Bitcoin L2 infrastructure is in its early stages—here's a comprehensive look at the ecosystem landscape and project map

TechFlow Selected TechFlow Selected

Bitcoin L2 infrastructure is in its early stages—here's a comprehensive look at the ecosystem landscape and project map

Bitcoin's design limitations are particularly evident in ensuring withdrawal security within Layer 2 solutions.

Author: Caliber

Translation: TechFlow

In the complex domain of fintech, Bitcoin functions as an innovative digital currency by enabling peer-to-peer transactions that bypass traditional financial intermediaries. However, as it evolves, Bitcoin faces a series of intrinsic challenges—particularly those related to scalability and transaction throughput—which represent major obstacles on its path toward broader adoption.

These challenges are not unique to Bitcoin. Ethereum, although designed with greater flexibility for application development, also suffers from similar issues. To address them, numerous solutions have been proposed, such as sidechains, Layer 2 networks, or payment channel systems. In Ethereum's ecosystem, the Layer 2 landscape is rapidly expanding, giving rise to diverse solutions like EVM rollups, sidechains transitioning into rollups, and projects pursuing varying degrees of decentralization and security. The security concerns surrounding Layer 2 solutions—especially asset protection and these systems’ ability to read and adapt to changes in the Ethereum blockchain—highlight a critical trade-off: higher security often comes at the expense of scalability and cost efficiency.

Although Bitcoin has made remarkable progress in enhancing its functionality, it still encounters significant hurdles when attempting to develop Layer 2 solutions comparable to those on Ethereum. The design limitations of Bitcoin are particularly evident in ensuring withdrawal security within Layer 2 solutions. Its scripting language is functionally limited and lacks Turing completeness, restricting its capacity for executing complex computations and supporting advanced features. This design choice prioritizes Bitcoin’s security and efficiency but limits its programmability relative to more flexible blockchain platforms like Ethereum. Additionally, probabilistic finality may undermine the reliability and speed required by Layer 2 solutions, potentially leading to issues such as chain reorganizations that affect transaction permanence. While Bitcoin’s design principles make it reliable and secure, these factors hinder the rapid adaptation of its Layer 2 systems to new developments.

Segregated Witness (SegWit) and Taproot have been transformative for Bitcoin. SegWit improves Bitcoin’s infrastructure by separating signature data, increasing transaction speeds, and enabling fast payment processing via the Lightning Network. Later, Taproot enhanced efficiency and privacy by compressing transaction data and concealing transaction complexity. Together, SegWit and Taproot have sparked a new wave of Layer 2 innovation, forming the foundation for future Layer 2 designs and significantly expanding Bitcoin’s capabilities as a digital currency.

Understanding Bitcoin’s Layer 2 Solutions

The Bitcoin Layer 2 Trilemma

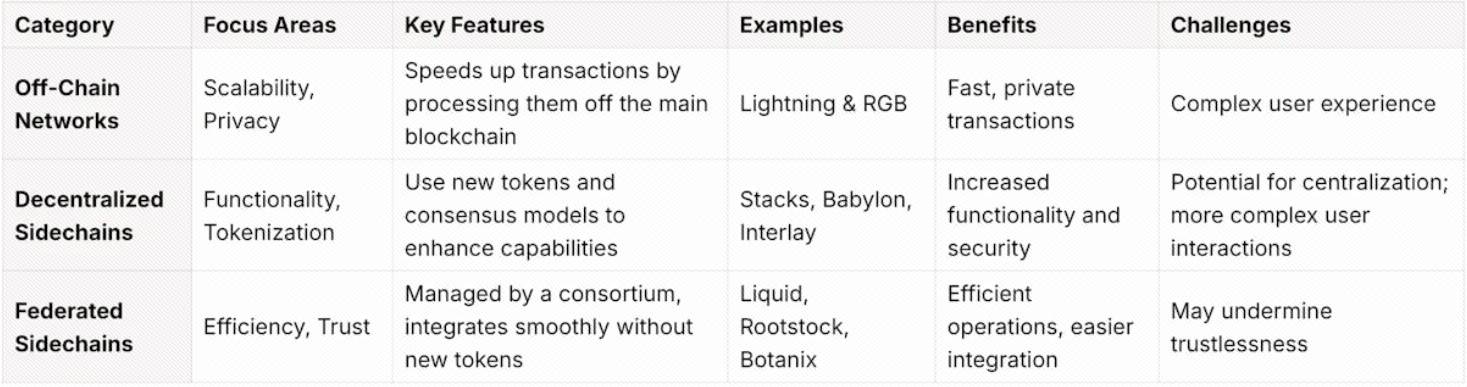

Within Bitcoin’s increasingly expanding Layer 2 ecosystem, many distinct systems have emerged, aiming to improve scalability and drive adoption. These solutions offer unique approaches to overcoming Bitcoin’s inherent limitations. Trevor Owens proposed a classification method that categorizes these solutions based on how they address the Bitcoin Layer 2 trilemma, dividing them into off-chain networks, decentralized sidechains, and federated sidechains—each involving distinct methods and trade-offs:

-

Off-chain networks: Prioritize scalability and privacy but may pose challenges for user experience. Examples include Lightning & RGB.

