The Year of Airdrops and Interactions: Seven High-Potential DeFi Products You Should Try

TechFlow Selected TechFlow Selected

The Year of Airdrops and Interactions: Seven High-Potential DeFi Products You Should Try

Whether or not you are bullish on the EigenLayer ecosystem airdrop, you can use Pendle to speculate on them—or simply to earn extra yield.

Author: THE DEFI INVESTOR

Translation: TechFlow

Introduction

This article aims to highlight several innovative DeFi products I've been actively using recently. Engaging directly with on-chain applications makes it far easier to grasp cryptocurrency concepts compared to merely reading about them. More importantly, early adopters have often received substantial rewards through token airdrops. Below are some particularly interesting DeFi products I highly recommend.

Pendle's Restaking Pools

Some may already know that Pendle is the largest yield-trading protocol.

Using Pendle, you can speculate on whether the yield from a particular opportunity will rise or fall, earn fixed yields on your capital, and more.

However, in this article, I’ll focus primarily on its newly launched liquidity restaking pools, as Pendle has done exceptionally well in leveraging the restaking narrative.

So far, Pendle has launched yield-trading pools for three liquid restaking tokens:

-

rsETH from Kelp DAO

-

eETH from EtherFi

-

ezETH from Renzo Protocol

All these liquid restaking protocols are built on EigenLayer and offer real-time points programs for their ETH depositors.

What makes Pendle’s restaking pools interesting is that they allow anyone to speculate on the potential airdrop value of EigenLayer and its restaking projects.

