Foresight Ventures: Undercurrents in Crypto – Traditional Capital May Be Moving Into RWA

TechFlow Selected TechFlow Selected

Foresight Ventures: Undercurrents in Crypto – Traditional Capital May Be Moving Into RWA

The main theme focuses on AI, MEME, and the SOL ecosystem. BTC saw a significant pullback this week, with spot ETFs experiencing net outflows.

Author: Mike, Foresight Research

A. Market Outlook

I. Macro Liquidity

Monetary liquidity has improved. The Fed turned dovish in this week’s meeting, signaling three rate cuts for the year, prompting markets to increase their bets on looser policy. Markets expect the Fed to slow quantitative tightening starting in May and fully end it by February next year—a period expected to coincide with the biggest investment market tailwinds. Japan's central bank raised interest rates for the first time in 17 years. U.S. equities remain near highs with volatility, while the crypto market followed a similar correction before rebounding.

II. Overall Market Performance

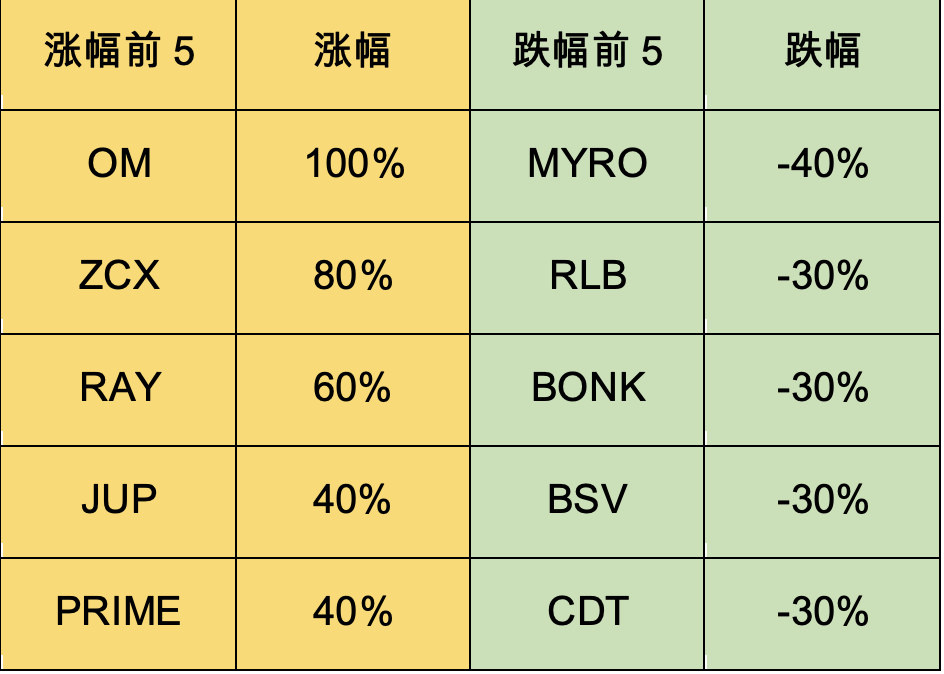

Top 100 gainers by market cap:

Main themes center around AI, MEME, and Solana (SOL) ecosystem. BTC experienced a sharp pullback this week, with spot ETFs recording net outflows. Market momentum shifted toward Meme coins and the Solana ecosystem. The Solana chain is exhibiting an ETH-like ICO rally from 2017, absorbing capital flowing out of BTC into altcoins. This recent surge in low-cap "dog coins" serves as a small preview of the full bull-market zoo cycle.

1. BOME: Launched by Pepe Meme artist Darkfarm, BOOK OF MEME surged over 1000x within three days of launch and was listed on Binance, triggering a wave of Meme presales on the Solana chain. BOME can be seen as a permanent library for storing Memes, with plans to expand into a suite of Meme creation tools. However, increasing scams ("rug pulls") are emerging on the Solana chain. Any Meme that fails to list on major exchanges will likely devolve into a PVP (player-versus-player) bloodbath.

2. JUP: Benefiting from the surge in speculative trading on Solana, Jupiter is a transaction aggregator on the Solana network handling over half of its trading volume. The protocol has expanded horizontally by launching a token launchpad and incubator platform.

3. POLYX: BlackRock launched its first tokenized fund on the Ethereum chain, with plans to tokenize real-world assets such as real estate. Polymesh is a Substrate-based public blockchain specifically designed for securities tokenization. However, it faces significant regulatory hurdles globally, limiting its ability to tap into global liquidity advantages.

