Sei's accelerated development, parallel EVM new narrative combined with positive operations

TechFlow Selected TechFlow Selected

Sei's accelerated development, parallel EVM new narrative combined with positive operations

The launch of parallel EVM in Sei V2 has introduced a new narrative.

I. Fundamental Analysis

1. Overview

Built on the Cosmos SDK and Tendermint Core, Sei is a Layer 1 blockchain designed specifically for DeFi, aiming to bring order book models on-chain to close the speed gap between DEXs and CEXs and become the "Nasdaq of crypto."

Sei is a general-purpose chain focused on trading rather than an app-specific chain tailored for a single application. In other words, Sei is a blockchain optimized for trading, achieving this positioning through features such as an order matching system, native matching engine, Twin-Turbo consensus, and transaction parallelism:

(1) Core – Order Matching System and Native Matching Engine:

As a Layer 1 "built for trading," Sei does not exclusively adopt either AMM or traditional order book mechanisms but instead chooses a hybrid approach—the Central Limit Order Book (CLOB). The CLOB constructs an on-chain order-matching engine at a lower-level infrastructure by embedding order books directly into the chain (Sei does not manage the order book itself but provides a framework for order matching). Various DeFi protocols built atop Sei can leverage this order-matching engine. A major issue in the current DeFi ecosystem is fragmented liquidity across individual protocols; however, with Sei, all DeFi protocols share a unified order-matching engine capable of aggregating deep liquidity, minimizing users' financial losses from slippage and related side effects.

For a simple example, suppose there are "Red Dex" and "Blue Dex" on Sei. If User A places an order on Red Dex to sell 1 ETH at $2,000, while User B submits a market buy order for 1 ETH on Blue Dex, Sei’s order-matching engine will match these two orders. Typically, DeFi networks suffer from fragmented liquidity because each protocol maintains its own liquidity pool. Sei, however, offers a deeply liquid pool that aggregates all liquidity tied to its matching engine, thereby minimizing user losses due to slippage.

(2) Twin-Turbo Consensus: Twin-Turbo consensus consists of two components: 1) Smart Block Propagation for efficient block dissemination; 2) Optimistic Block Processing, which reduces block time to enhance scalability.

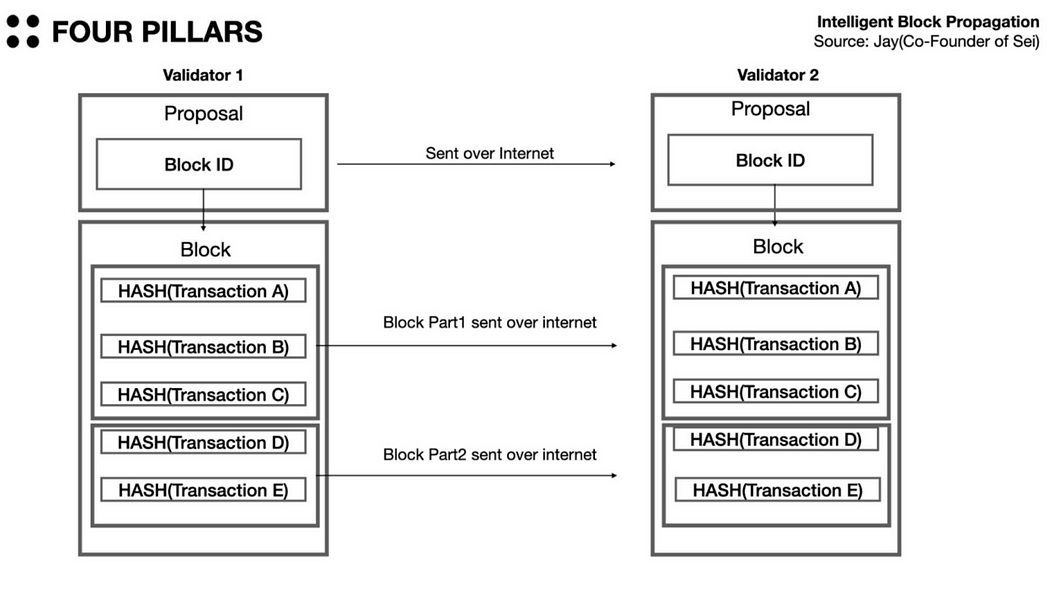

1) Smart Block Propagation: In a typical blockchain network, block proposers collect transactions from their local mempool, form them into a block, and broadcast it across the network. During this process, full blocks containing all transaction data are propagated—even if most nodes already possess nearly all transactions—resulting in redundant transmission and wasted bandwidth.

