The Rise of AI Agent Narratives: Which Projects Are Worth Watching Early?

TechFlow Selected TechFlow Selected

The Rise of AI Agent Narratives: Which Projects Are Worth Watching Early?

Cryptocurrency is like cash, blockchain is like a cash register, Dapp is like a POS machine, and AI agent is like a cashier.

By TechFlow

The AI narrative never lacks market interest.

As a theme running throughout the year, regardless of whether the crypto market rises or falls, there are always AI-related projects that stand out. In nearly every review and outlook article, bullish sentiment toward AI dominates.

However, AI is an extremely broad concept—so which specific subfields offer the most promising bets?

A relatively safe strategy is to treat short-term hot events as catalysts and seek out crypto projects directly tied to those concepts.

For example: AI agents.

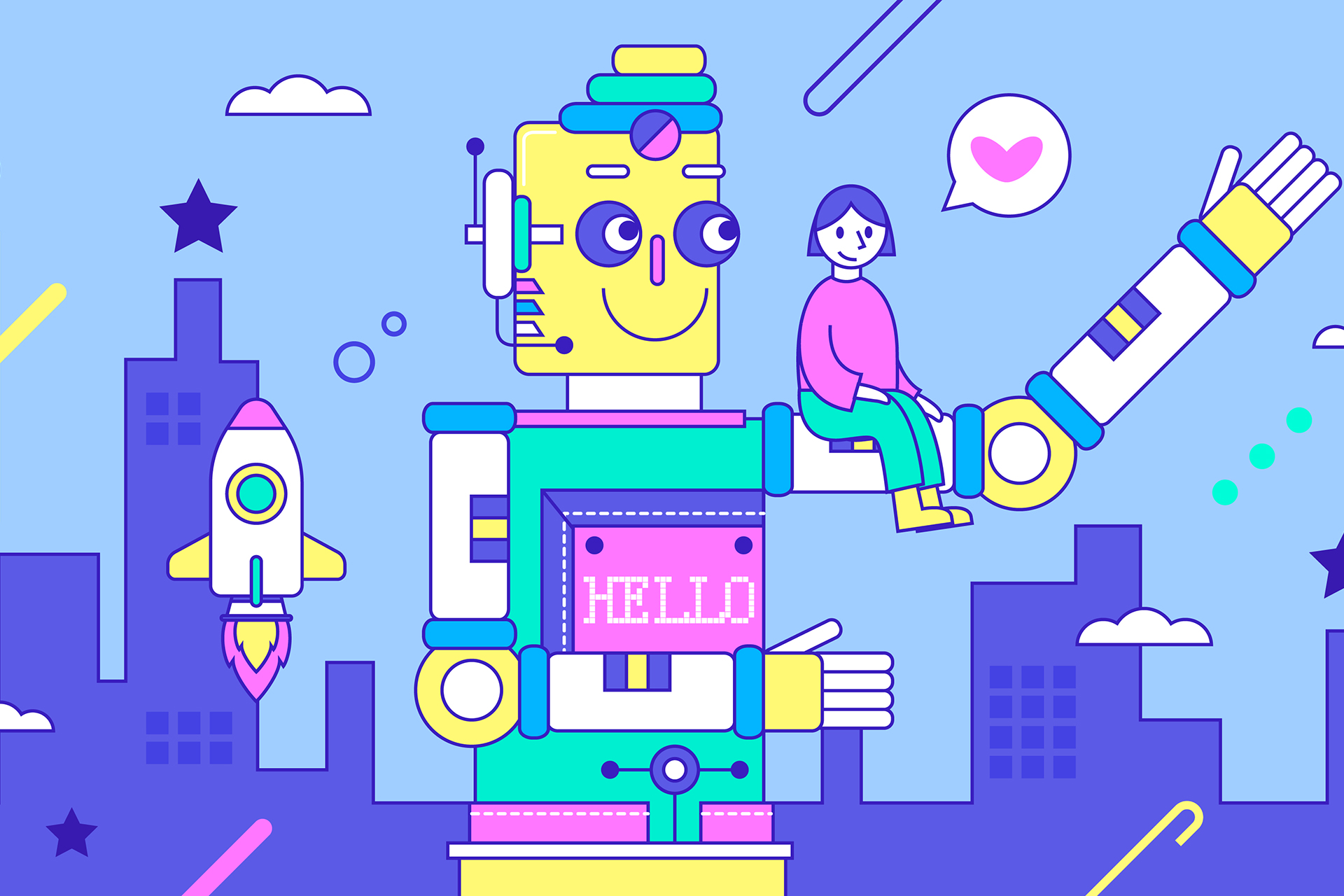

On January 11, ChatGPT officially launched its GPT Store. Unlike traditional apps, the GPT Store requires no programming skills—users simply describe in natural language what they want their GPT to do, and the system automatically creates a customized AI chatbot.

In essence, this is an AI agent marketplace filled with bots capable of autonomously performing predefined tasks. Backed by GPT’s popularity, we can expect explosive growth in store applications—and some may even integrate with crypto.

Whether these bots prove useful remains to be seen, but the rising visibility of AI agents as a trend is undeniable.

Almost simultaneously, renowned crypto VC Pantera explicitly stated in a recent long-form piece that it is particularly interested in the convergence of AI agents and Web3 in 2024.

(Related reading: Pantera's Key Focus Areas for 2024: AI Momentum Continues, Web3 to Support Development in Inference, Data Privacy, and Incentives)

If we view GPT’s app store as a fuse and top-tier VC attention as wind, could the AI agent narrative ignite this year?

We cannot predict the future—but we can prepare.

So now, more than ever, we should clarify:

How do AI agents actually work, and which crypto projects stand to benefit directly?

What Do AI Agents Have to Do With Crypto?

