Deep Dive into Sui: Finding the Right Niche Market

TechFlow Selected TechFlow Selected

Deep Dive into Sui: Finding the Right Niche Market

Sui is not the only competitor in this niche market.

Authors: THOR AND MODERN EREMITE

Compiled by: TechFlow

In today's report, we will dive deep into the Sui ecosystem. Created by Mysten Labs, Sui is hailed as a next-generation blockchain designed to meet the growing demand for blockchain adoption. You might ask—who exactly is adopting blockchains? The Web2 world is gradually finding its way and transitioning into the Web3 space, drawn by new frontiers in marketing, user acquisition, and network effects.

Domains associated with mainstream usage—such as the metaverse, gaming, social layers, and even commerce—require specialized blockchains tailored to their needs. We all remember how Ethereum’s costs could skyrocket during periods of high interest. Does anyone recall the burning of over $150 million in ETH gas fees during the Otherside NFT minting event? Indeed, this is precisely why, over the past several months—and even during the previous bull run—we’ve seen rising demand for a fast and low-cost Layer 1 network capable of supporting imminent mainstream adoption.

But what about Layer 2 ecosystems like Arbitrum or Optimism? Aren’t they the solution to Ethereum’s high gas fees?

Yes—but there’s still significant work to be done on L2 adoption, a topic worth exploring separately. If we’re to face massive demand from traditional finance, we need solutions available here and now—and this is where monolithic blockchains can take the lead.

Key Points of This Article

-

What is Sui, and why is it often compared to Aptos?

-

Recent developments in the Sui ecosystem

-

What to watch out for

-

Conclusion

Understanding Sui: The World of Parallel Chains

Sui is frequently compared to Aptos because both projects launched around the same time during the last bear market and are both linked to Facebook’s long-abandoned Diem project. Diem was primarily developed to handle lightweight payment traffic between a limited number of wallets. However, due to premature public readiness for blockchain adoption and regulatory resistance against tech giants like Facebook launching payment infrastructure, the project was suspended. As a result, both Sui and Aptos emerged as Proof-of-Stake (PoS) Layer 1 blockchains leveraging parallel execution to cater to upcoming mainstream adoption. While numerous technical differences exist—such as in consensus mechanisms or data architecture—we won’t delve into those here, as they fall outside the scope of our current discussion.

What is relevant, however, is that both Aptos and Sui are widely perceived as heavily venture capital-backed projects, leading to a less welcoming sentiment across the broader crypto community—a sentiment clearly reflected in their early price action post-launch.

Another similarity is that both blockchains use the Move programming language, though with slight variations in implementation. Aptos follows the original Move design from Diem, while Sui has modified certain concepts and adopted an object-oriented approach—making it better suited for mass adoption. This is precisely why Sui belongs to the growing trend of parallel-execution Layer 1 blockchains.

In the coming months, we’ll witness another round of the Layer 1 wars—a dominant narrative during the 2020/21 cycle. This time, however, new contenders are entering the arena: Aptos, Sui, Sei, Solana, and the yet-to-launch Monad. All are monolithic chains supporting parallel execution, all aiming to capture market share within the same niche.

Reverse Consensus: Recent Growth

As previously mentioned, Sui’s post-launch price trajectory wasn’t surprising—the prevailing trade on Crypto Twitter being short positions held for months, which proved highly profitable. However, in October 2023, as Bitcoin began its climb and finally broke above the $30,000 mark, SUI had already formed a bottom and started its upward journey.

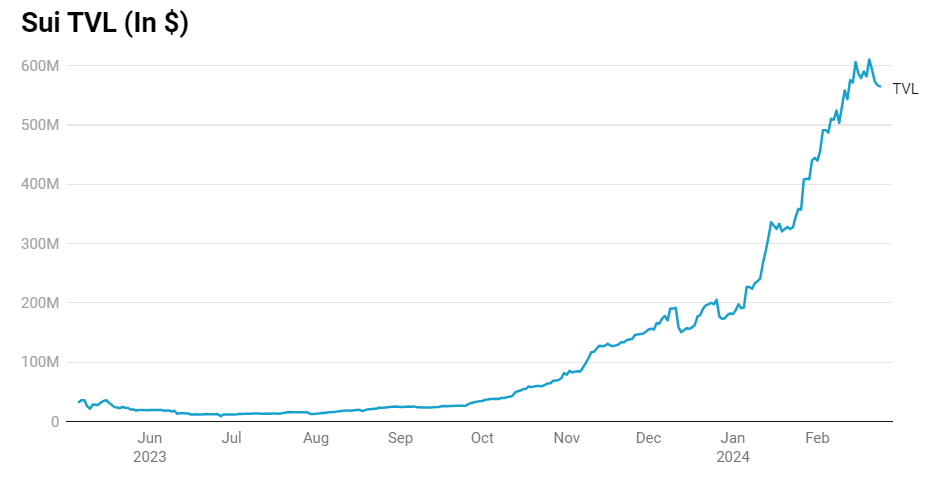

Yet price wasn’t the only metric on the rise—Total Value Locked (TVL) on Sui also surged. Growing from approximately $80 million in October 2023 to $567 million today, the Sui ecosystem has attracted increasing capital. But here lies a critical question: how, and with what?

