Generalization of ZK Technology: Starting from Dedicated L2s, but Ultimately Shining Across the Entire Blockchain

TechFlow Selected TechFlow Selected

Generalization of ZK Technology: Starting from Dedicated L2s, but Ultimately Shining Across the Entire Blockchain

Ethereum's development path has reached a critical juncture: a left turn would lead to horizontal scaling via modular architecture, while a right turn would lead to vertical layering through a stacked structure.

This article does not focus on the technical details of ZK technology, but rather aims to illustrate as many application directions of ZK as possible. While ZK technology continues to evolve, its real-world adoption depends on practical applications. We will proceed from user-facing application layers down to底层 components such as EVM, L2, cross-chain bridges, and public blockchains.

In the context of modern social division of labor, technologies in different fields often appear like magic to outsiders. Building tangible understanding through concrete use cases helps us grasp the core trajectory, allowing us to trace back and understand the essential characteristics of ZK technology—this aligns best with human cognitive logic.

Brief Development History

In 1985, Goldwasser, Micali, and Rackoff first proposed the Zero-Knowledge Proof model—an "interactive zero-knowledge proof" system that allows one party to prove knowledge of a secret to another without revealing the secret itself, through multiple rounds of interaction.

In 1991, Manuel Blum, Alfredo Santis, Silvio Micali, and Giuseppe Persiano introduced "non-interactive zero-knowledge proofs," enabling verification in a single step instead of requiring repeated exchanges between parties.

The advancement brought by non-interactive zero-knowledge proofs was significant. First, it reduced interactions to just one round, enabling offline and public verifications. The former laid the foundation for Rollups’ validity, while the latter, combined with blockchain’s broadcast mechanism, avoided resource waste from repeated computations.

Later, Zcash became the first large-scale implementation of SNARKs-based technology, serving as a bridge connecting ZK techniques with blockchain through dedicated privacy coins.

In short, this improvement emphasized “succinctness.” SNARKs aimed not only at reducing data size for verification but also compressing the actual information. In ZCash, the program circuit is fixed and unchanging, making polynomial verification also fixed.

Generalization of ZK Technology

Started in specialized L2s, but ultimately shines across the entire blockchain ecosystem.

Describing zero-knowledge proof technology as "late blooming" is fitting. This cryptographic algorithm originating in the 1980s only began finding real utility three decades later. With the emergence of early privacy coins like Zcash and Monero, ZK technology started integrating more deeply with blockchain systems.

At that time, Ethereum was still struggling for survival, yet scalability had already been part of long-term planning. After Plasma effectively failed, Ethereum shifted toward Layer 2 Rollup solutions. Meanwhile, ZK underwent engineering-driven iterations—from SNARK to PLONK and STARK—giving rise to today's thriving family of ZK Rollups.

Privacy (e.g., Tornado Cash) and scalability (e.g., L2s) became synonymous with the practical uses of this technology.

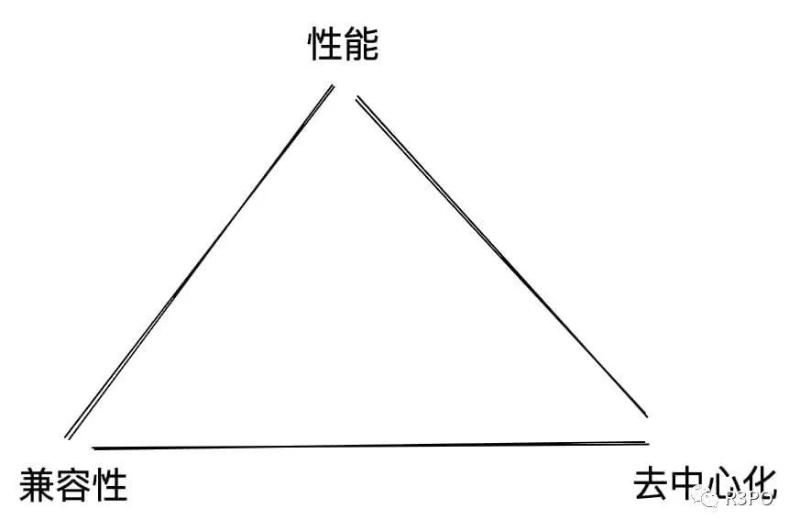

But this is merely the tip of the iceberg. At its core, ZK is a method for verifying information between two parties without exposing the information itself—ideally done efficiently and cost-effectively. We can borrow Vitalik’s concept of the blockchain trilemma to describe ZK’s own technological trade-offs.

