Four Pillars Research Report: How Does IO.NET Enable a Better Sharing Economy?

TechFlow Selected TechFlow Selected

Four Pillars Research Report: How Does IO.NET Enable a Better Sharing Economy?

IO.NET has successfully pioneered the utilization of idle computing resources.

Author: Four Pillars

Translation: TechFlow

Key Takeaways

-

The concept of the sharing economy—lending idle goods or services to those in need to optimize resource utilization—has evolved into a consumption culture and economic system, gaining attention amid increasingly rational consumer behavior and advances in information technology.

-

However, as the sharing economy market rapidly expands and user numbers grow, various negative effects have emerged, including declining service quality, early market entrants establishing monopolies, strong opposition from incumbent industry players, and regulatory challenges.

-

Blockchain technology enables the digitization of a broader range of assets and amplifies economies of scale, serving as a robust foundation for building the sharing economy. IO.NET has successfully pioneered the utilization of idle computing resources, demonstrating its potential in this domain.

I. Every System Is About Resource Optimization

A system refers to a collection of interacting elements—it is where we live. These systems span from biological systems sustaining life, to social groups sharing common values and identities, and even cosmic systems involving interactions between stars and planets within galaxies. Viewing the world through a systemic lens allows us to better understand our surroundings, analyze, and improve these systems to create a better world.

The core objective of any system is to operate in an economically sustainable and stable manner. Therefore, the most critical aspect of system design lies in optimizing and organizing its components—that is, its resources. For example, optimizing the healthcare system requires efficient deployment of medical staff, use of electronic medical records (EMR), and delivery of telemedicine services to ensure all patients receive timely and appropriate care. Such optimization improves healthcare efficiency, reduces treatment costs, and enhances patient satisfaction and outcomes.

However, as demands across industries become increasingly diverse, the complexity of system design grows, making system optimization research more important than ever. Due to limited resources, asymmetric development among various service systems further exacerbates this challenge. The recently emerged concept of the sharing economy, centered on the idea of lending idle goods or services to those in need, offers valuable insights into solving resource optimization problems.

II. The Sharing Economy Enhances Resource Optimization

2.1 The History of the Sharing Economy

The act of sharing resources has existed historically—such as communal ovens in medieval European villages or Korea's "pumasi" culture (shared agricultural labor). However, only recently has this concept taken on a commercial orientation aimed at generating profit (i.e., the sharing economy). Today, the sharing economy draws significant attention primarily due to two reasons: rationalization of consumption patterns and advancements in information technology.

Before the Industrial Revolution (i.e., in agrarian societies), demand for goods was generally high but supply was limited. After the Industrial Revolution (i.e., in industrial societies), although supply increased substantially, it did not always meet all demands, and demand forecasting occasionally failed. As we entered the knowledge society, continuous progress in production and technology has made both demand and supply abundant—today, it’s hard to find someone without a smartphone, and new models continue to be produced and consumed.

However, this pattern of overconsumption and overproduction has led to resource surplus (i.e., inventory and idle resources), which since the late 2000s has burdened both consumers and producers (i.e., suppliers), prompting a global shift toward more rational consumption patterns.

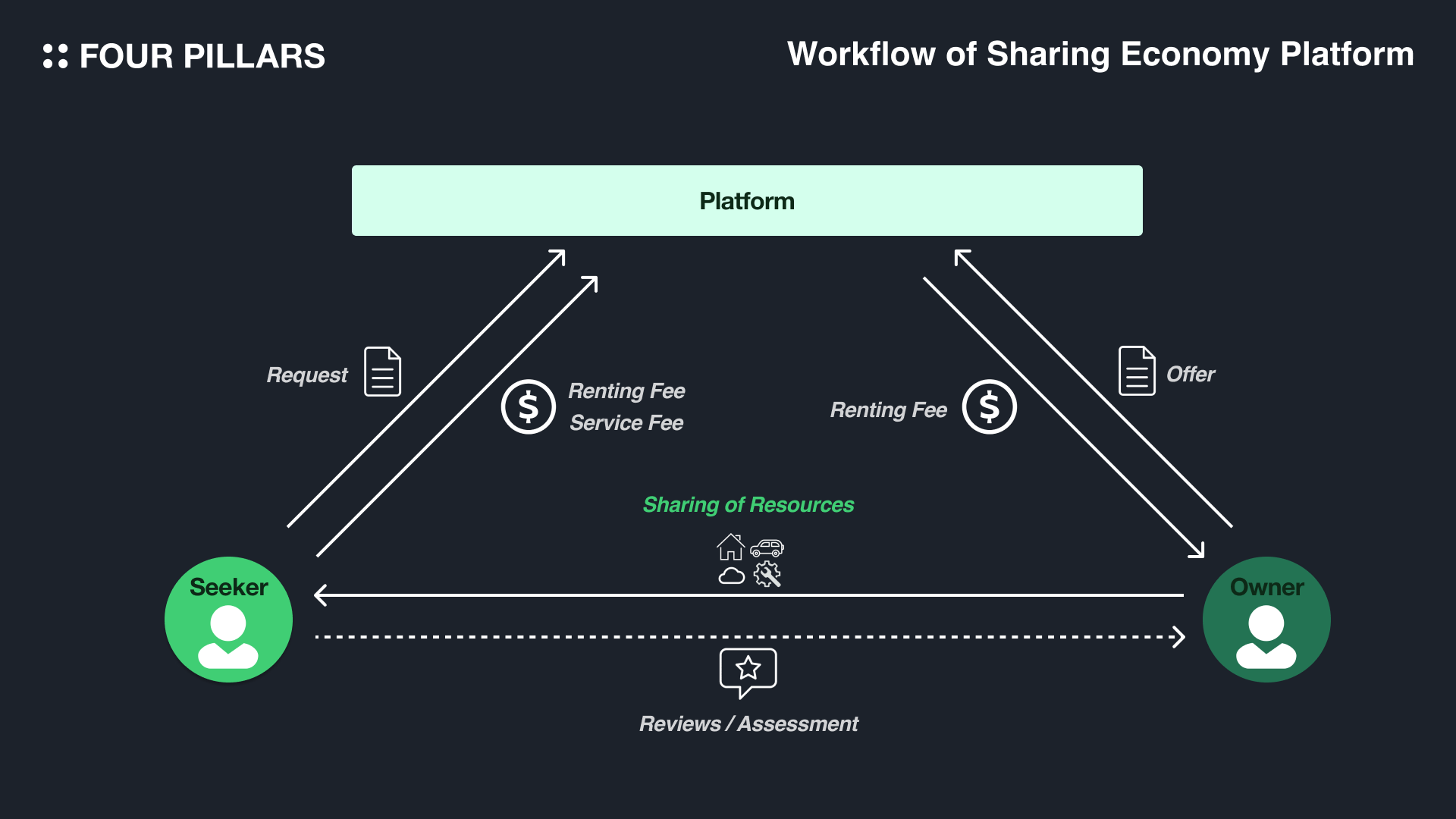

Rational consumption includes not only thoughtful decisions by consumers regarding price and quality when purchasing goods, but also the sharing and reuse of excess or surplus resources. Previously, physical constraints made it difficult to share such surplus resources. Now, however, advances in information technology have enabled sophisticated digital platforms that enhance human connectivity, significantly accelerating the emergence of the sharing economy by connecting individuals pursuing rational consumption with those aiming to maximize profits.

The sharing economy transcends individual resources to encompass entire industry resources. It represents a new economic system and consumer culture capable of driving societal wealth and economic development in the digital age. Today, numerous platform services are emerging, enabling not just individuals, but startups and large enterprises alike to leverage shared resources such as required IT technologies, data, software, and hardware.

