Exploring the PICASSO Network: A Restaking Project on Solana

TechFlow Selected TechFlow Selected

Exploring the PICASSO Network: A Restaking Project on Solana

This study provides an in-depth analysis of PICASSO's current status, particularly its integration with other ecosystems such as Ethereum and Solana.

Author: Greythorn

Project Name: Picasso Network

Project Type: Cross-chain, Restaking

Token Symbol: $PICA (Native Cross-chain Token)

Crypto Market Rank: #489

Market Cap: $67 million

FDV (Fully Diluted Valuation): $149 million

Circulating Supply: 4.53 billion (45.34%)

Total Supply: 10 billion

Project Overview

In recent technological advancements and blockchain collaborations, the Picasso network has emerged as a hub for cross-chain communication. Initially launched within the Kusama ecosystem, Picasso’s mission is to enable interoperability across ecosystems and build robust infrastructure within the Polkadot network. Alongside this development comes Composable Cosmos, aiming to expand the ability to transfer assets across chains, breaking free from the constraints of individual ecosystems.

Composable Cosmos has taken a significant step in simplifying the process of establishing IBC connections with Cosmos chains. Previously, this task was both complex and time-consuming; now, Composable Cosmos acts as a bridge, enabling Cosmos chains to quickly join cross-ecosystem IBC activities without requiring upgrades or modifications.

This chain is designed to be compatible with any IBC-enabled Cosmos chain using the Tendermint consensus mechanism, and it integrates with both Picasso and Ethereum, positioning itself as a central hub for IBC activity. It focuses on governance rather than hosting user-facing operations and uses Picasso’s native token PICA instead of a separate token.

A notable feature within the Composable Cosmos ecosystem is its validator set, capped at 100. The Composable Foundation plays a key role here, staking PICA tokens on behalf of Picasso and managing validator rewards. Under this framework, Picasso leverages its native PICA token to establish a growth foundation spanning Picasso’s parachain on Kusama and the Composable Cosmos chain on Cosmos.

This analysis delves into the project’s current state, particularly its integration with other ecosystems such as Ethereum and Solana. Special attention is given to the restaking functionality enabled via the Picasso-Solana IBC connection on Solana. This advancement represents a crucial step for Picasso in strengthening cross-chain interactions and expanding the utility of PICA across the blockchain landscape. Recently, Picasso announced the launch of SOL restaking services on January 28.

Inter-Blockchain Communication (IBC) Connection Between Picasso and Solana

At the recent Solana Breakpoint conference, the demonstration by the Composable Foundation and the University of Lisbon marked significant progress in their technical collaboration. Highlights included:

● Solana-IBC Integration: With support from Picasso, Solana can now join a broad IBC network encompassing Polkadot, Kusama, Cosmos, and soon Ethereum, creating an extensive cross-ecosystem IBC network.

● Enabling New Applications: Newly released features unlock novel opportunities for utility and participation across different blockchain networks, allowing innovative applications like restaking within interconnected ecosystems.

● Seamless Liquidity Exchange: This integration aims to seamlessly connect Solana’s vast user base and liquidity with other chains in the IBC network.

Picasso Network's series of integration initiatives not only reflect its pursuit of cutting-edge technology but also deepen its influence in the field of cross-chain interoperability for digital assets, bringing new growth opportunities to decentralized financial services in blockchain.

Technical Aspects

- Client Blockchain Solution: At the forefront of blockchain technology, Picasso Network is addressing a range of technical challenges faced by blockchains such as NEAR, Solana, and TRON through its advanced client blockchain solution. These chains were not originally natively compliant with IBC standards—such as ICS-23 specifications. This solution has already been deployed directly on Solana, introducing a provable storage mechanism that paves the way for IBC-based interactions and enables trust-minimized bridging between chains that are not naturally IBC-compatible.

- Validator Participation Mechanism: Regarding validator participation, Picasso employs an innovative mechanism where entities wishing to become validators on client blockchains must participate through a staking process tied to the supervising client contract. Once successfully staked, participants enter a candidate validator pool. At each epoch transition, the contract selects new validators from this pool, prioritizing those with the highest stake.

Picasso Introduces On-chain Restaking on Solana

Picasso is also introducing the concept of restaking within the Solana ecosystem—a mechanism initially developed by EigenLayer for Ethereum ETH. Restaking allows additional financial activities while keeping assets staked. This method has gained widespread adoption on Ethereum and shows great potential for expansion in networks like Solana where staking culture is mature.

Within the Solana domain, Picasso is driving restaking of SOL and receipt tokens from various SOL staking platforms. Enabled through validators connected via the Solana-IBC bridge, this strategy signals a new chapter in blockchain integration. Users can deposit assets into staking contracts via the trustless.zone platform, which will then allocate these assets to validators on specially constructed client blockchains designed to bridge the gap between IBC and Solana. This innovative restaking approach supports the PoS consensus mechanism of client blockchains while enhancing the security of the Solana-IBC connection.

