Interview with Dr. Ernst Friederike, Gnosis Co-Founder: Stories and Wisdom from the Entrepreneurial Journey

TechFlow Selected TechFlow Selected

Interview with Dr. Ernst Friederike, Gnosis Co-Founder: Stories and Wisdom from the Entrepreneurial Journey

Dr. Frederike shared her transition from academia to crypto entrepreneurship, along with some insights into the current development of crypto infrastructure.

Interview: Sunny, TechFlow

Guest: Dr. Ernst Friederike, Co-founder of Gnosis

"We don't envision a solitary island building skyscrapers, but rather an archipelago composed of multiple islands—some with low-rise buildings, others high-rise—all interconnected and trustworthy."

-- Dr. Ernst Friederike, Co-founder of Gnosis

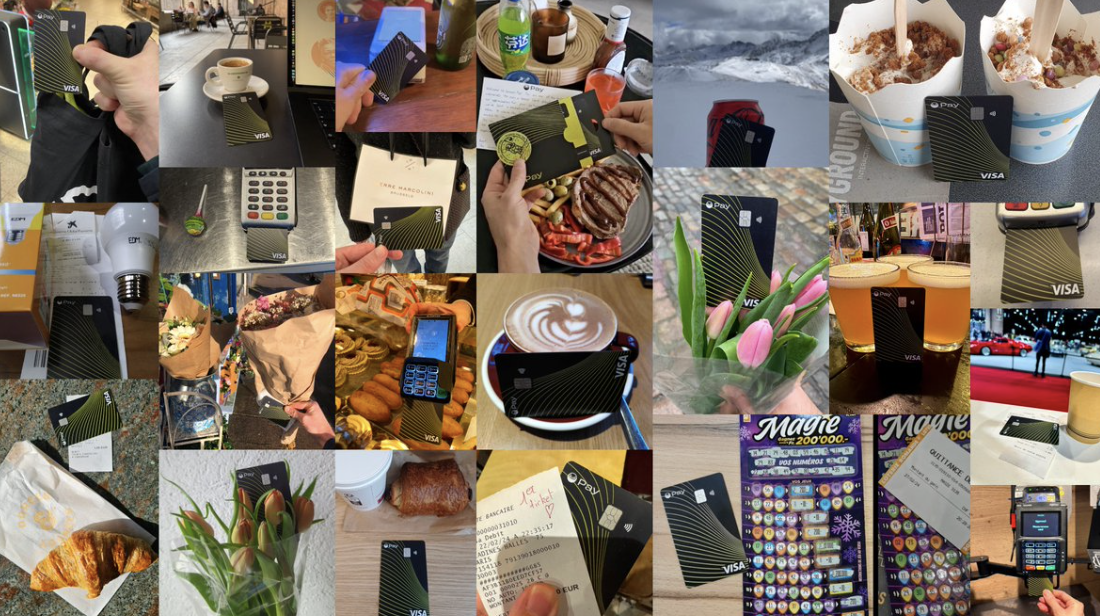

Two weeks ago, Gnosis began distributing crypto savings cards to early users (see image below). This marks Europe’s first major compliant payment application launch following the recent wave of similar products in Asia and America (refer to previous TechFlow article). Behind this payment product is Gnosis. If you haven’t heard of Gnosis yet, perhaps it’s time to do some research.

Two weeks ago, Gnosis began distributing crypto savings cards to early users (see image below). This marks Europe’s first major compliant payment application launch following the recent wave of similar products in Asia and America (refer to previous TechFlow article). Behind this payment product is Gnosis. If you haven’t heard of Gnosis yet, perhaps it’s time to do some research.

Beyond the crypto savings card, Gnosis’ Gnosis SAFE is currently the world's largest account abstraction wallet, boasting 6 million accounts, 30 million total transactions, and $7.3 billion in total value locked. These figures far surpass competing projects like Starknet and zkSync. Such user statistics reflect the team’s long-term dedication and deep product development. Gnosis' CEO and CTO were the second and third employees at ConsenSys, and the project was initially incubated within ConsenSys. Dr. Ernst Friederike of Gnosis is also one of the most fascinating figures in Western crypto circles.

