Top ARC-20 Assets: QUARK and SOPHON

TechFlow Selected TechFlow Selected

Top ARC-20 Assets: QUARK and SOPHON

For ARC-20 assets, the community is awaiting two positive developments to materialize.

Author: Asher, Odaily Planet Daily

Editor: Qin Xiaofeng

Recently, the persistent decline of BTC has made the inscription market relatively quiet, whether in primary minting or secondary trading. However, inscriptions on the ARC-20 layer still maintain some热度, especially Quark (QUARK) and Sophon (SOPHON). Odaily Planet Daily provides an in-depth look at ARC-20 tokens and popular projects within this ecosystem. Please note, markets are highly volatile—conduct thorough research before investing.

ARC-20 Assets

Both Quark and Sophon belong to the ARC-20 token category. ARC-20 tokens follow a colored coin model where registration information is inscribed into transaction scripts, balances are represented by the number of Satoshis in UTXOs, and transfer functions are fully handled by the BTC mainnet. The ARC-20 standard defines the smallest unit of each token as 1 Satoshi. This ensures a minimum value for tokens and makes creating and managing ARC-20 assets efficient and flexible. Notably, the uniqueness of the ARC-20 naming system reduces negative impacts from counterfeit tokens, keeping the system clear and unified. Below, we focus on two prominent projects in this sector—QUARK and SOPHON.

QUARK: Most Holder Addresses

During the last week of December, nearly the entire Bitcoin ecosystem was mining Quark (QUARK). The term "quark" refers to a fundamental unit of matter, similar to how SATS represent the smallest unit of Bitcoin. To some extent, Quark carries meme characteristics. Due to features such as a large number of holder addresses and strong foundational consensus, many community members believe Quark could become a breakout meme coin within the Atomicals ecosystem.

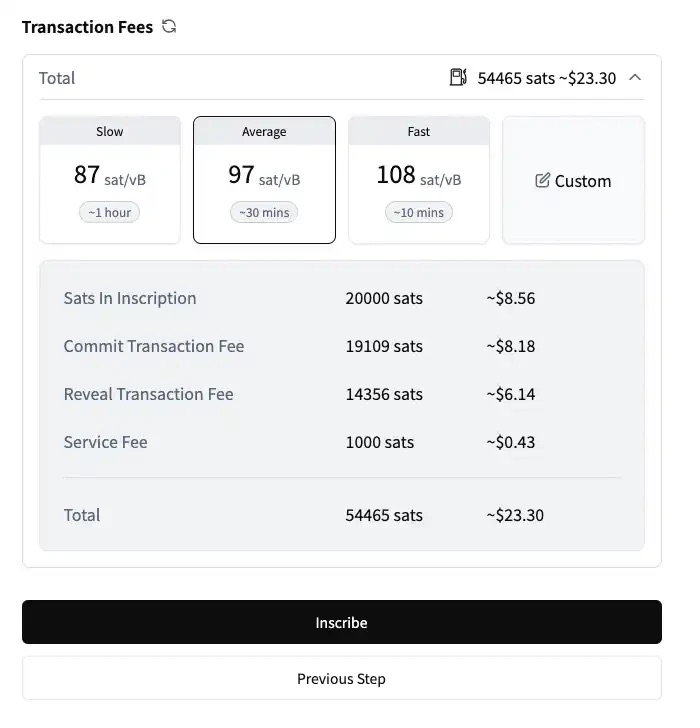

From a participation standpoint, Quark's design offers certain advantages. First, the total supply of Quark is 500,000, with each Quark card containing 20,000 tokens, meaning it will take considerable time to complete the full minting process. This design helps attract more participants and build broader consensus. Second, the mining difficulty for Quark is set at 6, which is relatively low compared to Electron and Neutron, allowing more users to participate in primary minting. On average, the cost to mint one Quark card ranges between $20–$30. The image below shows a minting cost of approximately $23.2 when BTC network gas is around 97.

Quark Minting Cost (Gas = 97)

