Sui Ecosystem Booms: Navi or Scallop, Who's the Leading Lending Platform?

TechFlow Selected TechFlow Selected

Sui Ecosystem Booms: Navi or Scallop, Who's the Leading Lending Platform?

SUI's current surge is primarily driven by a positive flywheel effect from high subsidies within its ecosystem leading to increased locked liquidity, along with the hosting of its ecosystem conference.

By: Boba Boba

What caused Sui's recent surge? Is Sui's ecosystem on the verge of an explosion? Let me walk you through a quick recap and introduce some notable projects currently worth watching in the Sui ecosystem.

After previously noticing significant growth in Sui’s TVL and cross-chain activity, I accidentally rode the wave of Sui’s price surge (without doing much research beforehand).

I had never looked into the Move ecosystem before and wasn’t familiar with it. But after writing several threads about Move-based smart inscriptions, I began to appreciate the advantages of the Move language—especially its strong suitability for financial applications, thanks to its ability to decouple asset ownership from smart contracts.

This is different from Ethereum’s model. In EVM-based systems, if a smart contract has a security vulnerability, the assets within it are also at risk. With Move, however, even if a contract is compromised, your assets can remain safe (depending on contract design—liquidity pools still carry risks). Overall, Move offers greater safety and flexibility compared to Solidity.

However, as the Move language is still relatively new and not widely understood, its developer ecosystem hasn't yet reached the level of Ethereum or Solana. It’s been somewhat quiet until now. But with the growing narrative around high-performance blockchains and Solana’s resurgence, I believe Sui may be entering a period of ecosystem expansion—particularly in finance, RWA, and DePIN sectors.

So let’s first briefly review the reasons behind Sui’s recent surge. Two main factors stand out:

-

The Move Ecosystem Conference—typically, when a blockchain holds a major event, there’s often a coordinated “rally” to boost morale and momentum 😂

-

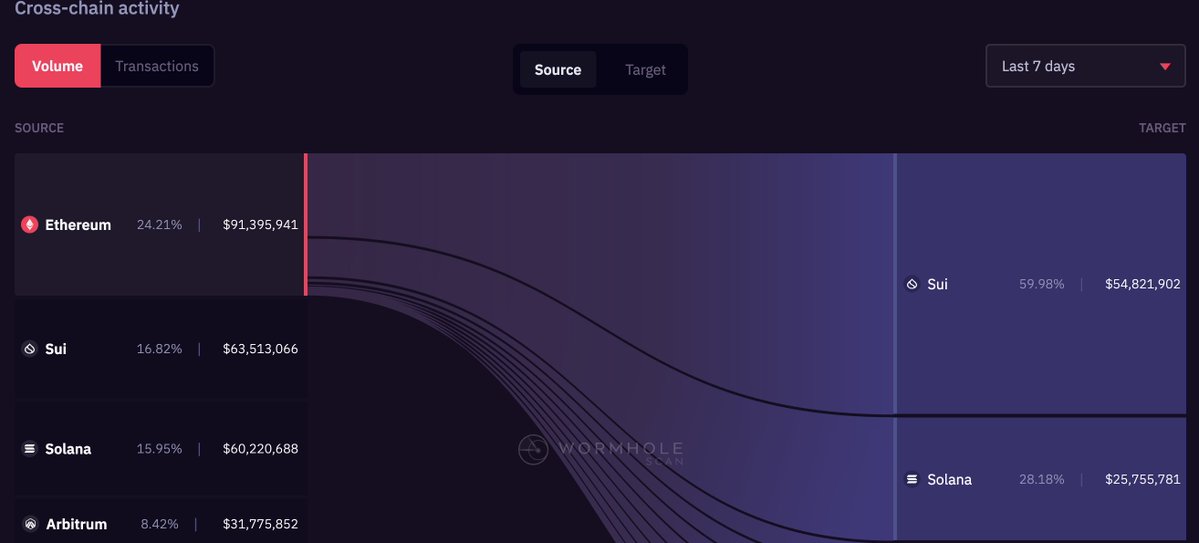

Generous incentives launched by Sui-based projects, which have directly driven rapid increases in TVL and cross-chain activity

For example, depositing SUI and USDC on Navi Protocol @navi_protocol offers interest rates exceeding 20%. These high subsidies have attracted substantial capital seeking yield, locking up large amounts of SUI in protocols to earn interest. This created a positive flywheel effect, pushing SUI’s price higher.

Sui’s recent breakout has drawn widespread market attention. Aside from Cetus, which has already launched its token, the two most watched pre-token DeFi lending projects are Navi Protocol @navi_protocol and Scallop Lend @Scallop_io.