Picasso is expanding its Solana <> IBC validator portfolio to include assets such as SOL, mSOL from Marinade Finance, jitoSOL from Lido, Orca LP tokens, and bSOL from Solblaze—marking a significant expansion in staking options available to users. The network’s Solana <> IBC initiative is undergoing rigorous third-party security audits to ensure system robustness and safety. Audit results will be publicly released upon completion, providing necessary transparency and assurance.

Tokenomics

Market Cap: $67.56 million

FDV: $149 million

Circulating Supply: 4.53 billion (45.34%)

Total Supply: 10 billion

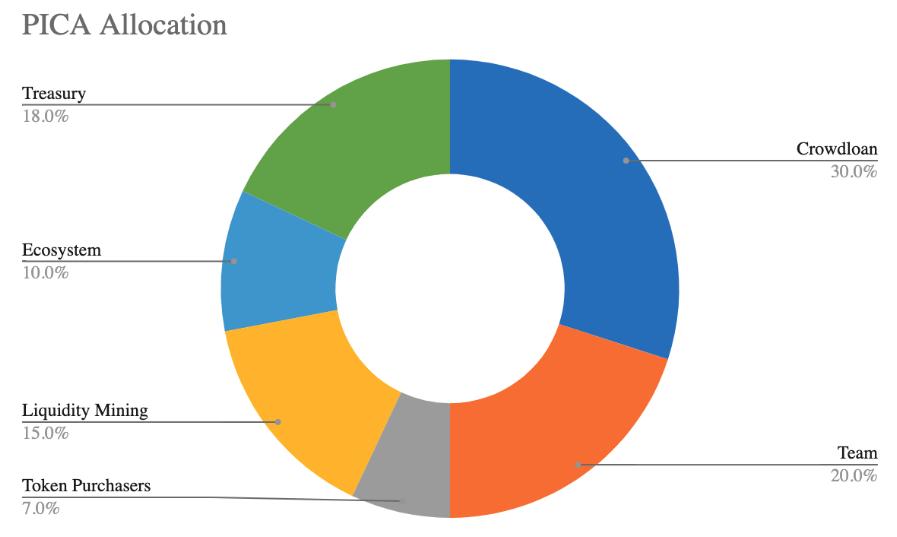

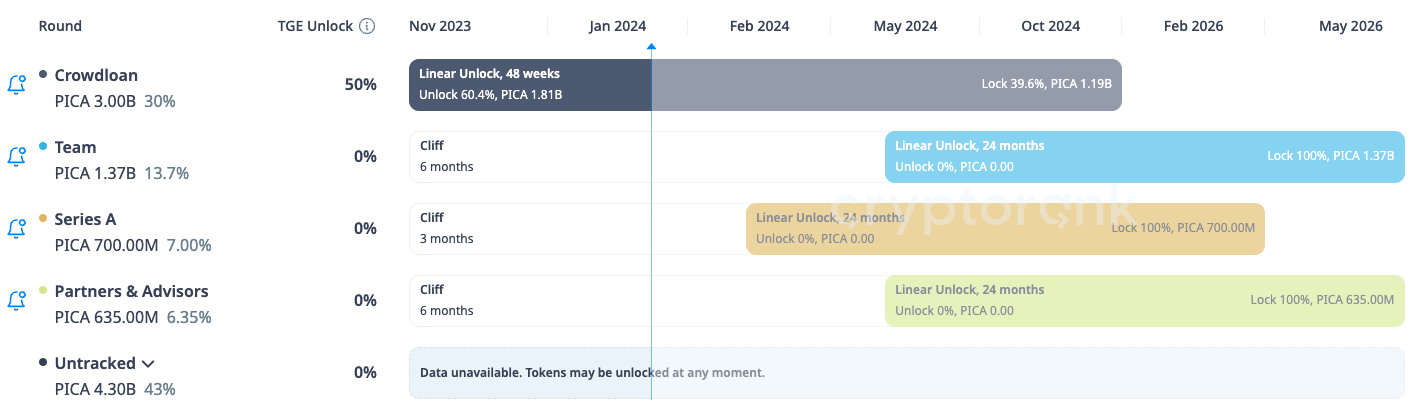

Token Distribution:

Crowdloan: Total 30% (18.1% unlocked, 11.9% locked)

Details: 50% released at Token Generation Event (TGE), remaining portion unlocks over the following 48 weeks. All balances are eligible for governance; unclaimed tokens revert to the Treasury after 3 months.

Treasury: Total 18% (-/-)

Details: Funded by 75% of network fees, initially managed by the General Council, later governed by PICA holders.

