Solana's Largest Airdrop in History: In-Depth Analysis of Jupiter's Products and Token Valuation

TechFlow Selected TechFlow Selected

Solana's Largest Airdrop in History: In-Depth Analysis of Jupiter's Products and Token Valuation

The first airdrop is scheduled for January 31, initially distributing 10% of the total supply to the community.

Author: AYLO

Translation: TechFlow

Introduction

This article provides an in-depth exploration of Jupiter, a key DeFi aggregator on the Solana network, and its upcoming JUP token airdrop. It analyzes Jupiter's unique features, the potential of the JUP token, and its significance within the Solana ecosystem. Additionally, it offers deep insights into JUP token pricing, market expectations, and potential returns.

Main Content

Following the massive success of the Jito airdrop, which briefly surpassed a $450 million market cap, the next major event on the Solana network is the JUP token airdrop—the native token of Jupiter, a leading DeFi aggregator on Solana.

The airdrop is scheduled for January 31 and is arguably the most anticipated event in Solana’s history.

What makes Jupiter special? Can JUP deliver on its promises? At what price should we sell—or buy?

In this report, I will dive deep into Jupiter’s product suite, future roadmap, and the potential opportunities presented by the JUP airdrop.

Jupiter: A One-Stop DeFi Service Platform on Solana

Since its inception in October 2021, Jupiter has been dedicated to delivering the best decentralized trading experience on Solana. The platform achieves this by integrating various DeFi functionalities into a single application and offering the smoothest possible user experience.

Although initially conceived as a swap engine, the protocol has evolved significantly, expanding into multiple products to serve diverse user needs—including Dollar-Cost Averaging (DCA), limit orders, perpetuals trading, and most recently, a launchpad platform.

In my view, the DCA tool may be the best product currently available in DeFi.

Source: Jupiter Exchange

Jupiter experienced remarkable growth in 2023, with monthly trading volume increasing nearly tenfold—from $650 million in January to $7.1 billion in December. Notably, November saw a record-high monthly volume exceeding $16 billion, following the Breakpoint announcement of the JUP token.

Jupiter Monthly Trading Volume in 2023

For comparison, Uniswap’s monthly trading volume during the same period ranged from a low of $17.4 billion to over $70 billion.