She, Dr. Ernst Friederike (hereinafter referred to as Dr. Friederike), is also a co-founder of Gnosis. If you follow crypto podcasts, you may know that Dr. Friederike is one of the hosts of the renowned English-language podcast Epicenter, alongside Sunny Aggarwal, founder of DeFi protocol Osmosis. Her background is exceptionally unique—she holds a PhD in physics, served as a professor, hosts a popular podcast, identifies as a woman in crypto, and is among the founders of one of the largest projects in the space.

In the interview below, Dr. Friederike shares her journey from academia to crypto entrepreneurship, along with insights into the current state of crypto infrastructure development. Through her candid reflections, we can clearly see how multiple identity roles have shaped her into a successful female founder in the crypto industry.

Social media post about the Gnosis crypto savings card (Source: official Twitter)

Journey of Transformation: From Physicist to Co-founder of Gnosis

TechFlow: Given your academic background and entrepreneurial experience, I'm curious—what skills or experiences from your journey do you find most transferable or beneficial in Gnosis’ development? Additionally, could you elaborate on how your training and expertise as a physicist have influenced your problem-solving approach in blockchain technology and entrepreneurship?

Dr. Friederike:

Ever since I was young, I've loved inventing things, identifying problems, and building solutions. Becoming a physicist was a natural extension of that interest. I truly enjoyed being a physicist—formulating hypotheses, reading others' papers, designing my own experiments, collecting large datasets, then analyzing and performing statistical work on them. I know it sounds nerdy, but for me, it has always been incredibly engaging and fulfilling.

Accordingly, I spent a long time in university—undergraduate, graduate, PhD, followed by several postdoctoral research positions. Eventually, I secured a professorship at a European accelerator in Hamburg, Germany. Prior to that, I worked at SLAC at Stanford—not the communication tool "Slack," but the Stanford Linear Accelerator Center.

There were several things about academia that didn’t sit well with me. I found it quite restrictive, with many rules to follow. Fundamentally, the incentive to make discoveries for the benefit of humanity has always been central to science for me, but these two aspects weren't aligning well.

I mean, some people discover things purely for the joy of exploration, and I completely understand that. But there are also those who want to see their discoveries applied in ways that benefit society. Personally, I found my motivation leaning more toward application.

In academia, there's a tendency to inflate publication counts by fragmenting research findings across multiple papers instead of consolidating them into comprehensive works. I never liked that practice. However, I deeply valued the freedom academia offered. Fundamentally, you express interest, write a proposal, secure funding, and conduct research—without needing to pursue anything beyond your chosen path. While academia suited me well, I couldn’t imagine spending the next 40 years in that environment.

To put it bluntly, talent distribution in physics is highly uneven. Some individuals are vastly more capable than I am—by orders of magnitude. While I consider myself a competent physicist with strong mathematical skills, I’ve always maintained a broad skill set—I’ve always been a generalist.

I was fortunate to meet many brilliant physicists during my time at Columbia and Stanford. During my PhD years, I realized I would never become an outstanding physicist like them.

In fact, being a generalist suits me better than being a specialist or even an entrepreneur.

At the same time, I’ve known Gnosis co-founders Martin Köppelmann and Stefan George for a long time. We’ve consistently discussed crypto-related topics. From a technical standpoint, it was genuinely fascinating—all physicists can code, and their backgrounds are technical, mostly computer engineers. We kept discussing the field, its synergies, and what could be built on top of it.

Later, Martin met Joe Lubin (co-founder of Ethereum) at a Bitcoin meetup in New York. Joe said what they were building on Bitcoin was interesting, but suggested building on Ethereum instead. Martin asked Joe which was easier—but at the time, Ethereum hadn’t launched anything yet. Joe shared Ethereum’s whitepaper with him, and after studying it, we found it extremely compelling.

