Expanding Boundaries: What to Watch as Arkham Enters the Perpetual Contracts Market?

TechFlow Selected TechFlow Selected

Expanding Boundaries: What to Watch as Arkham Enters the Perpetual Contracts Market?

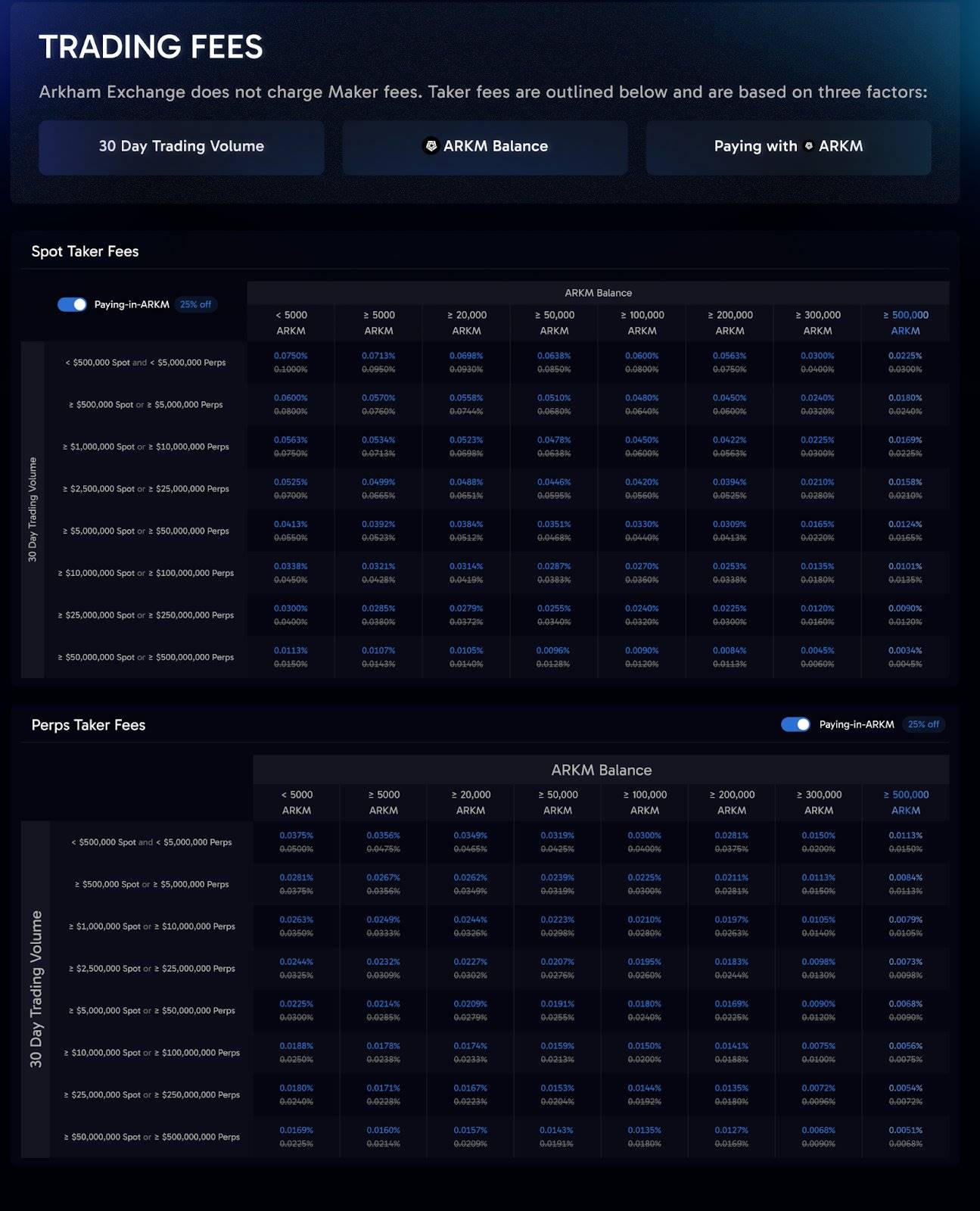

0 maker fee and discounted trading fees, with trading volume earning points redeemable for tokens.

