Binance's Latest IEO Project Xai: What Innovations Does the First Layer3 Game in the Arbitrum Ecosystem Bring?

TechFlow Selected TechFlow Selected

Binance's Latest IEO Project Xai: What Innovations Does the First Layer3 Game in the Arbitrum Ecosystem Bring?

Understanding XAI and esXAI: Grasping the Core Economic Mechanism Design and Development Dynamics of the Project

Author: Kasou Kazoku

TechFlow news, January 3 — Binance announced its 43rd Launchpool project, Xai (XAI), a gaming blockchain (L3) built on Arbitrum.

This article provides an introduction to the Xai project, including technical mechanisms, tokenomics, team information, and more.

On December 16, 2023, Arbitrum-based gaming Layer-3 network Xai posted a cryptic message on social media: “ai_dr_p soon,” sparking widespread attention in the crypto community. This brief yet suggestive message seemed to hint at an imminent airdrop from Layer-3 Xai, injecting fresh energy into the entire gaming ecosystem. As Xai prepares for its token distribution, let’s take a look back at the project’s journey so far.

Xai's tweet about the upcoming airdrop

Xai recently unveiled its tokenomics, drawing attention with its allocation mechanism

Looking back at Xai’s development, it released its tokenomics on October 26 this year. The total supply of Xai and esXai (staked) reached a staggering 2.5 billion tokens. More notably, over half of the supply—50.1%—was allocated to the community, Sentry node operators, and the Data Availability Committee (DAC), highlighting Xai’s emphasis on its community members and contributors. Meanwhile, 22.4% was allocated to investors, 20% to team members, and the remaining 7.5% dedicated to ecosystem development and maintenance.

On the technical front, XAI stands out. It is a permissionless Orbit chain utilizing the Arbitrum Nitro tech stack, designed to deliver a gaming-centric Layer-3 solution for the gaming industry. This technology not only improves transaction efficiency but also enhances network scalability, opening up new possibilities for game developers and players alike.

Dapps within the Arbitrum ecosystem

Additionally, Xai’s network allows anyone to participate by operating nodes. This not only gives regular users the opportunity to earn network rewards but also enables them to take part in network governance. This feature reflects Xai’s commitment to decentralization and offers community members meaningful opportunities to engage and contribute.

