Detailed Explanation of Arkham: A Cryptocurrency Analytics Platform and Data Tracking Dashboard

TechFlow Selected TechFlow Selected

Detailed Explanation of Arkham: A Cryptocurrency Analytics Platform and Data Tracking Dashboard

Arkham is a cryptocurrency analytics platform and data tracking dashboard designed to easily monitor the on-chain activities of various blockchain entities.

Author: Teahouse Waiter

1. Project Overview

Arkham is a cryptocurrency analytics platform and data tracking dashboard designed to easily monitor on-chain activities of various blockchain entities, offering in-depth market analysis, trading data, and comprehensive reviews of crypto projects.

The platform enables users to search individuals, funds, exchanges, and ENS addresses by name to gain an overview of their recent activity, or search specific addresses for similar insights. The collected data can be used for various purposes, including trade decisions, trend forecasting, risk management, and early threat detection—helping investors, researchers, and crypto enthusiasts better understand market dynamics, identify investment opportunities, and track the performance of crypto assets.

Arkham aims to enhance transparency by providing data previously accessible only to blockchain analysts and enthusiasts, leveling the playing field for crypto traders and aficionados. The platform leverages artificial intelligence to collect, categorize, and present vast amounts of on-chain data via the Arkham dashboard. Its proprietary AI-powered address-matching engine, named Ultra, automatically links on-chain addresses to real-world identities.

Additionally, Arkham has introduced a tokenized system allowing users to post bounties using Arkham (ARKM) tokens on the Arkham Intel Exchange marketplace to uncover desired on-chain intelligence—for example, identifying the owner of a wallet address. On-chain data analysts possessing valuable information can sell these insights through the platform, with interested users bidding competitively. Purchased data remains exclusive to the buyer for 90 days before becoming publicly available.

2. Core Mechanisms

As a cryptocurrency analytics platform, Arkham’s core mechanisms revolve around data collection, processing, analysis, and presentation.

Arkham Intelligence is a key component of this mechanism. It developed Ultra, a proprietary AI-powered address-matching engine capable of extracting intelligence from today's vast network of blockchain activity. This technology aggregates on-chain and off-chain data from multiple sources (and multiple chains), linking blockchain addresses to real-world entities to provide a complete picture of who is using cryptocurrencies and how they operate.

Purpose and Functions of Ultra:

-

De-anonymization: Ultra’s primary goal is to overcome the inherent anonymity of blockchain transactions. While blockchain records are public, they are typically represented by anonymous addresses, making it difficult to identify the parties behind them. Ultra systematically processes this data to reveal the real-world entities—individuals, companies, or institutions—behind blockchain addresses.

-

Data Synthesis: Ultra gathers and synthesizes on-chain and off-chain data from multiple sources. This includes transaction histories, wallet addresses, token movements, and other relevant data points across different blockchain networks.

-

AI-Powered Analysis: Using advanced artificial intelligence and machine learning algorithms, Ultra analyzes collected data to detect patterns, connections, and identifiers that link anonymous blockchain addresses to identifiable real-world entities. This may involve analyzing transaction behaviors, network interactions, and other digital footprints left on-chain.

Key Features and Advantages of Ultra:

-

Accuracy and Scalability: One of Ultra’s key strengths is its ability to efficiently process massive volumes of data while maintaining high accuracy when matching addresses to entities. This scalability is critical given the extensive and ever-growing nature of blockchain databases.

-

Real-Time Data Processing: Ultra operates in real time, delivering up-to-date insights and intelligence. This feature is crucial for users relying on timely information for trading decisions, risk assessments, or research.

-

Comprehensive Blockchain Coverage: While many analytics platforms focus on a single blockchain, Ultra is designed to aggregate and analyze data across multiple blockchain networks. This multi-chain approach ensures a more holistic understanding of the blockchain ecosystem, reflecting the interconnected nature of today’s crypto markets.