Author: 1912212.eth, Foresight News

Rumors have come true—Arkham has officially launched its derivatives trading platform and opened user registration. Combined with favorable market sentiment around the U.S. election, ARKM’s token price has performed strongly, rising three consecutive days from around $1.6 to a high of approximately $2.36.

Why is this former AI narrative leader now entering the perpetual futures market?

Arkham uses an AI-powered algorithmic engine called Ultra to systematically analyze and de-anonymize blockchain transactions. It offers comprehensive views into entity or address activities, including transaction history, holdings, balance history, profit and loss records, exchange usage, and top counterparties. Through its Profiler tool, users gain full visibility into entity behavior, enabling deeper analysis and insights. Over the past year, Arkham has gained significant attention for tracking major events such as the German government's BTC sales, Mt. Gox repayments, U.S. government wallet movements, and key whale activities.

Moreover, Arkham counts OpenAI CEO Sam Altman among its investors, which has helped boost its token price during periods of heightened interest in AI narratives, making ARKM one of the most prominent tokens in the AI-themed crypto sector.

However, in early April this year, Arkham faced intense controversy over a large token unlock, with critics accusing the team of improperly releasing locked tokens. Arkham responded by attributing the claims to disinformation spread by competitors, clarifying that all transferred tokens were already unlocked and properly allocated. After this incident subsided, ARKM’s price began a steady decline amid broader bearish market conditions.

So why is Arkham launching a derivatives platform now?

DeFi Derivatives: A High-Capacity Market

The derivatives market has long been seen as a high-ceiling, high-margin segment within DeFi. As of last month, Bitcoin’s daily spot trading volume was approximately $4 billion, while its derivatives volume exceeded $50 billion.

Nonetheless, total DeFi derivatives trading volume still lags behind DEX spot volumes and remains small compared to centralized exchanges (CEX).

This is due to various headwinds including bear markets, suboptimal user experience, and regulatory uncertainty. Nevertheless, new entrants continue to emerge and capture market share—for example, Hyperliquid briefly became one of the more popular Perp DEXs in the English-speaking community.

On one hand, Hyperliquid attracted trading volume through a points program that allocates 50% of its total supply proportionally to points holders. On the other, it continuously improved its Layer 1 infrastructure, optimizing throughput and user experience. Its market operations were also effective—quickly listing new and trending assets brought significant attention and trading activity.

According to DefiLlama data, Hyperliquid’s total TVL is now approaching $1 billion, up from just $57 million at the beginning of the year.

Arkham’s timing for launching its new derivatives market appears favorable. With the market clearly entering a new bull cycle, declining Fed interest rates, and expectations of lighter regulation under President-elect Trump, the growth potential for DeFi derivatives looks promising.

AI + Big Data Analytics for Trading Support

Data as a trading reference cannot be overstated. Leveraging its robust big data capabilities, Arkham is naturally well-suited for whales and traders conducting both spot and derivatives trading on its platform.

Arkham tracks numerous whale activities—including buy/sell records, held assets, and balances. After processing and filtering this data for predictive accuracy, it can serve as valuable trading signals.

In terms of market alerts, the movements of major institutions or governments often attract significant market attention. For instance, when a government begins large-scale selling or a VC firm liquidates its holdings, such information can directly influence trading decisions.

When users act on these intelligence insights and execute trades simultaneously, the process becomes seamless.

But beyond data intelligence, what other strategies does Arkham employ to attract users?

Trading Fee Discounts and Points Redemption for Tokens

According to official announcements, Arkham Exchange currently charges zero fees for placing limit orders in both spot and perpetual contracts. Traders can receive up to a 95% discount on trading fees based on their ARKM token balance and trading volume. Users who pay fees using ARKM tokens in their wallets receive an additional 25% discount.

