1kx: A Brief History of Meme Coins and the Path Forward

TechFlow Selected TechFlow Selected

1kx: A Brief History of Meme Coins and the Path Forward

The spread of internet memes is similar to that of infectious diseases.

Author: freezer, 1kx

Translated by: BlockBeats

In this article, we will cover:

· The origin of Meme coins: Proof-of-Work Meme blockchains

· How Meme coins evolved across cycles: ICOs, tokens, DeFi Summer, Solana

· How NFTs reshaped the Meme coin landscape

· Latest developments and emerging trends

· Potential risks and opportunities

What Is a Meme?

A meme is a unit that carries cultural ideas and symbols, spreading continuously from mind to mind. Like genes, memes vary in their ability to spread—those that resonate endure, while less impactful ones fade quickly.

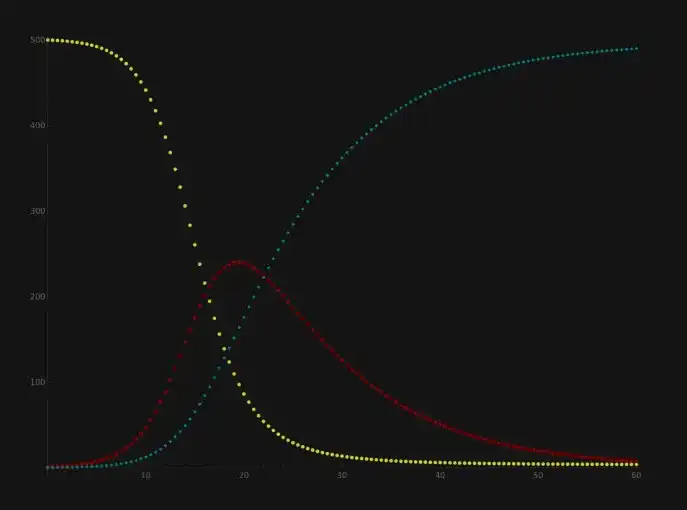

The internet introduced the concept of "internet memes," enabling faster propagation of cultural ideas, typically in the form of images, videos, GIFs, and jokes. One study compared the spread of internet memes to disease: "Memes propagate in a viral pattern, infecting individuals in a way reminiscent of the SIR model used for disease transmission."

The spread of internet memes resembles that of infectious diseases.

"Meme coins" are cryptocurrencies whose value derives solely from their associated meme. Essentially, they attach financial value to the concept of a meme.

With the rise of Meme coins, cultural ideas and symbols—and their spread—can now be traded and speculated upon. Their value is based on the relevance of the meme and its ability to capture mindshare, creating a new type of market where cultural resonance becomes quantifiable and financially valuable.