A likely recent driver could be speculation surrounding the upcoming Wormhole airdrop, which boosted bridge usage and temporarily inflated TVL across multiple chains. Needless to say, once snapshotting concludes, much of this liquidity will likely exit. The extent to which recent TVL growth on Sui is tied to Wormhole speculation remains uncertain.

So, how is DeFi shaping up on Sui? Currently, key protocols such as NAVI (offering liquidity restaking), Scallop (lending), Cetus and BlueFin (DEXs and Perps) are building the core infrastructure of a growing ecosystem. Expanding on this, incentivizing DeFi protocols can indeed attract users and liquidity—but this must go hand-in-hand with attracting developers who build diverse dApps and protocols. Notably, BlueFin recently partnered with Elixir, a protocol designed to boost order book liquidity on DEXs. This collaboration led to a ~50% surge in BlueFin’s TVL, rising from nearly $9 million to $13.1 million today. Whether this marks the beginning of cross-chain integration or just a one-off effect driven by Elixir’s influence remains to be seen—making future integrations within the Sui ecosystem worth close monitoring.

When it comes to attracting users and generating hype, Sui holds another potential ace: the lack of native tokens across many ecosystem projects. One of the most effective marketing tools in crypto is teasing users with the promise of future airdrops for using a platform. And if these airdrops span the entire ecosystem, even better—something entirely plausible on Sui.

Above all, we’ve seen the launch of Stardust, introducing wallet-as-a-service infrastructure aimed at attracting GameFi builders who will leverage Sui’s full suite of capabilities. Building on this, there’s also the notable partnership between Mysten Labs (Sui’s creator) and Team Liquid—one of Europe’s most prominent esports teams. In other words, Sui is actively targeting the GameFi space. But why this strategic shift?

It must be said that in the fiercely competitive landscape of parallel Layer 1s, each ecosystem must carve out its own niche to attract users and TVL—rather than competing for overly broad audiences. Solana seems to have found its edge in NFTs and memecoins within crypto culture, while Sui isn’t copying others’ playbooks. Instead, it’s pushing forward by targeting GameFi users, thanks to its object-oriented Move language and superior user experience—far smoother than what we’ve seen on StarkNet.