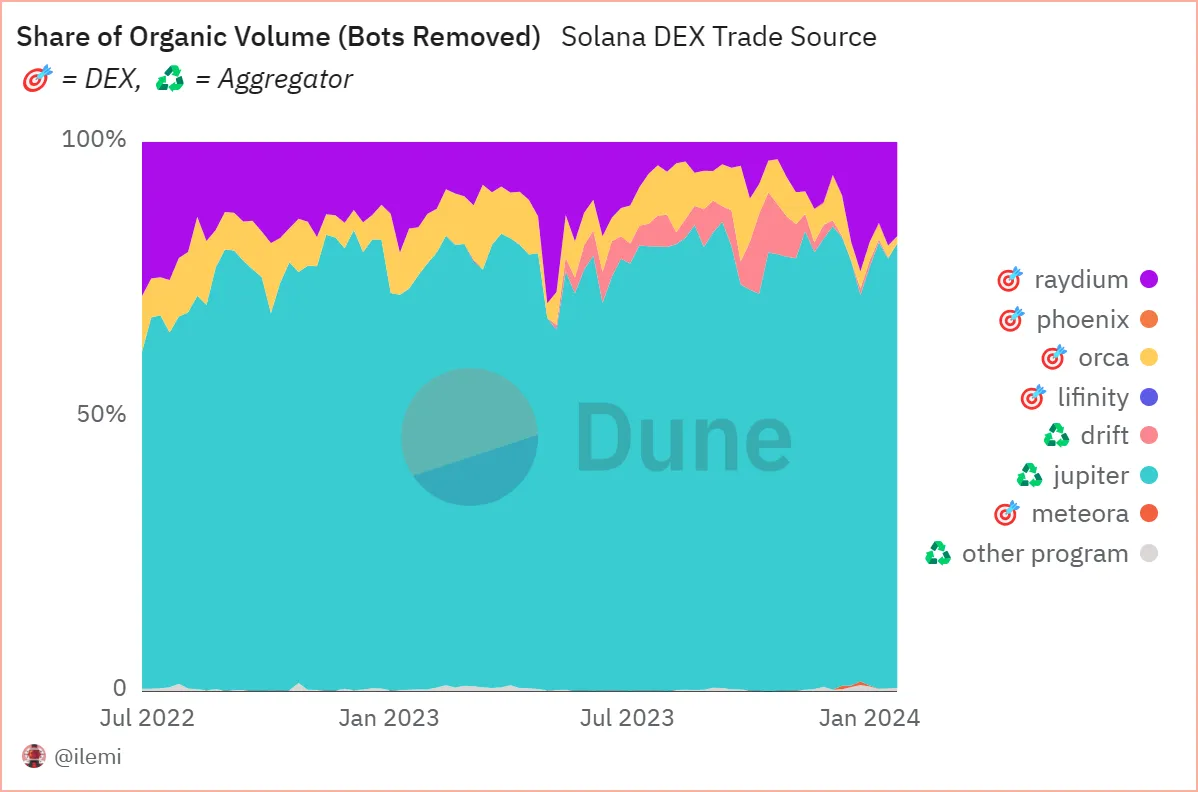

To date, Jupiter has processed over $66.5 billion in trading volume and more than 1.2 million transactions, establishing itself as a critical layer in the Solana ecosystem. It accounts for over 70% of organic trading volume across all Solana DEXs, making it the go-to trading platform on Solana.

Source: Dune Analytics

Despite this, Jupiter remains committed to continuous innovation, aiming to enhance existing features and launch new products aligned with its three core strategic pillars:

-

Delivering the best possible user experience

-

Maximizing the potential of Solana’s technological capabilities

-

Improving overall liquidity conditions on Solana

Given its unique positioning, I believe Jupiter represents a bet on two fronts:

-

Long-term adoption of Solana: 2023 was a year of recovery for Solana as network activity rebounded. I believe it has strong growth potential and will capture a larger share of the L1 market, which could benefit Jupiter.

-

Mainstreaming of DeFi: The future of trading lies on-chain. Even traditional financial leaders like Larry Fink, CEO of BlackRock, are now discussing "tokenization of every financial asset." Thus, it’s not far-fetched to suggest that Jupiter could play a role in enabling this shift.

The recently announced JUP token further exemplifies Jupiter’s strategic progression in this direction.

JUP: Symbol of DeFi 2.0

The JUP token marks a significant milestone in Jupiter’s evolution and vision. Just as Uniswap’s governance token UNI symbolized the first wave of DeFi on Ethereum, JUP aims to embody the essence of DeFi 2.0 on Solana.

JUP is designed as a governance token, allowing holders to influence key aspects of the ecosystem. This includes voting on critical elements of the token itself—such as timing of initial liquidity provision, future emissions after the initial mint, and key ecosystem initiatives.

Source: Jupiter Exchange

The primary goals of the token are:

-

Revitalizing the Solana ecosystem by attracting new capital flows and users

-

Creating momentum for launching new ecosystem tokens: JUP is poised to act as a catalyst for introducing more ecosystem tokens

-

Building a strong, distributed JUP community

As outlined by anonymous co-founder Meow, JUP aspires to build “the most effective, forward-thinking, decentralized, non-insider-voting DAO in DAO history.”

Moreover, the utility of JUP will evolve over time depending on the direction taken by the community. Potential future uses of the token may include:

-

Fee discounts on the perpetuals exchange

-

Access and allocations on the launchpad

-

Revenue sharing from Automated Market Makers (AMMs)

However, Meow has clearly stated that revenue sharing will not be activated until the user base expands at least tenfold.