Ride-sharing and Car-sharing Services

-

Uber and Lyft – Connect drivers who own vehicles with passengers

-

Turo and Getaround – Allow individuals to rent out their private vehicles to others

Accommodation Sharing

-

Airbnb and Vrbo – Enable homeowners to rent out homes, apartments, or rooms to guests

Peer-to-Peer Lending

-

LendingClub and Prosper – Facilitate peer-to-peer lending, allowing individuals to directly lend idle funds to others without going through traditional financial institutions

Freelance and Task Services

-

TaskRabbit and Fiverr – Allow individuals to offer or request services such as furniture assembly, home repairs, and graphic design

Clothing and Accessories Rental

-

Rent the Runway and Poshmark – Facilitate renting or reselling used clothing and accessories

Tools and Equipment Sharing

-

Fat Llama – Allows individuals to rent out tools they own to community members

Shared Office Spaces

-

WeWork and Regus – Provide flexible shared office spaces for individuals or companies

2.2 Challenges to the Sustainability of Sharing Economy Platforms

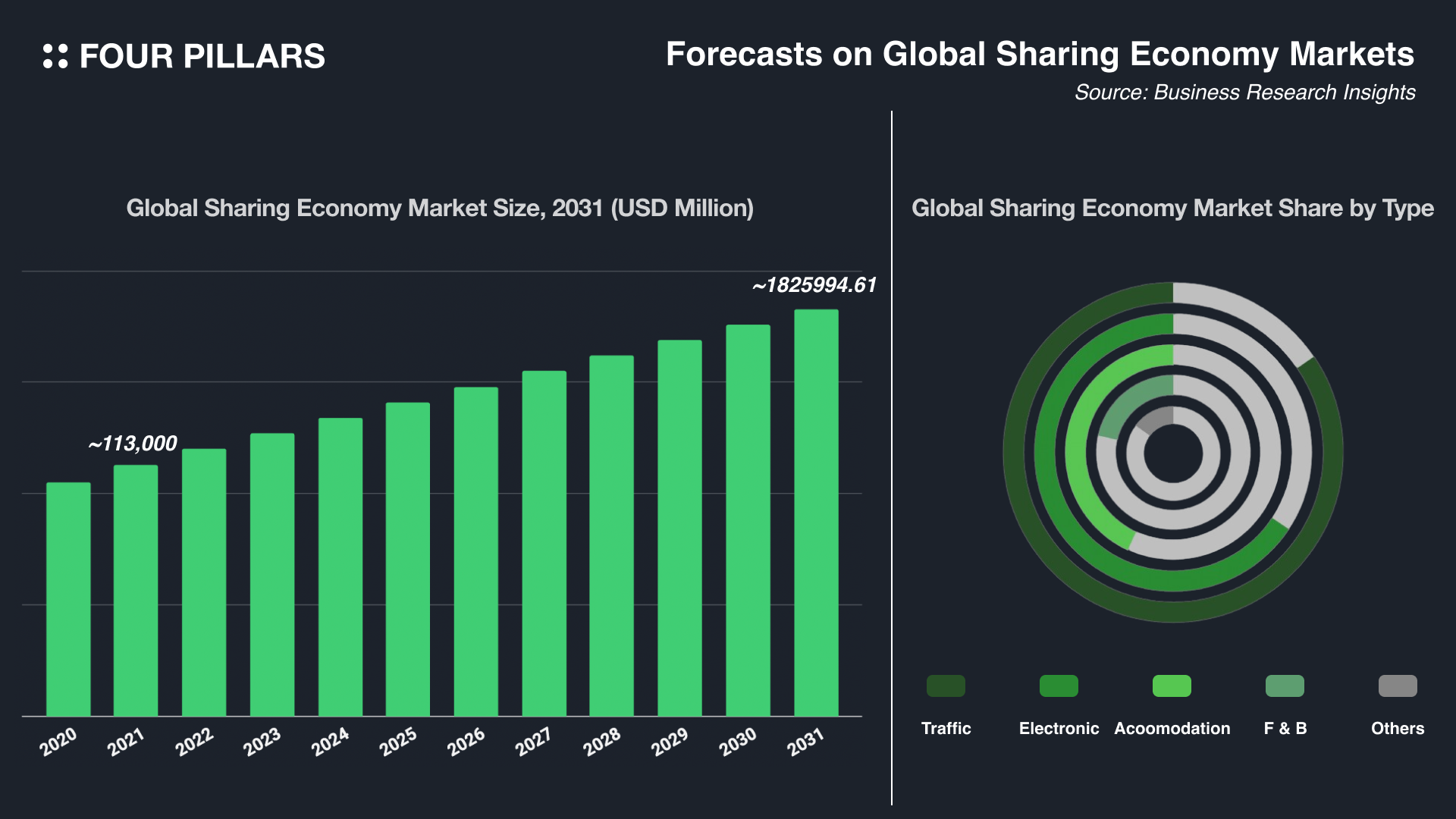

As previously mentioned, the concept of the sharing economy has penetrated various industries and begun to show significant impact, leading to rapid market expansion. According to Business Research Insights, the global sharing economy is projected to exceed $1 trillion by 2031, showing a steady upward trend.

However, this projection assumes ideal conditions where sharing economy platforms operate smoothly. Currently, with the rapid growth of the sharing economy market and increasing user numbers, several negative effects have surfaced. These include declining service quality, monopolistic positions established by early market entrants, strong resistance from existing industry players, and regulatory issues.

2.2.1 Misalignment with Existing Systems

Sharing economy platforms bring innovation to supply-constrained stagnant markets and enjoy broad user support due to their differentiation from traditional companies. However, new systems inevitably clash with old ones. The sharing economy sector faces substantial conflicts domestically and internationally, particularly concerning government licensing regulations and market share competition with existing firms.

For instance, Uber connects users with nearby drivers via smartphone apps, disrupting traditional taxi businesses' revenue models and reducing taxi license values, resulting in regulatory and legal disputes in many cities. Airbnb allows individuals to rent out homes or rooms, often offering cheaper and more unique accommodations than traditional hotels, thereby affecting hotel room demand—especially in tourist cities—and triggering concerns about changes in residential environments and rising rents.

Thus, conflicts with existing systems represent major obstacles to the sustained development of sharing economy platforms and must be addressed seriously. Platforms should proactively collaborate with regulators to establish fair frameworks, protect stakeholders' interests, and promote equitable market competition.

2.2.2 Unfair Fee Structures

Beyond the above issues, a structural criticism frequently leveled against the sharing economy is that while all platforms facilitate efficient market exchanges, the for-profit enterprises operating these services often become increasingly centralized. This creates a contradiction between the platform's role as a value distributor between providers and consumers and its role as a profit-seeking enterprise. This conflict is most evident in the abnormal fee policies implemented by monopolistic platforms.

A fair fee structure is crucial for platform sustainability. For example, excessively high fees burden service providers, potentially driving them away; overly low fees may harm platform profitability. Therefore, platforms must determine acceptable, industry-standard rates through market research and competitive analysis. Additionally, platforms should ensure fee transparency to build trust, regularly review pricing policies, and flexibly adjust based on user feedback to adapt to market changes.

2.2.3 Failure to Achieve Economies of Scale

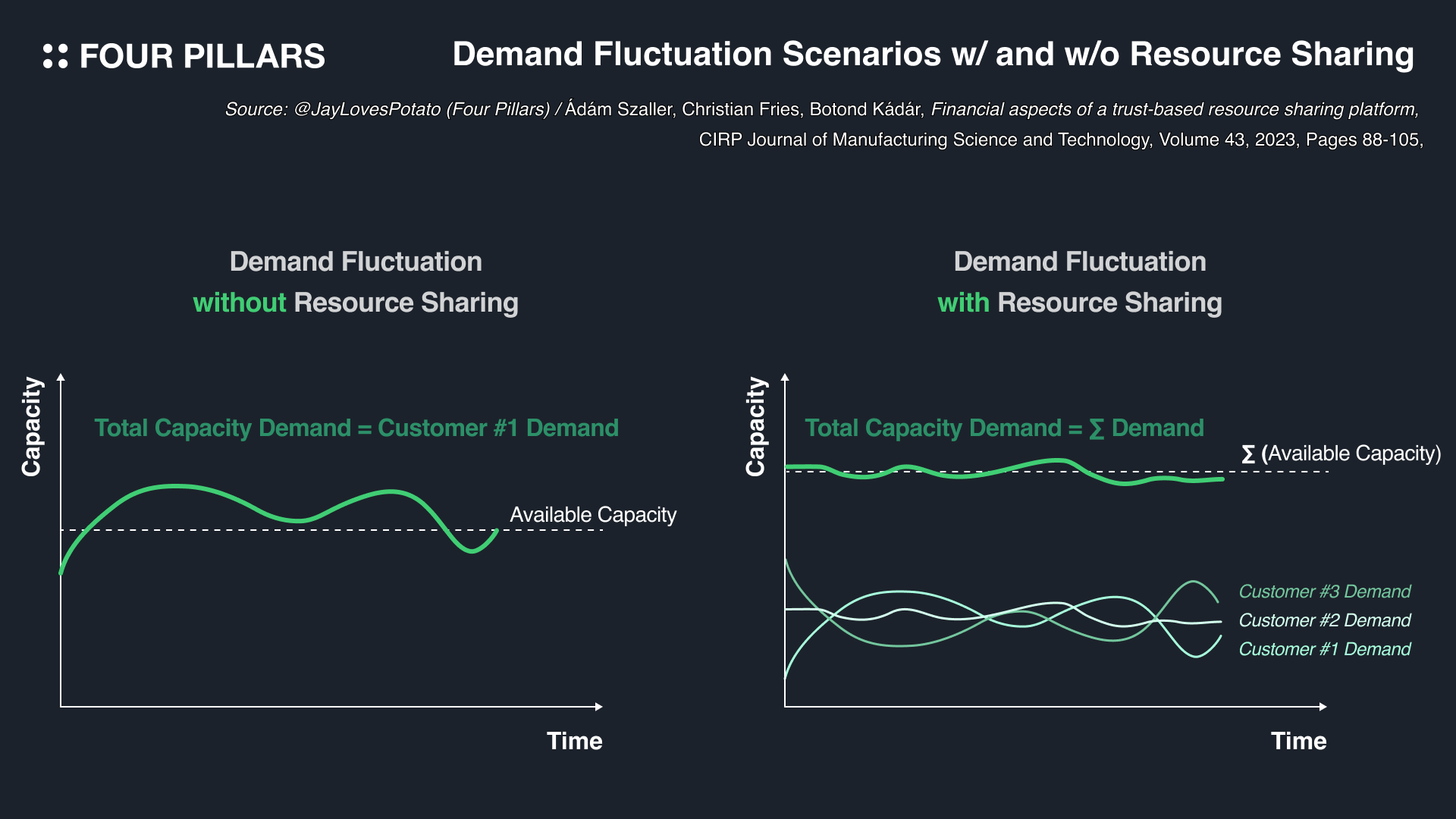

Achieving economies of scale on sharing economy platforms is particularly important for two reasons: first, it can enhance customer satisfaction by reducing service operation costs; second, it ensures service continuity.

