Which US stocks will outperform BTC as the crypto bull market arrives?

TechFlow Selected TechFlow Selected

Which US stocks will outperform BTC as the crypto bull market arrives?

This article reviews and analyzes data from the past year of the crypto bull market and explores the potential halving-driven market trends on the horizon.

By: RockFlow Universe

Key Takeaways

① Historically, Bitcoin halving events have triggered significant price volatility within a year before and after the event. In each of the previous three cycles, Bitcoin experienced substantial price increases. Following similar patterns, Bitcoin is highly likely to surpass $100,000 by the end of 2024.

② The latest crypto bull market began in 2022/23. Bitcoin recently broke its all-time high—but this is clearly not the end. Benefiting from improved regulatory clarity, more mature traditional investment products, and increasing inflows from conventional capital, Bitcoin is becoming an ideal asset class sought after by global investors amid current inflationary conditions.

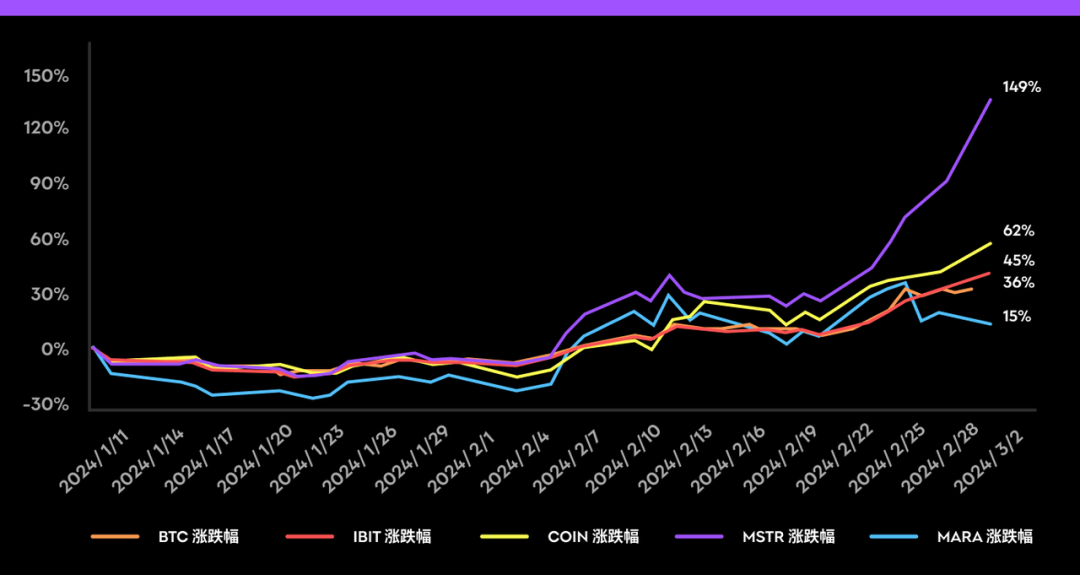

③ Since the approval of spot Bitcoin ETFs, funds like IBIT have surged nearly 40% in just two months. In this bull cycle, leading companies representing crypto trading, Bitcoin asset management, and Bitcoin mining—Coinbase, MicroStrategy, and Marathon Digital—are expected to outperform Bitcoin itself, offering greater leverage, better risk-return profiles, and higher returns.

The crypto industry has gone through multiple cycles.

Bitcoin briefly surged in 2013 but only entered the mainstream spotlight in 2017. At that time, the concept of "digital gold" started gaining traction as macroeconomic conditions matured and emerging crypto assets began flourishing.

Since then, the launch of ETH, the emergence of DeFi protocols, the introduction of liquidity mining, and the popularity of GameFi and NFTs have each driven smaller waves of excitement. Innovative assets and use cases, combined with an inflationary external environment, repeatedly pushed the crypto market to new highs.

Each mini-cycle brought increased attention, users, and capital to the crypto ecosystem, building upon prior progress and expanding the possibilities of blockchain technology.

The most recent crypto bull market began in 2022/23. A few days ago, Bitcoin surpassed its previous all-time high—but this is clearly not the end. Thanks to clearer regulations, more mature traditional financial products, and growing inflows from institutional capital, Bitcoin is increasingly seen as an attractive asset class (or at least one worth allocating more to) under today's global inflationary backdrop.

This article reviews and analyzes data from over a year of the ongoing crypto bull market and explores potential market dynamics around the upcoming halving event. If you believe Bitcoin prices will continue setting new records in 2024, which stocks stand to benefit the most? How do they compare against Bitcoin in performance, fundamentals, and investment rationale?