In Sei, block proposers do not include full transaction data in the initial proposal. Instead, they transmit only transaction hashes along with a Block ID—a reference to the block. Transaction hashes are compact summaries of existing transaction data, offering significant size advantages. The proposer first broadcasts the block proposal (as shown below), then sends the complete block in smaller chunks. Validators receiving the proposal who already have all corresponding transactions in their local mempool can immediately reconstruct the block locally without waiting for the full block. If a validator happens to be missing one transaction (a very low probability), it simply waits for the full block to arrive.

Source: Four Pillars, Jay-Sei Labs

The benefit of this smart block propagation is a dramatic reduction in the time validators need to receive and process blocks. According to co-founder Jay, this process has been proven to improve Sei’s overall scalability by 40%.

2) Optimistic Block Processing:

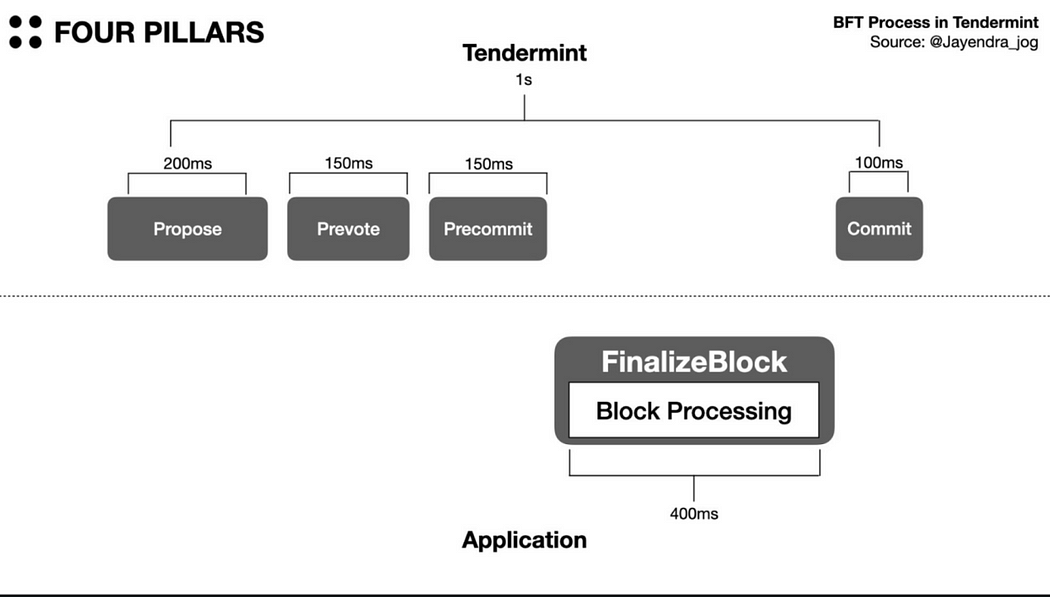

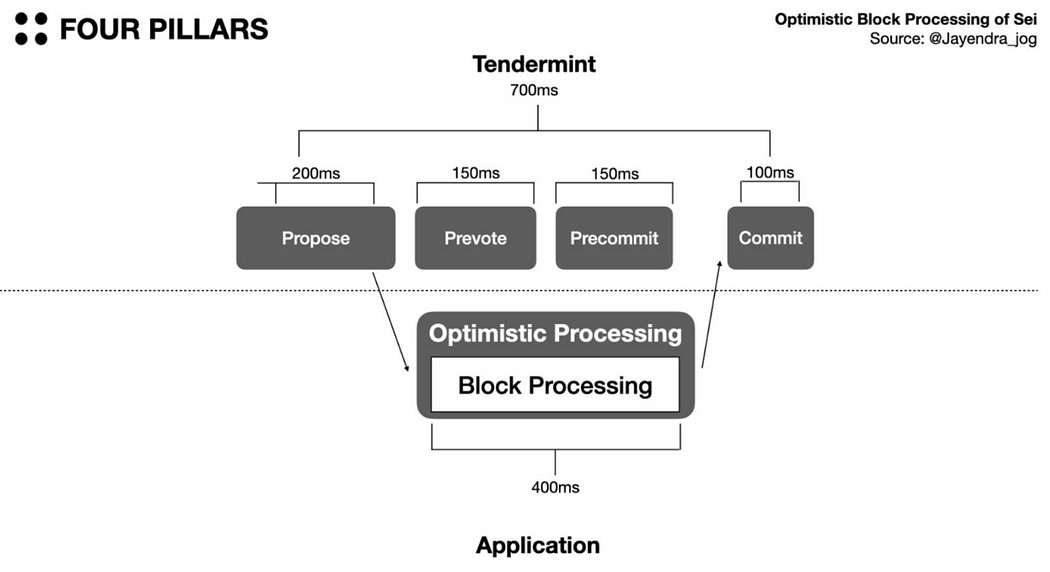

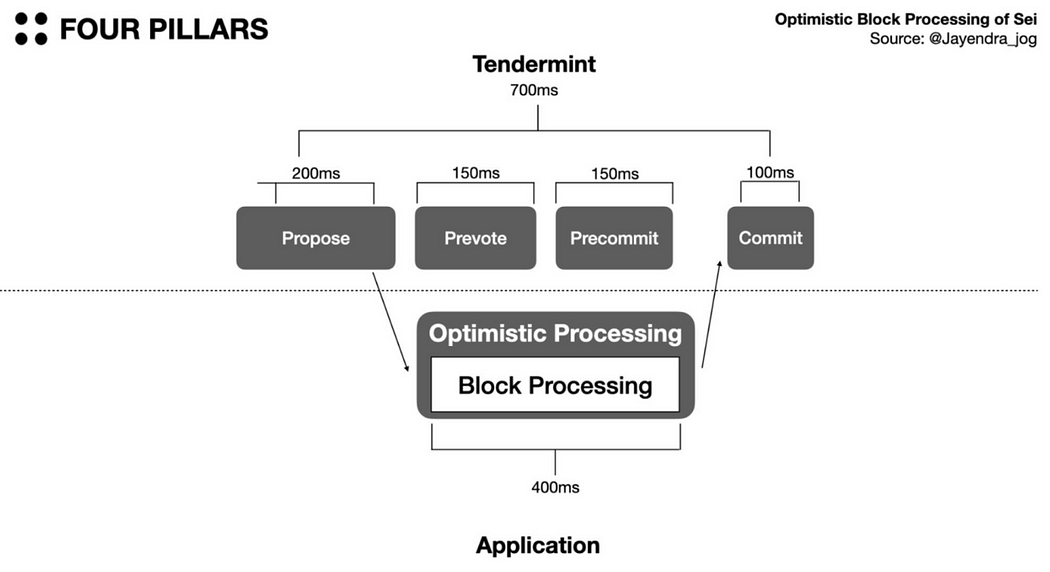

Sei uses Tendermint Core but modifies it to significantly reduce block time and boost scalability. Tendermint Core is a consensus engine combining Delegated Proof-of-Stake (DPoS) and PBFT algorithms. The standard Tendermint BFT consensus flow is: Propose → Prevote (2/3 consensus) → Precommit (2/3 consensus) → Commit.

Sei's Optimistic Block Processing modifies the Tendermint BFT workflow. Normally, block processing occurs between Precommit and Commit stages. Assuming few malicious nodes exist and validators have already received necessary data during the Prevote phase, Sei begins executing computations in parallel with Prevote. This optimistic processing reduces block time effectively since most blocks are valid. Invalid blocks rejected during execution can simply be discarded.

