Opinion: ETH gradually becoming the Democratic Party's cryptocurrency, with political and economic factors potentially driving its rise

TechFlow Selected TechFlow Selected

Opinion: ETH gradually becoming the Democratic Party's cryptocurrency, with political and economic factors potentially driving its rise

ETH will receive fund inflows from institutions that are "climate-sensitive."

Author: goodalexander

Translation: TechFlow

I am bullish on Ethereum. I believe current expectations around its ETF do not reflect the potential demand from family offices and Blackrock’s ESG/European clients who are looking to expand data centers globally while managing carbon footprint issues arising from AI.

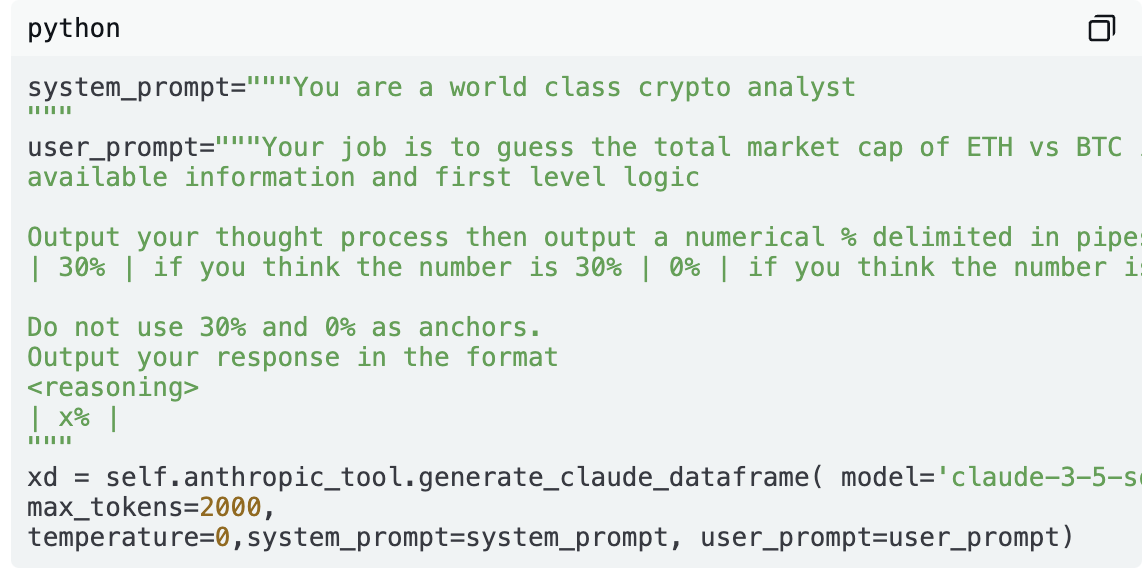

Current ETH/BTC Chart

The chart above shows the long-term trend of ETHBTC

-

Since the 2021 ICO frenzy, ETH/BTC has been under heavy selling pressure. The low point of ETHBTC at that time was around 0.052.

-

ETH/BTC attempted to break out of its downtrend channel on news of an upcoming ETF, but failed as IBIT continued to see accelerating inflows, while Trump and other prominent politicians publicly expressed support for Bitcoin.

-

If ETH/BTC breaks above 0.056, analysts may interpret this price movement as a sign of successful launch, rather than focusing on "flow" numbers—because ultimately, people care about price.

-

A Bloomberg article mentioned that after ETF approval, ETH/BTC could potentially "jump 90%." If so, this would push ETHBTC beyond its 2021 ICO peak. I’m skeptical of this thesis based purely on ETH's sensitivity to BTC, but I do believe ETHBTC can reach 0.07.

-

At current BTC prices, this would equate to approximately $4,600 for ETH/USD.

Expectations and Flows

Regarding flow expectations: Citi forecasts $6 billion, Wintermute expects $4 billion, and Bloomberg estimates 10–15% of Bitcoin ETF flows. Assuming first-year Bitcoin ETF flows reach $25 billion, the upper bound would be $3.75 billion, though analysts currently model around $2 billion in flows. It is reasonable to say $4 billion represents the annual inflow target.

IBIT, iShares’ Bitcoin ETF, currently holds $22.7 billion in assets—compared to just $13.2 billion for iShares Silver ETF despite having existed only half as long. The silver market is valued at $1.7 trillion versus Bitcoin’s $1.3 trillion, yet Bitcoin enjoys greater liquidity, investor interest, and asset management activity. Had Judas known about the Bitcoin standard, we’d be trading much higher. Frankly, Bitcoin’s global liquidity exceeds that of the New Zealand dollar (a G10 currency), significantly enhancing its monetary properties. Given these factors, Bitcoin surpassing silver in value is quite plausible, implying a 30–40% upside from current levels.