Typically, traditional systems forecast demand for service resources and manage supply accordingly, helping ensure service continuity. However, on sharing economy platforms, the platform does not control the quantity of provided resources—transactions are nearly peer-to-peer—so the entire platform must pre-prepare substantial supply capacity to meet demand and generate high transaction volumes.

Therefore, platforms must not only lower barriers for demanders—by simplifying UI, offering multiple payment methods, supporting multiple languages—but also help suppliers efficiently manage services and optimize earnings by streamlining registration, introducing training/support programs, and providing tools and resources, thus improving service accessibility.

2.2.4 Counterparty Risk and Lack of Operational Policies for Quality Control

The growth and scaling of sharing economy platforms attract users and service providers from diverse backgrounds and skill levels. As the range and nature of available resources diversify, maintaining consistent service quality becomes increasingly challenging, potentially undermining user trust. To address this, platforms need systematic, robust quality control mechanisms.

For example, thorough pre-screening and training programs for all service providers could establish baseline service standards. Additionally, continuous feedback and performance monitoring systems should be implemented to provide further training or guidance when needed. Actively using user feedback to quickly address service shortcomings is also effective—in fact, many sharing economy platforms now employ rating systems, penalizing providers whose ratings fall below certain thresholds.

2.3 Leveraging Blockchain to Build a Better Sharing Economy

However, realistically speaking, it is not easy for rapidly growing sharing economy platforms to fully overcome the aforementioned challenges. Moreover, assuming these platforms—especially profit-driven ones—will refrain from increasingly appropriating transaction-generated value would come at an uncertain cost.

One approach to structurally reduce intermediary platform authority and enhance the sustainability of the sharing economy is to adopt blockchain. Blockchain, driven by its intrinsic incentive mechanisms, can unleash unexpected spontaneity among large participant pools, enabling rich resource sharing and allowing service systems to operate more transparently and reliably.

2.3.1 True Peer-to-Peer Resource Sharing

As previously noted, one goal of profit-seeking sharing economy platforms is protecting platform profits (i.e., fees) generated from individual transactions. Thus, traditional platforms confine users within their ecosystem, withhold contact details, and almost prohibit external communication. Beyond basic infrastructure operations and maintenance, running such platforms involves various administrative costs.

However, blockchain networks’ decentralized nature enables true peer-to-peer transactions without additional management overhead or high intermediary fees, minimizing risks associated with centralized server failures or attacks.

2.3.2 Ensuring Abundant Idle Resources Through Incentives

The fundamental principle of system optimization is maximizing the utilization of idle resources. Typically, the vicious cycle hindering the sustainability of sharing economy systems stems from insufficient resource supply. By building systems on blockchain with well-designed incentive mechanisms, attracting numerous idle resource providers becomes much easier. This provides a buffer for meeting overall demand, greatly enhancing the efficiency of sharing economy platforms.

Adequate supply ensures service continuity, while lower costs (due to no intermediaries) make it easier to attract users. Under these conditions, both supply and demand sides achieve economies of scale, contributing to a sustainable sharing economy system—provided service quality remains at an acceptable level.

2.3.3 Defining Behavioral Rules Using Smart Contracts

Smart contracts on blockchain can automatically execute specific transaction terms, making transactions under the sharing economy model more efficient and transparent. For example, in car-sharing services, once a user finishes using a vehicle, smart contracts can automatically process payments and refund deposits if necessary. Thus, smart contracts significantly reduce service management costs, enhance user experience, and ensure all transactions comply with global standards/policies.

Smart contracts can also embed appropriate incentive and penalty rules to deter malicious behavior and foster fair competition within the system. This encourages rule compliance and plays a vital role in maintaining service quality and reliability. Essentially, using smart contracts allows sharing economy platforms to deliver more stable, sustainable services, creating a favorable transaction environment for both users and providers.

2.3.4 More Trustworthy Open Services

Today’s sharing economy platforms face challenges adapting to varying regulations and environments across different service domains. Certainly, as many services still revolve around physical resources like shared vehicles or spaces, this poses limitations. However, if physical assets could be digitized via blockchain technology, future sharing economy platforms could facilitate cross-border transactions of various digital assets. Furthermore, using cryptocurrency payments can reduce transaction costs, enable micropayments, and allow low-income individuals opportunities to rent low-value items. These changes could further democratize the sharing economy, enabling globally uniform value exchanges.

III. Case Study: IO.NET – Computing Resource Sharing

As previously noted, most existing sharing economy services remain largely confined to physical resources and are heavily dependent on local regions, making it difficult to apply uniform rules or operate across borders. In contrast, digitally managed online resources (i.e., digital assets) are less affected by regional characteristics and thus more easily operable internationally.

In this section, we will explore the operations and long-term vision of IO.NET, which aims to democratize computing resources within a blockchain context. We will also examine how IO.NET compares favorably with traditional cloud computing platforms like AWS in efficiently utilizing computing resources.