Image caption: The ZK Trilemma Image source: R3PO

These three goals conflict with each other: better compatibility requires off-chain computation for improved performance; pursuing decentralization demands more on-chain verification, which reduces performance and increases costs; achieving maximum compatibility sacrifices verification efficiency.

Yet ZK technology has evolved precisely through navigating these trade-offs, resulting in a rich set of applications. But we must first break away from conventional thinking: ZK is not limited to Layer 2. In this article, we will explore five key areas—Dapps, L2, ZK-EVM, ZK Bridges, and ZK Public Chains—and their practical applications.

ZK Dapp: A Glimmer of Light in the Dark Forest

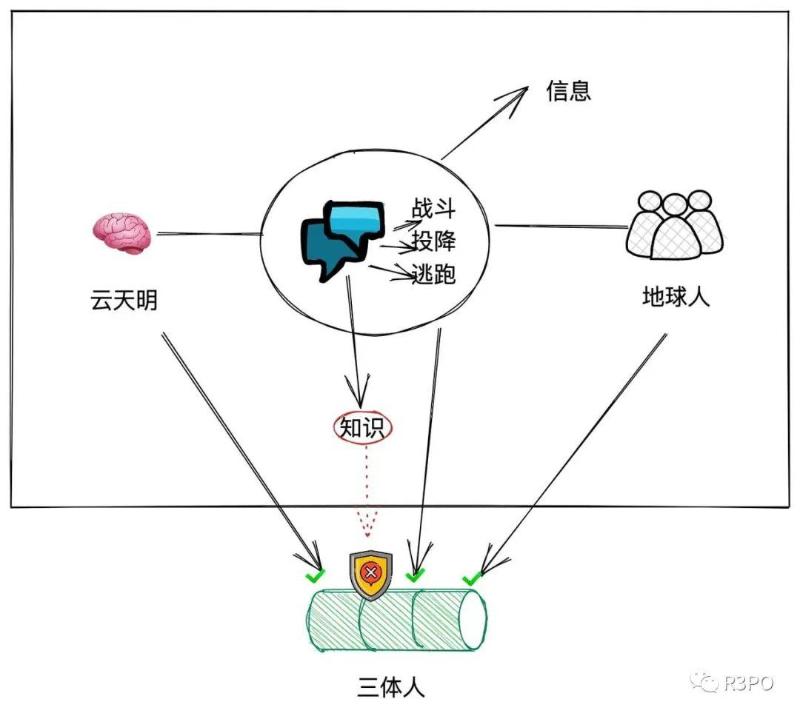

Image caption: Illustration of ZK principle Image source: R3PO

In Liu Cixin’s *The Three-Body Problem*, Yun Tianming conveys three survival strategies within the dark forest universe using fairy tales familiar to the Trisolarans:

Surrender—hide yourself, artificially lower your civilization level, signaling safety to hidden hunters;

Escape—develop curvature propulsion, abandon the idea that Earth is home; wherever humans go, there is home;

Fight—build an interstellar civilization and defeat the Trisolarans; if encountering stronger civilizations, resist fiercely.

The very act of conveying this message under Trisolaran surveillance mirrors a ZK workflow: all three parties know the "information," but only Yun Tianming and Earthlings understand the underlying "knowledge."

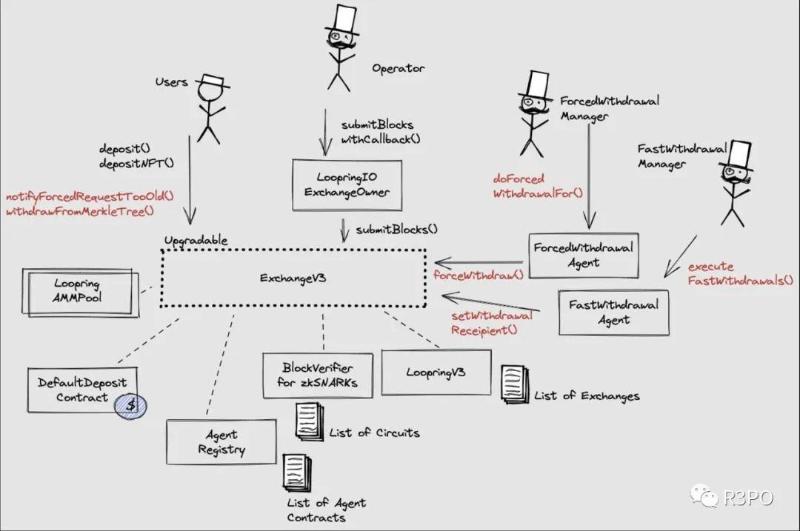

Image caption: Loopring operation principle Image source: L2Beat.com

This characteristic of ZK—where information encapsulates knowledge—is ideal for inter-chain communication, cross-chain DEXs, and other domains requiring encrypted knowledge transfer with public information broadcasting.