-

Decentralized sidechains: Introduce new tokens and consensus mechanisms to extend functionality, but may complicate user experience and raise centralization concerns. Examples include Stacks, Babylon, Interlay, among others.

-

Federated sidechains: Simplify operations through trusted consortia, offering efficiency at the potential cost of sacrificing Bitcoin’s foundational decentralization. Examples include Liquid, Rootstock, Botanix.

This trilemma provides a useful framework for classifying Bitcoin’s Layer 2 solutions, though it may not fully capture all nuances of their design. Moreover, it highlights current trade-offs rather than insurmountable barriers, indicating that elements of this trilemma are part of developers’ decision-making process.

For example, decentralized sidechains issue new tokens to enhance security and incentivize network participation, which can complicate user interactions and may be unpopular among Bitcoin purists. In contrast, federated sidechains opt to skip new token issuance, streamlining user experience and reducing resistance within the Bitcoin community. Another alternative involves using full VM/global state environments, enabling implementation of complex features such as creating new tokens on smart contract platforms. However, this approach increases system complexity and typically raises its vulnerability to attacks.

Technical Classification

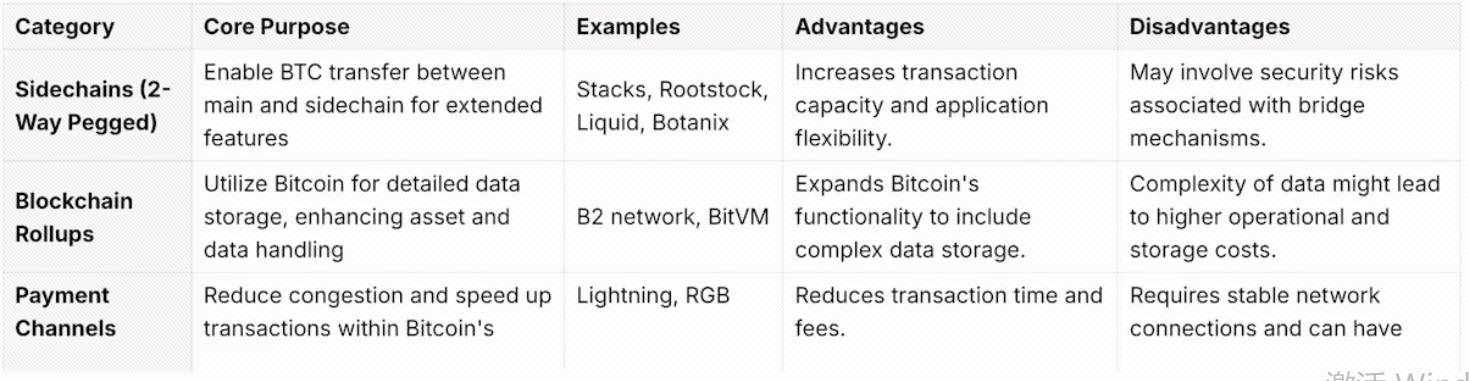

From another technical perspective, we can classify Bitcoin’s Layer 2 solutions according to their primary technological characteristics. This alternative classification examines various technical details and architectures, offering a nuanced understanding of how each solution contributes to enhancing Bitcoin’s scalability, security, and functionality. Each approach serves a unique purpose, and these purposes are neither conflicting nor inherently creating a trilemma. Nevertheless, each method has its own strengths and weaknesses regarding security and scalability. As such, some systems may combine multiple approaches. We will explore this further in the next section. Let us now examine these categories:

-

Sidechains using two-way peg protocols. These sidechains connect to Bitcoin similarly to Layer 2 systems through a mechanism known as a two-way peg. This setup allows Bitcoin to move between the main chain and the sidechain, supporting experimentation and implementing functionalities not directly supported by the main chain. The two-way peg mechanism plays a crucial role in transferring BTC value to the sidechain. On these sidechains, developers set up various environments—some choosing EVM-compatible ecosystems while others build VM environments with native smart contracts. Examples include Stacks, Rootstock, Liquid, Botanix, etc.

-

Blockchain rollups. This approach uses Bitcoin as a data storage layer, drawing inspiration from rollup technology. In this model, each UTXO acts like a small canvas capable of storing more complex information. Imagine each bitcoin storing its own detailed dataset—not only adding value but also expanding the types of data and assets Bitcoin can handle. It opens broad possibilities for digital interaction and representation, enriching and diversifying the Bitcoin ecosystem. Examples include B2 Network, BitVM.

-

Payment channel networks. These networks act as expressways across Bitcoin’s expansive landscape. They accelerate high-volume transactions off the main Bitcoin chain, reducing congestion and ensuring transactions are both fast and economical. Examples include Lightning & RGB.

