5 Little-Known Crypto Trading Tools to Know

TechFlow Selected TechFlow Selected

5 Little-Known Crypto Trading Tools to Know

This article introduces 5 lesser-known free crypto trading tools: SpotOnChain, Lore, Arkham, VeloData, and DexCheck.

By: The DeFi Investor

Translation: Yvonne, Mars Finance

Over the past two years, many crypto tools have emerged in the market.

The best part is that many of them are free—you can use these tools to gain an edge over others.

In this article, I’ll introduce five little-known but highly useful free crypto tools, along with their most interesting features.

Let’s dive in👇.

1. Spot On Chain

Spotonchain is an AI-powered cryptocurrency analytics platform.

It's one of my go-to tools when seeking on-chain insights.

It offers many useful features, such as an on-chain news feed, visualization tools that simplify complex blockchain transactions, and personalized alerts.

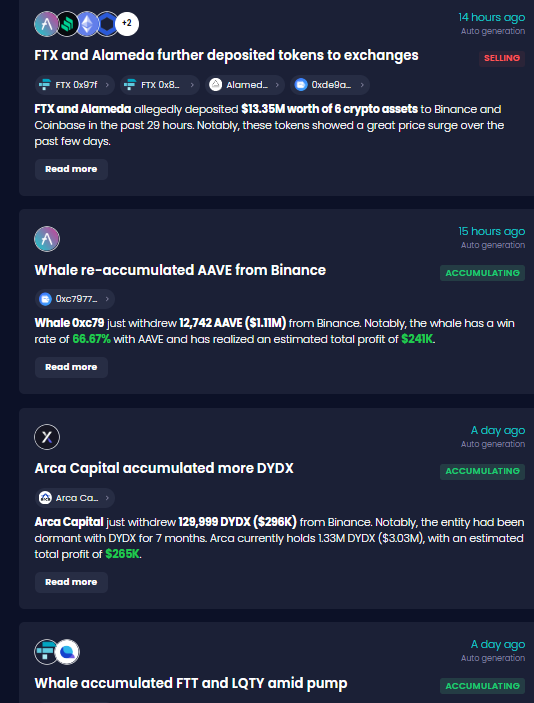

In my opinion, the most interesting feature is the simplified on-chain news feed.

It provides "on-chain signals" covering transactions from whales, "smart money" wallets, and venture capital firms. Monitoring what smart money is doing on-chain is extremely valuable.

For instance, when multiple VC firms purchase the same token, it may signal that a major announcement from the project is imminent.

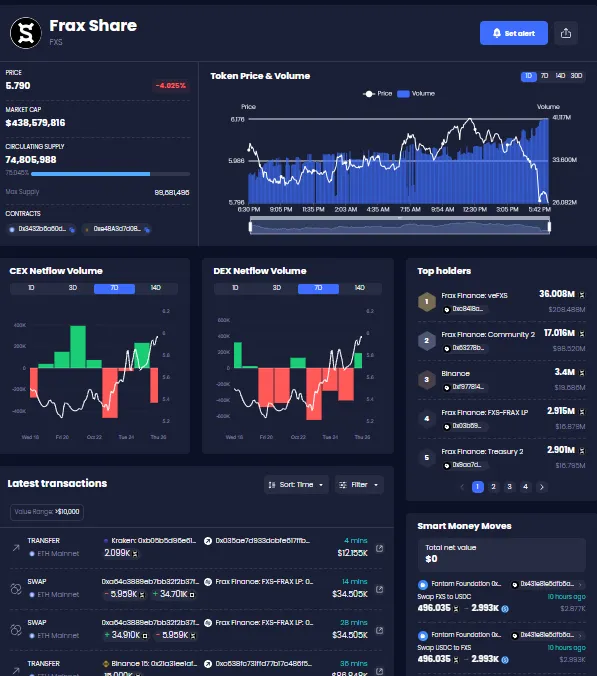

Moreover, searching for a specific token on the platform reveals various related insights, such as:

-

CEX net flow

-

Smart money movement (Are smart money wallets buying or selling this token?)

-

Recent large transactions

Typically, a negative CEX net inflow is a positive sign for a token, as fewer tokens remaining in exchanges make it easier for price rallies to occur.

