dYdX V4: How Will the Market React to the Version Upgrade Amid a Large Token Unlock?

TechFlow Selected TechFlow Selected

dYdX V4: How Will the Market React to the Version Upgrade Amid a Large Token Unlock?

From the current price perspective, $DYDX has promising prospects as a blue-chip asset that genuinely generates real earnings.

Author: AN APE'S PROLOGUE

Compiled by: TechFlow

The release of dYdX V4's full source code marks the beginning of a fully decentralized perpetual trading platform. Their latest V4 version launches as a Cosmos-based application chain, representing a migration from Ethereum L2.

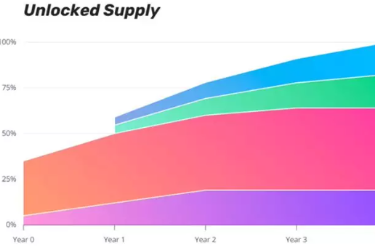

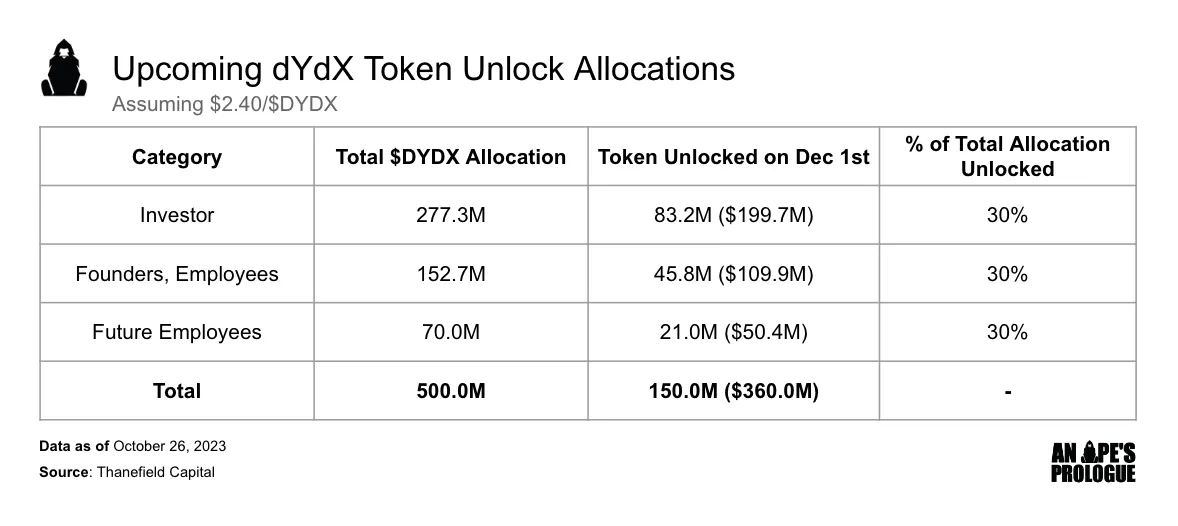

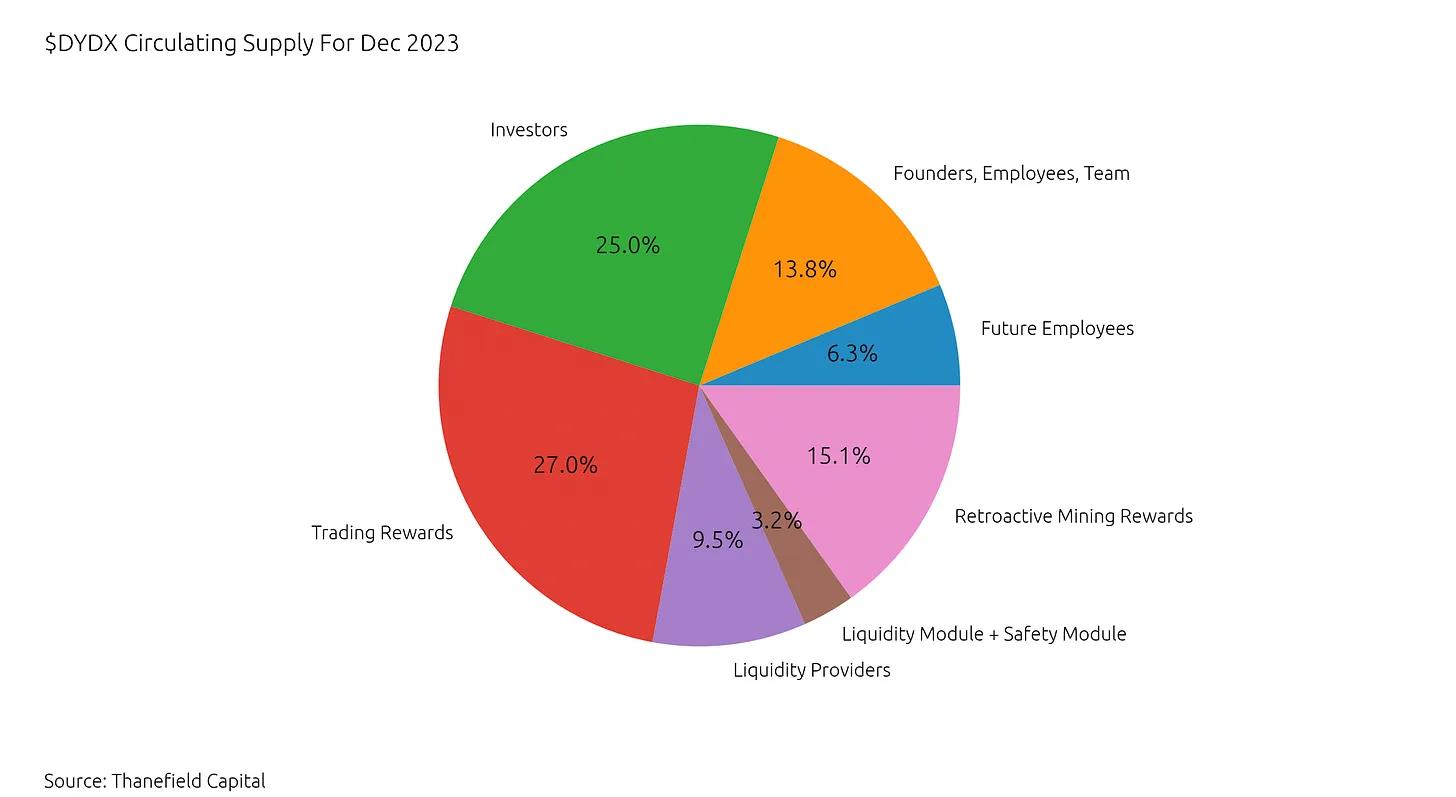

However, the upcoming $DYDX token unlock casts a shadow over this celebration. Over 45% of the circulating supply of $DYDX, worth $360 million, is about to be unlocked, with investors receiving the largest allocation—25% of the circulating supply, valued at $199.7 million.

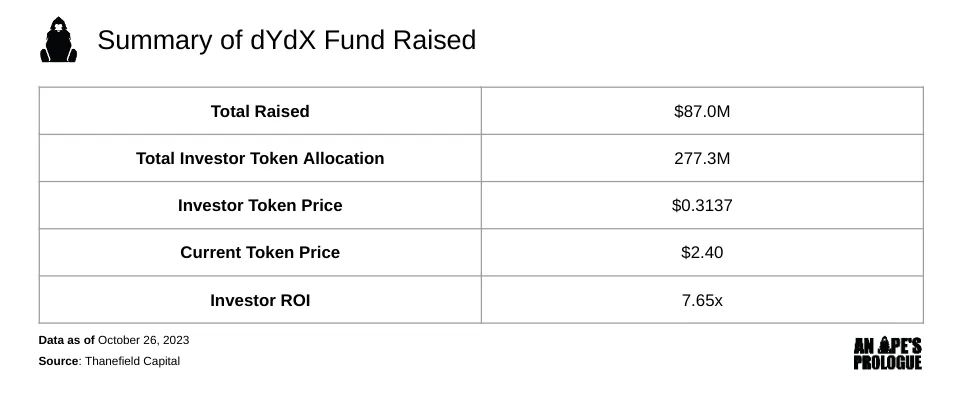

Due to limited fundraising information, we calculated the investors' token price by dividing the total funds raised by the total investor allocation. This results in an initial token price of $0.3137 per $DYDX, giving investors an initial investment return of 665%.

