Understanding Market Makers: Predators in the Gray Zone, Yet Vital to the Crypto World?

TechFlow Selected TechFlow Selected

Understanding Market Makers: Predators in the Gray Zone, Yet Vital to the Crypto World?

This article aims to explain what market makers are, the importance of their role, and their functions in the cryptocurrency market.

Author: Min Jung

Translation: TechFlow

Article Summary

-

Market makers contribute significantly to reducing volatility and trading costs by providing substantial liquidity, ensuring efficient trade execution, enhancing investor confidence, and enabling smoother market operations.

-

Market makers utilize various structures to provide liquidity, the most common being token loan agreements and retainer models. Under a token loan agreement, market makers borrow tokens from project teams to ensure market liquidity over a specific period (typically 1–2 years), in exchange for receiving call options as compensation. In contrast, the retainer model involves compensating market makers for maintaining long-term liquidity, usually through monthly fees.

-

As in traditional markets, clear rules and regulations governing market-making activities are crucial for the healthy functioning of cryptocurrency markets. Still in its early stages, the crypto market urgently needs well-structured regulations to prevent illegal behavior and ensure fair competition. Such regulations would greatly support market liquidity and investor protection.

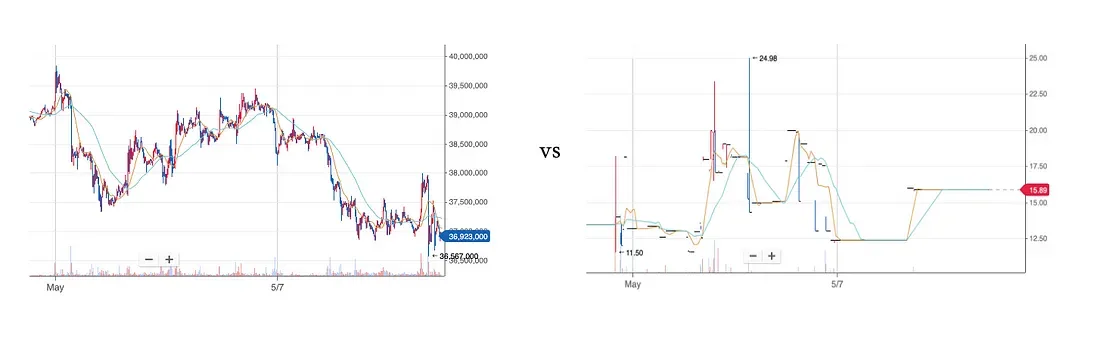

Which market do you want to trade in?

Source: Presto Research

Recent events in the cryptocurrency market have sparked strong interest in market makers and the concept of market making. However, market makers are often misunderstood and viewed as opportunities for price manipulation, including notorious pump-and-dump schemes. There is also a lack of accurate information about the true role of market makers in financial markets. It is common for emerging projects, upon their token listing, to overlook the importance of market makers and frequently question their necessity. Against this backdrop, this article aims to explain what market makers are, why their role is important, and how they function within the cryptocurrency market.

What Are Market Makers?

Market makers play a critical role in maintaining continuous market liquidity. They typically achieve this by simultaneously providing bid and ask quotes. By buying from sellers and selling to buyers, they create an environment where market participants can trade at any time.

This can be likened to the role of a used car dealer in everyday life. Just as these dealers allow us to sell our current vehicle and purchase a used one at any time, market makers perform a similar function within financial markets. Citadel, a global market maker, provides the following definition of a market maker:

Figure 2: The Role of Market Makers in Traditional Financial Markets

Source: Presto Research

Market makers are also essential in traditional financial markets. On Nasdaq, each stock has an average of about 14 market makers, totaling around 260. Moreover, in markets with lower liquidity than equities—such as bonds, commodities, and foreign exchange—most trades are conducted through market makers.

