visited task platforms and spent their time. The more products they engaged with, the higher their token rewards.

Founding Layer3

Layer3 was founded in 2021 by Brandon Kumar and Dariya Khojasteh. For those who remember, Layer3’s original landing page read “Earn crypto by doing things.” The core idea was to create a marketplace for protocols to use their tokens to coordinate user behavior. Interestingly, they raised their seed round using a website built entirely on Webflow and Airtable—two no-code platforms.

The platform has since grown into one of the fastest-scaling aggregators in the industry. Fueling this growth is a tech stack solving pain points around user identification, asset distribution, and user ownership.

Before joining Layer3, Brandon was an investor at Accolade Partners, a multi-billion-dollar asset management firm and one of the largest allocators to VC and PE globally. His investing experience helped him manage the supply side of the business. Building relationships with protocol builders and cross-selling across dozens of VC portfolios ensured strong supply-side momentum. Of course, this required a world-class product—which is where Dariya came in.

Dariya is an experienced app developer who previously built and scaled multiple consumer apps. He designed the now-renowned product experience at Layer3. Thoughtful gamification and effective UX strategies created a highly engaging, addictive consumer experience.

Essentially, Brandon focused on the B2B side—onboarding protocols—while Dariya led the B2C side—engaging consumers. This complementary approach was key to shaping Layer3 into a leading aggregator.

Solving Cold Start

In Layer3’s early days, it faced a classic “chicken-and-egg” problem. Exploration platforms only gain pricing power once they reach scale. Much like traditional aggregators, your control over value depends on your strength on the demand side. Amazon negotiates better terms because it commands massive user scale.

But what do you do when you have no users? How do you compete in a space with existing players? This was Layer3’s early challenge. They knew they’d struggle to command pricing power until they reached sufficient scale. So their initial focus was on attracting core believers.

Layer3’s earliest tasks centered on newly launched protocols—apps still in early stages, where users explored out of pure curiosity.

Layer3 initially aimed to surface new products before the market discovered them. Curation—not monetization—was the priority. Users quickly flocked to the product because they knew it was a reliable source for cool on-chain discoveries. A similar pattern emerged online in the mid-2000s.

As people went online, Google became many users’ home page. Why? Because remembering URLs was a hassle.

You’d just visit Google and type a query like “Face Book” to find the social network. While researching this piece, we spoke with multiple users whose main motivation for using Layer3 was discovering new protocols in a safe and enjoyable way.

One early strategy Layer3 used was running tasks for specific protocols before reaching out to pitch their product. Often, this alerted founders to a surge of users from a third-party platform—making them more inclined to collaborate with Layer3.

Chain-specific data for Optimism

At the time of writing, Layer3 is one of the most used applications on Arbitrum, Base, and Optimism. As of June 29, they’ve helped users from 120 countries complete over 120 million on-chain operations. Nearly 4.5 million wallets have interacted with the product.

Today, Layer3 drives growth across 31 different chains and 500+ protocols in gaming, AI, DeFi, and NFTs.

According to the team, they receive inbound interest from 60–90 protocols each month wanting to join their distribution network.

As mentioned earlier, without demand, you can’t attract supply. Now, let’s turn to user behavior and Layer3’s relationship with end consumers.