Many analysts have already evaluated these two projects, labeling Scallop as "Dragon No.1" and Navi as "Dragon No.2" based on TVL alone. But from another perspective, Navi actually holds certain advantages.

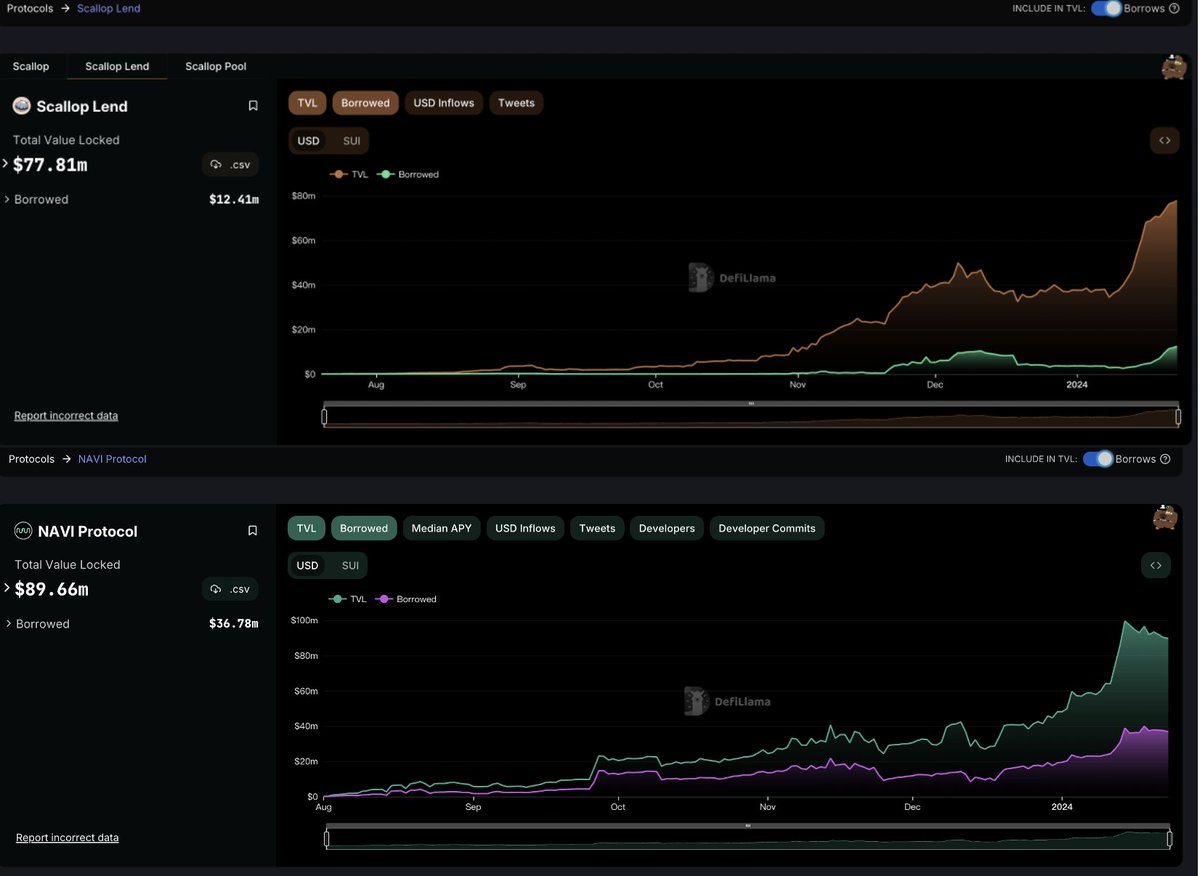

1. TVL

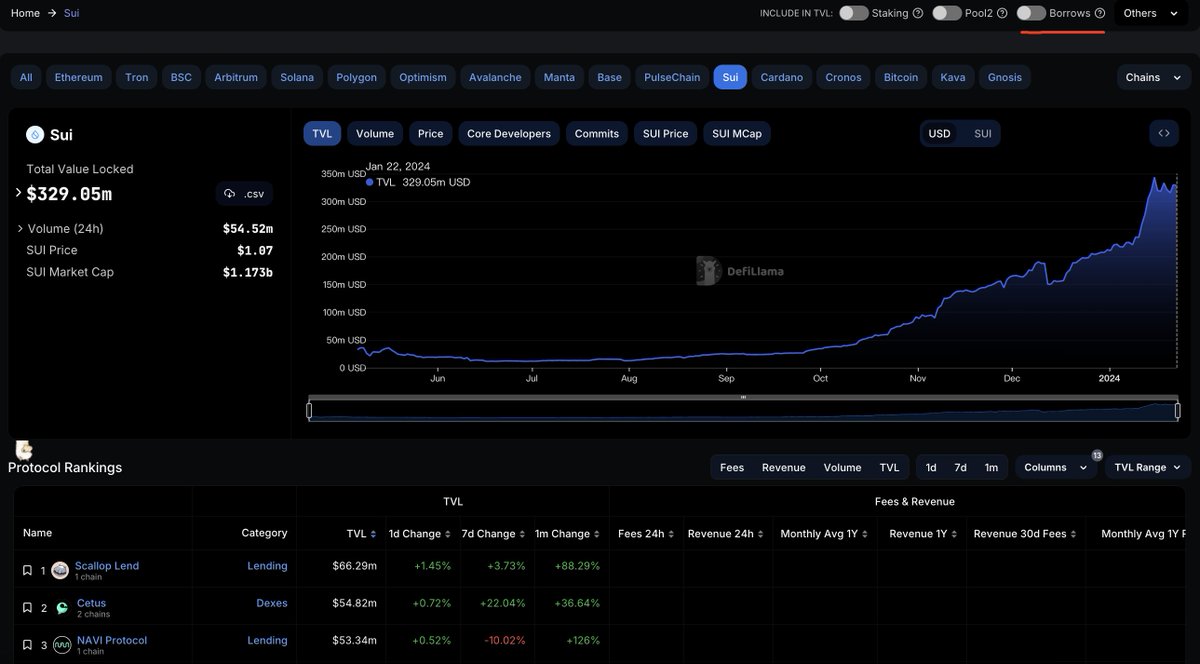

As shown on Defillama, Scallop currently has higher TVL than Navi, leading many to label it as the