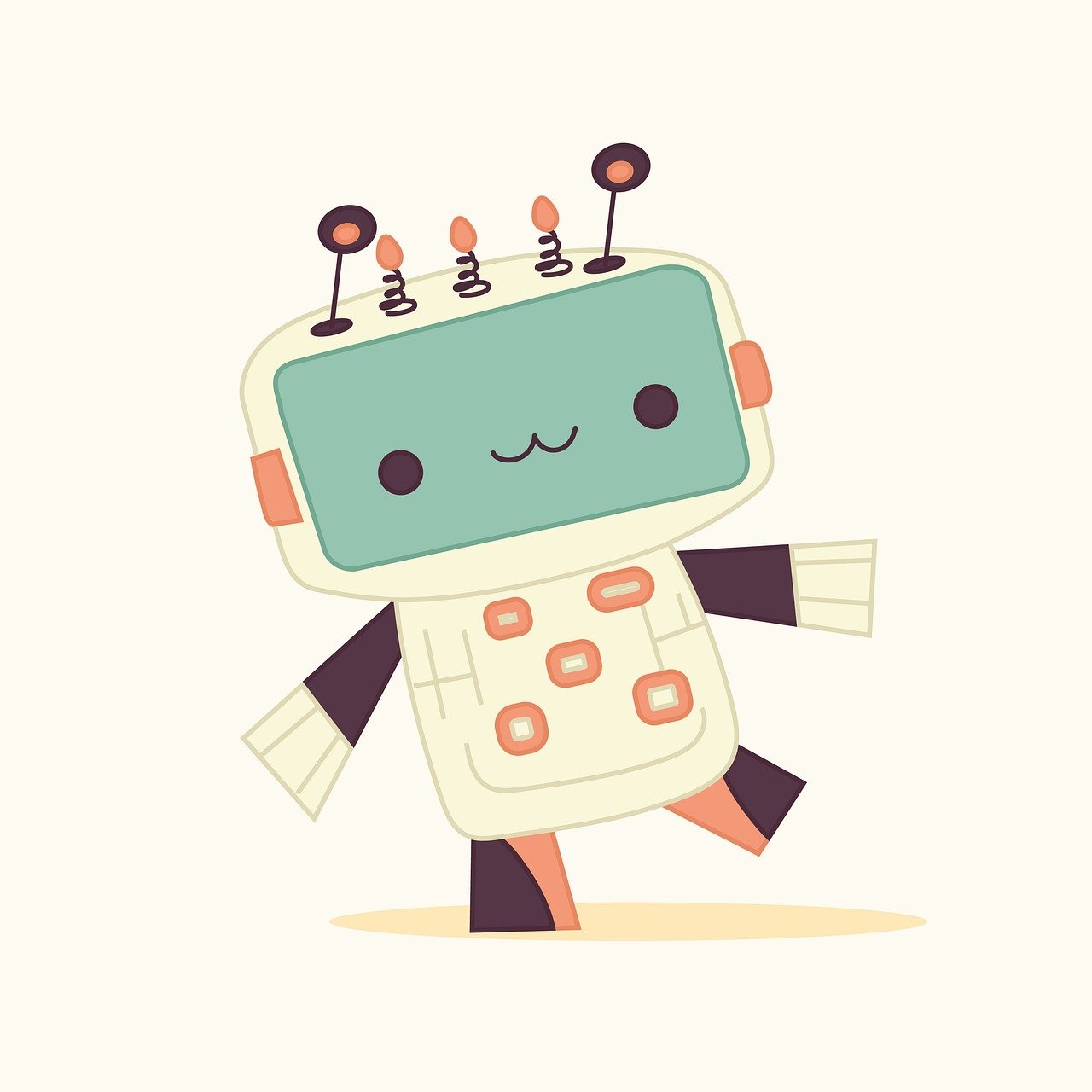

Here’s an example using the rsETH pool on Pendle:

-

If you believe the EigenLayer and Kelp DAO airdrops will be highly valuable: Buy YT rsETH on Pendle to gain exposure to up to 27x Kelp DAO points and 9x EigenLayer points (a high-risk strategy, as profitability depends entirely on these points having significant value—you're essentially buying the points directly).

-

If you think the airdrops are overvalued and would prefer a fixed APY above 30% on your ETH instead, buy PT rsETH.

-

If you want to retain your EigenLayer points while earning additional yield on your ETH, provide liquidity to the rsETH pool.

Whether or not you’re bullish on EigenLayer ecosystem airdrops, Pendle allows you to speculate on them—or simply earn extra yield.

Rabby Wallet

If you're still using Metamask, I strongly recommend trying Rabby.

Rabby is a crypto wallet for Ethereum and all EVM chains, built by the team behind DeBank, the most popular Web3 portfolio tracker.

Here are several reasons why I like it:

-

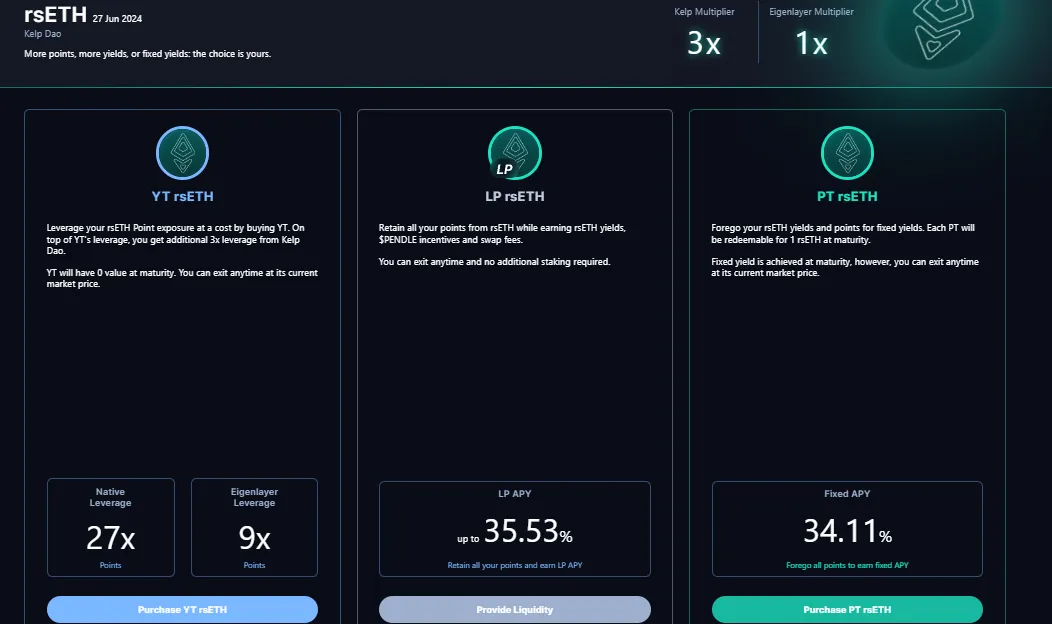

Pre-signing transaction checks for security: This is my top reason for recommending Rabby. The wallet displays many useful details for every transaction you attempt to sign.

-

Smoother multi-chain experience: When using dApps, the wallet automatically switches to the correct chain based on the site you're visiting.

-

Transaction simulation results: For every interaction with a dApp, the wallet shows your estimated balance changes.

-

Revoke token approvals: As an added security measure, you can check which dApps have access to your funds and easily revoke their permissions.

Additionally, performing specific actions on Rabby earns Rabby Points, which could qualify you for a future Rabby airdrop.

The points program was launched just a few weeks ago.

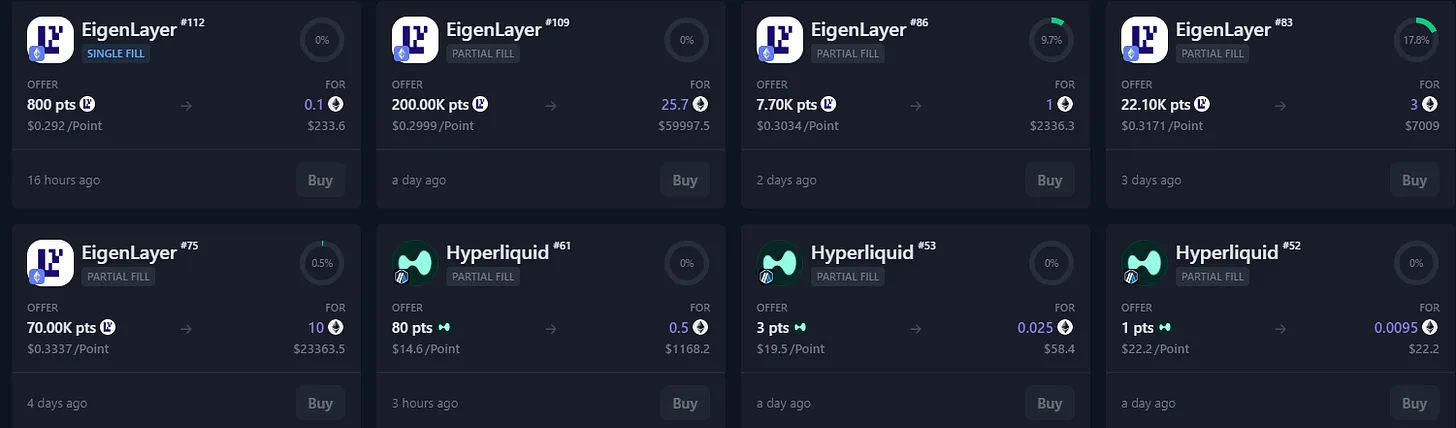

Whales Market

Whales Market is an over-the-counter (OTC) decentralized exchange.

It appears to be one of the most interesting Solana-native dApps. What sets it apart from other OTC DEXs is that, in addition to tokens and NFTs, it also enables trading of points and future airdrop allocations.

Whales Market has already enabled trading of points for EigenLayer, FriendTech, and Hyperliquid, and will soon support Blast, Kamino, Drift, and MarginFi points.

If you're farming airdrops and want to sell your future allocation, or if you want to buy future airdrop rights, this platform is worth checking out.