Aggregating Demand

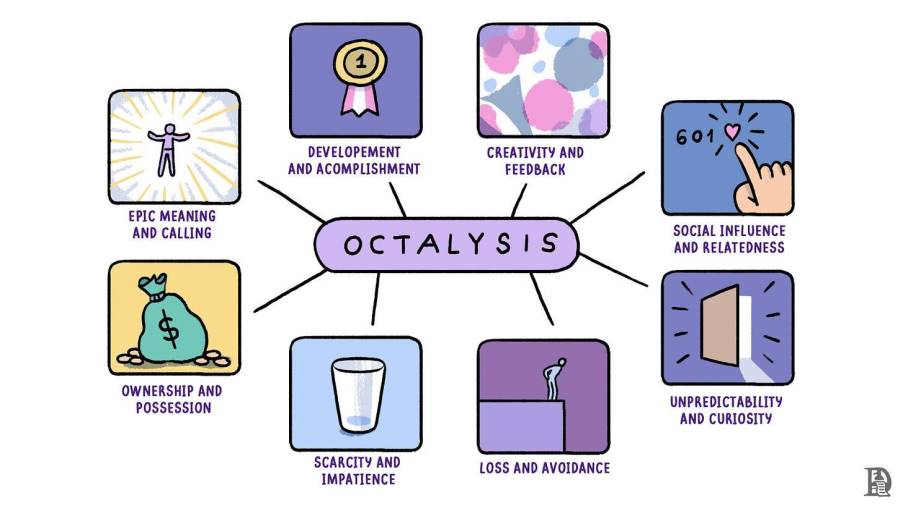

Layer3’s impressive growth and engagement metrics weren’t achieved overnight. In 2022, the company raised significantly less than peers, but thoughtful gamification enabled rapid scaling. Layer3’s platform draws heavily from the Octalysis framework, setting a benchmark for leading consumer experiences in the industry.

Developed by Yu-kai Chou, the Octalysis framework breaks down gamification into eight core drives that motivate human behavior. It forms the foundation of how the Layer3 team thinks about their product.

First, Layer3 taps into the drive for Epic Meaning & Calling by allowing users to gain ownership in protocols and projects—giving them a sense of contributing to something bigger. Development & Accomplishment is addressed through the XP system and rewards center, where users accumulate XP by completing activations (tasks, streaks, contests), maintaining competitive edges and unlocking further opportunities.

Creativity & Feedback is satisfied by letting users strategically use gems within the platform store, encouraging creativity and strategic planning. Ownership & Possession is a major focus—Layer3 ensures users feel strong ownership over their digital assets and identity via CUBEs and ERC-20 tokens. More on that shortly.

This sense of ownership deepens user engagement and loyalty.

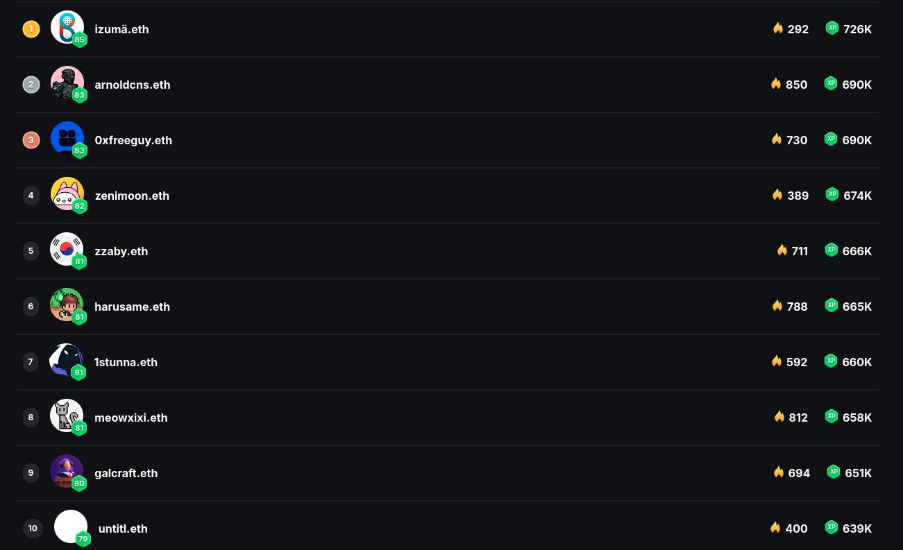

Layer3’s leaderboard. During our research, we interviewed several of their top users to understand their perspective on the platform.

Social Influence & Relatedness is driven by the leaderboard feature, showcasing top users and fostering competition—users strive to climb ranks and earn recognition. Scarcity & Impatience is created through time-limited or capped tasks, contests, and limited season durations, pushing users to act quickly to claim rewards.

Layer3 also leverages Unpredictability & Curiosity, introducing loot boxes and mystery chests that keep users engaged, eager to discover potential rewards. Finally, Loss & Avoidance is addressed via daily continuity features, motivating users to return regularly to avoid losing progress.

Some of the platform’s longest-standing users continue using the product after more than two and a half years—motivated by fear of losing their standing.

Google for Crypto

When the web first emerged, its profit potential was unclear. In the late 1990s, analysts speculated about how often people viewed Microsoft’s start page to assess ad potential. Attention was digitizing, but mechanisms to measure its value didn’t exist. Solutions emerged as users concentrated on a few platforms.

Google, Facebook, and Amazon created massive data silos capable of predicting user moods, preferences, and curiosities.

