The Forgotten WIF: The Life and Death Rules of Meme Coins in the Attention Economy

TechFlow Selected TechFlow Selected

The Forgotten WIF: The Life and Death Rules of Meme Coins in the Attention Economy

Here there is no gradual decline, only a cliff-like collapse.

By: June, TechFlow

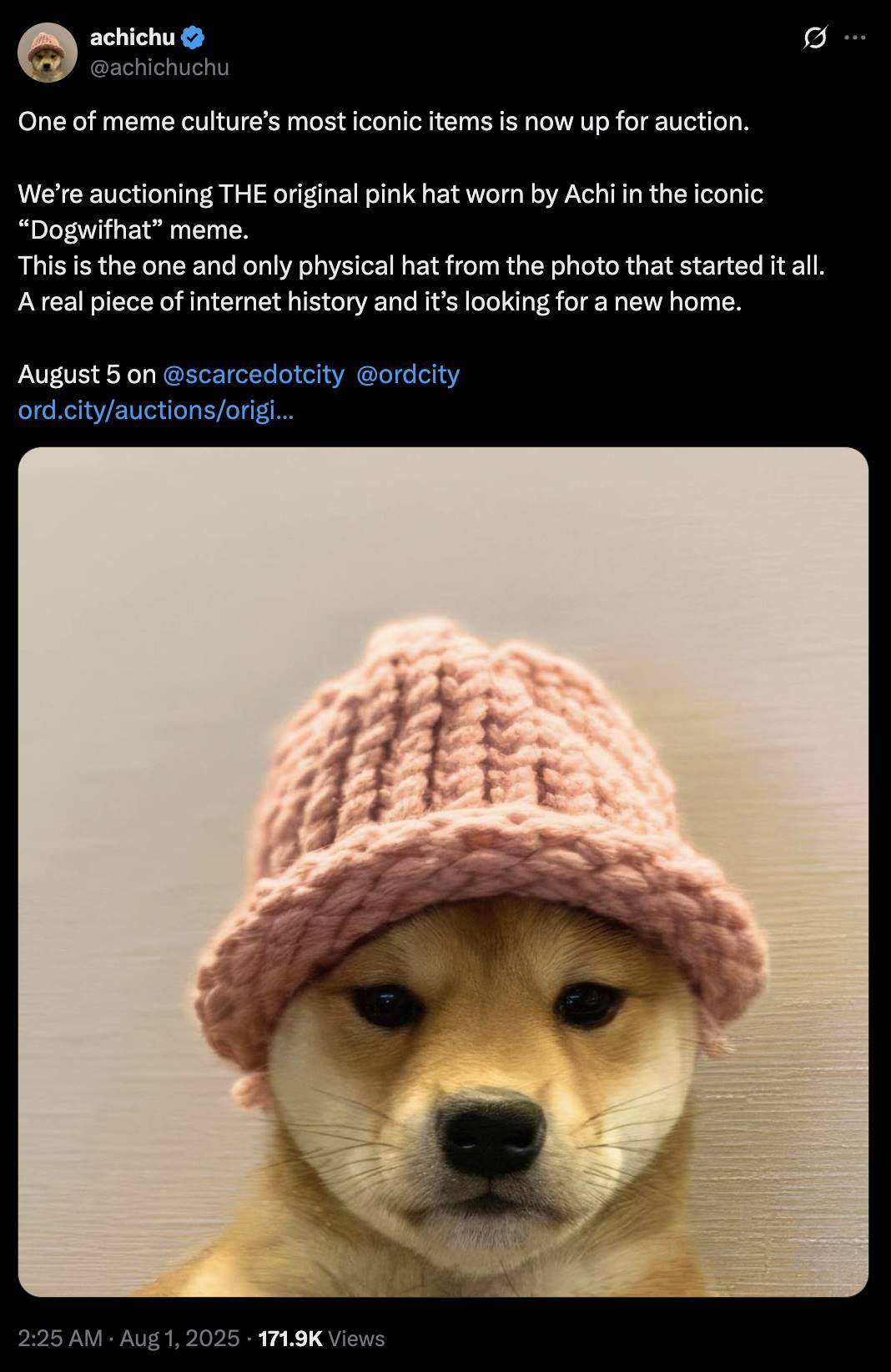

On August 5, 2025, a pink knitted hat will be auctioned.