By breaking down these tools in this way, we gain a clearer understanding of how each helps improve Bitcoin—making it more scalable, secure, and multifunctional. Let us now delve deeper into these tools:

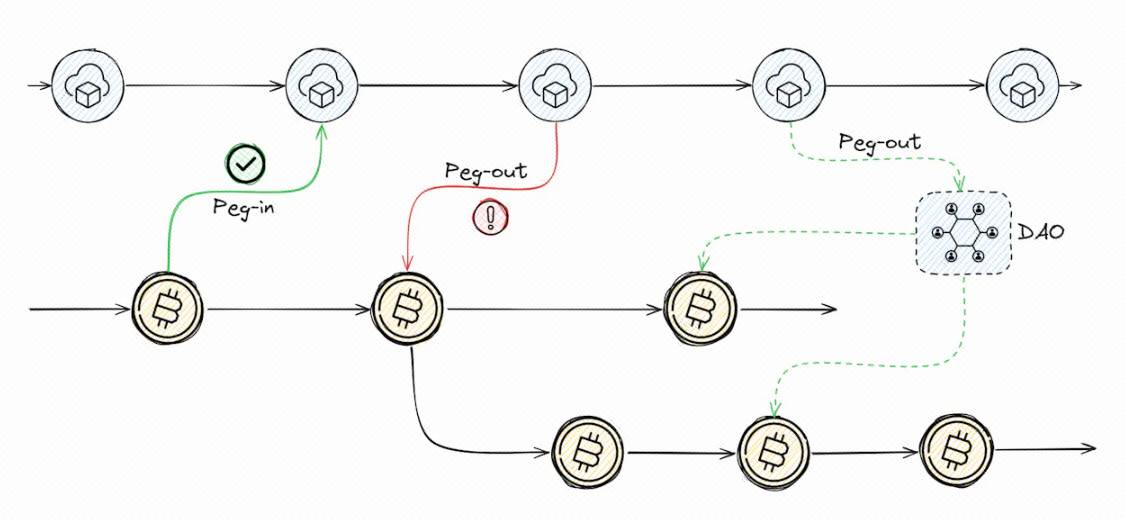

Two-Way Peg Protocols

A two-way peg enables asset transfers between two independent blockchains—typically a main chain and a sidechain. This system locks assets on one chain and then mints or unlocks equivalent assets on the other, maintaining a fixed exchange rate between the original and pegged assets.

Understanding the Peg-In Process

Imagine transferring your assets from a main chain (like Bitcoin) to a sidechain. The peg-in process marks your starting point. Here, your assets are securely locked on the main chain—similar to depositing them into a vault for safekeeping. A transaction is then created on the main chain to formalize this lock. Once the sidechain detects this transaction, it mints an equivalent amount of pegged assets. This process is akin to receiving a voucher of equal value on foreign land, allowing you to use your wealth in a new environment while keeping your original assets intact and secure.

Initiating the Peg-Out Process

When you decide to return your assets to the original main chain, the peg-out process begins. This reverse journey involves “burning” or locking the pegged assets on the sidechain, indicating they are being withdrawn and taken out of circulation. You then provide proof of this action to the main chain. Once the main chain verifies your claim, it releases an equivalent amount of the original assets back to you. This mechanism ensures integrity and balance in asset distribution across the two blockchains, preventing duplication or loss.

Implementation of Two-Way Peg Systems

Rootstock

RSK’s two-way peg system is an advanced framework designed to seamlessly integrate Bitcoin with smart contract capabilities through the RSK platform. By leveraging SPV for efficient transaction validation, employing a robust federation model for transaction approval, and integrating SegWit and Taproot, RSK enhances transaction efficiency while closely aligning with Bitcoin’s security model. Furthermore, merged mining strengthens the system’s security and incentivizes broader miner participation.

-

RSK Federation Model. Pegnatories—a selected group of functionaries—act as bridge guardians or trusted custodians in this federated model, ensuring every peg-in and peg-out complies with protocol rules. Think of them as a committee of gatekeepers, each holding a key to a collective vault. Their role is crucial—they ensure every cross-chain transaction follows integrity and consensus, safeguarding the secure and orderly flow of digital assets across this critical bridge.

-

SegWit and Taproot. SegWit reduces transaction size and increases processing speed by separating signature information from transaction data. Combined with Schnorr signatures, MAST (Merkelized Abstract Syntax Trees), and other enhancements from Taproot, transactions become more efficient and private.

-

RSK Merged Mining. In RSK’s merged mining approach, miners simultaneously secure both the Bitcoin and RSK networks without additional computational overhead, thereby enhancing RSK’s security. This method leverages Bitcoin’s mining power, offering extra rewards to miners and demonstrating innovative use of existing blockchain infrastructure. However, the success of this integration depends on accurately aligning labels within Bitcoin blocks with corresponding RSK blocks, emphasizing the importance of precise execution to maintain inter-network security and consistency.

Botanix

Botanix combines a Proof-of-Stake (PoS) consensus mechanism built atop Bitcoin with Spiderchain, a decentralized EVM network utilizing a multi-signature architecture, to manage Turing-complete smart contracts off the main chain. Bitcoin serves as the primary settlement layer, while Botanix ensures transaction integrity through advanced multi-signature wallets and off-chain cryptographic verification.

-

Spiderchain is a distributed multi-signature network responsible for holding all actual bitcoins on Botanix.