Afterward, Martin and Stefan joined Joe as the 2nd and 3rd employees at ConsenSys. Due to pregnancy, I had the opportunity to pause my academic work, and together we founded Gnosis as an independent company outside ConsenSys. That was where it all began. I gave myself a chance to explore whether this was something I wanted to pursue—or if I should return to academia.

Now, I’m still at Gnosis. Clearly, this path has been successful for me.

Gnosis: Building Infrastructure from the First Prediction Market on Ethereum

TechFlow: Could you elaborate on Gnosis’ evolution from its initial focus on prediction markets to broader ecosystem development, including projects like Safe Wallet and Cow Swap?

Dr. Friederike:

Initially, Gnosis aimed to build a prediction market platform—a system enabling information to be traded, with the goal of curbing misinformation, what we now call fake news. At the time, this term wasn’t common, but that was the original idea. As early participants—and actually the first application live on Ethereum—we had to build extensive infrastructure ourselves. We pivoted to focus on ecosystem infrastructure, which continued for years and led to key outcomes: Safe Wallet, Cow Swap, and Zodiac.

As founders, we’ve always considered how to achieve technical excellence while empowering people with autonomy to accomplish things independently. We remain committed to fairness. That’s why we built an MEV-resistant DEX in Cow Swap and a self-custodial wallet. Recognizing the importance of self-custody should be a higher priority because it reduces dependency on others. Theoretically, individuals should be able to choose to delegate custody to someone else and trust their decisions, but that shouldn’t be mandatory.

This philosophy has underpinned our work—it’s how we’ve spun out several ventures. Although Safe Wallet and Cow Swap remain closely aligned with our North Star, you can’t focus on too many things at once. Doing ten things simultaneously is the opposite of focus.

We identified individuals internally who were willing to lead these projects and granted them full autonomy. Through Gnosis DAO, we retained partial ownership. Operationally, we stay connected with everyone, but execution-wise, that’s no longer our responsibility—and everything has progressed very smoothly.

TechFlow: It's well known that you're skeptical about scaling via L2s. Could you explain why you believe L2s have limitations and why alternative solutions are needed?

Dr. Friederike:

A few years ago, we asked ourselves: “What does the ecosystem really need right now?” We were dissatisfied with the direction of the scalability discussion. Essentially, easier scaling mainly meant Layer 2s, while Layer 3s were seen as fallback options when L2s became congested or too expensive. From an engineering perspective, this approach unnecessarily limits scalability.

Looking back, there was a vision for scaling Ethereum through smart contracts—envisioning 64 private execution environments, conducting 1,028 different executions, all connected in a trustless way to form Ethereum collectively. However, this vision was delayed by five to ten years, shifting focus to Layer 2s to simplify usage on Ethereum.

The Cancun upgrade embodies this approach, making data storage and L2 availability cheaper and easier.

We find the original vision of interconnected, trustless shards highly appealing. While there's little debate about the necessity of L2s and beyond, we believe we need more trusted, interconnected chains with credible neutrality and high decentralization.

We envision not a single isolated island building skyscrapers, but an archipelago of multiple islands—some low-rise, others high-rise—all interconnected and trustworthy. The only trade-off is losing synchronicity; however, this asynchronicity is an inherent feature of such interconnected systems.

TechFlow: How does the decision to merge with the X Dai chain align with Gnosis’ vision for scalability and decentralization in the blockchain ecosystem?

Dr. Friederike:

For us, this wasn’t an unacceptable condition. Instead, we chose to merge with a well-known Ethereum sidechain—one of the earliest, called the X Dai chain. This chain was used for notable projects like the Burner Wallet.