Take Loopring as an example. Though self-identified as an L2, it is a specialized solution focused on trading and payments using zkSNARKs. As per its official documentation, most validation work occurs off-chain, while minimal verification data is stored on-chain.

To maximize throughput, only off-chain balances are supported—stored in Merkle trees. Users deposit and withdraw tokens via smart contracts, updating their balances in the tree. This enables token transfers between users via off-chain Merkle tree updates, avoiding costly on-chain token movements.

The benefit lies in designing domain-specific ZK schemes—effectively treating Rollup as a single-application solution. dYdX, built on StarkEx, popularized this model and became a leader in derivatives trading.

However, such non-generalized approaches suffer from isolation. Communication with external systems remains problematic, and internal upgrades must balance both Ethereum mainnet requirements and application-specific needs—a precarious balancing act unsustainable in the long run. dYdX’s migration to Cosmos and the launch of general-purpose rollup Taiko signal that L2 competition now centers on universality.

ZK Rollup: The Midpoint of the Dream

Starting mid-stack is a defining trait of this wave of ZK innovation. Earlier privacy coin projects like ZCash and Tornado Cash faltered due to regulatory pressures and failed to carry the ZK torch forward.

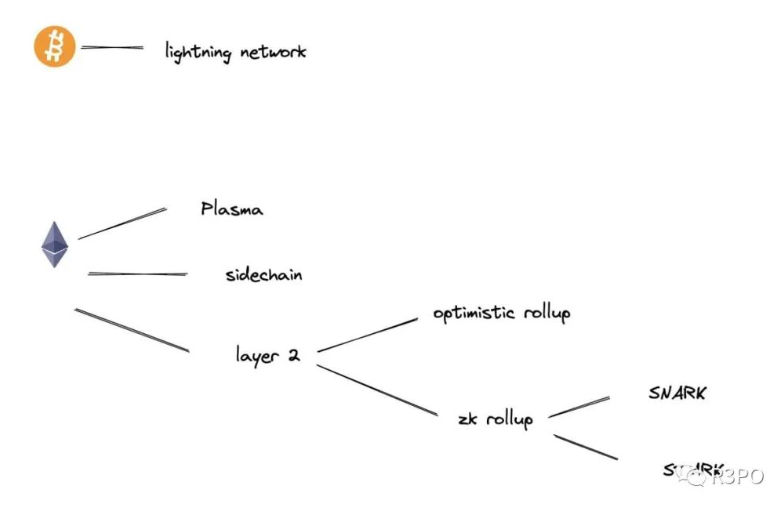

Image caption: The rise of ZK Image source: R3PO

L2 Rollups occupy an odd position—not quite base-layer public chains nor top-tier applications. Yet they exist because Ethereum dominates the landscape, with other chains essentially treated as EVM-compatible alternatives.

L2s aren’t exclusive to Ethereum. Theoretically, Bitcoin’s Lightning Network is also an L2. But only Ethereum’s L2 space qualifies as a full-fledged sector. Vertically, it has evolved over years—from Plasma, sidechains, Optimistic Rollups, to ZK Rollups. Horizontally, even within ZK Rollups, distinctions have emerged: ZK VM vs. ZK EVM, SNARK vs. STARK—leading to a fragmented, diverse project landscape.

At its essence, Rollup is a quasi-public chain narrative. It doesn’t generate direct revenue but relies on the ecosystem effects of applications built atop it. zkSync focusing on Gitcoin donations and dYdX building an appchain via StarkEx both demonstrate how Rollups mirror public chain dynamics.