These datasets were isolated—developers couldn’t access them publicly to target users. Online advertising became a tax paid to platforms to reach users. The longer users spent on Facebook, the more ads they saw. The more ads they saw, the more likely they were to buy. Facebook had an incentive to keep users hooked—because their revenue depended on it.

From 2010 to 2020, the internet became a honey pot for attention—gluing our eyes to screens.

Blockchains as payment networks allow advertisers to directly reward users

Incentives often explain why systems work the way they do. On Meta’s Instagram, WhatsApp, or Facebook, we shared intimate details. In the mid-2010s, we checked into restaurants, posted photos, and logged our emotional states.

What we didn’t realize was that platforms were incentivized to extract our data—and we were completely unaware it was happening.

As mobile devices became more powerful, the web no longer needed us to log into their products. We leaked data via Google searches, GPS coordinates, and sometimes even chat logs.

Layer3 disrupts this model in two powerful ways.

Users Own Their Data

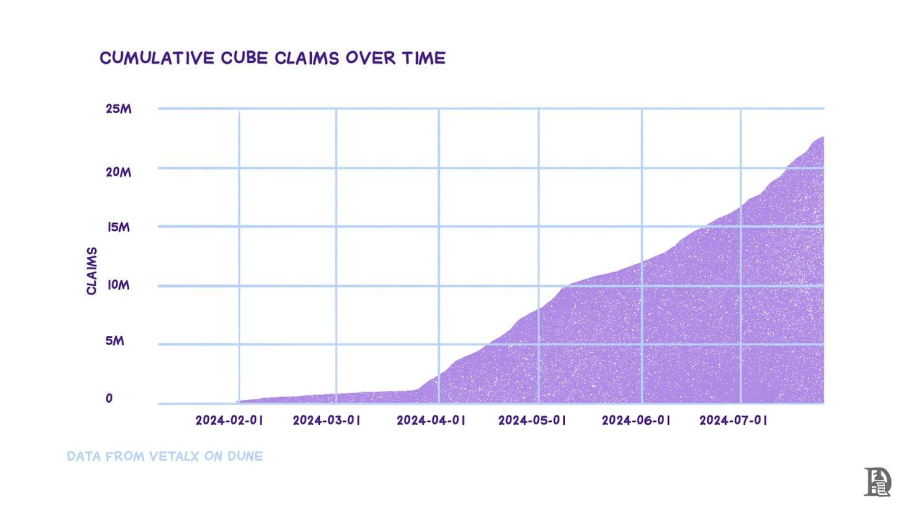

Unlike traditional ad models, consumers on Layer3 own their data via CUBEs. These credentials are portable and permanently held by users. Once issued, Layer3 cannot reclaim them. CUBEs are ERC-721 tokens users earn on Layer3 upon completing activations. Each CUBE contains custom metadata that unifies a user’s on-chain session data. This allows users to own their on-chain footprint and helps protocols better target the right users.

According to Growthepie.xyz (as of June 17, 2024), CUBEs are the most popular NFTs on Base, Optimism, Arbitrum, and zkSync—with over 1.5 million wallets holding Cube NFTs across chains.