Liquidity Mining: Total 15% (-/-)

Details: Rewards for participation in liquidity programs.

Team: Total 13.7% (fully locked)

Details: Distributed over two years, with an initial six-month lock-up period.

Ecosystem: Total 10% (-/-)

Details: Rewards for network activities such as operating an oracle.

Series A Funding: Total 7% (fully locked)

Details: 3-month lock-up, followed by 2-year vesting.

Partners & Advisors: Total 6.35% (fully locked)

Details: Distributed over two years, including a six-month lock-up period.

Distribution Schedule

Source: Cryptorank.io

From January to December 2024, the PICA token will undergo a series of unlocking events, impacting its total supply and market cap. This pattern includes:

1. Regular Crowdloan Unlocks: Nearly every week, 31.26 million tokens (approximately 0.31% of total supply) will unlock. These continuous releases aim to support crowdloan participants.

2. Larger Unlock Rounds at Key Moments: At several critical points throughout the year, significantly larger unlocks will occur, each releasing 108 million tokens (approximately 1.08% of total supply). These tokens will be distributed to different stakeholders:

- Team: Release portions of team allocations, reflecting their ongoing contributions to the project.

- Series A Investors: Unlock investments made by Series A investors, acknowledging their early support for the project.

- Partners and Advisors: This group, vital for strategic guidance and partnership building, will also receive a portion of tokens.

Token Use Cases

The PICA token plays a pivotal role in the Picasso and Composable Cosmos ecosystems, serving multiple functions:

1. Fragment Staking on Picasso: 25% of Picasso transaction fees reward fragment producers for block production, with the remainder flowing into community governance reserves.

2. Oracle Staking via Apollo: By staking PICA tokens, users can operate Oracle nodes, enhancing the security of network data.

3. Composable Cosmos Staking: PICA tokens secure the Composable Cosmos chain, demonstrating dual utility across the Kusama and Cosmos ecosystems. The network requires 1 billion PICA tokens staked by validators to provide security, offering approximately 10% annualized returns.

4. Polkadot Liquid Staking: Composable introduced Liquid Staked DOT (LSDOT), generating yield for PICA holders through liquid staking fees.

5. Gas Token in Picasso Ecosystem: PICA facilitates transactions and dApp operations, with fees dynamically adjusted based on network load.

6. Primary Trading Pair on Pablo DEX: PICA serves as a primary trading pair on Pablo DEX, incentivizing liquidity provision.

7. Governance: PICA plays a crucial role in governance for both Picasso and Composable Cosmos, supporting decentralized decision-making.

Fundraising Summary:

1. Seed Round (July 2021): Composable successfully completed its seed round, raising $7 million, marking a key milestone in its financial journey.

2. Series A (March 2022): This round raised over $32 million, representing a major step forward. Backers include prominent investors such as Coinbase Ventures, Blockchain Capital, Figment Capital, Fundamental Labs, GSR, Jump Capital, New Form Capital, NGC Ventures, and Krypto Ventures—demonstrating strong confidence in the project.

Additionally, Composable recently established partnerships with two strategic collaborators to enhance its capabilities and drive cross-ecosystem growth: DAO5 and Santiago Santos.

About DAO5: DAO5 is an emerging cryptocurrency fund transitioning toward a DAO structure, aiming to be co-managed by portfolio founders. Led by influential figures in crypto such as Tekin Salimi, the fund is supported by several advisors—more details available on their website.

About Santiago Santos: Santiago R. Santos is a distinguished expert in finance and crypto, known for significant contributions to investment firms and substantial influence in the crypto space. He co-hosts "The Empire Podcast" with Jason Yanowitz of Blockworks, delivering key insights into industry trends.

Statistics:

As of January 23, 2024:

A quick review of statistics reveals that while performance is not outstanding, network activity is relatively high, averaging over 500 transactions per day with an average transfer amount of $1,700. With integrations into Solana and Ethereum underway, these metrics may shift—an interesting point to observe.

Current Integrations:

Picasso has successfully achieved interoperability with the following ecosystems, enabling seamless data transmission, asset movement, and smart contract interaction between Picasso and these ecosystems. Below are the sources of these ecosystems:

Table Source: Picasso Asset List

Bullish Fundamentals:

1. As Solana integrates via IBC with Polkadot, Cosmos, Kusama, and Ethereum, these connections are expected to enhance the holder value of $PICA, positioning PICA at the heart of an expanding cross-chain landscape.

2. Strong partnerships and successful funding rounds—including a $7 million seed round and a $32 million Series A—reflect solid investor confidence and strategic network support.

3. The multifaceted role of the PICA token in staking, governance, and liquidity within the ecosystem strengthens its intrinsic value and appeal.

