Binance Research Report: Exploring the Restaking Domain

TechFlow Selected TechFlow Selected

Binance Research Report: Exploring the Restaking Domain

This article outlines the fundamental principles and key projects in the restaking domain, and introduces the current major liquid restaking protocols.

Author: Binance Research

Introduction

In 2024, the restaking market has gained momentum, rapidly evolving from an emerging narrative into tangible innovation. To date, Ethereum restaking dominates this narrative, primarily because EigenLayer—the pioneer of this sub-sector—is based on Ethereum.

EigenLayer is the most mature project in its restaking roadmap and holds the majority share of the total value locked (TVL) in the restaking market.

Nevertheless, other projects are actively developing restaking or restaking-related solutions across multiple blockchains—some already launched, others soon to follow. These include Picasso (Solana restaking) and Babylon (Bitcoin staking). Integration between Cosmos application chains and EigenLayer is also a hot topic, while AltLayer extends its rollups-as-a-service (RaaS) protocol to include restaking rollups (1). Additionally, liquid staking tokens (LSTs) saw strong development in 2023, and now liquidity restaking tokens (LRTs) have emerged this year.

In this report, we first briefly introduce the fundamentals of restaking, then dive into EigenLayer and its ecosystem development, restaking on other chains, liquidity restaking protocols, and LRTs. We conclude with an outlook on the future of restaking.

Restaking Fundamentals Recap

Before diving deep into restaking, let’s revisit what "staking" means

At its most basic level, a blockchain can be defined as an immutable ledger of transactions that must chronologically record valid activity. To achieve this, a blockchain ("chain") must perform four key functions:

-

Consensus: Validators or miners agree on transaction ordering, such as Proof-of-Stake (PoS), Proof-of-Work (PoW), etc.

-

Data Availability: Ensuring transaction data is accessible to the entire network

-

Execution: Processing transactions to update the blockchain state

-

Settlement: Resolving disputes, verifying transaction validity, and ensuring "finality" of transactions

Consensus is sometimes considered the most fundamental of these functions and is crucial for the chain's immutability. In essence, under a Proof-of-Stake (PoS) consensus mechanism, a set of validators exists on-chain who propose, validate, and add new blocks to the blockchain. To become a validator, one must stake the chain’s native token. In return, validators earn staking rewards in the form of newly minted tokens and fees. However, if a validator acts maliciously or engages in any wrongdoing, they risk being "slashed"—meaning part of their staked tokens may be confiscated.

The slashing mechanism incentivizes validators to operate correctly. Furthermore, the more validators join (and thus the more tokens staked), the harder it becomes to attack the network. For example, a typical way to attack a blockchain network is attempting to gain control over a majority (51%) of staked tokens within the PoS system, thereby gaining the right to propose malicious blocks or reorganize the chain. The greater the number of staked tokens—or the higher their value—the more costly and difficult such an attack becomes. This is the fundamental reason why staking helps secure blockchains.

How Does Restaking Work?

Restaking takes this further by enabling users to stake their assets multiple times—both on their original blockchain and on other protocols. For instance, EigenLayer allows Ethereum stakers to reuse their already-staked ETH to secure applications built atop its network. Stakers can choose which additional services they want to support using their currently staked ETH and earn extra yield in return. In exchange, they agree to grant EigenLayer additional slashing rights over their staked ETH—on top of the slashing rights enforced by the base Ethereum staking contract.

In essence, restaking protocols provide a suite of smart contracts that enable staked tokens to be reused and restaked (i.e., restaked again), thereby providing security to applications beyond the original blockchain.

What Problem Is Restaking Trying to Solve?

Restaking aims to solve the problem of fragmented blockchain security. Fundamentally, if builders want to create a decentralized network, they need to establish some form of cryptoeconomic security. On Ethereum, this is achieved through staking ETH tokens. However, replicating this approach for every new service would be highly inefficient. For example, launching a new Proof-of-Stake (PoS) network like Ethereum or BNB Chain requires massive capital costs.

Suppose a project attempts to achieve this security function by issuing a new token; then they must convince ecosystem participants to bear both the price risk of this new token and the opportunity cost compared to simply staking ETH.

Moreover, generating sufficient security is extremely time-consuming. Even when achieved, the resulting security might still be weaker than Ethereum’s own. This often forces many projects—which don’t necessarily need to issue their own token—to do so anyway, struggling slowly to build their own cryptoeconomic security. Restaking attempts to address this by pooling the security of large chains like Ethereum and making it available for use by other applications.

Key Projects

EigenLayer

How It Works?

EigenLayer brands itself as an “Ethereum restaking aggregation platform,” aiming to create a decentralized trust marketplace. It is the pioneering platform in the restaking space and remains the largest and most significant project in this domain. We can think of EigenLayer as offering “security-as-a-service” via Ethereum, or Ethereum security “as a service.”

