ARK Invest: Bitcoin, a Unique Safe-Haven Asset

TechFlow Selected TechFlow Selected

ARK Invest: Bitcoin, a Unique Safe-Haven Asset

Bitcoin has gained significant prominence as a safe-haven asset, yet remains undervalued.

Author: Yassine Elmandjra, Head of Digital Assets at ARK Invest

Translation: Luffy, Foresight News

Trust in governments and financial institutions declined following the 2008 global financial crisis. Since then, events such as the European sovereign debt crisis, the Federal Reserve's response to COVID-19, and the collapse of major U.S. regional banks have exposed the drawbacks of relying on centralized institutions.

As accelerating technological innovation intersects with declining trust, investors are beginning to question the effectiveness of traditional safe-haven assets in protecting modern portfolios. Has the risk of government bonds decreased after events like the European sovereign debt crisis? Has physical gold become less effective as a hedge in the digital economy? Could inconsistent Federal Reserve policies threaten the dollar’s status as a reserve currency? While traditional safe-haven assets may still play a role in portfolio construction, their limitations give investors reason to reassess so-called “safe-haven” assets.

While "risk-on" and "risk-off" characteristics of traditional assets are mutually exclusive, Bitcoin blurs this distinction. Its revolutionary technology and novelty are risk-on attributes, while its absolute scarcity and function as a bearer instrument position it as a risk-off monetary asset.

Bitcoin presents an intriguing paradox: through its breakthrough technology, it can effectively hedge against economic uncertainty while also offering the potential for exponential growth.

Source: ARK Investment Management LLC, 2024

Born in 2008 as a response to the global financial crisis, Bitcoin has evolved from a fringe technology into a novel asset class worthy of institutional allocation. As the network matures, investors may increasingly evaluate Bitcoin’s value as a safe-haven asset.

Bitcoin as a Safe-Haven Asset

Although Bitcoin’s explosive growth and price volatility have led many investors and asset allocators to view it as the epitome of a risky asset, we believe the Bitcoin network embodies safe-haven characteristics by enabling financial sovereignty, reducing counterparty risk, and increasing transparency.

Bitcoin is the first digital, independent, global, rules-based monetary system in history. By design, its decentralization should mitigate systemic risks inherent in traditional finance, which relies on centralized intermediaries and human decision-makers to establish and enforce rules. Capital-B Bitcoin refers to a financial network that facilitates the transfer and custody of lowercase-b bitcoins—scarce digital monetary units.

We believe Bitcoin is the purest form of money ever created, possessing the following characteristics:

-

A digital bearer asset similar to a commodity.

-

A scarce, liquid, divisible, portable, transferable, and fungible asset.

-

An auditable and transparent asset.

-

An asset that can be fully matched to ownership and held without liability or counterparty risk.

Critically, Bitcoin’s properties stem from the Bitcoin network operating on open-source software. While multiple institutions coordinate functions in traditional finance, Bitcoin operates as a single institution. Instead of relying on central banks, regulators, and other government actors, Bitcoin depends on a global network to enforce rules—shifting execution from manual, private, and opaque to automated, public, and transparent.

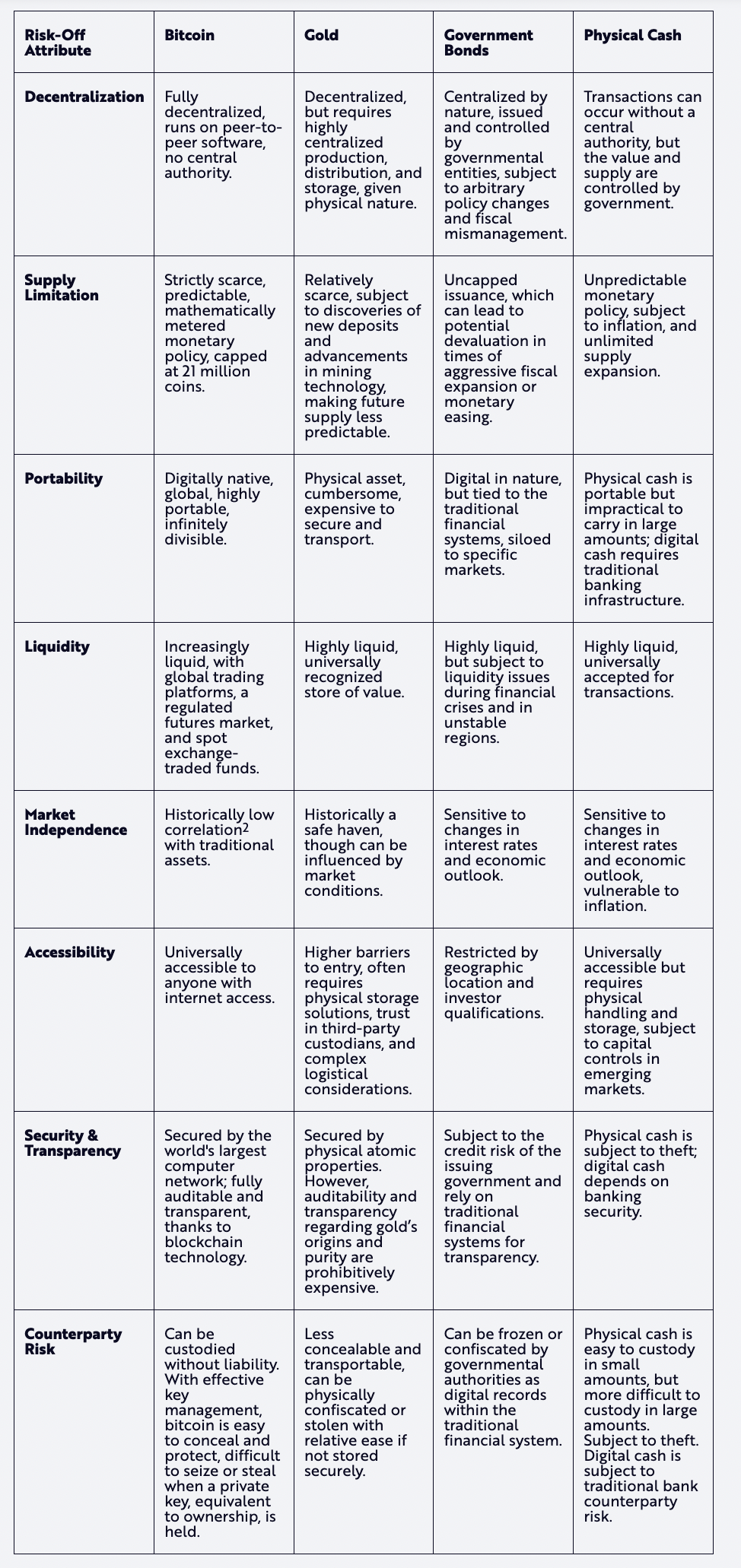

Given its technological foundation, Bitcoin occupies a unique position relative to traditional safe-haven assets, as illustrated below.

