Understanding Zircuit: The zk L2 Backed by Pantera and Dragonfly, a New Destination for Restaking to Earn Points (With Participation Guide)

TechFlow Selected TechFlow Selected

Understanding Zircuit: The zk L2 Backed by Pantera and Dragonfly, a New Destination for Restaking to Earn Points (With Participation Guide)

In a year of booming airdrops, active engagement and participation are the baseline.

By: TechFlow

The restaking赛道 is getting increasingly competitive this year.

Not only are there numerous restaking protocols linked to EigenLayer, but now even infrastructure projects not directly related are jumping on this high-traffic, high-yield trend, attempting to leverage the yield-generating properties of restaked assets to inject more liquidity into their own chains.

On February 23, Zircuit—a zk-Rollup backed by Pantera and Dragonfly—announced a new campaign on social media: Zircuit Staking. Users can deposit native ETH or liquid staking and restaking tokens into Zircuit to earn project points and native rewards from restaking.

This means another new destination has emerged for maximizing returns from layered liquid staking products.

If you’ve actively participated in EigenLayer-related restaking projects before, now is the perfect time to put your LRTs to full use by depositing them into Zircuit—maximizing yields while also positioning yourself for a potential Zircuit airdrop.

Considering Zircuit’s backing by top-tier VCs and its partnerships with multiple LRT projects, participating in this staking campaign could become the next hot topic in the LRT space.

To help readers understand Zircuit better, this article provides a brief overview of the project and explains how to participate in staking and earn points.

What is Zircuit?

Zircuit is a fully EVM-compatible zk Rollup currently in testnet phase.

We won't go into too much detail about zk Rollups here—you can think of them simply as Ethereum Layer 2 solutions using zero-knowledge technology, designed primarily to address Ethereum’s performance and efficiency issues, enabling faster and smoother transactions.

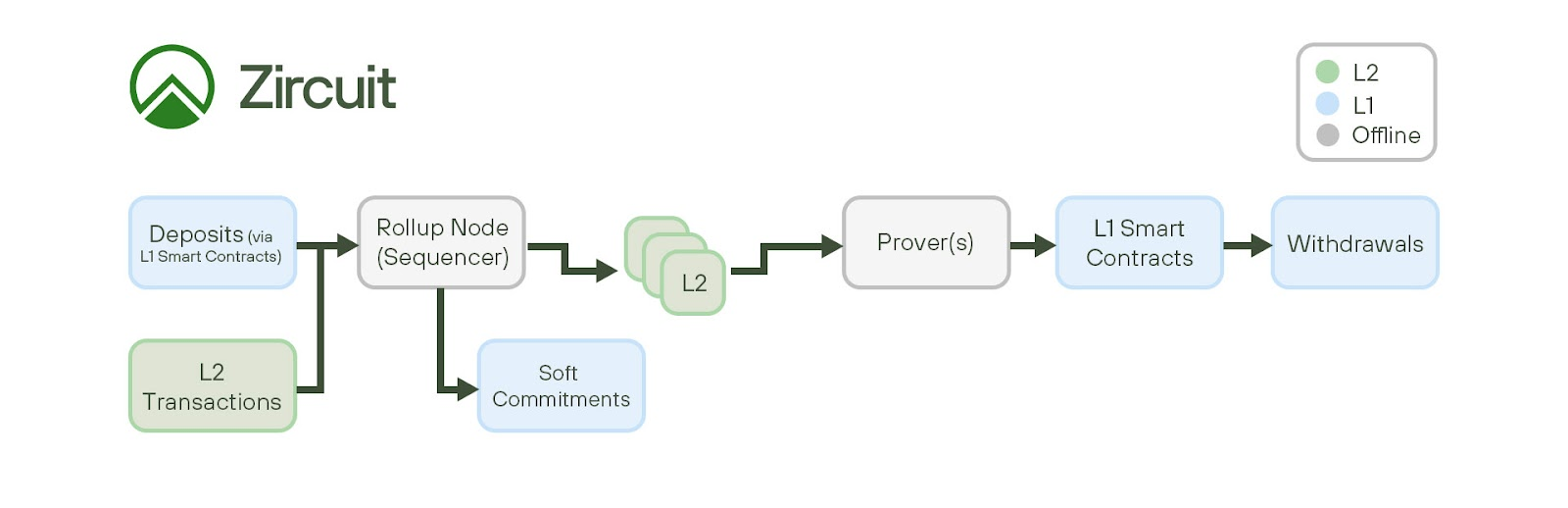

Its architecture consists of three main components:

-

Sequencer – processes transactions and builds L2 blocks

-

Prover – generates validity proofs for these blocks

-

Smart contracts – interact with the L1 system

Compared to OP-based architectures, Zircuit achieves fast finality as a zkEVM Rollup, eliminating the need for a challenge period when withdrawing funds.