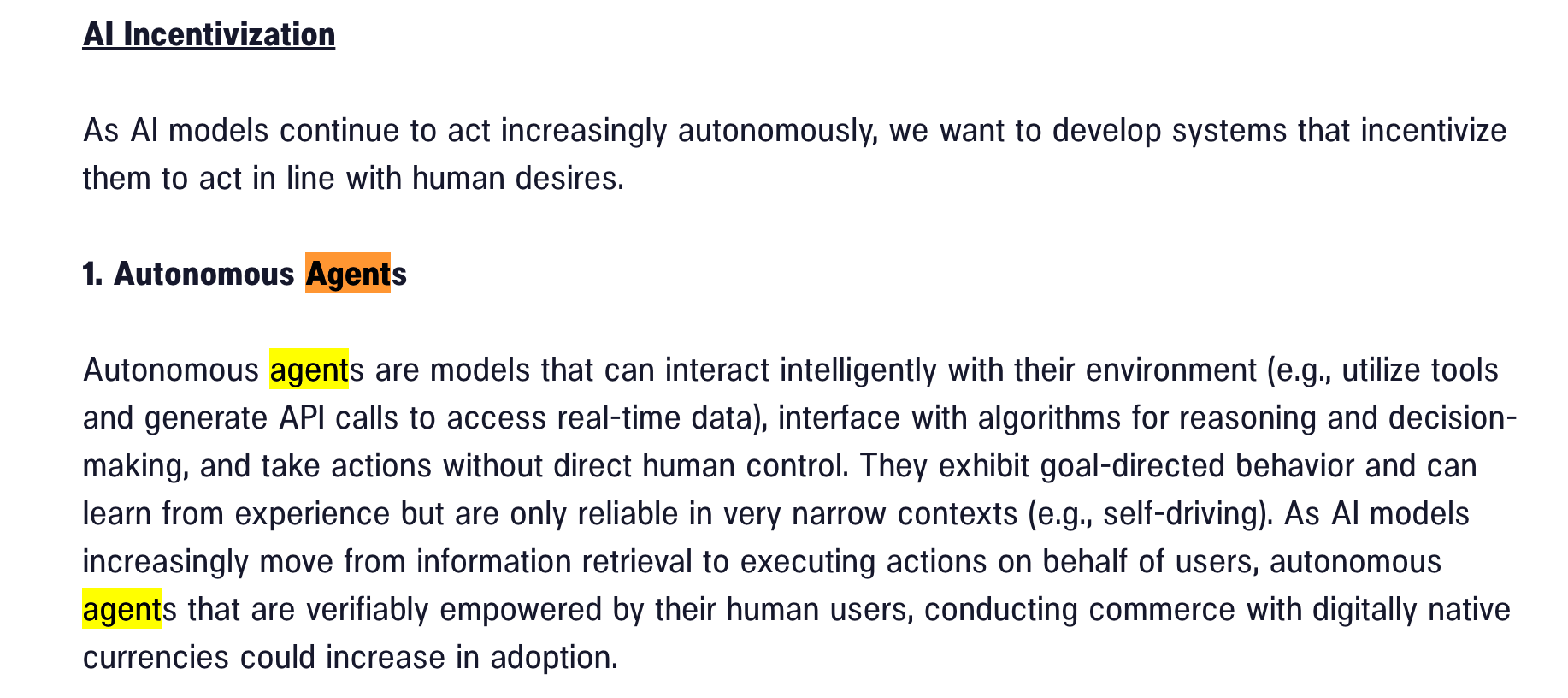

First, we need to understand how AI agents actually function—this helps us distinguish genuine AI agent projects from those merely riding the hype.

The bots in GPT’s store give users an intuitive sense of AI agents; but technically speaking, what defines a product as an AI agent?

In my view, identifying whether a product qualifies as an AI agent comes down to one key point:

A program or device powered by AI that can autonomously perform tasks or assist users.

From simple chatbots to complex automation systems, all can be considered AI agents. But such systems must at minimum meet the following criteria:

-

Automation: Ability to execute tasks with little or no human intervention.

-

Environmental Perception: Capable of sensing their operating environment via sensors or data inputs.

-

Decision-Making: Can make decisions based on programmed logic and incoming data.

-

Learning & Adaptation: Possesses learning capabilities and improves performance through new data and experience.

-

Interactivity: Can interact with human users or other systems, responding to requests or providing information.

But if we abstract these traits, AI agents begin to resemble smart contracts—given preset conditions, they automatically execute outcomes.

Therefore, to tell whether a project genuinely uses AI agents or just leverages smart contracts to ride the AI wave, we can apply a simple litmus test:

Does it have agency?

Smart contracts lack autonomy—they passively react (reactive) based solely on pre-written rules, without the ability to make independent decisions in response to changing external conditions. Example: You set a price, and when reached, it buys a token.

In contrast, AI agents are typically active (active)—they collect data, learn, make decisions, and initiate tasks independently without external commands. Example: Monitoring market data and purchasing a token when the AI determines optimal profit conditions.

With this distinction clear, let’s explore how AI agents relate to the crypto industry.