Tokenomics

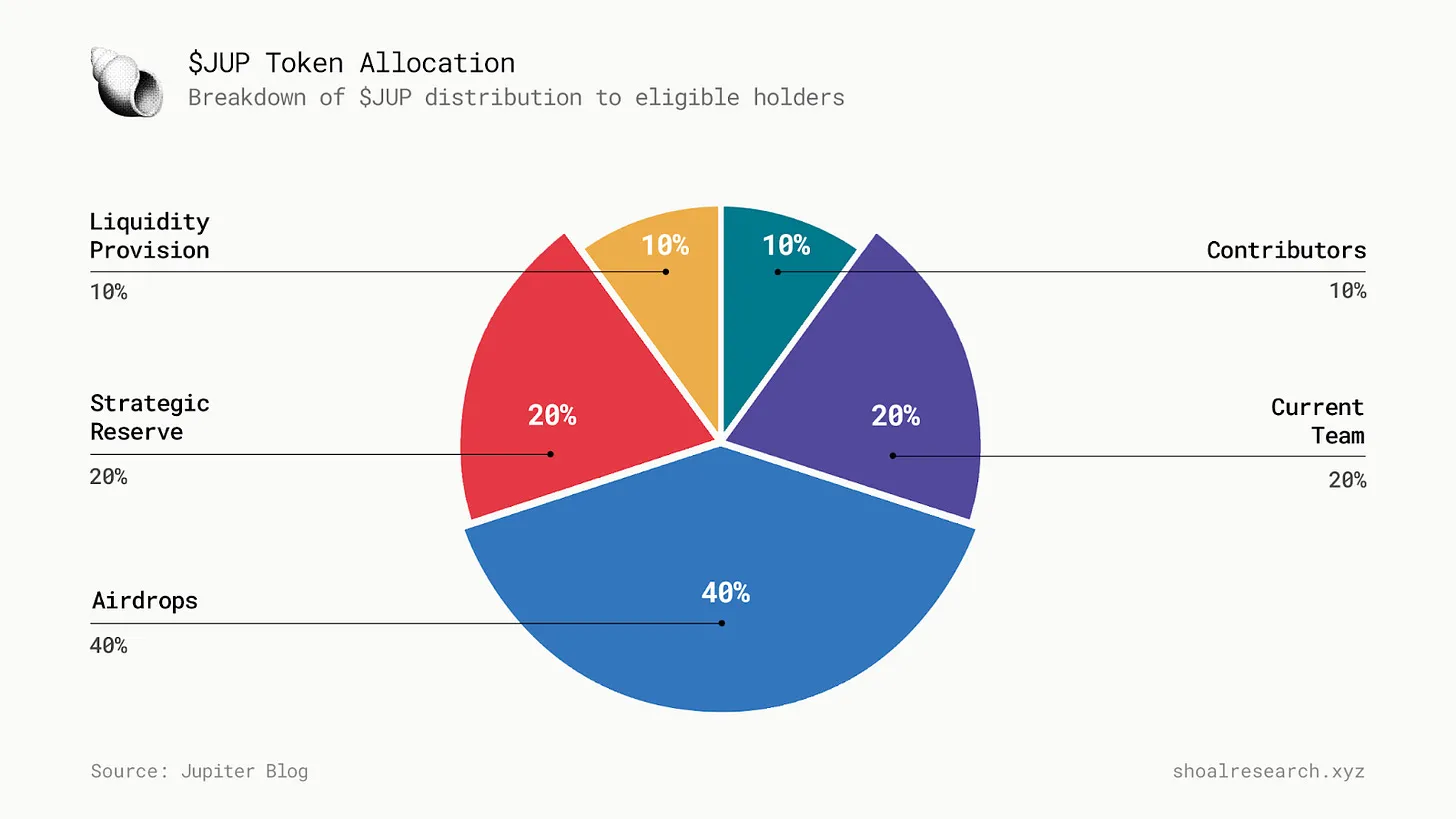

Tokenomics reflect the spirit of the project, and Jupiter’s vision is to keep it as simple as possible. JUP has a maximum supply of 10 billion tokens, equally split between two cold wallets—team wallet and community wallet. The team wallet will be used for current team members, treasury, and liquidity provisioning, while the community wallet will support airdrops and various early contributors.

Airdrop Details

The first round of the airdrop is scheduled for January 31, initially distributing 10% of the total supply to the community. The airdrop allocation is as follows:

-

Equal distribution to all wallets (2%): 200 million tokens will be evenly distributed to all users who used Jupiter before November 2, 2023—approximately 200 JUP per user

-

Tiered scoring based on unadjusted volume (7%), allocated roughly as follows:

-

Tier 1: Top 2,000 users, each receiving 100,000 tokens (estimated volume over $1M)

-

Tier 2: Next 10,000 users, each receiving 20,000 tokens (estimated volume over $100K)

-

Tier 3: Next 50,000 users, each receiving 3,000 tokens (estimated volume over $10K)

-

Tier 4: Next 150,000 users, each receiving 1,000 tokens (estimated volume over $1K)

-

Community members (including Discord, Twitter users, and developers, 1%): 100 million tokens will be allocated to the most valuable contributors and community members

-

Additionally, there will be three more rounds of airdrops in the future.