Zircuit uses parallel proof generation to speed up proof creation and leverages proof aggregation to produce a single, on-chain verifiable proof. By breaking down the circuit into specialized parts and aggregating evidence, Zircuit achieves higher efficiency and lower operational costs. The final validity proof is an aggregated proof covering a batch of L2 blocks.

Another notable feature of Zircuit is its Sequencer-Level Security (SLS), which helps prevent malicious transactions and hacker attacks. Due to the technical complexity involved, we won’t delve deeper here; interested readers can refer to the project documentation for more details.

Another point many users care about:

Zircuit uses native ETH and currently has no governance token (though that doesn’t rule out launching one in the future).

Therefore, farming interactions to position for a future airdrop has become the most practical strategy at this stage.

Restaking for Points: A New Way to Maximize Returns

As everyone knows, the biggest pain point in farming is opportunity cost—if funds are limited, farming A often means missing out on B.

With airdrops becoming increasingly competitive and protocols aggressively vying for user attention and liquidity, being able to generate multiple yields from a single deposit is naturally the most desirable option.

Zircuit takes this concept to the extreme, officially launching its points-earning campaign today—with no additional capital required:

Deposit your existing restaking tokens into Zircuit to achieve multi-layered yield generation.

First, let's look at Zircuit’s points rules.

According to the official announcement, users can earn Zircuit Points by completing various tasks within the ecosystem, which will be redeemable for future rewards. The goal is to reward active participants and community members while helping Zircuit attract more native liquidity. Users earn points through staking, but those who migrate their assets to the mainnet upon Zircuit’s mainnet launch will receive the highest rewards.

In other words, staking for points is just the current campaign—future cross-chain asset incentives may follow.

Focusing on the current points-earning campaign, the first question to consider is: “Which assets can I deposit to earn points?”

Zircuit categorizes eligible deposits into two types:

-

Native ETH, which will be returned in wETH form upon withdrawal

-

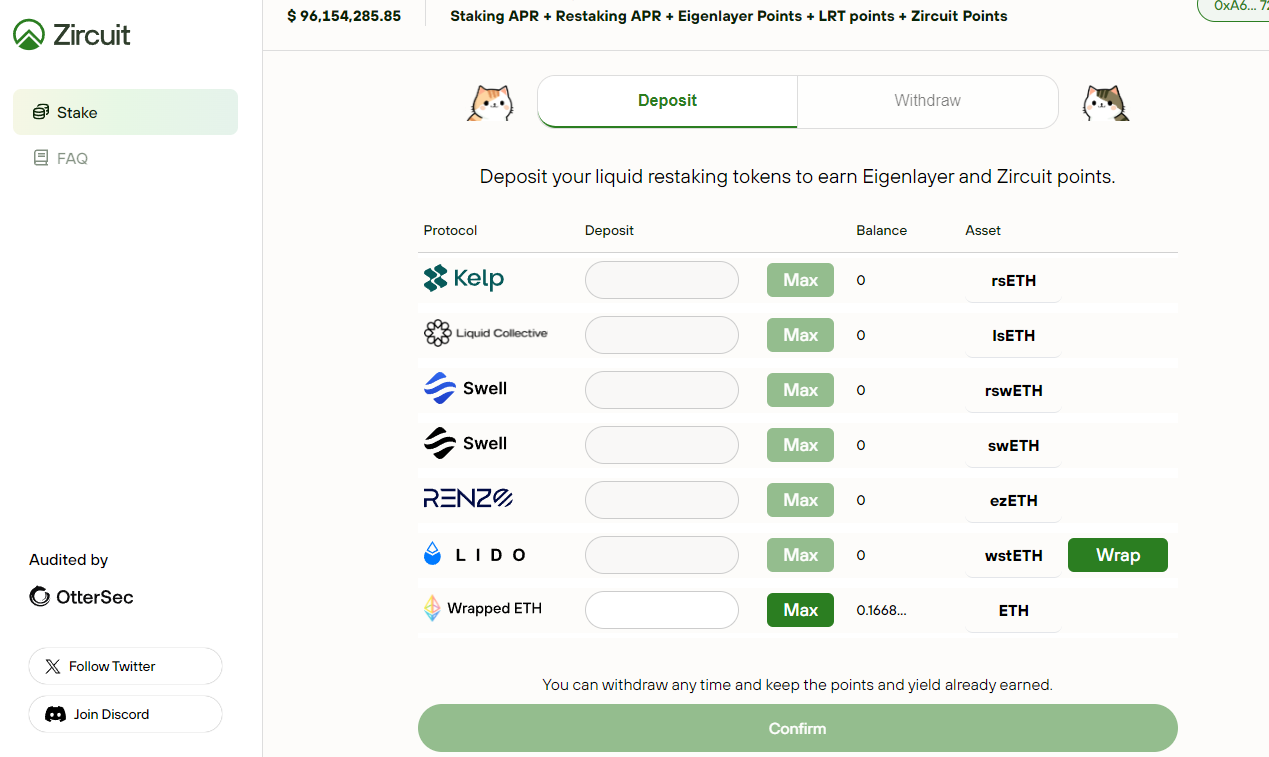

Various LST/LRT tokens, including supported restaked ETH from Swell, Renzo, KelpDAO, EtherFi, Liquid Collective, and Lido

However, it’s important to note that Zircuit strongly encourages depositing LST/LRT tokens because different assets offer varying point-earning efficiencies:

-

Depositing ETH: multiplier of 0.5x

-

Depositing LRT/LST: multiplier of 1x

In other words, the point-earning efficiency of native ETH is only half that of LST/LRT deposits.

Secondly, the author believes Zircuit’s points campaign is particularly friendly to small investors.

There is no minimum deposit requirement to earn Zircuit Points, and the above multipliers remain unchanged regardless of deposit size. Additionally, there is no unstaking period—users can withdraw at any time, offering greater flexibility.

Staking Guide

Below is a step-by-step guide on how to participate in staking.

-

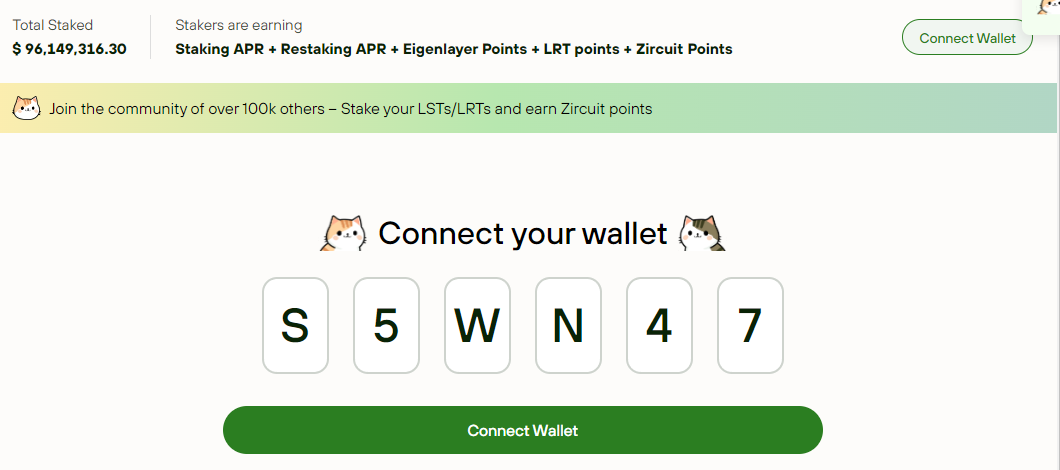

First, click here to access Zircuit’s official staking page. You can register and connect your wallet, optionally entering the referral code S5WN47. Using this code grants an extra 15% bonus in OG referral points when staking.

-

On the following screen, deposit any supported token from LST/LRT protocols.

-

Enter the amount you wish to stake, then click Confirm below. After signing via your wallet, staking will be successful.

-

The total staking rewards breakdown is as follows:

Total Staking Rewards = Staking APR + Restaking APR + EigenLayer Points + LRT Points (e.g., ezETH, rswETH, rsETH) + Zircuit Points (future rewards)

This makes it easy to achieve multi-layered yield generation.

However, high profitability and low barriers naturally lead to congestion.

At the time of writing, there is limited Chinese-language coverage of Zircuit; over time, more participants are expected to join the staking and points-earning race.

Increased competition means reduced individual expected returns, but greater participation also increases the certainty of rewards.

In this airdrop-heavy year, active interaction and participation set the floor; the ceiling depends on diversified strategies and time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News