Delphi: Modular Lending is the Next Stage of DeFi Money Markets

TechFlow Selected TechFlow Selected

Delphi: Modular Lending is the Next Stage of DeFi Money Markets

Explore the features, design, and potential of modular lending products Morpho and Euler.

Author: Delphi Digital

Translation: Luffy, Foresight News

The DeFi lending sector has remained sluggish, primarily due to complex multi-asset lending pools and governance-driven project decisions. Our latest report explores the potential of a new type of lending product—modular lending—revealing its characteristics, design, and implications.

Current State of DeFi Lending

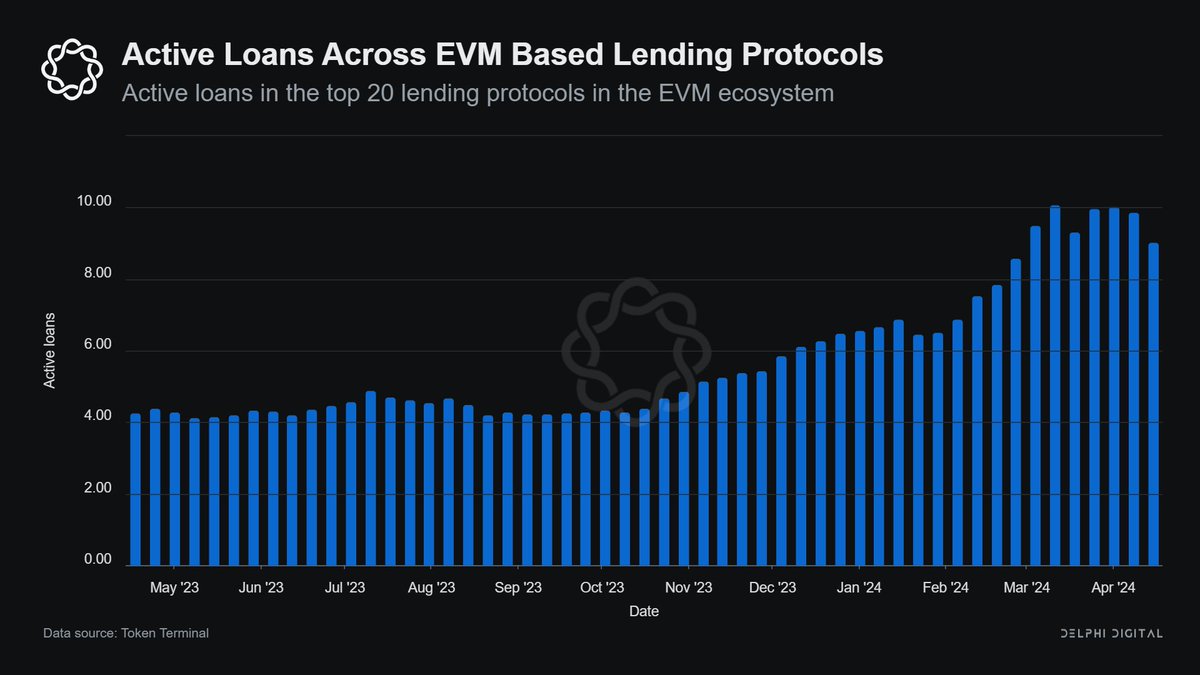

DeFi lending protocols are becoming active again, with borrowing volume growing nearly 250% year-over-year, rising from $3.3 billion in Q1 2023 to $11.5 billion in Q1 2024.

At the same time, demand is increasing to whitelist more long-tail assets as collateral. However, adding new assets significantly increases risk exposure for asset pools, thereby hindering lending protocols from supporting a broader range of collateral assets.

To manage these added risks, lending protocols must adopt risk management tools such as deposit/borrow caps, conservative loan-to-value (LTV) ratios, and high liquidation penalties. Meanwhile, isolated lending pools offer flexibility in asset selection but suffer from fragmented liquidity and low capital efficiency.

