Bitcoin Staking and Restaking Research: Project Overview and Trend Analysis

TechFlow Selected TechFlow Selected

Bitcoin Staking and Restaking Research: Project Overview and Trend Analysis

Bitcoin Staking and Restaking protocols are redefining their roles and benefits in the crypto economy through restaking mechanisms.

Author: CryptoMemento

Translation: Baicai Blockchain

The crypto bear market is shifting once again.

Now is the perfect time to write something about Bitcoin. With constant news emerging from numerous restaking protocols, we have plenty to discuss.

In today's article, we'll guide you through Bitcoin’s shifting positioning within the Bitcoin staking/restaking landscape, the utility of liquid Bitcoin staking, key active players, and future trend predictions.

Summary: At its core, Bitcoin stands for stability and security. Yet amid popular topics like Ordinals, Bitcoin NFTs, inscriptions, the Bitcoin community is undergoing a renaissance, with entrepreneurs striving to build Bitcoin layers and ecosystems. Bitcoin is a permissionless protocol—anyone can build on it, including those aiming to create Bitcoin-driven financial and credit systems. Bitcoin staking and restaking may follow a similar path: major projects (like Babylon) are establishing "orthodox" foundations, while numerous liquid restaking protocols compete and define their roles, eventually expanding boundaries into a networked ecosystem. Currently, the restaking space includes projects such as Babylon, Lorenzo, Pell Network, OrangeLayer Protocol, Chakra, Bedrock, and Lombard, with dozens more expected to enter. This sector remains on the verge of major breakthroughs. For now, Babylon leads in native restaking, but innovative newcomers with strong technical iteration deserve close attention. A key goal for these projects is identifying the lowest-cost incentive pathways, building effective incentive and transmission mechanisms, securing sufficient TVL (total value locked), and ultimately creating a flywheel effect.

1. The Starting Point of Leverage: Making BTC More Capital-Efficient

Before diving into the Bitcoin staking and restaking landscape, let me outline how Bitcoin’s positioning and identity have evolved since its inception:

-

2008–2017: Peer-to-peer electronic cash system, emphasizing payment functionality. However, Bitcoin’s performance limitations (TPS) hindered scalability. The Lightning Network (LN) made significant attempts in Bitcoin payments but ultimately failed to gain widespread adoption.

-

2017–2023: Digital gold—as a store of value, inflation hedge, and monetary unit similar to the U.S. dollar, primarily serving as a store or medium of value.

-

2023–present: The rise of the Bitcoin renaissance and construction of Bitcoin trends, accelerating exploration into overcoming Bitcoin’s performance limits (scalability, smart contract programmability), aiming to build Bitcoin layers and a Bitcoin economy.

-

2024–present: Bitcoin is recognized by traditional financial institutions as a financial asset, with BTC spot ETFs bringing in broader investor participation. Bitcoin’s essence remains stability and security, focused on a single use case—but things are always changing.

Fast forward to 2023 and 2024: assets like Ordinals, Bitcoin NFTs, memecoins, inscriptions, and Runes began surging. Investors benefiting from these price spikes proposed a "new" Bitcoin, transforming it from a "medium of value" into a "cultural" asset. Based on a consistent spirit of Bitcoin (though somewhat strained), they attempted to offer a pricing framework to reassess Bitcoin’s value, naturally creating demand for credit and yield among Bitcoin holders.

Abiding by the principle that existence implies legitimacy, expecting Bitcoin yield products to disappear is unrealistic. Therefore, we no longer judge Bitcoin maximalists or fundamentalist culture—Bitcoin is a permissionless protocol where anyone can build, including those seeking to establish Bitcoin-driven financial systems, inevitably introducing credit and leverage.

At this stage, the narrative around this sector essentially boils down to “making BTC more capital-efficient.” According to Mikhil Pandey, co-founder and Chief Strategy Officer at Persistence Labs, the barriers to making Bitcoin more capital-efficient can be concretized as follows:

-

Lack of sustainable yield opportunities

-

Friction for risk-averse holders in "moving" BTC

-

Absence of institutional-friendly yield products

-

Unknown security risks when moving BTC off the Bitcoin network

-

Opposition from some OG Bitcoin holders

Undeniably, the pursuit of diversified returns based on Bitcoin remains in early exploratory stages—especially after the 2022 collapses of centralized entities like Celsius, BlockFi, and FTX. Centralized yield platforms/projects need to rebuild trust during market expansion.

2. Understanding Bitcoin Staking/Restaking Protocols

To understand Bitcoin staking, we must first grasp how staking generates returns and where rewards come from.