4. The team’s ongoing efforts to explore new functionalities, especially in interoperability and trustless DeFi, demonstrate a commitment to evolving and adapting to the changing demands of the blockchain industry.

Bearish Fundamentals:

1. The project’s utility and technical complexity may be overly complicated for new and average users, potentially reducing participation. This risk could increase if competitors introduce similar yet more user-friendly features. While there is currently no competing restaking project for SOL, this market could quickly attract competition.

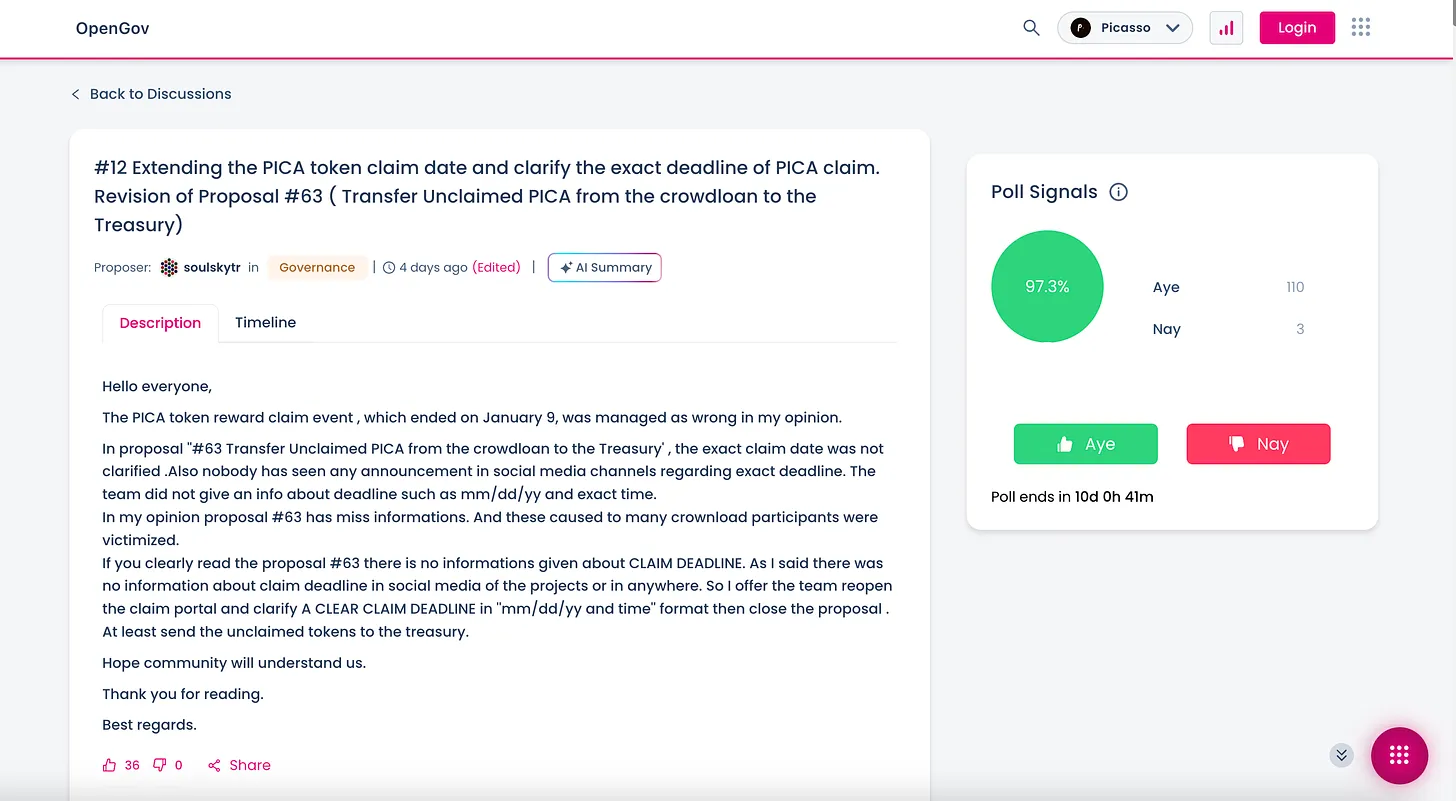

2. Poor management regarding unclaimed $PICA tokens from crowdloan participants—mainly due to insufficient communication about claim deadlines—has led to contributor dissatisfaction. The Picasso OpenGov forum community pushed back against the decision to reallocate unclaimed tokens to the treasury, making this a critical issue affecting community relations.

3. CEO Omar Zaki’s past disputes with the U.S. SEC and associations with controversial projects (such as Bribe Protocol) pose reputational challenges. This issue was significant enough to cause the departure of key team members, including former CTO Karel Kebab.

4. Anticipated large-scale token unlocks are expected to exert significant downward pressure on the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News