Cubes are on-chain credentials awarded to users for performing actions

Unit Economics That Work for Consumers

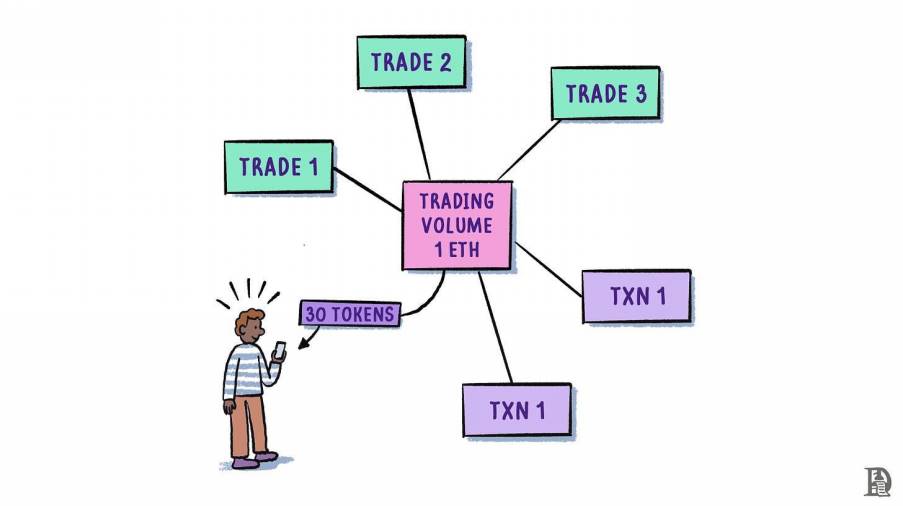

Beyond owning their data, users actually gain ownership in the protocols they use via Layer3. For example, if a consumer completes an Optimism activation on Layer3, they earn OP. If they complete an Arbitrum activation, they earn ARB. This is facilitated by Layer3’s distribution protocol, which dynamically rewards users based on their on-chain activity.

We’ll dive deeper into this dynamic in the next section.

The result is a strong moat built around consumer adoption and attention—enabling Layer3 to attract large audiences, onboard them into more protocols, and thus draw in even larger audiences.

A few years ago, Jesse Walden wrote a blog post titled The Ownership Economy. The premise: as individuals contribute more to platform value creation, the next evolution is software built, operated, funded, and owned by users. This ownership is unlocked via tokens.

We believe in this future—but acknowledge it hasn’t materialized yet, due to the lack of effective ownership distribution infrastructure until recently. Mechanisms like airdrops and liquidity mining attempted to solve this but largely underperformed.

One of Layer3’s core value propositions to protocols is offering a more efficient way to distribute tokens for user acquisition. Protocols route tokens through Layer3 so they reach the right users at the right time.

The Milestones feature lets developers require users to complete a series of actions over time to earn rewards

Further, last month, Layer3 launched a product called Milestones. This product observes user behavior over time, rewarding not single transactions but sustained activity. For example, a user might need to deposit funds into a smart contract for 30 days, or make five trades on Uniswap within a month.

Unlike traditional airdrop models focused on single events or cumulative volume, Layer3’s Milestone product lets developers mix and match on-chain interactions that drive real value.

To me, this highlights a key difference between scaling businesses in Web2 vs. crypto. Unlike Google or Meta, Layer3 holds almost no monopoly over user data. As noted, anyone can query it. They don’t even monopolize how users gain value—anyone can query CUBE holders and send them tokens. Layer3 accumulates value in two primary ways:

- Long-term relationship with users: On-chain transactions can’t be faked. Layer3 manages users through years of transaction data generated via exploration on its platform—a significant moat.

- Curating the best products: Their curation power stems from user scale. Early on, they had to reach out—but today, products come to them. Across multiple user interviews, users consistently cited trust in Layer3 as a product discovery engine. At the time of writing, Layer3 has partnered with nearly 500 different products.

Users benefit immensely from this model.

In the Web2 ad model, users gain little from the flood of products thrown at them. They spend their most scarce asset—time—hoping to find relevant content. Layer3 flips this. Products compete in token rewards for user attention. The more valuable the user, the higher the reward.

This bidding for users also happens in Web2, but most value is captured by platforms like Google—not end users.

In contrast, Layer3 passes most value to end users. Now, you might ask: “What sets Layer3 apart from others?” Remember how I said community is essential for aggregation in crypto? That’s the key. In products with large communities, part of user stickiness comes from loyalty and relative status within the community. This translates into long-term, timestamped proof of on-chain activity.

Sure, you can use tools like Etherscan to find a million active wallets. But to find a curated list of users with timestamped proof of early engagement with new products—and a place where they can discover you—requires a platform. That’s where Layer3 stands today.

While researching this article, I stumbled upon a blog post by a Layer3 founder. Dariya wrote an article titled “Attention Is All I Have” on his personal site. In a concluding passage, he elaborates on Layer3’s moat.

Attention, coordination, and distribution are interconnected. Can you reach people and get them to do things beneficial to your ecosystem? A few analogies clarify this: attention is oil, distribution is kerosene, coordination is gasoline. On the internet, value typically accrues only to platforms that aggregate your attention.

But at Layer3, we aim to flip this. You own the network. You accrue value. Projects distribute value directly or indirectly to you—as shown by Layer3 users capturing 20.4% of the entire Arbitrum airdrop. In the past sixty days alone, over twenty projects have distributed incentives directly via the protocol.

In other words, Layer3 captures value while overturning the historical relationship between ad networks and products. To me, that’s the definition of a disruptor.