Source: ARK Investment Management LLC, 2024

Bitcoin’s Relative Performance

As an emerging asset, Bitcoin attracts attention due to its speculative nature and short-term volatility. Fifteen years after its inception, Bitcoin’s market capitalization has surpassed $1 trillion, enhancing its purchasing power while maintaining independence.

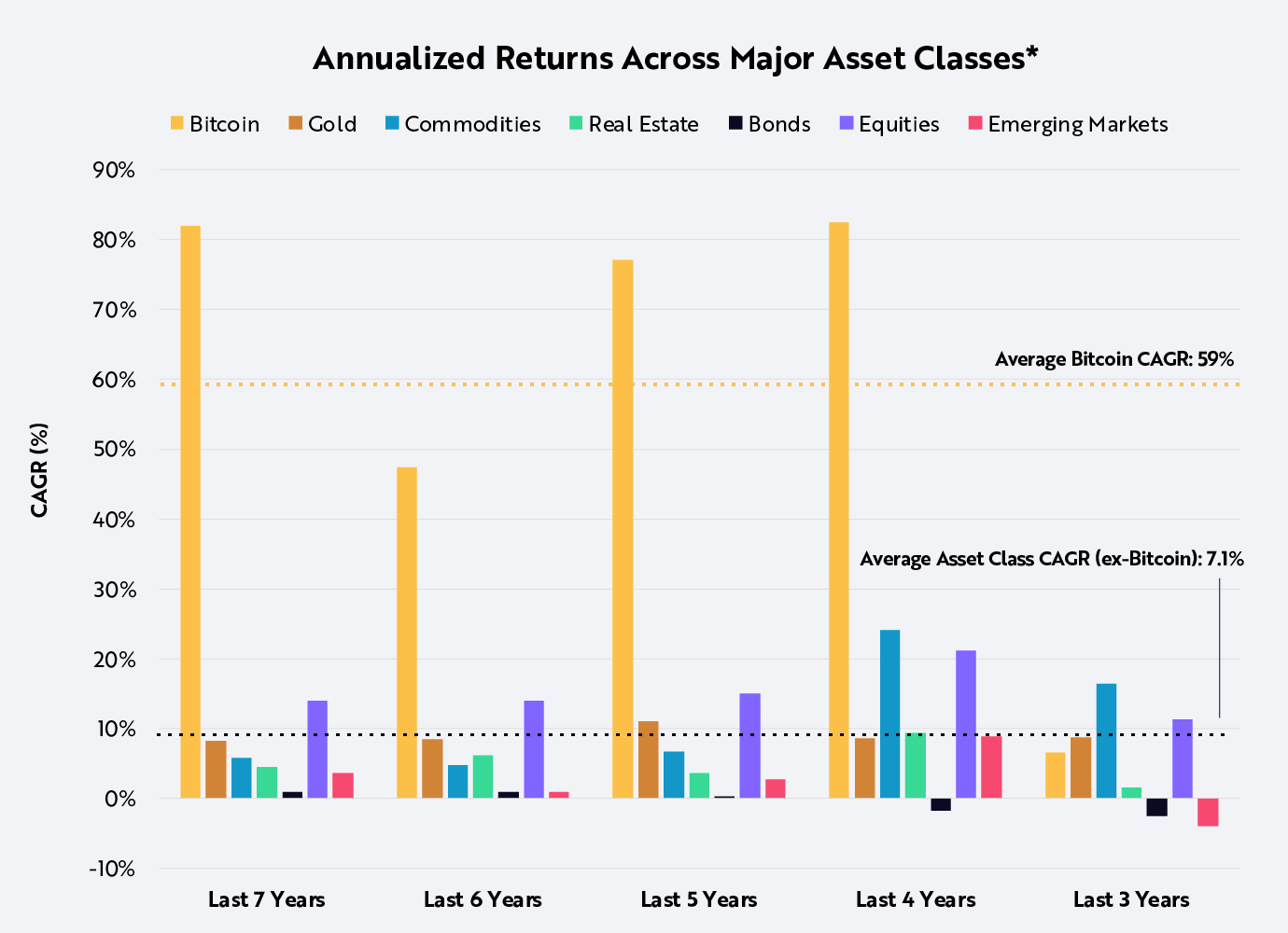

In fact, Bitcoin has outperformed all other major asset classes over both short- and long-term horizons. Over the past seven years, Bitcoin has delivered an annualized return of nearly 60%, compared to an average return of just 7% for other major assets, as shown below.

Source: ARK Investment Management LLC, 2024, based on data and calculations from PortfolioVisualizer.com; Bitcoin price data from Glassnode, as of March 31, 2024

