6 Big Ideas You Need to Know About Bitcoin Halving

TechFlow Selected TechFlow Selected

6 Big Ideas You Need to Know About Bitcoin Halving

Historically, after each of the three halvings, prices have surged significantly within the following year.

Author: Tide Capital

At Bitcoin block height #837188, with 20 days remaining until the fourth halving, Bitcoin has reclaimed the $70,000 mark. Market sentiment is undergoing subtle shifts—will the upcoming halving repeat past halving cycles or spark new narratives? Bulls and bears are locked in intense battle.

Tide Capital has released a new research report on its website titled "6 Big Ideas You Need to Know About the Bitcoin Halving", outlining the six most critical factors driving Bitcoin’s price movement.

This article presents an excerpt from the report for public release. For the full version, please visit the Tide Capital official website to download the complete report.

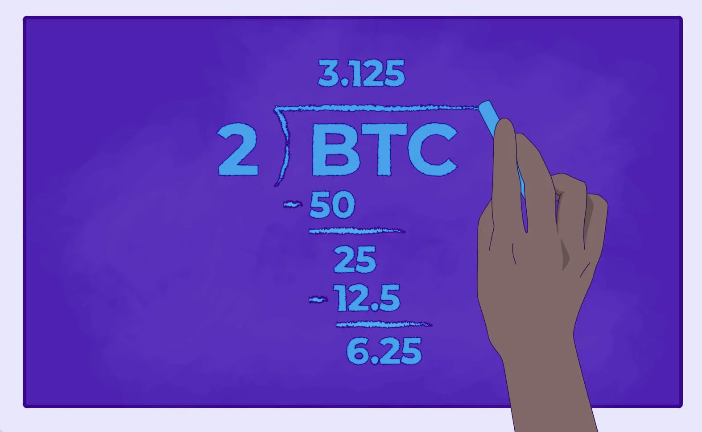

Bitcoin: Approaching the 4th Halving, Reducing Annual Sell Pressure by $10 Billion

Bitcoin will complete its 4th halving on April 18, 2024. The block reward will be reduced from 6.25 BTC to 3.125 BTC, further decreasing Bitcoin's supply output and market sell pressure.

Before the halving, Bitcoin's annual production is approximately 330,000 BTC. At a price of $65,000, this creates over $20 billion in annual sell-side pressure. After the halving, this annual sell pressure will be cut in half—effectively reducing it by $10 billion—and significantly alleviating downward pressure on Bitcoin’s price.