leader. However, using TVL alone as a metric is overly simplistic.

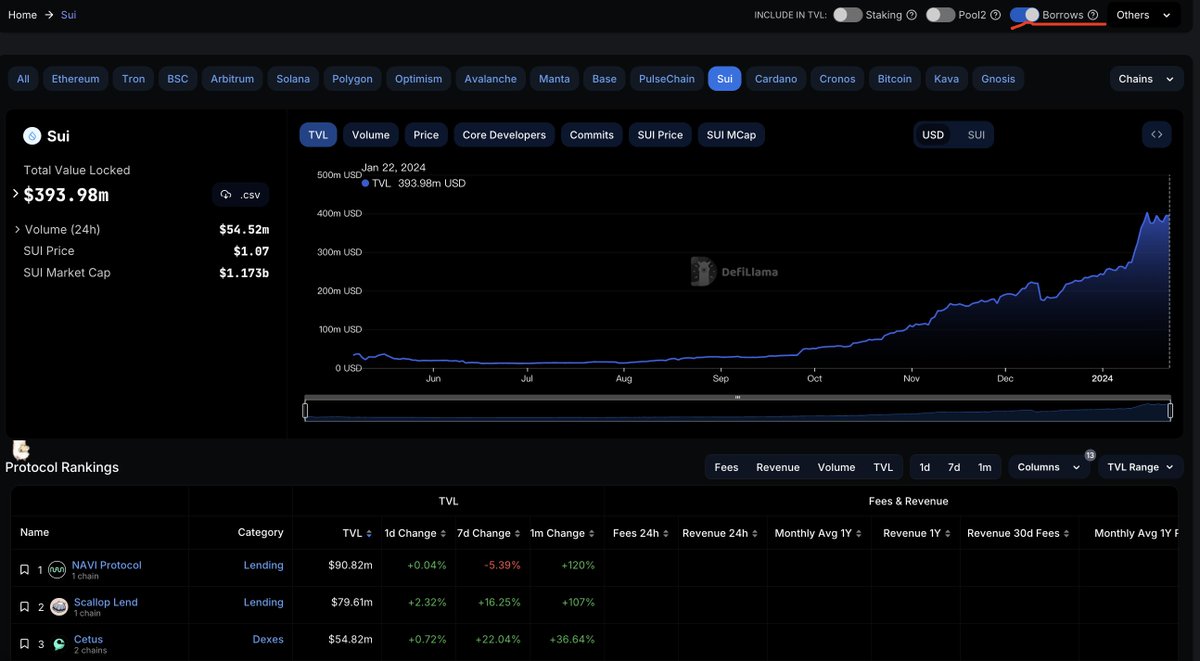

Another key metric for evaluating a DeFi lending protocol is borrowing volume. If we include borrowed funds that are re-deposited, Navi becomes the top project in Sui’s ecosystem by effective TVL—since Defillama’s default view doesn’t count funds recycled through borrowing and redepositing.