-

Architecture: Spiderchain consists of coordinating nodes (node operators and liquidity providers across the chain). It operates through a sequentially arranged multi-signature wallet managing asset custody within the network. Each transaction in the wallet requires approval from multiple coordinating nodes, eliminating single points of failure.

-

Dynamic Operations. For each new Bitcoin block, a verifiable random function (VRF) based on the Bitcoin block hash determines the coordinating node responsible for the upcoming “epoch” (defined in the Botanix system as the period between Bitcoin blocks). Then, by hashing the block hash with SHA256 and applying modulo operation with the number of active coordinating nodes (N), fairness and randomness in node selection are ensured. This guarantees equitable and secure task allocation, minimizing centralization risks.

-

-

Two-Way Peg System. Multi-signature wallets play a pivotal role here, requiring consensus among designated coordinating nodes to execute any transaction.

-

Peg-In Process. Users send Bitcoin to a new multi-signature wallet, where it is securely locked. This action triggers the minting of an equivalent amount of synthetic BTC on the Botanix chain. Creating this wallet requires multiple coordinating nodes who must all agree and sign, ensuring no individual can control the wallet independently.

-

Peg-Out Process. Conversely, during a peg-out, synthetic BTC is burned, and the corresponding Bitcoin is released from the multi-signature wallet back to the user’s Bitcoin address. This process is secured by the same multi-signature protocol, requiring multiple coordinating nodes to approve the transaction.

-

-

PoS Consensus and EVM Implementation

-

Consensus. In Botanix’s PoS system, coordinating nodes stake their Bitcoin to participate in the network. They validate transactions and create new blocks on the Botanix chain. Node selection is based on their stake and the aforementioned randomization method used in Spiderchain.

-

EVM Implementation. The EVM on Botanix supports all Ethereum-compatible operations, enabling developers to deploy and execute complex smart contracts.

-

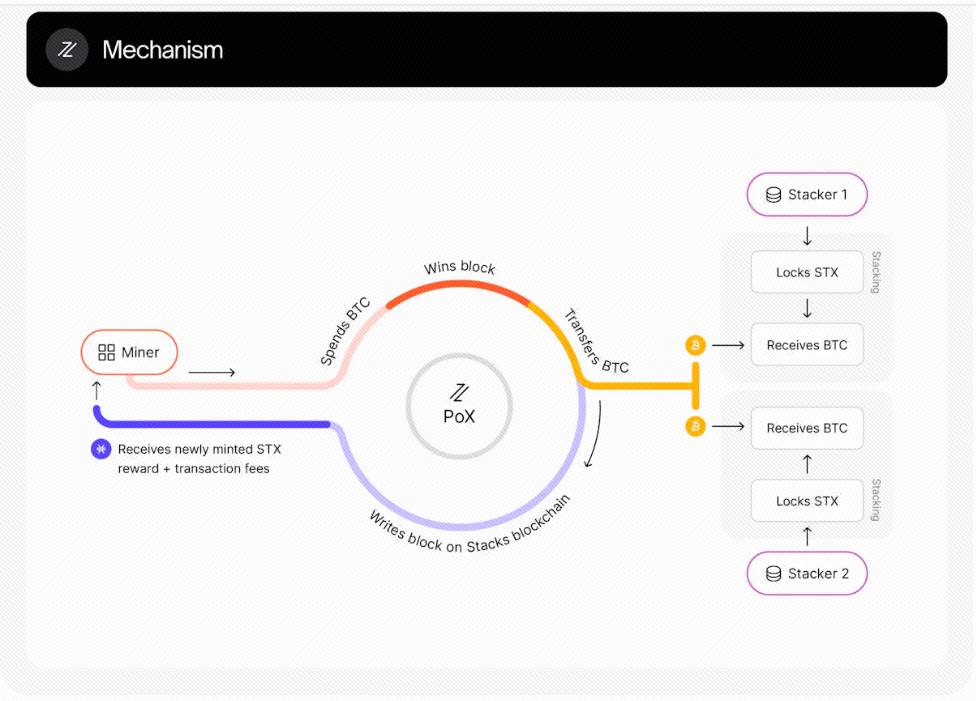

Stacks:

The Stacks platform aims to expand Bitcoin’s infrastructure through innovative mechanisms such as the sBTC two-way peg, Proof of Transfer (PoX), and Clarity smart contracts, enabling support for smart contracts and decentralized applications (dApps).

-

sBTC Two-Way Peg Protocol:

-

Threshold Signature Wallets: These wallets use a threshold signature scheme requiring a predefined group of signers (Stackers) to jointly sign pegging transactions. Stackers are selected via a verifiable random function (VRF) based on the amount of STX they have locked, rotating every cycle (typically two weeks), ensuring dynamic membership and continuous alignment with the network’s current state. This significantly enhances the security and robustness of the pegging mechanism, preventing dishonest behavior and potential collusion while ensuring fairness and unpredictability in the selection process.