A Brief History of Meme Coins

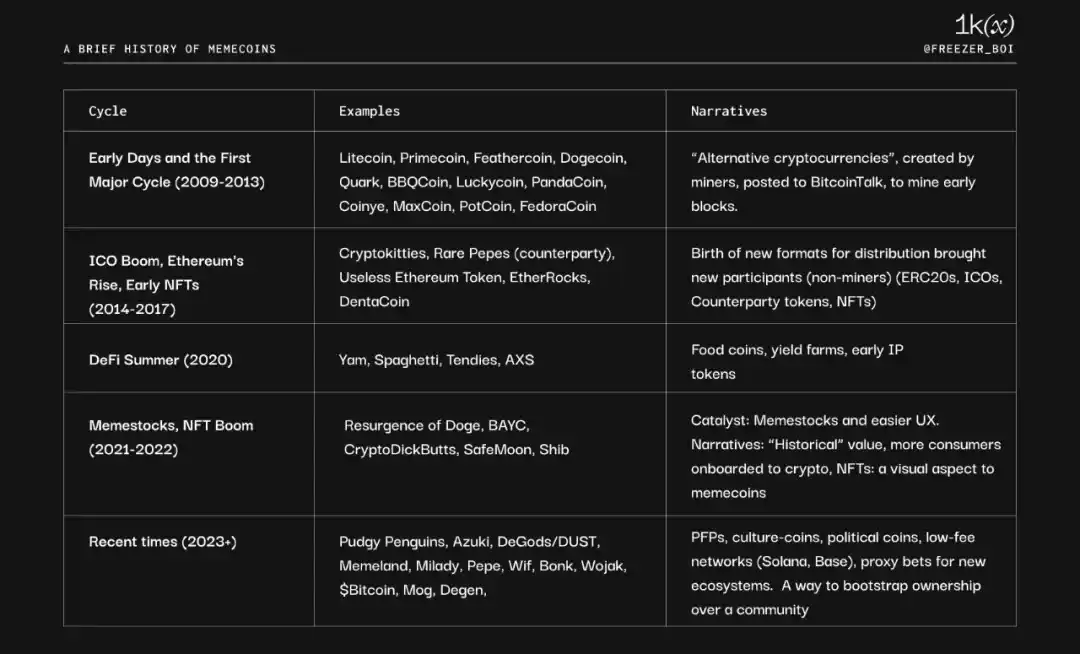

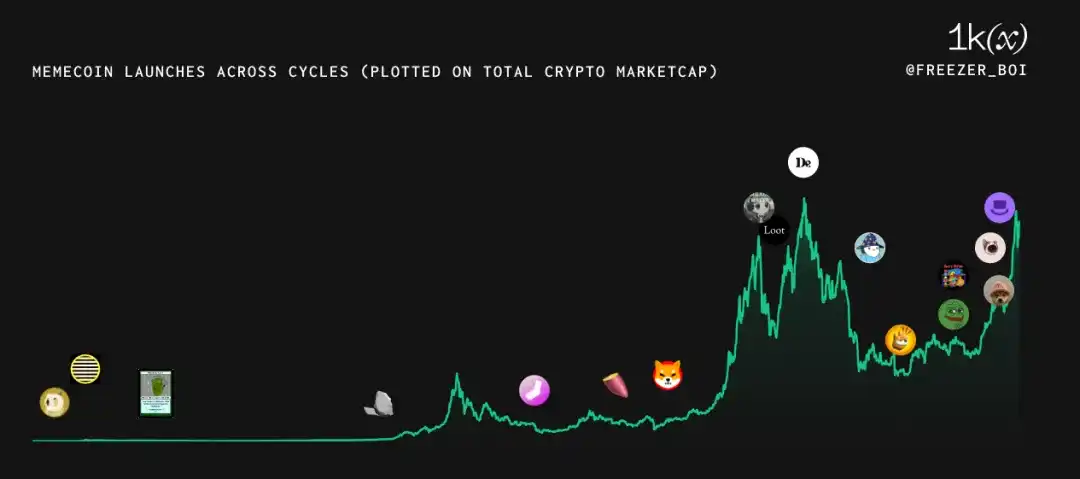

The following charts and timelines offer a brief overview of crypto cycles and the Meme coins that emerged during each:

Proof-of-Work (PoW) Meme Coins

Proof-of-work Meme coins were primarily designed for miners, directing their resources toward mining and selling newly minted tokens. Many of these coins first debuted in the "alternative cryptocurrency" subforum of Bitcointalk. While numerous Meme coins failed to reach exchanges, the successful ones found trading venues on platforms like Cryptsy and BTC-E—centralized services that have since shut down. Each Meme coin was typically differentiated by name and branding, hash algorithm, block time, and supply, all contributing to its overall narrative (or "meme").