Initially, X Dai was a highly centralized chain operating on a Proof-of-Authority consensus mechanism, with only 20 entities authorized to produce blocks. To address this, we followed a path similar to Ethereum’s transition from Proof-of-Work to Proof-of-Stake. We launched a beacon chain and focused on decentralizing the network as much as possible to attract home validators—individuals verifying transactions at home using simple devices. This significantly increased validator count from 100,000 to 170,000, roughly 20% of Ethereum’s total validator count.

While our chain may not be as decentralized as Ethereum, it remains highly decentralized and operates as an Ethereum secondary network. Additionally, we use ZK technology to build a trustless bridge to Ethereum, ensuring interoperability and maintaining compatibility with Ethereum smart contracts.

Building On-chain Payment Networks Using Gnosis Infrastructure

TechFlow: What’s next for Gnosis? You’ve launched the Gnosis crypto savings card for crypto users. Is decentralized payments the next mission?

Dr. Friederike:

Once we’ve built this infrastructure, we consider what comes next. We focus on current infrastructure development and explore use cases that can have real-world impact. In the past, using Web3 products was extremely challenging. Though tools now exist to simplify this, it’s still difficult for many. But we believe the right mindset can make it easier. We asked ourselves: Where can we add the most value? What’s the lowest-hanging fruit? That led us to payments.

In crypto, we often refer to peer-to-peer cash transactions, but in reality, most ordinary people use payment services like Venmo, WeChat, or PayPal. While the payment use case is relatively simple compared to others, we recognize that placing it on a decentralized layer could greatly benefit most people. In Northern Hemisphere regions, payments usually aren’t a bottleneck because most people have access to low-cost, reliable options. However, in high-inflation countries like Argentina, Brazil, or Turkey, people seek alternatives, such as holding U.S. dollars. This seems disconnected from the Web3 world, where holding stablecoins requires almost no effort. We believe opening these options and bridging Web3 and traditional payment systems is crucial.

For example, in Europe, we’re familiar with IBANs. In principle, we could offer wallets with IBANs, allowing users to receive funds directly and conduct separate transactions within the wallet. All the infrastructure is already ready—we just need to build a new on-chain bank offering products traditional banks cannot. This includes international remittances at dramatically lower costs compared to conventional methods like Wise. Similarly, “accredited investor” rules act as gatekeepers, preventing certain individuals from investing in specific instruments regardless of their knowledge. Our goal is to democratize banking services and provide dollar accounts for the unbanked.

We’ve partnered with Visa, enabling users to hold funds in their own wallets and make payments anywhere Visa is accepted—including over 100 million merchants worldwide. However, to make this accessible to average users, we need to drastically improve user experience. Current complexities, like managing private keys, aren’t suitable for the next billion users. With current abstraction and technical tools, we can greatly enhance UX.

In short, we’re currently building the infrastructure for decentralized payment networks, bridges connecting to traditional payment systems, and wallets enabling access to these services. These wallets should feel familiar to anyone accustomed to using Wise, Revolut, N26, or Monzo.

TechFlow: How will Gnosis’ payment solution overcome adoption barriers in cryptocurrency?

Dr. Friederike:

That’s the challenge—we must build it so these barriers disappear.

Fundamentally, tools like Monerium allow you to assign an IBAN to a wallet, making it much simpler. You can send euros from your Wise, Revolut, or other account to an IBAN, and it appears in your wallet. You don’t need to go through any centralized exchange or give up custody of your assets.

I think saying “people should use crypto” is somewhat inaccurate. I don’t believe people should be required to use crypto or understand how to use it. For me, it’s about building better technology than what we currently have. Just as you wouldn’t want people to understand TCP/IP just to browse the internet, you shouldn’t expect them to understand crypto—or even know it’s crypto.

You simply build a product that uses this crypto technology. Because it leverages this technology, it can outperform equivalent Web2 products. My view is that, based on account abstraction principles, registration should be possible via email or phone number. Every time you log into your wallet, passive verification through biometrics can be added. You shouldn’t need to remember passwords or private keys. That should remain an option—if you choose to, you can retrieve your laptop password—but no one should be forced to.