III. BTC Market Analysis

1) On-chain Data

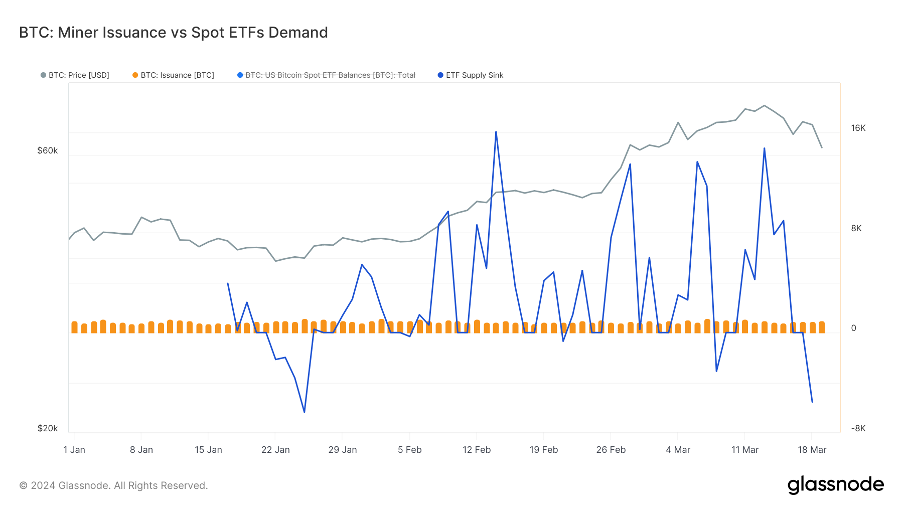

What’s different about this BTC cycle? As the halving approaches, the impact of newly mined BTC entering circulation becomes increasingly negligible compared to growing ETF-driven demand. The amount of BTC withdrawn by ETFs exceeds several times the daily issuance of new BTC. Currently, miners bring approximately 900 BTC to market each day; after the halving, this will drop to 450 BTC. Under past market conditions, this reduction could amplify BTC scarcity and drive prices higher.

Stablecoin market cap remained flat week-on-week, with slowed off-exchange capital inflows. Algorithmic stablecoin USDE rapidly surpassed $1 billion in supply, driven primarily by a 60% staking yield.

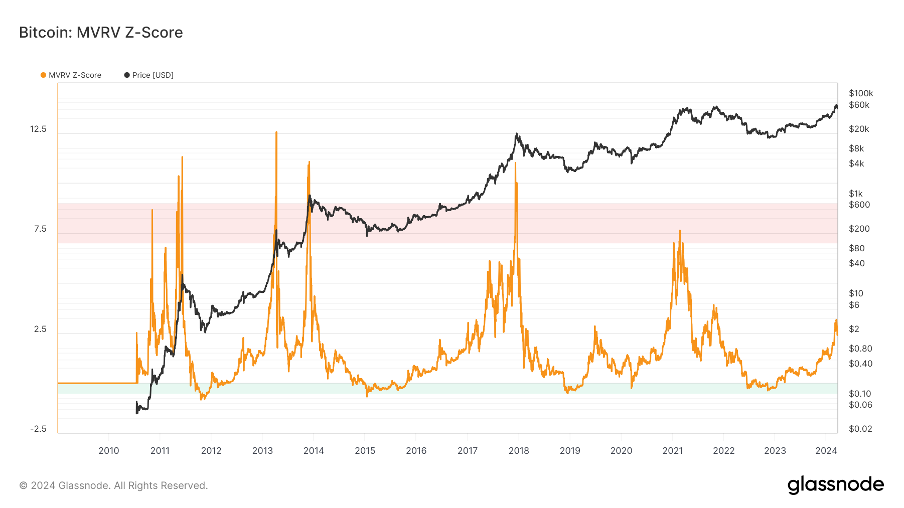

The long-term trend indicator MVRV-ZScore measures overall market profitability based on total cost basis. A reading above 6 indicates a top zone; below 2 signals a bottom zone. The MVRV has dropped below the critical level of 1, meaning holders are generally underwater. The current reading is 2.8, indicating a neutral mid-range phase.