-

Enhanced Market Insights: By de-anonymizing blockchain addresses, Ultra provides users with deeper insights into market dynamics. Understanding the actions and strategies of major players in the crypto space offers significant advantages in trading, investing, and risk management.

In addition, Profiler serves as the central platform supporting Arkham’s product suite. It acts as a hub for accessing detailed insights into blockchain participants’ transaction histories, asset holdings, financial performance, and interaction patterns. By aggregating and presenting a wide range of data points, Profiler enables users to conduct in-depth analyses of entities, enhancing their ability to make informed decisions, perform research, or monitor market trends.

Main Features of Profiler:

-

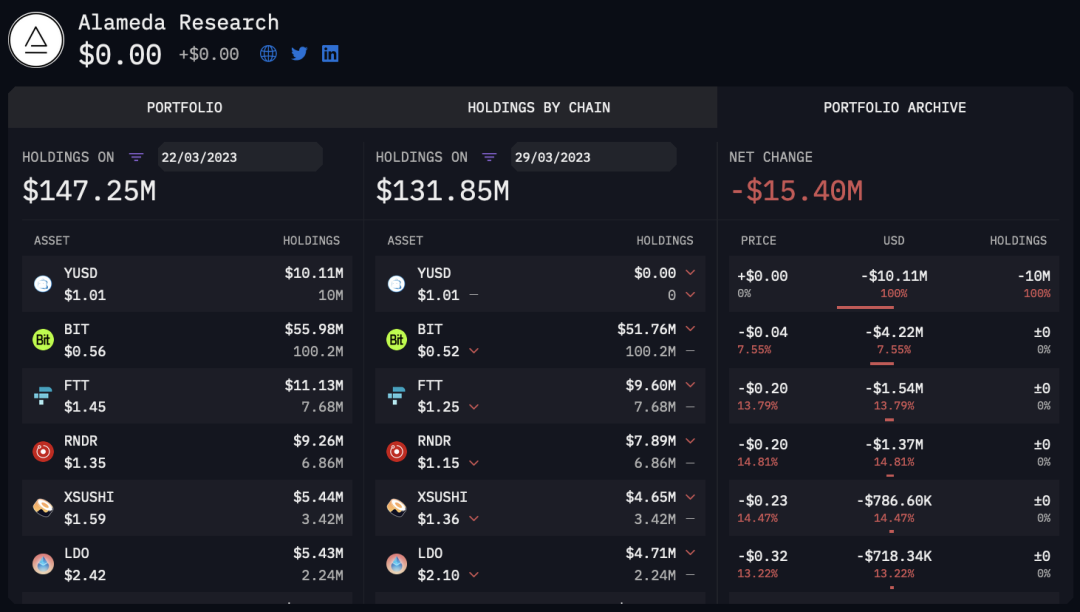

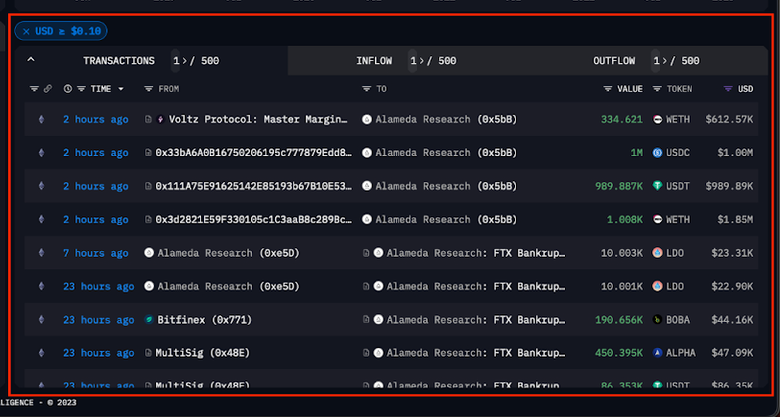

Transaction History: Users can view a complete record of incoming and outgoing transactions for any entity or address. This history can be filtered and sorted by criteria such as dollar value, specific tokens, counterparties, and timeframes, offering detailed insights into transaction behavior.

