Data and Insights: dYdX Trading Volume Surges, AAVE TVL Reclaims Top Spot

TechFlow Selected TechFlow Selected

Data and Insights: dYdX Trading Volume Surges, AAVE TVL Reclaims Top Spot

Judging from daily trading volume, during the Azuki sell-off following the launch of Elementals, Blur's trading volume was significantly higher than OpenSea's.

Written by: The Block

Compiled by: TechFlow

Last week brought another series of major developments in the Bitcoin spot ETF space, including Fidelity joining the race. It was also dramatic as the SEC told Nasdaq and Cboe their recent filings were "incomplete and insufficient." Despite setbacks, Cboe resubmitted an updated registration statement, demonstrating its determination.

From last week's notable data trends, we observed Azuki’s floor price decline, a surge in dYdX trading volume, a hot lending market, and Blur’s liquidity provision during the NFT sell-off.

1: ElementaL

Last week saw the highly anticipated launch of Azuki’s Elemental Beans. Each bean can be “burned” to reveal an Azuki character controlling earth, wind, fire, or lightning. The initial sale generated $37.5 million in revenue for Azuki and sold out within 15 minutes—without even entering public sale.

However, the new collection wasn’t spared from criticism. Two main points of controversy were the chaotic minting process and the high similarity between the new Elemental series and the original Azuki collection.

The Azuki team admitted they “messed up” in their latest release. They pledged to rebuild trust within the community.

Yet, the team’s efforts failed to prevent a massive NFT sell-off. Azuki’s floor price dropped from 14.44 ETH the day before the launch (June 26) to 5.6 ETH earlier this week—a 61% decline.

Long-term Azuki holders began selling their collections, pushing Azuki’s weekly trading volume to $53 million—the highest level in over a year.

This week, Azuki’s average sale price fell to just under $13,000, down approximately $20,000 from two weeks prior. This marks the lowest weekly average sale price since November last year, while the floor price in ETH has hit the lowest level since the collection’s launch.

Since the downturn began, Azuki holders have lost about $21,500 per NFT on average.

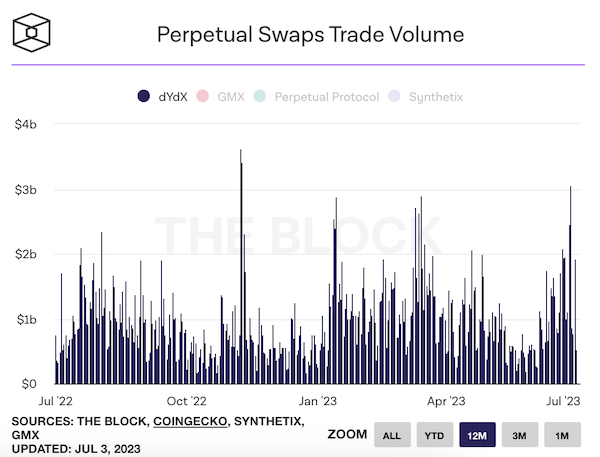

2: dYdX Trading Volume Surge

Decentralized derivatives exchange dYdX saw its trading volume spike to $3.07 billion on June 27—the highest daily volume since November 2022.

This surge appears linked to the end of the exchange’s nearly one-year-long fee-free trading campaign. The trading frenzy likely stemmed from users rushing to make last-minute trades before fees resumed.

Binance’s resumption of fees on Bitcoin trading pairs led to a 65% sequential drop in spot trading volume for the asset. Time will tell how this affects dYdX, the largest decentralized derivatives platform.

The day after the spike (also the first few days with fees reinstated), platform volume dropped to $866 million, but rebounded to $1.9 billion on June 30—comparable to pre-fee levels.

Coincidentally, the day after the surge, dYdX announced the public testnet launch date for its Cosmos-based blockchain. It is set to go live on July 5, marking the next step in the exchange’s v4 upgrade.

With the new version on Cosmos, the protocol will launch its own blockchain within the ecosystem. The exchange stated that although their approach hasn’t been tested yet, they believe the migration will enhance decentralization and represents the “best long-term chance to deliver a competitive product experience comparable to centralized exchanges.”