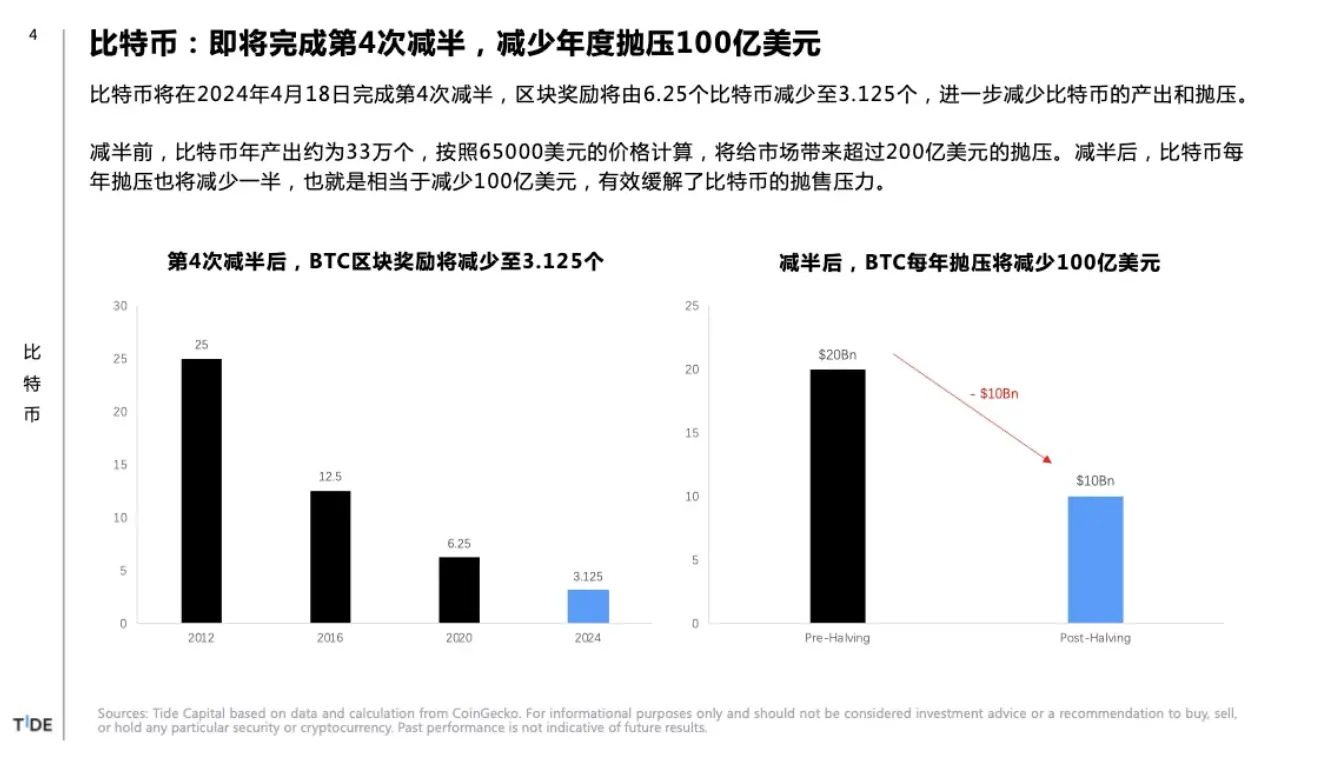

Bitcoin: Three Historical Halvings All Led to Major Gains Within the Following Year

Bitcoin has undergone three halvings historically—in November 2012, July 2016, and May 2020—all followed by significant price increases within the subsequent year. With less than 30 days remaining before the 4th halving, markets are beginning to price in its impact, making a continued upward trend highly probable.