3.1 Challenges in Supply and Demand of Computing Resources

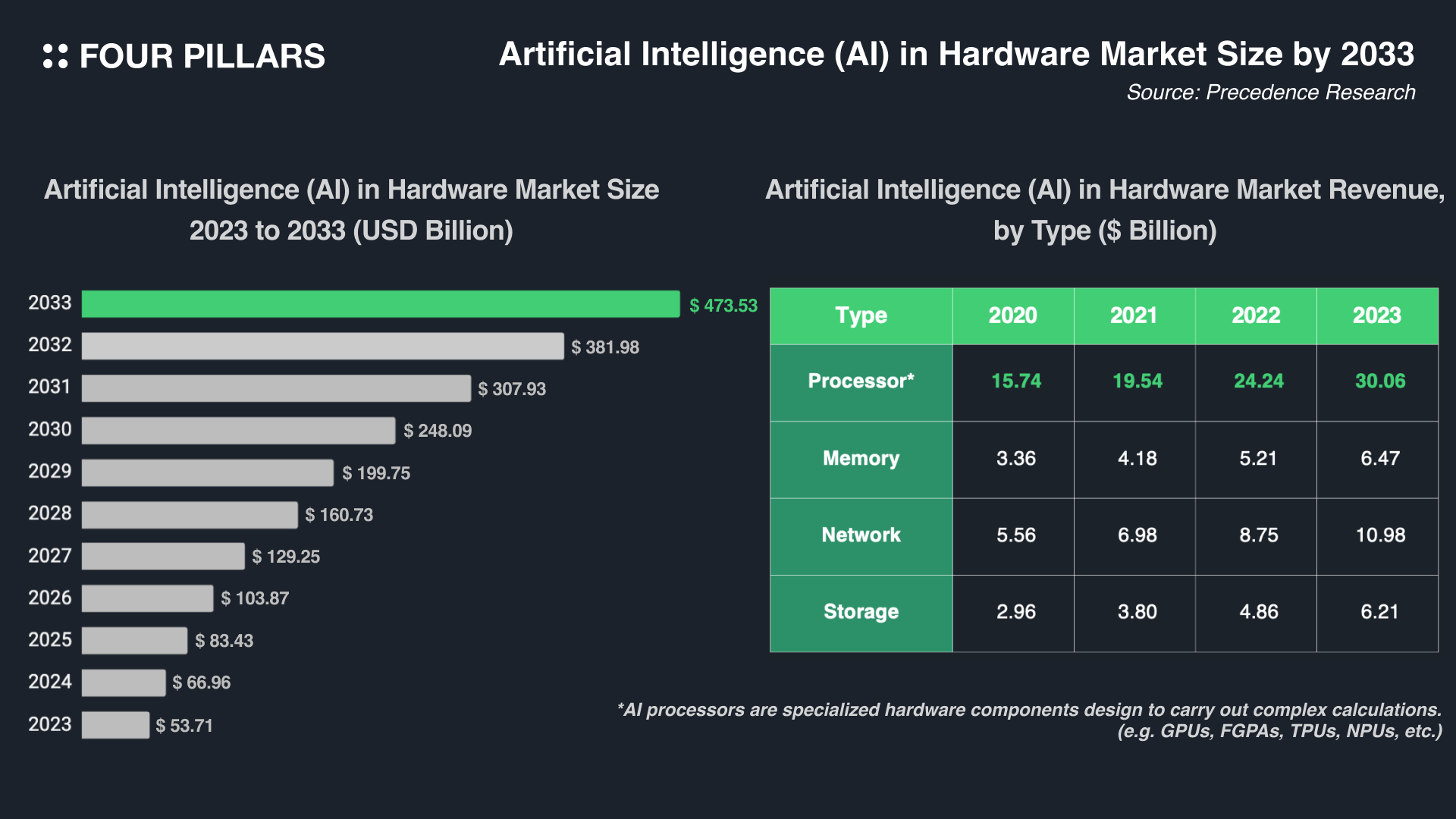

Advancements in AI technology have dramatically increased demand for high-performance computing resources like GPUs. According to Precedence Research, the global AI hardware market is expected to grow at a CAGR of 24.3%, exceeding $473.53 billion by 2033.

However, despite booming demand and increasingly complex AI/ML models, the global AI hardware market struggles to keep up with production challenges, exacerbated by international political/diplomatic conflicts, leading to supply crises. Consequently, acquiring popular computing chips may require high costs and long waiting times, with limited rental options. This particularly hinders AI startups from expanding the scope and capabilities of their projects.

While AI holds potential to transform and improve lives in numerous ways, observing more diverse innovations requires backing many AI startups with cost-effective, scalable computing resources. Without resolving these computing resource issues, the AI industry may face stagnation in innovation efforts, and asymmetric development in the AI market could lead to significant societal impacts.

3.2 Solutions by IO.NET

3.2.1 Overview of IO.NET

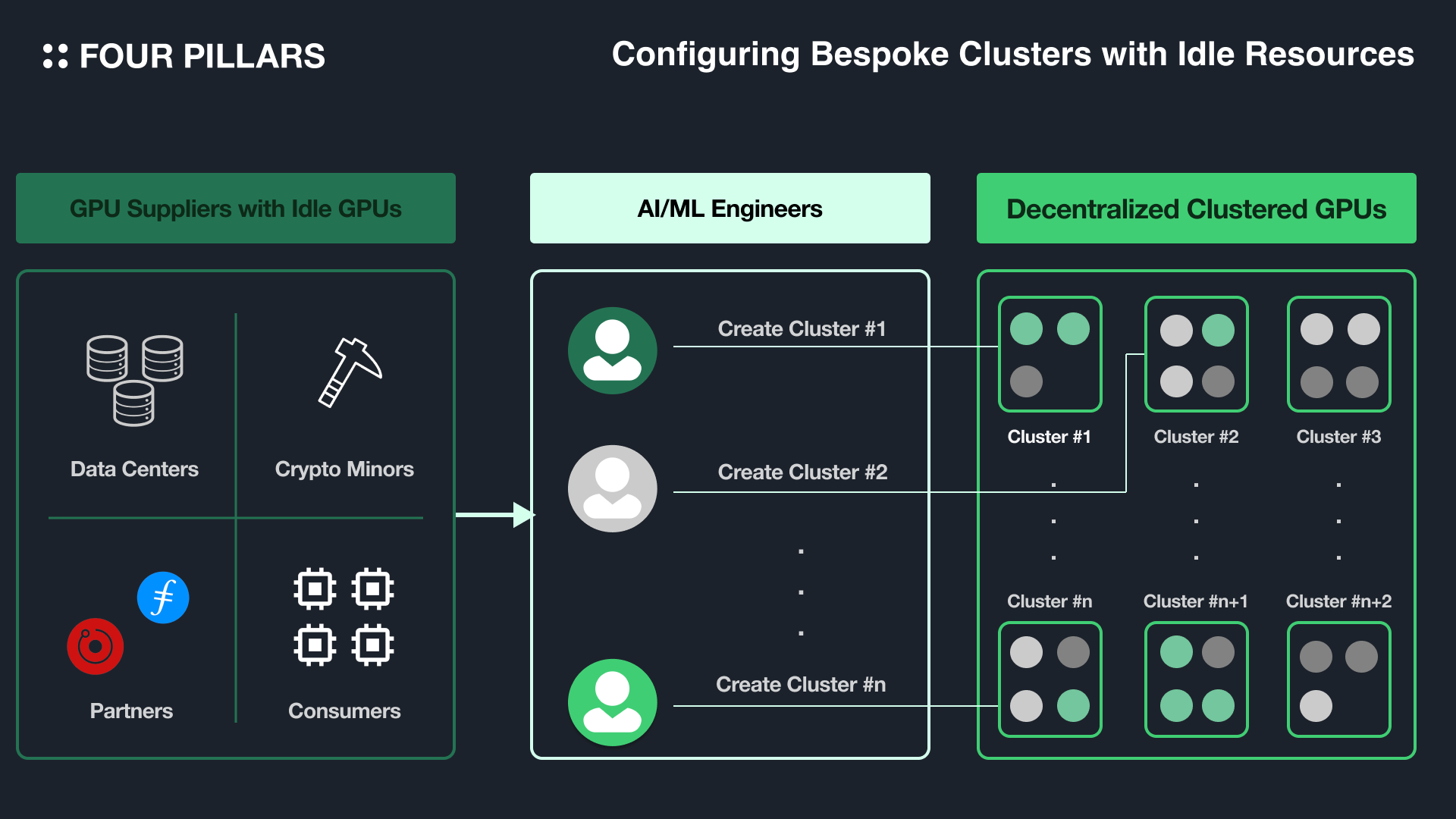

Ultimately, the key question is how to simultaneously achieve abundant, cost-effective computing resource supply while ensuring quality. IO.NET is a Solana-based coordination layer that addresses this by aggregating idle computing resources from data centers, miners, crypto projects (like Render Network, Filecoin), and consumers—rewarding computing power providers with tokens while enabling users to economically configure various types of idle computing resources for their GPU clusters using these tokens*.

*Currently, before launching the $IO token, payment supports fiat and USDC, but in the future will also support other network tokens including $IO; non-$IO token payments require a 2% processing fee.