The first wave of post-Bitcoin tokens were essentially "Meme coins"—offering little beyond a novel idea. The image below illustrates some early examples:

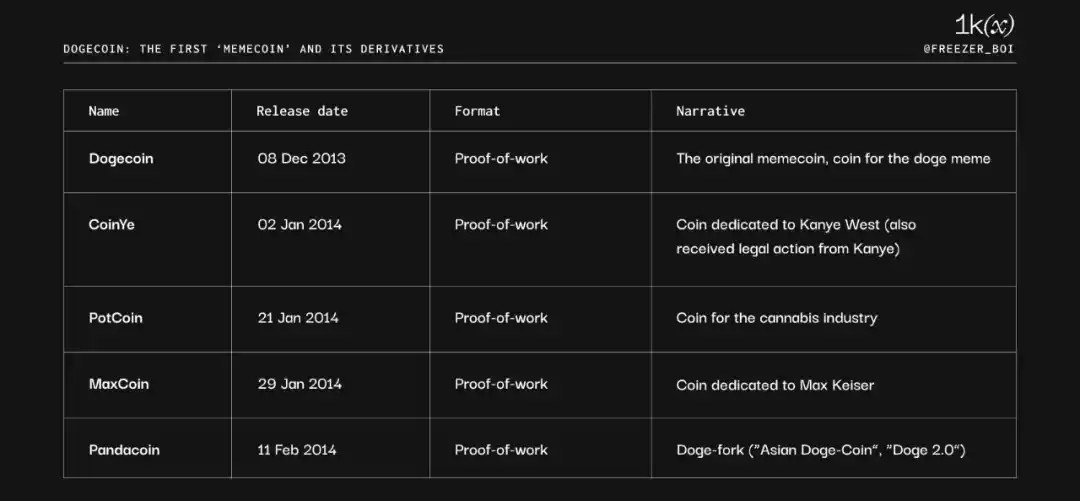

Except for Litecoin, all these tokens eventually died out due to low trading volume and market cap, lack of exchange support, and vulnerability to 51% attacks. This may have stemmed from weak meme stickiness (lack of cultural longevity) and high participation costs (each being a full blockchain).

Litecoin's survival can likely be attributed to the meme value of Bitcoin ("digital gold"), its earlier emergence, and sustained support from major exchanges.

Dogecoin: The First Meme Coin

In summer 2013, the original Doge meme ("such wow") began spreading across 4chan and Reddit. On December 8, 2013, Jackson Palmer and Billy Markus leveraged this cultural trend to launch Dogecoin on Bitcointalk—the first cryptocurrency based on an internet meme.

Dogecoin's success established a new category of cryptocurrencies—playful, humorous, satirical, often featuring celebrities (e.g., Kanye West, Max Keiser), animals (e.g., PandaCoin), or aiming to represent specific communities. These were proof-of-work tokens launched on Bitcointalk’s “Alternative Cryptocurrency” forum. Technical details became secondary—everything revolved around the “meme.” Below are some examples:

The ICO Boom and Rise of Ethereum

Ethereum's emergence sparked a wave of innovation, introducing new use cases, improved user experiences, and attracting new users.

Key improvements included:

· Easier token creation (via ERC20 standard)

· Broader user base (beyond miners)

· Greater revenue potential for creators (ERC20 tokens sold directly via ICOs, unlike zero-premine PoW coins)

· Interoperability, unified ecosystem, and wallet compatibility (via ERC20)

The ICO era saw a wave of more "serious" projects such as theDAO, Filecoin, Tezos, EOS, Cardano, Tron, and Bancor—aiming for utility beyond mere meme value. During this period, only a few Meme coins stood out, though they remained relatively obscure.

One example is the Useless Ethereum Token, launched in June 2017, which mocked the ICO craze and raised 310 ETH.

Dentacoin, initially intended as "the dentist’s cryptocurrency," is still considered a Meme coin despite its niche focus. It peaked at a $2 billion market cap in January 2018.

HAYCOIN was one of the earliest Meme coins created during this era (2018). It was the first ERC20 token listed on Uniswap, created by Uniswap founder Hayden Adams for protocol testing. Initially overlooked with minimal trading volume, it resurged in 2023 due to its historical significance.