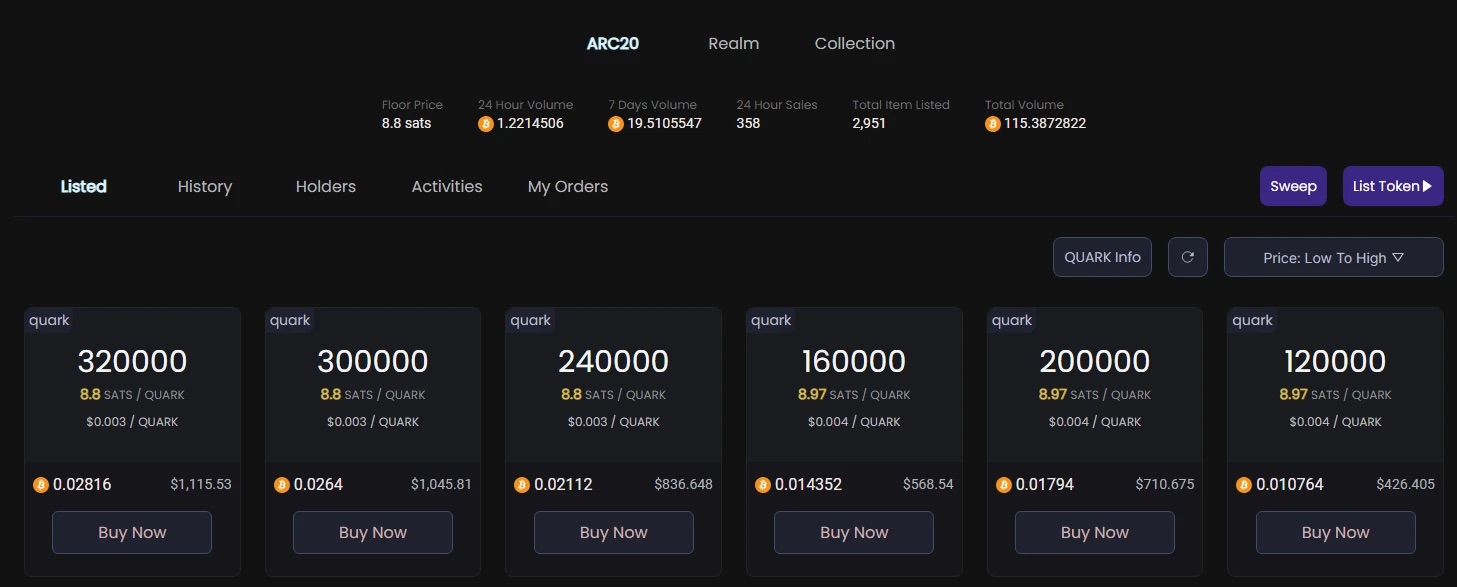

In the secondary market, Quark reached a peak price of 17.4 SATS, equivalent to 0.00348 BTC per card (i.e., 20,000 Quarks), or about $139—representing a maximum increase of 450% compared to the average primary minting cost. The current price stands at 8.73 SATS. Quark boasts 14,181 holder addresses, making it the ARC-20 asset with the highest number of holders.

Quark Secondary Market

Secondary market purchase link: https://atomicalmarket.com/market/token/quark.