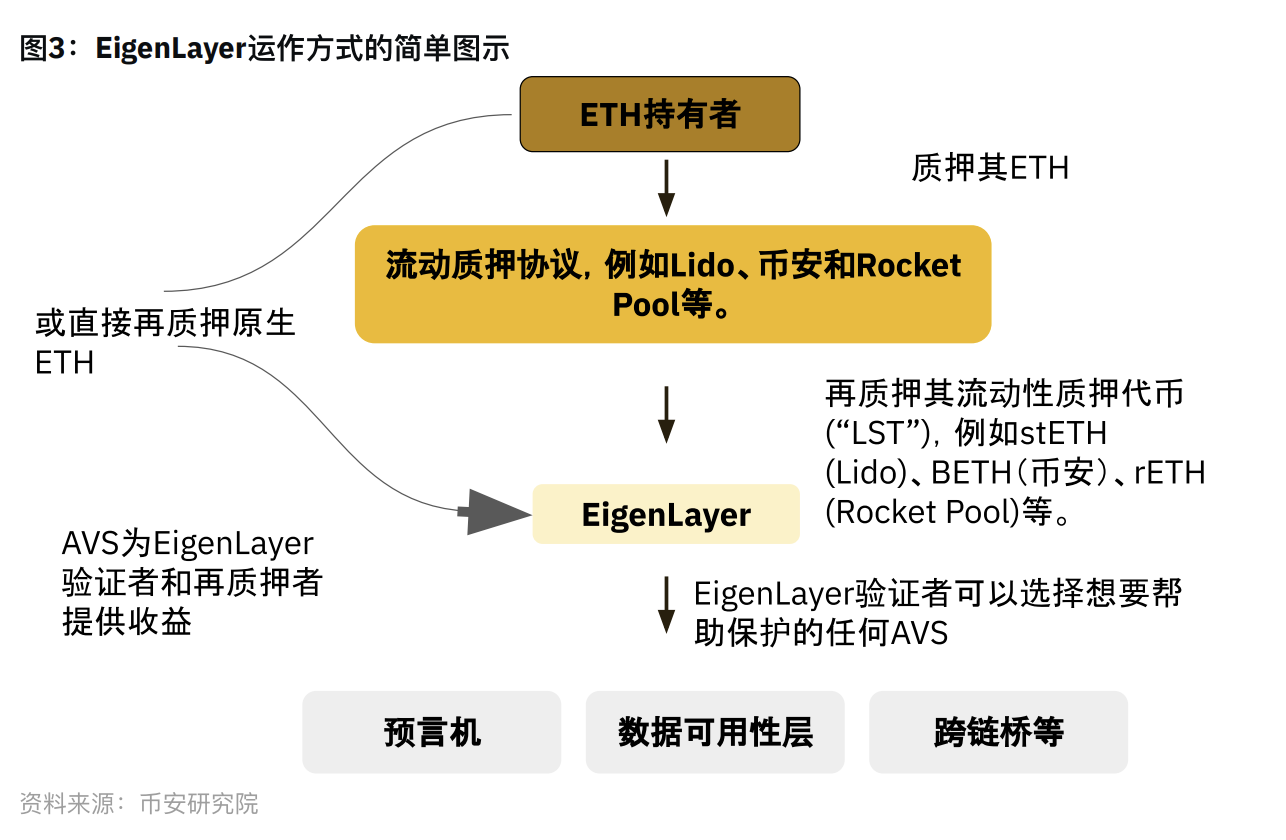

The EigenLayer marketplace operates three core participant groups:

-

Restakers: Individuals who use liquid staking tokens (LSTs) to secure other applications on the network. They earn additional yield but are subject to additional slashing conditions. Users can also choose to directly stake their ETH into EigenLayer (a process known as native restaking).

-

Node Operators (Validators): Individuals running EigenLayer software. Many restakers may choose to delegate to trusted node operators instead of running nodes themselves (similar to how stakers delegate tokens to trusted validators). Node operators can pool delegated stakes, launch Ethereum nodes, and earn fees from Ethereum’s Proof-of-Stake (PoS). They can also earn additional yield from protocols they choose to secure. After retaining some fees, they pass the remainder to delegators. If operators misbehave in the EigenLayer modules they participate in, their stake (and delegated stakes) will be slashed.

-

Active Validation Services (AVSs): Services built on top of EigenLayer that aim to attract restakers to help enhance security. These AVSs—sometimes called modules—can be anything from new blockchains and data availability (DA) layers to virtual machines, oracle networks, cross-chain bridges, and more.

Through this system, EigenLayer introduces two novel concepts: (1) pooling security via restaking, and (2) free-market governance.

1. Pooling Security via Restaking: EigenLayer enables pooled security by securing new modules with restaked ETH (rather than their own token).

-

Specifically, after stakers lock their LSTs or native ETH with a validator, the validator can decide which modules to protect.

-

Validators set their withdrawal credentials to the EigenLayer smart contract, allowing automatic slashing if they act maliciously.

-

In return, these modules pay fees to validators and restakers for security and validation services.

-

This results in leveraging Ethereum’s extremely robust cryptoeconomic security for protocols built atop it.

2. Free-Market Governance: EigenLayer provides an open market mechanism where validators can independently weigh risks and returns and choose which modules to secure.

-

EigenLayer views this as analogous to venture capital firms, supporting innovation where profits come with risks (in this case, slashing risks).