Collectible Memes and Early NFTs

Outside of cryptocurrency, a subset of the Pepe the Frog meme known as "Rare Pepes" emerged—memes not publicly shared, or if posted, watermarked with "RARE PEPE DO NOT SAVE."

Between 2016 and 2018, a group of Counterparty (a smart contract protocol built on Bitcoin) developers and Pepe-meme enthusiasts created Rare Pepe wallets and curated "Rare Pepe" memes for trading on the Counterparty protocol.

Rare Pepes are widely regarded as the second-ever NFT collection and continue to hold significant value, with some selling for over $500,000.

With the launch of CryptoPunks, MoonCats, and CryptoKitties, NFTs entered the mainstream Ethereum era—non-fungible tokens linked to images and media. EtherRocks debuted as a joke on Reddit in 2017: a collection of 100 multicolored clip-art rocks. It received little attention at launch (only 30 minted), but later revived into a buying frenzy, reaching a floor price of 305 ETH (worth $1 million at the time) in August 2021.

Another example of collectible Meme coins is Unisocks (SOCKS), launched by Hayden Adams on May 9, 2019. He listed 500 physical socks redeemable with SOCK (an ERC20 token). At the time of writing, each sock trades for as high as $53,000—possibly making them the most expensive socks in the world.

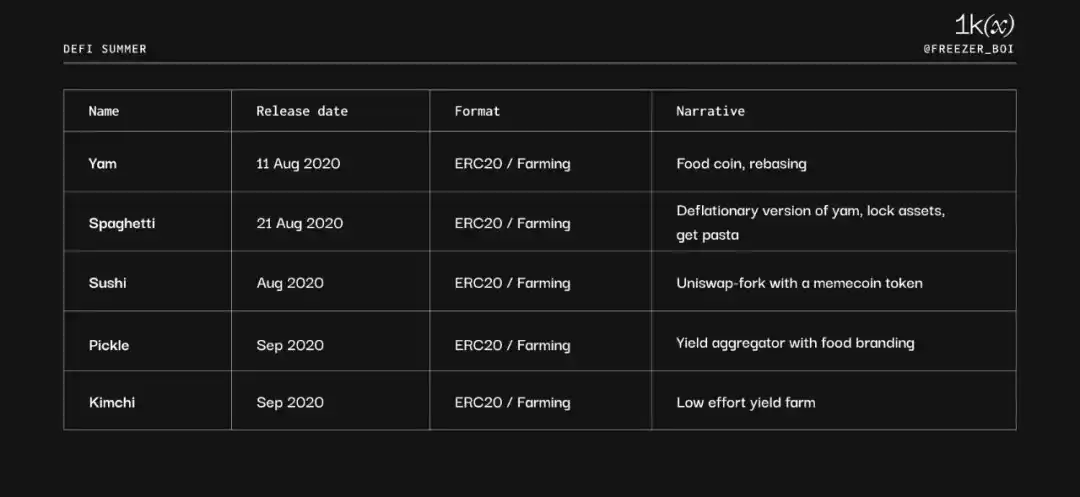

DeFi Summer

In June 2020, Compound Finance pioneered a new token distribution method—"liquidity mining," also known as "yield farming." Users locked assets to provide liquidity and earned token rewards in return.

This new primitive kicked off "DeFi Summer," culminating in "food coins" yield farms offering annual yields of 10,000% (in Meme coins) for locking tokens in contracts like Yam or Pickle.