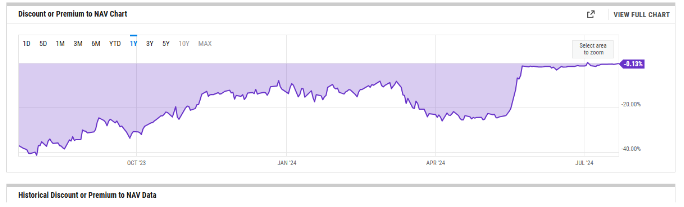

Sentiment has remained bullish on ETHE since May following ETH ETF approval

IBIT has demonstrated the significance of crypto ETFs, but sentiment on ETHE has been bullish since May, and investors are growing tired of aggressive SOLETH trades, especially since SOL typically generates more fees than the ETH chain.

However, most retail investors don’t know SOLETH, and the key question is how pure ETH interest will compare against BTC ETFs.

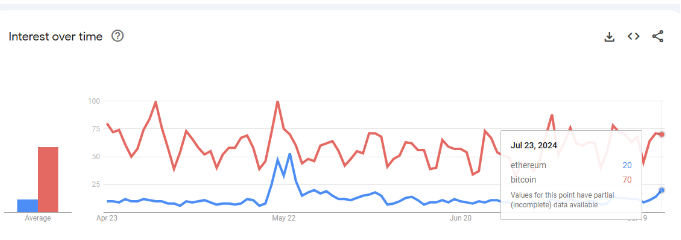

Based on Google Trends, we can expect ETH to capture 20–30% of total search interest.

The chart above shows recent Google Trends data, suggesting a realistic expectation of 20–30% of total interest (potentially higher if ETH rallies strongly, as seen during the May approval).

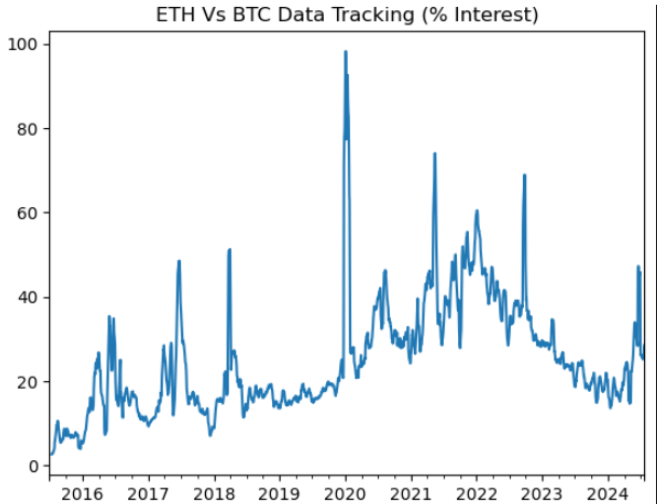

Internal data tracking (web traffic, related terms)

Due to Ethereum’s broader use cases, it also has greater narrative potential. Internal data tracking indicates ETH penetration among retail investors ranging between 20–60%, heavily dependent on application usage.

Digging deeper into why this number could be high—there are many applications built on Ethereum. During the NFT bull run, ETH-related tracking reached 60%.

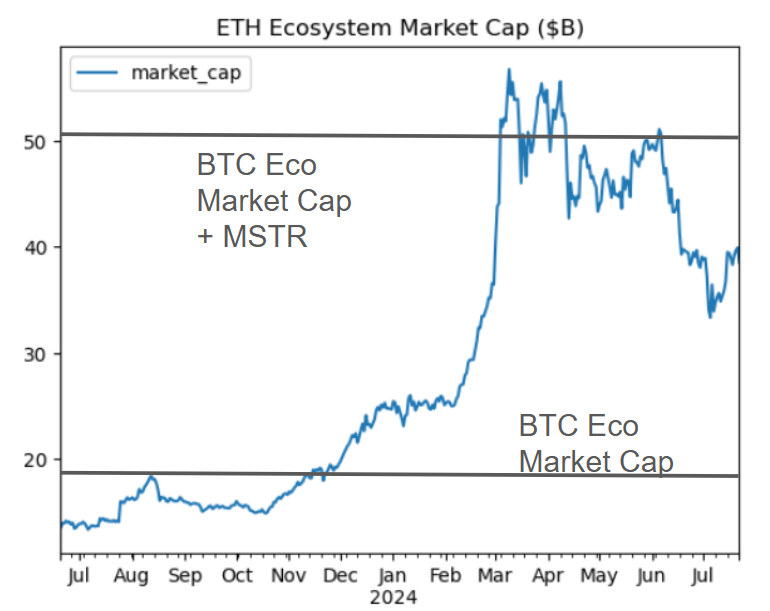

Finally, using the Claude API for a quick simulation to estimate Ethereum’s market cap ratio relative to Bitcoin.