The chart below shows the price changes since January 11—the day spot Bitcoin ETFs were approved—for Bitcoin, Bitcoin ETFs (represented by BlackRock’s IBIT), Coinbase, MSTR, and Mara (as of closing on March 4):

The RockFlow research team believes that in this bull market, top-tier companies representing crypto trading, Bitcoin asset management, and Bitcoin mining—Coinbase, MicroStrategy, and Marathon Digital—will outperform Bitcoin itself, delivering greater elasticity, superior risk-return ratios, and higher return potential.

1. The Beginning of the 2023 Crypto Bull Market

In 2023, Bitcoin had three major catalysts.

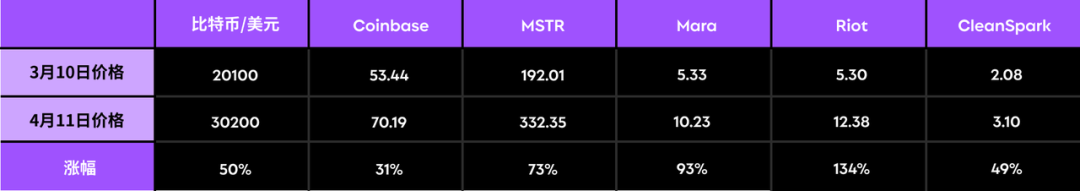

The first catalyst was the banking crisis triggered by the collapse of Silicon Valley Bank on March 10. This event heightened interest in Bitcoin as an alternative to traditional finance. On that day, Bitcoin crossed $20,100. Just one month later, on April 11, Bitcoin reached $30,200—an increase of 50% since the start of the crisis.

In comparison, crypto-related stocks such as Coinbase, MSTR, Mara, Riot, and CleanSpark rose by 31%, 73%, 93%, 134%, and 49%, respectively. As shown in the table below:

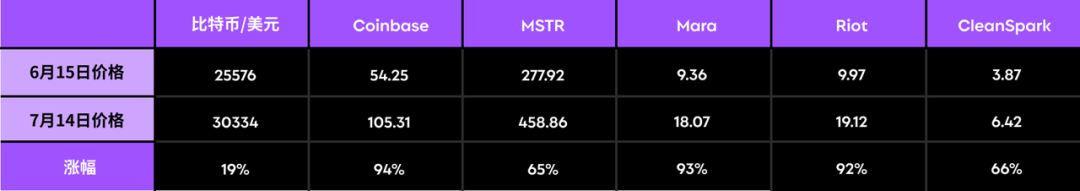

The second catalyst—and the biggest driver for Bitcoin in 2023—was BlackRock’s filing for a spot Bitcoin ETF with the U.S. SEC on June 15, 2023. The news quickly swept through markets and was widely interpreted as a sign of Wall Street embracing digital assets. Fueled by this development, Bitcoin rose 19% from $25,500 on June 15 to $30,300 on July 14.

During this period, Coinbase, MSTR, Mara, Riot, and CleanSpark saw share gains of 94%, 65%, 93%, 92%, and 66%, respectively:

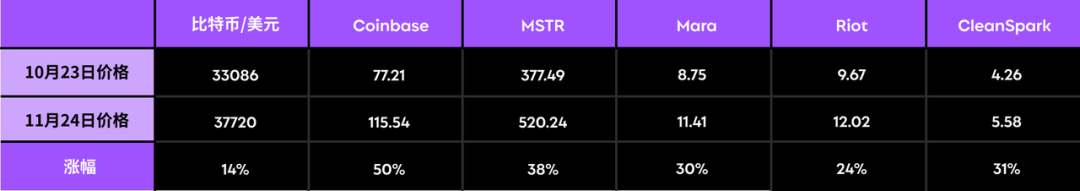

The third catalyst occurred on October 23, 2023, when a ticker symbol for BlackRock’s ETF appeared on DTCC’s website, sparking speculation about imminent approval. Bitcoin swiftly climbed 14% from $33,000 on October 23 to $37,700 on November 24. Meanwhile, Coinbase, MSTR, Mara, Riot, and CleanSpark rose by 50%, 38%, 30%, 24%, and 31%, respectively:

These three pivotal events helped gradually clear the shadow cast by the FTX collapse. As Bitcoin prices climbed, the crypto bull market was officially declared underway.

2. Learning From History: What to Expect in the 2024 Halving Cycle

The approval of spot Bitcoin ETFs marks a key milestone—but it is clearly not the end. (For more details on spot Bitcoin ETFs, read: Spot Bitcoin ETF Arrives: Analyzing the Strengths of 11 Issuers and the Biggest Winners.) On April 19, 2024, the crypto market will face another major event—the fourth Bitcoin halving—when block rewards are expected to drop from 6.25 BTC to 3.125 BTC.