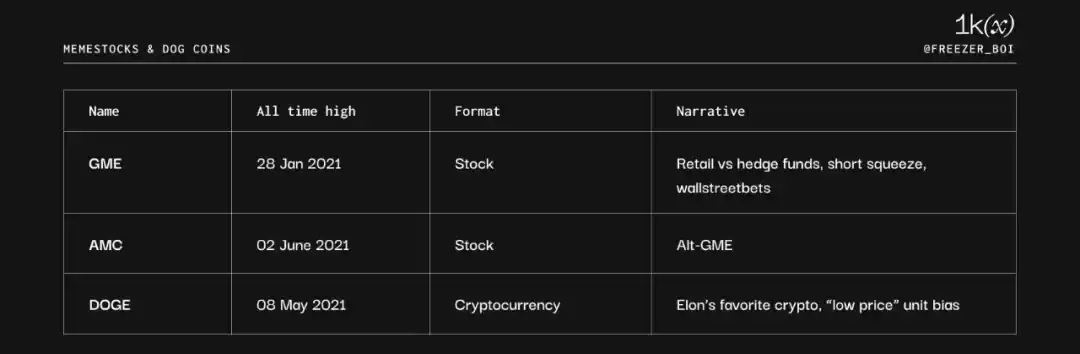

Meme Stocks and the Doge Army

Stimulus measures, interest rate cuts, cheap capital, and global lockdowns throughout 2021 created a high-risk environment worldwide.

In early 2021, retail traders gathered on Reddit, spreading the "Gamestonk" meme through images and videos that drove rapid stock price increases. Thanks to Robinhood’s user-friendly interface (mobile app, zero fees), massive retail participation followed.

The GME frenzy led many to speculate on other assets, particularly those tradable on Robinhood. DOGE had been listed on Robinhood since 2018, priced at $0.008 in late January—a psychologically appealing "low price" for retail investors. In early February 2021, Elon Musk began tweeting extensively about Doge. DOGE peaked in May 2021 with a $90 billion market cap.

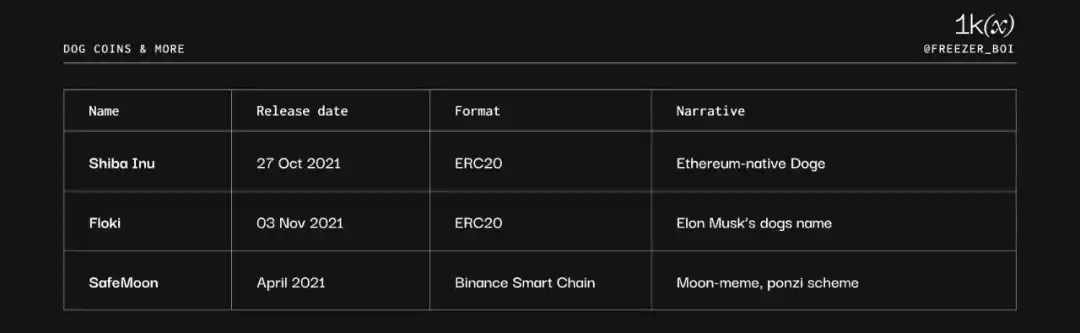

DOGE’s popularity spawned a wave of dog-themed Meme coins, including Shiba Inu, Floki, and Safemoon—all reaching valuation peaks within months.