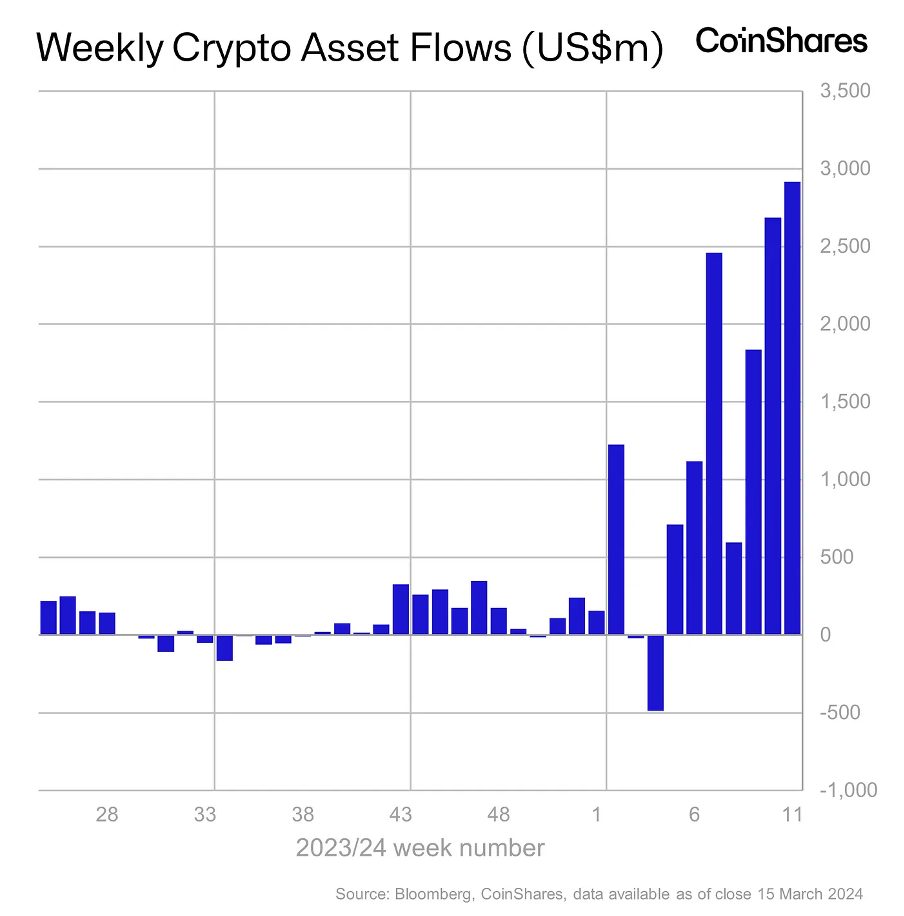

Institutional capital continued net inflows, reaching a new weekly high.

2) Futures Market

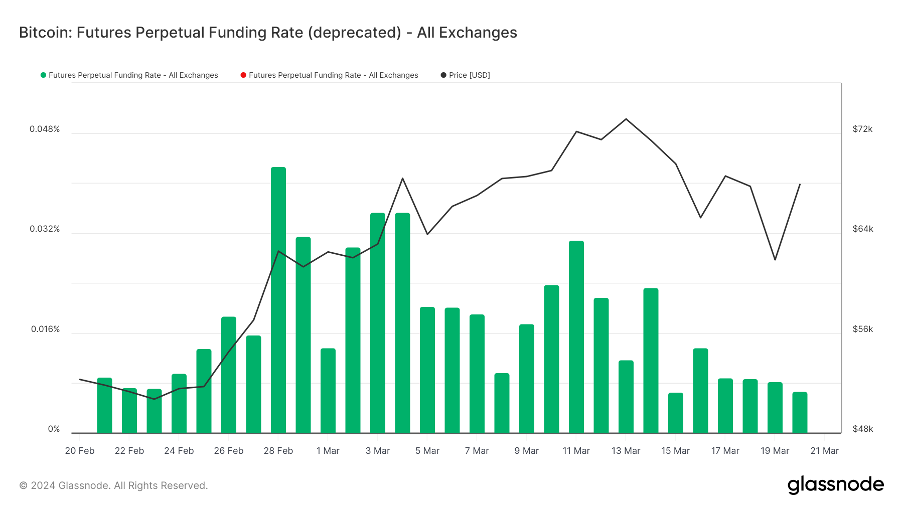

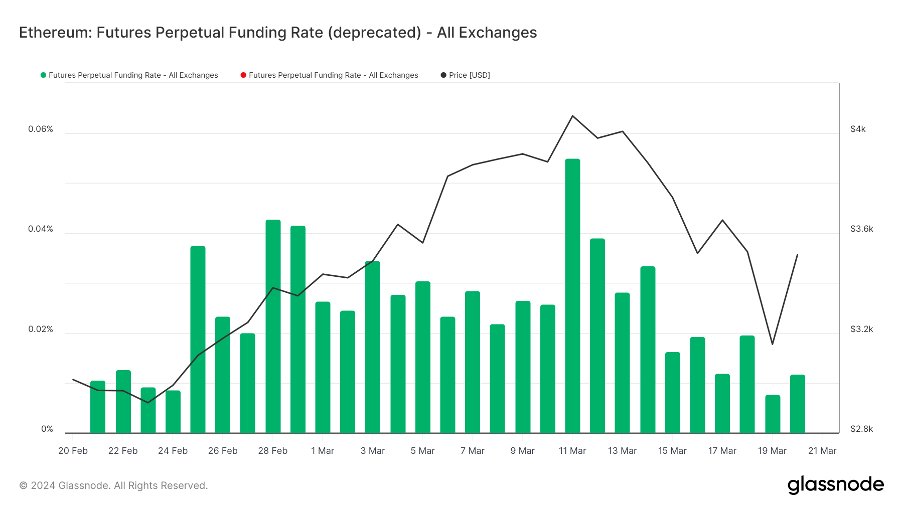

Funding Rates: Rates normalized this week. Rates between 0.05–0.1% indicate excessive long leverage, often marking short-term market tops. Rates between -0.1–0% suggest heavy short leverage, typically signaling short-term bottoms.