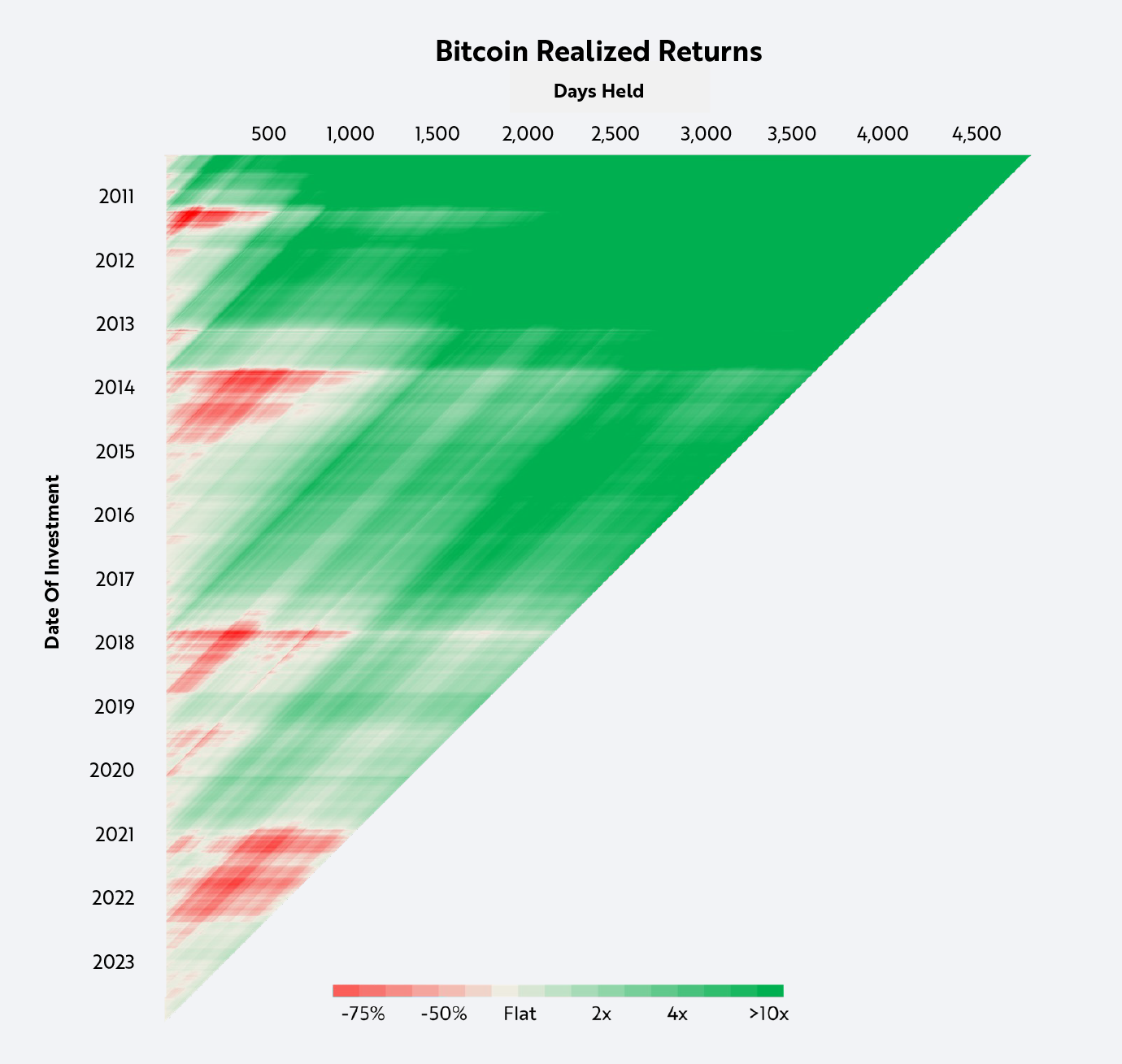

Importantly, since Bitcoin’s inception, investors who held for five years have been profitable regardless of purchase timing, as illustrated below.

Source: ARK Investment Management LLC, 2024, based on Glassnode data as of December 31, 2023

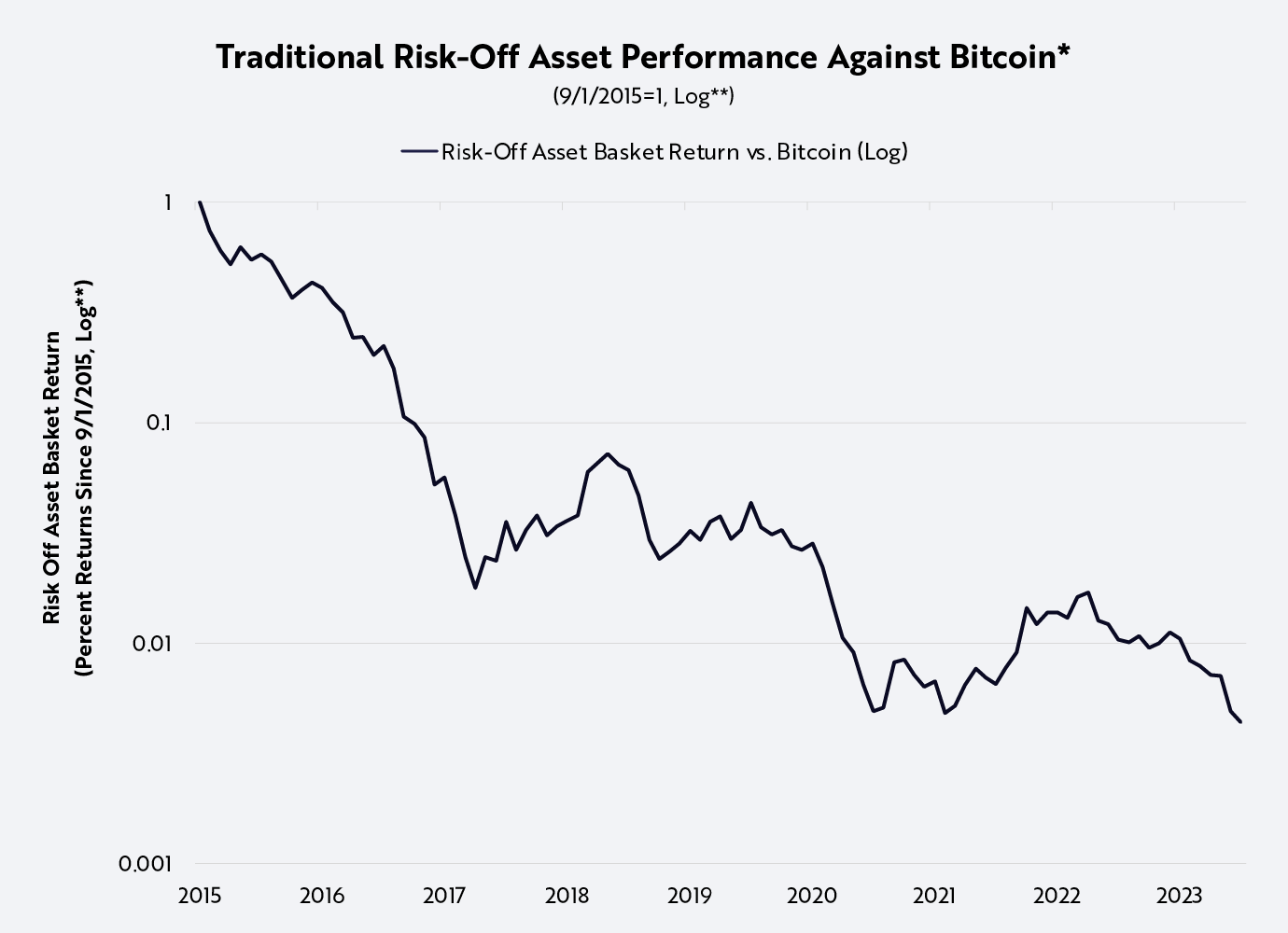

In contrast, traditional safe-haven assets such as gold, bonds, and short-term U.S. Treasuries have lost 99% of their purchasing power over the past decade, as shown below.

