Delphi Digital: From Beginner to Expert in the Bitcoin Ecosystem

TechFlow Selected TechFlow Selected

Delphi Digital: From Beginner to Expert in the Bitcoin Ecosystem

A Guide to Key Projects and Participation Opportunities in the Bitcoin Ecosystem

Author: Delphi Digital

Chapter 1: What Are Ordinals and BRC-20

Introduction

2023 was one of the most transformative years in Bitcoin's history. Previously known for its stagnant network, Bitcoin has now entered an exciting technological revolution with the emergence of inscriptions.

First came Ordinals—a new technology that rapidly gained traction and widespread adoption. With digital collectibles, meta-protocols, and emerging Bitcoin token standards like BRC-20, a vibrant ecosystem is quickly growing, already surpassing a market cap of $1.8 billion.

The once rigid Bitcoin network is now a thing of the past, filled with exciting new elements. But what exactly are inscriptions, and what is their value proposition? How do Ordinals and BRC-20 work? Most importantly, how can you get involved and harvest everything you want within this ecosystem?

Chapter 2: A Closer Look

Technical Overview

Satoshis

Before diving into Ordinals, we need to understand their foundation: Satoshis.

Satoshis, commonly abbreviated as "Sats", are the smallest denomination of BTC. One BTC equals 100 million Sats, and conversely, 100 million Sats make up one BTC. The name comes from Bitcoin’s anonymous creator, Satoshi Nakamoto. With BTC’s maximum supply capped at 21 million, the total number of Sats is capped at 2.1 trillion.

What’s the purpose of Sats?

Sats are the native currency of the Bitcoin network. They are used to pay transaction fees and, due to their small size, enable microtransactions.

Not all Sats are created equal!

Throughout Bitcoin’s operation, several recurring events occur due to key mechanisms hard-coded into Bitcoin’s protocol. These recurring events provide us with a simple way to classify Satoshis—by their rarity.

and participate in this ecosystem to harvest everything you desire?

Jargon Decoded

One of crypto’s most confusing aspects is jargon—it truly is a maze of unfamiliar slang. To eliminate confusion, all crypto-native terms in this article are written in italics and either immediately explained or defined in the glossary at the end.

Ordinal Theory: The Value Proposition

How do we track rare Sats?

This is where Ordinal Theory, introduced by former Bitcoin Core contributor Casey Rodarmor, comes into play. In essence, Ordinal Theory assigns a unique identifier to each Satoshi.

The theory proposes a numbering scheme for Satoshis, assigning each Sat a unique number based on its mining order. This makes tracking, transferring, and collecting Sats possible, opening up an entirely new market based on rarity.

Inscriptions: The Birth of Ordinals

In 2021, Bitcoin completed a critical upgrade called "Taproot," designed to help scale the network. Casey Rodarmor pioneered a unique method leveraging Taproot features to embed data directly onto the Bitcoin blockchain—specifically onto Satoshis—giving birth to inscriptions. A Sat inscribed with data is now commonly referred to as an Ordinal.

The easiest way to understand an Ordinal is to imagine someone carving artwork onto a coin. If the holder wishes, they can still spend the coin (to buy a bowl of luosifen), but the artwork remains permanently etched. Similarly, once data is bound to a single Sat, users can spend that Sat to transfer the associated data.

With the newfound ability to track and identify Sats using Sat theory, the trend of engraving arbitrary data onto Sats took off, birthing a completely new ecosystem.