Looking Ahead: Potential Challenges

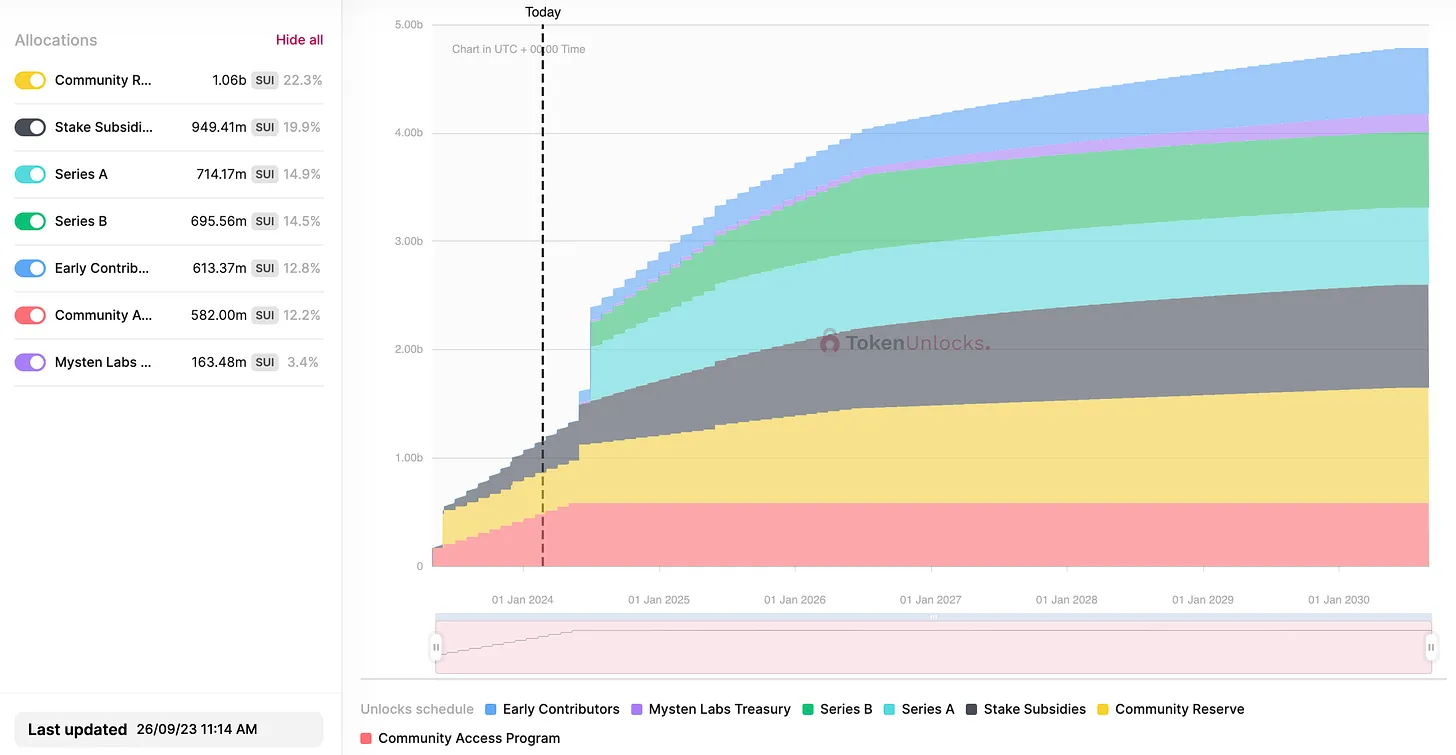

While all of this may sound overwhelmingly positive and promising, we must not overlook the risks involved—including the impact of upcoming token unlocks on the SUI price.

As noted earlier, SUI has been steadily climbing since its $0.36 bottom in October 2023, nearly doubling in value since the start of 2024 and almost reaching the $2 mark. However, momentum within the parallel-L1 narrative has begun to slow. This suggests real profit opportunities for those exploring the ecosystem and betting on its projects and meme coins—if prices continue rising, a strong incentive indeed. Yet the reality for Sui is more complex.

Among the most well-known DeFi projects on Sui—such as BlueFin, Aftermath, and Scallop—only Cetus currently has a native token. The absence of tokens fuels future airdrop speculation. But for now, it severely limits the ecosystem’s appeal, lacking tradable or investable assets.

The clearest example is Solana’s meme coin season, which generated multiple micro-cycles punctuated by brief cooling periods. During these lulls, broader market attention shifted to other trends, often centered around meme coins on different chains. Sui attempted a similar move with its most anticipated meme coin, $FUD, riding the then-popular dog-themed coin trend. However, price action offered little beyond an initial spike, followed by fading interest and rapid liquidity withdrawal.

What appeared to be a promising path to attract liquidity turned out to be extremely short-lived, with liquidity vanishing within hours of launch. Moreover, trading participation was minimal—with around only 150 active traders across the top four meme coins. Unsurprisingly, genuine interest was virtually non-existent, especially when compared to Solana, where even during sluggish periods, thousands of market participants engage daily.

Another looming issue within the ecosystem is the token unlock schedule. Monthly unlocks are set at 0.65% of the max supply—equivalent to roughly 5.5% of the current market cap, or about $110 million. These are rough estimates, as $SUI’s price, market cap percentage, and dollar value fluctuate. While monthly releases appear digestible by the market so far, the upcoming May unlock could significantly impact the price.

On May 3rd, Sui’s circulating supply will increase by 8.27%—approximately $1.4 billion in value, representing about 71% of the current market cap. Predicting market reaction to such a large unlock is difficult. However, we may see a “liquidity cushion” gradually form—an effect often observed during major unlocks like $DYDX—which could partially offset the released supply. On the other hand, given the relatively low current interest in the Sui ecosystem, attracting enough liquidity to build such a buffer may prove challenging. Markets may begin pricing in the unlock weeks in advance.

While predicting the future is impossible, observing market volume and the SUI trading volume-to-market-cap ratio may reveal how the market is preparing for the upcoming unlock.

Conclusion

The coming months and years may witness explosive growth in blockchain adoption—not just among mainstream users, but also among Web2 brands—as we already saw signs of during the 2021 metaverse craze. Given this trajectory, there’s an urgent need for fast and affordable blockchains capable of supporting millions of users exploring emerging frontiers and the multitude of dApps that follow.

Sui is not the only contender in this space. Strong competitors like Solana, Aptos, Sei, and the upcoming Monad are all vying for market share. Additionally, L2 ecosystems will rapidly evolve, offering similar performance while benefiting from Ethereum’s overarching security and network effects—potentially becoming formidable rivals to Sui in the same segment.

The theme of the last cycle was the war between alternative Layer 1s. This time, a similar scenario will unfold—but instead of competing L1 ecosystems, we’ll witness battles between sub-ecosystems and monolithic chains, all fighting to become the preferred home for “mainstream-facing” dApps.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News