The defining feature of blockchains like Bitcoin, Ethereum, and Solana is their trustless networks. Miners and nodes worldwide update the entire network state (data, transactions, balances, etc.) consistently based on consensus rules. PoW networks rely on computational power (mining), whereas PoS chains require validators to stake tokens before proposing or voting on blocks. This allows PoS protocols to hold bad actors accountable and slash their staked tokens as punishment. Of course, honest participants receive block rewards—a mechanism designed to maintain network consistency.

As previously mentioned in our biweekly Bitcoin report, Bitcoin staking is the second-largest unified track in the Bitcoin ecosystem after Bitcoin L2s, with relatively unified consensus among early-stage investors and entrepreneurs. The logic is this: due to lack of external economic incentives, the security of many emerging PoS chains (new projects constantly emerge, mostly PoS-based) is constrained by the scale of their on-chain economies, posing control risks. Bitcoin staking and restaking protocols address this by leveraging Bitcoin—the asset with the strongest consensus—to provide security for PoS networks.

We can draw insights about this space from Ethereum ecosystem project EigenLayer and its ecosystem initiatives.

EigenLayer is an Ethereum-based restaking protocol allowing ETH already staked on Ethereum to be restaked to enhance network security. By leveraging ETH already secured on Ethereum, it supports secure operation of other blockchain protocols and applications—a process known as restaking. Restaking enables Ethereum validators to use part or all of their staked ETH to support other Active Validation Services (AVS), such as bridge protocols, sequencers, and oracles. Typically, these services require their own staking and validation mechanisms to ensure security, but via EigenLayer’s restaking function, they can inherit Ethereum-level security without attracting massive capital themselves.

Key features of EigenLayer include:

Establishing a new shared security model: Enables different blockchain protocols to share Ethereum’s security infrastructure without building large validator networks, significantly lowering startup costs for new blockchain protocols. Additionally, restaking increases overall network resilience against attacks, as compromising any protected protocol requires overcoming additional security from restaking.

Improving ETH capital efficiency: The same ETH can serve multiple networks simultaneously. Users earn original staking rewards while gaining additional yields by participating in other AVS protocols.

Lowering participation thresholds: Through restaking, even small stakers can contribute to Ethereum’s network security. Participants don’t need to meet the full 32 ETH staking requirement; individuals can join via liquid staking tokens (LST).

Increasing decentralization: Smaller stakes reduce reliance on large stakers across the network.

3. Types and Characteristics of Restaking

Currently, EigenLayer supports two restaking methods: native restaking and liquid restaking.

Native restaking involves Ethereum PoS node validators connecting their staked ETH on the network to EigenLayer to participate in AVS validation.

Liquid restaking allows circulating credentials issued by LSPs (liquid staking protocols). These represent rights to originally staked ETH and can be freely used across various decentralized finance (DeFi) protocols without affecting the staker’s staking status or reward accrual on Ethereum. Furthermore, Liquid Staking Tokens (LST) can generate extra income in DeFi protocols or be sold on markets without waiting through long unstaking periods, earning EigenLayer platform points and other rewards.

In contrast, native restaking avoids intermediate tokens, reducing risks from token volatility or mismanagement, while liquid restaking offers superior liquidity with shorter unlock and transfer times.

Currently, the EigenLayer ecosystem has begun supporting multiple AVS and integrating with several well-known DeFi protocols and other blockchain services. It allows using different types of proof-of-stake (e.g., LST and native ETH) to support these services, improving capital utilization efficiency.

Likewise, Bitcoin staking and restaking may follow a similar trajectory: mainstream projects (like Babylon) continue building “canonical” foundations, while numerous liquid restaking protocols compete and define their roles, ultimately expanding boundaries into a networked ecosystem.

4. Mapping the Bitcoin Restaking Ecosystem

After reviewing most projects in this space, we identify several common narratives they use to justify their existence and convince markets of their relevance. Below are some familiar phrases—approach them with caution:

Bitcoin is the most secure blockchain in existence—no asset has stronger foundational trust than Bitcoin.

Unlock Bitcoin’s economic potential, mobilizing $1.5 trillion worth of Bitcoin to provide sustainable yield opportunities for holders.

By inheriting Bitcoin’s trustless foundation, we leverage Bitcoin’s native security to generate yield or make BTC more capital-efficient, thereby building a BTC financial system.

We bridge the gap between PoW and PoS blockchain systems, fully utilizing Bitcoin’s security.