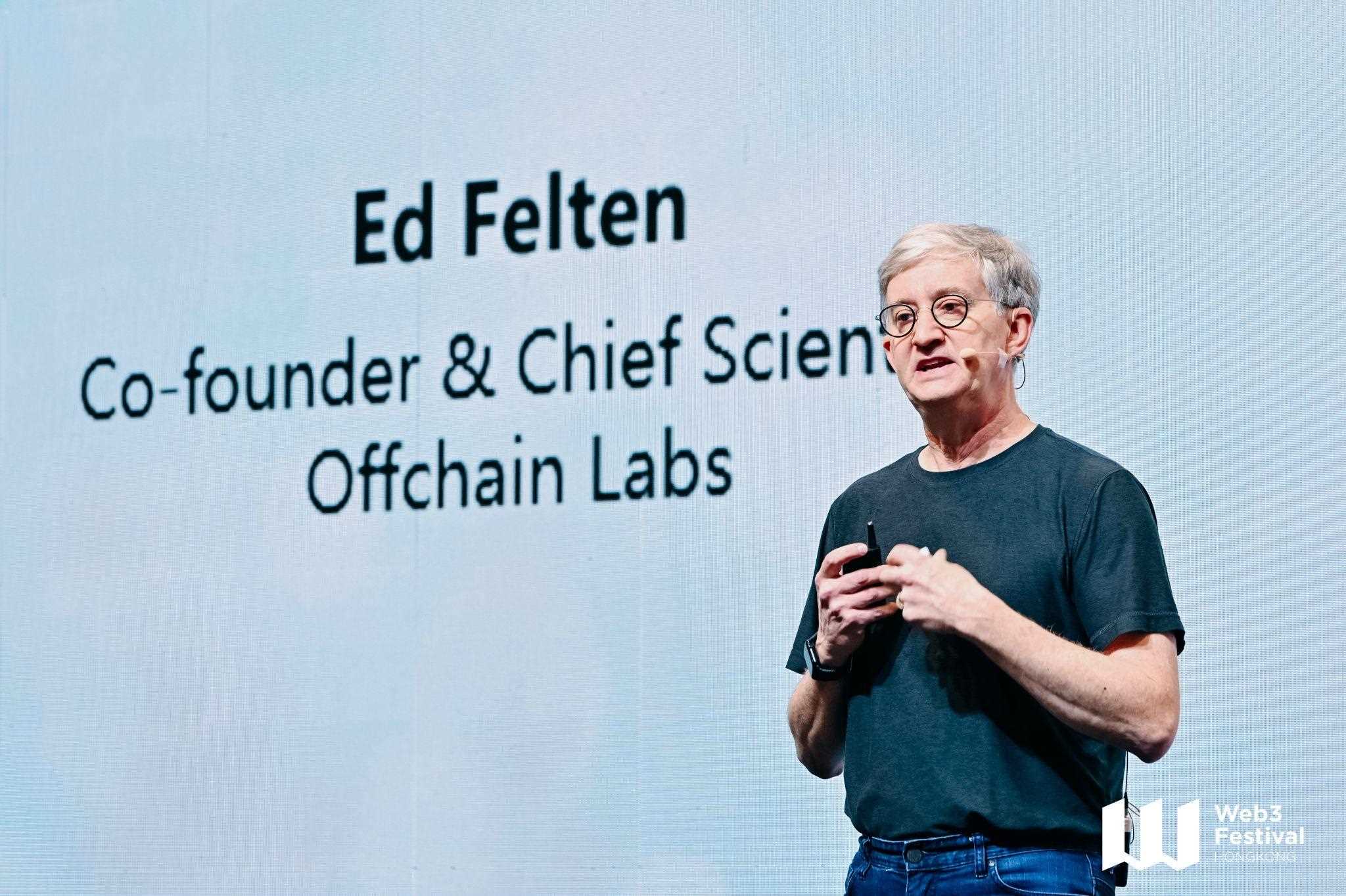

Notably, Xai was developed by Offchain Labs using Arbitrum technology. This collaboration showcases Xai’s potential in technological innovation and ecosystem building, further solidifying its position and influence within the cryptocurrency industry.

As community anticipation for Xai’s airdrop grows stronger, we can foresee that this ecosystem is poised for new developmental opportunities. In the following sections, we will delve deeper into Xai.

Approaching L3's technical solution: A closer look at XAI’s foundation and new developments around Sentry nodes

A deeper understanding of XAI reveals that financial backing and technical architecture are key to its success. Like many blockchain projects, XAI is supported by a foundation. Specifically, Xai is backed by the Ex Populus Foundation, which raised $12 million two years ago, plus undisclosed additional funding. This funding scale—especially when compared to Offchain Labs’ fundraising of over $120 million—indicates that the XAI project has a solid economic foundation.

Now, regarding the Sentry nodes for XAI Games—there are some new developments. As an L3 blockchain, XAI Games is designed to allow different operators to run nodes across multiple platforms, whether cloud servers, laptops, or desktops, ensuring network integrity and security. This flexibility opens up new opportunities for a broad range of users to participate in blockchain operations.

Particularly noteworthy is the sales model for Sentry nodes. XAI Games plans to sell 50,000 node key NFTs through a Dutch auction. This method allows prices to change over time, starting at 0.13 ETH, with the current price at tier 9 already reaching 0.4 ETH. Linking Sentry node pricing to Ether may be a strategy to attract investors, but it also introduces considerations around market volatility.

In summary, the financial support behind the Xai Foundation, combined with the innovative sales strategy for its Sentry nodes, forms two pillars supporting the XAI project. These elements not only provide a solid financial foundation for XAI’s future growth but also offer participants new technological and economic opportunities. In the next section, we’ll explore Xai’s token economy and its potential impact on the broader ecosystem.