Currently, the dominant technical rivalry in the L2 space is between SNARK and STARK, represented by zkSync and StarkWare respectively. Their key differences are outlined below:

zkSync: Toward EVM-Compatible ZK-SNARK

Basic Information:

Developer: Matter Labs

TVL: $52M ($170M peak)

Transfer fee: $0.10

Technical paradigm: ZK-SNARK

Team:

Alex Gluchowski – Co-founder & CEO

Danil Lugovskoi – Senior Software Engineer

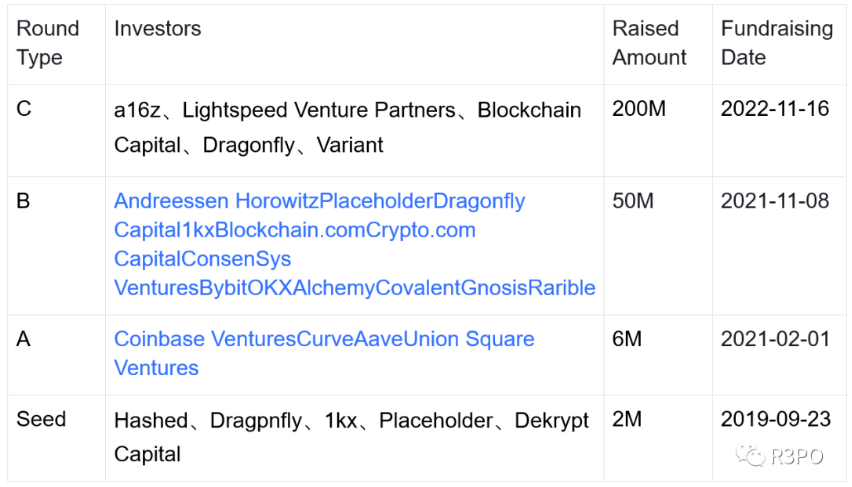

Funding History: As of November 2021, Matter Labs raised $58 million from a16z, Union Square Ventures, and Placeholder.

Table caption: Matter Labs funding history Table source: R3PO

Image caption: zkSync ecosystem Image source: @ZK_Daily

Ecosystem Overview: Currently hosts over 70 applications. Post-launch of version 2.0, EVM compatibility may further increase this number.

ZigZag: An order-book DEX built on zkSync, one of the earliest DeFi apps supporting zkSync.

ZigZag is a decentralized, non-custodial order book trading protocol. Built on ZK Rollup architecture, it moves computation and state storage off-chain, excelling in simple payments, trades, and specific app use cases, offering near-zero transaction fees. ZigZag also provides bridge services and plans to launch an NFT marketplace.

ZigZag received a $100,000 grant last October and launched ETH/USDT, ETH/USDC, and USDC/USDT pairs on zkSync 1.0. According to Gitcoin, it received nearly $300,000 in donations, becoming one of the most popular projects in Gitcoin Round 12.

ZigZag Bridge supports asset swaps between Ethereum and zkSync, and has launched a zkSync-to-Polygon cross-chain bridge.

ZigZag planned to launch an NFT marketplace on zkSync mainnet.

Upon announcing its token, ZigZag established a DAO to govern token use cases and revenue sharing.

Current user count: 310,000, active accounts: 2,216, new users: 504.

1.zkSync 1.0

zkVM-compatible, primarily used for payments and transfers. Its most successful use case supports 98% of Gitcoin donation channels.

Stable operation for two years, reduced gas fees by 50x, supported 4 million transfers.

2. zkSync 2.0

Will fully support zkEVM. zkSync 2.0 will launch mainnet within 100 days, with real-time production-ready EVM smart contract ZK proofs expected in autumn.

Oct 29, 2022: zkSync released Baby Alpha version of its Layer 2 scaling solution on mainnet.

Oct 18, 2022: zkSync completed Milestone 3: Proof Merging, launching an end-to-end verifier on testnet. With validity proof integration, zkSync 2.0 officially runs zkEVM on public testnet and will showcase a fully operational ZK-rollup 11 days before mainnet launch.

Sept 7, 2022: zkSync 2.0 opened mainnet project registration.

Aug 31, 2022: zkSync 2.0 testnet completed dynamic fee upgrade, estimating fees based on required system resources and charging based on actual usage. Includes new fee model, Paymasters account abstraction, EIP-1559 support, Vyper language support, zkEVM improvements, and Hardhat compiler plugin binaries.

May 25, 2022: Orbiter Finance’s cross-rollup bridge added zkSync 2.0 support on testnet.