-

-

Proof of Transfer (PoX):

-

In PoX, miners contribute BTC to the Stacks network instead of burning Bitcoin as in Proof of Burn. This not only incentivizes participation through BTC rewards but also directly ties Stacks’ operational stability to Bitcoin’s proven security attributes. Stacks transactions are anchored on Bitcoin blocks, with each Stacks block recording a hash in a Bitcoin transaction using the OP_RETURN opcode, which allows embedding up to 40 bytes of arbitrary data. This mechanism ensures that any change to the Stacks blockchain requires a corresponding change on the Bitcoin blockchain, thus benefiting from Bitcoin’s security without modifying its protocol.

-

-

Clarity. Clarity, the smart contract programming language used by the Stacks blockchain, enforces strict rules to ensure all operations execute exactly as defined, avoiding unintended outcomes and providing predictability and security for developers. It offers decidability—each function’s result is known before execution—preventing surprises and enhancing contract reliability. Additionally, Clarity interacts directly with Bitcoin transactions, enabling development of complex applications while leveraging Bitcoin’s security. It also supports traits similar to interfaces in other languages, aiding code reuse and maintaining clean codebases.

Liquid:

The Liquid Network provides a federated sidechain for the Bitcoin protocol, significantly enhancing transaction capabilities and asset management. At the core of Liquid Network’s architecture is the concept of strong federation—a group of trusted functionaries responsible for block validation and signing.

-

Watchmen: Watchmen oversee the peg-out process from Liquid to Bitcoin, ensuring every transaction is authorized and valid.

-

Key Management: Watchmen use hardware security modules to protect the keys required to authorize transactions.

-

Transaction Validation: Watchmen verify transactions by checking cryptographic proofs that comply with Liquid’s consensus rules, using multi-signature schemes to enhance security.

-

-

Pegging Mechanism:

-

Peg-In: Bitcoins are locked on the Bitcoin blockchain (using multi-signature addresses managed by Watchmen), and an equivalent amount of Liquid Bitcoin (L-BTC) is issued on the Liquid sidechain via cryptographic methods to ensure accuracy and security of the transfer.

-

Peg-Out: This process involves burning L-BTC on the Liquid sidechain and releasing the corresponding Bitcoin on the Bitcoin blockchain. It is closely monitored by designated entities called Watchmen, ensuring only authorized transactions proceed.

-

-

Proof of Reserves (PoR): Developed by Blockstream, PoR is a vital tool providing transparency and trust in network asset holdings. PoR involves creating a partially signed Bitcoin transaction proving control over funds. Although this transaction cannot be broadcast on the Bitcoin network, it proves the existence and control of the claimed reserves. It allows entities to prove fund ownership without moving assets.

Babylon:

Babylon is designed to enhance the security of PoS chains by allowing Bitcoin holders to stake their assets, integrating Bitcoin into the PoS ecosystem and leveraging Bitcoin’s massive market capitalization without requiring direct transactions or smart contract functionality on the Bitcoin blockchain. Importantly, Babylon maintains the integrity and security of staked assets by avoiding movement or locking of Bitcoin through vulnerable bridges or third-party custodians.

-

Bitcoin Timestamping: Babylon employs a timestamping mechanism that embeds PoS chain data directly into the Bitcoin blockchain. By anchoring PoS block hashes and key staking events onto Bitcoin’s immutable ledger, Babylon provides historical timestamps secured by Bitcoin’s extensive proof-of-work network. Using Bitcoin for timestamping leverages not only its security but also its decentralized trust model. This approach adds an extra layer of defense against long-range attacks and state corruption.

-

Accountable Assertions: Babylon uses accountable assertions to manage staking contracts directly on the Bitcoin blockchain, enabling the public exposure of a staker’s private key in case of misbehavior (e.g., double signing). The design uses chameleon hash functions and Merkle trees to tightly bind a staker’s assertion to their stake, enforcing protocol integrity through cryptographic accountability. If a staker deviates—for instance, by signing conflicting statements—their private key is deterministically revealed, triggering automatic penalties.

-

Staking Protocol: A key innovation of Babylon is its staking protocol, which allows rapid adjustment of staking allocations based on market conditions and security needs. The protocol supports fast unstaking, enabling stakers to move their assets quickly without the long lock-up periods typical in PoS chains. Additionally, the protocol is built as a modular plugin compatible with various PoS consensus mechanisms. This modular approach allows Babylon to provide staking services to a wide range of PoS chains without significant modifications to existing protocols.