Together, this creates an open and competitive market where validators can sell pooled security and protocols can purchase security at a given price. This eliminates the massive capital costs of creating new security models, as protocols can simply buy security. It also helps create a flywheel effect: the higher the value of modules protected via EigenLayer, the higher the returns for ETH stakers, leading to increased ETH value, enhanced Ethereum security, better security for each EigenLayer module, and further incentives for users to build new modules on it.

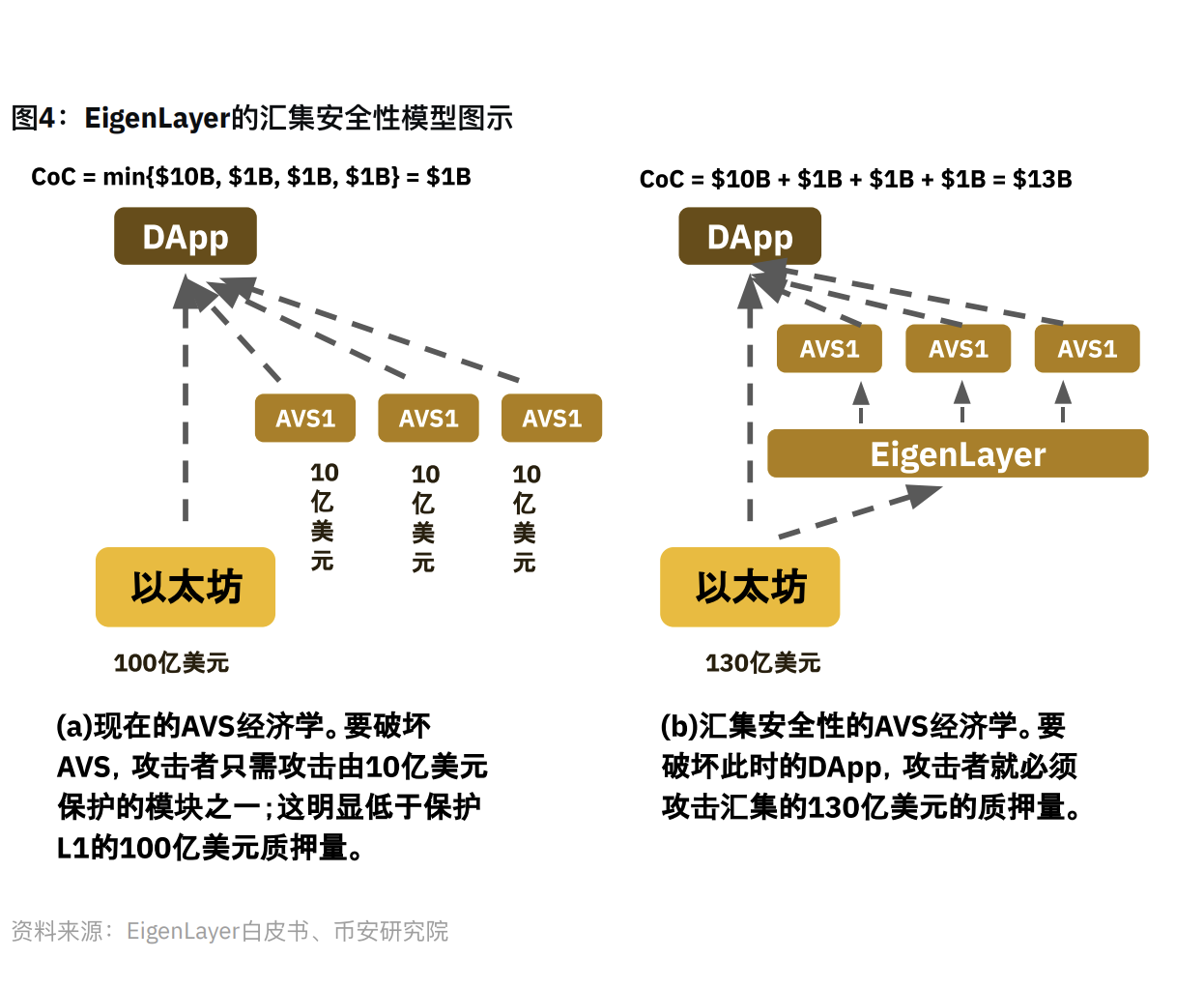

Impact of Trust Aggregation

As illustrated below, the trust aggregation provided by EigenLayer is substantial. Because new AVSs can be secured by a much larger capital pool, the cost of corruption (CoC) is significantly higher than otherwise.

For example, a new Ethereum module no longer needs $1 billion in staked capital to be secured—it can instead be protected by a larger shared pool. This mechanism effectively increases CoC from the minimum stake amount to the sum of all stakes.