I’ve also found it useful for estimating the potential value of airdrops I’m targeting.

For example, one Hyperliquid point currently trades for $2 on Whale Market, though it has fluctuated significantly over the past few weeks.

RocketX

There are now many different cryptocurrency bridges.

But the problem with most bridges is that they only support a handful of blockchains, typically the most popular ones.

If you want to bridge your funds to Cosmos L1 or another less popular chain, you may find it difficult to do so without using a centralized exchange.

RocketX is essentially a hybrid CEX and DEX aggregator.

For any cross-chain swap you want to make, it searches across dozens of bridges and centralized exchanges to find the best price for your order.

Its key advantage is supporting asset transfers across more than 200 blockchains, covering nearly every relevant blockchain.

For those who sometimes struggle to find a bridge supporting a specific cross-chain trade, I recommend giving RocketX a try.

Picasso

On Ethereum, restaking is undoubtedly the hottest topic right now.

There isn’t much discussion about restaking on other blockchains, but Solana is certainly one of the most vibrant ecosystems at the moment.

Just last week, Picasso launched the first restaking project on Solana.

Users can now deposit SOL or SOL liquid staking tokens into Picasso’s restaking vault. These restaked assets will be used to secure validators in upcoming Solana-IBC connections.

In simple terms, thanks to Picasso’s restaking, Solana will, for the first time, achieve seamless interoperability with IBC-enabled chains in a minimally trusted manner.

IBC-enabled chains include Cosmos Hub, Cosmos SDK chains, Polkadot, and Kusama parachains.

SOL restakers on Picasso receive a 71% APY reward on their capital via token emissions. The protocol’s treasury cap is currently full but will be increased soon.

In the long run, restaking has the potential to significantly increase demand for L1 tokens, so it's exciting to see restaking expanding beyond Ethereum.

Orca

Orca is a product built by Kujira, a Cosmos L1 project whose core team develops a wide range of products.

In short, this product enables discounted purchases of assets through liquidations.

Typically, on money markets and exchanges, only bots can participate in liquidation processes.

Orca democratizes this process by allowing anyone—without coding skills or bots—to bid on liquidated collateral.

On the Kujira network, users can borrow the USK stablecoin using various collateral assets. If their loan-to-value ratio becomes too high, their position gets liquidated, and their collateral is auctioned off on ORCA.

Orca users now have the opportunity to purchase these liquidated assets at a discount to the current market price. All they need to do after accessing the platform is decide:

-

Which liquidated assets to bid on

-

How much to bid

-

The discount (premium) of their bid

After that, Orca handles everything else.

Currently, the total value of bids on liquidated collateral is relatively low (only $26,000 over the past 7 days), so not many bids are being fulfilled.

But as the Kujira ecosystem grows, this value is likely to increase as well.

