dYdX's Token Flywheel and Permissionless Long-Tail Asset Market

TechFlow Selected TechFlow Selected

dYdX's Token Flywheel and Permissionless Long-Tail Asset Market

Will the DYDX flywheel kick in?

Author: RainAsleep

In this cycle, I’ve particularly enjoyed the concept of “old projects with new narratives,” which is evident from my earlier positioning in $MKR. The upcoming $MKR token split, rebranding, SubDAO development, and the founder’s continuous accumulation of $MKR—all these factors have solidified my conviction in holding $MKR. A simple yet effective logic is that during bull markets, a project’s own initiative often determines the price trajectory of its token. It's obvious that many teams are actively aligning themselves with trending narratives.

Among older DeFi protocols, Uniswap is advancing the intent narrative, Compound’s founder is working on RWA, and dYdX has launched v4, departing from the Ethereum ecosystem to build the dYdX Chain using the Cosmos SDK framework.

Now let me briefly walk you through dYdX’s recent updates ⬇️

Btw, feel free to use my referral link for trading—thanks for your support: https://dydx.zone/sleepintherain1

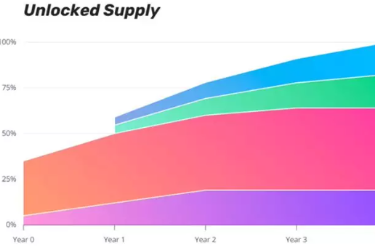

1/ $DYDX Tokenomics Update

In v3, the primary utility of $DYDX was to receive fee discounts. However, with v4, $DYDX has evolved into a real-income token—both stakers and validators now earn dividends paid in USDC (100% of fee revenue), and even the team must stake $DYDX to access protocol fees. Additionally, the team is incentivizing user trading activity via $DYDX rewards (trade-to-earn).

Thus, the $DYDX flywheel is now taking shape, as illustrated below (P1) ⬇️

The engine driving this flywheel is the $DYDX price itself. Only when $DYDX appreciates will sufficient users be attracted to trade on dYdX, generating higher fee revenues.

So, after the recent market downturn, does $DYDX still have potential?

We can find some clues in the founder’s recent tweets ⬇️

On April 7, the founder announced that part of the treasury’s $DYDX would be staked, and the generated income would be used to repurchase $DYDX.

In short, the team aims to support the token price through buybacks.

Related links:

https://twitter.com/AntonioMJuliano/status/1776223258926600312

https://twitter.com/AntonioMJuliano/status/1776982841860960303

2/ Customized High-Performance Decentralized Exchange

As shown in @TechFlowPost’s comparison chart, here’s how dYdX v3 compares to v4 performance-wise ⬇️

The performance improvements and reduction in user costs brought by the v4 upgrade are clearly visible.

3/ Interoperability and Composability Enabled by Cosmos SDK

First, joining the Cosmos ecosystem brings more than just a customizable appchain and improved tokenomics—dYdX Chain also inherits Cosmos’ strong interoperability and composability.

Since the launch of v4, most LSD protocols in the Cosmos ecosystem have already enabled liquid staking for $DYDX. Widespread adoption of liquid staking provides tangible benefits for both $DYDX staking metrics and price performance (LSD protocols will use their $DYDX staking revenue in USDC to buy back $DYDX).

Second, Noble has leveraged CCTP to bring native USDC to dYdX Chain, forming the foundation for USDC-based settlements on dYdX Chain.

4/ Conclusion

According to dYdX’s 2024 roadmap, the team plans to focus on three key areas: Permissionless Markets, Core Trading Improvements, and UX/Onboarding Upgrades.

As I mentioned in my article on Vertex, decentralized derivatives exchanges are expected to compete directly with centralized ones. To win this competition, they need superior tokenomics, better products, and unique features that centralized platforms lack but the market demands:

-

Tokenomics: dYdX has redesigned its token model, distributing 100% of fee revenue to validators and stakers, thereby establishing a potential flywheel effect.

-

Better product and user experience: dYdX aims to enhance reliability, accuracy, and responsiveness in trading functions to deliver better feedback, while also lowering entry barriers and improving usability.

-

Competitive advantage of decentralized derivatives: Permissionless Markets. In my view, supporting long-tail assets is a key competitive edge for decentralized derivatives platforms. dYdX aims to create a permissionless market where new markets can be launched instantly without governance approval, with liquidity provided via LP Vaults.

Beyond tokenomics, both Permissionless Markets and UX/Onboarding Upgrades are still works in progress.

$DYDX still early

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News