Timeline

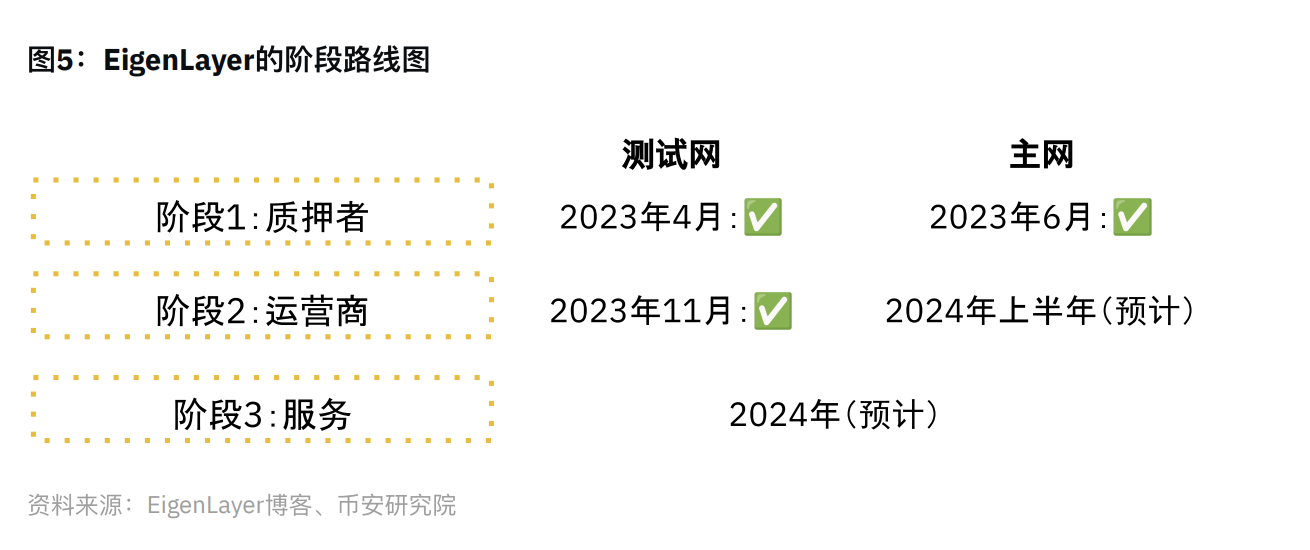

EigenLayer follows a phased rollout approach across three stages, aiming to ensure a smooth onboarding experience for all participants expected to join the EigenLayer ecosystem.

Stage 1 focused on stakers and initially launched in June last year. The idea behind Stage 1 was to familiarize stakers with the restaking process and get them accustomed to EigenLayer modules and interfaces. In addition to native ETH, EigenLayer initially supported three LSTs for restaking. After gradual additions over several months, EigenLayer now supports 12 LSTs.

Stage 2 focuses on operators, with the testnet initially going live in November 2023. Since launch, operators have been able to register on the network and begin validating for the first AVS—EigenDA. Naturally, restakers can also delegate to their chosen operators to start utilizing shared security. Rollup developers can integrate EigenDA as a DA layer and experiment with it in testnet scenarios. The mainnet launch for Stage 2 is expected in the latter half of 2024.

Stage 3 will focus on onboarding AVSs (beyond EigenDA) and adding payment and slashing functionalities. Stage 3 is expected later this year. Only after completing all three stages will the EigenLayer protocol be fully launched.

Deposit Caps

To ensure a smooth transition to mainnet, EigenLayer has used deposit caps to manage the amount of staked capital on the protocol. At the time of Stage 1 mainnet launch, there was a cap of 9,600 tokens each for three LSTs and native ETH. Over the past few months, both deposit caps and the number of accepted LSTs have gradually increased.