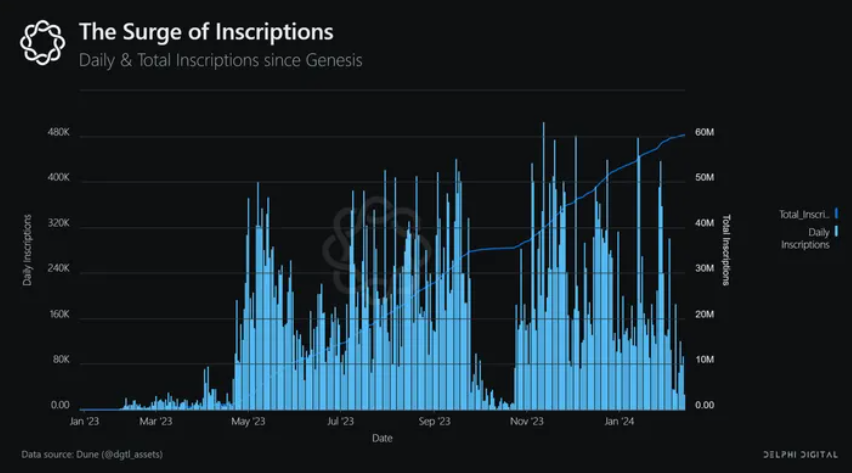

By early February 2023, the total number of inscriptions surpassed 60 million, demonstrating the ecosystem’s strong momentum.

Data inscribed on Sats can include images, GIFs, videos, and even HTML code. The only limitation is Bitcoin’s block size limit (4MB). Note that each inscription requires a fee, just like any other transaction on the Bitcoin network. Transaction fees for inscribing Sats typically vary depending on file size—the larger the file, the higher the cost.

NFTs vs. Ordinals

Ordinals with inscribed images resemble NFTs on Ethereum. Hence, people began calling them Bitcoin NFTs. While there are similarities, Ordinals differ from NFTs in four key ways:

- Ordering: Ordinals are etched onto Sats, which are numbered according to their mining sequence. Unlike NFTs, every Sat has true chronological ordering.

- Limits: As mentioned, inscribing data onto Sats faces a bottleneck—Bitcoin blocks are limited to 4MB, restricting the total data capacity per block across all Sats. In contrast, smart contract-based NFTs theoretically have no clear data capacity limits.

- On-chain: Ordinals are fully stored on-chain, meaning inscriptions on Sats exist permanently on the distributed ledger and are immutable. NFT metadata, however, is often stored on centralized servers—if the server goes down, the NFT loses its path and cannot point to the correct data source.

- Concurrency: A Sat can host multiple different files. Since inscriptions can be arbitrary data, unique digital products can be created. For example, a Sat can be inscribed with HTML code pointing to different files on the same Sat, enabling internal hyperlinks and giving embedded Sats web-like functionality.

Mempool

Understanding the Bitcoin mempool is crucial before interacting with Ordinals-enabled applications.

Bitcoin transactions aren’t added directly to the blockchain. Instead, they first enter a queue called the mempool. All valid transactions wait here until miners validate and package them into a block—this process takes approximately 10 minutes. When the network is busy, a large volume of transactions floods the mempool, making it difficult for miners to process them quickly, causing congestion and longer confirmation times. The direct consequence? Increased transaction fees.

Bitcoin miners receive transaction fees as rewards for validating and adding transactions to the blockchain. Users can choose the fee for each transaction, meaning they can increase fees to incentivize miners to prioritize their transaction. The higher the fee offered, the greater the incentive—and thus, the higher the priority in the mempool.

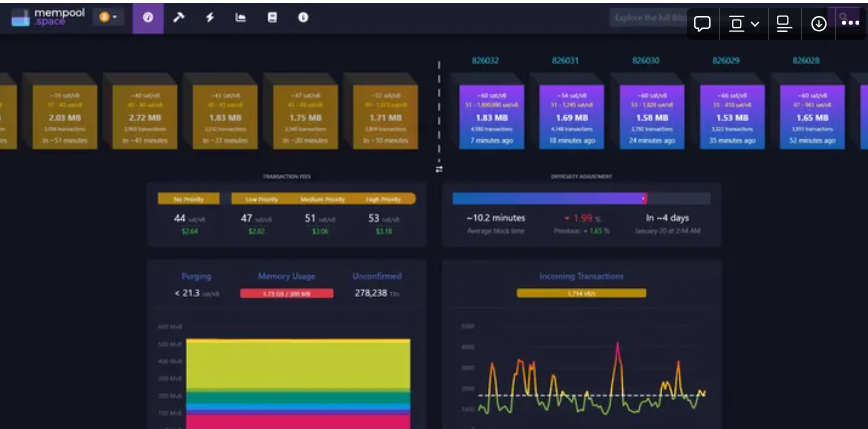

Below is a screenshot of a mempool browser.