The result consistently converges to 45% across 10 runs. This would represent an optimistic high-end estimate. Note that ETH/BTC market cap is currently around 32%.

So essentially—I believe IBIT could reach $30 billion by year-end. A conservative 20% allocation to ETH would imply $6 billion in ETH ETF assets, matching Citi’s “aggressive” high-end forecast. Thus, even based on retail investor data tracking alone, I believe expectations remain low enough that ETH remains investable—even after recent underperformance. Which brings us to

Interwoven Factors

Trump is scheduled to speak at the Bitcoin conference

Trump will speak at the Bitcoin conference alongside Snowden, Russell Brand, Cathie Wood, Michael Saylor, and others. Even if not directly associated with Trump, some of these figures may unsettle institutional investors. Many Republican senators will also be speaking at the event.

Therefore—on one hand, this conference may reduce interest in ETH, which is short-term bearish.

On the positive side, it may position Bitcoin as a right-wing asset—which, from a capital flows perspective, could benefit ETH.

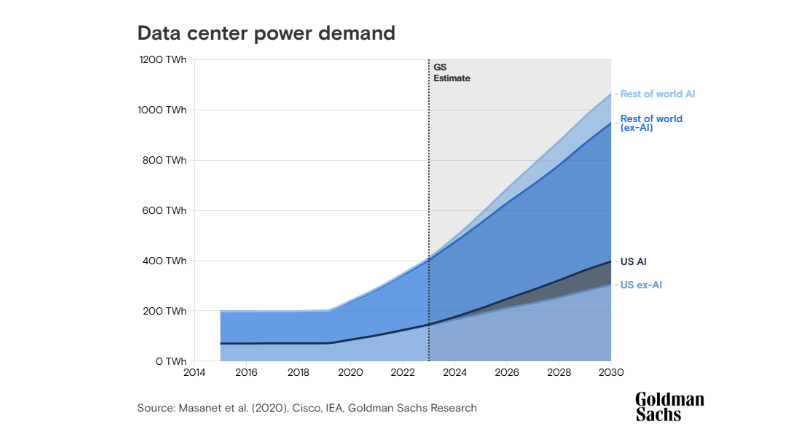

Harris' Rise and the Politicization of Bitcoin

Since Harris "took over" Biden’s campaign duties, Trump’s odds in prediction markets have declined, falling from a high of 70 to the current 59 on PredictIt—one of Trump’s historically highest levels.

The New York Times on Kamala Harris: “When Ms. Harris ran for president in 2020, her climate plan called for $10 trillion in spending over a decade and proposed putting a price on carbon, with proceeds returned directly to households. Economists say a carbon tax is the most effective way to push industries to pollute less.”

She also supports banning fracking, whereas Biden opposes it. Fracking is a technique that injects high-pressure water and chemicals underground to extract hard-to-reach oil or gas.

Logically, Harris’ stance implies significant impact on deficit expansion and reduced energy consumption—both highly unfavorable for Bitcoin mining operations.

Institutional Energy Narrative

This forms the foundation of a key bullish case for Ethereum. Bitcoin is extremely power-intensive. A ban on fracking—as advocated by Harris, unlike Biden—could place immense strain on the power grid. While arguments for renewable energy exist, most institutions do not accept them. Remember, what matters isn’t facts—it’s perception.

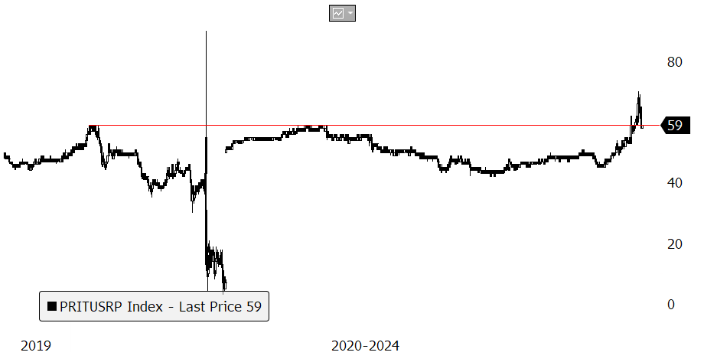

Goldman Sachs projects AI will dramatically increase electricity demand

Goldman’s chart forecasts trillions in capital expenditure, with $1 trillion needed just in Europe to manage rising power costs.