Market Makers’ Profits and Risks

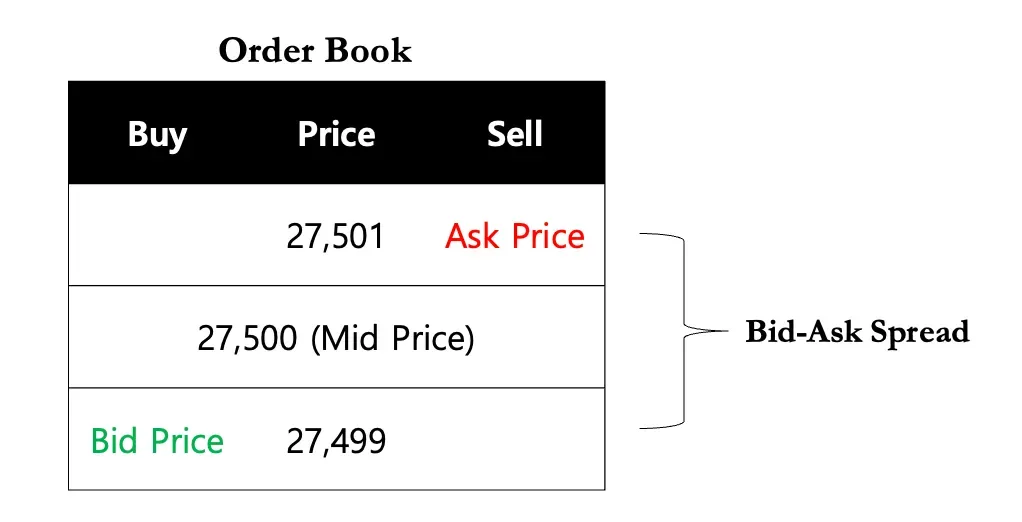

Market makers earn profits through the bid-ask spread of financial instruments. Since the ask price is higher than the bid price, market makers profit by buying financial instruments at a lower price and selling them at a higher price (i.e., the bid-ask spread).

Figure 3: Bid-Ask Spread

-

Consider a scenario where a market maker simultaneously offers a bid price of $27,499 and an ask price of $27,501 for an asset. If both orders are executed, the market maker buys the asset at $27,499 and sells it at $27,501, earning a $2 profit ($27,501 - $27,499), which represents the bid-ask spread.

-

This concept aligns with the earlier example of a used car dealer who purchases a vehicle and then sells it at a slightly higher price, profiting from the difference between the buy and sell prices.

However, it's important to note that not all market-making activities generate profits—market makers can indeed incur losses. In rapidly fluctuating markets, the price of a particular asset may move sharply in one direction, resulting in only the bid or ask order being executed, rather than both. Market makers also face inventory risk—the risk associated with being unable to sell an asset. This arises because market makers always hold a portion of the assets they are making markets for, in order to provide liquidity.

For example, if a used car dealer purchases a vehicle but cannot find a buyer, and an economic downturn causes used car prices to fall, the dealer will suffer a financial loss.

Why Do We Need Market Making?

Providing Substantial Liquidity

The primary goal of market making is to ensure sufficient market liquidity. Liquidity refers to the extent to which an asset can be quickly and easily converted into cash without causing financial loss. High market liquidity reduces the transaction cost impact of any given trade, minimizes slippage, and enables efficient execution of large orders without causing significant price fluctuations. Essentially, market makers facilitate faster, larger, and easier buying and selling of tokens for investors at any given time, without major disruptions.