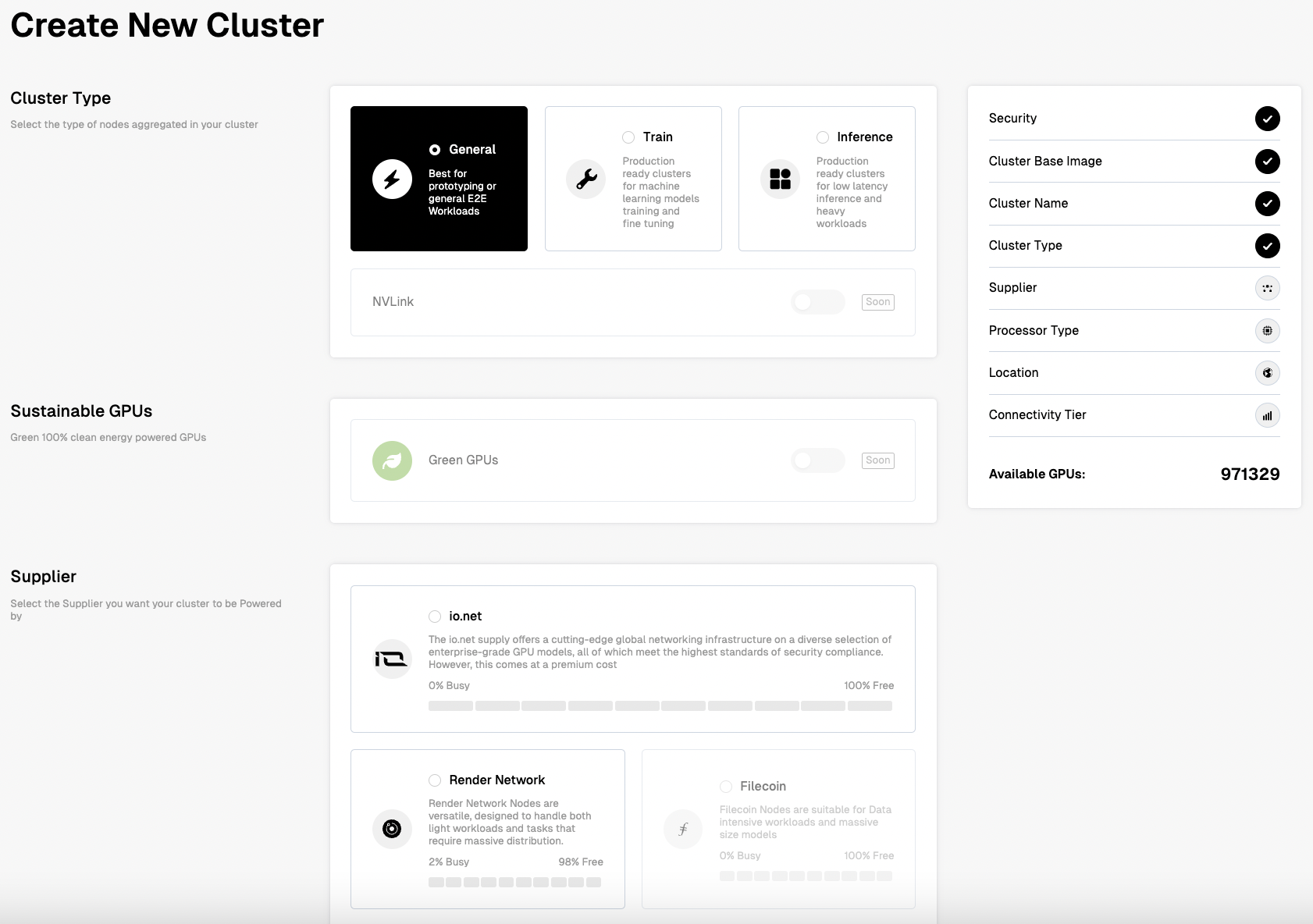

IO.NET leverages cluster frameworks such as Ray and Kubernetes*. Users can configure clusters on IO Cloud and parallelize workloads by setting processor type, location, communication speed, security compliance level, and duration. Clusters configured via IO.NET serve general computing purposes but are primarily optimized for AI/ML development tasks such as batch inference, model serving, parallel training, parallel hyperparameter tuning, and reinforcement learning.

IO.NET partners with mining networks of Render Network and Filecoin, allowing users to source from these networks as well as IO.NET as cluster providers. Supported processors include various GPU and CPU options such as NVIDIA RTX series, AMD Ryzen series, and Apple M-series, offering high flexibility in processor configuration and enabling organic adjustment of GPU counts within clusters based on changing needs.

*Frameworks for various uses will soon be supported, such as Ludwig, PyTorch, Unreal Engine 5, Unity Streaming, etc.

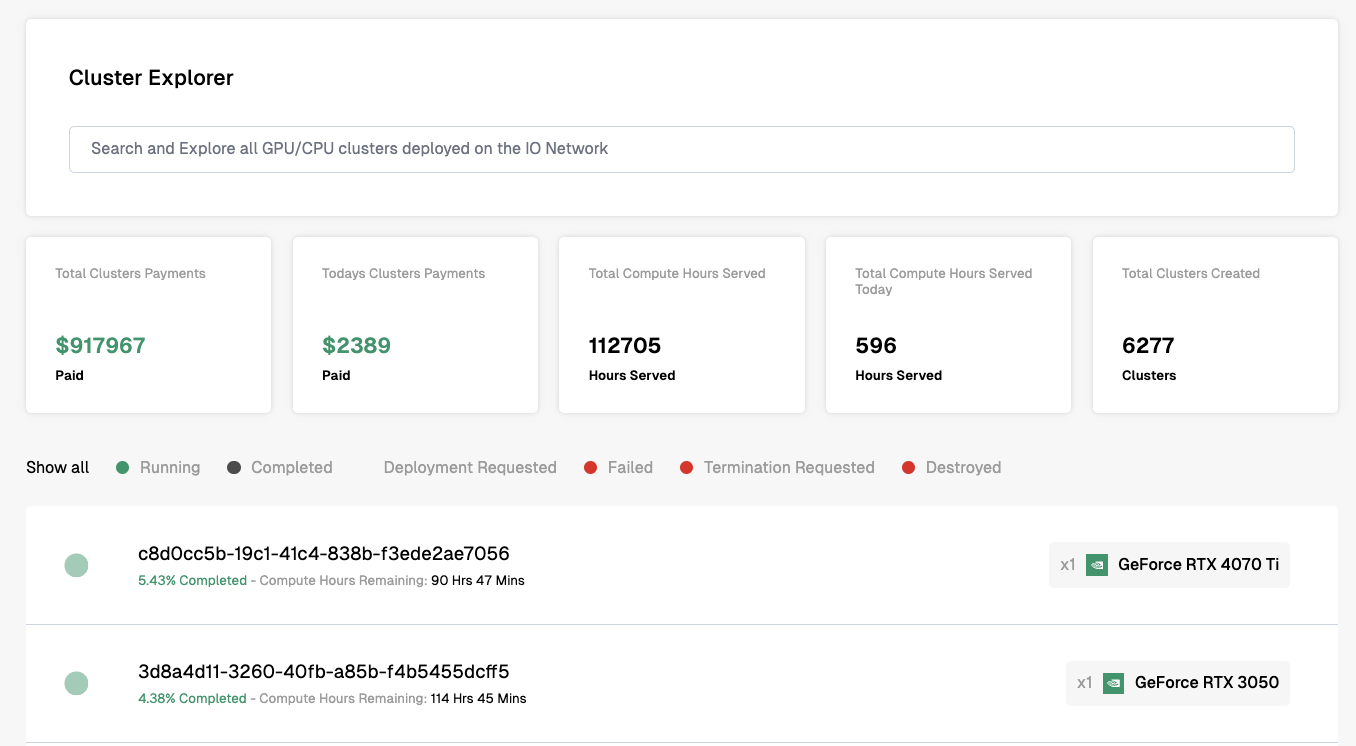

As of this writing (April 21, 2024), users can configure clusters in approximately 140 countries, with nearly 970,000 GPUs available on the platform. However, the actual number of users utilizing GPUs through the (nascent) IO.NET platform is only about 15,000. Most GPUs operate at 0% workload, while popular processors often have limited initial supply or are already utilized beyond 90% capacity (e.g., A100 PCIe 80 GB K8S(NVIDIA), H100 80GB HBM3(NVIDIA), RTX A5000(NVIDIA)). According to IO Explorer, approximately 6,270 clusters have been created so far, with payments totaling around $910,000.

