Zircuit under the AI narrative: Is it still worth long-term attention after TGE?

TechFlow Selected TechFlow Selected

Zircuit under the AI narrative: Is it still worth long-term attention after TGE?

If you missed the first two airdrops, you can continue to follow the current staking program and free airdrop opportunities.

Introduction

If you missed the initial airdrop, don't worry—Zircuit has reserved 8.55% + 13.08% of its tokens for future rewards and incentives to the community. Below, we analyze Zircuit's core highlights from the perspectives of AI narrative, tokenomics, airdrop design, and ecosystem development.

1. The Ideal Entry Point into the AI Narrative

In recent years, cross-chain bridge attacks and smart contract vulnerabilities have occurred frequently. User demand has gradually shifted from "high yield" to "high security." Leveraging its innovative Sequencer-Level Security (SLS) system, Zircuit accurately identifies potential risks and provides real-time alerts, achieving a 99.5% accuracy rate in security assessments—demonstrating strong competitiveness in both security and technological innovation:

-

Security industry opportunity: Zircuit addresses user pain points by prioritizing security, aligning with market trends and capturing user attention effectively.

-

Technological innovation breakthrough: By integrating AI models to assess transaction risks, Zircuit not only raises the bar for security standards but also taps into the current market’s popular narrative, injecting fresh momentum into the industry.

These advantages establish a long-term market moat for Zircuit, offering greater application and expansion potential amid an increasingly challenging industry landscape.

2. Tokenomics Analysis

Zircuit’s tokenomics are carefully designed to balance community incentives with market stability:

-

Community reward allocation: 21% of tokens are allocated to community rewards and airdrops—one of the highest ratios in the industry—highlighting the project’s commitment to users. An additional 8.55% is reserved for future airdrops with a phased unlock mechanism (6-month and 12-month cliff periods followed by 24-month linear vesting), a well-structured lock-up design that strengthens market confidence.