Source: ARK Investment Management LLC, 2024, based on PortfolioVisualizer and Glassnode data as of March 31, 2024

Is Bitcoin Too Volatile to Be a Safe-Haven Asset?

Paradoxically, Bitcoin’s volatility is a function of its monetary policy, underscoring its credibility as an independent monetary system. Unlike modern central banks, Bitcoin does not prioritize price or exchange rate stability. Instead, by controlling supply growth, the Bitcoin network prioritizes free capital flow. Therefore, Bitcoin’s price reflects demand relative to fixed supply—which explains its volatility.

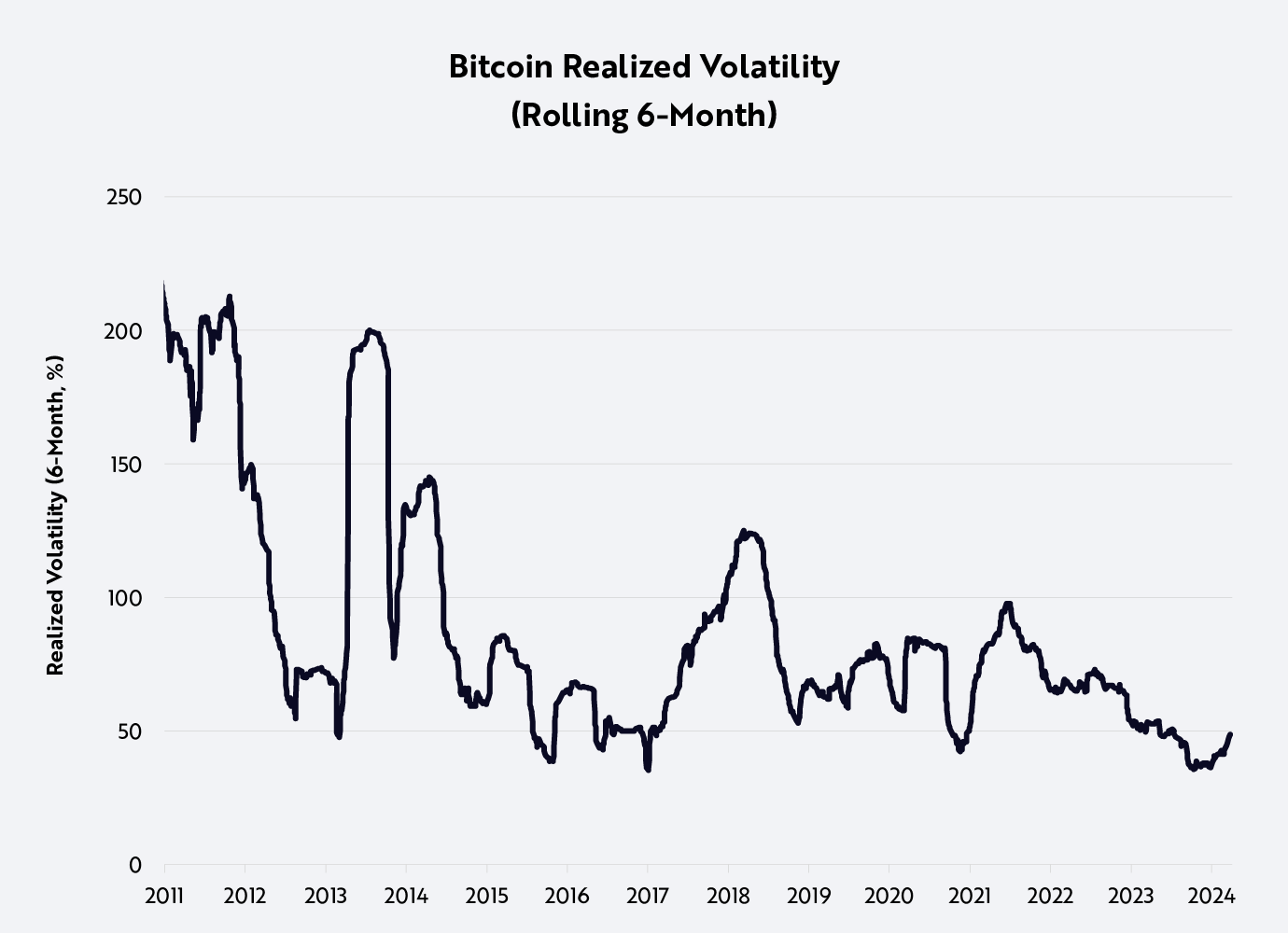

Nevertheless, Bitcoin’s price volatility has declined over time, as shown below:

Source: ARK Investment Management LLC, 2024, based on Glassnode data as of March 31, 2024

Why has Bitcoin’s price volatility decreased over time? As adoption grows, marginal demand represents a smaller share of Bitcoin’s total network value, thereby reducing the magnitude of price swings. All else equal, $1 billion in new demand would have a much larger impact on price when the network value is $100 billion than when it is $1 trillion. Importantly, amid significant price appreciation, volatility should not undermine Bitcoin’s role as a store of value.