-

Portfolio Holdings: Profiler displays the current portfolio holdings of an entity or address, broken down by individual assets. It provides insights into asset distribution, concentration levels, and exposure to specific cryptocurrencies.

-

Balance History: Users can track historical balances of an entity or address over time. This feature helps visualize how total asset value has evolved, highlighting periods of significant accumulation or withdrawal.

-

Profit and Loss: By analyzing transactions and portfolio changes, Profiler estimates the profit and loss of an entity or address. This estimation is crucial for evaluating financial performance and assessing the effectiveness of investment strategies.

-

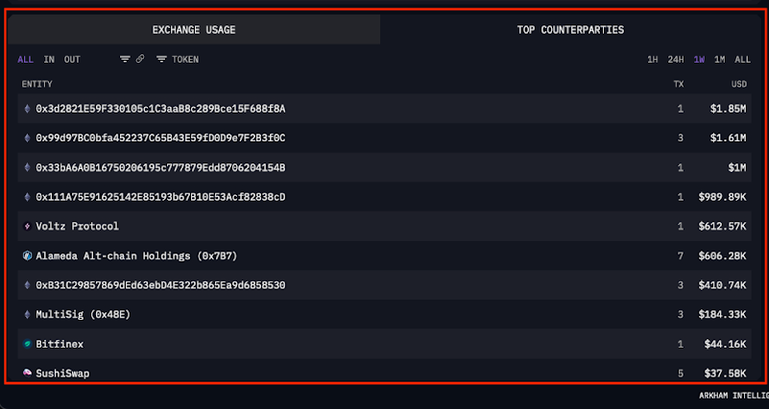

Exchange Usage: The tool provides data on an entity’s interactions with exchanges, detailing deposit and withdrawal activity. This information is essential for understanding liquidity management and risk exposure.

-

Main Counterparties: It identifies and lists the primary counterparties with whom an entity or address transacts. This insight is highly valuable for uncovering relationships and networks within the blockchain ecosystem.

Advantages of Profiler:

-

Comprehensive Analysis: By integrating diverse data points into a single interface, Profiler allows users to conduct thorough analyses of entities or addresses without needing multiple tools or platforms.

-

Real-Time Insights: The real-time nature of Profiler’s data ensures users have access to the latest information, enabling quick responses to market shifts or new developments.

-

Strategic Decision-Making: With detailed transaction history and financial performance data, users can better understand the strategies employed by entities on-chain. This knowledge can inform their own investment decisions, risk assessments, and research efforts.

-

Market Transparency: By making it easier to analyze the behaviors and positions of blockchain participants, Profiler contributes to greater market transparency. This promotes a fairer competitive environment and fosters a healthier trading ecosystem.

-

Customization and Alerts: Users can customize views and set alerts for specific activities or thresholds, making Profiler a versatile tool tailored to individual analytical needs and preferences.

Meanwhile, filtering capabilities allow users to sort and navigate results based on specific metrics, simplifying the task of finding required data.