Ultimately, making this technology easy to use is something our ecosystem must achieve. Sometimes we almost treat difficulty as a badge of honor—believing that because we can use it, we’re special. I think that’s wrong. It means we need to improve user experience.

I believe features like easy onboarding, social recovery, institutional recovery, and GAS abstraction should become standard in Web3 applications. Whenever you surf the internet, you incur some cost; if you search Google or use Google Cloud, there’s an actual cost involved.

Of course, searching Google for “what to do in London this weekend” might be a service you receive, but they’d never bill you “you generated 3 cents in cost for us—please pay.” Their business model is primarily ad-based—they sell ads, and when you search “things to do in Hong Kong this weekend,” they sell ad space to providers actually offering services there. They pay to show you those results. Thus, Web2 services effectively abstract the business model away from the customer.

I believe Web3 should follow the same path. You shouldn’t say, “Okay, I’ll pay 3 cents to send this transaction.” If commercially it makes sense—because it provides you a service and you bear the cost—then it should be included in that service, which is exactly what gas abstraction enables. They say, “We’ll cover your gas costs and compensate elsewhere.” Then, there are features batching transactions together.

When you use Web3 products today, it’s “approve this, now transact, now re-approve.” We can’t roll this experience out to regular users. Integrating these functions into seamless batches—like the smooth experiences we get from mobile apps and today’s internet—is where we need to be.

We don’t need to convince people to use crypto, just as we don’t need to convince them HTTPS is better than HTTP. App developers need to use better tech, but in a way that hides the massive backend improvements. It should just make the experience better. I think that’s where we must get to.

Basically, if you look at today’s ecosystem, a large portion revolves around speculation. That’s fine—people should be allowed to speculate on anything. But as an ecosystem, I think we should aim higher.

We can’t just say we’re meme coins. I believe crypto’s original promise was to create a better internet and better societal systems. We must make that real. I think this is what people working in the space for a while complain about. In the early days, cypherpunks believed you should be able to use any crypto tech you want, have peer-to-peer cash, etc. I think that ethos got overshadowed by crypto-bros who thought, “We arrived early, so we deserve rewards.” But the real ethos should be, “We can build something better than what we have now.” I believe this spirit must exist for crypto to endure long-term.

Because if the “early mover” advantage no longer works, and everyone interested has already joined, then no one brings new ideas. Providing real utility is absolutely essential. That’s what we need to do.

TechFlow: Do you think supply-driven approaches (builder-driven) are currently more important than demand-driven ones in building the internet of value? We don’t have many altruists like Jeff Bezos or visionaries sharing grand visions, nor effective accelerationism. I understand this skewed distribution. Do you think pushing industry progress from the supply side is more critical?

Dr. Friederike:

I think a big part comes down to funding. There are many idealists, but few who are both idealistic and skilled at building businesses. It’s about sticking to your vision, embracing it, and leveraging it to generate revenue. That’s how you get others to invest in you; otherwise, if you’re not turning it into a business, they’re just donating. People who have ideas and are great entrepreneurs are rare.

Part Four: Advice for the Young

TechFlow: I think your journey is a great example. Transitioning from academia to entrepreneurship, you gave yourself a year. You showed remarkable patience and calmness in taking risks. I find that deeply admirable. What qualities do you think an idealist—a person who truly gets things done—needs to become a great entrepreneur?

Dr. Friederike:

I think that’s a great question—I actually need to think deeper about it. One issue is that saying “I want to make money” carries shame, especially in left-liberal circles, where it’s seen as forbidden. But I don’t think there’s anything wrong with it. That mindset needs to shift. You can be thoughtful and also want to make money.

I think it’s a cultural issue—I’m not entirely sure. And I wonder how this differs across countries, having visited China, Taiwan, Hong Kong, and others many times. I think it’s quite different. What about London versus Hong Kong? Do you see differences?