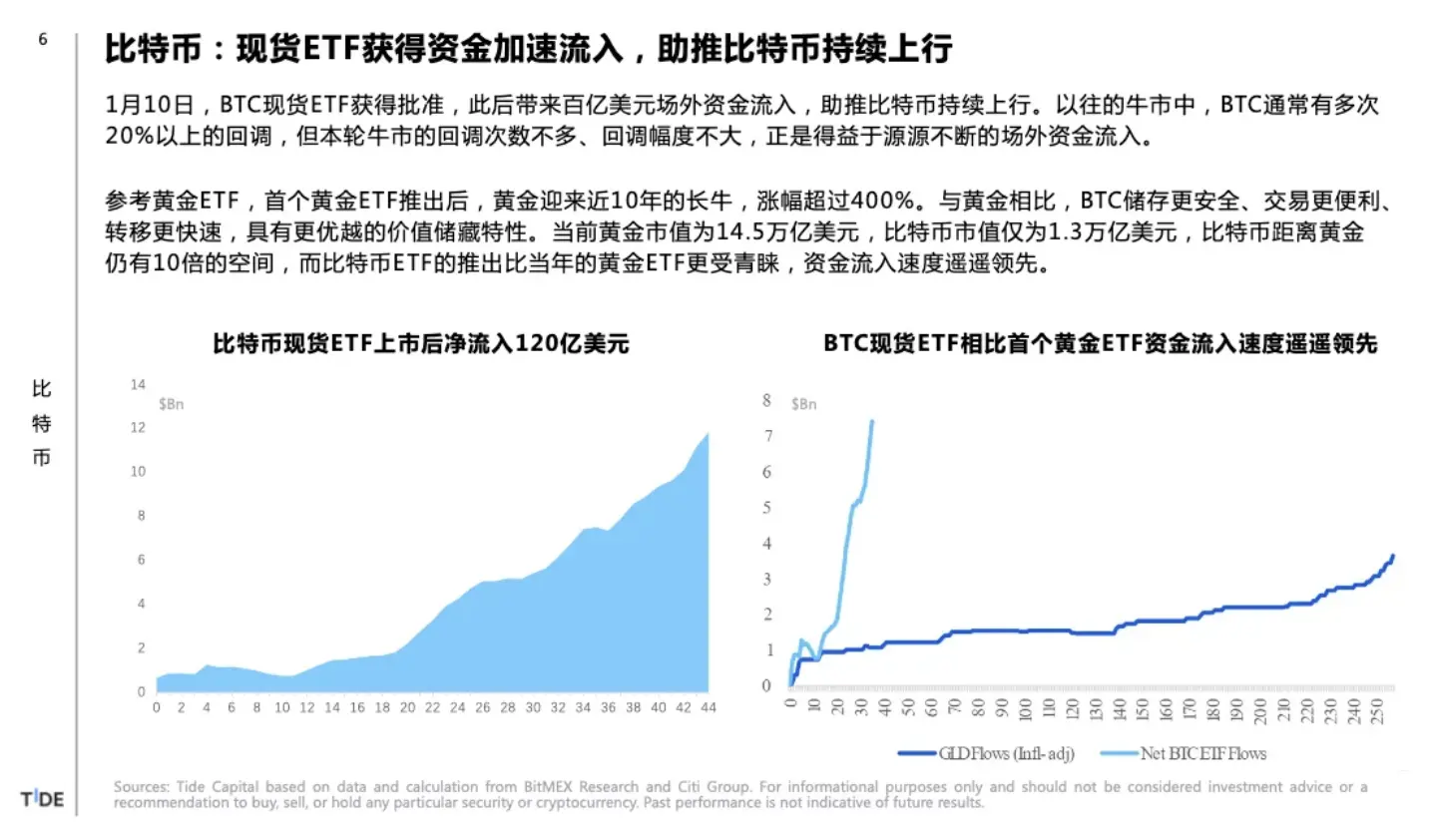

Bitcoin: Spot ETFs See Accelerated Capital Inflows, Fueling Sustained Price Growth

On January 10, BTC spot ETFs were approved, triggering inflows of billions in off-exchange capital and fueling Bitcoin’s sustained rally. In previous bull runs, BTC typically experienced multiple corrections of 20% or more. However, this cycle has seen fewer pullbacks and shallower declines, thanks largely to continuous external capital inflows.

Looking at gold ETFs as a precedent, the launch of the first gold ETF ushered in nearly a decade-long bull market for gold, which rose over 400%. Compared to gold, BTC offers superior attributes for value storage—safer custody, easier trading, and faster transfers. Currently, gold has a market cap of $14.5 trillion, while Bitcoin stands at just $1.3 trillion. This suggests Bitcoin still has room for 10x growth. Moreover, Bitcoin ETFs have attracted far stronger investor interest and faster capital inflows than gold ETFs did at their inception.