Here, you can view several metrics such as current gas fees, block height, and average block time. The mempool block explorer also visually represents the Bitcoin blockchain, with pending blocks shown in orange and confirmed blocks in blue-purple gradients. In the top-right corner, you can input any transaction ID or wallet address to retrieve more details—for instance, the transaction’s position in the queue or tokens held by a specific address. Overall, the mempool is a vital tool for tracking transactions when interacting with applications.

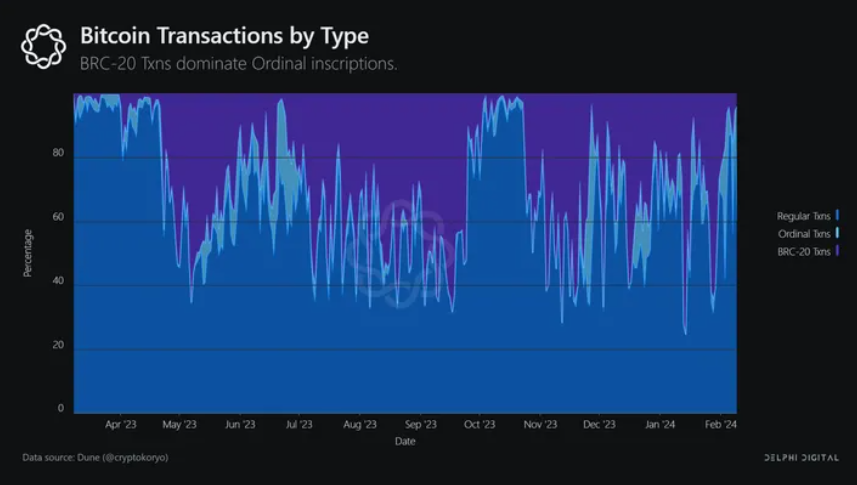

BRC-20: A New Token Standard

Shortly after Ordinals emerged, a Twitter user named redphone first proposed a new token standard. Domo implemented the idea and designed the new standard: BRC-20. BRC-20 inscriptions quickly gained popularity and began dominating transactions related to Ordinals.

BRC-20 refers to Ordinals inscribed with JSON data, enabling the creation and transfer of tokens. It includes three token functions: deploy, mint, and transfer. Token ownership is proven by the latest transfer receipt—in practice, wallets and other applications read these receipts and assign BRC-20 balances to the addresses holding them.

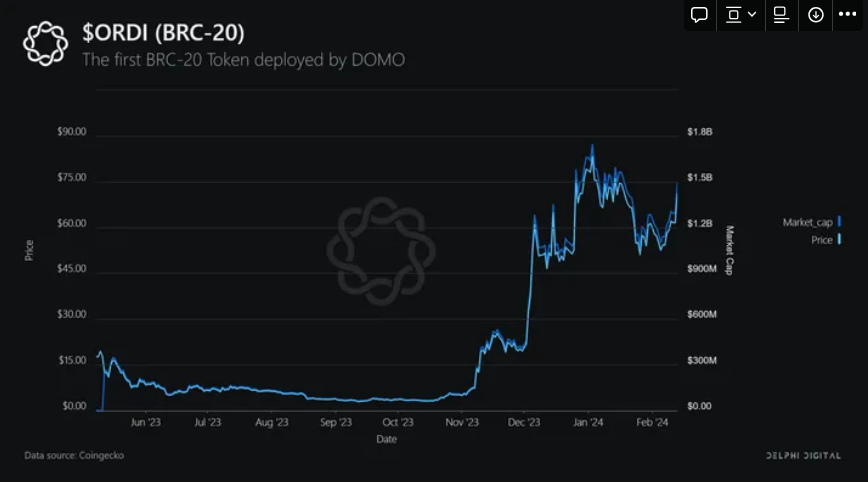

The original BRC-20 token contract created by Domo was $ORDI. Initially, the minting fee was $5 for every batch of 1,000 ORDI. Recently, $ORDI’s market cap surpassed $1.4 billion, with the token currently trading at $67.72! This means anyone who minted an original batch of 1,000 ORDI at $5 would now hold over $67,000 worth of value.