SOPHON: Requires Locking 100,000 Sats per Card

Overview

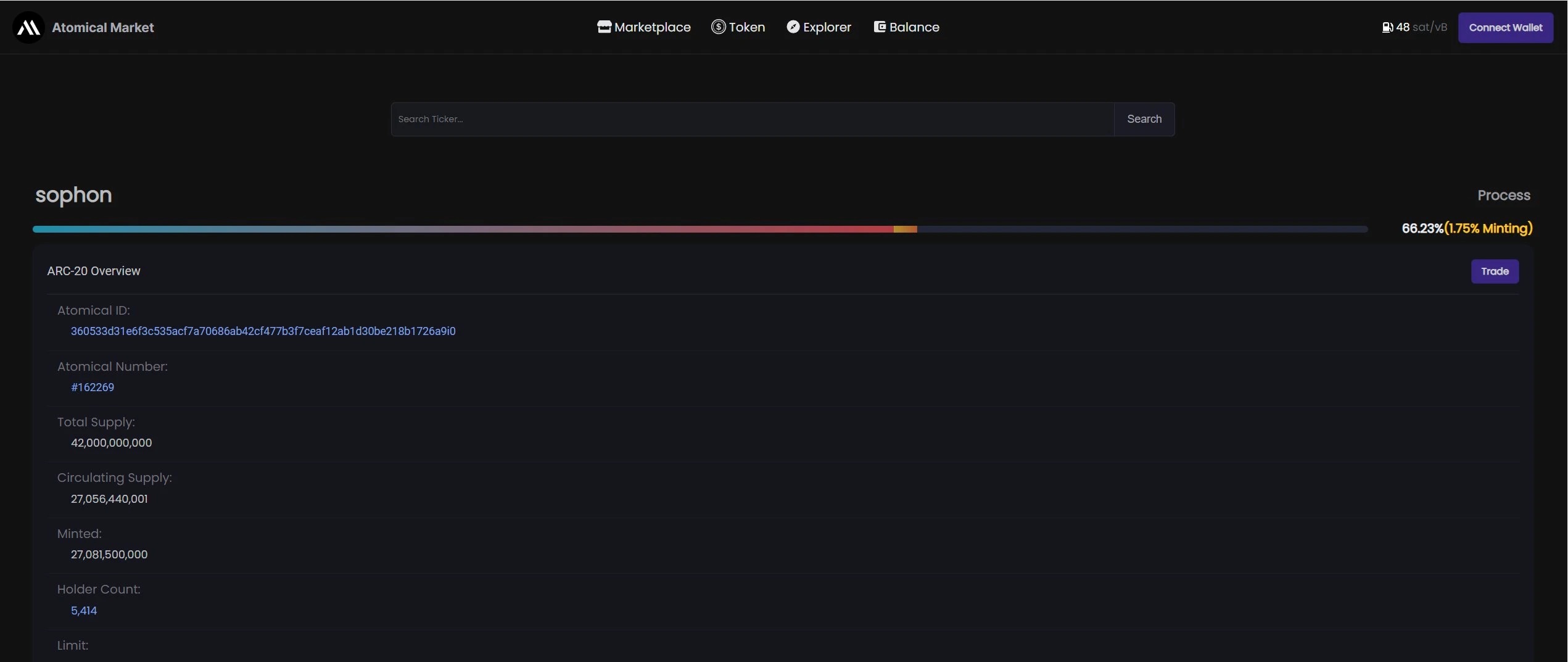

Sophon (SOPHON) differs from Quark. In short, mining each Sophon card requires locking 100,000 SATS of BTC. Assuming the current BTC price is $40,000 per coin, this equates to locking BTC worth approximately $40, plus an additional gas fee. Given that the total supply of Sophon is 420,000 cards, based on the mining rules, completing all minting would lock up a total of 420 BTC.

Based on initial minting data, aside from the required 100,000 SATS locked per Sophon card, gas costs range between $5 and $7. Therefore, even if Sophon’s market value drops to zero, its intrinsic value remains at 0.001 BTC. Effectively, minting or purchasing Sophon serves as an alternative way to hold BTC. For those bullish on future market trends, holding Sophon may be a viable strategy.

Sophon Minting Process

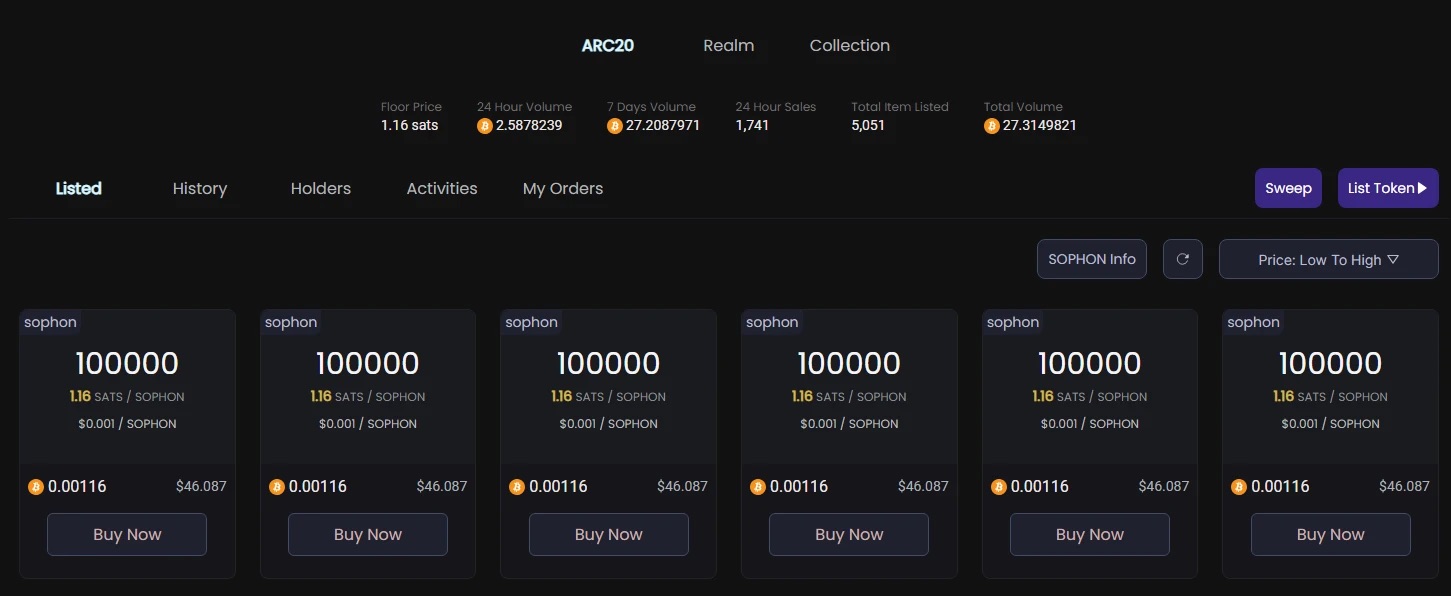

In the secondary market, Sophon trades primarily between 1.16 and 1.2 SATS, translating to a value of approximately 0.00116 to 0.0012 BTC per card (i.e., 100,000 Sophons), or $46.5 to $48. In terms of 24-hour trading volume, Sophon ranks second only to ATOM at 2.35 BTC (about $94,000). Regarding holder addresses, Sophon currently ranks second after Quark, with 7,474 addresses. Thus, despite high holder counts and trading volume, Sophon has not seen significant price appreciation over its primary minting cost.

Sophon Secondary Market

Secondary market purchase link: https://atomicalmarket.com/market/token/sophon.

Summary

For ARC-20 assets, the community widely anticipates two potential catalysts: first, OKX Web3 Wallet launching an ARC-20 marketplace; second, Binance Wallet introducing an inscription market, potentially including ARC-20 support. If these developments materialize, Quark and Sophon could become focal points within the ARC-20 sector, possibly delivering solid investment returns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News