The team behind Spot On Chain recently confirmed an airdrop for early users.

If you’d like to try it, click here.

2. Lore

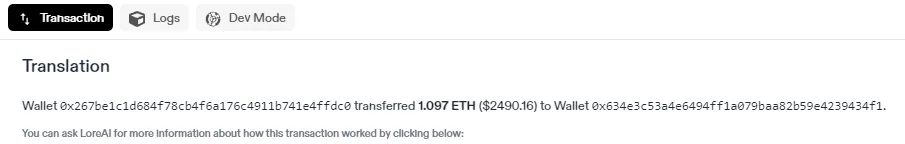

Lore is a novel AI-powered multi-chain explorer.

With Lore, you can search popular wallets, transactions, contracts, and other on-chain data using natural language.

On this platform, you can:

Analyze wallets and locate specific transactions.

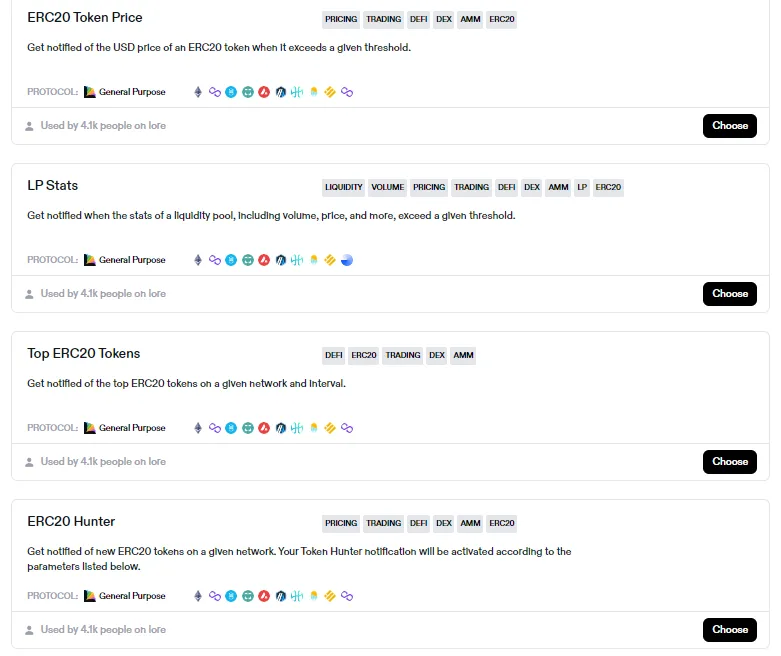

Set up advanced notifications for various on-chain events (e.g., receive alerts when liquidity pool metrics exceed a threshold or when a token’s USD price hits a certain level).

View network statistics across the most popular blockchains.

Use LoreAI to understand what’s happening within a transaction or smart contract.

Additionally, the team behind the project is developing an automation layer called "Lore Stories" for DeFi. With Lore Stories, users will be able to automatically execute on-chain actions in response to specific on-chain events.

This could enable automatic swaps, loan and margin position management, profit-taking, and setting up recurring purchases using Lore’s trigger templates.