DeFi lending is reviving through innovation, shifting from purely "permissionless" lending toward "modular" lending. Modular lending caters to a wider base of assets and allows for customized risk exposure.

The core of modular lending platforms lies in:

-

A foundational layer that handles functions and logic

-

An abstraction and aggregation layer that ensures user-friendly access to protocol functionality without increasing complexity

The goal of modular lending platforms is to establish primitive components with a modular architecture at the base layer, emphasizing flexibility, adaptability, and encouraging end-user-centric product innovation.

Two major protocols stand out in the shift toward modular lending: Morpho Labs and Euler Finance.

Below we highlight the unique features of these two protocols. We delve into the trade-offs, all distinctive features, improvements, and conditions required for modular lending to go beyond DeFi money markets.

Morpho

Originally launched as an enhancer for lending protocols, Morpho successfully grew into the third-largest lending platform on Ethereum, with over $1 billion in deposits.

Morpho’s solution for developing modular lending markets consists of two distinct products: Morpho Blue and MetaMorpho.

Morpho’s Liquidity Amplification

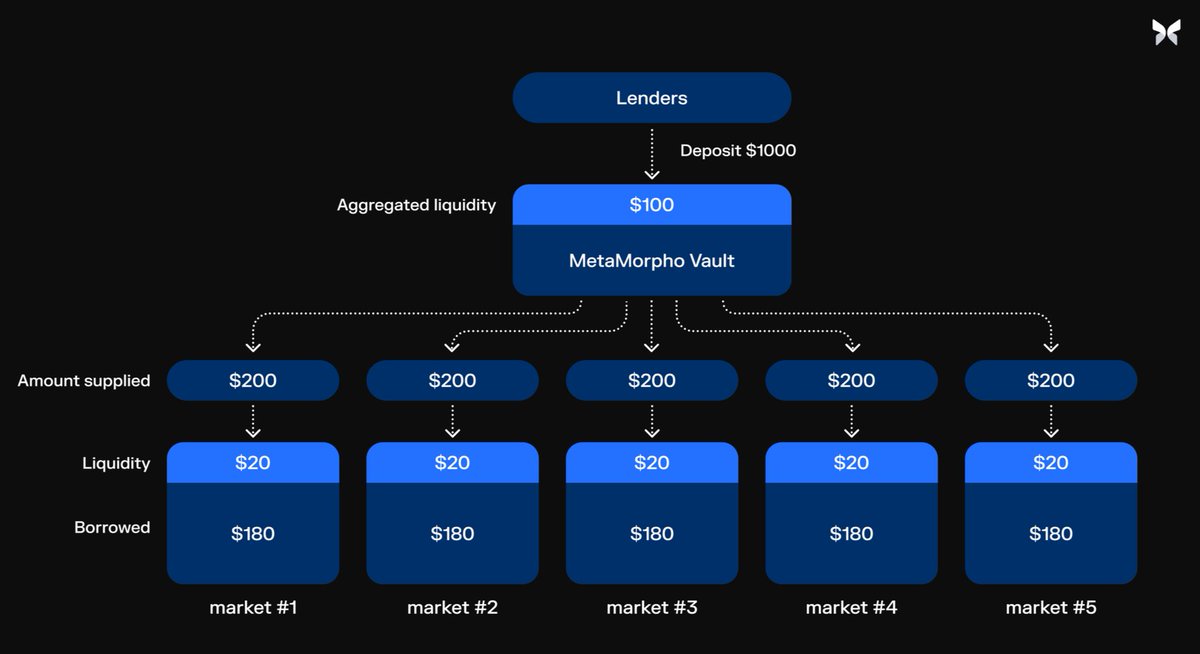

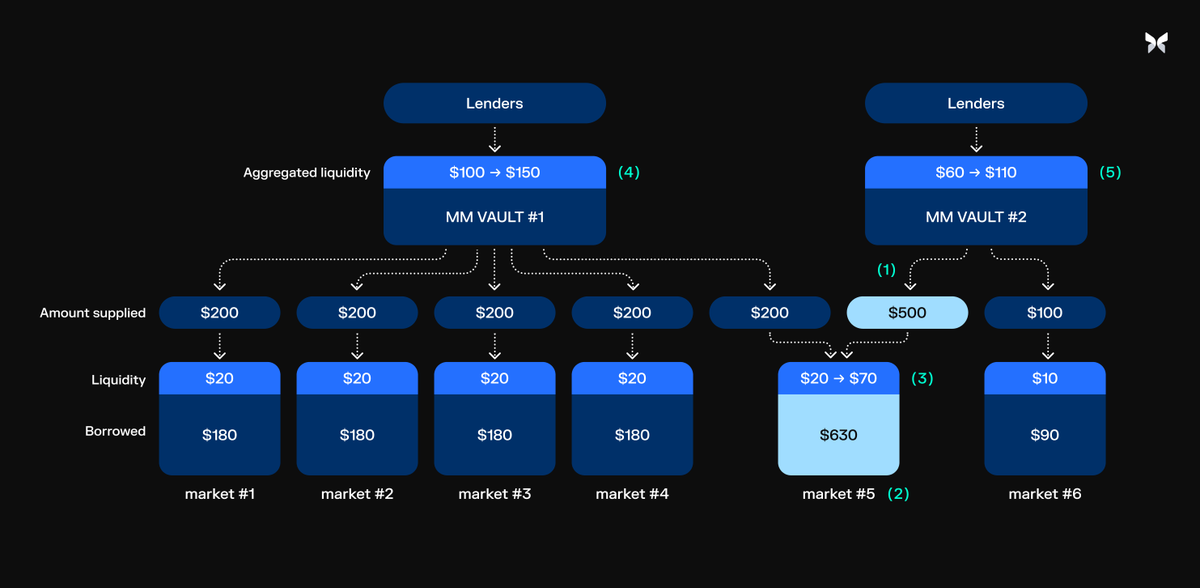

Prior to Morpho Blue, fragmented liquidity was the main criticism of isolated lending markets. However, the Morpho team addressed this challenge by aggregating liquidity at both the lending pool and vault levels.

Re-aggregating Liquidity

Lending to isolated markets via MetaMorpho vaults avoids liquidity fragmentation. The liquidity of each market is aggregated at the vault level, giving users withdrawal liquidity comparable to multi-asset lending pools while maintaining market isolation.

Shared Model Expands Liquidity Beyond Individual Pools