Bitcoin staking derivatives hold immense market potential, including collateralized stablecoins, lending/borrowing and derivative looping loans, structured products, liquidity management protocols, yield management or interest rate swap protocols, and governance rights management protocols.

To gain deeper insight into the current restaking landscape, we reviewed several projects and provide brief introductions and commentary.

1) Babylon

Babylon is infrastructure / general middleware for sharing Bitcoin’s security. The team developed two security-sharing mechanisms—Bitcoin timestamping protocol and Bitcoin staking protocol—to share Bitcoin’s security with PoS chains or Layer 2s in a trustless, self-custodial manner, earning corresponding security rewards while significantly reducing their own inflation.

Current development stage: Bitcoin staking testnet-4 is live.

Brief comment: Most restaking protocols currently choose Babylon as their starting point, hoping to leverage more asset-layer protocols as “proxies” to diversify asset sources and distribute costs. Naturally, these projects also depend on Babylon for yield generation.

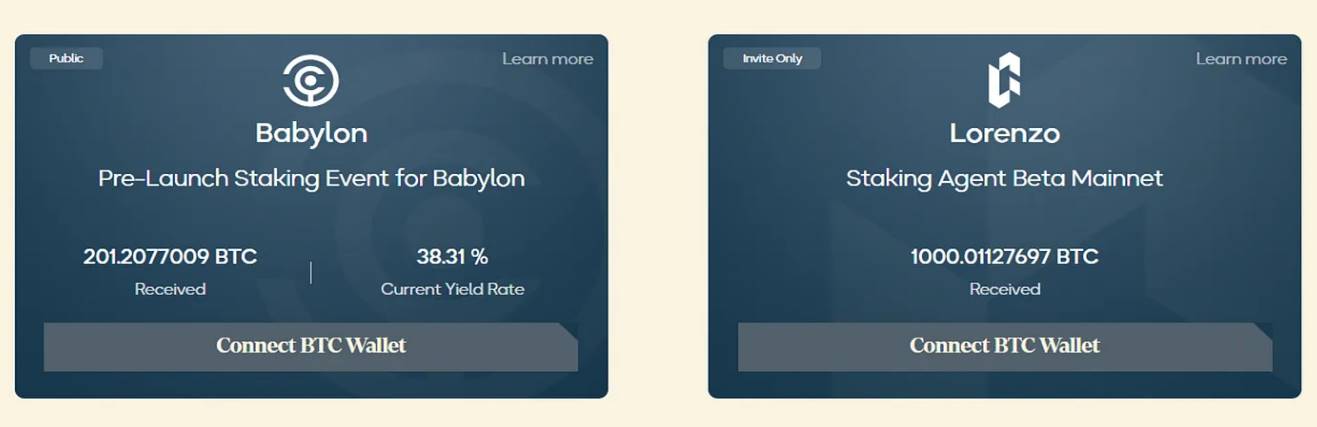

2) Lorenzo

Built atop Babylon, Lorenzo allows Bitcoin holders to convert BTC into stBTC, participate in Bitcoin staking, and earn rewards without locking funds. Additionally, Lorenzo splits Liquid Restaking Tokens (LRT) into Liquidity Principal Tokens (LPT) and Yield Accumulation Tokens (YAT), planning to develop interest rate swaps, lending protocols, structured BTC yield products, and stablecoins. The project focuses on building efficient Bitcoin liquidity allocation markets and asset liquidity.

Current development stage: Beta mainnet is live.

Current data: Invite-only; 1,000 BTC deposited on beta mainnet.

Brief comment: One of the participants; the biggest marketing highlight is BN’s involvement.

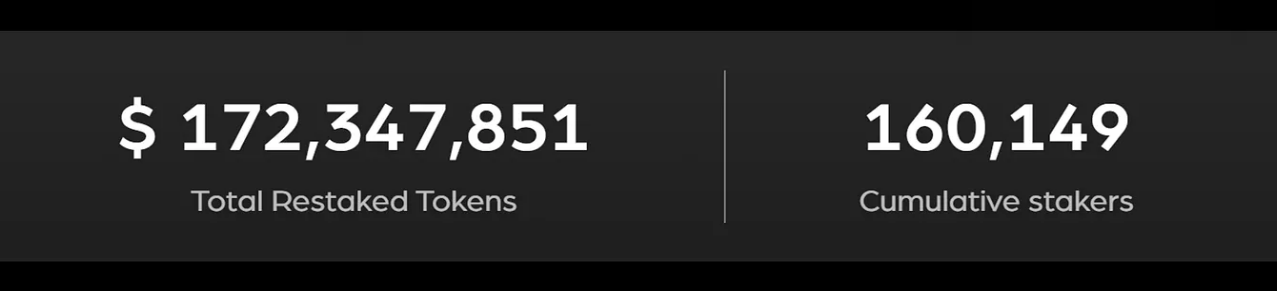

3) Pell Network

Pell Network is an Active Validation Service (AVS) network built upon restaking protocols within the Bitcoin ecosystem. Its goal is to aggregate fragmented BTC and its LSD liquidity assets scattered across various Layer 2s into a unified Pell Network ledger, creating a decentralized AVS ecosystem service network.

