Reviewing My WIF Trading Journey: From Gambling to Focused Growth—How I Turned $400 Into $940,000

TechFlow Selected TechFlow Selected

Reviewing My WIF Trading Journey: From Gambling to Focused Growth—How I Turned $400 Into $940,000

Seize opportunities in rising markets, capture opportunities in falling markets, and find opportunities during market volatility.

Author: Pika

Translation: TechFlow

Recently, I made a trade on the token WIF, entering at $400 and cashing out at $940,000!

Many people have asked me how I did it. My answer is: seize opportunities during uptrends, downtrends, and even market consolidation.

After experiencing two full crypto market cycles, I finally pulled off a trade worth writing an article about. So let’s dive in.

Phase One: Meme Hunting

In this phase, luck played a bigger role than skill.

Of course, knowing where to look is crucial, but stumbling upon the right token was more accidental than strategic or skill-based.

Telegram, Discord, or crypto Twitter are great places to discover new cryptocurrencies, but by the time information reaches you, there's a high risk of getting rugged or scammed.

Fortunately, my prior adventure into the Solana chain proved serendipitous.

While platforms like Dexscreener or Dextools are go-to choices for many, they tend to favor Ethereum. For Solana, I highly recommend birdeye.

My search started with one simple criterion: catch my attention within 1–2 minutes. The token name had to be catchy—like a gem among countless others.

So, I headed to the “Find Gems” section (a feature on Birdeye).

Among countless names, one stood out: WIF, “dogwifhat.”

A quick check of its market cap showed it wasn’t large. Reviewing the security tab carefully, everything seemed in order. The price chart? Flat, but acceptable.

Then I searched Twitter and found: @dogwifcoin, with a profile picture of a dog wearing a hat.

A smile spread across my face. After browsing tweets and searching the $WIF hashtag, I stumbled upon the legend of “dogwifhat.”

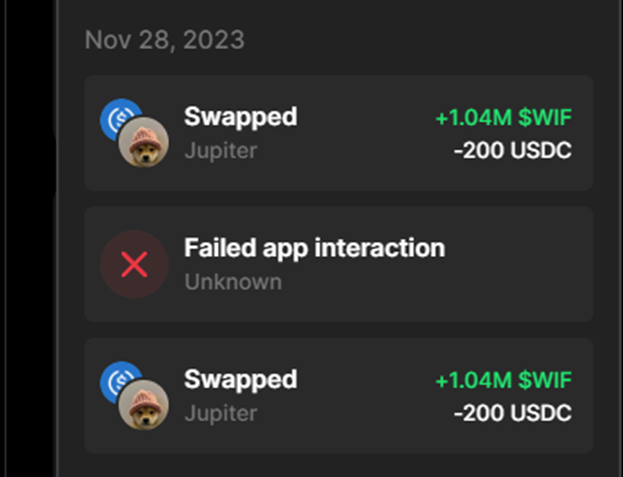

At that moment, I knew. I had to invest—come what may. With limited funds in my Solana wallet, I placed two trades of $200 each, promising myself I’d return to decide whether to increase my position once the price moved.

Phase Two: Stepping Up

This is how my $400 turned into an astonishing $45,000.

In the following days, I completely forgot about my investment. Then one day, while busy with other things, I decided to sneak a peek at my wallet.

And there it was: WIF, shining brightly, worth $45,000.

My first reaction? Doubt. Could this be a glitch? I quickly checked the price chart and realized the token had indeed surged. The @dogwifcoin account’s followers were multiplying, holder count skyrocketed. It was madness.

Out of curiosity, I joined the WIF Telegram group, where discussions never stopped. The chat was flooded with stickers and images of dogs wearing all kinds of hats, sparking endless laughter.

It was so simple, yet so entertaining. At that moment, it hit me: this meme is infinitely scalable. Just by swapping the dog’s hat, infinite possibilities emerge (Editor’s note: this is an inside joke within the community).

I thought my $45,000 stake was huge. Holding 2.08 million coins, I decided not to add more.

But unfortunately, regret soon followed. Why did I only invest $400? I could easily have put in $1,000, $2,000, or even $4,000.

But such thoughts were futile. I had to accept my decision and embrace the community I had joined.

Phase Three: The Rise of WIF

From here, the journey shifted from luck to strategy.

With a balance of $60,000, I continued researching how tokens like Doge, Shiba Inu, and Pepe achieved massive gains.

I discovered only two ways:

-

You must be at either extreme of the intelligence curve (very high IQ or very low IQ)

-

You need to be wealthy enough to ignore a $60,000 profit

Realizing I was somewhere in between, I devised a simple and precise plan: sell high, buy low.

Simple, right? Well, not exactly. As time passed, discussions around WIF intensified. Many KOLs noticed it, and its value soared beyond $100,000. Normally, I would’ve cashed out immediately. But this time, discipline was key.

Then came the terrifying 70% drop, testing my resolve. I instantly regretted not selling more.

The next two months felt like a turbulent rollercoaster, marked by sharp declines and exhilarating rallies.

Despite the challenges, I remained steadfast, even surviving a 70% crash down to $0.07.

Nevertheless, as WIF became a hot topic on crypto Twitter and its market cap expanded, I set my sights on an ambitious goal: $1 million or a Binance spot listing.

I systematically traded through the frenzy, gradually selling as prices climbed.

As a Binance spot listing approached, I sold off a large portion of my remaining holdings between $1.8 and $1.9.

Though I left $60,000 on the table, I recouped that amount through other WIF trades. (Am I truly satisfied?)

Phase Four: What If I Had Held?

What if I had held all my coins (2.08 million) until the end and sold everything at $1.9? That would have been roughly $4 million.

If you can do that, you’re a god.

Ultimately, I entered with $400 and exited with a $940,000 profit.

What if WIF hits $4? What if it hits $10? Of course, anything is possible. But I had a target number in mind, and I strictly followed my investment principles!

How did I lock in profits? When SOL was around $122–$128, I sold a significant amount of WIF and bought SOL.

I know I’m not someone with extremely high IQ who can perfectly predict prices.

Nor am I someone with extremely low IQ who can perfectly execute "low-IQ investing."

So my advice is: seize opportunities during uptrends, downtrends, and even market consolidation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News