Is Solayer's Restaking a Good Business?

TechFlow Selected TechFlow Selected

Is Solayer's Restaking a Good Business?

Solayer will occupy a significant infrastructure role within the Solana ecosystem in the future.

By Yu Zhong Kuangshui

Why did Binance Labs invest in Solayer?

And how does Solayer differ from Jito Restaking?

Today, I’ll share my thoughts based on currently available information.

First, if you want a quick overview of the project, Rootdata makes it easy to access Solayer’s project summary and investment background.

In its latest funding round, Solayer received investment from Binance Labs. In the previous Builders Round, participants included Anatoly Yakovenko (co-founder of Solana), Ansem (core Solana community influencer), Sandeep Nailwal (co-founder of Polygon), Dong Xingshu (Chief Strategy Officer at Babylon), as well as co-founders of Tensor and founder of Solend.

I believe that in today’s market, the key to content isn't exhaustively detailing protocol architecture or analyzing data—but rather clearly conveying how the market should perceive a project. So starting with this piece, I’d like to shift my previous writing style—moving away from long explanations of technical design and metrics—and instead directly share my understanding of this project.

Currently, market perception of restaking is dominated by EigenLayer—where $ETH restaking aggregates and extends Ethereum’s economic security (shared security). In short, blockchain teams can use EigenDA as their data availability (DA) layer. Celestia offers competing DA services. That said, while DA is conceptually simple, it requires sufficient clients and active application users to create a sustainable flywheel effect.

Although Solana restaking shares the same name as Ethereum restaking, the two focus on different business areas and target distinct customer bases. EigenLayer primarily provides services externally (exogenous AVS), whereas Solayer focuses on serving applications within the Solana ecosystem (endogenous AVS). Of course, Solayer could expand beyond Solana in the future—this is simply its first phase.

Solayer’s blog post offers a fitting analogy for its initial business model:

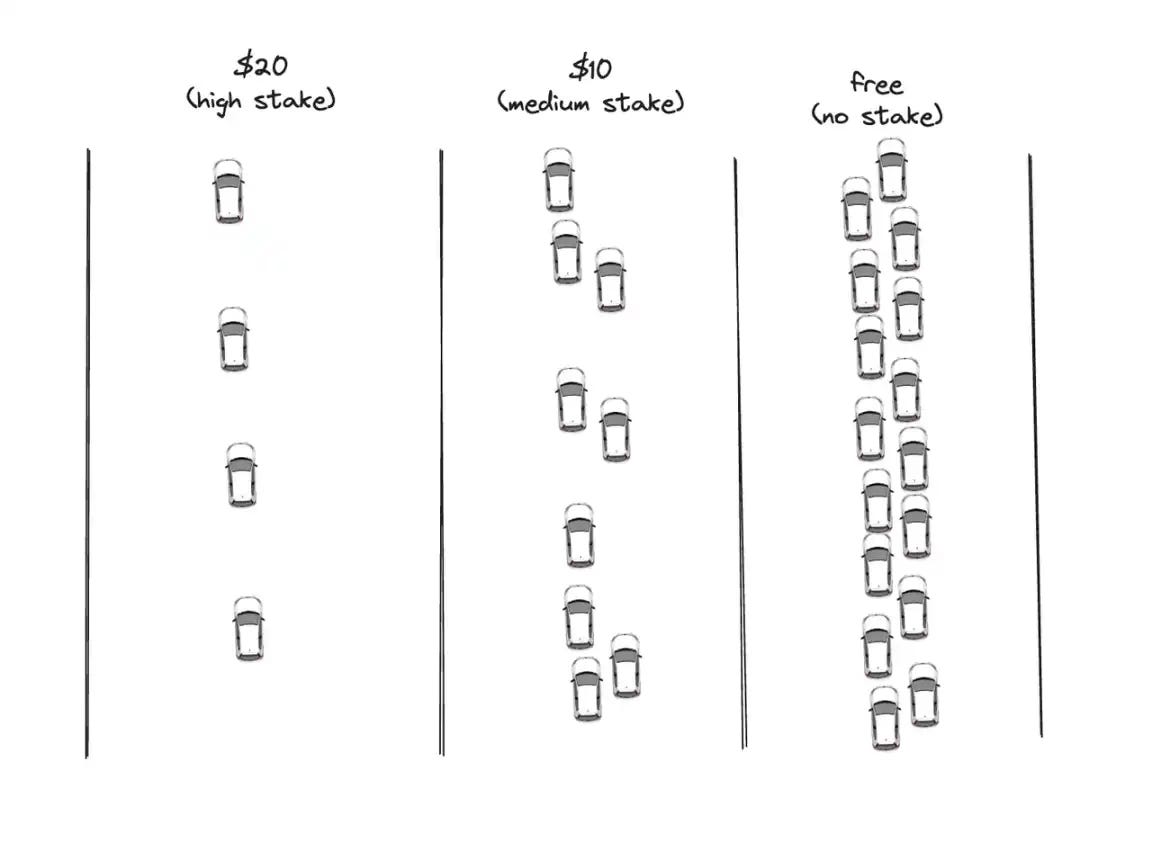

Imagine Solana as a highway with multiple lanes, each having different tolls and traffic conditions representing various staking tiers. Different DApps are like vehicles traveling on this highway, each with different speed requirements and tolerance for fees. Solayer acts as a coordinator between these vehicles (DApps), the highway lanes (validators), and toll collectors (restakers).

In other words, DApps in the Solana ecosystem can leverage Solayer’s service according to their needs (block space and priority transactions) to ensure they’re in the fast lane or standard lane, thereby enhancing user experience.

Users participating in Solayer restaking earn returns from three sources:

-

Solana staking rewards;

-

MEV income;

-

Potential Solayer token airdrop;

With this explanation, we may better understand why Binance Labs chose to invest in Solayer—it's positioned to become a critical infrastructure player within the Solana ecosystem.

Now let’s briefly discuss Solayer’s competitors: Jito and the recently trending Sanctum.

In “Announcing Jito Restaking”, Jito doesn’t explicitly state its future strategic focus but highlights product advantages. However, from the oracle example they provide, it appears Jito Restaking aims more toward offering economic security services for cross-chain bridges, oracles, or rollups—similar to EigenLayer. This contrasts with Solayer’s current model focused on internal Solana applications. These are still preliminary observations; once more details emerge, I’ll follow up with deeper analysis.

Sanctum’s narrative is less ambitious compared to Jito or Solayer. It aims to build a liquidity layer for LSTs. Simply put, smaller liquid staking tokens (LSTs) often suffer from insufficient liquidity, making it hard to quickly swap out. Sanctum addresses this by creating an aggregated liquidity layer supporting all kinds of LSTs on Solana. In short, Sanctum’s goal is to solve liquidity issues for SOL-based LSTs.

Finally, let’s answer the opening question: Is Solana restaking a good business?

From Solayer’s perspective alone, I believe yes—it’s a solid opportunity. Unlike exogenous AVS models, Solayer’s initial target customers are existing DApps within the Solana ecosystem. Its service has low adoption barriers—any DApp in need can easily integrate with Solayer’s offerings. This, I believe, is precisely what enables Solayer to rapidly build a strong moat within the ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News