This is no designer fashion piece, nor a historical artifact—it’s the emblem of Dogwifhat (WIF), the hat worn by the Shiba Inu that once captivated the crypto world. In November 2024, this hat symbolized a meme coin worth over $4 billion in market cap. The community even raised nearly $700,000 to project the image of the hat-wearing dog onto The Sphere, the massive spherical screen in Las Vegas.

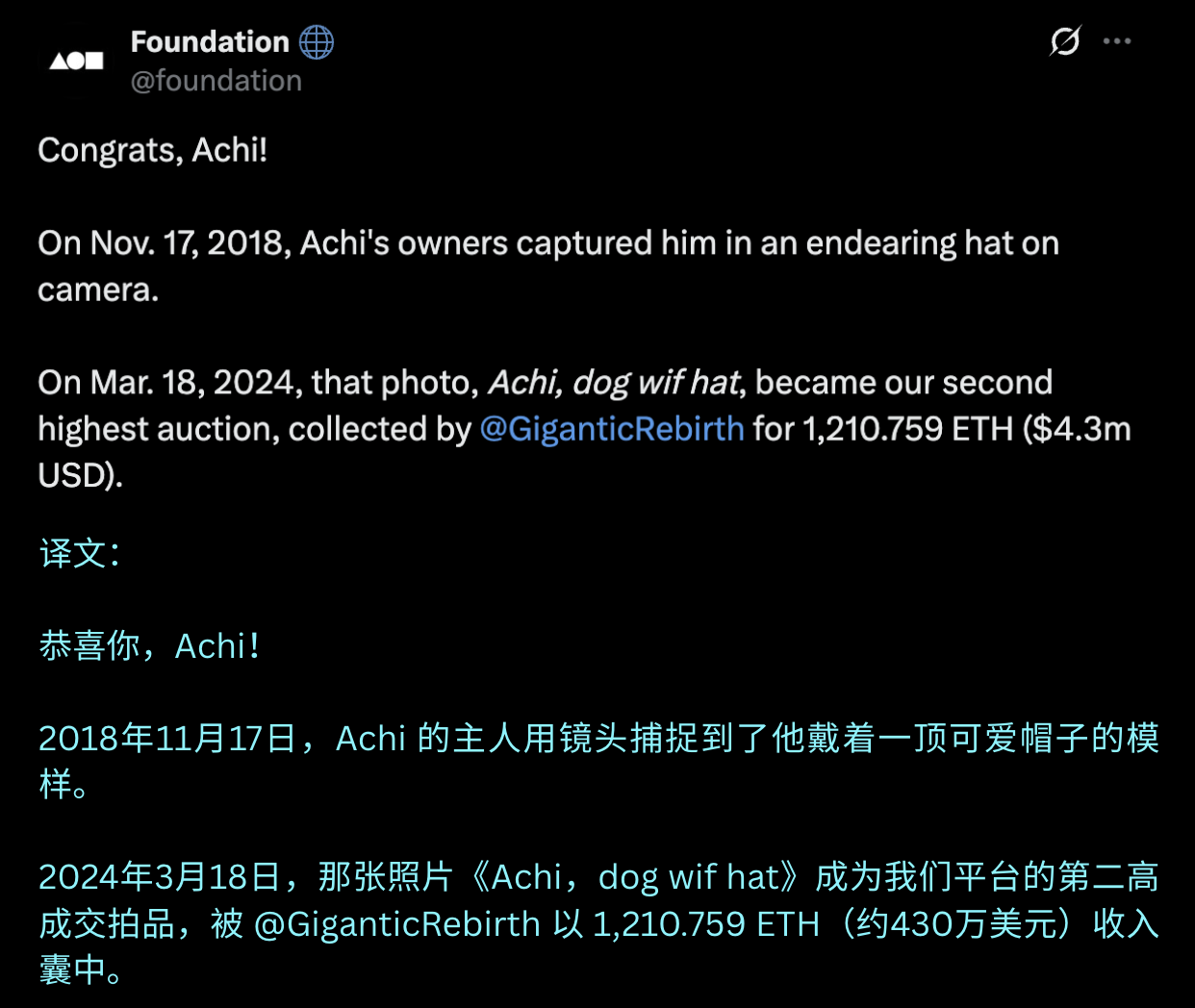

Earlier, on March 18, 2024, this “hat-wearing Shiba Inu” was minted as an NFT and listed for auction on Foundation. It was ultimately purchased by GCR, one of the most renowned traders in cryptocurrency, for 1,210.759 ETH (approximately $4.3 million), becoming the second-highest-selling artwork on Foundation at the time.