TechFlow: For me, I really like London. There’s an atmosphere. You can think freely, and you actually meet many interesting people striving to realize their ideas. Compared to the U.S., London is somewhat conservative. People care about real problems, not just opportunities. But London has potential—an untapped potential somewhere in the UK. In Hong Kong, capital is certainly more abundant, but people don’t truly have the freedom to think. You need an environment with less peer pressure and higher freedom—where you can think freely, speak openly, and have sufficient capital. That’s what we see in the U.S. But in Asia, I think the hunger for money is very strong. We operate in survival mode, not in a mindset of changing the world.

Dr. Friederike:

Perhaps the universal principle at play is the philosophy of abundance—that “there is enough, you have enough.” With sufficient resources, you have enough—you don’t need to fight for survival. Fundamentally, it’s not a zero-sum game; giving something to someone doesn’t necessarily mean you lose. Maybe that’s post-scarcity thinking. Perhaps there’s a connection here.

TechFlow: I really envy European founders—they truly have free thinking... it’s amazing. I attended the Berlin DeSci conference. It felt like going to university, attending lectures—very cyberpunk, very idealistic, filling yourself with the bloodlust to create things. As for me, I’m still considering whether to combine my biology background with blockchain to do something interesting.

Dr. Friederike:

I think it’s a fantastic area, especially synthetic biology, longevity research, what VitaDAO is doing, and the entire open science movement. I find it very powerful and incredibly exciting.

Also, I think something often underestimated—and I didn’t appreciate enough when we started—is having people you collaborate with well, where you can share wild ideas without diminishing each other’s worth. It’s a bit like finding the right marriage partner. I don’t think you consider that at the time. But over the years, I’ve seen many founders split up, some very messily. I didn’t cherish that enough then, but I really enjoy working with Martin and Stefan because we share the same mindset.

More Q&A About Dr. Friederike

TechFlow: Were you a cypherpunk during university?

Dr. Friederike:

When I was in school, I read a book by Simon Singh about cryptography. I thought it was so cool—the coolest thing. What you can do with math is just insane. That was magic. I was probably too young to be among the original cypherpunks, but the ideals are definitely similar—I think yes, absolutely.

TechFlow: You understand languages, math, physics. What specific aspects of cryptography opened your eyes? What made you choose this field over physics?

Dr. Friederike:

For me, it was the idea that you can coordinate with others in a trustless way, without a central agent deciding who’s right or wrong. To me, that opened doors to many new technologies. I mean, cryptography is truly a gift that keeps giving. The zero-knowledge proofs we have today are magical, and fully homomorphic encryption will be even better—being able to prove you are someone or that your funds are legitimate without revealing where they came from.

I think this is very important. And if you look at how technology evolved, in the beginning, the internet was very collaborative, and few business models were built around it. Now, if you look at how internet companies make money, it’s data. We’ve grown accustomed to our data being mined and used, powerless to stop it. I don’t think it should be this way. If people want to use crypto to protect themselves, it should be easy. Obviously, if you want, you can sell your data. You can sell your blood too, if you wish.

But I think it should be a conscious choice, not something abstracted away from you, saying, “Look, I want sovereignty over my data, over my communications. I don’t want Google reading my emails and showing me ads based on what I wrote to friends.” I think this has become normalized—even bank account data. Banks even grant anonymized access to data mining firms to analyze consumer behavior. They won’t know it’s you, but they’ll know a 22–30-year-old in London shops at Pop Shop and Sephora, then analyze it. I don’t think this should exist.

I think people should learn more about this. If they find it concerning, they should be protected, because you can easily manipulate people—that’s what we saw in the entire Cambridge Analytica scandal. If you micro-target people enough, everyone has a button you can press.

In a world where our data is fair game because it’s unprotected and unencrypted, I think we can actually build a better internet. We absolutely can leverage this to build a better internet and a better world for ourselves.

I know it sounds a bit crazy, but I truly believe it’s real.

Further Reading: Link

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News