To mitigate the impact of a large volume of tokens entering the market, the dYdX team has planned multiple catalytic events to stimulate demand for their token. The most significant updates are the return of $DYDX staking and profit-sharing for $DYDX stakers.

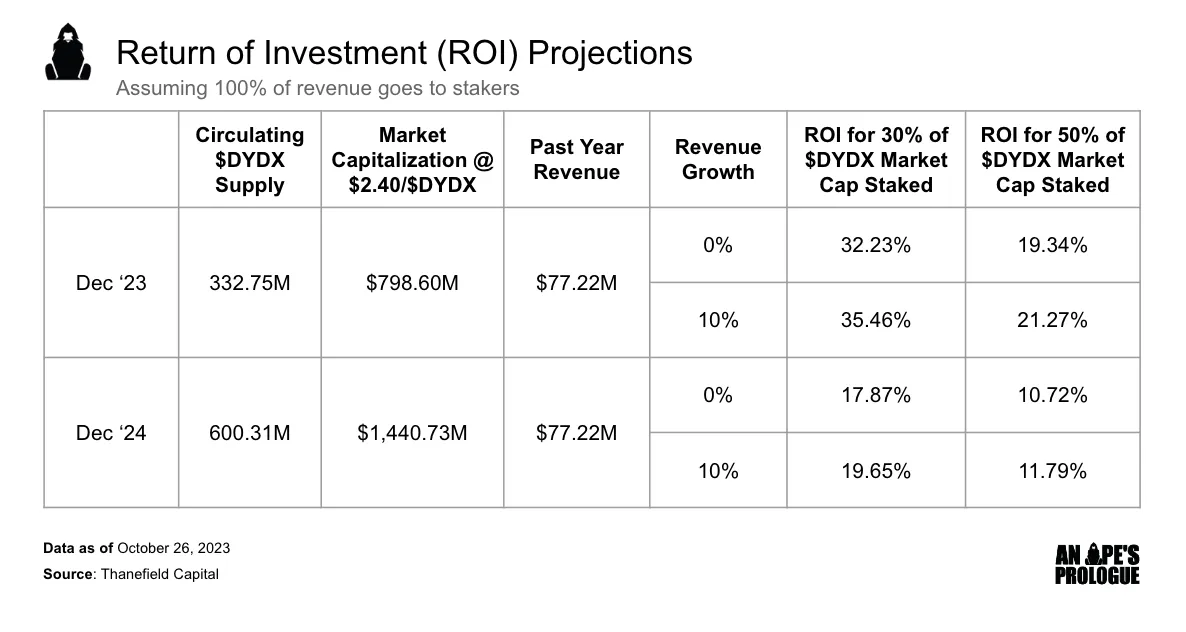

Our revenue-sharing forecast suggests that stakers will receive substantial returns. Assuming a 10% annual growth in protocol revenue with all revenue distributed to stakers, a 30% $DYDX staking rate could yield a 35.5% return.

In earlier versions of dYdX, all protocol revenue went to the team; in V4, revenue will be redirected to $DYDX stakers. As the staking ratio increases and/or protocol revenue grows, staker profitability will only rise. Although this may be less profitable for the team, they still have strong incentives to encourage increased trading volume on the platform.

Throughout this year, the dYdX team has carefully crafted strategies, aligning announcements and events with the V4 launch. In an industry where derivatives speculation thrives, dYdX has proven itself a strong contender in the space. The team’s sustained efforts and dedication to building the best decentralized derivatives exchange should translate into greater market share upon V4’s launch.

What remains to be seen is whether dYdX’s revenue-sharing strategy will serve as a sufficiently compelling catalyst to generate net buying pressure on the token; from its current price level, $DYDX holds promise as a blue-chip asset that genuinely generates real yield.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News