Moats, Value, and Habits

In my years of writing, I’ve learned crypto will become a value network. Blockchains are fundamentally about enabling value transfer. The primary use case is transactions that happen globally. Serving 4.5 million wallets across nearly 120 countries, Layer3 is the closest thing I’ve seen to a fully functional, scalable “value transfer network.”

During the web’s development, advertising was necessary to make the internet accessible to billions. But we’ve moved past that phase. Users are already here. What we need now is a better form of monetization and targeting. Layer3 sits precisely at this inflection point—from attention networks to value networks. We’re shifting from an era where users contributed time and data to one where users own data and receive economic value.

If users can gain value (in tokens or NFT mints), platforms will inevitably compete to offer the best returns. This is where Layer3’s business model gains a strong moat.

Given the number of people currently using their product, Layer3 can continue attracting users and building incentive mechanisms. A large protocol like Uniswap may have no incentive to partner with a new task platform serving fewer than 100k users. But what if you can target 5 million wallets?

In scale terms, that’s the size of the entire DeFi market in 2021. That’s Layer3’s positioning. It’s akin to being featured on Google Play or Steam’s front page in early 2012.

This changes how developers think about launching apps. Crypto-native products typically face cold-start problems—finding the initial sticky user base to collect data is extremely hard. Historically, products partnered with well-known networks like Polygon or Solana to solve this. But with platforms like Layer3 offering distribution from day one, dependency on networks drops dramatically.

Developers can run campaigns on Layer3 to find core users and reward them as early adopters. To me, this is crypto’s Google Ad Manager moment—when developers realize they can effectively allocate resources to platforms that offer meaningful targeting instead of influencers.

Of course, such targeting also opens doors. Layer3’s scale means they can expand beyond their core product. They could integrate with exchanges, as hundreds of millions flow back and forth when users swap tokens within their product. They could even launch their own exchange or launchpad.

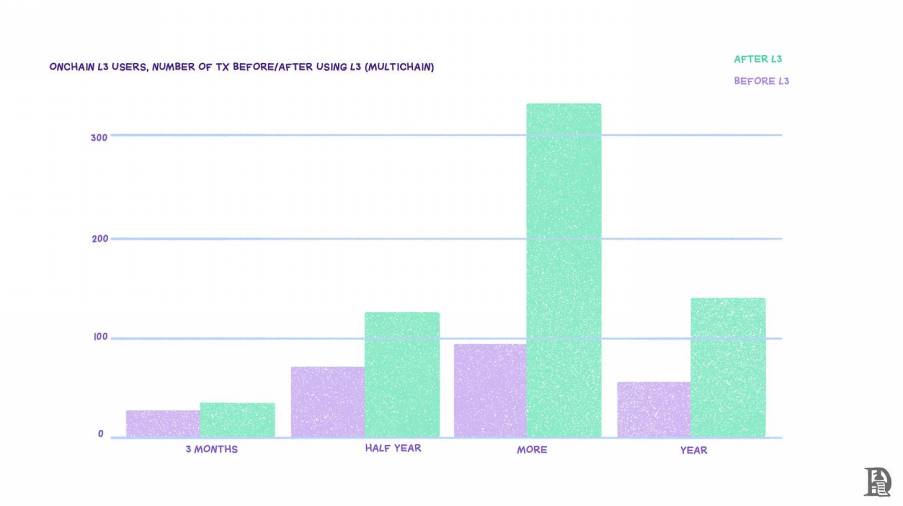

Data shared by Layer3 investors. The data tracks transaction counts over specific periods for users who use Layer3 versus those who don’t. Notably, Layer3 users are more active across all timeframes.

Attention trumps liquidity. Layer3 aggregates the former to a large extent. The more transactions users conduct within their ecosystem, the greater the surface area for increasing user lifetime value. A natural extension is expanding into verticals where users have demand. For example, Jupiter takes 1% of token supply to issue new tokens.

What stops Layer3 from doing the same? It would create a flywheel—users flocking to the product hoping to get in early on new projects, while new projects use Layer3 to achieve scale.

Around 2003, Google decided to focus solely on web indexing. In the next five years, they went public, launched Gmail, acquired YouTube, and bought Android. These moves laid the foundation for the internet as we know it. Google’s edge was recognizing that growing attention was flowing online and waiting to be monetized. Their position helped identify acquisition targets by seeing where demand was headed. That’s the power of positioning.

Layer3 is in a similar position of

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News