ChiefBuidl, co-founder of prominent crypto project Space and Time, offered a classic and vivid analogy:

Cryptocurrency is like cash, blockchain like a cash register, dApps like POS machines, and AI agents like cashiers.

Reflecting on this: When cryptocurrency functions like cash in transactions, underlying blockchains handle record-keeping and accounting. DApps serve as POS-like interfaces, while AI agents act as cashiers who say:

“Don’t worry about how money is spent or accounts recorded. Just tell me your intent—I’ll automatically spend your money and deliver the service you want.”

In this chain, cryptocurrency, blockchain, and dApps are inherently complex and hard to grasp, whereas AI agents are the layer most likely to interact directly with users and simplify complexity.

Thus, AI agents matter to crypto—they can enhance user experience across crypto products (including, but not limited to, trading).

Which Crypto Projects Are Related to AI Agents?

Which projects align with the AI agent concept?

We might categorize them into two types: those offering native AI agent capabilities for others to use, and those integrating AI agents to improve their existing products.

Type 1: Crypto Projects Directly Building AI Agent Services

Autonolas ($OLAS): AI Agents Built for Efficiency in Crypto Projects

Autonolas is a project directly tied to AI agents, whose core business is designing AI agents for the crypto industry to automate various scenarios.

Specifically, Autonolas’ tech stack includes:

-

Autonomous agent services

-

Composable autonomous applications

-

On-chain protocols securing agent services and incentivizing development

(Related reading: Deep Dive Into Autonolas: AI Agent-Powered Off-Chain Services, Product and Economic Model Explained)

The centerpiece is autonomous agent services.

These AI agents can pull data from any AI model globally. Every GPT, LMM, or subnet is included (meaning potential synergy with $TAO). Through service coordination, models are assigned to specific agents for handling dedicated tasks.