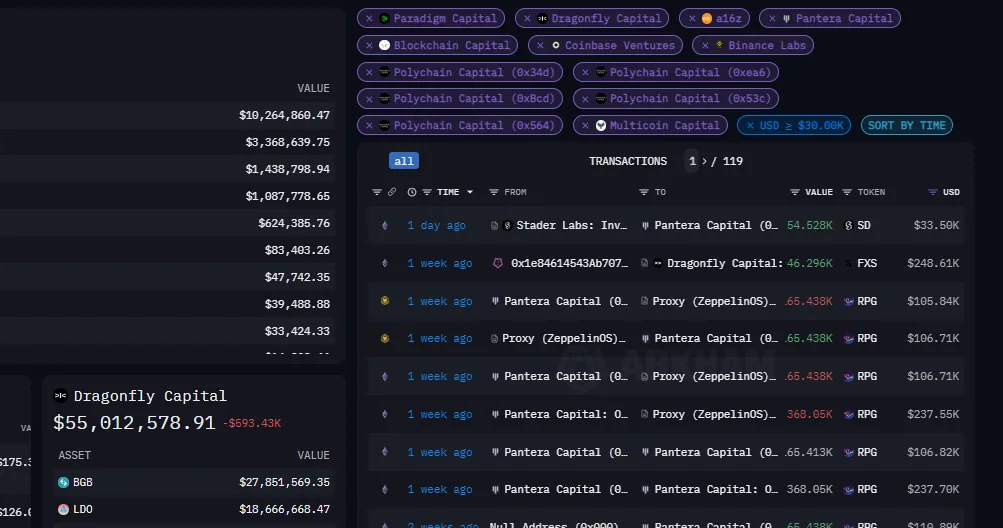

3. Arkham

Last year, Arkham received significant attention, and I’ve mentioned it several times on my X account.

But I believe it’s worth highlighting again, as the team has rolled out many interesting features over the past few months that seem underappreciated, including:

-

Arkham's Swaps – Track on-chain swaps from any address supported by the platform. Like other transactions, swaps can also be filtered by multiple criteria.

-

Arkham Labels – Brief descriptions of what entities or wallet addresses do on-chain (e.g., early Ethereum holders, contract deployers, etc.)

-

Oracle – An AI-driven blockchain analyst that answers questions related to on-chain data

How to use it?

There are many ways to use Arkham, but its popularity primarily stems from its diverse transaction filters (filtering transactions by value, token, time, etc.).

For example, this is particularly useful for identifying smart money wallets that bought a token at scale before its price surged.

Another interesting feature is the ability to create custom dashboards.

Arkham’s database includes labels for hundreds of notable individuals, venture capitalists, market makers, and centralized exchanges.

For instance, you can search for top crypto VCs on Arkham and add them all to your custom dashboard to monitor their activity.

Arkham has many other features that I won’t cover here.

Last year, the project also conducted an airdrop, with each eligible user receiving at least $150.