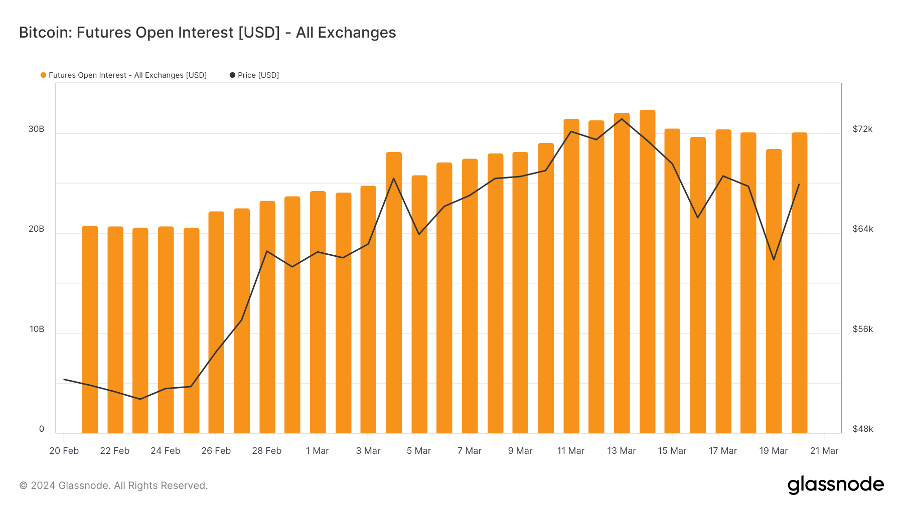

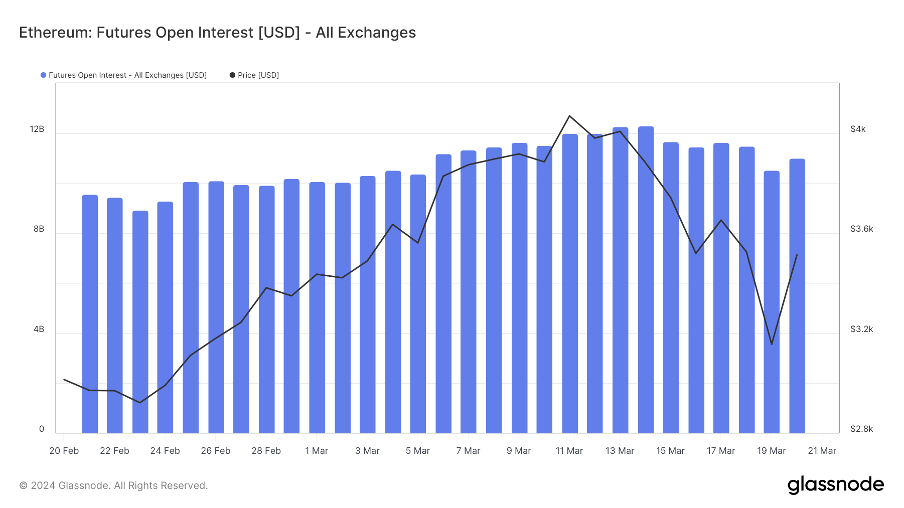

Open Interest: BTC open interest declined alongside price corrections this week.

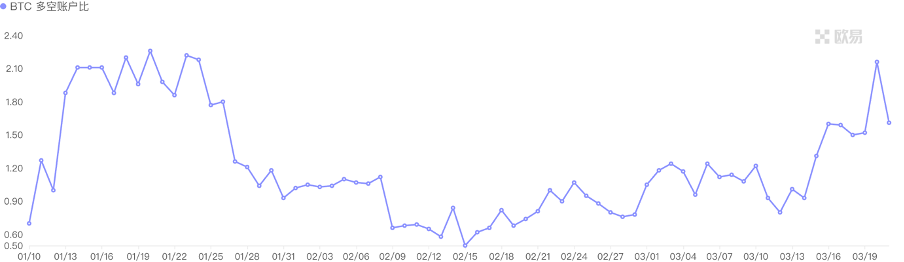

Long-to-Short Ratio: 0.8, indicating normal market sentiment. Retail sentiment often acts as a contrarian indicator—ratios below 0.7 signal fear, while above 2.0 suggest greed. However, due to high volatility, the reliability of this metric is weakened.

Long-to-Short Ratio: 1.2, indicating normal market sentiment. Retail sentiment often acts as a contrarian indicator—ratios below 0.7 signal fear, while above 2.0 suggest greed. However, due to high volatility, the reliability of this metric is weakened.