Historically, halving events have led to significant Bitcoin price movements within a year before and after:

The first Bitcoin halving occurred on November 28, 2012, when Bitcoin traded at $12. One year earlier, it was priced at $3—representing a 300% gain during that period. This strong momentum continued post-halving: on November 28, 2013, Bitcoin reached $1,016, up 8,367% from the halving date and 33,767% from a year earlier.

A similar pattern emerged during the second halving on July 9, 2016. On that day, Bitcoin was at $647, up 141% from $268 a year earlier. Prices kept rising afterward, reaching $2,491 exactly one year post-halving on July 9, 2017.

The same upward trend held true during the third halving on May 11, 2020, when Bitcoin was at $8,563—up 18% from $7,232 a year earlier. Prices continued climbing into 2021, surpassing $56,000 on May 11, 2021, a 561% increase from the halving point.

Will this trend repeat during the upcoming fourth Bitcoin halving? Very likely. On April 19, 2023, Bitcoin was around $29,000. By early March 2024, it had surpassed $66,000—a gain of over 127%. Following historical patterns, Bitcoin is highly likely to exceed $100,000 by the end of 2024.

3. Three U.S. Stocks That Could Outperform Bitcoin

Currently, investment products based on Bitcoin (including futures and spot ETFs) globally manage over 1 million BTC (worth approximately $64 billion), highlighting the growing interest from traditional financial markets in crypto portfolios.

According to K33 Research, over 83% of these 1 million BTC are held by U.S. spot and futures ETFs, followed by products in Europe and Canada. As of the close on March 4, they collectively held 1,008,436 BTC—about 5.13% of Bitcoin’s circulating supply.

Take BlackRock’s IBIT as an example: it reached over $10 billion in assets under management (AUM) in just seven weeks. Fidelity’s FBTC fund now holds more than 115,000 BTC (valued at $7.5 billion). To put this growth into perspective: among today’s 3,400 ETFs, only about 150 have AUM exceeding $10 billion—and most of them took over ten years to reach that level.

These investment vehicles are dramatically reshaping Bitcoin’s market structure. A few years ago, exchanges held 20% of Bitcoin’s circulating supply. Today, that figure has dropped to 11%, while ETFs/ETPs and other Bitcoin-linked derivatives are rapidly expanding.

Unlike past scenarios where Bitcoin sat on exchanges as collateral for leveraged trades, today’s traditional asset managers are entering the space. They significantly lower the barrier to Bitcoin investment (e.g., pension funds couldn’t buy Bitcoin directly before, but now can via ETFs). However, once purchased, these Bitcoins are held in custody and cannot be lent out or used by market makers—greatly reducing liquidity spillover effects.

If you believe Bitcoin will enter a bull market in 2024, which stocks will benefit the most? How do they compare to Bitcoin in terms of performance, fundamentals, and investment logic? Next, the RockFlow research team provides a detailed analysis of the investment outlook for three leading companies across crypto trading, Bitcoin asset management, and Bitcoin mining—Coinbase, MSTR, and Mara.

It should also be noted that holding crypto stocks instead of Bitcoin directly carries lower risks. Direct Bitcoin ownership exposes investors to risks such as hacking, fraud, wallet failures, and exchange collapses. A notable example is the collapse of FTX in late 2022, which resulted in customers losing $8.9 billion in crypto assets.

1) Coinbase

On February 15, Coinbase released its Q4 2023 earnings report, which far exceeded expectations. In the following weeks, its stock price surged nearly 30%. This quarterly result reassured investors that Coinbase’s fundamentals are improving due to the broad recovery in the crypto market. Moreover, the SEC’s approval of spot Bitcoin ETFs has further strengthened investor confidence in the sector. Coinbase has become one of the best proxies for betting on the thriving crypto economy.

Indeed, anticipation of a positive SEC decision on Bitcoin ETFs had already fueled a general rise in crypto prices during Q4 2023, reflected directly in Coinbase’s soaring transaction revenues. Drawn by rising crypto prices, both institutions and retail investors flocked in, causing Coinbase’s transaction revenue to jump 64% year-on-year in Q4 2023. Institutional trading revenue rose 160% quarter-on-quarter, while retail trading revenue grew 79%.