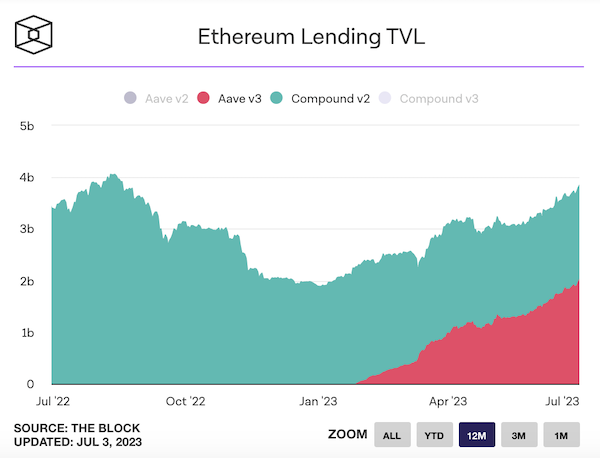

3: Aave Loan Data Rises

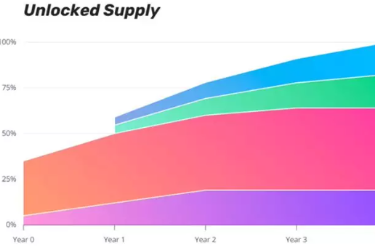

Recently, there’s been some heat in the Ethereum lending market, with Aave’s latest v3 version surpassing Compound’s v2 in total value locked (TVL).

Aave v3 operates across platforms including Ethereum, Avalanche, Polygon, Arbitrum, Optimism, Harmony, Fantom, and Metis. Since launching on Ethereum, its growth has been steady, consistently rising to reach $2.03 billion in TVL on Ethereum (as of two days ago).

In contrast, Compound v2, like Aave v2, is the project’s original version, which achieved great success during DeFi’s boom period, with its TVL exceeding $20 billion in September 2021. However, it has since declined and has hovered around $2 billion since November, currently standing at $1.81 billion.

Compound, like Aave, has also begun exploring a v3 version, but its data hasn’t taken off like Aave v3. Aave v3 is very similar to Aave v2, featuring improvements such as cross-chain asset portability and gas optimization, along with introducing eMode, which increases capital efficiency for collateral and borrowed assets with high price correlation. In contrast, Compound v3 differs significantly from the original Compound, offering only a more limited set of assets (only USDC and ETH can be borrowed on Ethereum), but with enhanced capital efficiency and risk management features.

Aave v3 appears to have overtaken the previously dominant Compound v2 in June. June 14 marked the first time Aave v3 took the lead, and after June 20, the gap—which had remained narrow—began to widen, making Aave v3 seem like the clear winner.

It should be noted that TVL isn’t the only metric, but for lending protocols, higher locked value means more loans can be created. Lending protocols want users to supply assets to their platforms to expand their market size.

4: Blur Provides Liquidity for NFTs

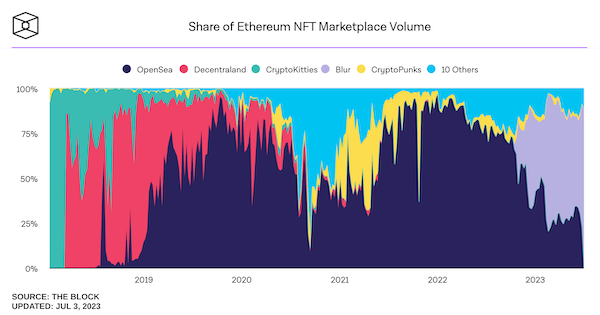

As expected, June marked the fourth consecutive month of declining NFT trading volume. The overall NFT market shows clear signs of slowing, especially after the hype around the newest NFT marketplace Blur (and its associated token) cooled down.

However, last week, Blur reached its highest Ethereum NFT trading volume market share since February.

For the week ending June 25, Blur accounted for 68.3% of trading volume, compared to OpenSea’s 22.3%. Earlier this week, OpenSea’s volume was projected to fall to 18.6%, its lowest level since September 2020, and even now it has reached comparable lows—down 8% from the previous week.

Looking at daily trading volumes, during the Azuki sell-off following the Elementals launch, Blur’s volume far exceeded OpenSea’s.

Blur’s volume surged from $10 million on June 26 to $43.9 million the next day—an increase of 337%—while OpenSea’s volume rose only from $4.3 million to $10.6 million, a 143% increase.

Users earn points on Blur for placing bids, with longer and riskier bids earning more points. These points play a role in Season 2 airdrops, incentivizing users to bid aggressively on NFTs. Thus, Blur played a part in the rapid decline of Azuki prices.

Beyond bidding, Blur’s lending platform Blend also contributed, as pricing pressure on the collection forced users to repay or face liquidation of loans collateralized by Azukis. Unlocked NFTs increased the freely tradable supply of the collection, enabling sales even during panic-driven moments. On June 27 (launch day), there were 532 outstanding loans backed by Azuki; this number dropped sharply to 237 by the end of the day.

There is some good news for NFT enthusiasts: despite another drop in trading volume, both the number of NFT traders and transaction counts on Ethereum reversed their downward trend in June. OpenSea still leads in both metrics, even though its trading volume now trails behind Blur.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News