3) Spot Market

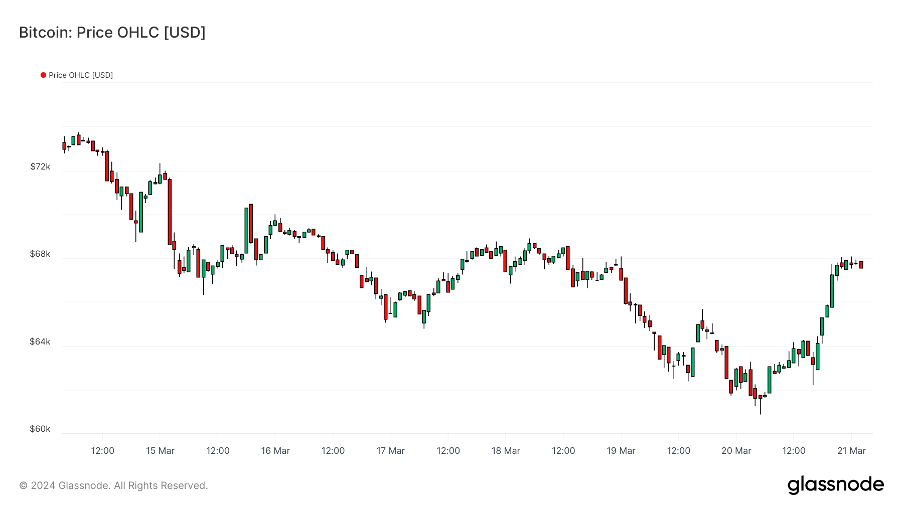

BTC endured a turbulent week, rallying to new highs before sharply correcting. Funding rates returned to healthier levels following the liquidation of excessive leveraged positions. Historically, bull markets see an average of seven major corrections, each ranging 20–30%. After the first major correction, capital typically rotates from BTC into altcoins, suggesting stronger performance from altcoins going forward.

B. Market Data

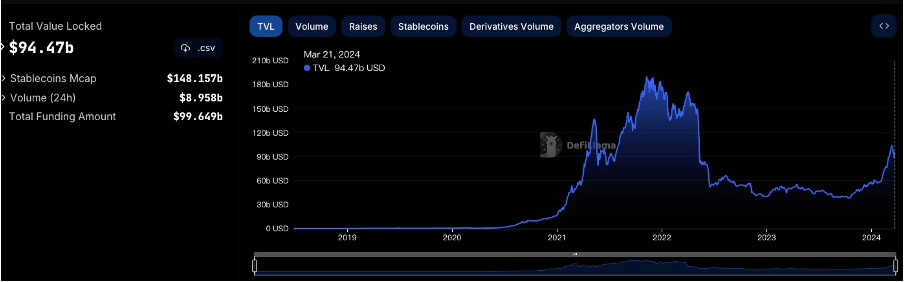

I. Total Value Locked (TVL) Across Chains

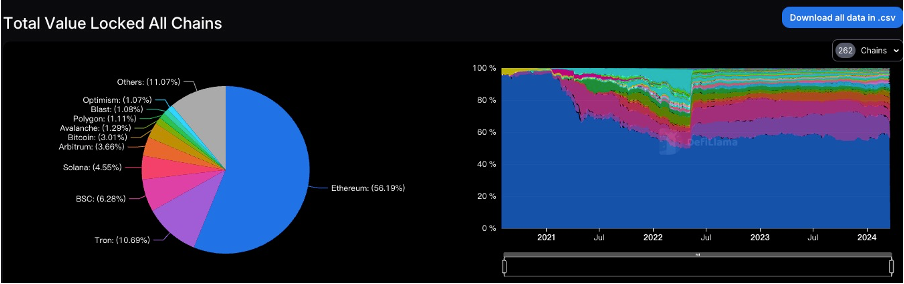

II. TVL Distribution by Chain

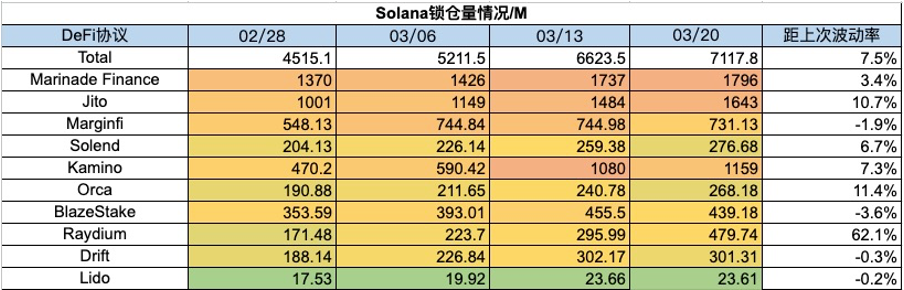

This week’s total TVL stood at $94.5 billion, down $8.4 billion (8.2%). BTC corrected nearly 20%, finding support at $60,000 with strong upward momentum. All major chains saw declines except Solana. Solana has emerged as the hottest chain recently, up 6% over the past week and surging 85% over the last month. In contrast, Ethereum has been sluggish—down 14% this week. Polygon fell 15%, while OP, BLAST, and ARB each dropped around 9%. BSC declined 7%, and TRON fell 8%.