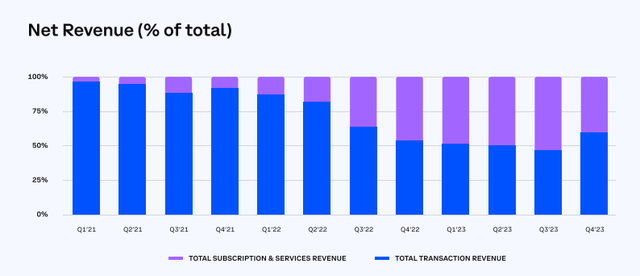

Additionally, since 2022, Coinbase has diversified its revenue streams and reduced reliance on volatile trading income. Its subscription and services revenue surged 78% year-on-year, reaching $1.4 billion in fiscal 2023. These include blockchain staking rewards, custody services, interest income from customer loans, and fees from stablecoin issuers.

In fiscal 2023, 48% of net revenue came from non-trading sources, compared to just 25% in fiscal 2022. This diversification helps reduce future revenue volatility and leads to more stable profitability.

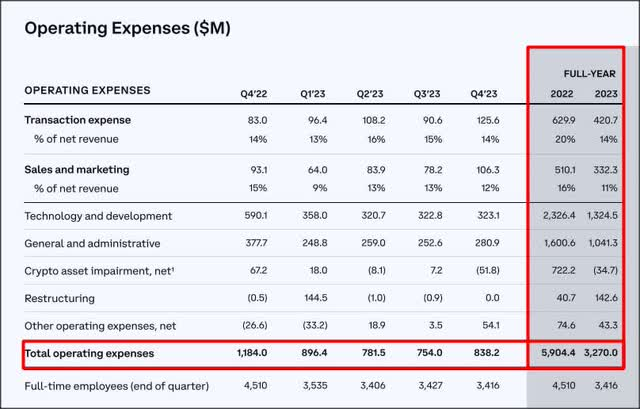

On the cost side, Coinbase’s aggressive operational expense reductions are beginning to pay off. During the last bear market, Coinbase laid off many employees and cut costs significantly. Today, it operates as a much leaner company, with operating expenses down 45% year-on-year in fiscal 2023.

Today, Coinbase is a financially sound and profitable crypto exchange. The SEC’s approval of spot Bitcoin ETFs has directly boosted demand for Bitcoin trading, greatly lifting investor sentiment and further legitimizing the entire crypto economy.

However, Coinbase is not without risks. Investors should monitor regulatory developments, cyclical fluctuations in the crypto market, and the potential bankruptcy of competing platforms. The collapse of FTX in 2022 severely damaged market sentiment, and similar events could again undermine bullish momentum.

2) MicroStrategy

MicroStrategy (MSTR) was originally a provider of business intelligence (BI) and analytics software. It still runs those operations and has recently expanded into AI. But what truly defines its value today? Its holdings of nearly 200,000 Bitcoins.

MSTR adopted a “dollar-cost averaging” strategy to buy and hold Bitcoin long-term—one of the best approaches for investing in volatile assets like Bitcoin. This strategy is now generating massive returns during the current bull market.

MSTR began purchasing Bitcoin in August 2020, about three months after the third halving. About a year after its first purchase, its Bitcoin holdings jumped to 92,000. The company now holds 193,000 BTC, worth over $13 billion at current prices, with unrealized gains exceeding $6 billion.

Due to its continuous debt financing to buy Bitcoin, MSTR’s stock price has shown a strong correlation with Bitcoin since 2020. Historical data shows that MSTR tends to amplify Bitcoin’s price swings—on average, MSTR’s volatility is 1.5 times that of Bitcoin.

Therefore, if you are bullish on Bitcoin’s future, MSTR offers a way to gain leveraged exposure beyond Bitcoin’s direct price appreciation.

That said, given Bitcoin’s inherent price volatility, MSTR’s stock will experience even greater swings. Unexpected global events—such as geopolitical tensions or macroeconomic shocks—could impact the crypto market and, by extension, MSTR.

3) Marathon Digital

Thanks to improving macroeconomic conditions and surging Bitcoin prices, Bitcoin mining stocks have delivered strong returns in recent months. The RockFlow research team believes Marathon Digital (Mara) stands out as the best-in-class mining stock, as its hash rate and Bitcoin reserves dwarf those of competitors. Mara offers investors a more elastic opportunity—and with Bitcoin potentially hitting new highs post-halving, Mara is well worth watching.

As a leading Bitcoin miner, Mara’s strategy is to mine Bitcoin and hold it long-term after covering operational costs. Currently, Mara mines Bitcoin through joint ventures in the U.S., Abu Dhabi, and Paraguay. While some mining operations were previously outsourced to third parties, Mara is moving away from this model, helping reduce mining costs and improve efficiency.

As previously noted, halving events tend to be highly positive for Bitcoin’s price—but their impact on mining stocks differs.