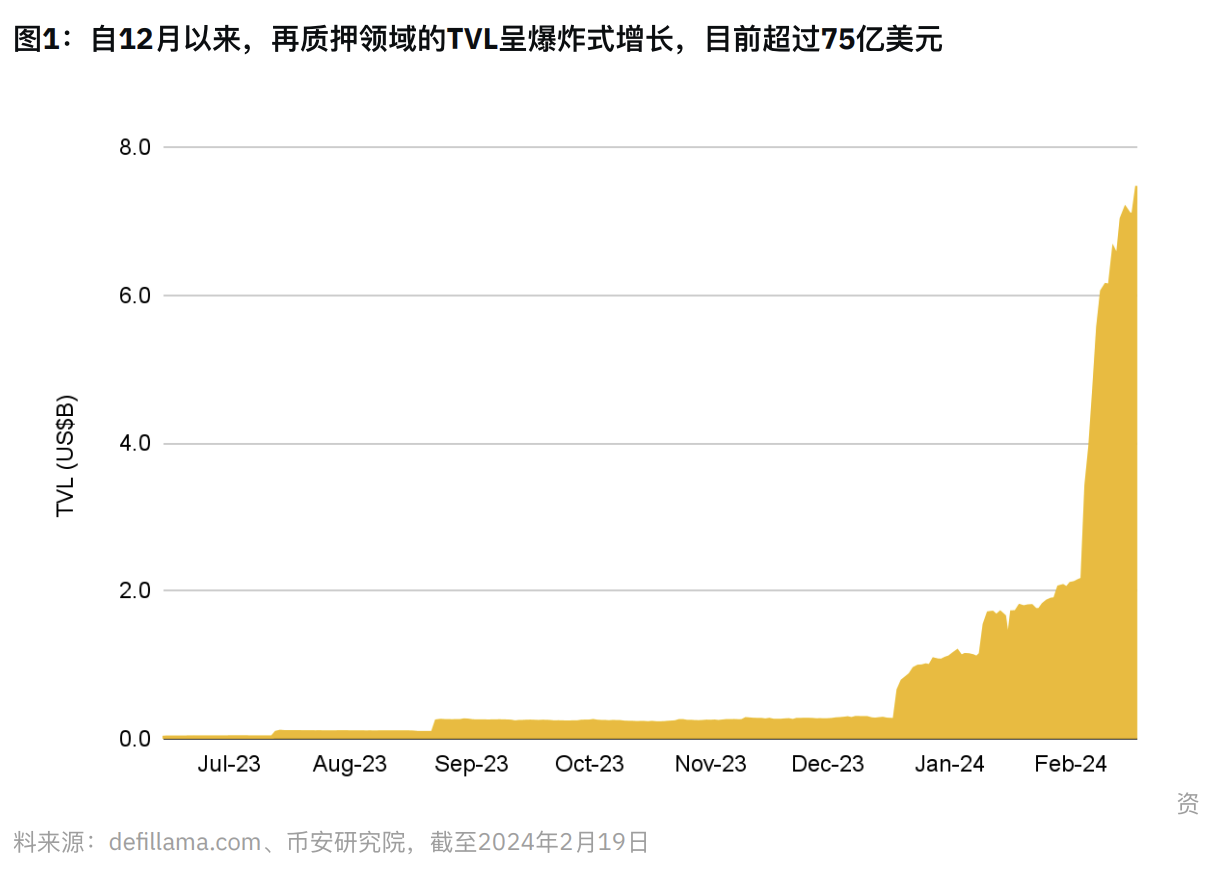

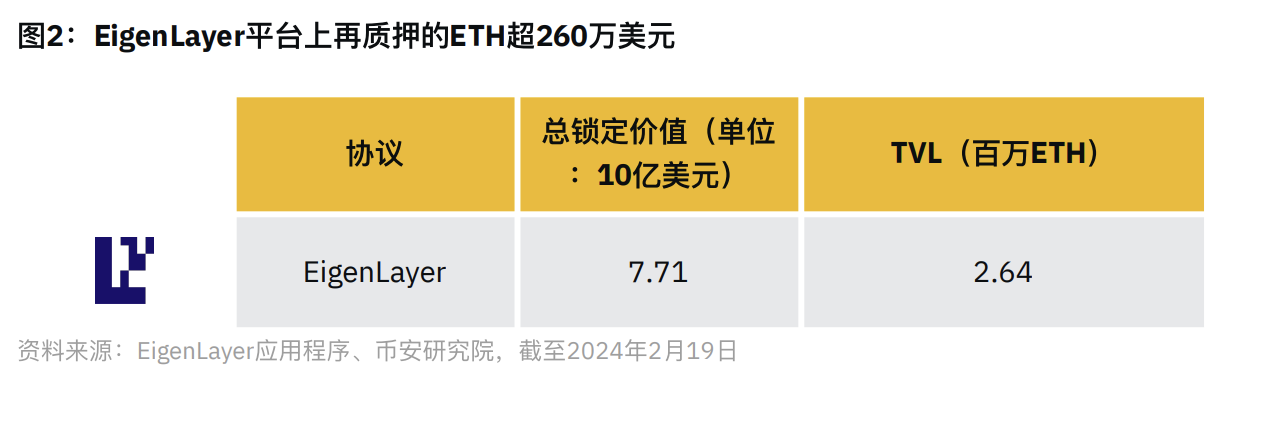

Recently, EigenLayer raised its deposit caps and temporarily removed all TVL limits—the first time all TVL limits were lifted. The goal is to capture all organic demand for restaking and observe user interest without constraints. During the pause period from February 5 to 9, EigenLayer’s TVL grew over 180%, surging from around $2 billion to over $6 billion, making it the fourth-largest DeFi DApp. At the time of writing, EigenLayer’s TVL exceeds $7.5 billion, with over 2.6 million ETH restaked.

Ecosystem Projects

One area worth watching is the projects EigenLayer will bring to its ecosystem. EigenLayer seeks to transform Ethereum’s functionality, particularly from an infrastructure standpoint. We will continue monitoring the various modules participating in it.

The possibilities enabled by EigenLayer are quite broad, covering everything from Ethereum sidechains to oracles and bridging layers. Nevertheless, the most relevant protocols are likely those facing the greatest difficulty in establishing security and those with some degree of synergy with Ethereum—at least during this relatively early stage.

❖ EigenDA: EigenDA is the first AVS to use EigenLayer for its security—a DA layer, as the name suggests.

➢ What is a DA Layer? Simply put, the idea behind DA is to ensure blockchain transaction data is accessible to the entire network. This is especially relevant to Ethereum L2 rollups, which send transaction data back to Ethereum L1. Until recently, L2s relied entirely on native Ethereum DA to meet their DA needs. However, this is changing with the emergence of alternative solutions like Celestia and Avail, which are progressively realizing their visions. EigenDA is another player in this market and aims to collaborate with rollups to offer lower transaction costs and higher throughput.

