Analyzing the Network Upgrade Proposal Dynamic TAO: A Major Shift in Bittensor's Economic Model

TechFlow Selected TechFlow Selected

Analyzing the Network Upgrade Proposal Dynamic TAO: A Major Shift in Bittensor's Economic Model

What impact does Dynamic TAO have on Bittensor?

(Note: The following content is compiled based on information from Dynamic TAO: Bittensor Improvement Template 1. Since this proposal is still under discussion, changes may occur.)

What is Dynamic TAO?

Dynamic TAO (BIT001) is a network upgrade proposal submitted by the Opentensor Foundation. It aims to alleviate root validator power concentration and potential collusion issues in the Bittensor network by reforming its staking mechanism and $TAO block reward distribution rules, while empowering all $TAO holders to actively participate in determining how block rewards are allocated.

Which mechanisms will Dynamic TAO change?

1. Changing the $TAO staking mechanism:

Under the current system, validators stake their $TAO on a subnet and perform validation tasks to receive newly minted $TAO as incentives, without any reduction in their originally staked $TAO amount. In other words, there is no risk to the principal staked—making it a "guaranteed return" model regardless of performance. Due to this risk-free mechanism, the circulating staking ratio for $TAO is quite high: currently, approximately 4.75 million out of a total circulating supply of about 6.25 million $TAO are staked, resulting in a staking rate of around 75.94%. Validators enjoy an average annualized yield of about 19.38% through staking.

However, this status quo could be altered. Dynamic TAO proposes allowing each subnet to issue its own “token,” collectively referred to as “Dynamic TAO” ($dTAO), with different Greek letter symbols used for differentiation.

These “subnet tokens” cannot be directly traded but can only be exchanged (unstaked/swapped) into $TAO via a unique liquidity pool.

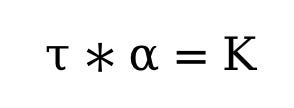

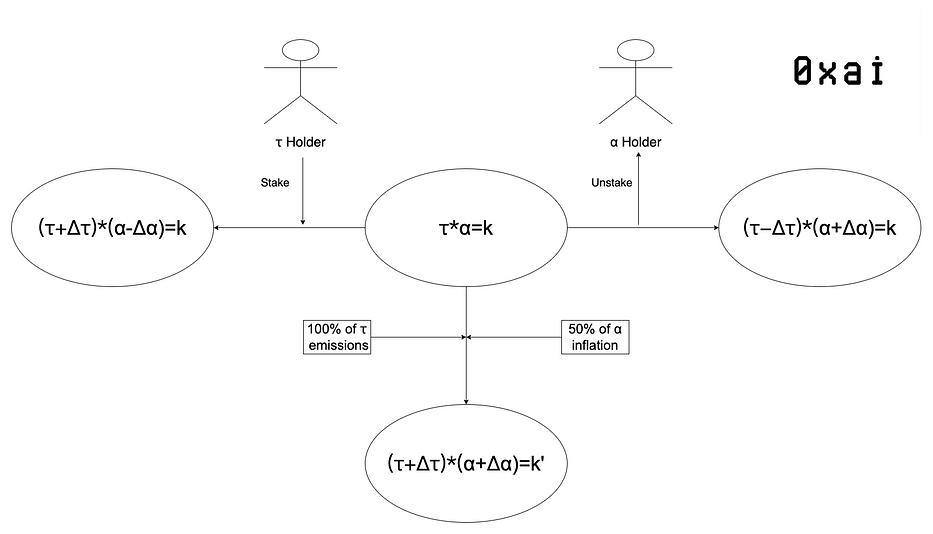

Each subnet will have one dedicated liquidity pool containing a certain amount of $TAO and its corresponding $dTAO. The pricing between $TAO and $dTAO during exchange follows the same constant product formula as Uniswap V2:

where τ represents the quantity of $TAO, and α represents the quantity of $dTAO. Assuming no additional liquidity injection, K remains constant regardless of how much $TAO is swapped for $dTAO or vice versa.

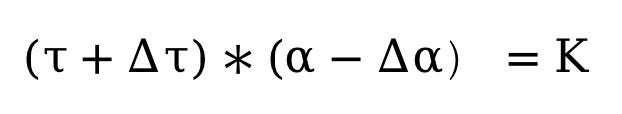

When a $TAO holder stakes, it is equivalent to purchasing $dTAO with $TAO, and the amount of $dTAO received is calculated using the following formula:

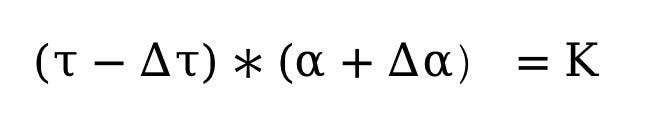

Conversely, when a $dTAO holder unstakes, it is equivalent to selling $dTAO for $TAO, and the amount of $TAO received is determined by:

However, unlike Uniswap V2, liquidity pools for $dTAO do not allow direct liquidity provision. Except when the subnet owner initially creates the subnet, all new liquidity comes solely from distributed $TAO rewards and 50% of the total new issuance of $dTAO. Specifically, the newly issued $TAO allocated to each subnet is not directly given to that subnet’s validators, miners, or owners; instead, it is entirely injected into the liquidity pool as backing. Meanwhile, 50% of newly minted $dTAO is also added to the liquidity pool, while the remaining 50% is distributed among validators, miners, and owners according to the subnet's own incentive design.

Staking and unstaking do not alter the value of K, whereas liquidity injections increase K to K’.