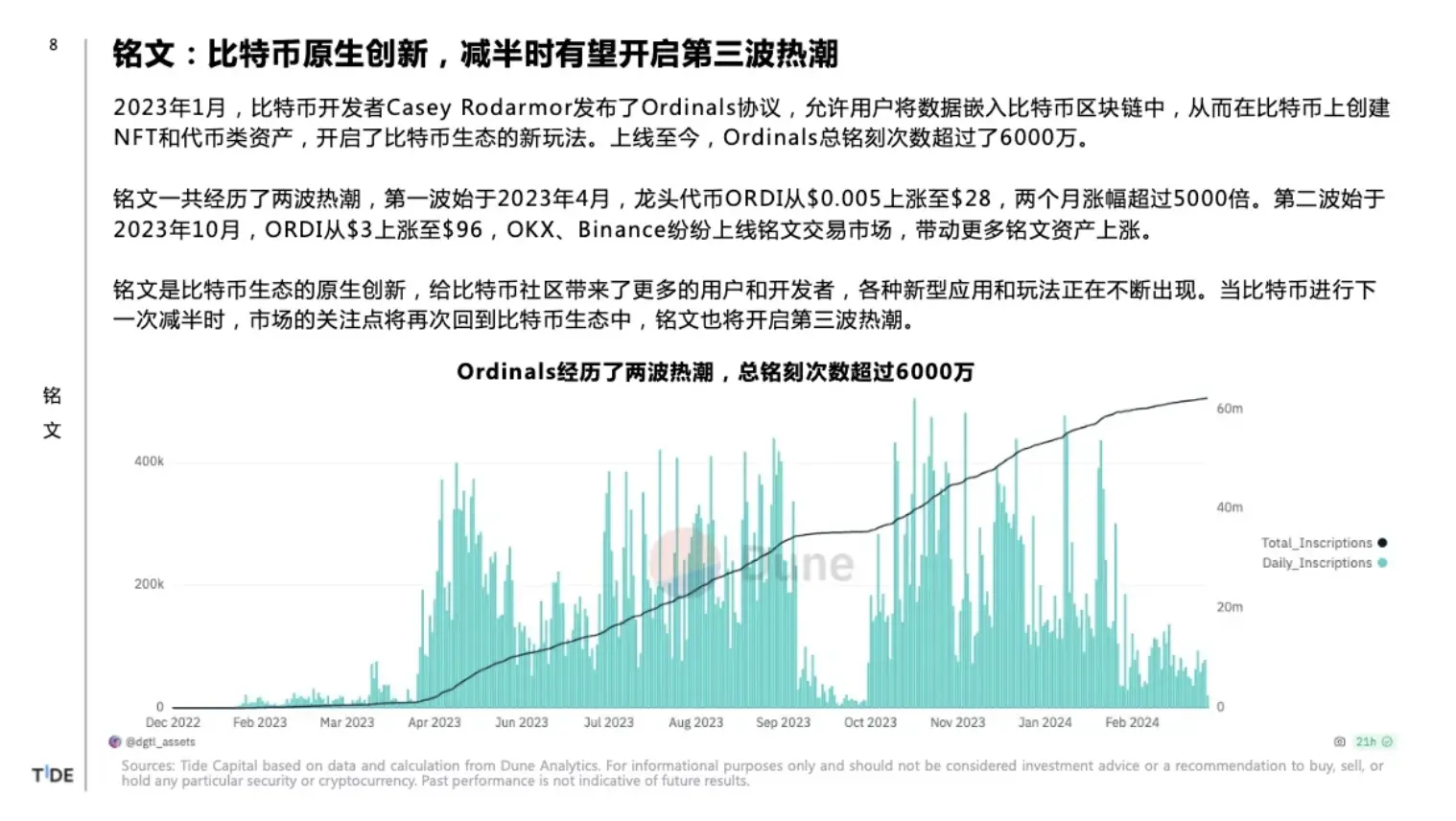

Ordinals: Native Innovation on Bitcoin, Poised for a Third Wave During the Halving

In January 2023, Bitcoin developer Casey Rodarmor launched the Ordinals protocol, enabling users to inscribe data directly onto the Bitcoin blockchain, thereby creating NFTs and tokenized assets on Bitcoin. This innovation opened up new possibilities within the Bitcoin ecosystem. Since launch, total Ordinal inscriptions have surpassed 60 million.

The Ordinals trend has already gone through two major waves. The first began in April 2023, when leading token ORDI surged from $0.005 to $28—a gain of over 5,000x in two months. The second wave started in October 2023, with ORDI rising from $3 to $96, as OKX and Binance launched dedicated Ordinals trading markets, driving broader gains across other inscribed assets.

As a native innovation on Bitcoin, Ordinals have brought new users and developers into the ecosystem, with novel applications and use cases emerging rapidly. As the next halving approaches, market attention is expected to shift back toward the Bitcoin ecosystem, potentially sparking a third wave of enthusiasm for Ordinals.