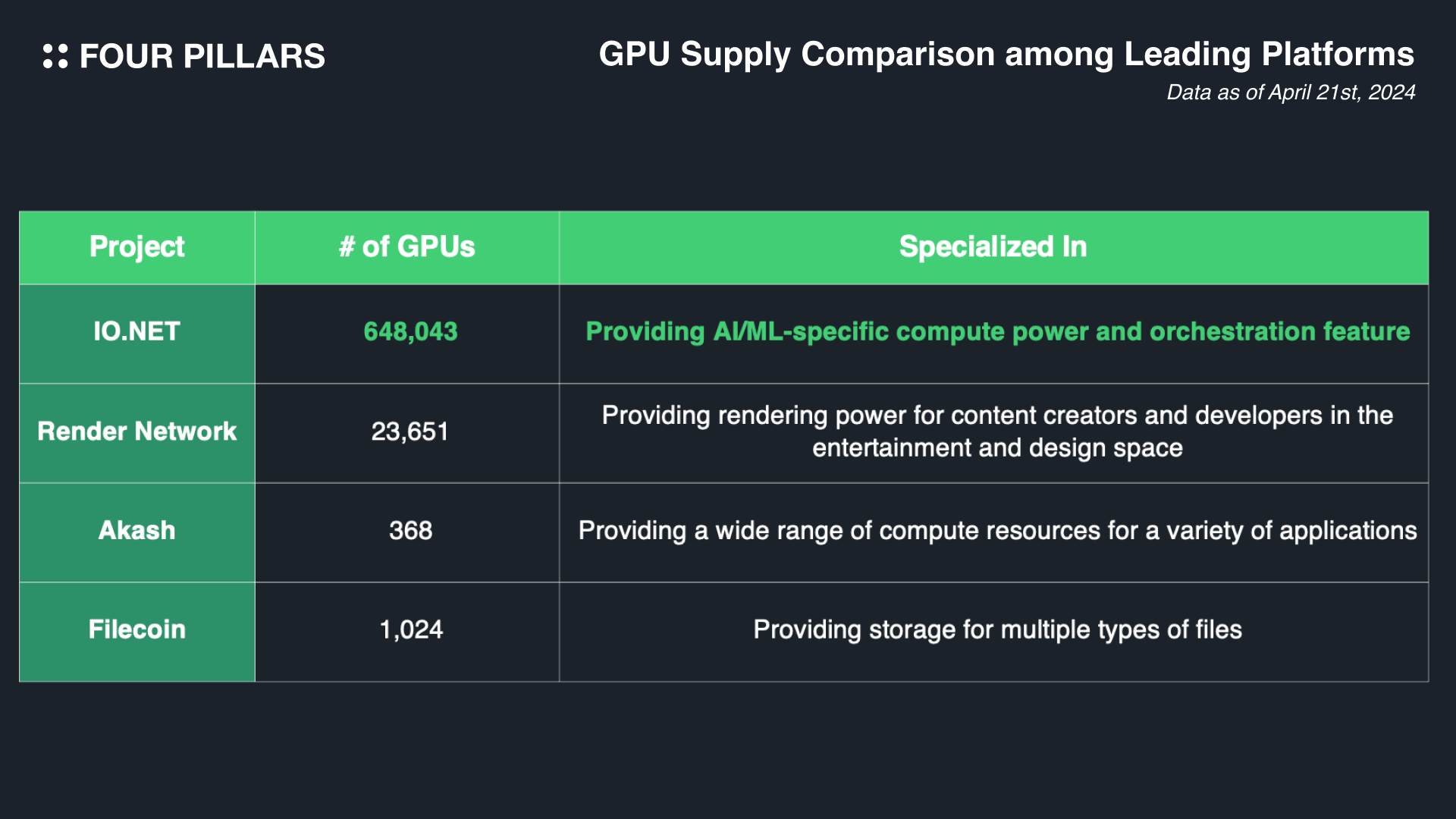

Indeed, IO.NET is not the only project in the Web3 space offering computing resources; other leading projects in this domain include Akash, Render Network, and Filecoin. However, as previously noted, IO.NET's competitive advantage lies in providing specialized computing power for AI/ML and introducing clusters rather than single instances, enabling dynamic allocation of computing resources across connected GPUs and optimized workload distribution.

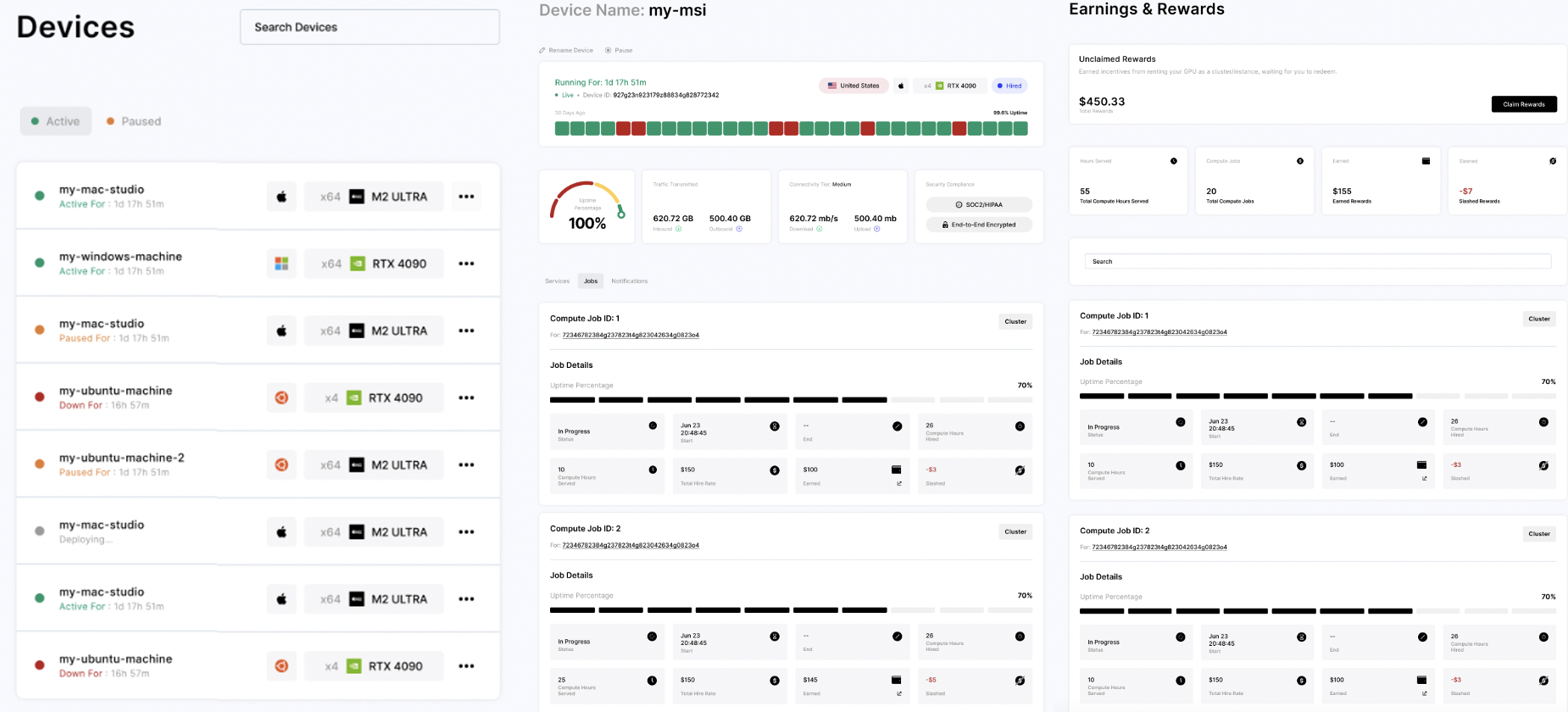

To become a GPU provider (i.e., IO Worker) and generate income, users can first add new devices under the Worker tab. After entering details about the desired operating system and device specifications, the process continues as shown in the image below, allowing users to manage multiple devices and view earnings status under the Worker tab.

3.2.2 Architecture of IO.NET

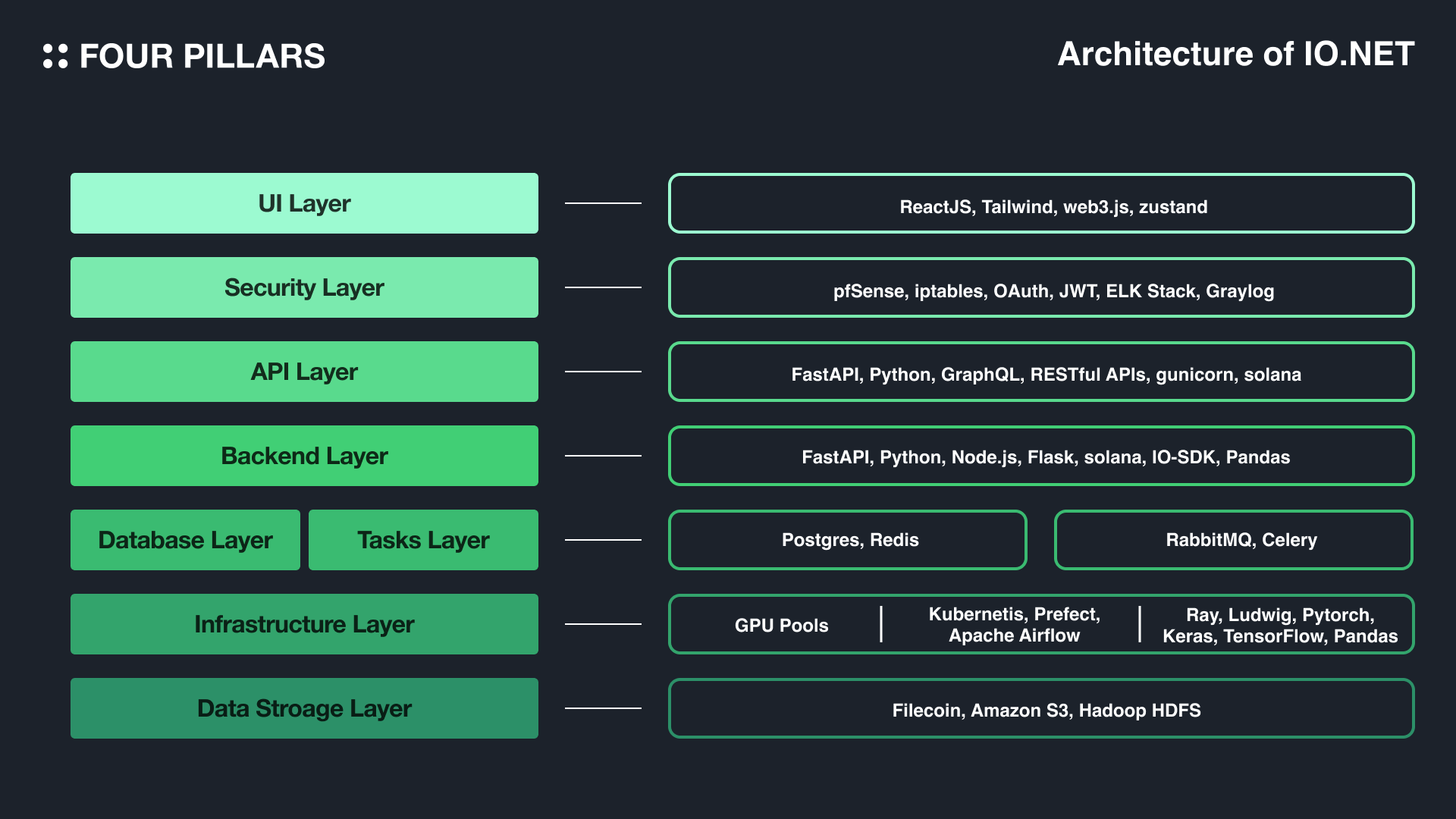

IO.NET employs a modular architecture composed of multiple layers, each optimized for its unique function. Beyond the technical stacks listed below, IO.NET integrates reverse tunnels and mesh VPN networks, enabling engineers to securely access and smoothly control data.