Want to learn more about the complexities of BRC-20 tokens? Check out these deep dives by Delphi Digital:

- “BRC-20: Past, Present, and Future”

- “State of Bitcoin”

Chapter 3: Getting Started

This section covers how to create and use a Bitcoin wallet, along with the pros and cons of different wallets for interacting with inscriptions. If you’re already experienced, feel free to skip this chapter.

How to Create a Bitcoin Wallet Supporting Ordinals

The first step is creating a Bitcoin wallet and funding it. Your Bitcoin wallet will store your Sats and Ordinals, and allow interaction with various applications.

The most important point here is: your wallet must integrate a separate address for Ordinals or have the ability to freeze inscribed Sats. As previously stated, Sats are the native currency of the Bitcoin network, used to pay transaction fees. Ordinals are simply data-inscribed *Sats*,* creating a risk—you might accidentally spend your valuable Ordinal Sats to pay transaction fees.

Therefore, it’s strongly recommended to use a wallet supporting two addresses or capable of freezing Sats to prevent loss of inscribed Sats.

Two solid options offering this functionality are Unisat and Xverse. Unisat offers better application interoperability, while Xverse focuses more on user experience. The choice is yours! In the following tutorial, we use the Xverse wallet.

Install Your Bitcoin Wallet

Visit the Xverse website. The Xverse wallet is available as a mobile app or browser extension. For easier future interaction with applications, using the browser extension is recommended. To install, click download and add the extension to Chrome.

Create Your Bitcoin Wallet

Once installed, click the icon under browser extensions, then click “Create Wallet.” Each new wallet generates a unique mnemonic phrase, typically consisting of 12 words.

This is your wallet’s private key—your only way to recover it if lost. Store it securely! Anyone with access to this mnemonic phrase gains full control over your wallet and assets. It’s generally recommended to write it down physically (e.g., on paper) rather than storing it electronically (e.g., in a document or photo album) to prevent unauthorized access due to device compromise.

After backing up your mnemonic, select the correct words to confirm storage.

Finally, create a password. You’ll use this every time you access your wallet via the browser extension.

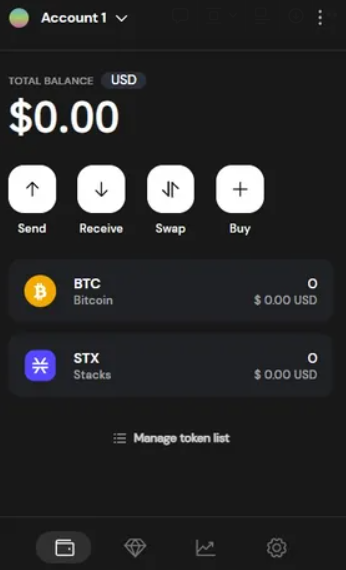

Meeting Your Bitcoin Wallet

Your wallet displays your token balance and allows sending, receiving, swapping, and purchasing tokens. Under “Settings,” you can access your mnemonic and change display currencies. Currently, my token balance is zero.

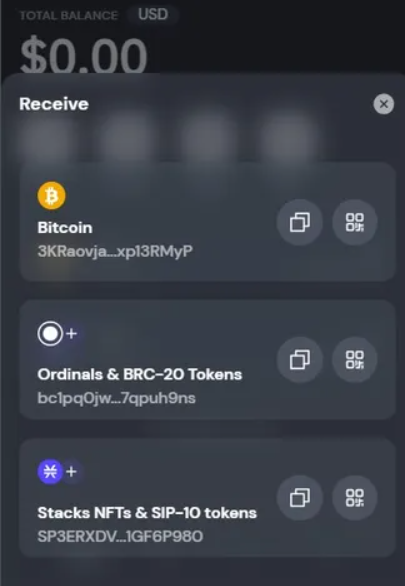

When clicking “Send” or “Receive,” your wallet displays three distinct Bitcoin addresses—similar to bank accounts, these must be provided when sending or receiving funds. Here, Xverse’s user-friendliness shines.