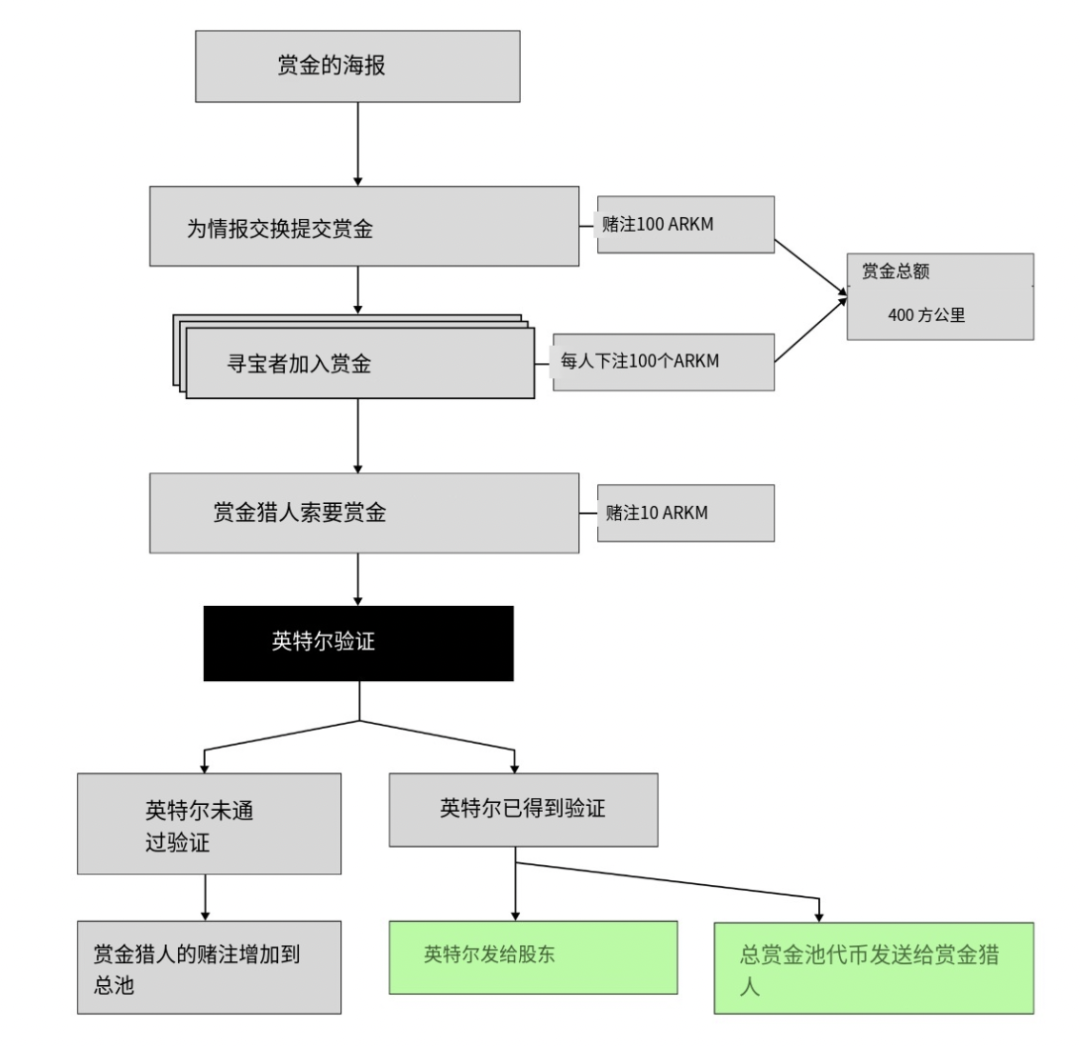

Additionally, Arkham Intel Exchange is an innovative component of Arkham Intelligence—an decentralized marketplace for buying and selling crypto-related intelligence. The platform uses its native ARKM token as a medium of exchange, facilitating the trade of actionable insights and data among users. Arkham Intel Exchange aims to democratize access to valuable crypto intelligence, opening it not only to large institutions with substantial resources but also to individual traders and analysts.

Features and Characteristics of Arkham Intel Exchange:

-

Decentralized Intelligence Marketplace: The exchange operates in a decentralized manner, enabling direct user interactions without a central authority. This setup enhances transparency and fairness while reducing risks associated with centralized platforms.

-

Bounty System for Intelligence Requests: Users seeking specific intelligence can post bounties on the exchange, specifying the information needed and the amount of ARKM they’re willing to pay. Other users can then fulfill these requests to earn rewards. This system incentivizes targeted intelligence gathering and sharing.

-

Intelligence Auctions: Users possessing valuable crypto intelligence can auction it to the highest bidder. This feature allows individuals with unique insights, data, or analysis to effectively monetize their knowledge.