-

UI Layer Serves as the gateway for users to access IO.NET services (e.g., ReactJS, Tailwind, web3.js, zustand)

-

Security Layer Ensures system integrity and security (e.g., firewalls (pfSense, iptables), authentication (OAuth, JWT), logging services (ELK Stack, Graylog))

-

API Layer-- Middleware layer acting as a communication hub (e.g., FastAPI, Python, GraphQL, RESTful API, gunicorn, solana)

-

Backend Layer-- Manages suppliers (workers), cluster/GPU operations, customer interactions, monitoring, etc. (e.g., FastAPI, Python, Node.js, Flask, solana, IO-SDK (fork of Ray 2.3.0), Pandas)

-

Database Layer Manages primary storage for structured data and caching for transient data (e.g., Postgres (primary), Redis (cache))

-

Task Layer Coordinates asynchronous communication and task management to ensure efficient data flow (e.g., RabbitMQ (message broker), Celery (task management))

-

Infrastructure Layer Manages GPU pools, deployments, computing, and machine learning tasks (e.g., orchestration (Kubernetes, Prefect, Apache Airflow), execution/ML (Ray, Ludwig, Pytorch, Keras, TensorFlow, Pandas), monitoring (Grafana, Datadog, Prometheus, NVIDIA DCGM), etc.)

3.2.3 Upcoming Launch of $IO and IOG Network Tokens

IOG Network and Ecosystem

IO.NET's long-term vision is to create a currency for computing operations (i.e., the $IO token) and build an ecosystem upon it. Accordingly, the $IO token, designed according to Solana token standards (SPL), is expected to launch around Q2, while the "IOG Network," built on both Aptos and Solana, is currently under development. The IOG Network will host a full suite of services for building, training, and deploying diverse machine learning models. The IO.NET suite will integrate into this network. Additionally, a universal ID for the IO ecosystem (IO ID) and an open-source SDK for developers to deploy their services are also being developed.

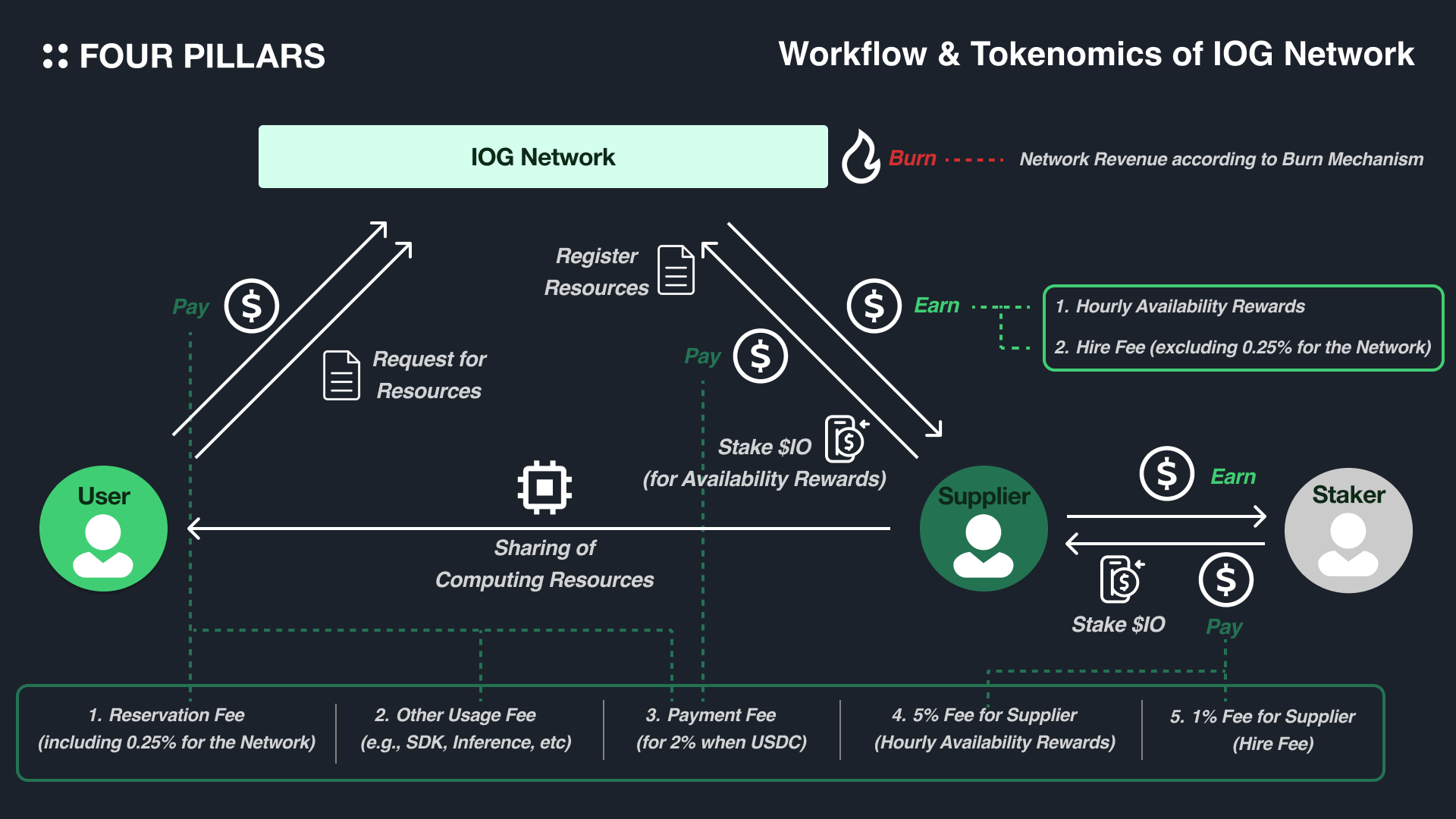

The IOG Network will be operated by nodes providing on-demand computing resources. To qualify for operational rewards—availability rewards (i.e., idle rewards)—nodes must stake at least $100 worth of IO. Similar to other delegated proof-of-stake (DPoS) protocols, $IO token holders can pre-set maximum stakes per node (i.e., max stake per node) and ensure network fidelity in exchange for rewards (excluding a 5% node fee).

Per Node Max Stake = Device Max Stake x (2 + 3 x [SUM of Modifier Options])

Max Stake Per Node = Max Device Stake x (2 + 3 x [Sum of Modifier Options])

*Once staked, $IO requires 7 days to unstake, and cannot be unstaked during periods when the node is rented.

Demand for $IO Token and Supplier Rewards

$IO tokens can not only reserve GPU clusters via IO.NET but also deploy various types of applications (or instances) hosted on the IOG Network via SDK, and utilize multiple inference models. When booking or renting GPUs, the network charges a 0.25% fee. After reviewing booked nodes’ performance and uptime against slashing conditions, suppliers receive rewards—referred to as “hire rate” or “rental rate” within the IOG Network. If suppliers receive stakes from $IO token holders, 1% of these rewards will be returned to the stakers.

Total Hire Rate = Current # of Cards on the Worker x Current Card Price x Computation Hours Reserved x (1 + SUM of Modifier Options) x 99% Supplier Share*

Total Hire Rate = Current Number of Cards on Worker x Current Card Price x Reserved Computation Hours x (1 + Sum of Modifier Options) x 99% Supplier Share *

*Modifier options are items identified by IO.NET as additional services and hardware deployed by providers to enhance overall cluster performance (e.g., bandwidth, location, GPU interconnect options, node disk attributes).

The previously mentioned “availability rewards (hourly)” are separate node operation rewards introduced alongside “hire rates” to incentivize sufficient supply on the network. These rewards are calculated per node and consider various factors such as bandwidth, uptime percentage, and hardware type. Like “hire rates,” if suppliers receive stakes from $IO token holders, 5% of these rewards will be returned to the stakers. Additionally, to prevent nodes from constantly connecting and disconnecting, there is a 12-hour cooldown period after each node restart or pause before availability rewards reactivate.