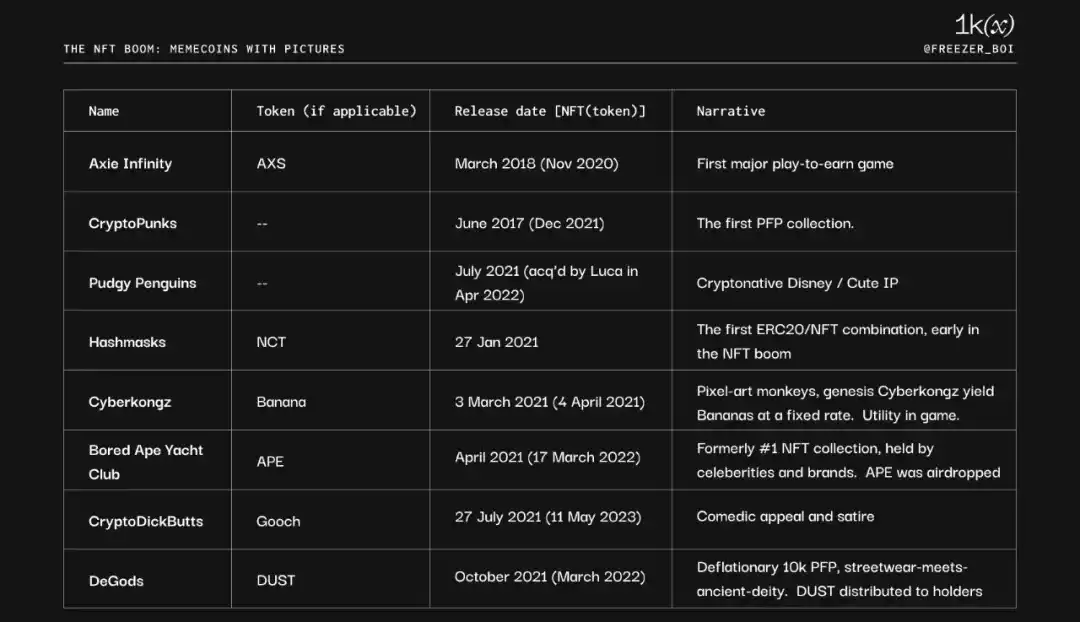

NFT Boom: "Meme Coins with Pictures"

With the introduction of the ERC721 standard and general-purpose markets like OpenSea, NFTs created a new class of crypto assets—unique visual representations of culture or memes.

Some of the most notable NFTs include: CryptoPunks, Bored Apes, Squiggles, and Pudgy Penguins. NFTs serve as profile pictures on platforms like Twitter and Discord, spreading virally as users adopt them as identity markers. These PFPs represent status and membership in a "cultural club." Many collectors became wealthy, yet selling their NFTs could mean "leaving the community." To reward loyal holders, several NFT projects issued their own "Meme coin" (ERC20), providing liquidity, utility, and a cultural currency tied to the NFT.

Examples from this NFT era (and their associated Meme coins) include:

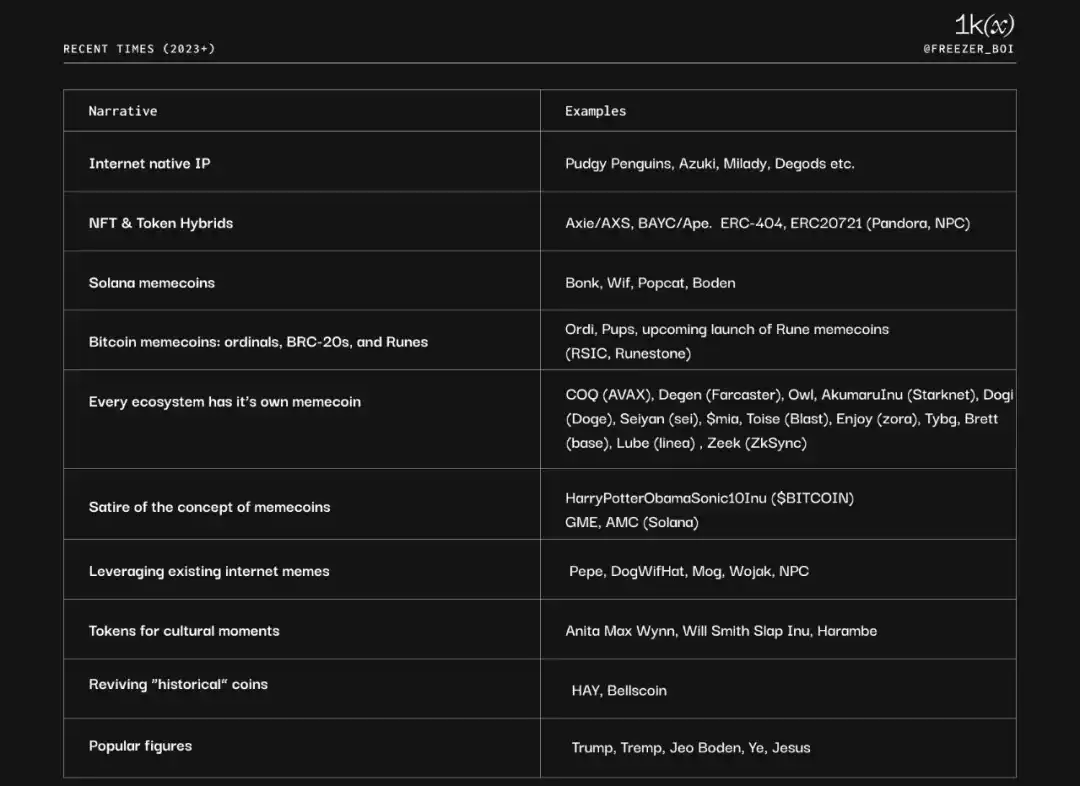

Recent Developments (2023+)

As crypto recovers from the bear market, new memes, cultures, ideas, and ecosystems continue to emerge. Meme coins remain one of the few asset classes sustaining consistent attention—whether measured by trading volume, market cap growth, or social interest—with interest recently surging.

Recent Meme narratives include:

Common Patterns

Meme coins appear in every cycle: Depending on underlying technology, Meme coins take different forms—PoW coins, ERC20s, NFTs—and are often among the earliest applications of new technological paradigms.

Despite differing mediums, their value accrual is the same: They all rely on attention, narrative, and hype to survive and spread. While new mediums spark initial excitement, long-term value requires sustained attention. Simply turning something into an NFT isn’t enough; merely creating an Ordinal isn’t enough. Attention is highly cyclical—after the first wave of hype around a new medium fades, deeper drivers of attention are needed.

Meme first, coin second: For the most successful Meme coins—like doge, pepe, and dogwifhat—the internet meme came first; the coin simply leveraged existing meme popularity for propagation.

Crypto-native memes are just beginning: Crypto natives are now creating memes that successfully spread beyond web3 circles. A prime example is the rise of crypto-native intellectual property, particularly NFT projects like Pudgy Penguins.

Low price as meme: Since the early days of altcoins, users have favored speculating on tokens with low nominal prices (due to high supply). There's psychological appeal in the idea that a seemingly insignificant token reaching $1 could make holders instant millionaires. Thus, the price itself becomes a meme.

Strong community + marketing: Meme coins require a strong community, founder, or "spokesperson" to generate content, promote the brand, and spread the meme.

From organic growth to professional operations: The first wave of Meme coins was relatively primitive—often fair launches with no team allocations. While this approach has benefits, it also brings risks like rug pulls and theft. An emerging solution is dedicated teams driving ecosystem development around Meme coins, as seen with PFP projects.