➢ Mechanism: DA costs typically make up a relatively high proportion of rollup costs. Therefore, dedicated DA layers could be a strategic move for many rollups, especially as user bases grow. The following example illustrates how an L2 might choose to use EigenDA and become part of the EigenLayer ecosystem:

i. An Ethereum L2 may opt to use EigenDA as its DA layer instead of Ethereum L1.

ii. Taking Arbitrum as an example, whenever it uses EigenDA, some $ARB tokens flow back to validators running EigenDA software and helping secure it.

iii. Validators retain some of these tokens, while others are passed back to underlying restakers, providing additional yield for both parties.

iv. To incentivize honest behavior, validators have their ETH staked into EigenLayer subjected to additional slashing conditions, as previously described.

➢ Partnerships: EigenDA has established partnerships with many major crypto projects and will announce more as mainnet launch approaches. Key projects include:

i. Arbitrum Orbit: EigenDA announced support for Arbitrum Orbit chains, enabling developers to build Orbit rollups based on EigenDA. This integration was achieved through collaboration with rollup infrastructure provider AltLayer. For more information on Arbitrum Orbit, please see our report “The Layer-2 Evolution: Superchains, L3s, and More”.

ii. OP Stack: At the end of December, EigenDA open-sourced a branch of the OP Stack and integrated support for EigenDA. The OP Stack powers the OP mainnet and numerous new rollups including Base, Zora, and Mode. See our latest update in the report “OP Stack: What’s New”.

iii. Launch Partner Program: EigenDA recently announced its Launch Partner Program, with eight rollup infrastructure providers actively integrating EigenDA as a DA option for users.

➢ Outlook: The EigenDA testnet initially launched in November 2023 (Stage 2 of the EigenLayer roadmap). Its mainnet is expected to go live in the latter half of 2024.

❖ Other Active Validation Services (AVSs): While EigenDA will be the first AVS to launch, many other teams have been developing their modules and are preparing to go live alongside the EigenLayer mainnet. Notable teams include Espresso (decentralized sequencer), AltLayer (rollup infrastructure), Lagrange (building light clients for optimistic rollups), Hyperlane (interchain communication), Near (building fast finality layers to improve composability across the Ethereum rollup ecosystem), Omni (cross-rollup communication), and others. For full details, click here to visit the EigenLayer website.

Restaking Rollups via AltLayer

AltLayer is a rollup infrastructure provider that helps developers launch and maintain their rollups. Originally a rollups-as-a-service (RaaS) provider, AltLayer has recently expanded its product offerings and formed a significant partnership with EigenLayer to further advance its vision. AltLayer maintains collaborations with many leading rollup teams in the industry and assists developers in launching on platforms like OP Stack, Arbitrum Orbit, ZK Stack, and Polygon CDK.

We detailed AltLayer and its RaaS platform in our recent report “A Primer on Rollups-as-a-Service”. We recommend readers review this report for comprehensive background on AltLayer and its various products. In this section, we will focus primarily on their new restaking rollups, excluding their full product suite.

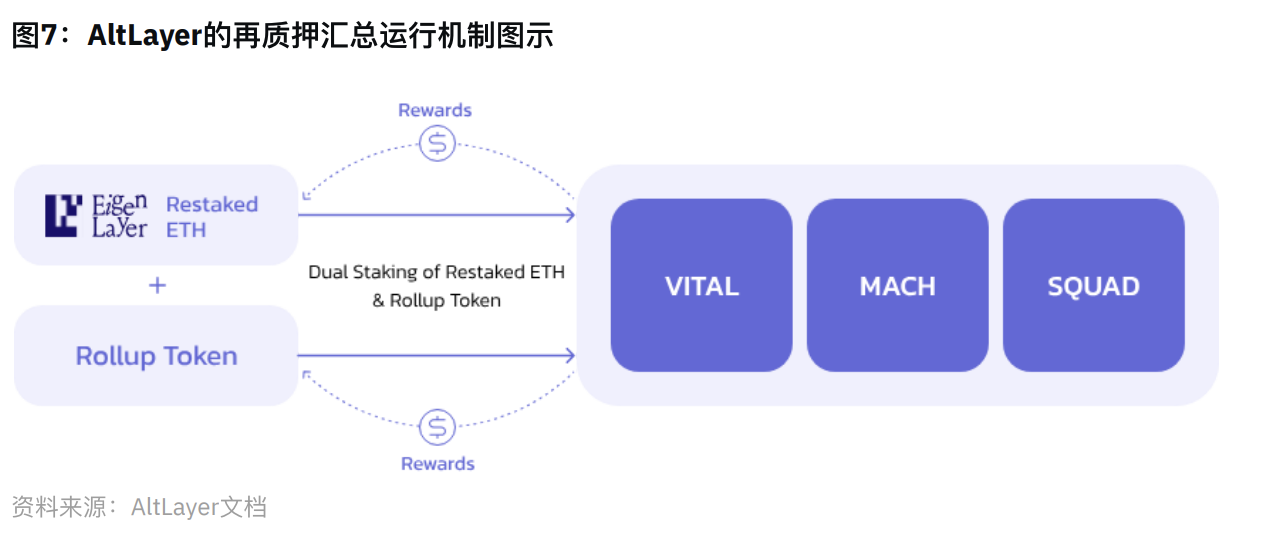

❖ Restaking Rollups: AltLayer’s restaking solution consists of three vertically integrated AVSs that can be created on-demand for any given rollup.