The first address is your BTC address, which should always be used to fund your wallet. Your BTC is stored here and used to pay transaction fees. Never manually use this address to receive Ordinals or BRC-20 tokens to avoid spending ordinal Sats on transaction fees.

The second address is exclusively for Ordinals and BRC-20 tokens. When deploying or minting inscriptions, Xverse automatically ensures Ordinals and BRC-20 tokens are sent to this address. However, if conducting a peer-to-peer transaction (direct receipt), ensure you provide this address to receive Ordinals and BRC-20.

The third address is for Stacks NFTs and SIP-10 tokens—beyond the scope of this guide.

Funding Your Wallet

You can fund your wallet in several ways:

- Purchase BTC directly from your wallet: Click the “Buy” button to purchase BTC directly through third-party services like Moonpay or Transak. These gateways allow buying Bitcoin with debit or credit cards. Note that using third parties introduces additional potential risks.

- Send BTC from a centralized exchange: If you use centralized exchanges like Coinbase or Robinhood, you can directly fund your wallet from your exchange account. Even if you don’t have an exchange account yet, creating one may help avoid extra risks associated with other funding options. When sending BTC, provide your Bitcoin wallet address (first address). Transactions typically take around 10 minutes to confirm.

- Bridge: If you’re a crypto native and already have a wallet on networks like Ethereum, you can bridge BTC from your existing wallet to your Bitcoin wallet. Note that this method may introduce security risks, counterparty risks, and smart contract risks. Research carefully before using such applications!

If you plan to interact with any applications listed below, we recommend starting with small amounts until you’re fully comfortable with the process.

Chapter 4: Guide to the Ordinals and BRC-20 Ecosystem

Although the Ordinals ecosystem is still relatively young, several applications support trading of Ordinals and BRC-20 tokens. Below is a list of notable platforms worth trying:

OKX, Unisat, and Magic Eden: Ordinals Marketplaces

Ordinals marketplaces facilitate buying, selling, and swapping of Ordinals and BRC-20 tokens. Through these platforms, you can effortlessly sell your Ordinals and BRC-20s and browse various collectibles. Additionally, these markets often allow users to deploy, mint, and transfer inscriptions.

Based on scale and trading volume, the top three markets are OKX, Unisat, and Magic Eden. While OKX currently leads this race, it restricts certain features to users of its native OKX wallet only. On the other hand, Unisat and Magic Eden offer more user-friendly experiences.

Quick Recommendation

While you can trade Bitcoin NFTs on these marketplaces, Ordinals Market and Ord.io cover a broader range of NFT collections and are excellent tools for tracking trending collections over the past 24 hours, 30 days, 90 days, etc.

Ordinals Bot: Deploy, Mint, and Transfer Ordinals

One of the easiest ways to create inscriptions and deploy any type of Ordinal is the OrdinalsBot application. Through integrated APIs, users can generate bulk inscription orders—especially convenient when creating entire collections. API service payments can be made via the Lightning Network or directly on Bitcoin.

It supports all types of inscriptions, with additional features like inscribing onto specific Satoshi types—for example, only on uncommon Sats.

Magisat: Rare Sats Marketplace

Magisat is a marketplace dedicated to trading Rare Sats. You can trade, buy, and sell Satoshis, covering any rare or unusual Sats, such as Pizza Satoshis. Pizza Satoshis are a famous case in the Bitcoin community, linked to the 2010 Pizza Event (a programmer bought two pizzas for 10,000 BTC, marking BTC’s first real-world purchase).

Additionally, Magisat allows you to scan your wallet to check the rarity of any Sats.