Understanding XAI and esXAI: Grasping the core economic design and development dynamics of the project

XAI is not just the native token of the Xai blockchain—it is the cornerstone of its ecosystem. Similar to traditional L1 and L2 tokens, XAI serves broad and critical utility functions. It is fully transferable and acts as the gas fee token within the Xai L3 ecosystem. This means all network operations and transactions require XAI as fuel.

The total supply of XAI is clearly allocated across different groups. Among them, 20% is allocated to the core team and early contributors, which begins unlocking 6 months after the token generation event (TGE) and fully unlocks over the subsequent 36 months. Another 22.41% was purchased by early investors, unlocking 6 months post-TGE and completing over 24 months. For ecosystem allocations, 2% is designated for market makers and unlocks immediately at TGE; 5.5% is reserved for ecosystem development, beginning to unlock 6 months after TGE and fully unlocking over 36 months.

Xai testnet has surpassed 60 million transactions

XAI can also be converted into esXAI, a special type of token. Unlike XAI, esXAI is non-transferable and primarily used for staking within the Xai ecosystem, granting stakers various benefits. These include rewards for Sentry node operators and access to exclusive privileges. The esXAI staking mechanism allows node operators to freely adjust their staked esXAI across three distinct accounts:

Yield Account: Node operators who stake esXAI here receive additional esXAI rewards.

Culture Account: By staking esXAI, node operators gain access to exclusive in-game activities and NFTs related to games launching on the Xai blockchain.

Governance Account: Node operators can obtain DAO governance rights through staking, including the ability to propose how DAO/foundation funds are used.

The conversion mechanism between XAI and esXAI is bidirectional, allowing users to choose based on their needs. Converting XAI to esXAI is free, incurs no penalties, and maintains a fixed 1:1 ratio. However, converting esXAI back to XAI involves a lock-up period that users can set themselves. The conversion rate varies depending on the length of the lock-up—longer lock-up periods yield higher conversion ratios.

This conversion mechanism has significant implications for the Xai ecosystem. First, it introduces deflationary pressure, as all gas fees paid within the Xai ecosystem are burned. Second, the emission of esXAI to Sentry nodes depends on the current circulating supply of both XAI and esXAI. This dynamic emission rate is designed to automatically adjust according to changes in total supply, ensuring flexibility and adaptability.

Moreover, the XAI-esXAI conversion mechanism effectively reduces market sell-off pressure. Combined with Xai’s robust gaming ecosystem and partnerships with major players like Tencent, this design is particularly significant. It not only supports the sustainable development of the Xai ecosystem but also gives community members time to observe explosive growth post-mainnet launch and decide whether to hold.

Another important aspect is the network reward system for Sentry nodes in the Xai ecosystem. While accurately predicting rewards per Sentry node is difficult, estimates can be made based on market conditions and assumptions. These projections assume that the total supply of XAI and esXAI will not exceed 2.5 billion, that 100% of gas fees are burned (creating deflation), and that the Xai Foundation will not sell more than 50,000 Sentry keys.

The economic models of XAI and esXAI form the core of the Xai ecosystem. Their interplay not only affects network operational efficiency but also profoundly influences the overall stability and sustainability of the ecosystem.

The future of Xai is unpredictable, but its innovative efforts are commendable

As the Xai ecosystem continues to grow and mature, the design of XAI and esXAI tokens reflects ambitious goals in creating a diverse and sustainable blockchain environment.

XAI, as the base token of the ecosystem, provides the fuel necessary for network operations, while the introduction of esXAI creates additional staking opportunities and incentives for participants. This dual-token system ensures efficient network operation while encouraging community participation and investment.

With this in mind, we can anticipate that the XAI ecosystem will continue attracting more participants and investors. Its deflationary mechanisms and staking incentives are expected to foster a stable and vibrant environment for Xai in the future—driving internal ecosystem growth and potentially bringing new innovation and momentum to the broader blockchain industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News