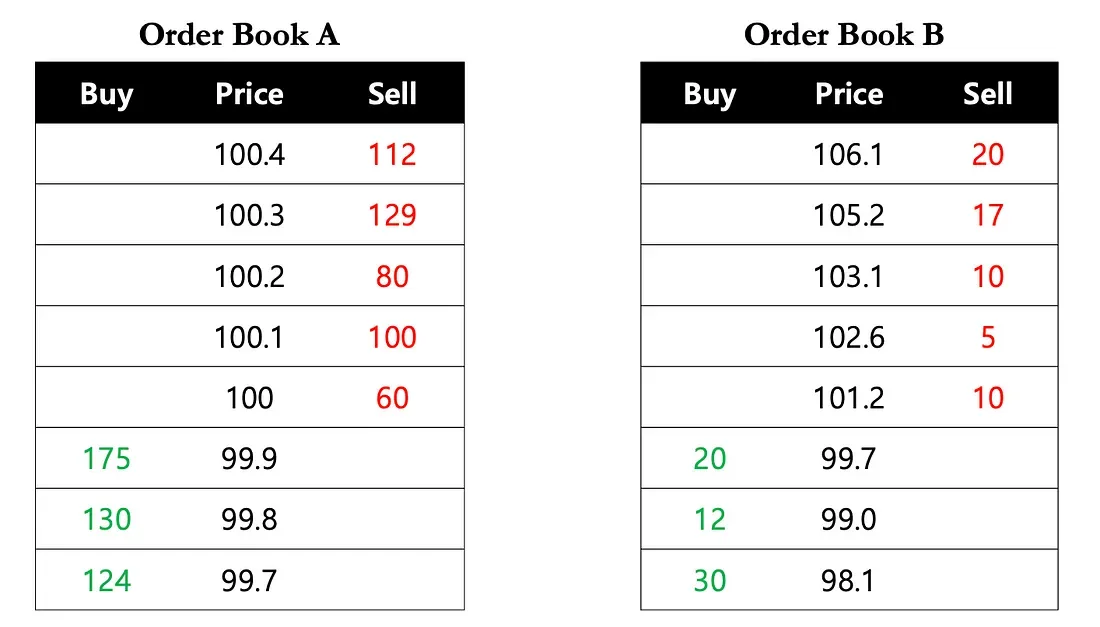

Figure 4: Why Liquidity Matters

Source: Presto Research

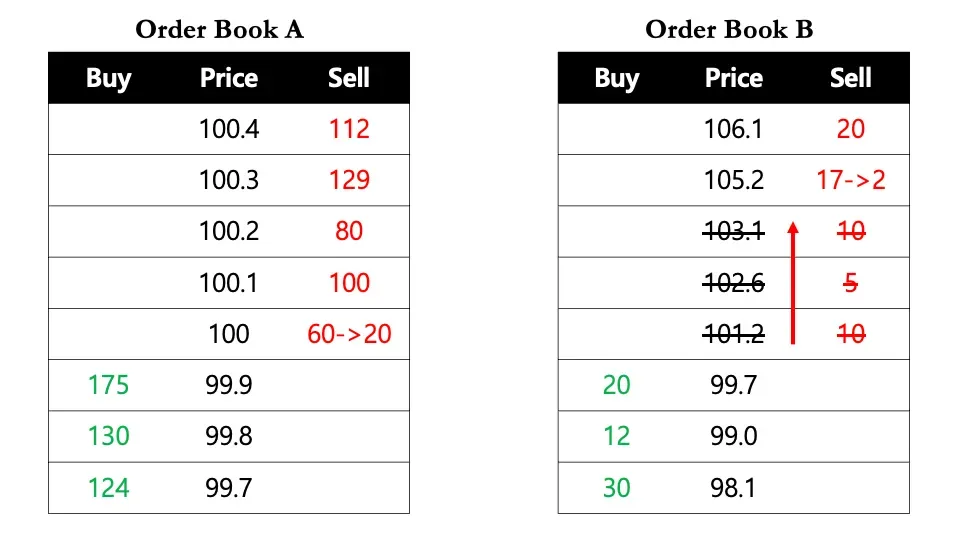

For example, consider an investor needing to immediately purchase 40 tokens. In a highly liquid market (Order Book A), they can instantly buy all 40 tokens at $100 each. However, in a less liquid market (Order Book B), they have two options: 1) Buy 10 tokens at $101.2, 5 at $102.6, 10 at $103.1, and 15 at $105.2, resulting in an average price of $103.35; or 2) Wait a long time for the token price to reach their desired level.

Reducing Volatility

As illustrated in the previous example, the substantial liquidity provided by market makers helps mitigate price volatility. In the above scenario, after the investor purchases 40 tokens, the next available price in Order Book B is $105.2. This indicates that a single trade caused approximately a 5% price swing. In real-world cryptocurrency markets, even small trades can trigger significant price changes for assets with very low liquidity. This is especially true during periods of market volatility, when fewer participants can lead to pronounced price swings. Thus, market makers play a key role in reducing price volatility by bridging this supply-demand gap.

Figure 5: How Market Makers Help Reduce Volatility

Source: Presto Research

The role of market makers described above ultimately enhances investor confidence in a project. Every investor wants to be able to buy and sell their holdings as needed with minimal transaction costs. However, if investors perceive wide bid-ask spreads or anticipate long wait times to execute trades at desired quantities, they may become discouraged—even if they have a positive outlook on the project. Therefore, consistent market maker activity, providing ongoing liquidity, not only lowers the barrier to entry for investors but also encourages investment. This action, in turn, brings more liquidity, creating a virtuous cycle and fostering an environment where investors can trade with confidence.