Ordinalhub: Aggregator and Analytics Tool for Ordinals

Ordinalhub is an aggregator—a tool that consolidates Ordinals from different markets onto one platform, offering features like trends, recent sales, and floor price displays. It simplifies trading by helping users find the best prices, since BRC20 tokens and collectibles often have varying prices across platforms.

Liquidium: Ordinals Lending Platform

Liquidium is one of the first applications supporting decentralized finance (DeFi) with Ordinals. The protocol enables peer-to-peer lending of Bitcoin using Ordinals inscriptions as collateral.

Currently, top-tier lending markets include NodeMonkes, Bitcoin Frogs, and RSIC.

Alex Go: Leading DeFi

With over $800 million in total trading volume and $122 million in TVL, AlexGo is one of the leading protocols for DeFi on Stacks, a Layer 2 for Bitcoin. It supports Ordinals through four applications:

- AMM DEX: A native decentralized exchange using automated market makers (AMMs) to facilitate trading between various Bitcoin ecosystem assets.

- B20: A native trading app supporting order-book-based trading of BRC-20 tokens.

- Kickstart: A launchpad for various projects, including Ordinals and BRC-20.

- Connect: An asset bridge supporting Bitcoin, BRC-20, and EVM-compatible networks.

Chapter 5: Key Developments in the Ecosystem

Recursive Inscriptions

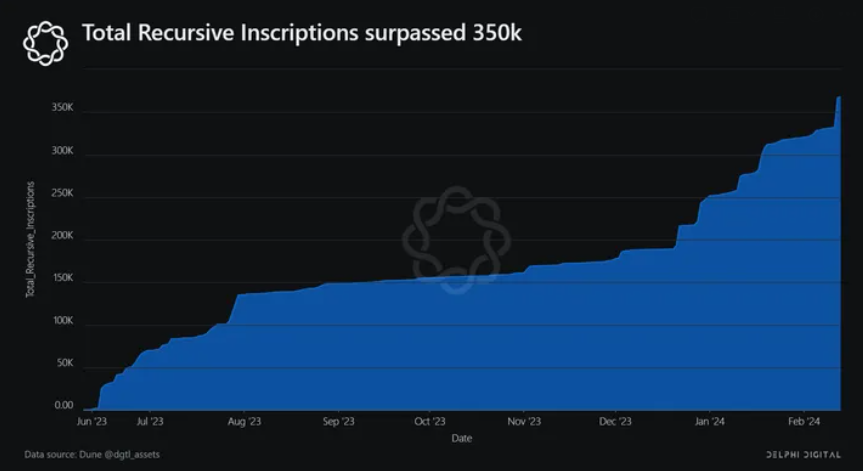

One of the earliest breakthrough developments in the inscription space was the introduction of recursion. Recursive inscriptions first gained attention in June 2023, and recently, the total number of recursive inscriptions has exceeded 350,000.

In short, recursive inscriptions allow new inscriptions to call and reference data from existing ones. This might sound dull, but the implications are profound!

First, recursion provides a practical way to bypass Bitcoin’s 4MB block limit. By splitting data into multiple inscriptions across different blocks that reference each other, large files can easily be uploaded to the Bitcoin network. Two other notable benefits are improved storage efficiency and reduced transaction costs.

Most importantly, recursion is the origin of numerous developer tools. With recursion, code libraries can be built using inscriptions. Thus, Ordinals truly reach the next level of optimization. For example, we can now create high-quality NFT collections on Bitcoin—recursion allows creators to leverage existing inscription libraries, aggregating traits to simplify the creation of thousands of unique NFTs without having to individually mint thousands of sets as before.

Alternative Token Standards

BRC-20 tokens have only three functions (deploy, mint, transfer), making them functionally limited and static in development. As a result, new experimental token standards have emerged, aiming to improve upon BRC-20. Below is a quick overview of two current alternatives:

The CRBC-20 token standard, developed by Cybord, leverages the fact that inscriptions can directly store arbitrary data. As a result, inscription fees are significantly reduced, and indexing is greatly simplified, making CRBC-20 a cheaper and faster alternative to BRC-20.