So what can these agents actually do?

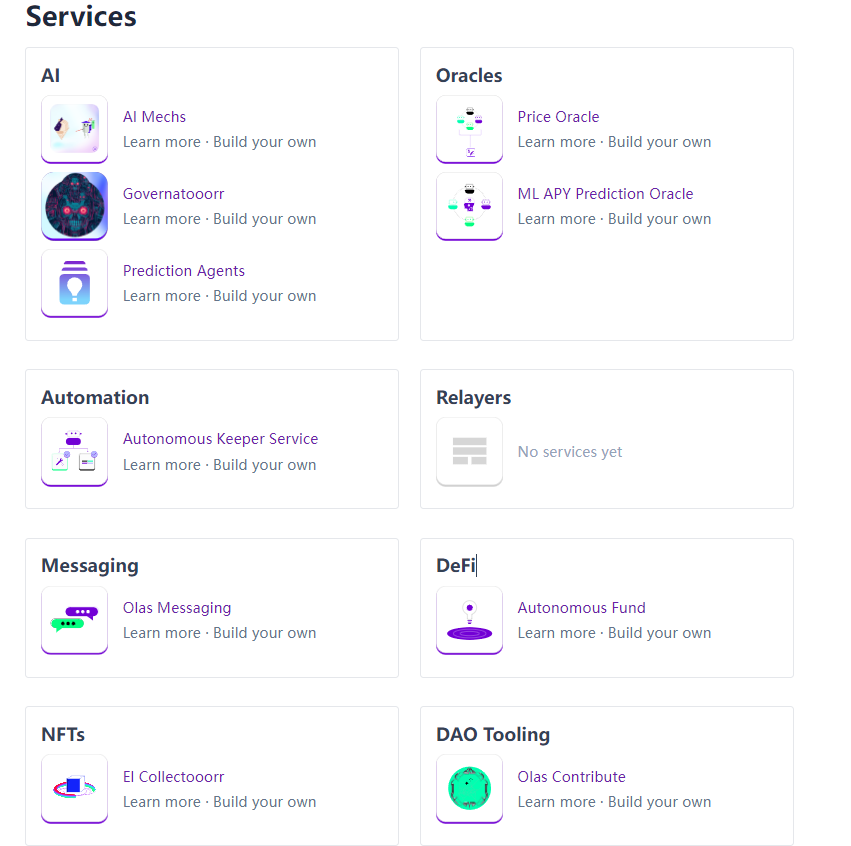

According to product collections listed on Autonolas’ official site, its crypto-related applications include—but are not limited to—using AI agents for market forecasting, predicting protocol APYs, serving as oracles to provide more accurate off-chain data, assisting DAO governance, automating smart contract operations, and automatically creating DeFi liquidity pools.

Overall, any process-driven operation within crypto projects has room for AI agents.

The other two components of Autonolas build upon these autonomous services. By offering foundational tools, developers can freely combine functionalities to create custom applications. Additionally, Autonolas can host an app store where developers register and monetize their services.

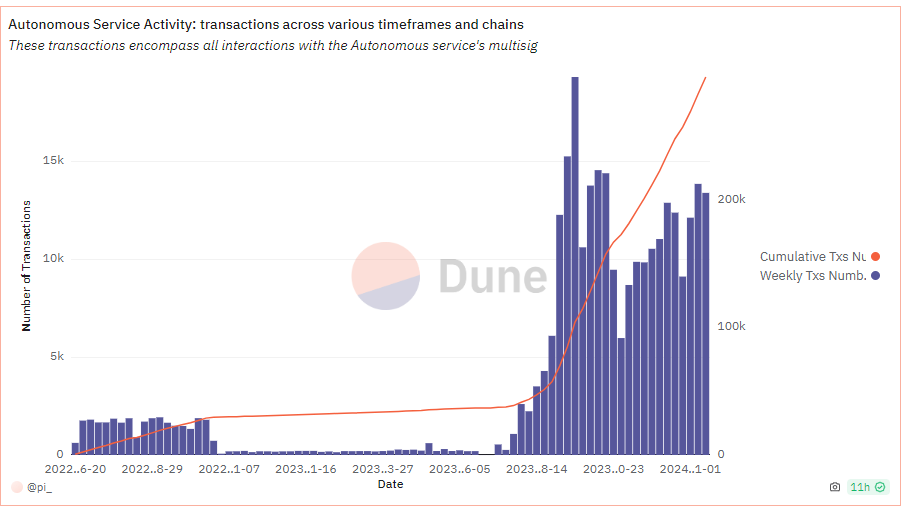

In terms of metrics, usage of the project’s AI agent services continues to grow. Since it doesn’t limit partner projects, Autonolas could theoretically become a standard add-on for any crypto project seeking AI-powered automation.