Source: Four Pillars, Jay-Sei Labs

To illustrate with actual numbers: under normal Tendermint BFT, total block time is 200+150+150+400+100 = 1000ms. With optimistic block processing, 300ms of Prevote and Precommit time is saved, reducing block time to 700ms. With unchanged block size, reducing block time from 1000ms to 700ms means producing 1000/700 ≈ 1.43x more blocks in the same duration—an increase of 43% in scalability.

(3) Transaction Parallelization:

Another method Sei uses to enhance scalability is transaction parallelization. The Ethereum Virtual Machine (EVM) is the industry’s most popular virtual machine, processing transactions sequentially—an inherent bottleneck for scalability. By default, even the Cosmos SDK upon which Sei is based processes transactions serially. In typical Cosmos app-chains, validators execute BeginBlock logic, DeliverTx, and EndBlock logic sequentially when a block arrives. Sei modifies DeliverTx and EndBlock to enable parallel transaction processing.

DeliverTx handles transactions like token transfers, governance proposals, and smart contract calls. Crucially, parallelized transactions must not reference the same keys. For instance, "A sends X tokens to B" and "C sends Y tokens to D" can be processed simultaneously, but "A sends X tokens to B" and "B sends X tokens to C" cannot—they must be processed sequentially.

To enable parallelization, Sei builds a DAG (Directed Acyclic Graph) to check dependencies among transactions before execution. As shown below, if R3 depends on R2 in the first column and the third-column R3 depends on W1 in the middle, transactions are processed accordingly.

Source: Four Pillars, Jay-Sei Labs

In the final EndBlock phase, transactions related to the matching engine are executed by the native matching engine. Similarly, these transactions are not processed serially but in parallel after confirming they are independent.

By default, the network assumes all transactions are unrelated and processes them immediately. Only dependent transactions may fail. Thus, developers building on Sei’s matching engine must first identify interdependent transactions. Experimental results show performance improvements of 60–90% in block time and TPS compared to non-parallelized systems.