Current Total Value Locked (TVL): $172 million

4) OrangeLayer Protocol

OrangeLayer is infrastructure providing Bitcoin staking, aiming to bring Bitcoin’s cryptoeconomic security into the Ethereum ecosystem and offer broader Bitcoin Protection Services (BPS). Unlike protocols relying on ETH or BTC for security guarantees (such as EigenLayer and Babylon), OrangeLayer supports converting all forms of Bitcoin (native, wrapped, or pegged) into yield-generating assets.

Current development stage: Testnet phase, with mainnet planned for Q3 2024.

5) Chakra

Chakra is a zero-knowledge (ZK)-driven Bitcoin restaking protocol. The team introduced the concept of SCS (Settlement Consumer Services), integrating Bitcoin restaking into PoS systems. The project plans to integrate with Babylon.

Current development stage: Testnet is live.

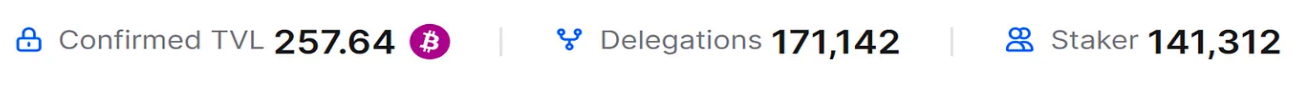

Current Total Value Locked (TVL): 257.64 BTC

6) Bedrock

Bedrock is a liquid restaking protocol developed by RockX. It currently supports uniETH, uniIOTX, and uniBTC as base assets for restaking operations, enabling holders to earn additional yields through ecosystem integration.

Current Total Value Locked (TVL): $141.55 million

7) Lombard

Lombard is a Bitcoin staking protocol. When users stake Bitcoin via Babylon, Lombard issues LBTC tokens to unlock liquidity and represent yield from staked Bitcoin. Lombard plans to integrate LBTC into Ethereum DeFi protocols later this year.

Current development stage: Internal testing phase.

5. Conclusion

Interesting things are unfolding in the Bitcoin space.

I’m personally excited about how these building blocks will converge. Below are my summary and outlook on the current state of Bitcoin staking and restaking. Of course, given the industry’s rapid evolution, these views will likely require continuous iteration and adjustment.

Credit can enable more complex and efficient economic structures, yet the current market remains dominated by a few large Bitcoin holders who constitute most of the TVL. The market lacks vitality and needs further education.

It’s important to note that the entire sector remains in a phase of rapid dynamic change. Market positions and solutions from leading projects continue evolving.

Currently, leveraging technological accumulation (Bitcoin timestamping and staking protocols to counter long-range attacks and high inflation/security issues in new projects) and institutional backing, Babylon leads upstream in the native restaking value chain. However, Babylon’s stability, security, and efficiency metrics require time to prove, and restaking protocols remain highly dependent on it. We’ll keep watching innovative newcomers with strong technical iteration.

Most protocols entering this space position themselves as providing liquid restaking, directly serving suppliers through flexible, efficient models. The market remains in restructuring, with no clear dominant leader yet. Dozens more projects are expected to launch in this space.

Although the market appeal from PoW to PoS is substantial, a significant gap remains between the two ecosystems. Service providers like EigenLayer have already established strong user mindshare. Whether Bitcoin ecosystem restaking protocols can capture existing market share remains to be seen.

From past experience, Active Validation Services (AVS) are likely to appear on many protocols’ roadmaps. Their most direct differentiation will be offering exclusive AVS access to restakers—either through subsidies or custom partnership agreements. They will gradually build competitive advantages, and some may even achieve network effects.

Compared to the Ethereum staking space, the Bitcoin track remains pre-explosion. In terms of both quantity and quality, the Bitcoin ecosystem still requires technological maturation and time to cultivate greater demand for new chain security microservices.

At this stage, the critical goal for projects in this space is identifying the lowest-cost incentive pathways, establishing effective incentive and transmission mechanisms, securing sufficient TVL, and ultimately creating a positive flywheel effect.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News