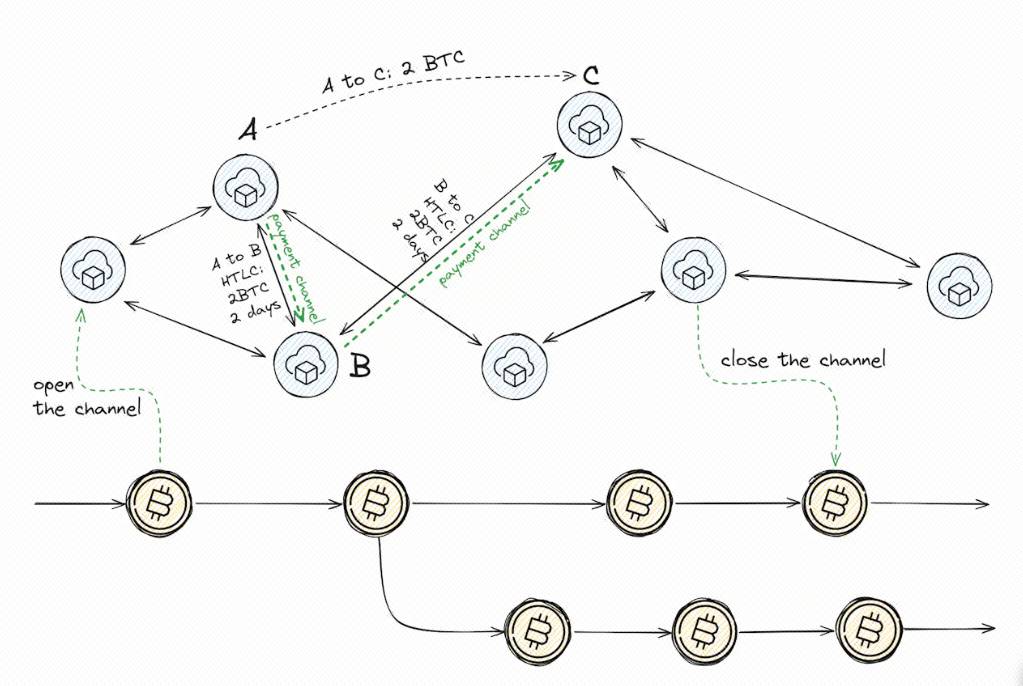

Payment Channels and the Lightning Network

Payment channels are tools designed to enable multiple transactions between two parties without immediately submitting all transactions to the blockchain. They streamline transactions by:

-

Initialization: A channel is opened via a single on-chain transaction, creating a shared multi-signature wallet between the two parties.

-

Transaction Process: Within the channel, both parties transact privately, adjusting their respective balances via instant transfers without broadcasting to the blockchain.

-

Closure: The channel is closed via another on-chain transaction, settling final balances based on the most recently agreed-upon transaction.

Exploring the Lightning Network

Building upon payment channels, the Lightning Network extends these concepts into a networked structure, enabling users to route payments across the blockchain via interconnected paths.

-

Routing: Much like finding a path through city backstreets, the network routes payments even if you don’t have a direct channel with the final recipient.

-

Efficiency: This interconnected system dramatically reduces transaction fees and processing times, making Bitcoin suitable for everyday transactions.

-

Smart Locks (HTLCs): The network uses advanced contracts called Hash Time-Locked Contracts to secure payments across different channels. It ensures your payment safely reaches its destination through several checkpoints. It also reduces counterparty default risk, making the network reliable.

-

Security Protocol: In case of disputes, the blockchain acts as a judge, validating the latest agreed-upon balance to ensure fairness and security.

Taproot and SegWit enhance Bitcoin’s network—especially the Lightning Network—in terms of privacy and efficiency:

-

Taproot: Acts as an aggregator for Bitcoin transactions—bundling multiple signatures into one. This keeps off-chain transactions clean, more private, and cheaper.

-

SegWit: Changes how data is stored in Bitcoin transactions, allowing more transactions per block. For the Lightning Network, this means opening and closing channels is cheaper and smoother, further reducing fees and improving transaction throughput.

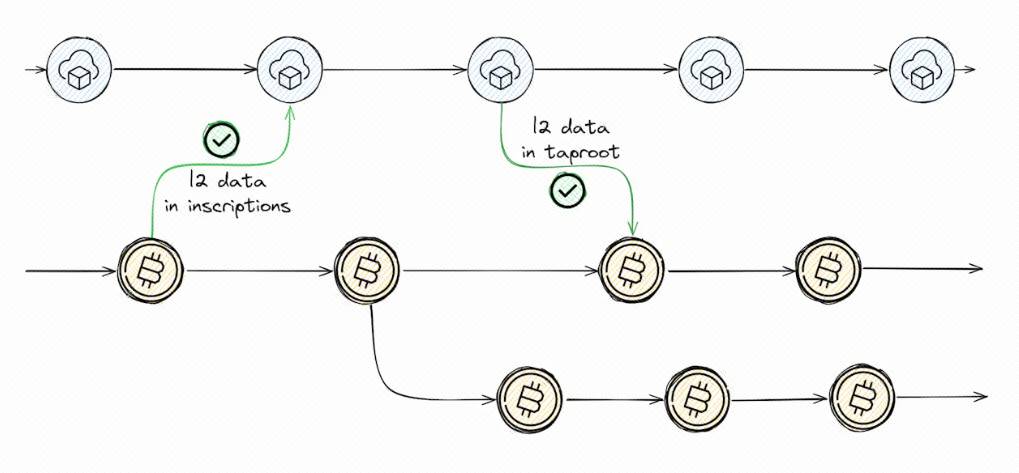

Inscription-Based Layer 2 Solutions

Inscriptions have triggered a wave of innovation in Bitcoin’s Layer 2 ecosystem. With the introduction of two groundbreaking upgrades—SegWit and Taproot—the Ordinals protocol was launched, enabling anyone to attach additional data to the Taproot script of a UTXO, up to 4MB. This development led the community to realize that Bitcoin could now serve as a data availability layer. From a security standpoint, inscriptions offer a new perspective. Data such as digital artifacts are now stored directly on the Bitcoin network, making them immutable and protected from tampering or loss due to external server issues. This not only enhances the security of digital assets but also embeds them directly into Bitcoin’s blocks, ensuring permanence and reliability. Most importantly, Bitcoin rollups have become feasible, with inscriptions providing a mechanism to add extra data or functionality within transactions. This enables more complex interactions or state changes off the main chain, while still relying on the main chain’s security model.