-

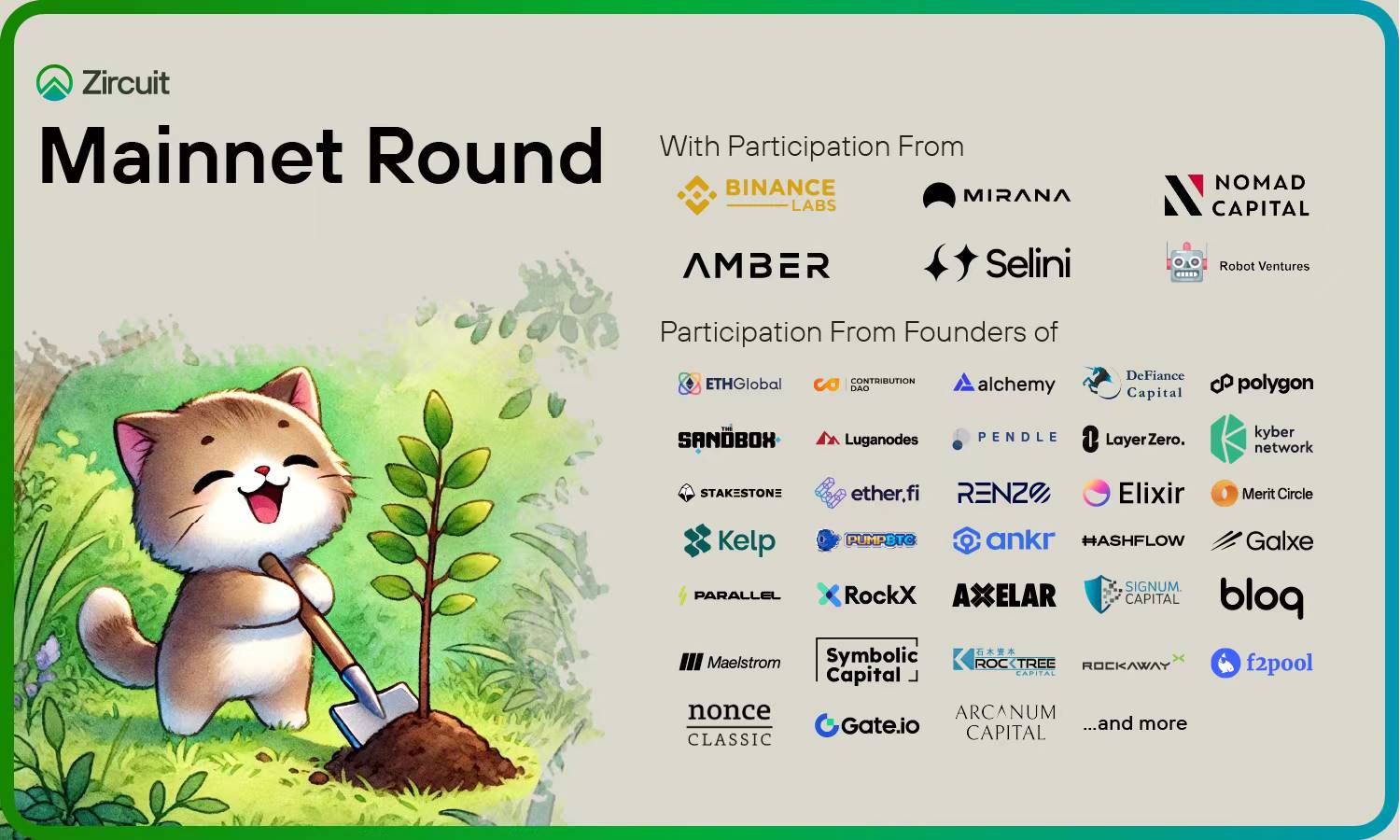

Team and core holder locks: Tokens held by the team and foundation are subject to a 1-year lock-up period. Investors hold only 10%, and most are founders within the industry, reflecting the team’s confidence in the project’s long-term vision.

-

Market performance: ZRC was listed on exchanges yesterday and is currently trading stably at $0.78, surpassing the market cap of Scroll, a leading peer project, demonstrating notable competitiveness and market recognition.

3. Airdrop Design and Fairness

Zircuit’s airdrop strategy emphasizes high returns and fairness, successfully attracting broad user participation:

-

Phase 1 and Phase 2 airdrops: Designed for free-to-claim participants, these airdrops feature low barriers and simple participation, with each account averaging over 100 ZRC—worth approximately $10 at current prices—delivering high yields. This approach attracted many new users and significantly boosted community activity.

-

Fair distribution praised: The equitable distribution model targeting EigenLayer token holders granted around 750 ZRC per person, ensuring both small and large holders had equal opportunities—a move widely recognized and appreciated by the community.

-

Future airdrop opportunities: With 8.55% + 13.08% of tokens reserved for future airdrops via phased unlocking, the project avoids market sell-off pressure while continuously incentivizing user engagement and strengthening community cohesion.

4. Growth Potential Still Untapped

-

TVL data: As of November 25, Zircuit’s TVL reached $2.166 billion, yet it still holds significant room for growth compared to category leaders.

-

Active user base: With over 123,000 active addresses, the project has laid a solid foundation for ecosystem development.

-

Cross-chain expansion: Plans to include Solana in its staking incentive program will further enrich its multi-chain staking ecosystem and unlock additional growth avenues.

5. Steady Progress in Ecosystem Development

-

Build-to-Earn program: Attracted over 1,600 project submissions, with more than 80 already live, forming a growing ecosystem matrix.

-

Strategic partnerships: Established deep collaborations with top-tier institutions like Binance, which led both funding rounds, further solidifying market trust and influence.

-

Exchange listings: On November 25, ZRC was simultaneously listed on major exchanges including Gate, Kucoin, and Bybit, reaching a broad user base.

6. Conclusion: Why Zircuit Still Deserves Attention

Zircuit demonstrates strong growth potential across security, tokenomics, airdrop strategy, and ecosystem development:

-

AI-powered security: The SLS system leverages AI technology to significantly enhance security, directly addressing industry pain points.

-

Robust tokenomics: High community reward allocations and stable market valuation reflect confidence in long-term development.

-

Fair airdrops: High-yield, low-barrier airdrop campaigns have earned widespread praise from users and the community.

-

Solid ecosystem and user base: A strong foundation of users and extensive partnerships enhances the project’s resilience and future scalability.

Even if you missed the first two airdrop phases, keep an eye on the current staking programs and free claim opportunities—Zircuit remains a high-potential project combining innovation and sustainable growth.

Note: This article is sponsored by Zircuit for traffic exposure. The content does not constitute investment advice! Do your own research!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News