-

Intel-to-Earn Model: The exchange introduces an “Intel-to-earn” model, rewarding contributors to the ecosystem. Whether fulfilling bounty requests or participating in auctions, contributors earn ARKM tokens, encouraging active participation and continuous growth of the platform’s intelligence pool.

-

Smart Contract-Based Transactions: All transactions on Arkham Intel Exchange—including bounties and auctions—are conducted via smart contracts. This ensures transparency, security, and trust, as terms are programmatically enforced and cannot be tampered with.

-

Exclusive Access Period: Purchased intelligence is initially available exclusively to the buyer for a predetermined period before potentially being made public on the Arkham platform. This exclusivity window allows buyers to maximize the value of the acquired intelligence.

Impact and Benefits of Arkham Intel Exchange:

-

Improved Market Efficiency: By facilitating the exchange of intelligence, Arkham Intel Exchange supports more informed decision-making across the crypto market, improving efficiency and reducing information asymmetry.

-

Empowerment of Individual Participants: The platform gives individual traders and analysts access to high-quality intelligence previously available only to well-resourced entities, creating a level playing field.

-

Incentivized Knowledge Sharing: Through its reward system, the exchange encourages users to share insights and analysis, fostering a collaborative environment with freer access to information.

-

Enhanced Transparency and Trust: The combination of decentralization and smart contract usage strengthens trust among participants. Users can engage confidently, knowing the platform’s mechanisms ensure fairness and transparency.

3. ARKM

The ARKM token is a core element of the Arkham Intelligence ecosystem, designed to drive the acquisition, sharing, and trading of crypto intelligence. As the native token, ARKM plays a vital role on the Arkham Intel Exchange—not only as a medium of exchange but also in forming a decentralized, intelligence-driven economy.

Functions of the ARKM Token:

-

Intelligence Trading: ARKM is used to buy and sell crypto-related intelligence on the Arkham Intel Exchange. Users can post bounties or purchase shared intelligence using ARKM.

-

Incentive Mechanism: The Arkham ecosystem incentivizes users to share valuable intelligence through a bounty-based "intel-to-earn" model. Users earn ARKM tokens by providing intelligence, completing bounty tasks, or selling intelligence in auctions.

-

Governance: ARKM token holders may participate in governance decisions, such as voting on platform updates, intelligence verification standards, and bounty policies.

-

Transaction Fees: ARKM may be used to pay fees on the Arkham Intel Exchange, including bounty posting fees, trading fees, or other potential service charges.

Characteristics of the ARKM Token:

-

Decentralization: As a blockchain-based token, ARKM supports decentralized transactions and economic activity, reducing reliance on centralized exchanges and enhancing security and transparency.

-

Community-Driven: ARKM is designed to encourage community members to actively shape the platform’s development—through sharing high-quality intelligence, participating in governance votes, and contributing to the evolution of the Arkham ecosystem.

-

Transparency and Security: Smart contract-based transactions ensure the transparency and security of ARKM transfers. All transactions are recorded on-chain and publicly verifiable, minimizing fraud risks.