➢ VITAL: Helps provide decentralized verification of rollup states through validity proofs or zero-knowledge proof generation.

➢ MACH: Enables rollups with fast finality and cross-rollup interoperability, along with features to reduce maximum extractable value (MEV) within rollups.

➢ SQUAD: Supports decentralized sequencing for rollups. Together, these features help create decentralized, interoperable, and efficient rollups secured via EigenLayer’s restaking mechanism.

These capabilities collectively enable the creation of decentralized, interoperable, and efficient rollups secured via EigenLayer’s restaking mechanism.

❖ Outlook: The restaking rollup product is currently running on testnet, while its existing RaaS product is already live. AltLayer also offers ephemeral rollups—custom one-off rollups tailored for specific apps, with use cases including popular NFT mints, gaming, and event ticketing.

❖ $ALT: AltLayer recently launched the $ALT token, used as economic collateral, for governance, protocol incentives, and protocol fees across the entire AltLayer ecosystem.

Considerations

Like any new primitive in the fast-moving crypto market—especially infrastructure protocols like EigenLayer—there are many risks to note. Readers should understand this is not an exhaustive list, primarily because predicting future vulnerabilities of new technologies is nearly impossible. However, these are factors you may want to consider when analyzing EigenLayer.

Technical Risks

❖ One risk to consider is validators colluding to simultaneously attack a group of EigenLayer protocols. This risk arises because validators might choose to restake across multiple different services, which could theoretically make attacks economically viable. The EigenLayer whitepaper discusses this in more detail and proposes an open-source dashboard to monitor validator restaking, enabling protocols to incentivize validators who participate in only a limited number of protocols.

❖ The risk of accidental slashing is also worth considering. Such risks could stem from programming errors or smart contract security issues in protocols built on EigenLayer. Two proposed solutions are: (1) security audits; and (2) a governance layer that can veto slashing decisions via multi-sig (though this may raise centralization concerns).

Structural Risks

❖ A popular topic in the community recently is whether restaking constitutes leverage. The answer depends on multiple factors, and both sides of the debate have valid points.

➢ At the current stage of development, AVSs haven’t even launched yet—users are simply depositing funds into EigenLayer or liquidity restaking protocols—so some argue leverage doesn’t exist. Essentially, pooling security to ensure cryptoeconomic security for other applications (i.e., restaking) is conceptually different from borrowing funds to generate yield (i.e., using leverage).

➢ However, as any “gambler” knows, this could lead down a slippery slope. Once EigenLayer launches, undoubtedly some users will borrow funds, restake them (perhaps via liquidity restaking protocols), and use them as collateral in DeFi to perpetuate this cycle—an activity that could be viewed as leverage within the system.

❖ It should also be noted that AVSs can freely set their own unique slashing conditions. What happens if an AVS can slash validators for relatively trivial reasons and distribute rather than burn ETH? How might incentive structures around slashing alter system costs for validators and restakers?

➢ When the system goes live, AVS selection and slashing analysis will become critical factors for users and validators.

Other Considerations

❖ Protocol sustainability is another risk associated with adopting EigenLayer. Tokens can provide useful monetary incentives and revenue streams—if all value accrues in ETH rather than the protocol’s native token, certain projects may struggle to thrive long-term. However, we should note that EigenLayer may implement dual staking, combining restaked ETH and the AVS’s native token for security. The whitepaper discusses this in greater detail.

❖ We recommend readers review Vitalik Buterin’s blog posts “Don’t Overload Ethereum Consensus” and “Should Ethereum Wrap More Functionality?” The former discusses potential risks of building complex financial systems atop restaking. If such systems fail and cause massive financial losses, some in the community might expect an Ethereum hard fork to fix the damage. Vitalik argues such expectations should be resisted and emphasizes that Ethereum cannot be responsible for application-layer failures. This may limit the types of protocols that can launch on EigenLayer and could push some toward other platforms. Nonetheless, EigenLayer founder Sreeram Kannan has responded constructively, stating that EigenLayer’s core philosophy aligns with Vitalik’s.

The second article discusses “wrapping”—integrating new technologies into the core Ethereum protocol. With the rise of restaking over recent months, some in the community have discussed wrapping it into core Ethereum. Vitalik explores many functionalities beyond restaking, and this article helps understand the philosophical reasoning behind Ethereum’s simplicity and how we should view wrapping.

Outlook

As outlined in the timeline section, EigenLayer is expected to complete all three phases of its phased mainnet rollout in the second half of 2024. Below are additional factors to consider:

❖ EigenLayer’s TVL has continued rising over the past few months, meeting strong demand with each deposit cap increase. The primary driver of this capital inflow is the EigenLayer restaking points program. Points measure a user’s contribution to sharing security in the EigenLayer ecosystem and scale proportionally with the amount of staked capital deposited.

➢ A key question to ask is: how much of this capital will remain post-mainnet launch? While unconfirmed, many users anticipate an EigenLayer token issuance. A legitimate concern is: how much of EigenLayer’s $7+ billion TVL stems from potential airdrop farming? This is particularly important because although EigenDA is live on testnet, most other AVSs are still largely under construction. Thus, after mainnet launch and the conclusion of the points program, many users may consider more efficient uses of their capital—at least until a wave of AVSs launches.