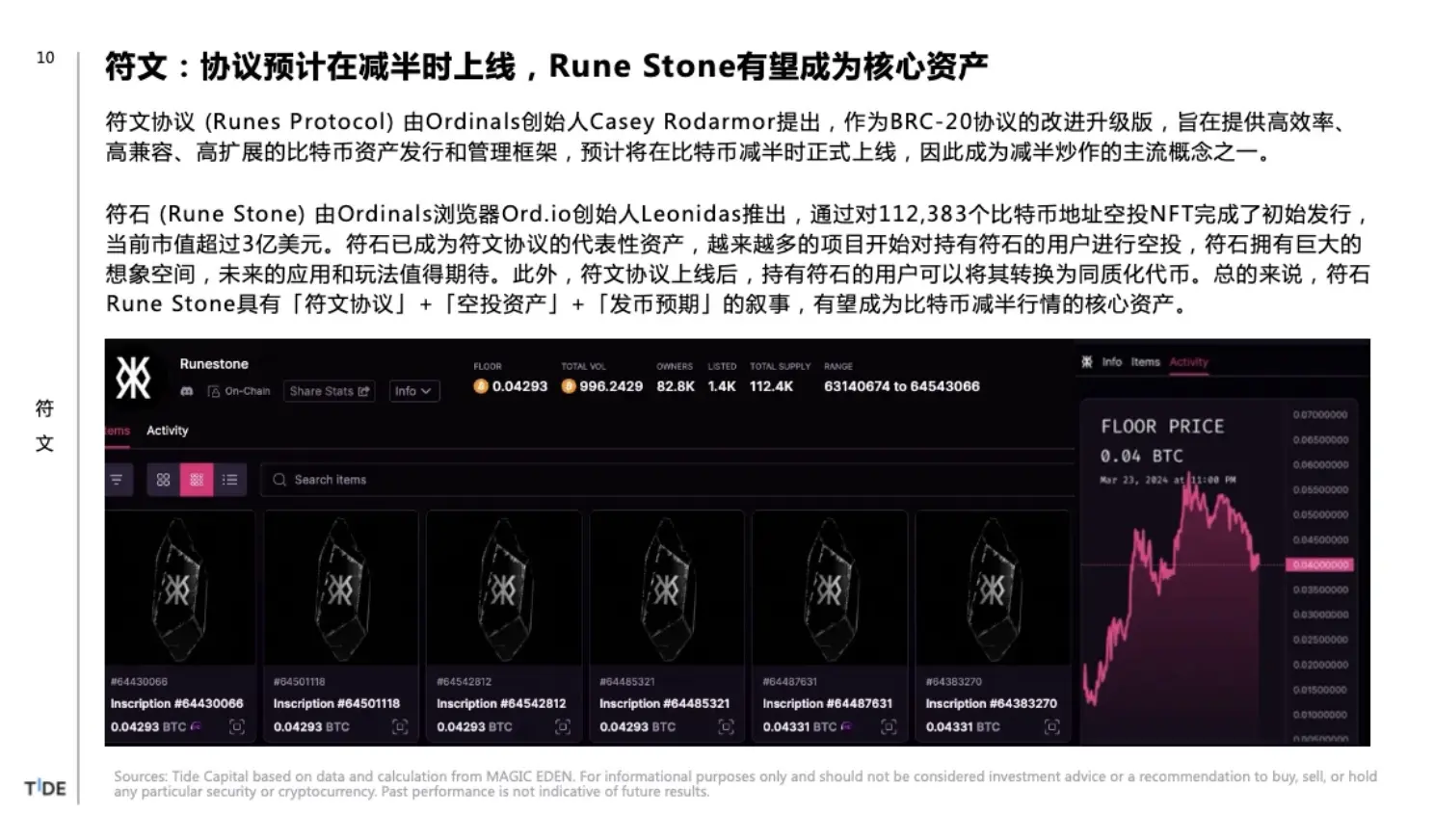

Runes: Protocol Expected to Launch at Halving, Runestone Could Emerge as Key Asset

The Runes Protocol, proposed by Ordinals creator Casey Rodarmor, is an upgraded successor to the BRC-20 standard. Designed to offer high efficiency, compatibility, and scalability, it aims to become a robust framework for issuing and managing assets on Bitcoin. It is expected to officially launch around the time of the Bitcoin halving, making it one of the key speculative themes tied to the event.

Runestone, introduced by Leonidas—the founder of the Ordinals explorer Ord.io—completed its initial distribution via an NFT airdrop to 112,383 Bitcoin addresses and now holds a market cap exceeding $300 million. Runestone has emerged as the flagship asset of the Runes ecosystem. An increasing number of projects are conducting airdrops to Runestone holders, suggesting strong future potential. Additionally, once the Runes Protocol launches, Runestone holders will be able to convert their NFTs into fungible tokens. Altogether, Runestone carries compelling narratives—"Runes Protocol," "airdrop asset," and "token launch expectation"—positioning it as a core asset likely to benefit during the halving cycle.

Meme: Blue-Chip NFT 'mfers' Launches Token, Reaches $200 Million Market Cap in 12 Hours

On March 30, sartoshi, the creator of the blue-chip NFT project mfers, launched the token mfercoin. The whitepaper describes mfercoin as a meme coin with no intrinsic value, no profit expectations, and no defined utility. 80% of the supply was directly added to liquidity pools, while the remaining 20% was reserved for airdrops to the mfers community.

The mfers NFT collection launched in 2021 and helped ignite the PFP (profile picture) craze in the crypto space, earning its status as a well-known blue-chip NFT. Upon launch, mfercoin gained rapid traction through organic community support and viral sharing, reaching a $200 million market cap within just 12 hours. As the mfers community puts it: “$1 mfer = $1 mfer.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News