Implementation of Inscription-Based Layer 2 Solutions

BitVM:

BitVM is designed using a combination of optimistic rollup techniques and cryptographic proofs. By moving Turing-complete smart contracts off-chain, BitVM significantly improves transaction efficiency without compromising security. While Bitcoin remains the base settlement layer, BitVM ensures transaction data integrity through clever use of Bitcoin’s scripting capabilities and off-chain cryptographic verification. Currently, BitVM is under active community development and has already become a platform for several top-tier projects such as Bitlayer and Citrea.

-

Inscription-like Storage Method: BitVM leverages Bitcoin’s Taproot to embed data into Tapscript, similar to the concept behind inscription protocols. This data typically includes critical computation details such as the virtual machine’s state at various checkpoints, the hash of the initial state, and the hash of the final computational result. By anchoring this Tapscript into an unspent transaction output (UTXO) held at a Taproot address, BitVM effectively integrates transaction data directly into the Bitcoin blockchain. This approach ensures data persistence and immutability while leveraging Bitcoin’s security to protect the integrity of recorded computations.

-

Fraud Proofs: BitVM uses fraud proofs to ensure the security of its transactions. Here, a prover commits to the result of a specific computation, which is not executed on-chain but verified indirectly. If a verifier suspects the commitment is incorrect, they can submit a concise fraud proof using Bitcoin’s scripting capabilities to demonstrate the error. This system significantly reduces the computational burden on the blockchain, avoiding full on-chain computation and aligning with Bitcoin’s design philosophy of minimizing transaction load and maximizing efficiency. At the core of this mechanism are hash locks and digital signatures, linking claims and challenges to actual off-chain computational work. BitVM adopts an optimistic verification model—operations are assumed correct unless proven otherwise—enhancing efficiency and scalability. Only valid computations are accepted, and anyone in the network can independently verify correctness using available cryptographic proofs.

-

Optimistic Rollups: BitVM employs optimistic rollup technology to significantly increase Bitcoin’s scalability by batching multiple off-chain transactions. These transactions are processed off-chain, with their results periodically recorded on the Bitcoin ledger to ensure completeness and availability. In practice, BitVM processes transactions off-chain and intermittently records their outcomes on the Bitcoin ledger. The optimistic rollups used in BitVM represent a method to overcome Bitcoin’s inherent scalability limitations, leveraging off-chain computational power while ensuring transaction validity through periodic on-chain verification. This system effectively balances the load between on-chain and off-chain resources, optimizing the security and efficiency of transaction processing.

Overall, BitVM is not merely another Layer 2 technology—it represents a potentially fundamental shift in how Bitcoin can scale and evolve. It offers unique solutions to Bitcoin’s limitations but still requires further development and refinement to fully realize its potential and gain broader acceptance within the community.