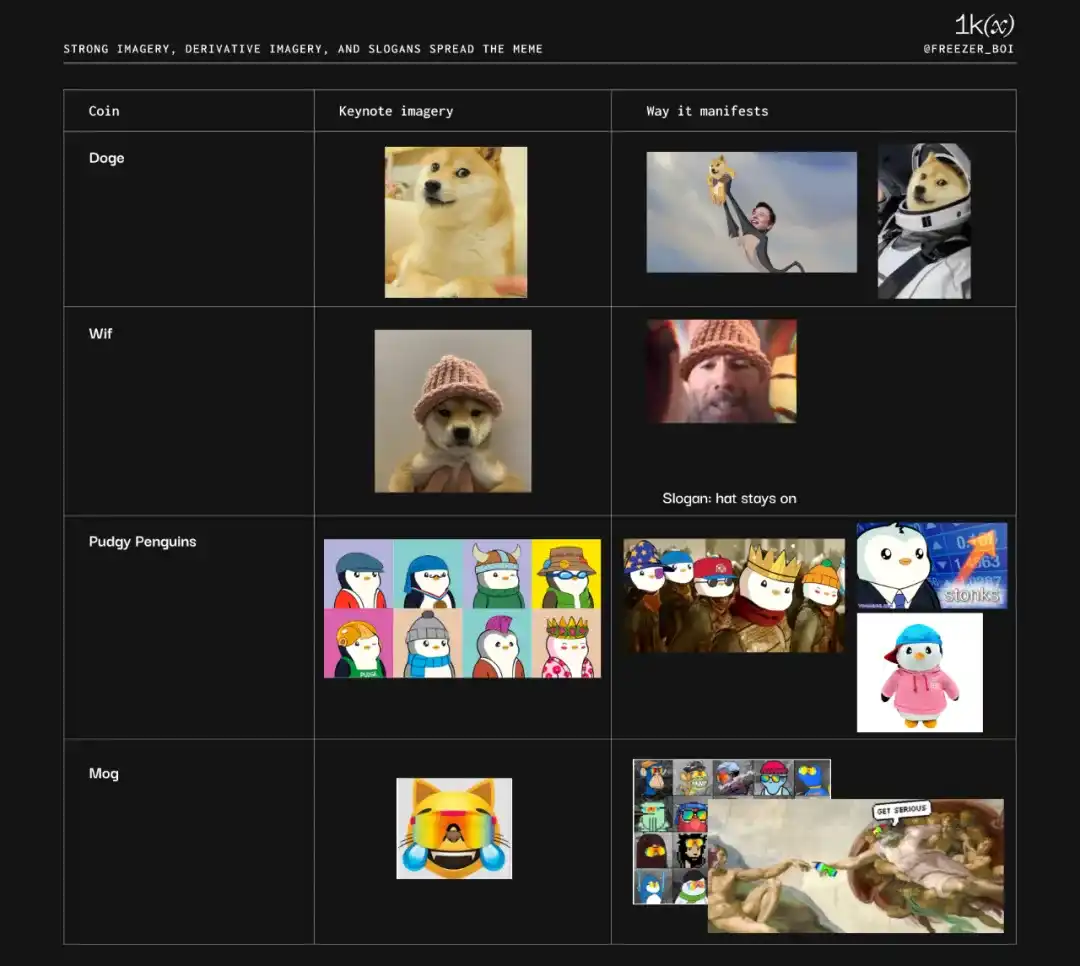

Using strong imagery, derivative visuals, and slogans to spread memes: Imagery is the primary vehicle for meme propagation on social networks. Typically, it starts with a core symbol and evolves through various reinterpretations.

Opportunities

With a total market cap exceeding $60 billion and daily trading volume surpassing $13 billion, Meme coins represent substantial financial value.

Since the sole function of a meme is to spread from mind to mind, identifying the next big "meme" early can be highly profitable. Creators and investors "work for the meme" by amplifying its reach, earning rewards as early believers.

Whether viewed as a lottery ticket to wealth, a way to follow a specific KOL, or a bet on social trends, Meme coins have experienced explosive growth since the dawn of crypto.

Criticisms and Risks

Despite abundant opportunities, Meme coins come with significant risks. Many attract users seeking effortless, instant wealth—treating them as lotteries or gambling.

Another common issue is "rug pulls" and "pump-and-dumps," which occur almost daily in the Meme coin space. According to a recent report by blockchain analytics firm CipherTrace, rug pulls accounted for 99% of all crypto scams in 2023, resulting in $2.1 billion in losses. Therefore, scrutinizing key features of a Meme coin is crucial—such as LP token status (burned or centrally held?), team allocations, transfer taxes, and whether contract permissions have been renounced.

Additionally, Meme coins face regulatory uncertainty. The most prominent regulatory action occurred in June 2021 when Thailand’s Securities and Exchange Commission banned tokens "without clear purpose or substance" whose prices were driven by social media trends and KOLs.

Another major risk—setting aside malicious intent—is that memes may simply fail to "survive" due to lack of interest, attention, or emotional resonance. Such failures can leave behind hostile or apathetic holder communities, leading to significant investment losses.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News