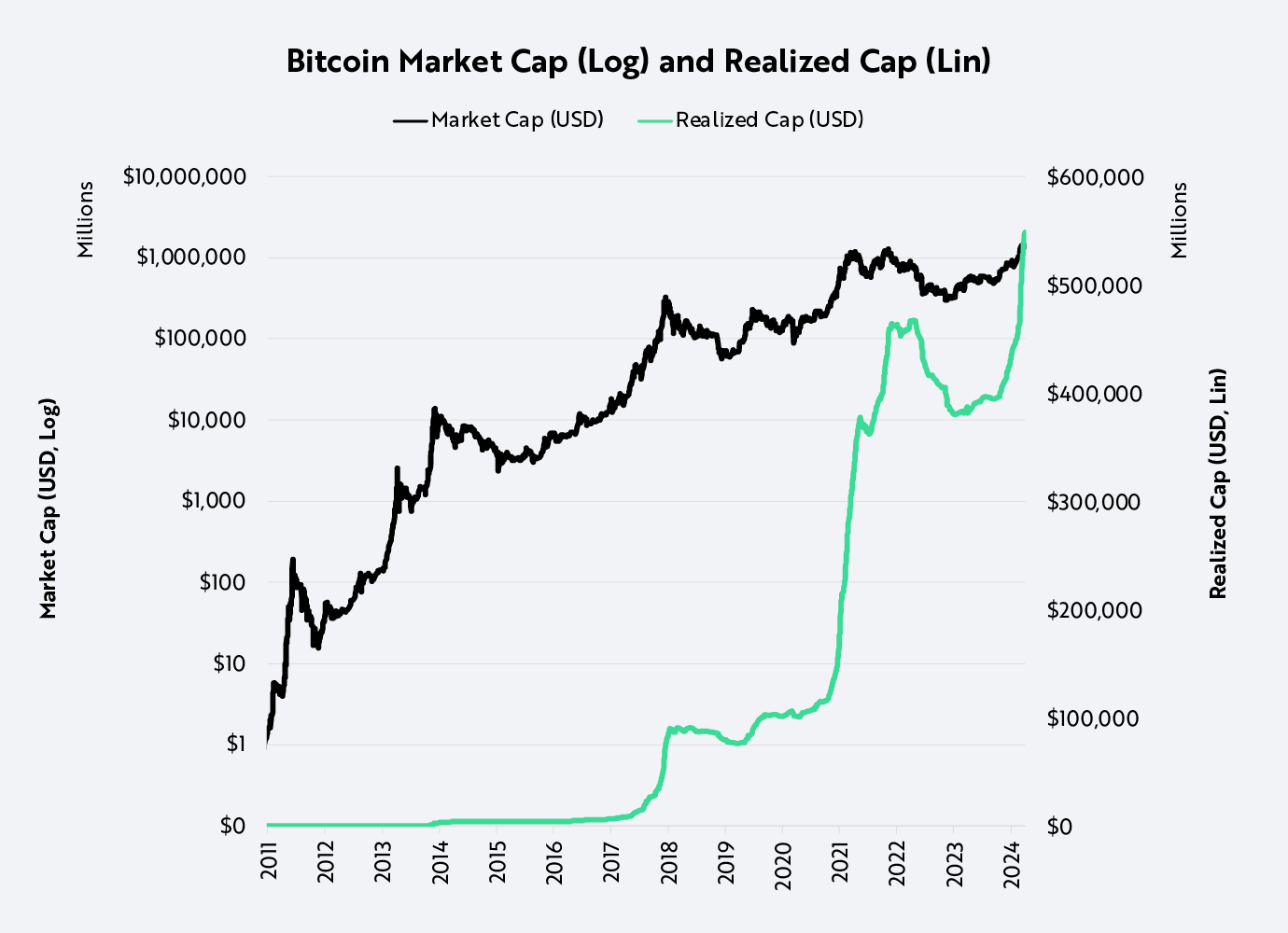

Perhaps a more relevant metric demonstrating Bitcoin’s ability to preserve capital and purchasing power is its on-chain cost basis. While market cap aggregates the value of all circulating bitcoins at current prices, the market cost basis values each bitcoin at its last movement price. The cost basis provides a more accurate measure of changes in purchasing power. Cost basis exhibits significantly less volatility than price, as shown below. For example, although Bitcoin’s market cap declined approximately 77% from November 2021 to November 2022, its cost basis fell only 18.5%. Today, Bitcoin trades above its all-time high cost basis, 20% higher than its 2021 market peak.

Source: ARK Investment Management LLC, 2024, based on Glassnode data as of March 31, 2024

Bitcoin’s Independence from Other Asset Classes

Low Correlation

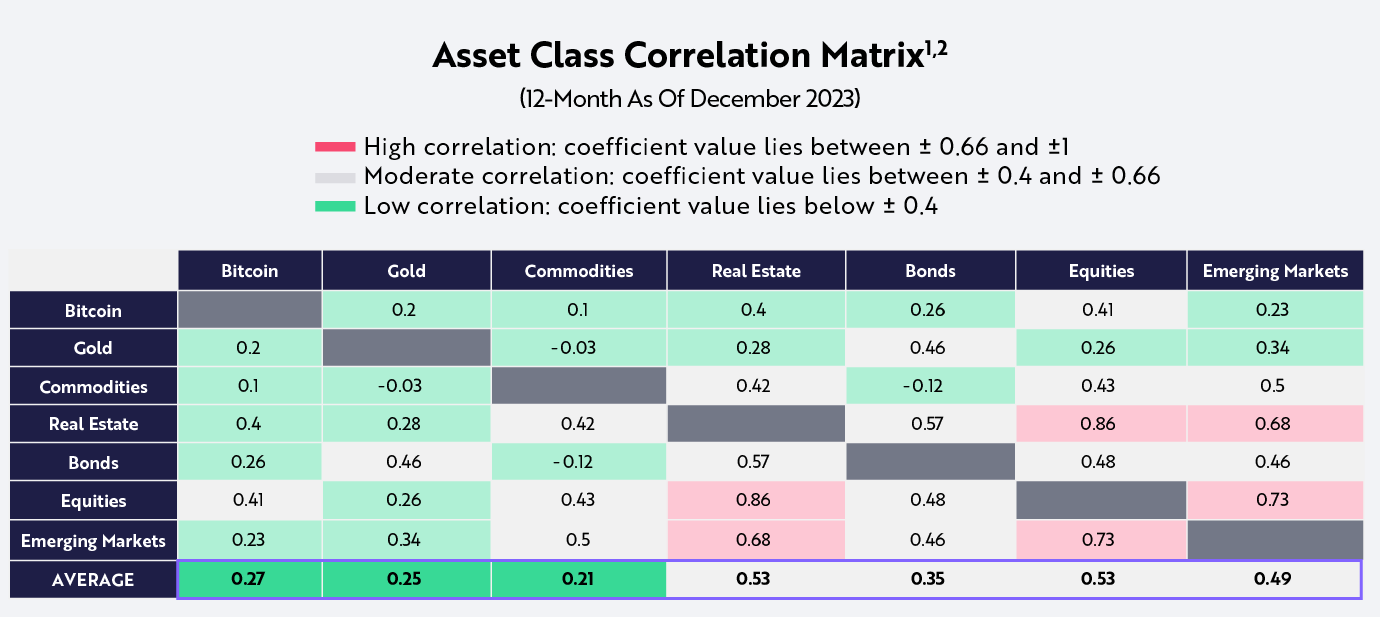

Another reason Bitcoin is suitable as a safe-haven asset is its low correlation with returns of other asset classes. Bitcoin is one of the few assets that consistently exhibit low correlation, as shown below. Between 2018 and 2023, Bitcoin’s return correlation with traditional asset classes averaged just 0.27. Notably, bonds and gold—traditionally considered safe-haven assets—have a relatively high correlation of 0.46, while Bitcoin’s correlations with gold and bond returns are 0.2 and 0.26, respectively.