No one could have imagined then that less than a year later, the same hat would enter another auction—this time drawing little attention. Against the backdrop of a collapsed NFT narrative and a dormant market, a former top-tier meme now faces silent indifference. And WIF, as a representative of older memes, is in even worse shape. The auction announcement on August 1 didn’t even create a ripple on Twitter.

From global spotlight to obscurity, WIF’s story reveals a harsh truth: in the Web3 world, being forgotten is true death.

The hat is about to be auctioned—perhaps this is WIF’s final mark in crypto history. But its story deserves deep reflection from every project fighting for attention.

The Rise of WIF

At the end of 2023, a simple photo began circulating across crypto Twitter: a Shiba Inu wearing a pink knitted hat. No one could have predicted that this seemingly random combination would generate a multi-billion-dollar market cap in the following months.

WIF’s explosion owes much to one key figure—Ansem. As one of the most influential KOLs in crypto, when he started frequently mentioning this "hat dog" on Twitter, miracles happened. Each of his tweets acted like a stimulant injected into the market, propelling WIF from an obscure meme coin to center stage in the crypto world.

WIF’s rise was staggering—its market cap surpassed $1 billion in just 81 days. Community enthusiasm exceeded all expectations. They weren’t content merely sharing the hat dog image online; they wanted to do something unprecedented—project WIF onto The Sphere in Las Vegas. This largest spherical LED screen in the world sees millions pass by daily. If the hat dog appeared there, it would become the most iconic moment in meme coin history.

In March 2024, the crowdfunding campaign, initially targeting $650,000, was met within days and eventually exceeded nearly $700,000. Community members generously contributed, believing this wasn’t just a marketing stunt but a crucial step toward mainstream recognition for WIF. Excited discussions flooded Twitter, with everyone counting down to the moment the hat dog would light up the Las Vegas night sky.

On March 31, 2024, right after the Sphere crowdfunding ended, market sentiment peaked and WIF hit its all-time high of $4.83. During that wild period, WIF seemed invincible. Almost every crypto community talked about the Shiba Inu in the pink hat. Ansem’s influence, community passion, and market FOMO converged perfectly, pushing WIF to its peak.

It was WIF’s golden era, and every holder believed they were witnessing the birth of a new Doge. The hat was more than fabric—it became a cultural symbol, an identity, a belief in the infinite possibilities of the crypto world.

WIF’s Las Vegas Nightmare

The turning point came swiftly. In January 2025, the Trump meme emerged out of nowhere, sucking liquidity from the crypto market like a black hole. Then in February, President Trump’s announced tariff policies triggered macroeconomic uncertainty, causing a sharp correction in crypto markets. Meme coins, in particular, suffered devastating losses. To this day, while BTC, ETH, and SOL have rebounded to high levels, most meme coins remain stuck in deep correction.

The deadliest blow came in April 2025. It began with false hope at the start of the year—on January 29, the official Dogwifhat X account released a long-awaited Las Vegas Sphere project teaser, instantly igniting community excitement and sending WIF up 34% within a week. But the euphoria didn’t last. The Sphere’s official team quickly issued a statement clarifying they had “never engaged in commercial discussions with any cryptocurrency project.” That cold splash of reality caused WIF to plunge nearly 10% within an hour.

Worse still, serious divisions emerged within the community. Some members questioned project transparency and demanded full disclosure of how the fundraising money was used. A trust crisis spread like a virus.

After nearly a year of anxious waiting, on April 1, 2025, Edward, one of the initiators of The Sphere project, finally officially announced the project's cancellation and began issuing refunds. Nearly $700,000 in funds, countless nights of anticipation—all vanished. By then, WIF had already dropped to $0.42. After the abandonment news broke, WIF plunged again, hitting a yearly low of $0.3. This final straw completely shattered community confidence. Even WIF’s own organizing team seemed to give up.

To make matters worse, Ansem’s voice began to fade. This KOL, who once mentioned WIF daily, gradually shifted focus to other projects. After months of stagnation, WIF seemed to vanish from Twitter. The flood of hat dog memes disappeared, heated community discussions fell silent, and even the most loyal supporters began migrating elsewhere.

Meanwhile, other meme coins surged ahead on their own paths:

Doge remains the unshakable king. Every new meme aspires to match or surpass Doge. Elon Musk has never stopped engaging with Doge—he has become its ultimate ambassador.

Pepe occupies another stronghold with its classic frog image. Pepe, backed by a vast ecosystem of memes, has become part of internet language.