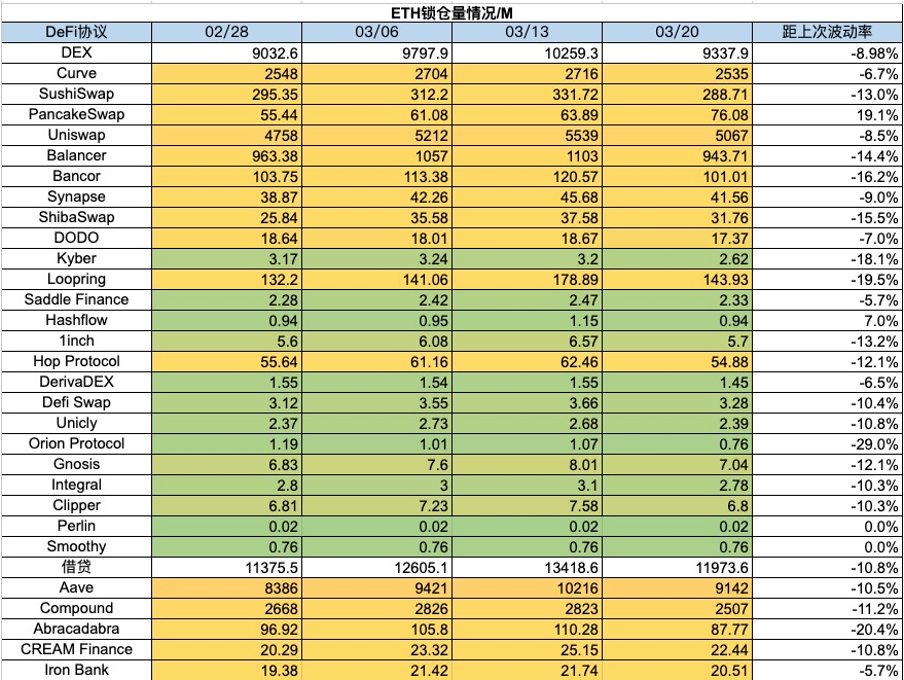

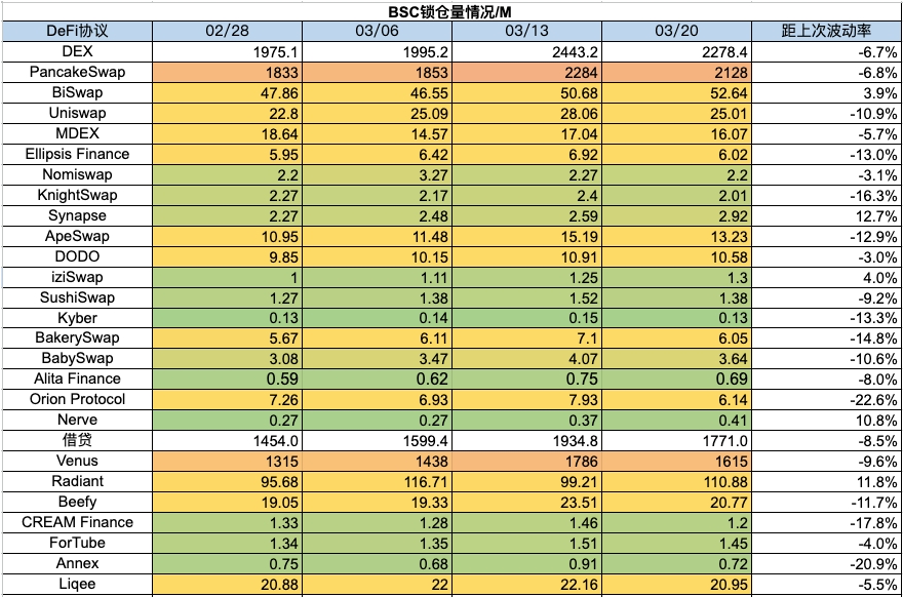

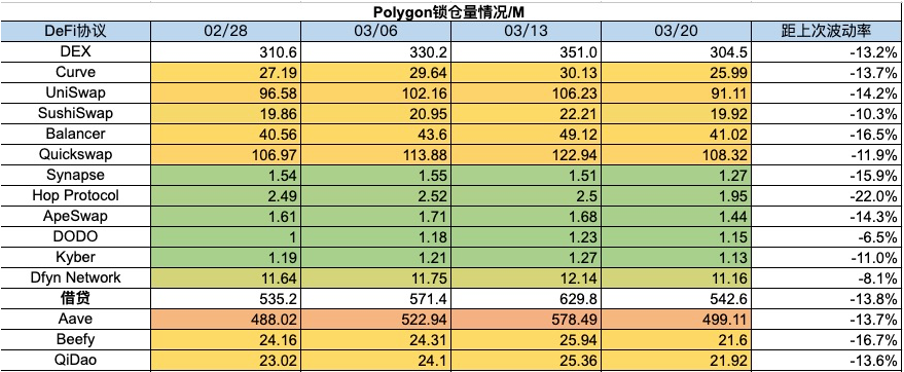

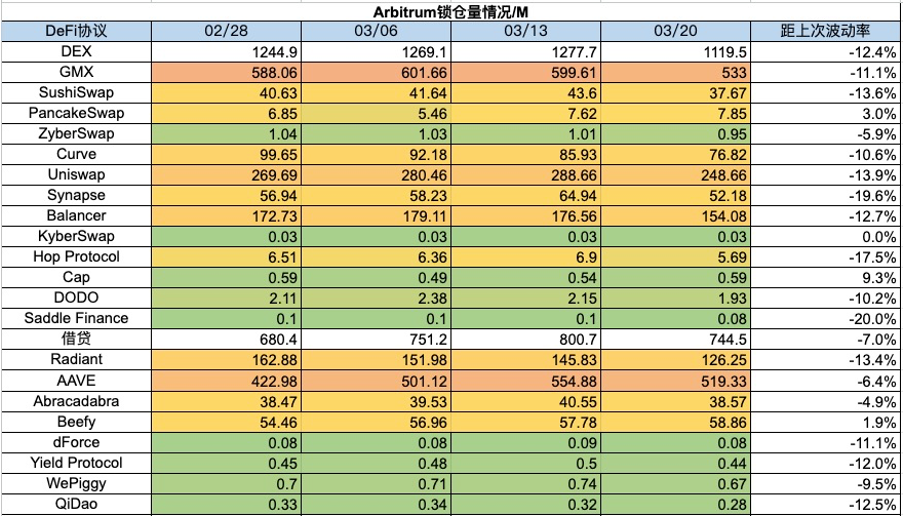

III. Protocol-Level TVL by Chain

1) Ethereum TVL

2) BSC TVL

3) Polygon TVL

4) Arbitrum TVL

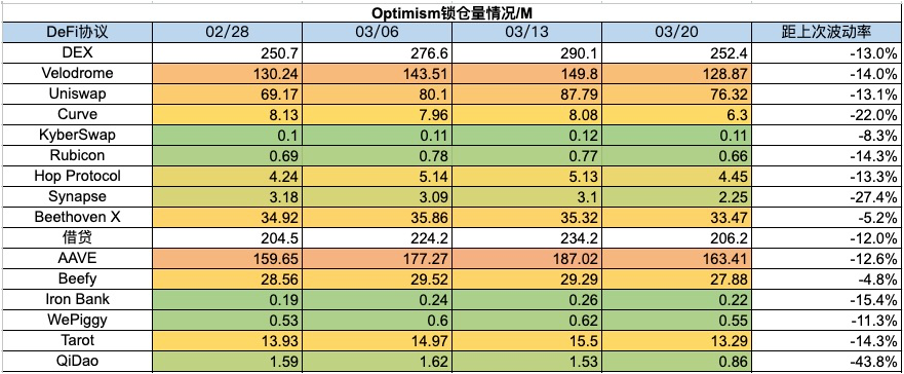

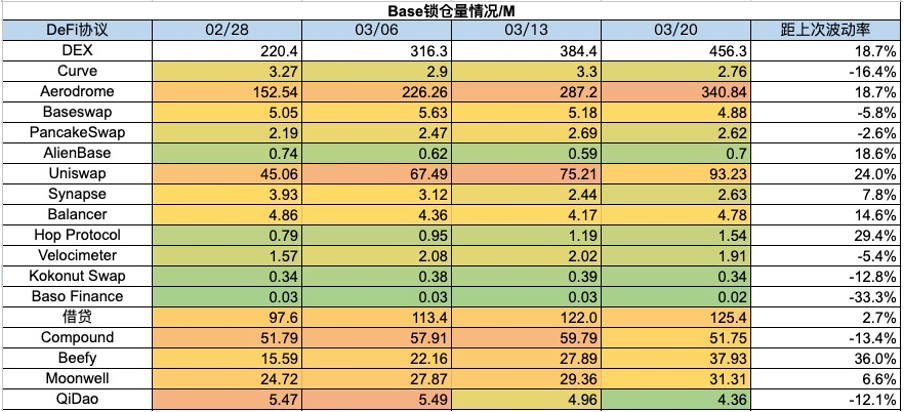

5) Optimism TVL

6) Base TVL

7) Solana TVL

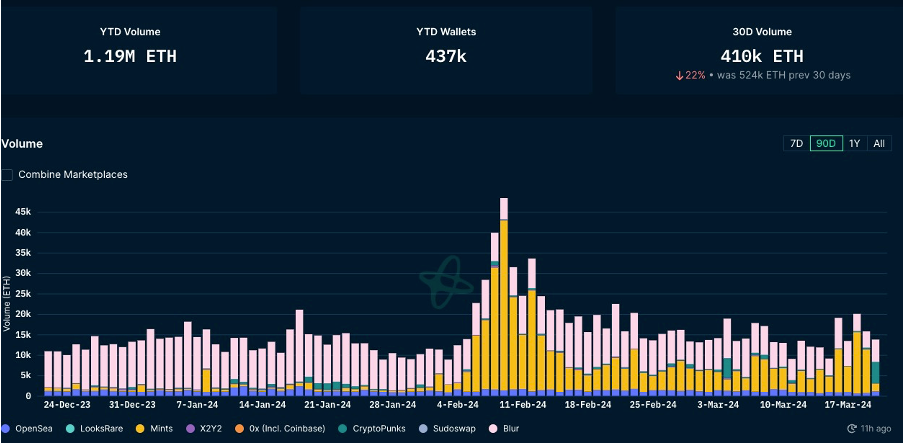

IV. NFT Market Data Trends

1) NFT-500 Index

2) NFT Market Overview

3) NFT Marketplace Share

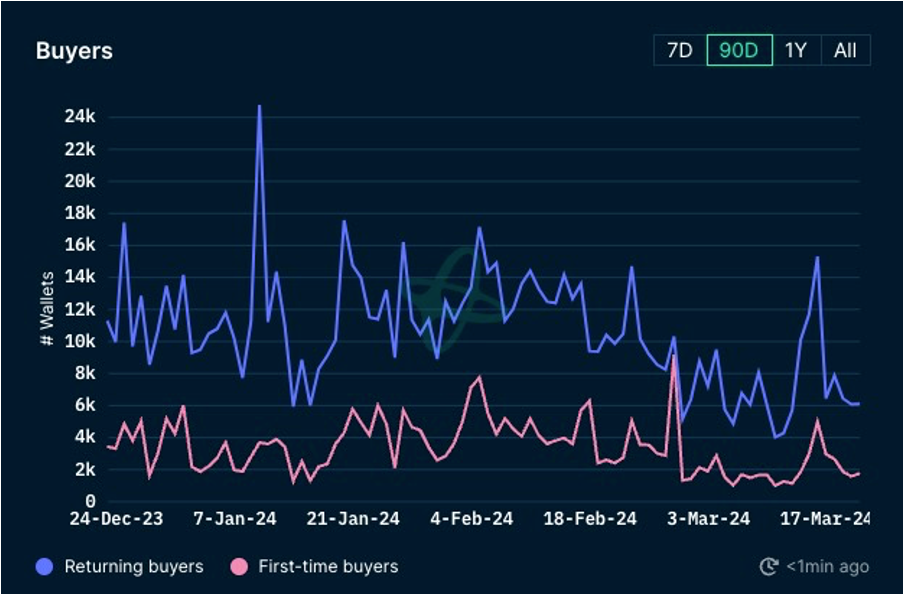

4) NFT Buyer Analysis

Blue-chip NFT floor prices showed mixed results this week, with limited volatility. BAYC down 4%, MAYC up 2%, CryptoPunks up 7%, Azuki up nearly 3%, Pandora down 2%, Milady up 6%. The broader NFT market continued to decline, now reaching its lowest level in the past year. While total NFT trading volume