❖ It’s worth noting that Ethereum was originally a Proof-of-Work (PoW) chain and only began transitioning to Proof-of-Stake (PoS) with the launch of the Beacon Chain at the end of 2020, completing the transition with “The Merge” in 2023. Therefore, it’s unsurprising that Ethereum’s staking ratio remains relatively low compared to peers.

➢ Currently, about 25% of ETH is staked (15). In contrast, Solana, Cardano, Avalanche, and others exceed 50%. Prior to restaking and the popularity of LSTs, many in the Ethereum community believed staking would stabilize around 20–30%. Given that threshold has already been reached and restaking is relatively new, Ethereum’s staking ratio may surpass 30%.

➢ Note that restaking adds another layer of yield to staking, so it’s logical to expect an increase in the proportion of staked ETH. At the same time, the more ETH staked, the lower the yield (as staking rewards are distributed across the total staked ETH supply). The relative strength of each effect warrants careful study to better understand restaking’s potential impact on Ethereum’s staking ratio in the coming months.

❖ Finally, we should consider that projects may choose to launch on EigenLayer for reasons beyond shared security. Joining EigenLayer could serve as a distribution and marketing strategy for projects, especially given the activity generated by restaking over the past few months. This is an important consideration when analyzing EigenLayer’s growth trajectory and the extent of network effects it can generate.

Restaking on Other Chains

While restaking is primarily associated with the Ethereum ecosystem, the concept of shared security exists on other chains too. In our report “Modular Blockchains: The Race to Become the Top Security Provider”, we examined the Cosmos ecosystem and its Replicated Security and Mesh Security models. We also explored Bitcoin-related solutions like Babylon and Stacks. Here, we revisit Babylon and discuss Picasso’s Solana restaking.

Bitcoin “Restaking”: Babylon

Babylon is a Bitcoin staking protocol aiming to leverage Bitcoin’s over $1 trillion cryptoeconomic security to enhance the security of other PoS chains. Babylon seeks to create a two-sided market where Bitcoin holders can securely stake their BTC and choose which PoS chains and DApps to support and earn yield from. PoS chains and DApps can opt to use BTC-backed security to establish their cryptoeconomic security, as previously discussed in this report.

❖ How Does Babylon Work?

➢ Similar to EigenLayer, Babylon’s key mechanism is enforcing slashing. If stakers misbehave, their staked BTC must be slashed.

➢ However, they face the challenge of Bitcoin’s limited expressiveness. Unlike smart contract L1s such as Ethereum, BNB Chain, and Solana, Bitcoin lacks native smart contract functionality.

➢ One solution would be linking BTC to another PoS chain and executing slashing on the latter, but that introduces reliance on a third party.

➢ Therefore, Babylon overcomes the lack of smart contracts by combining advanced cryptography and optimizing Bitcoin’s scripting language. Babylon expresses staking contracts using UTXO transactions written into Bitcoin scripts. See their lite paper for details.

➢ Notably, Babylon’s solution does not involve bridging BTC—only locking it natively on the Bitcoin chain.

❖ Bitcoin Timestamping

➢ A key feature of Bitcoin used by Babylon is timestamping. Bitcoin forms the basis of its PoW consensus by timestamping transactions and distributing them, solving double-spending. These timestamps provide irreversible time records of transactions, helping resolve on-chain security issues.

➢ Bitcoin can also be used to timestamp events from other chains in a process called checkpointing. Transactions that timestamp these events are called checkpoints.

➢ Babylon leverages this capability by regularly recording checkpoints of other PoS networks onto the Bitcoin blockchain, adding a layer of security. If an attacker tries to compromise a PoS network using Babylon, they would have to attack the Bitcoin blockchain itself, effectively granting these chains Bitcoin-level security.

❖ Babylon Chain

➢ Babylon’s Bitcoin staking protocol essentially serves as a middleman—what they call a “control plane”—between Bitcoin’s security and its own PoS chain and Bitcoin holders. This protocol is implemented as a chain (Babylon Chain) to ensure security, scalability, and censorship resistance.

➢ Due to the scarcity and high cost of block space on the Bitcoin blockchain, having every PoS chain using Babylon directly timestamp onto it is unsustainable. To solve this, the Babylon team designed a Bitcoin timestamping protocol and runs it as a Cosmos-SDK chain—Babylon Chain.

➢ Babylon Chain aggregates timestamps from any number of Cosmos SDK chains via the Inter-Blockchain Communication (IBC) protocol.

➢ Initially focusing on Cosmos app chains, Babylon aims to eventually expand to all types of PoS chains.

❖ Babylon Architecture:

➢ Babylon uses a three-part architecture: (1) Bitcoin, as the timestamping service; (2) Babylon Chain, as the intermediate layer and aggregator (a Cosmos Zone); (3) other Cosmos Zones, as consumers of security.

➢ Checkpoints from participating zones are sent via IBC to Babylon Chain. Babylon Chain aggregates these checkpoints so that only one aggregated checkpoint needs to be placed on the Bitcoin chain, timestamping transactions from all different zones.

➢ This aggregated checkpoint is sent to the Bitcoin chain. Bitcoin network finality typically

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News