Mar 10, 2022: zkSync upgraded its 2.0 portal to support paying gas fees in any ERC20 token (not just ETH), added block explorer, and enabled test token requests.

Feb 22, 2022: zkSync announced launch of 2.0 public testnet, releasing the first EVM-compatible ZK Rollup on public testnet.

StarkNet

After dYdX left for Cosmos,StarkNet wrote ZK-EVM using Cairo.

Basic Information:

Issuer: StarkWare

TVL: $1.26M ($1.5M peak)

Technical paradigm: ZK-STARK, ZKVM model. Uses proprietary language Cairo (incompatible with Solidity), but optimized to implement ZK-EVM.

Main Products:

StarkEx – B2B service providing dedicated Rollup tech for individual apps. Launched on Ethereum mainnet in 2020, mature and exemplified by dYdX.

StarkNet – General-purpose L2 supporting arbitrary smart contracts, unlike StarkEx’s custom development per app. Testnet launched last June, mainnet in November.

StarkNet builds general-purpose ZK circuits, whereas StarkEx builds application-specific circuits—making StarkNet’s problem scope far more complex.

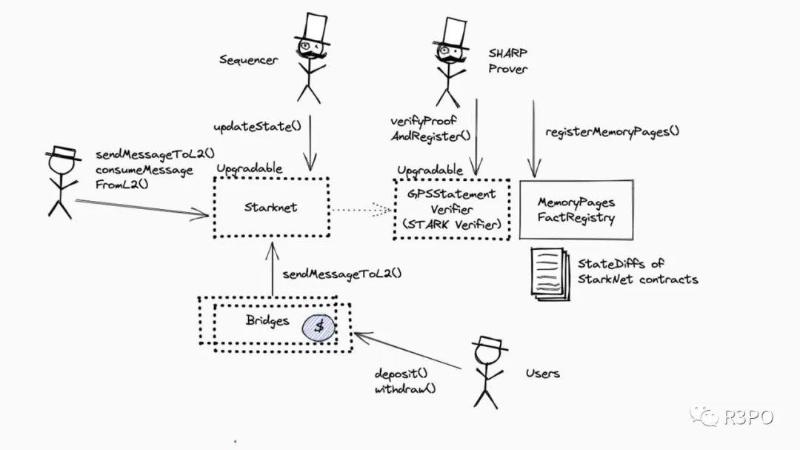

Image caption: StarkNet operation principle Image source: L2BEAT.COM

Team:

Co-founder & President Eli Ben-Sasson: PhD in theoretical computer science from Hebrew University (2001), specializing in cryptography and zero-knowledge proofs. Co-inventor of STARK proof system, involved in Zcash. Former professor at Technion.

Co-founder & CEO Uri Kolodny: BSc in Computer Science from Hebrew University, MBA from MIT Sloan. Serial entrepreneur with companies like OmniGuide (medical devices) and Mondria (big data visualization). Former EIR at Israeli VCs and McKinsey analyst.

Co-founder & Chief Architect Dr. Michael Riabzev: PhD student under Eli Ben-Sasson and co-inventor of ZK-STARK protocol.

Co-founder & Chief Scientist Alessandro Chiesa: Co-founded Zcash with Eli Ben-Sasson, faculty at UC Berkeley CS department.

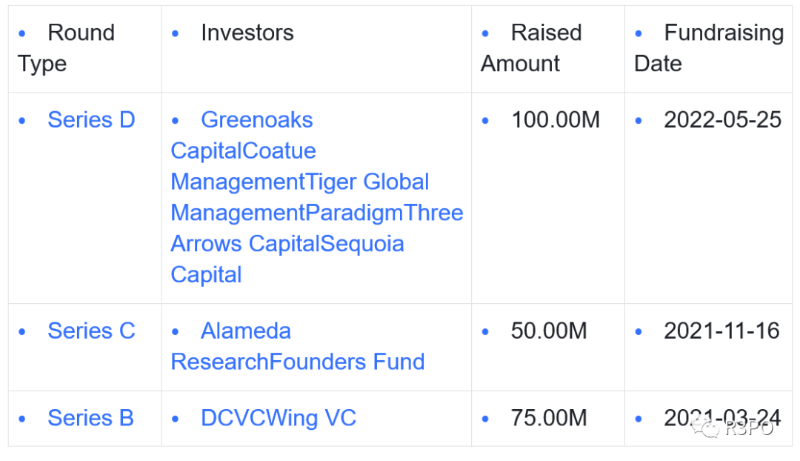

Funding History: Raised $225 million total.

