First community sale exceeds expectations by 15x, forced delay—can Solayer, the narrative shifter, become a dark horse?

TechFlow Selected TechFlow Selected

First community sale exceeds expectations by 15x, forced delay—can Solayer, the narrative shifter, become a dark horse?

Is Solayer's rising popularity due to the market forming new expectations for the SVM sector, or does the project itself have inherent potential as a dark horse?

Author: Frank, PANews

At the beginning of 2025, new launch activities in the SVM sector on Solana have repeatedly sparked frenzy across various airdrop farming groups. First came the Sonic SVM airdrop, which ignited discussions on social media, followed by Solayer—an ecosystem project on Solana—announcing an upcoming community sale, reigniting market imagination around the next wealth-generating opportunity.

According to multiple social media accounts, due to Solayer's KYC requirements, the price of overseas KYC information being resold in the market has surged. Numerous farming influencers have even jokingly posted images of themselves traveling to African countries collecting KYC data. Amid such intense demand, Buidlpad—the partner collaborating with Solayer on this sale—urgently announced on January 13 that the community sale would be delayed by three days to January 16, as registration numbers far exceeded expectations, aiming to ensure fair distribution.

Is Solayer’s popularity driven by renewed market expectations for the SVM sector, or does the project itself possess genuine breakout potential?

From Restaking to Hardware Acceleration: Three Narrative Shifts in One Year

Solayer is a relatively young project, founded in 2024. In less than a year since its inception, it has undergone multiple narrative transformations—each time seemingly catching the latest trend at just the right moment.

Initially positioned as a restaking protocol, Solayer launched its mainnet in August and quickly became one of the hottest restaking protocols on the Solana chain. That same month, it successfully raised $12 million in seed funding led by Polychain Capital, with participation from Binance Labs and Arthur Hayes’ family office Maelstrom, valuing the company at $80 million post-funding. Prior to this, Solayer had also completed a pre-seed round of undisclosed size, with investors including Solana co-founder Anatoly Yakovenko and Polygon co-founder Sandeep Nailwal.

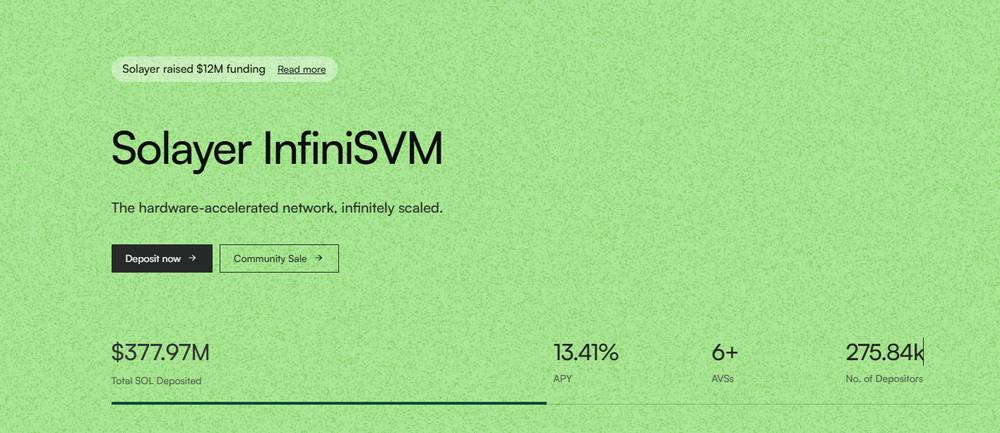

In the restaking space, Solayer has achieved notable results. As of January 13, official data shows its TVL has reached $370 million, with approximately 275,000 depositors and an average annual yield of 13.41%. It ranks ninth in TVL on Solana and sixth among all restaking protocols.

However, restaking may not be Solayer’s final destination. In October, Solayer introduced an RWA narrative by launching a synthetic stablecoin called Solayer USD—a treasury-backed asset similar in concept to Usual’s recently popular USD0. The current market cap of this stablecoin stands at around $30 million, ranking sixth within the Solana ecosystem, though still small overall at only 46th globally.