Its token $OLAS launched on-chain liquidity pools last July at around $0.10, currently trades near $4.60, and has achieved a market cap of approximately $200 million.

Considering the enduring AI narrative and expected utility of the project, this valuation does not appear excessively high. For comparison, $TAO—a different AI-focused project—has a market cap of around $1.5 billion.

Fetch.ai ($FET): An Established Project Offering Industry-Wide AI Agents

Fetch.ai (FET) also focuses on building and promoting AI agent services. These agents are designed as modular components programmable to perform specific tasks. They can autonomously connect, search, and trade, forming dynamic markets that transform traditional economic activity.

Compared to OLAS, Fetch is a veteran project—founded in 2017 and launched mainnet in December 2019. It has since integrated with Cosmos IBC, making it an AI player within the Cosmos ecosystem.

However, Fetch isn't limited to crypto—it extends its AI agent services across industries. Official examples include e-commerce, automotive, legal, IoT, and weather services.

Another distinguishing feature of Fetch is developer-friendliness.

Fetch has introduced Agentverse—an no-code management service that simplifies AI agent deployment. Much like how no-code platforms (e.g., Replit) and GitHub Copilot democratized coding, Fetch aims to similarly democratize Web3 development.

Through Agentverse, users can easily launch their first agent, significantly lowering the barrier to using advanced AI technology.

However, despite its history, Fetch’s actual products remain largely on the roadmap and are not yet fully open to the public. This raises questions about whether the team is delivering tangible progress.

On the token side, $FET serves as gas for the network and is used for node staking to maintain operations. Its market cap has reached $500 million. In my view, it offers weaker value compared to OLAS, with more limited upside potential. Still, it can be viewed as a beta play—when AI agent narratives gain momentum, FET may see short-term gains.