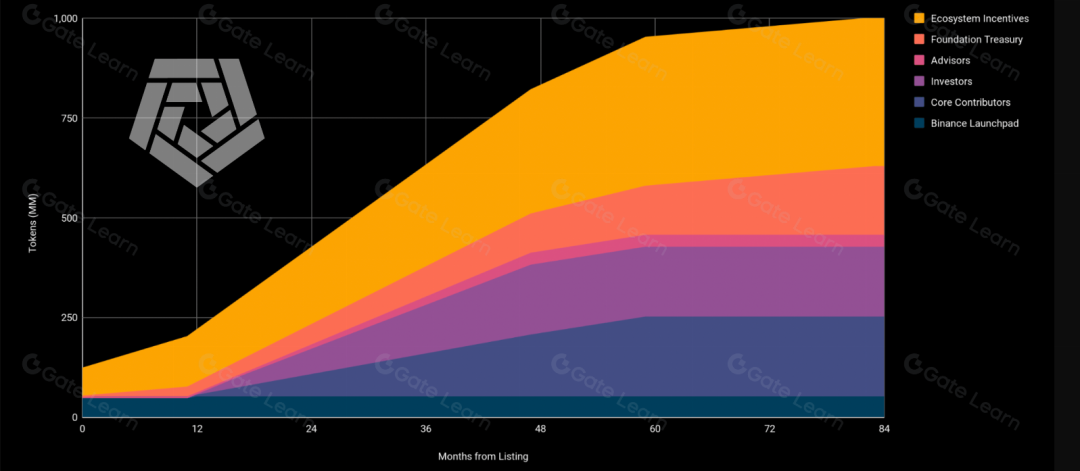

The total supply of ARKM is 1 billion tokens, allocated as follows: 37.3% for ecosystem sustainability; 20% reserved for core contributors; 17.5% for investors; 17.2% for foundation funding; 5% for Binance Launchpad; and 3% for advisors.

Initial token circulation is 15%, with all tokens fully circulating over seven years. Tokens allocated to investors, core contributors, and advisors will be locked for one year after launch, followed by a three-year gradual unlock. Ecosystem tokens will unlock over five years, while foundation funds will unlock over seven years.

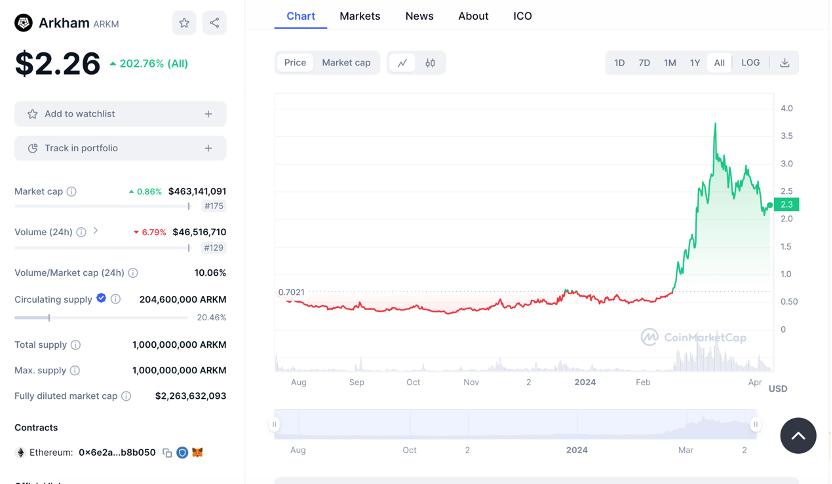

As of now, the ARKM token price is $2.24, with a market cap of $459,060,903, ranking #175. The trading volume-to-market cap ratio is 10.06%, which is relatively high—indicating strong trading activity or significant price volatility. If the entire ARKM supply were valued at the current price, the market cap would reach approximately $2,243,699,429.

4. Team / Funding Status

Arkham was founded in 2020 by Miguel Morel, who is also a co-founder of the algorithmic stablecoin project Reserve Protocol and currently serves as Arkham’s CEO.

According to Arkham’s official website, the company raised over $12 million in its Series A round. Investors include an anonymous co-founder of OpenAI—the creator of ChatGPT, one of 2023’s most influential AI products—Joe Lonsdale, co-founder of Palantir; Geoff Lewis, founder of venture capital firm Bedrock; and Tim Draper, founder of Draper Fisher Jurvetson, among other industry leaders.

To date, Arkham’s strategic partners include Base, BNB Chain, Polygon, and Optimism. Through these key partnerships, Arkham has expanded its coverage across Ethereum and other blockchain ecosystems.

5. Advantages and Controversies

Arkham’s analytical products have played a notable role in resolving high-profile crypto incidents.

-

Asset Recovery for Alameda Research

According to Bitcoin Magazine, Arkham Intelligence discovered that the liquidator responsible for recovering assets following the collapse of hedge fund Alameda Research had taken control of 34.94 BTC, worth approximately $110 million at the time. Arkham’s report showed that, as of March 2023, multiple wallets had been receiving BTC from exchanges and cold wallets.