In December, Solayer quietly published a blog post titled “Software Scaling Has Reached Its Limits – The Future Lies in Hardware Scaling.” The article argued that Ethereum EVM Layer 2 networks are hitting bottlenecks in software upgrades due to state fragmentation, throughput limitations, latency, cost, and system complexity. In contrast, high-performance blockchains like Solana and Sui benefit from software simplification combined with hardware acceleration. However, the post did not yet reveal Solayer’s next step: upgrading through hardware to become the fastest network globally.

Million TPS, 100Gbps—Does Technical Storytelling Still Work?

It wasn’t until January 7 that Solayer unveiled its 2025 roadmap, announcing the launch of a novel hardware-scaling SVM capable of achieving 1M TPS and 100Gbps bandwidth. According to PANews’ review of the whitepaper, the core technical principle behind Solayer’s claim lies in a hardware acceleration technology known as Infiniband RDMA, enabling microsecond-level cross-node communication. This consists of two key components.

The first is Infiniband (high-bandwidth networking), a high-performance network architecture used to efficiently connect computing nodes, storage systems, and other devices, widely adopted in supercomputers and data centers. The second is RDMA (Remote Direct Memory Access), which allows devices to directly access remote node memory without OS intervention. This "zero-copy" communication method significantly reduces CPU load and latency. Currently, these technologies are primarily used in high-performance computing (HPC), AI and machine learning, finance, and distributed storage. Their application in blockchain networks appears to be pioneered by Solayer. Whether this can be fully realized remains uncertain for now.

In terms of team background, Solayer’s founder Rachel Chu was previously a core developer at Sushiswap. Co-founder Jason Li graduated from UC Berkeley with a degree in computer science and previously founded MPCVault, a non-custodial Web3 wallet. Additionally, on January 8, Solayer announced the acquisition of Fuzzland, a smart contract hybrid fuzzer company, with one of the stated goals being to focus on building a hardware-accelerated SVM chain.

Community Sale Sparks Participation Frenzy

On January 9, Solayer announced a joint community sale with Buidlpad. According to disclosed details, the total supply of LAYER tokens will be 1 billion, with 30 million offered in this sale, raising $10.5 million at an average token price of approximately $0.35—implying a valuation of $350 million. All LAYER tokens from the community sale will be fully unlocked on the day of the Token Generation Event (TGE).

Beyond the token sale, Solayer also introduced the Solayer Emerald Metal Card—a Visa-powered virtual and physical debit card usable online and offline for fiat spending and withdrawals. Specific release timelines will be announced separately by Solayer. Participants in the sale will have a chance to receive this card. While it's common for token sales to grant whitelist spots to users holding certain hardware or products, Solayer’s model of “buying tokens to get a card” is relatively rare.

Regardless of motivations, numerous farming studios and crypto KOLs have already taken to social media boasting about securing KYC registrations. Drawing comparisons with the recently launched Sonic SVM, whose current market cap is around $240 million and fully diluted valuation approximately $1.6 billion, market expectations for Solayer appear even higher. Even assuming a conservative $1.6 billion valuation, LAYER could still see 4–5x upside potential.

Under such anticipation, KYC registration for LAYER has been exceptionally hot. Buidlpad revealed that sign-ups have exceeded initial projections by more than 15 times, with widespread detection of bots and farming operations. This overwhelming demand forced them to pause registrations and delay the sale to January 16.

Of course, we cannot predict how LAYER will perform upon listing. But judging from Solayer’s development over just one year—from restaking to RWA, then to hardware acceleration and crypto payment cards—the team clearly demonstrates strong expertise in narrative crafting and timing, following a path similar to Hyperliquid’s approach of delivering product first, then technology. If its technical and operational capabilities can match its ambitions, achieving milestones like million-TPS throughput and millisecond transaction speeds, Solayer could truly emerge as a major player to watch. The ultimate verdict, however, depends on when Solayer can deliver its product to market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News