Like CRBC-20, ORC-20 addresses BRC-20 limitations, focusing on enhanced security and flexibility. Unlike BRC-20, ORC-20 supports a wider range of data formats, allows transaction reversals, and maintains backward compatibility with BRC-20. Additionally, ORC-20 saves on transaction fees by reusing inscriptions, reducing costs.

Chapter 6: The Road Ahead

Key Takeaways

In early 2023, Bitcoin underwent a major development centered around inscriptions, creating immutable digital assets: Ordinals and BRC-20 tokens. Although the emerging Ordinal ecosystem is still immature, its market cap has already surpassed $1.7 billion, and undoubtedly, it has driven innovation in Bitcoin by enabling users to store various data on Sats.

The ecosystem currently includes centralized and decentralized exchanges, marketplaces, popular token standards, and protocols built on this technology. In its early stages, speculation and enthusiasm among Ordinals supporters continue to rise alongside new token standards, and even DeFi applications are beginning to experiment with financializing Ordinals.

Moreover, the recent approval of spot Bitcoin ETFs marks a milestone in institutional adoption. While long-term effects remain debated, the Ordinals and BRC-20 ecosystem stands to benefit from Bitcoin’s broader adoption and growing demand.

Outlook

Despite thriving growth, criticism persists—some Bitcoin enthusiast groups advocate eliminating Ordinal technology and its related elements. While this criticism is multifaceted, it stems from technical drawbacks and perceived negative impacts on the Bitcoin network, with some even viewing inscriptions as system vulnerabilities.

A detailed discussion exceeds this guide’s scope. However, it’s important to acknowledge that Ordinals and BRC-20 transactions have caused explosive demand for Bitcoin block space, potentially negatively impacting network health. Congested mempools leading to unreasonably high fees and long confirmation times are just one of the adverse consequences. On the other hand, inscriptions are a significant revenue source for miners securing the network. The upcoming Bitcoin halving, expected around late April 2024, when miner block rewards are halved, will further intensify this debate.

Although the future of Ordinals and BRC-20 remains uncertain, excitement around ecosystem development remains intense. We hope this guide not only sparks your interest but also encourages deeper exploration of Bitcoin’s Ordinals world. To keep your curiosity alive and point toward potential research paths, here are two upcoming trends to watch:

Trac Network: Pioneer of Decentralized Indexing

For Ordinals to function properly, Ordinals indexing is required. Without delving into technical complexity, it’s crucial to understand that Ordinal and BRC-20 transactions rely on off-chain indexing of on-chain data—enabling the network to identify, track, and order Ordinals. This means indexing is critical infrastructure.

To exchange inscriptions between parties, both entities must run the same indexer. Currently, the vast majority of projects use the ord indexer to solve compatibility issues, making this vital infrastructure highly centralized. Dependence on a single indexer poses serious technical risks, prompting some protocols to build viable competitors. One such project is Trac Network.

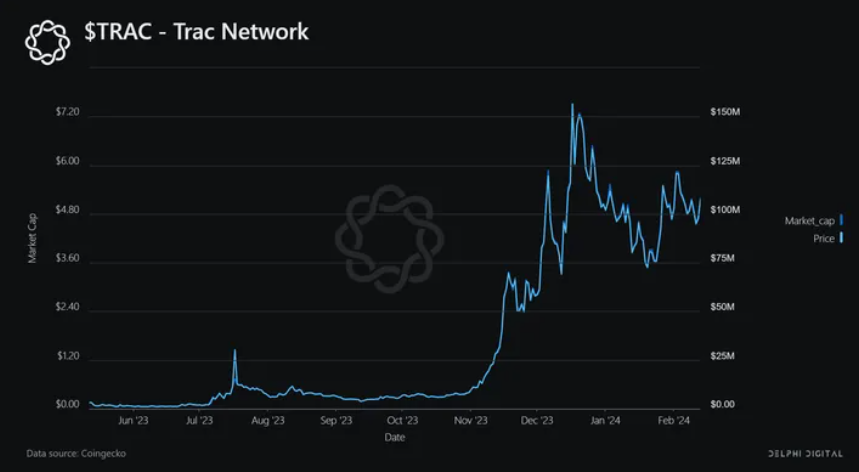

Trac Network’s core product is Trac Core, with a value proposition of being a decentralized, open-source indexer. It achieves decentralization by introducing a governance token, $TRAC. This means $TRAC holders can influence direction and manage Trac Core’s development by voting on key initiatives.