Source: ARK Investment Management LLC, 2024, based on data and calculations from PortfolioVisualizer.com; Bitcoin price data from Glassnode, as of December 31, 2023

Adapting to Changing Interest Rate Policies

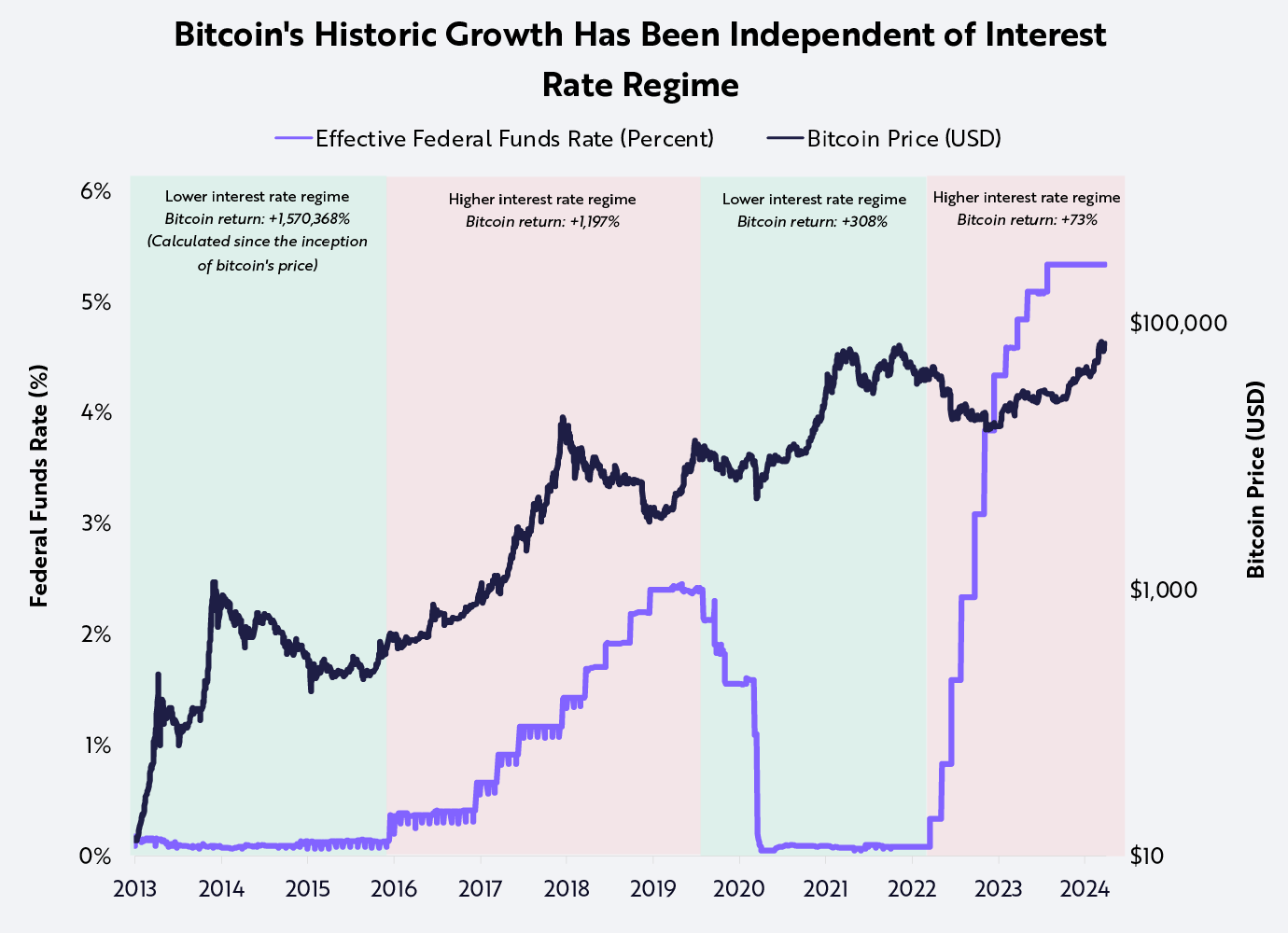

Additionally, comparing Bitcoin’s price to the federal funds rate reveals its resilience across different interest rate regimes and economic environments, as shown below. Importantly, Bitcoin’s price has surged significantly under both high- and low-interest-rate environments.

Source: ARK Investment Management LLC, 2024, based on FRED and Glassnode data as of March 31, 2024