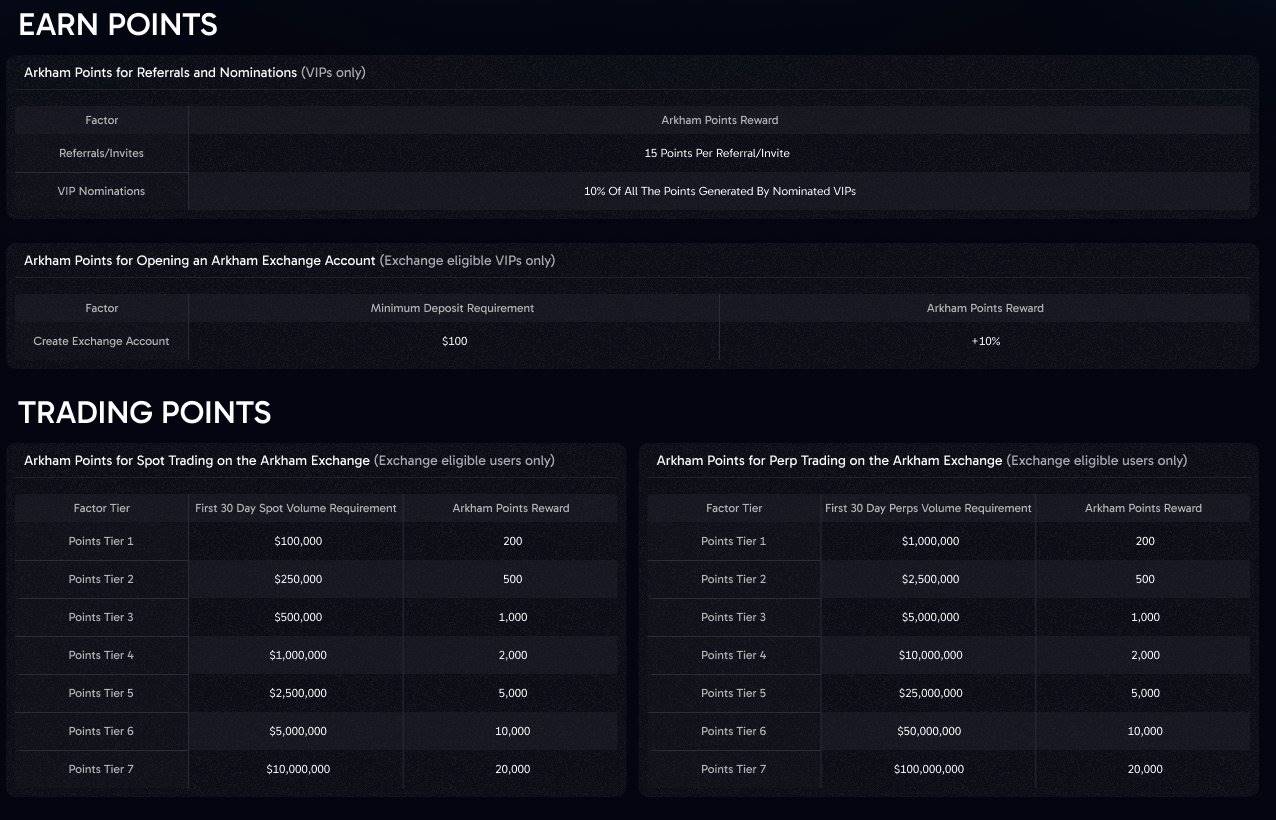

In addition to opening registration, Arkham has launched a points campaign to incentivize trading. Users earn points based on their trading volume on the Arkham Exchange. VIP account holders receive a 10% bonus on earned points.

Points can be redeemed for ARKM tokens 30 days after the exchange officially launches trading. Arkham plans to activate trading functionality within the coming week.

Token Utility

The utility of the ARKM token has so far been limited—mainly governance voting and access to intelligence services such as address labeling, hacker tracking, and curated data sources. The extent to which these use cases support token price appreciation remains uncertain.

CEO Miguel Morel has stated that Arkham aims to keep core functionalities free forever—such as viewing entities, searching portfolios, and exploring investment positions. However, he anticipates introducing paid premium features later this year to monetize the platform.

Token holders are expected to receive a share of these revenues.

While details about the paid features remain unconfirmed, the deep integration of ARKM with the new perpetuals exchange means that if the platform achieves strong growth, it could create a positive feedback loop for the token’s value.

Summary

The derivatives market is undeniably vast, but gaining a foothold is no easy task. While Arkham’s new perpetuals exchange adds utility to its token, success will depend heavily on execution—particularly in market operations, long-tail asset listings, and liquidity depth. Trading volume is likely to rise initially due to incentive programs, but sustained performance afterward will determine whether Arkham can truly expand its boundaries.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News