Approximate Per Node Hourly Availability Rewards = Staker Collateral Multiplier x (Hardware CapEx / Hours in 18 Months) x Uptime Percentage x 95% Supplier Share

Approximate Per Node Hourly Availability Reward = Staker Collateral Multiplier x (Hardware CapEx / Hours in 18 Months) x Uptime Percentage x 95% Supplier Share

$IO Token Distribution Plan

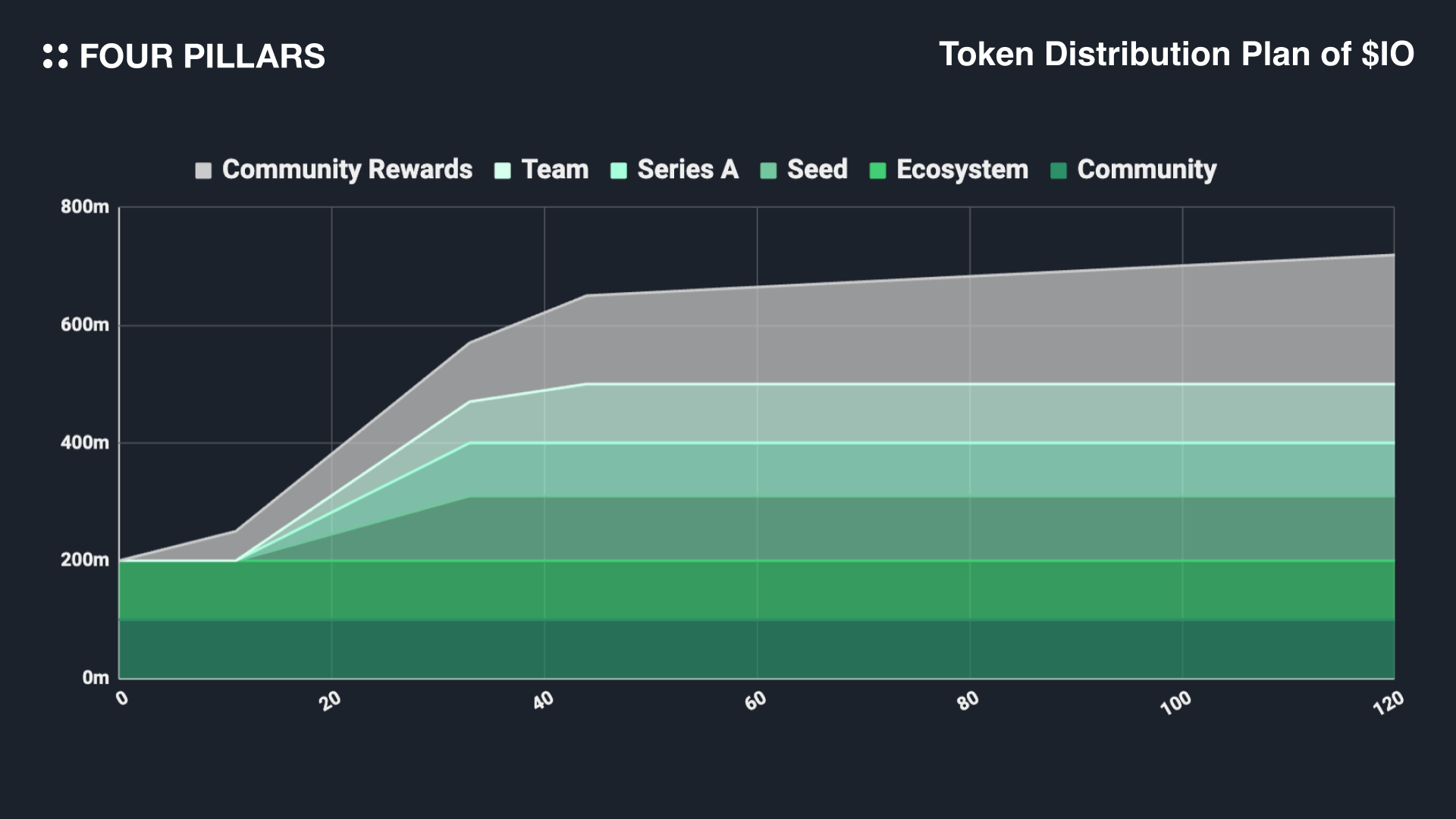

The total fixed supply of $IO is 800 million tokens, with 500 million initially circulating, and the remaining 300 million allocated to suppliers and subscribers (i.e., community rewards). These community rewards start at 8% in the first year, decreasing monthly by approximately 1.02% (about 12% annually), until the full 800 million $IO tokens are distributed, following a deflationary model.

As previously noted, the IOG Network generates revenue by charging booking and rental fees (i.e., 0.25%) and payment and withdrawal fees (i.e., 2% when withdrawing in USDC). Then, based on the $IO price, the network determines the amount of $IO to burn and uses revenue to purchase and burn $IO tokens.

3.3 Impact and Advantages of Cloud Services

First, one of the most apparent advantages of IO.NET compared to traditional cloud services is that anyone, regardless of technical expertise, can easily share their idle computing resources and earn rewards with just a few clicks. This drastically lowers entry barriers, meaning individuals can effortlessly share idle resources as long as rewards are properly distributed, facilitating easy initiation of abundant computing resources from the supply side. Consequently, users can quickly assemble GPU clusters with desired specs without signing long-term contracts or enduring typical wait times associated with traditional cloud services.

Additionally, IO.NET offers relatively cheaper and more flexible development setups. Resources shared on IO.NET are primarily individuals’ idle computing resources, meaning they do not incur the high maintenance costs typical of large data centers, thereby lowering suppliers’ marginal costs. Moreover, supplier diversity ensures a wide selection of computing resources and eliminates single-point failure risks. IO.NET further enhances user development efficiency via IO Cloud by supporting various frameworks, surpassing general possibilities of conventional cloud services.

A third advantage is the flourishing IOG Network ecosystem fueled by broad demand for $IO tokens. As previously noted, $IO tokens can not only reserve computing resources but also build and use various applications or instances hosted on the IOG Network. Strong token demand increases pressure on $IO supply, promoting liquidity of abundant computing resources within the ecosystem.

Moreover, IO.NET's success enables small investors to actively participate in the computing resource market. Until now, computing resource allocation has been monopolized by a few large companies like AWS, GCP, and Azure. However, for small investors viewing computing resources as investment assets, IO.NET presents a compelling alternative—offering a marketplace where anyone can easily buy and trade idle computing resources. If one of finance’s core goals is democratization, then IO.NET exemplifies achieving such financial inclusivity.

Furthermore, effective management of large-scale idle computing resources would also increase utilization rates, contributing positively to environmental sustainability.

3.4 Challenges and Considerations

As repeatedly emphasized, the optimistic outlook for blockchain-based sharing economy systems like IO.NET hinges on well-designed incentive mechanisms that achieve economies of scale. In other words, if these mechanisms are poorly designed or initial supply bootstrapping and delicate supply-demand balances are inadequately managed, it could trigger a vicious cycle where token value, resource supply, and service quality collapse simultaneously.

Therefore, system designers must not only ensure adequate current resource supply but also remain vigilant against oversupply situations. If the number of active suppliers exceeds demand, it may severely dilute token value in the medium to short term, potentially causing mass exodus of suppliers or heightened supply volatility.

Likewise, ensuring supplier rewards are not excessively high is equally crucial. Overly generous rewards might incentivize potential suppliers to acquire additional resources beyond idle assets purely for higher profits, disrupting the overall computing resource market equilibrium and potentially leading to market failure.

Finally, excessively broadening access to financial resources may fuel speculative mindsets, obscuring original demand intentions. Hence, ensuring token liquidity primarily circulates among actual users is also essential.

IV. Anticipating Another “Uberization”

Within blockchain concepts, numerous unspecified individuals gather around P2P networks centered on valuable assets—a notion highly aligned with the ideals pursued by the sharing economy. Or, assuming more value can be reliably digitized on blockchains in the future, one might argue that the future of the sharing economy lies not in the physical realm, but in blockchain space.

IO.NET exemplifies this potential, successfully initiating access to valuable digital shared resources usable by many. As highlighted in this article, maintaining a delicate balance between token demand and supply to continuously deliver high-quality, abundant resources on the platform will be critical.

Faced with ongoing global economic uncertainty and enduring value-based consumption patterns, resource optimization has become an unavoidable task. To effectively extend sharing economy approaches into this domain, larger economies must be built around broader asset classes.

Digital resources transcend physical limitations, instantly connecting people across the globe. Blockchain technology has the power to fluidize the value of diverse assets, bringing together large groups around this value flow to build an efficient economic system. Starting with examples like IO.NET, we hope to soon begin optimization experiments on broader resources within blockchain, potentially ushering in innovations akin to another Uberization for our lives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News