MetaMorpho vaults enhance lenders’ liquidity position, making it superior to a single lending pool. Each vault's liquidity is concentrated on Morpho Blue, benefiting anyone lending to the same market.

Vaults significantly strengthen lenders' liquidity. As deposits accumulate on Blue, subsequent users depositing funds into the same market increase withdrawal capacity for both themselves and their vault, unlocking additional liquidity.

Euler

Euler V1 revolutionized DeFi lending by supporting non-mainstream tokens and enabling permissionless platform access. However, after suffering a flash loan attack in 2023 that resulted in losses exceeding $195 million, Euler V1 was retired.

Euler V2 is a more adaptable modular lending primitive, consisting of:

(1) Euler Vault Kit (EVK): Enables permissionless deployment and customization of lending vaults.

(2) Ethereum Vault Connector (EVC): Allows vaults to connect and interact, enhancing flexibility and functionality.

Euler V2 is set to launch this year, and we’re curious how long it will take to gain traction in the competitive DeFi lending landscape.

Below is an overview of Euler V2 use cases, highlighting unique DeFi products made possible by Euler V2’s modular architecture.

Morpho vs. Euler

Comparing Morpho and Euler reveals key differences resulting from distinct design choices. Both projects have designed mechanisms to achieve similar end goals—lower liquidation penalties, easier reward distribution, and bad debt accounting.

Morpho’s solution is limited to isolated lending markets, uses a single liquidation mechanism, and is primarily focused on ERC-20 token lending.

In contrast, Euler V2 supports multi-asset pool lending, allows custom liquidation logic, and aims to serve as a foundational layer for lending all types of fungible and non-fungible tokens.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News