Pengu, supported by the strong NFT community of Pudgy Penguins, has also won favor from Wall Street institutions like VanEck. Pengu focuses on expanding into web2 ecosystems and recently announced a collaboration with Suplay, a Chinese consumer IP brand. It also stays active across Telegram, Instagram, WhatsApp, and other platforms.

These successful meme coins share one common trait: multidimensional vitality. They either have representative KOL support, strong community-driven content creation, or institutional backing. Most critically, they’ve built diversified communication networks that don’t collapse when a single pillar fails.

In contrast, WIF’s problems are glaring. It relied too heavily on Ansem’s personal influence, failed to build its own content ecosystem, lacked innovation mechanisms, and never gained institutional interest. Once the initial hype faded, it had no support system to fall back on.

In this age of extreme attention scarcity, once you begin to be forgotten, returning to the spotlight becomes nearly impossible. WIF is undergoing this brutal process—from universal attention to complete neglect—in just a few months.

The Harsh Truth of the Crypto World

Ramping is justice. Though crude, this phrase accurately captures the essence of this market. In traditional finance, we talk about fundamentals, value investing, long-termism. But in the world of meme coins, all these concepts are reduced to a single number: price.

When the price rises, everything is justified. Communities stay active, KOLs promote enthusiastically, new holders pour in, and a positive cycle begins. When the price falls, every flaw surfaces. Communities fracture, KOLs quietly exit, panic spreads, and a death spiral follows.

For WIF, two fatal issues loom:

First, it’s no longer remembered. Time moves ten or a hundred times faster in the crypto world. A hot topic from three months ago is ancient history here. When Ansem stops talking about WIF, when the community stops creating content, when trading volume shrinks, WIF shifts from “present continuous” to “past perfect.” In a market obsessed with chasing the next get-rich-quick opportunity, no one cares about history.

Second, it has lost the wealth-generation appeal. The failure of The Sphere fundraiser wasn’t just a marketing setback—it exposed a harsh reality: when prices drop, even the most loyal community members grow cautious. Without new capital inflows, there’s no upward price momentum; without rising prices, new capital won’t come. It’s an unsolvable dilemma.

The deeper truth is that in this attention-driven economy, the life or death of a meme coin often hinges on a single moment. One tweet can create a 100x coin; one failure can destroy years of effort. There’s no gradual decline—only cliff-like collapse.

WIF’s story mirrors countless other meme coins. They streak across the crypto sky like meteors, briefly illuminating a corner before vanishing into darkness. A few lucky ones become stars, but most face the fate of being forgotten.

This is the survival law of the crypto world: stay relevant, or die. No middle ground.

Being Forgotten Is True Death

On August 5, the pink knitted hat will find its new owner.

When the auction hammer falls, it may mark WIF’s final footnote in crypto history. In a way, the hat’s fate is deeply ironic—it once represented a multi-billion-dollar valuation and a community’s dream, yet now it must be auctioned to find meaning.

But this ending confirms our opening argument: in the Web3 world, being forgotten is true death. The hat can be auctioned, collected, displayed in a museum case. But as a meme, a cultural symbol, a cryptocurrency, WIF’s heat has faded. Not because of code failures, not due to hacks—but because people no longer remember it.

This is an era where attention is scarcer than gold. New projects emerge daily, new stories unfold, new wealth myths circulate. In this endless cycle, only those projects that continuously occupy people’s minds survive. All others, no matter how glorious their past, will be washed away by the river of time.

Ironically,NFTs, relics of the previous era, have shown stronger resilience in this current meme-coin-dominated cycle. Even during the NFT winter, BAYC still generates buzz through occasional IP licensing news, CryptoPunks occasionally make headlines with astronomical sales, and Pudgy Penguins return to public view with physical toy releases. These teams keep working, communities remain strong, carving bloody paths forward while generating real commercial value and profit.

In contrast, meme coins are mostly products of wild growth. They often lack clear team structures, long-term business plans, and struggle to form deep partnerships with mainstream brands. Small-team backgrounds make it harder for meme coin projects to gain recognition in traditional business circles and generate broad resonance beyond their communities. When the hype fades, these projects often lack the resources and capabilities to sustain long-term brand value.

WIF’s story blazed across the crypto sky like a meteor, briefly lighting up a corner before vanishing into darkness. One thing is certain: in this consensus-driven world, memory is the most valuable asset. When no one remembers your name, you’re truly dead.

This is the life and death of a meme coin in the crypto world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News