Crypto Projects ↔ Market Makers

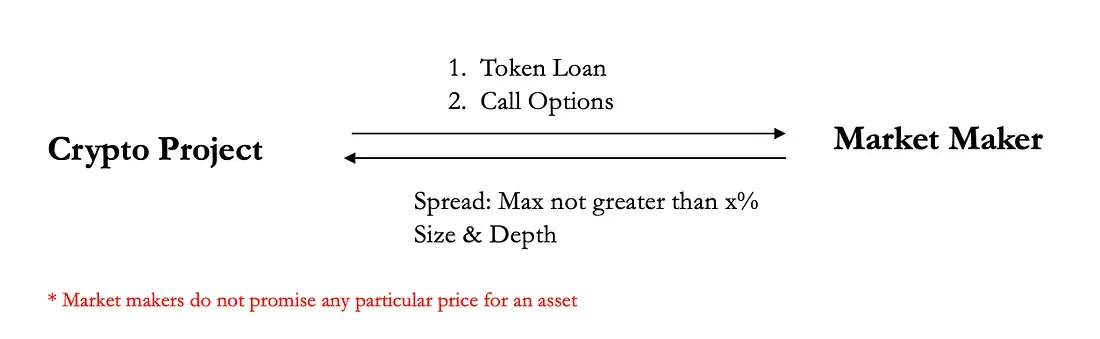

Although there are various contract structures between crypto market makers and projects—including token loan + prepayment models—the most widely used structure (token lending + call options) works as follows:

Figure 6: Project <-> Market Maker Structure

Source: Presto Research

Project → Market Maker

-

Market makers borrow tokens required for market making from the project team. During the initial phase after a token launch, tokens are often in short supply due to limited availability in the market. To offset this imbalance, market makers borrow tokens from the project, typically for an average term of 1–2 years (aligned with the duration of the market-making contract), to ensure market liquidity.

-

In return for their market-making services, market makers receive call options exercisable upon loan maturity. These call options grant them the right to purchase tokens at a predetermined price. Given the limited cash resources of most projects, instead of paying in fiat currency, they offer call options as compensation. Additionally, since the value of call options is directly tied to the token price, this arrangement provides market makers with protection against early "pump-and-abandon" scams.

Market Maker → Project

-

During the contract period, market makers provide services—negotiated with the project—to maintain maximum bid-ask spreads and sufficient liquidity. This arrangement supports favorable trading conditions under strong liquidity.

In summary, market makers borrow tokens from projects, receive call options as compensation, and deliver services aimed at ensuring liquidity within specified bid-ask spreads during the loan period. However, it is important to note that legitimate market makers do not make any price guarantees.

Regulatory Gaps in Crypto Market Making

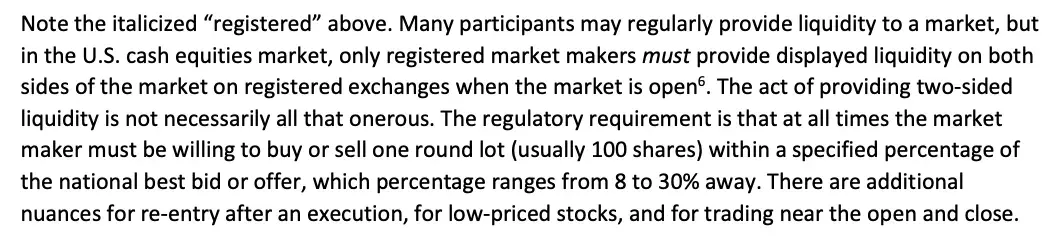

Negative perceptions of market makers in the cryptocurrency market largely stem from the lack of regulation compared to traditional financial markets. In U.S. equity markets such as Nasdaq and the New York Stock Exchange, market makers are required to maintain bid and ask quotes for at least 100 shares and are obligated to fulfill orders when matched (see Figure 7). There are also very specific requirements—for example, orders must be placed within certain ranges (e.g., 8% or 30% for large-cap stocks). These measures prevent market makers from placing orders at absurd prices (far from the best bid/ask) and selectively executing only when profitable.

Figure 7: NYSE Rules on Market Making

Source: Presto Research

However, as previously mentioned, market making in the cryptocurrency market remains largely unregulated in comparison. Unlike traditional financial markets, there is no separate licensing or regulatory body overseeing these operations.

Consequently, news reports frequently emerge about companies illicitly profiting under the guise of "market making." The biggest issue is that while traditional exchanges like Nasdaq enforce strict penalties and regulations against illegal market-making activities, the decentralized nature of the crypto market lacks meaningful enforcement against deceptive practices. This clearly exposes a significant regulatory gap and highlights the need for equivalent regulatory oversight in the cryptocurrency market as exists in traditional financial markets.

Conclusion

Despite regulatory shortcomings that allow gray areas in crypto market making, market makers will continue to play a vital role in markets. Their fundamental function—buying financial instruments from sellers and selling them to buyers to provide liquidity—remains essential. Especially in the illiquid cryptocurrency market, market makers help reduce trading costs and volatility, thereby creating an environment where investors can trade with greater confidence. Therefore, by integrating market makers into a regulated system and promoting fair competition and sound market-making practices, we can expect a market environment where investors can trade with greater security.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News