JUP Token Valuation and Comparison with JTO

A common question with new airdrops is determining the token’s fair value.

While there’s no direct answer, one approach could be comparative analysis using the recent Solana-based JTO token airdrop.

JTO is the governance token of Jito Labs, a liquid staking platform built on Solana. The airdrop distributed 10% of the JTO supply to approximately 10,000 users. At its peak, the airdrop was valued at over $450 million.

JTO Price Analysis

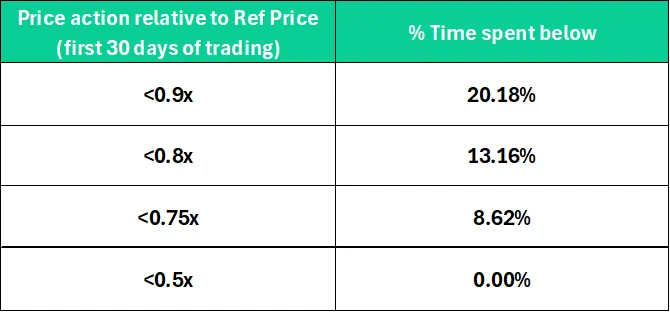

Using Binance’s initial quote of $2.13 (after initial market volatility) as the reference price, here’s a summary of JTO’s price trajectory post-launch:

Source: Binance

Several trends emerge from this data:

-

Initially, on the first trading day, the token showed strong volatility ranging from $1.74 to $3.77. Moreover, the price remained above the initial $2.13 quote 83% of the time.

-

Notably, the first week was indeed positive for JTO. The token traded above its reference price over 97% of the time and reached an all-time high (ATH) of $4.45.

Looking at time percentages across different price ranges, we see that JTO spent very little time at its ATH—only 0.18% of the time above twice the reference price of $2.13.

Additionally, we observe that JTO never experienced a drop exceeding 50% from its initial quote. It spent only about 8.6% of the time in drawdowns exceeding 25%.

While JUP’s price behavior may not exactly mirror JTO’s path, we can make some assumptions:

-

JUP’s first trading day is expected to be highly volatile, potentially creating opportunities for short-term traders

-

The JUP launch may excite investors, with the first week possibly reaching local highs. A rapid price surge beyond double the initial quote could signal a selling opportunity

-

Conversely, a drop exceeding 50% from the initial quote could represent a buying opportunity

Overbought Indicator: JTO FDV / LDO FDV Ratio

Jito is similar to the Lido protocol. Their main difference lies in their chains—Jito on Solana, Lido on Ethereum. Therefore, a reasonable pricing method at JTO’s launch was to examine the ratio between JTO’s Fully Diluted Valuation (FDV) and LDO’s FDV. This comparison helps us understand how the market values JTO relative to its Ethereum counterpart.

Here’s the JTO FDV / LDO FDV ratio over time since JTO’s launch:

We observe that JTO rapidly surpassed LDO’s FDV post-launch, reaching a ratio of nearly 1.9—indicating its FDV was almost twice that of LDO. However, this peak likely reflected market euphoria, and prices were soon repositioned downward. Over subsequent weeks, the JTO/LDO FDV ratio declined until a strong rebound from the 0.4 mark to the 0.7–0.8 range. Now, the market appears to have settled on a fair value within this band, close to the historical average of 0.9 over recent months.

We can conclude that for JTO, a ratio above 1.6 represents a clear overbought signal, while 0.4 indicates a strong oversold condition.