Combine this with stagnant quarterly YoY growth in Bitcoin hash rate post-halving, and you have a compelling narrative. Miners are effectively short electricity prices, which may make Bitcoin less secure over time and force them to sell held BTC to cover rising power costs. This also explains their expansion into AI data center businesses.

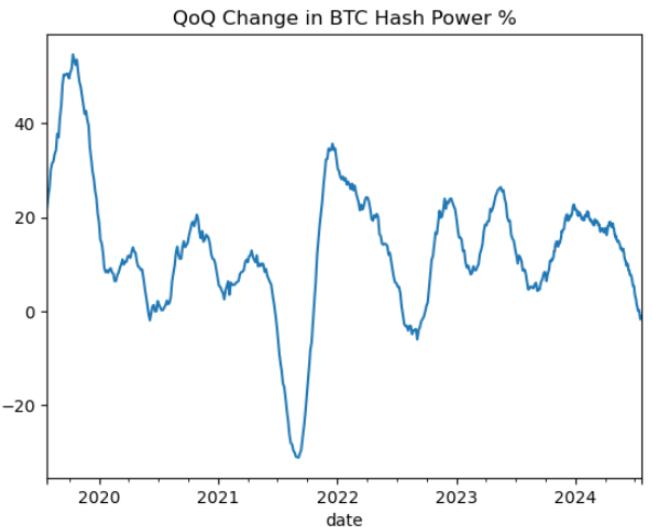

Bitcoin hash rate 84-day moving average percentage change (note: hash rate has recently begun recovering, which is positive for BTC)

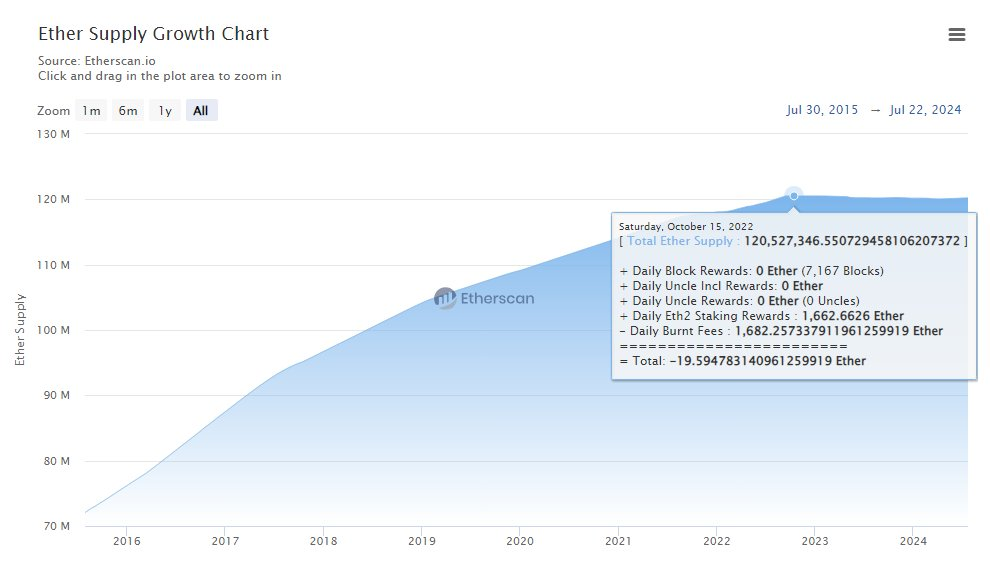

Meanwhile, since Ethereum’s transition to Proof of Stake via The Merge, its supply has slightly decreased, as shown below.

This chart is crucial evidence that Ethereum’s Proof of Stake can generate a "scarce" asset without consuming electricity. Ideally, we’d want this line trending downward rather than flat, but this is reality.

This isn’t a new idea—Soros fund manager Dawn Fitzpatrick has expressed similar views.

Finally, it’s worth noting that Blackrock has been actively discussing climate issues over the past three years and manages substantial European assets.

Conclusion

I believe that in the coming weeks, media coverage will intensify around Kamala Harris, increasingly highlighting her $10 trillion climate plan, advocacy for banning fracking, and concerns over AI-related power costs. As these narratives shape institutional thinking—and given Blackrock’s strong positioning from a marketing standpoint—I believe ETH will emerge as the “Democratic cryptocurrency.” ETH will attract inflows from “climate-conscious” institutions, many of which are hostile toward Donald Trump, yet recognize that large-scale climate investment necessitates quantitative easing and monetary devaluation as political inevitabilities.

Furthermore, with ETFs themselves reducing custody risks, such large-scale institutional flows are most likely to materialize. That’s my view (disclosure: I hold ETH, not investment advice).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News