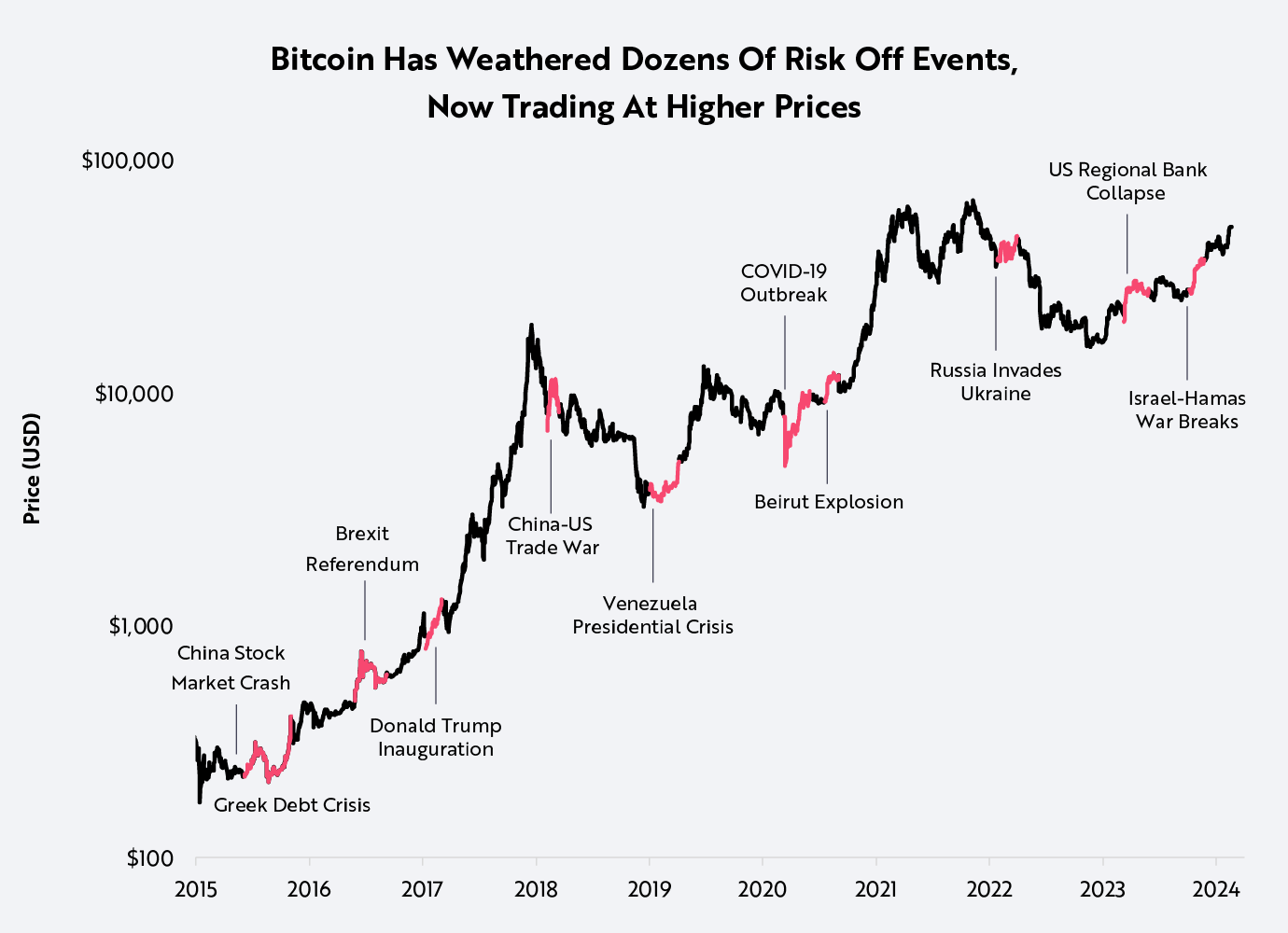

Over the past decade, Bitcoin has performed well during risk-off periods. As of this writing, Bitcoin’s price has increased following every crisis event, as illustrated below.

Source: ARK Investment Management LLC, 2024, based on Glassnode data as of March 31, 2024

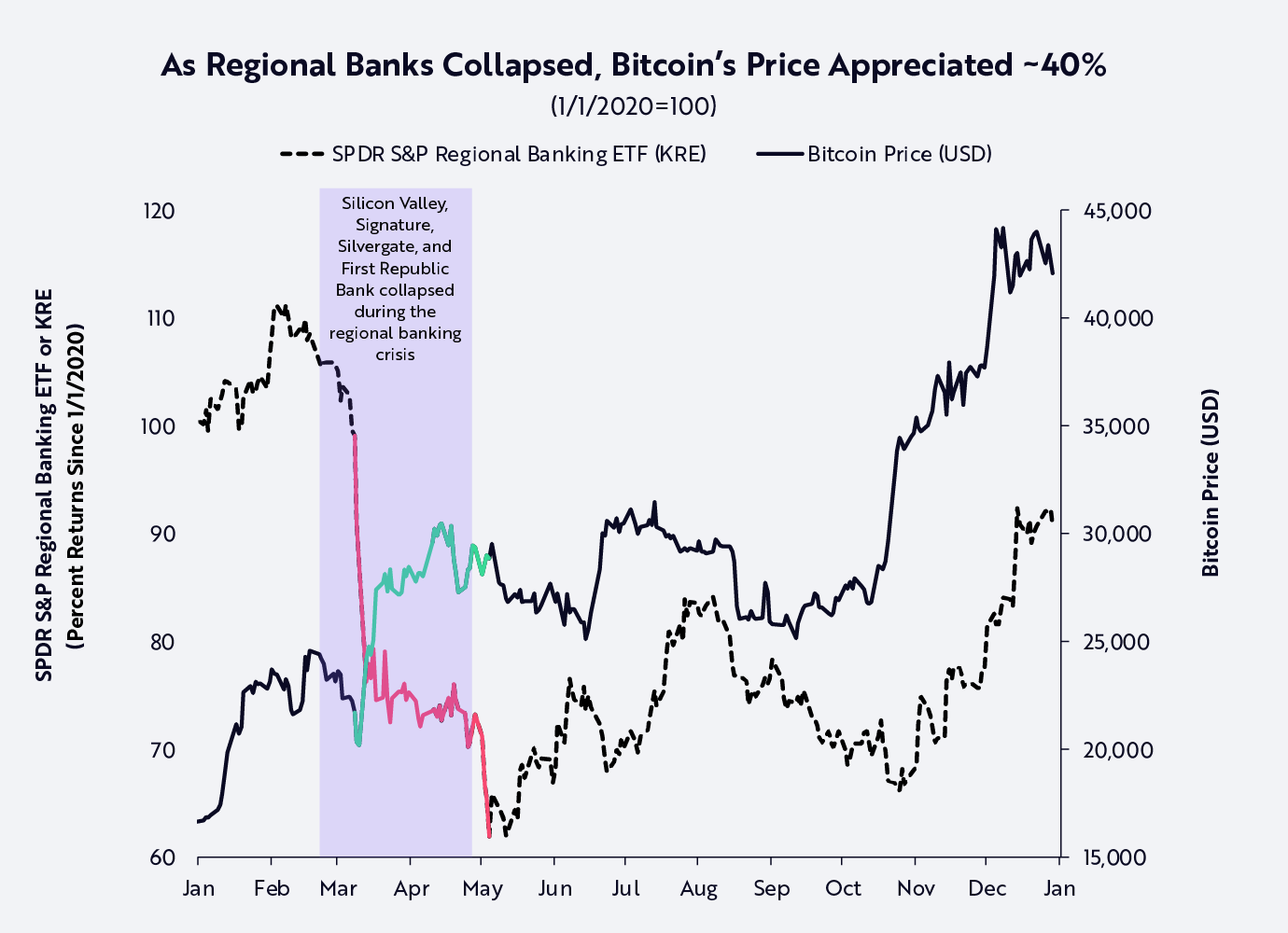

Bitcoin’s performance during regional banking crises is particularly notable. In early 2023, during the historic collapse of U.S. regional banks, Bitcoin’s price rose over 40%, highlighting its role as a hedge against counterparty risk, as shown below.