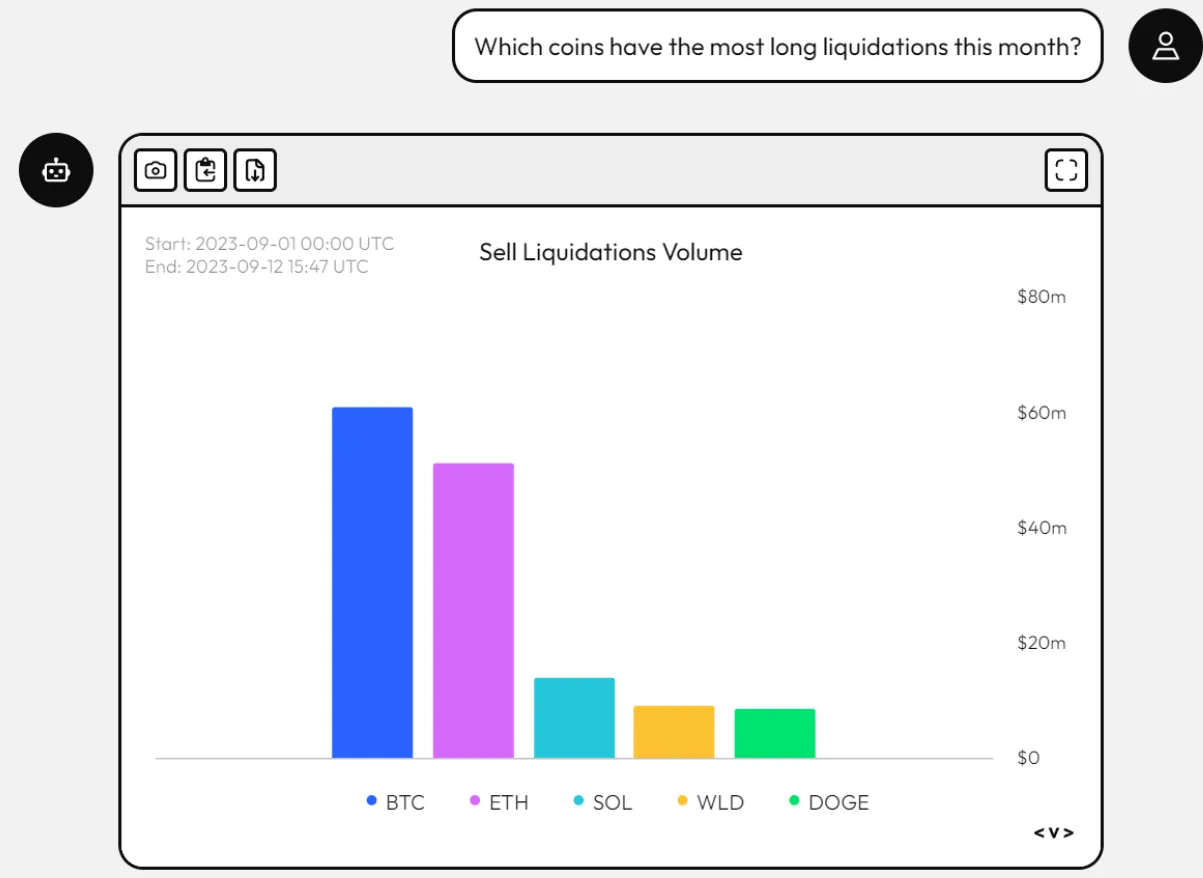

4. Velo Data

Velo Data is a cryptocurrency data application launched in February last year.

It provides futures data, options data, market structure data, and more—helping you understand current market conditions.

On Velo, you can find charts showing:

-

Total open interest

-

BTC implied volatility

-

Crypto liquidations

-

Price changes across the market, biggest losers, DeFi tokens, etc.

-

Market trading volume

-

BTC price reactions to recent headlines

The team behind it is also developing an AI-powered chatbot named Velo AI, set to launch in the coming months.

Most notably, Velo AI will also be able to generate charts.

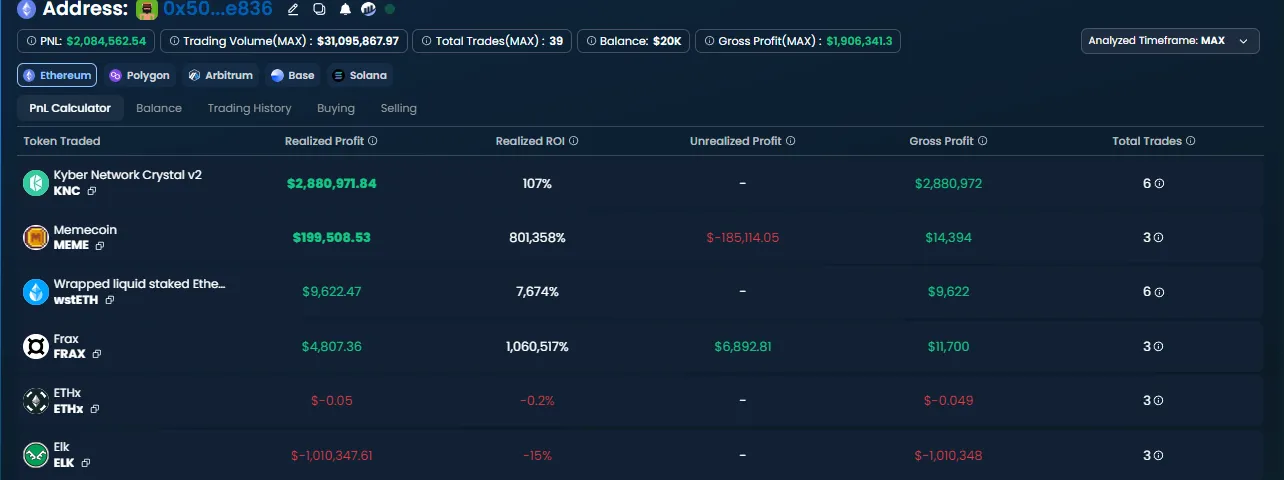

5. DexCheck

DexCheck is an AI-enhanced analytics platform offering a wide range of features.

I’ve covered it in previous newsletters, but I want to highlight its free features again because I use DexCheck frequently and find these tools particularly helpful.

-

News aggregator – Especially useful for news traders, as it aggregates crypto-related news from multiple trusted media sources by category.

-

Crypto whale tracker – View whale buy/sell activities in real-time

-

Crypto address analyzer – Visually display PnL and transaction history for EVM and Solana wallet addresses

The platform’s team continuously rolls out new features and tools, with a BRC-20 tracker and AI arbitrage scanner on the way.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News