saw a slight rebound, both first-time and repeat buyer counts remain stagnant. Despite the ongoing bull market narrative, the NFT sector remains depressed.

V. Latest Project Fundraising

VI. Post-Investment Updates

1) Space Nation — GameFi

Space-themed Web3 MMORPG game Space Nation released a teaser trailer for its upcoming title Space Nation Online. The game features four main factions, powered by the Unity engine, and includes both PvE (player versus environment) and PvP (player versus player) modes. Space Nation Online is scheduled to launch a closed PC beta on April 1st, followed by a soft launch later in summer, with a global release planned for fall across PC and mobile platforms.

Previously, Space Nation Online announced plans to advance its AI+Web3 universe over the next year, redefining how players interact with MMOs through AI-generated personalized storylines, delivering immersive interactive experiences.

2) Node Guardians — Infrastructure

Node Guardians v1 is即将 launching, offering an immersive gamified experience for experienced smart contract developers to master Solidity and Zero-Knowledge DSL.

Node Guardians has collaborated closely with L2s such as Starknet, Aztec, Optimism, and Arbitrum, helping hundreds of developers enhance their skills.

3) Ether.fi — Non-custodial Liquid Staking Protocol

ETHFI has completed its airdrop distribution and been listed on Binance. According to the disclosed tokenomics, ETHFI has a total supply of 1 billion tokens, with 115.2 million in circulation. Token allocation includes 2% for Binance Launchpool, 11% for airdrops, 32.5% for investors and advisors, 23.26% for the team, 1% for Protocol Guild, 27.24% for DAO Treasury, and 3% for liquidity provision.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News