Source: ARK Investment Management LLC, 2024, based on Bloomberg and Glassnode data as of December 31, 2023

While Bitcoin has experienced downturns, these setbacks were industry-specific and idiosyncratic. They include the 2014 Mt. Gox exchange hack, the 2017 initial coin offering (ICO) bubble, and FTX’s 2022 collapse due to fraud. In each cyclical drawdown, Bitcoin has demonstrated antifragility.

Looking Ahead

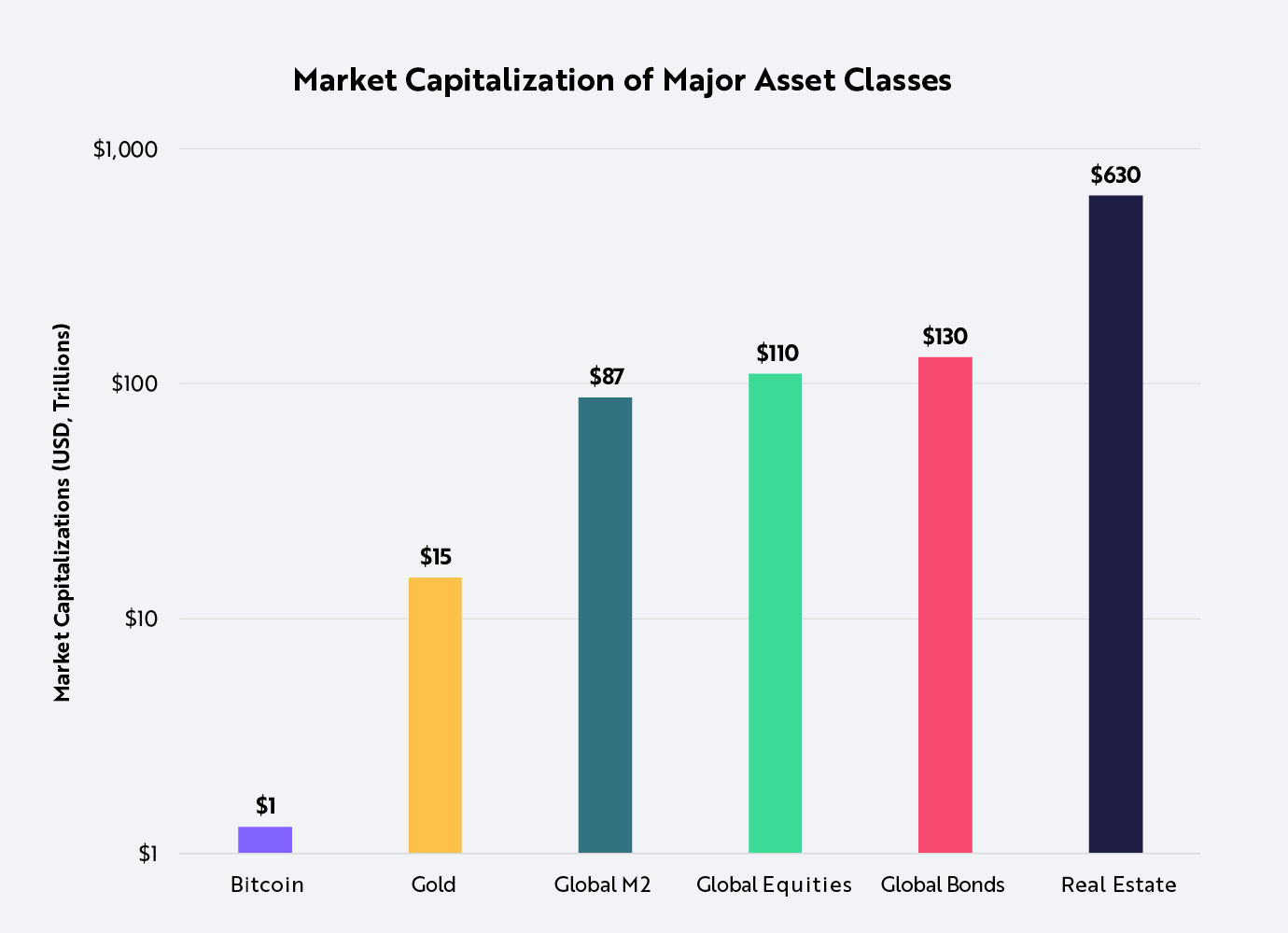

In its brief history, Bitcoin has gained significant traction as a safe-haven asset—yet remains undervalued. As the global economy continues shifting from physical to digital, adoption of Bitcoin’s decentralized global monetary system should continue rising, potentially positioning it alongside traditional safe-haven assets. Recent developments increase this likelihood, including U.S. approval of spot Bitcoin ETFs, nation-state adoption of Bitcoin as legal tender (e.g., El Salvador), and corporate treasury allocations by companies such as Block, MicroStrategy, and Tesla. With a current market cap of approximately $1.3 trillion versus $130 trillion in fixed income assets, the global safe-haven landscape appears ripe for disruption.

Source: ARK Investment Management LLC, 2024, based on data from Glassnode, VisualCapitalist, Statista, Macromicro.me, and Companiesmarketcap.com, as of March 31, 2024

Conclusion

Bitcoin is a relatively new asset class, and its market is dynamic and uncertain. Bitcoin is largely unregulated, and investments in Bitcoin may be more susceptible to fraud and manipulation compared to regulated asset classes. Bitcoin faces unique and substantial risks, including extreme price volatility, lack of liquidity, and theft.

Bitcoin’s price is highly volatile, influenced by actions and statements from public figures and media, shifts in supply and demand dynamics, and other factors. These challenges make it difficult for Bitcoin to consistently maintain its value over the long term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News