Brief Evaluation:

STARK is harder to develop but promising and quantum-resistant—explaining high funding despite low TVL.

dYdX’s departure was a blow, but MakerDAO and Aave plan future deployments. Long-term, suitable for apps needing unique security guarantees.

StarkNet handles heavy computation well, beneficial for game development—projects like @LootRealms and @TheDopeWars preparing to launch.

StarkNet produced the first ZK-EVM earlier than any Solidity-compatible L2 competitor. StarkWare plans to open-source Cairo 1.0 in Q1 2022, with the compiler’s first release early next year, aiming to support all existing StarkNet features.

Ecosystem Growth:

Nov 29: StarkNet upgraded Mainnet alpha to v0.10.2 and released a performance roadmap.

Key developments include sequencer parallelization, new Rust implementation of Cairo-VM, and reimplementation of sequencer in Rust—preparing for TPS improvements.

Currently over 40 projects on StarkNet: 13 infrastructure, 14 DeFi, 11 NFT/gaming.

Image caption: StarkWare vs zkSync ecosystem comparison Image source: @ETH_Daily

dYdX Moves to Appchain

dYdX will develop a decentralized off-chain order book and matching engine, migrating from Ethereum to a dYdX-specific appchain. dYdX V4 will be open-sourced by year-end.

As an Ethereum-based derivatives trading protocol, dYdX currently uses StarkWare’s StarkEx for scalability and low cost. However, in June 2022, dYdX announced V4 plans to build its own appchain using Cosmos SDK and Tendermint.

Messari data shows Uniswap and dYdX hold 44% and 38% of DEX market share respectively.

Regarding departure from Ethereum, dYdX cited dissatisfaction with current speeds (~10 tx/sec, ~1000 orders/cancels per sec). Scaling would require centralized off-chain matching, conflicting with dYdX’s decentralized ethos. Thus, V4 will feature a decentralized off-chain order system balancing performance and philosophy.

dYdX’s current setup on StarkEx relies on a centralized sequencer—like all current Rollups (though Starkware hinted at future decentralized sequencers). Centralized sequencing creates concentration risk, as only one entity submits batches to Ethereum. Cosmos allows setting validator sets, theoretically enabling protocol decentralization.

Immutable: L2 on L2

Founded in 2018, Immutable owns NFT card game Gods Unchained and ImmutableX—a Web3 gaming-focused NFT scaling solution powered by StarkWare. It advances the NFT world via game studio Immutable Studios.

Immutable X uses Validium data availability—transaction data stored off-chain via Data Availability Committee instead of fully on-chain.

Immutable X is an Ethereum NFT scaling solution using StarkWare tech. It functions both as an NFT marketplace and a Layer 2 chain. Some projects will deploy on StarkEx for advanced DeFi interactions and composability.

Note the distinction between Immutable X platform, marketplace, and token. The platform is core infrastructure enabling L2 deposits, withdrawals, minting, trading. The marketplace enables gas-free NFT minting/trading, developed by Immutable with platform tech. IMX is the ERC-20 utility token rewarding contributions.

Most Immutable X volume comes from Gods Unchained—one of its prior products. Free card packs available via email signup. IMX airdropped to Gods Unchained users at launch. CryptoSlam shows ~5.35M NFT transactions (~$45.21M volume), mostly from Gods Unchained.

Polygon Hermez

Strictly speaking, Polygon and Hermez together form an L2 solution. Below, we do not strictly distinguish between Polygon and Polygon Hermez.

Basic Information:

Developers: iden3 + Polygon

TVL: $309K ($29M peak)

Technical paradigm: ZK-SNARK, soon launching zkEVM. Post-acquisition, merged into unified L2 strategy.

Main Components:

July 20: Polygon Hermez announced and open-sourced the first EVM-equivalent ZK L2 (ZKR).

Key components of Polygon zkEVM Rollup: PoE consensus, zkNode, zkProver, STARK & SNARK Proof Builder, Rollup bridge.

PoE Consensus: Replaced Hermez 1.0’s PoD for better security, efficiency, and decentralization. Compatible with PoS, ensuring decentralized and efficient block production. Any miner running zkNode can become a Sequencer; those running zkNode and zkProver can become Aggregators. Block rights paid in $MATIC.

zkNode: Software miners must run to join Polygon zkEVM network. Handles

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News