What does restaking bring to Ethereum?

TechFlow Selected TechFlow Selected

What does restaking bring to Ethereum?

The positive impact of Restaking on ETH Staking is far less than that of the Shanghai upgrade.

Author: NingNing

The value foundation of restaking lies in EigenLayer's AVS. From the perspective of block space economics, Rollup L2 abstracts Ethereum's block space for resale, while AVS abstracts Ethereum's economic security for sale.

There is a market theory suggesting that although restaking increases Ethereum's consensus load, LRT projects offering higher staking yields could help increase Ethereum's staking rate and price, thereby enhancing the mainnet's economic security.

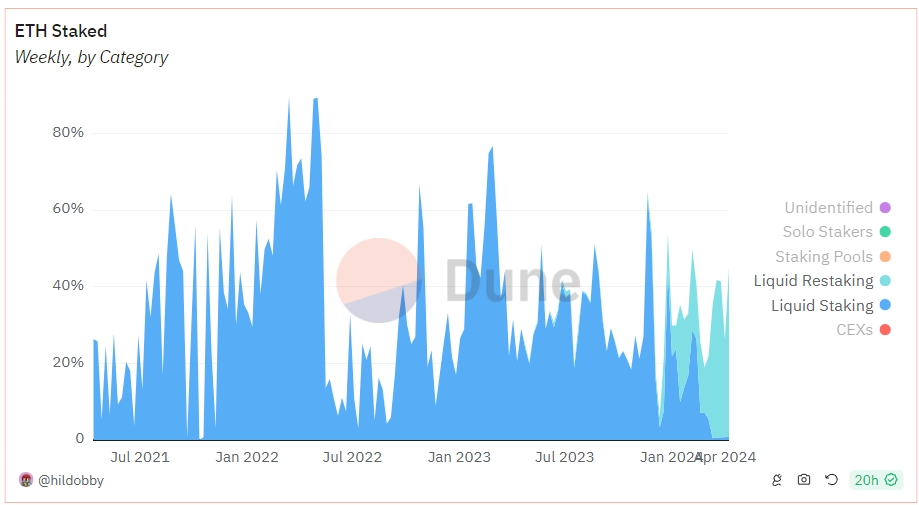

However, observing on-chain data dashboards on Dune reveals some discrepancies between this hypothesis and reality:

1. The net inflow growth of ETH staking driven by the restaking FOMO frenzy was short-lived, lasting only from January 19 to February 13 this year—less than one month. Although net inflows currently remain slightly above zero, they are at historically low levels.

The overall positive impact on ETH staking pales in comparison to the Shanghai upgrade.

2. Since 2024, total Ethereum staked has grown from 29.206 million to 32.1214 million ETH, a 10% increase. However, the growth slope during this period is nearly identical to that seen in Q3 2023, a sideways bear market phase. Notably, January 2024 coincided with market adjustments following the approval of Bitcoin ETFs.

This suggests that product-market fit (PMF) for restaking projects stems more from high ETH-denominated passive returns combined with market adjustment periods, rather than strong correlation with EigenLayer’s AVS narrative.

3. Restaking projects like Etherfi and Renzo are capturing new staking份额 from traditional LST providers such as Lido and Rocket Pool. Currently, restaking projects account for 40% of all new staking activity.

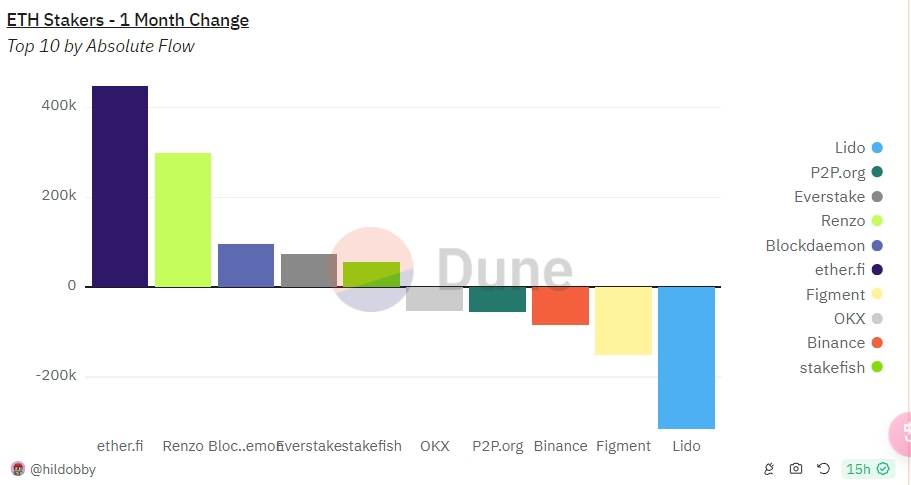

4. On a monthly basis, traditional staking protocols and platforms—including Lido, Figment, Binance, and P2P.org—are seeing outflows, while restaking protocols like Etherfi and Renzo are experiencing significant net inflows.

Notably, however, Figment and Binance have been actively investing in and incubating restaking protocols at the primary market level, while Lido has remained passive—partly due to constraints around approaching its self-imposed threshold of holding one-third of the total staked supply.

Therefore, restaking can be viewed as a coordinated encirclement initiated jointly by restaking projects and Lido’s competitors.

In this process, Lido loses market share but gains ethical security within the Ethereum ecosystem. Figment and Binance, on the other hand, are essentially shifting assets internally—sacrificing some passive income to issue new assets during a bull market. Etherfi stands as the first successful example of this strategy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News