$TRAC is currently trading at $4.65 with a market cap of $97M, though this decentralized indexer hasn’t been fully launched yet.

For more information, check out “Many Words On Trac Network”.

Rune: Fungible Token Protocol

Casey Rodarmor, creator of Ordinal Theory, is developing a fungible token protocol expected to launch in April. This new Bitcoin fungible token protocol, called Rune, built on the Ordinals tech stack, aims to resolve many issues with the current BRC-20 standard. For example, tokens created using the Rune protocol won’t require off-chain infrastructure, eliminating many pain points associated with BRC-20.

Given that it’s built by the same person who introduced Ordinal Theory, speculation about an official Ordinal token issuance is rampant in the community. Such a token standard could genuinely have the potential to replace BRC-20.

Aaron summarized Casey Rodarmor’s latest podcast on Rune here—a goldmine of alpha.

Glossary

- Aggregator (Aggregator): An aggregator integrates products, activities, data, and information from various markets and exchanges onto a single platform. Using an aggregator helps users efficiently determine optimal pricing.

- Automated Market Makers (AMMs): AMMs are algorithms facilitating decentralized trading of digital assets. In short, AMMs automatically swap assets using liquidity pools—smart contracts containing two or more cryptocurrencies.

- Bitcoin Halving (Bitcoin Halving): A key mechanism built into Bitcoin’s core design. Approximately every four years, the block reward halves to control Bitcoin’s supply, scarcity, and inflation. Miners secure the network by solving complex mathematical equations and are rewarded via block rewards to incentivize validation and maintenance of Bitcoin’s state. After each halving, miner rewards are cut in half.

- BRC-20: A token standard designed to generate and manage fungible tokens on the Bitcoin blockchain. It uses the Ordinals protocol for data inscription and is a type of Ordinal.

- Bridging & Bridges (Bridging & Bridges): Bridges in crypto are applications allowing users to exchange assets between two different networks. Bridging refers to transferring assets across networks.

- Decentralized Finance (DeFi): Refers to applications using blockchain technology to provide financial services without intermediaries. DeFi allows trading assets, earning interest, borrowing, lending, etc., without third-party middlemen.

- EVM-Compatible (EVM-compatible): EVM refers to the Ethereum Virtual Machine, Ethereum’s computational engine. It controls the network state and enables smart contract execution. EVM-compatibility means a network or protocol can write and deploy code compatible with the Ethereum Virtual Machine.

- Floor Price (Floor Price): The lowest market price for an asset—essentially the cheapest price at which an item can be purchased.

- Governance Token (Governance Token): A utility token granting holders the right to participate in project decisions, typically through voting on governance proposals that impact the project’s trajectory.

- L2: Short for Layer 2, referring to networks built atop Layer 1 blockchains—such as Bitcoin’s Layer 2 networks. Generally, L2s enhance and extend the underlying blockchain’s functionality, such as reducing transaction fees.

- Ordinals: Specific Sats inscribed with arbitrary data on Bitcoin. Data can include text, images, video, GIFs, audio, or even code.

- Satoshis (Sats): The smallest denomination of BTC, commonly abbreviated as Sats. One BTC equals 100 million Sats. Named after Bitcoin’s anonymous creator, Satoshi Nakamoto. Sats are used to pay transaction fees and enable microtransactions. With Bitcoin’s maximum supply capped at 21 million, the total number of Sats is capped at 2.1 trillion.

- TVL: Total Value Locked—an indicator commonly used in crypto to define the total value of digital assets locked within an application.

Special thanks to Redphone and Gutz for their valuable feedback and contributions to this report.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News