-

Gradual Recovery of Euler Hacker Funds

According to CoinDesk, in April 2023, Arkham Intelligence tracked the gradual return of about $200 million stolen by hackers from the lending protocol Euler Finance. The analysis revealed that the exploit involved a combination of DAI, wrapped Bitcoin (wBTC), staked Ether (sETH), and USD Coin (USDC). As Euler and the hacker negotiated a resolution, Arkham’s analysis was used to monitor bulk repayments of the funds.

However, beyond positive developments, Arkham has also sparked controversy.

-

User Email Addresses Exposed via Invite Code Links

Arkham previously launched a referral feature allowing users to generate invite code links to onboard others. However, after announcing an airdrop on July 10, users on Twitter reported that the invite codes could be easily decoded, exposing their email addresses—a move that upset parts of the crypto community.

These codes were generated by Base64 encoding users’ email addresses. Using free online tools, anyone could reverse-decode the strings and reveal the referrer’s email. This meant that users who publicly shared their invite links on social media inadvertently exposed their personal emails.

Following the incident, Miguel Morel explained on Twitter that the link system was created during the beta phase to enable rewarding users via email. He stated the company used emails solely for communication and rewards, not for other purposes. Additionally, referred users could see the inviter’s email upon first visiting the link—to confirm the referrer was a genuine Arkham user.

Nonetheless, Morel admitted that as the user base grows, the link generation method must change. The team has since updated the mechanism so that future links encrypt email addresses, preventing reverse derivation.

-

Accusations of Monetizing Doxxing and Violating Privacy

Anonymity has long been a hallmark of the crypto space. However, Arkham advocates for “de-anonymization,” stating in its whitepaper that “raw, unprocessed, and anonymous transaction data is useless”—justifying its services. Nevertheless, the Arkham Intel Exchange, which allows users to buy and sell intelligence, has drawn criticism from privacy-conscious members of the crypto community who oppose profiting from doxxing.

Mark Zeller, founder of Aave DAO, said on Twitter: “Doxxing isn’t cool. I’m deeply disappointed in your shitcoin that sells out the values of the entire ecosystem. This will bring a lot of harm.”

Crypto investment commentator Scott Melker, known as The Wolf of All Streets on Twitter, also opposed the idea that Arkham is ethical or justified, arguing the crypto space should move toward greater privacy, not regress backward.

On the other hand, some argue Arkham’s functionality helps combat common hacking issues in crypto. According to a Chainalysis report, crypto investors lost a record $3.8 billion to hacks in 2022 alone.

-

Suspected Ties to the U.S. Government

One of Arkham’s investors is Joe Lonsdale, co-founder of big data company Palantir. Since Palantir’s major clients include U.S. government agencies—assisting in anti-terrorism efforts—Arkham has faced speculation of ties to the CIA or other government bodies, raising privacy concerns.

Arkham has denied these claims, emphasizing it is not a secret U.S. government project and has no affiliations with governmental organizations.

6. Future Outlook

As an early adopter and innovator in crypto intelligence technology, Arkham stands to benefit from the growth of this emerging field, leveraging accumulated experience as new entrants establish their positions in the market.

If global adoption of cryptocurrencies continues, intelligence may become a key competitive advantage. Users could employ increasingly sophisticated and creative analytical tools to make better-informed decisions on trade entries and exits, asset selection, and pattern recognition. Meanwhile, exchanges and other platforms may further integrate crypto intelligence into their offerings as a strategy to attract traders with more compelling products.

From a cybersecurity perspective, widespread crypto adoption will likely demand stronger security measures. Indeed, if transparency can deter malicious behavior, new applications of crypto intelligence could enhance security for everyone.

In summary, while Arkham may serve as a powerful tool for tracking hacker-related data, it’s understandable why this might concern major players in the crypto space—making it a double-edged sword. It remains unclear how significant an impact Arkham will ultimately have on the industry. Only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News