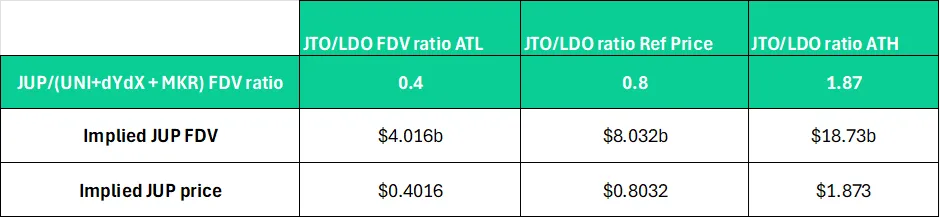

Applying This Valuation to JUP

Just as LDO serves as a peer benchmark for JTO, we need to find a comparable benchmark for JUP on Ethereum.

Given Jupiter’s position as Solana’s largest decentralized exchange—with features including AMM, DCA, perpetuals, and a launchpad—finding a single comparable project on Ethereum is challenging. Therefore, I’ve chosen a composite benchmark combining Uniswap, dYdX, and DAO Maker as the closest equivalents to JUP. We can then compare the combined FDVs of their respective tokens. At the time of writing, their total FDV stands at approximately $10.04 billion.

We can use this combined FDV figure along with key levels from the JTO/LDO FDV ratio to estimate JUP’s price under different scenarios.

Source: Binance

By applying this relative valuation analysis, we can elevate our decision-making at the time of the airdrop:

However, it’s important to note that JTO has a relatively high daily beta to Solana of 0.86. Therefore, JTO’s price movements are closely tied to SOL, and JUP is likely to follow a similar pattern. As such, prevailing market conditions could significantly influence the热度 generated by this airdrop.

At the time of writing, Solana is trading at $80–$82, down over 30% from previous levels of $120–$130—suggesting market conditions may be less bullish than during the JTO airdrop.

Comparing SOL’s price one month before the JTO airdrop with recent levels clearly shows a shift in market conditions. It seems reasonable to assume this could negatively impact JUP’s price performance.

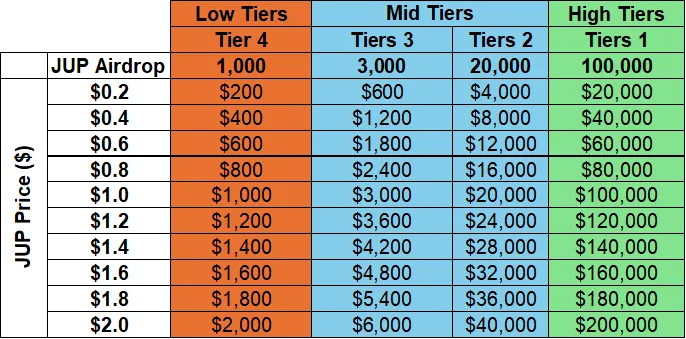

Potential Airdrop Returns

Will the rewards from this airdrop be as large as those from JTO? Let’s analyze together.

If we refer to the different rewards offered at each tier, we can derive the potential airdrop value of JUP at given price points:

Source: Jupiter Exchange

In contrast, here are the JTO rewards across tiers and key price points:

Source: Jito Labs

Even at its lowest point of $1.323, the JTO airdrop delivered significantly higher rewards across tiers compared to JUP’s potential payouts—even if JUP reaches $2, it still falls short of our valuation (e.g., $20,000 vs. $2,000).

For example, for the lowest-tier JUP reward to match the lowest-tier JTO reward at its historical low, JUP would need to trade above $20—implying a $200 billion FDV, a completely unrealistic figure.

However, it must be emphasized that the JTO airdrop focused on only 10,000 users, whereas JUP is distributing tokens to nearly 1 million users. This wider distribution also means fewer initial buyers for JUP.

The market also did not anticipate JTO reaching such a large market cap, and expectations around JUP appear extremely high—a key difference to consider. When everyone expects the same outcome, events rarely unfold as predicted.

Therefore, although the JUP airdrop may not deliver as generous individual rewards as JTO, its impact on a broader user base makes it one of the most significant airdrops in Solana’s history to date.

We are likely to see a notable increase in on-chain activity following the JUP airdrop. It will serve as a catalyst for many, and for risk-seeking degens, using their perceived "free money" (from the JUP airdrop) to take on additional risks is a common behavior.

Last but not least, as people realize profits from JUP and convert into SOL, SOL could also benefit from increased buying pressure. However, given the lack of short-term bullish sentiment in the market, it’s difficult to assess SOL’s performance in lower timeframes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News