B2 Network

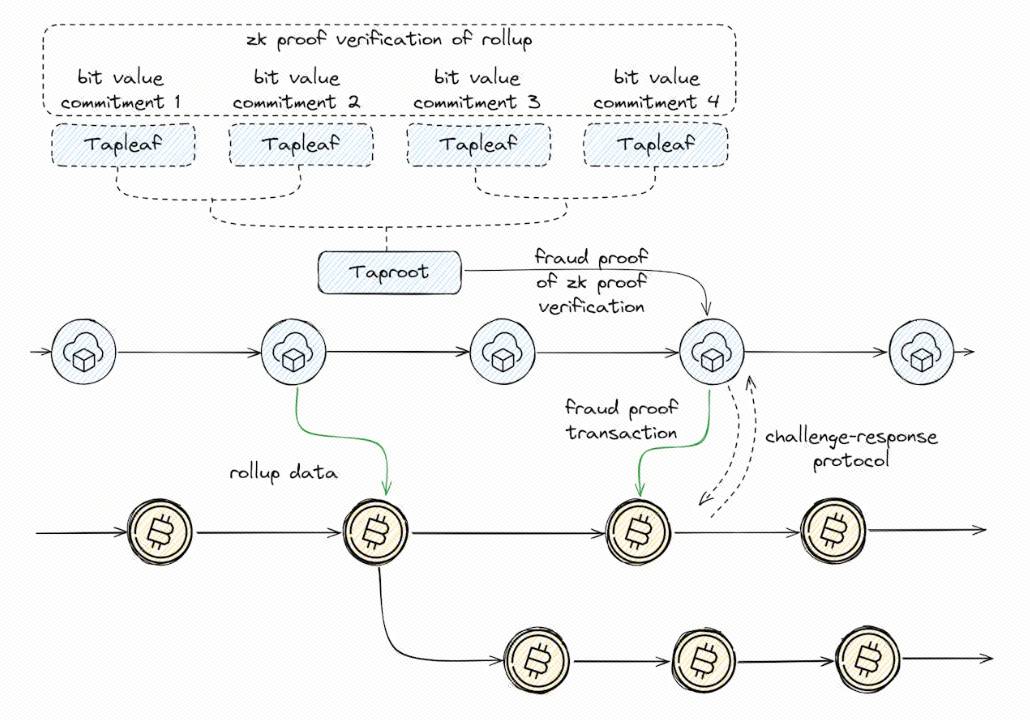

As the first zero-knowledge proof verified-commitment rollup on Bitcoin, B2 Network enhances transaction speed and reduces costs. This setup enables off-chain execution of Turing-complete smart contracts, significantly boosting efficiency. Bitcoin serves as B2 Network’s foundational settlement layer, storing B2 rollup data. This configuration allows complete retrieval or recovery of B2 rollup transactions using Bitcoin inscriptions. Additionally, the computational validity of B2 rollup transactions is verified through zero-knowledge proofs posted on Bitcoin.

-

Crucial Role of Inscriptions: B2 Network leverages Bitcoin inscriptions to embed additional data into Tapscript, including the storage path of rollup data, the Merkle root hash of rollup data, zero-knowledge proof data, and the parent B2 inscription UTXO hash. By writing this Tapscript into a UTXO and sending it to a Taproot address, B2 effectively embeds rollup data directly into the Bitcoin blockchain. This method not only ensures data persistence and immutability but also leverages Bitcoin’s robust security mechanisms to protect the integrity of rollup data.

-

Zero-Knowledge Proofs for Enhanced Security: B2’s commitment to security is further demonstrated through its use of zero-knowledge proofs. These proofs allow the network to verify transactions without exposing transaction details, preserving privacy and security. Within B2, computational units are broken down into smaller components, each represented as bit-value commitments in tapleaf scripts. These commitments are linked within a taproot structure, offering a compact and secure method for verifying transaction validity on both Bitcoin and the B2 network.

-

Rollup Technology for Scalability: At the heart of B2’s architecture lies rollup technology—specifically ZK-Rollup—which aggregates multiple off-chain transactions into one. This approach dramatically increases throughput and reduces transaction fees, addressing Bitcoin’s most pressing scalability issues. B2’s rollup layer processes user transactions and generates corresponding proofs, ensuring transactions are validated and finalized on the Bitcoin blockchain.

-

Challenge-Response Mechanism: In the B2 Network, after zk-proofs are batched and transactions verified, nodes have the opportunity to challenge these batches if they suspect invalid transactions. This critical phase utilizes a fraud-proof mechanism, requiring challenges to be resolved before batches proceed. This step ensures only transactions verified as legitimate advance to final confirmation. If no challenge is raised or existing challenges fail within the specified time lock, the batch is confirmed on the Bitcoin blockchain. Conversely, if any challenge is validated, the rollup will be subsequently reverted.

Final Thoughts

Advantages

-

Unlocking DeFi Markets: By enabling EVM-compatible Layer 2 solutions, Bitcoin can access the multi-billion-dollar DeFi market. This not only expands Bitcoin’s utility but also unlocks new financial markets previously accessible only through Ethereum and similar programmable blockchains.

-

Expanding Use Cases: These Layer 2 platforms support not just financial transactions but also diverse applications across finance, gaming, NFTs, or identity systems, greatly extending Bitcoin’s original scope beyond simple currency [3, 4, 5].

Disadvantages

-

Centralization Risks: Some Layer 2 solutions involve mechanisms that may lead to increased centralization. For example, in systems requiring BTC value to be locked, unlike Ethereum’s Layer 2 solutions, the interaction between Layer 2 and Bitcoin is not protected by Bitcoin’s security model. Instead, it relies on smaller decentralized networks or federated models, potentially weakening the trust model’s security. This structural difference may introduce failure points absent in fully decentralized models.

-

Increased Transaction Fees and Blockchain Bloat: Data-intensive uses—such as Ordinals and other inscription protocols—may cause blockchain bloat, slowing down the network and increasing transaction costs for users. This could lead to higher costs and slower transaction validation times, affecting network efficiency.

-

User Experience and Technical Complexity: The technical complexity of understanding and interacting with Layer 2 solutions may pose a significant barrier to adoption. Users need to manage additional components, such as payment channels on the Lightning Network or handling different token types on platforms like Liquid.

The Ugly Side

-

Regulatory and Ethical Issues: While the immutability of inscriptions is a technical advantage, it also raises potential regulatory and ethical concerns. If the data is illegal, unethical, or simply erroneous, it poses serious challenges, resulting in permanent consequences with no recourse.

-

Impact on Fungibility: If certain bitcoins are “marked” with non-financial data, it may affect their fungibility—the idea that each unit should be indistinguishable—potentially leading to situations where some bitcoins are valued or accepted less than others.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News