This is similar to comparing two banks: Bank A has more reserve deposits, while Bank B has fewer reserves but significantly more loans issued. The amount of “credit money” generated via lending in Bank B exceeds that of Bank A—even though “credit creation” doesn’t formally exist in DeFi today.

In simple terms, Navi surpasses Scallop in both borrowing activity and scale. Since a DeFi lending project’s revenue primarily comes from lending activities, Navi clearly leads in real-world lending operations.

2. Yield

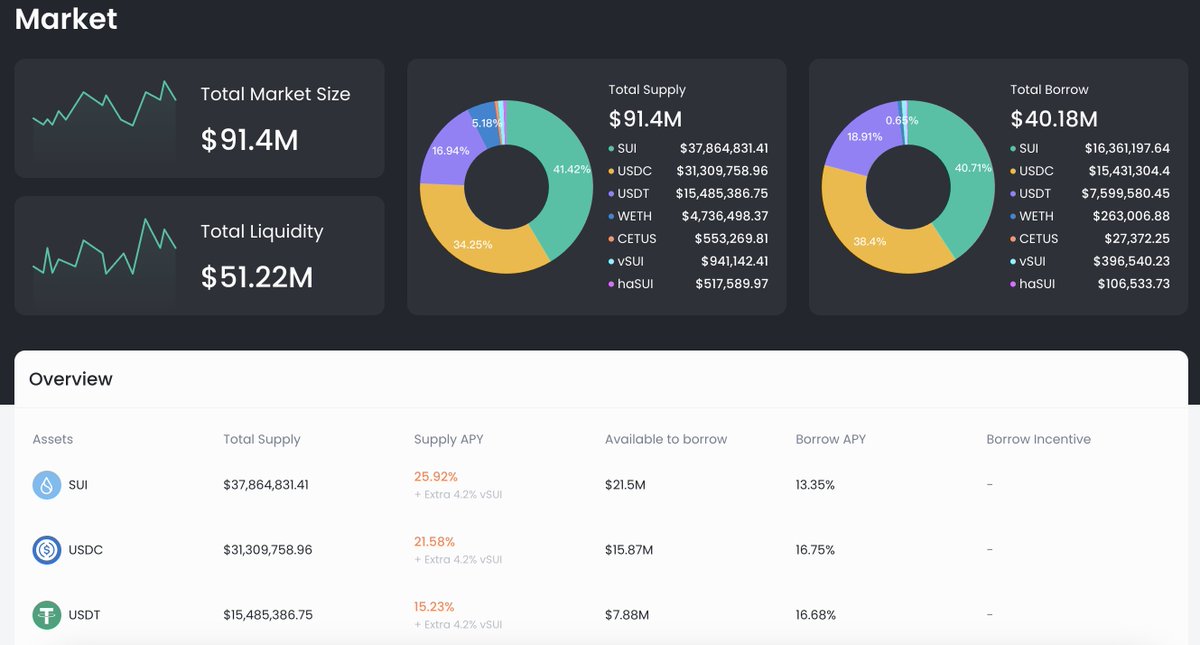

Another important factor is yield potential and future demand. Visiting both project websites, we can see that Navi currently offers higher deposit yields and higher TVL per token compared to Scallop. Including extra rewards from vSUI, Navi provides approximately 5%–13% higher APY on SUI and USDC/USDT than Scallop.

Moreover, Scallop does not support recursive lending, whereas Navi’s deposit-loan spread allows users to achieve higher returns through looping strategies. For instance, users can deposit SUI to earn ~25.8% + 4.2%, then borrow SUI at 13.51% interest and redeposit it. Borrowing native tokens with native collateral carries almost no liquidation risk, making Navi’s current yield advantage even more pronounced.

Regarding SUI’s future trajectory, I understand that these generous incentives will likely continue for another one or two quarters. Given the strong anticipation of token airdrops from both projects, they are expected to attract massive inflows of TVL. As performance metrics improve, speculation becomes easier—you know how it goes.

To summarize: SUI’s recent surge was primarily driven by a positive flywheel of staking due to generous ecosystem incentives, along with the Move Ecosystem Conference. From a Move ecosystem standpoint, SUI’s TVL has already far surpassed APTOS, yet its market cap remains lower. With increasingly strong data ahead, there’s significant room for further speculation. Among the two leading DeFi projects, Scallop ranks first by basic TVL, but when factoring in total borrowing volume and lending activity, Navi holds a clear edge—with higher yields and stronger fundamentals. Technically speaking, the Move language offers distinct advantages in financial use cases, and combined with Sui’s high-performance infrastructure, areas like RWA and DePIN on Move-based chains may also be worth watching closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News