2. Changing the allocation rule for newly issued $TAO:

Currently, the proportion of newly minted $TAO that each subnet receives is decided by validators on the Root Network. This setup has revealed potential problems—for example, because power is concentrated among a small number of root validators, even if they collude to allocate rewards to low-value subnets, there is no penalty.

Dynamic TAO proposes ending the privilege of the Root Network and transferring decision-making power over $TAO allocation to all $TAO holders. The specific approach is:

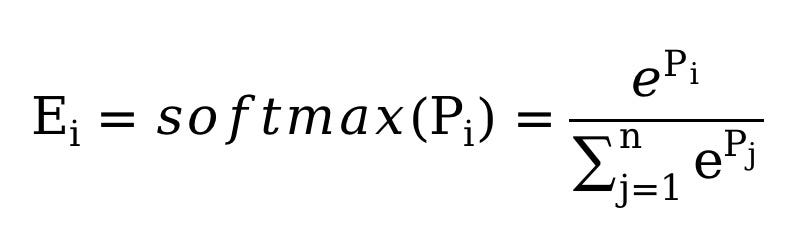

Adopting the new Yuma Consensus V2, which applies a softmax operation on the prices of various Subnet Tokens to determine their respective release ratios:

Softmax is a commonly used normalization function that converts each element in a vector into a non-negative value while preserving relative magnitudes, ensuring the sum of all transformed elements equals 1.

Where,

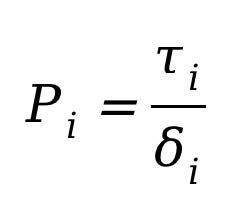

P denotes the price of $dTAO relative to $TAO, calculated by dividing the amount of $TAO in the liquidity pool by the amount of $dTAO.

According to the formula, the higher a subnet token’s price relative to $TAO, the greater its share of newly issued $TAO.

3. Delegating incentive-setting authority to individual subnets:

Under the current model, $TAO incentives received by a subnet are distributed in a fixed ratio of 41%-41%-18% among validators, miners, and owners.

Dynamic TAO proposes granting each subnet the right to issue its own “Subnet Token” and stipulates that aside from mandating 50% of new $dTAO issuance to be injected into the liquidity pool, the remaining 50% can be distributed among validators, miners, and owners according to mechanisms determined autonomously by participants within the subnet.

Example:

Per the current proposal, once Dynamic TAO is formally implemented, all existing subnets will mint corresponding $dTAO tokens. The genesis supply of $dTAO will equal the amount of $TAO previously locked by the subnet owner at creation. Of this, 50% of $dTAO will be deposited into the subnet’s liquidity pool, while the remaining 50% will go to the subnet owner.

Suppose the owner of Subnet #1 had previously locked 1,000 $TAO. Then, the initial $dTAO supply would also be 1,000. Among these, 500 $dTAO and 1,000 $TAO would serve as initial liquidity in the pool, while the remaining 500 $dTAO would be allocated to the owner.

Next, if a validator registers on Subnet #1 and stakes 1,000 $TAO, they would receive 250 $dTAO. At this point, the liquidity pool contains 2,000 $TAO and 250 $dTAO.

Assuming Subnet #1 earns 720 $TAO in daily block rewards, the liquidity pool will automatically receive 720 $TAO per day. The daily injection amount of $dTAO depends on the inflation rate set independently by the subnet.

What new features does Dynamic TAO bring?

-

The allocation of newly minted $TAO will no longer be decided by a few validators, but indirectly and collectively determined by all $TAO holders.

-

Staking $TAO will no longer be risk-free. Choosing to stake on unpromising subnets and exiting slower than others may result in significant principal loss.

-

Rather than “staking,” it is more accurate to view it as a “swap.” Staking $TAO on a subnet is effectively buying that subnet’s token.

-

In the short term, the impact of staking and unstaking activities on $dTAO prices will far outweigh the influence of actual $TAO earnings by the subnet.

What are the good and bad consequences?

Benefits:

-

The dominance of top validators over the entire Bittensor block reward distribution will disappear. The cost for potential attackers to manipulate the network by controlling staking volume will increase significantly.

-

The opportunity for newer subnets to rise will greatly improve. Viewing staking as swapping, early validators supporting high-quality subnets stand to gain enormous returns. Under the current model, supporting early-stage subnets doesn't substantially boost a validator’s annual yield. With Dynamic TAO, such support could yield tenfold or even数十fold (tens of times) returns on staked capital.

-

Competition among subnets will intensify, leading to a more vibrant Bittensor ecosystem. Given subnets’ autonomy in distributing half of their $dTAO emissions, subnet owners and validators will likely go to great lengths to attract higher staking volumes.

-

Delegators' enthusiasm for participating in subnet development and governance will rise sharply. No longer able to expect average annual yields, every staking action becomes an investment decision. Rational delegators will invest more effort into due diligence to identify the highest-quality and most promising subnets.

Drawbacks:

-

Speculative behavior may surge in the short term, raising concerns about a "race to the bottom." A subnet might achieve large staking volumes and rapidly inflate its $dTAO price—even without strong fundamentals—providing exit liquidity for early stakers (buyers). Subnets skilled at narrative marketing and price manipulation could crowd out genuinely high-quality ones with weaker promotional capabilities.

-

The "guaranteed return" staking model will cease to exist, potentially reducing the network’s overall staking ratio. Not all stakers are willing to “buy” subnet tokens—they may simply prefer holding $TAO. With staking returns becoming uncertain under Dynamic TAO, a portion of current stakers may choose to exit staking altogether.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News