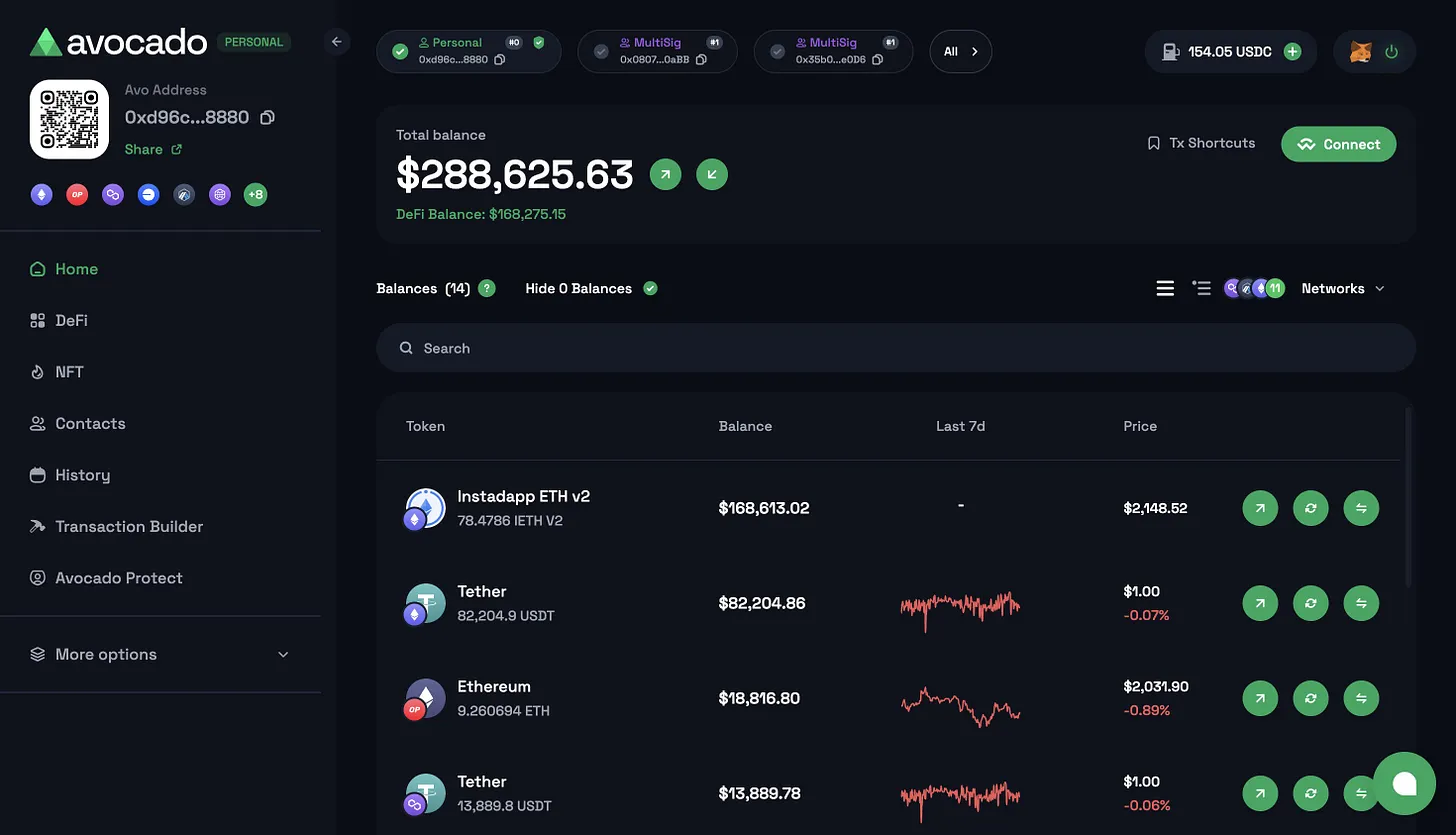

Avocado Wallet

Avocado Wallet is a smart contract wallet with advanced account abstraction features.

It was created by Instadapp, one of the most popular DeFi projects on Ethereum, with over $2 billion in total value locked (TVL).

For users engaging in DeFi across multiple blockchains, Avocado can simplify your on-chain activities thanks to several key features:

-

Network abstraction: Like Rabby, the smart contract wallet automatically connects to the correct network for each dApp you interact with.

-

Gas abstraction: Avocado abstracts gas fees using a unified USDC gas reserve. Simply top up USDC on any network, and your transaction fees on major chains like Ethereum, Polygon, and Avalanche will be denominated in USDC (note: Avocado charges a 20% fee on gas costs).

-

Cross-chain sending: You can easily transfer funds directly from one blockchain to another within the wallet.

Since it's a smart contract wallet rather than a standard wallet, you can connect to Avocado just like you would with Metamask or any other wallet when using dApps.

You don't need to download any extensions. Poor cross-chain user experience is one of the biggest problems in crypto, and Avocado Wallet is one of the best solutions available today.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News