2. The New Narrative: Parallel EVM

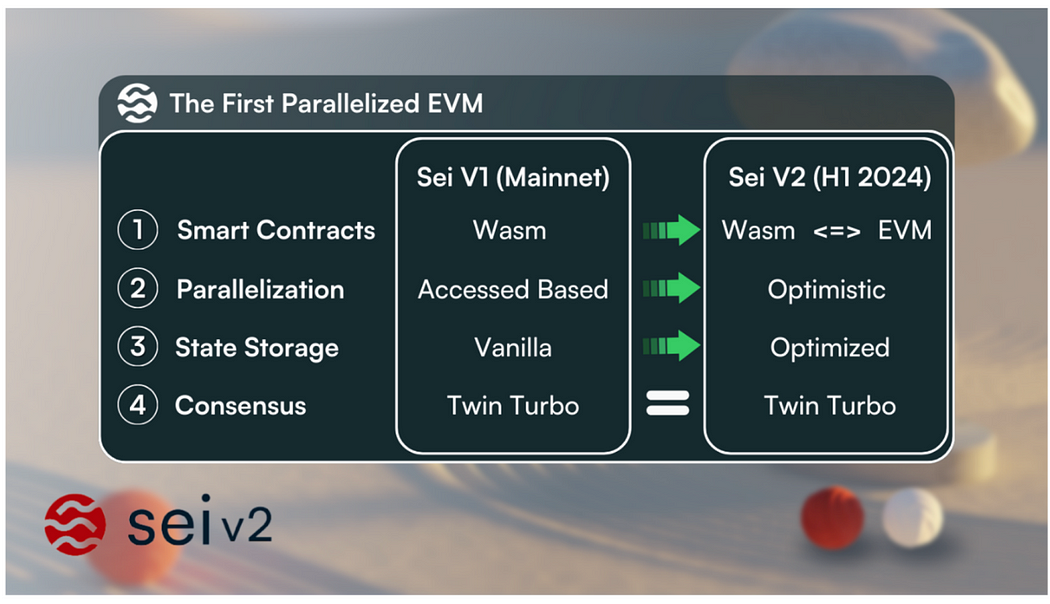

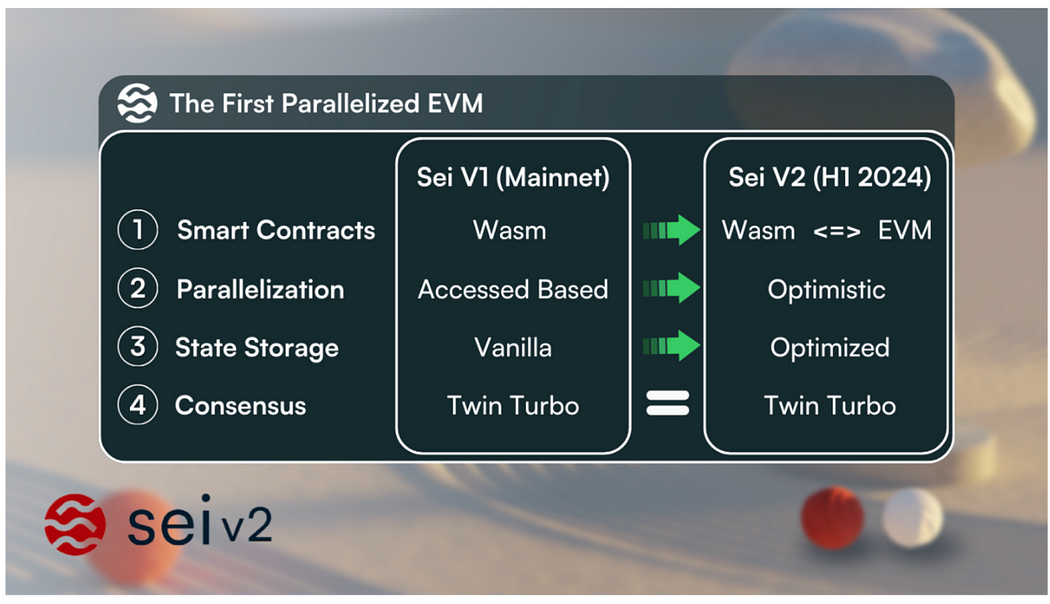

Since the official launch of Sei’s public mainnet Pacific-1 on August 16, 2023, and the announcement of Sei V2 on November 29, 2023—which plans to support the first parallel EVM—developer demand has grown.

Currently, Sei supports Cosmwasm smart contracts written in Rust. As interest grows and the ecosystem expands, developers increasingly request more flexible execution environments. Supporting parallel EVM makes Sei accessible to the global EVM developer community.

Source: Sei Labs

(1) What Is Parallel EVM?

Parallel EVM (Ethereum Virtual Machine) is a concept aimed at improving the performance and efficiency of the existing EVM. The EVM is Ethereum’s core component responsible for running smart contracts and processing transactions. Currently, the EVM has a critical limitation: transactions are executed sequentially.

Sequential execution ensures deterministic ordering of transactions and smart contracts, simplifying state management and predictability. This design prioritizes security and minimizes potential complexity and vulnerabilities associated with parallel execution, but it can lead to network congestion and delays under high load.

Imagine the original EVM design as vehicles moving single-file—one behind another—each constrained by the speed of the vehicle ahead. Any traffic jam (transaction delay) stalls all following vehicles. In contrast, a parallel EVM is like expanding that road into a multi-lane highway, allowing multiple vehicles to move simultaneously. Technically, parallel EVM enables concurrent execution of independent transactions or smart contracts, greatly increasing processing speed and system throughput.

General Approaches to Parallel EVM Processing:

- Partitioning or Sharding: Group transactions so they can be executed in parallel across different processing units, similar to Solana’s SVM.

- Optimized Algorithms: Develop new scheduling algorithms and optimization techniques to efficiently manage and execute parallel tasks while maintaining correctness and ordering.

- Security and Consistency Guarantees: Implement complex synchronization mechanisms and consistency models to ensure system safety and data integrity even under parallel processing.

In summary, parallel transaction processing allows the EVM to handle more transactions simultaneously, significantly increasing TPS, reducing congestion, and enhancing scalability.