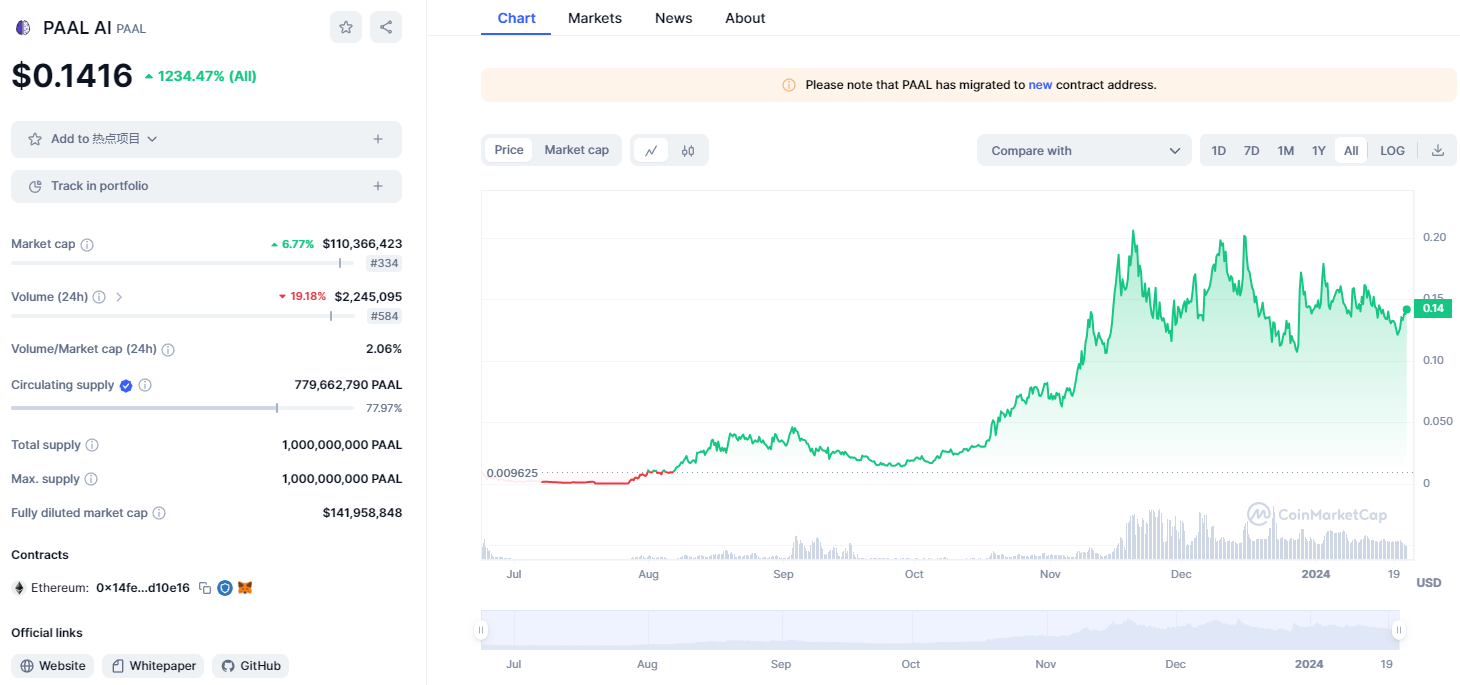

PAAL AI ($PAAL): Focused on Building AI Assistants for Crypto Users

PAAL aims to create an AI-powered platform that is accessible, user-friendly, and delivers comprehensive knowledge, support, and tools in the fast-evolving world of cryptocurrencies and blockchain technology.

The project wants to give users personal AI assistants they can rely on for accurate information, customizable help, and deeper insights into the crypto ecosystem.

More concretely, PAAL can be understood as a crypto-native GPT combined with a trading bot.

Key AI tools offered by PAAL include:

-

Mypaal: The aforementioned knowledgeable AI bot that answers user questions about crypto projects;

-

Autopaal: Acts as a crypto expert, providing research, insights, and analysis centered on cryptocurrencies, monitoring market trends and alerting users to specific conditions;

-

Autopaal X (not yet launched): An upgraded version combining the above features with automated trading, sharing revenue with $PAAL stakers to provide additional incentives.

Conceptually, PAAL qualifies as an AI agent, though its scope is narrower than the previous two projects, currently focused only on helping crypto users with trading and education. Without overcomplicating distinctions, we might simply view it as a sophisticated trading bot.

Currently, the $PAAL token has a market cap of around $100 million—lower than the prior two. Given its narrow focus and strong correlation with crypto market cycles, its overall potential appears less expansive than OLAS.

Type 2: Projects Enhancing Existing Products with AI Agents

The above projects are directly building AI agent services. Others aren't primarily AI agent companies but integrate AI agent functionality into their existing offerings to boost performance.

Due to space constraints, we won’t dive deep into each one here, but will list notable examples:

Root Network ($ROOT): A purpose-built L1 optimized for metaverse, gaming, and Web3 user experiences, backed by Futureverse, which provides AI and metaverse technologies. AI agent capabilities can already be integrated into games built on this network to enhance gameplay.

Parallel ($PRIME): A sci-fi themed card battle game funded by Paradigm. The game currently uses AI characters to generate new in-game items, which are stored in the AI character’s own wallet—effectively functioning as AI agents that create game assets.

Oraichain ($ORAI): A company offering AI Layer 1 data economy and oracle services, aiming to build trustworthy AI tools supporting Web3, scalable dApps, and data economies. Recently launched a token analytics tool called DeFi Lens, enhanced with AI agent capabilities for predictive token analysis.

Due to resource limitations, we haven’t listed every AI agent-related project in the market.

But whether directly or indirectly related to AI agents, beyond the hot AI label, we must assess whether their AI agent implementations are real and functional—not just empty promises.

The AI bubble is large—the hype around crypto projects jumping on the AI bandwagon may be even bigger.

Focusing on projects with stronger fundamentals increases the likelihood of capturing solid, sustainable value amid the year-long AI narrative.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News