With block rewards halved, miners essentially see their production costs double. Therefore, mining stocks rely heavily on post-halving price increases to offset the drop in output. For this reason, weaker miners with insufficient capital may not survive, while top players are more likely to dominate.

Why do we believe Mara will emerge as a winner?

First, Mara’s largest advantage lies in its Bitcoin reserves. With 15,741 BTC, Mara holds the largest stash among mining companies. In contrast, its top rivals Riot and CleanSpark hold 7,648 and 3,573 BTC, respectively. Thus, Mara stands to gain the most from any Bitcoin price surge.

Second, Mara leads in hash rate. Its deployed hash rate is currently 26.7 EH/s, ahead of Riot and CleanSpark (12.4 and 10.09 EH/s in January, respectively). Mara expects to grow its hash rate to 34.7 EH/s by year-end; Riot targets 28.8 EH/s by Q4; CleanSpark aims for 20 EH/s in the first half, having already surpassed 16 EH/s after completing its Sandersville expansion. With higher hash power, Mara is better positioned to keep producing more Bitcoin post-halving.

Third, Mara has stronger cash reserves. As of January, Mara had $319 million in cash—more than Riot’s $290 million and CleanSpark’s $173 million. Greater financial flexibility enables Mara to pursue additional growth opportunities, such as acquiring mining rigs from weaker players post-halving, buying more equipment, or developing new facilities.

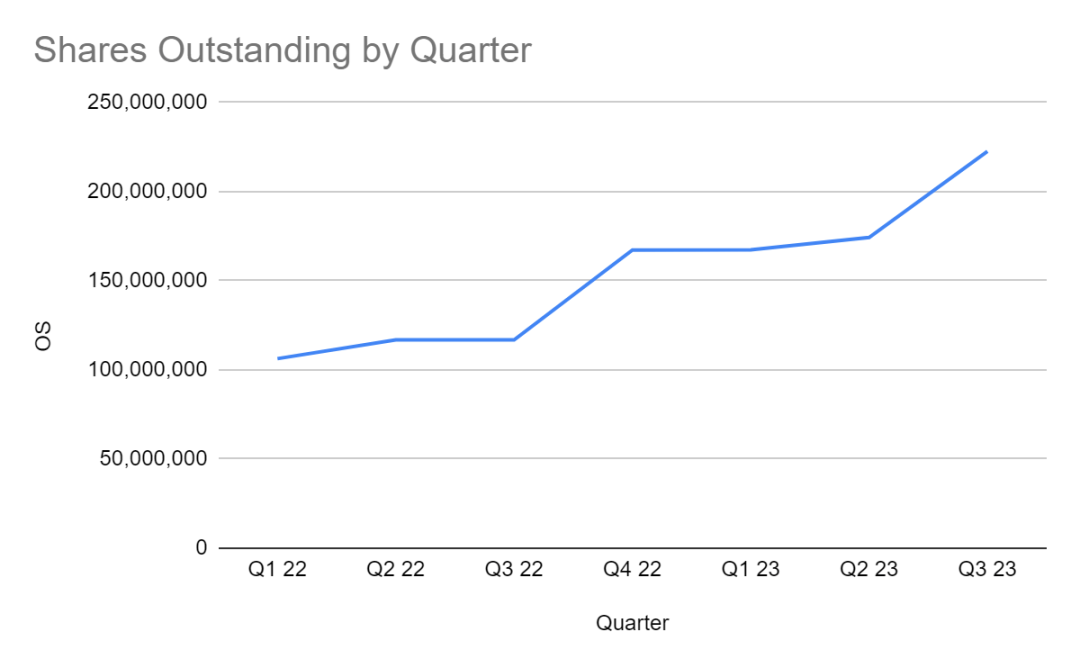

However, Mara does carry certain risks. First is continuous share dilution: its outstanding shares increased from 106.3 million in Q1 2022 to 222.6 million in Q3 2023—a near 110% rise—posing a headwind to its stock price.

A bigger risk comes from Bitcoin itself. Mara’s upside depends on sustained Bitcoin price appreciation. If Bitcoin fails to rally sharply post-halving or declines due to unforeseen events, Mara could face serious challenges.

4. Conclusion

Since the approval of multiple spot Bitcoin ETFs, both Bitcoin and Bitcoin ETFs have risen nearly 40% in less than two months. Given the upcoming halving in April and the historical price volatility associated with past halvings, the RockFlow research team believes Bitcoin prices will continue to climb in 2024.

Coinbase, MSTR, and Mara—each a top-tier player in their respective domains—serve as excellent alternatives to Bitcoin in this cycle, offering investors greater leverage, superior risk-adjusted returns, and higher profit potential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News