(2) Key Elements of Sei V2 Implementation

1> Backward Compatibility for EVM Smart Contracts — Enables developers to deploy audited smart contracts from EVM-compatible blockchains without code changes, supporting reusability of familiar and widely used tools (e.g., MetaMask):

Backward compatibility means new products are designed to work with older versions. In Sei V2, most existing Ethereum smart contracts can be deployed on Sei without any modifications.

Source: Sei Labs

2> Optimistic Parallelization — Allows the chain to support parallelization without requiring developers to define dependencies:

Sei V2 processes transactions in parallel assuming all operations are valid—executing them first and rerunning only if issues arise during validation. The result should match sequential processing. In short, Sei V2 takes an optimistic approach: it executes transactions upfront and uses information about any conflicts that emerge to resolve them, rather than pre-validating relationships. This optimistic parallelization applies to all transactions on Sei—including native Sei, Cosmwasm, and EVM transactions.

Source: Sei Labs

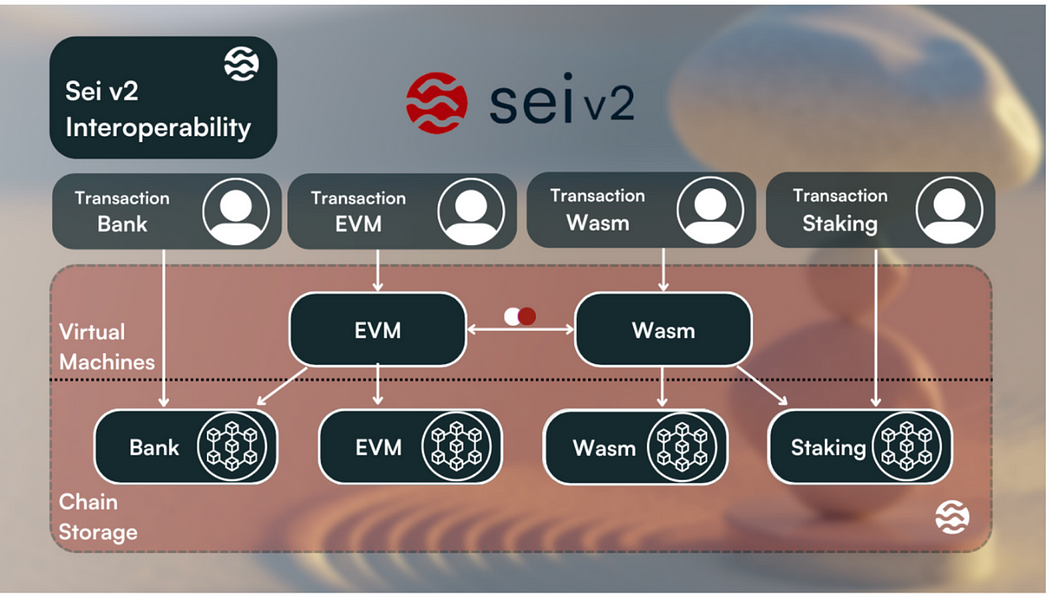

3> Interoperability with Existing Chains — Enables seamless composability between EVM and any other execution environment supported by Sei:

As an integrated chain, all transactions entering different components of Sei (Cosmwasm, EVM, bank, staking) can communicate with each other. Although serving different purposes, these transactions share common characteristics such as gas, sender, and payload. When the chain receives them, they are processed as native Sei transactions and routed to appropriate modules (e.g., CosmWasm transactions go to the wasm module). This creates a smoother developer experience—EVM developers can easily access native tokens and other chain functionalities (e.g., staking).

Source: Sei Labs

4> SeiDB — Improvements to the storage layer to prevent state bloat, enhance read/write performance, and make state sync easier for new nodes.

(3) Significance of Parallel EVM

Former Polygon co-founder JD previously suggested on social media that he expects every L2 in 2024 to rebrand itself with the label "parallel EVM," while Paradigm CTO Georgios believes 2024 will be the "year of parallel EVM," noting that Paradigm is internally exploring related technologies.

For developers, blockchain development has long been unfriendly—whenever a new VM or programming language emerges, builders must adapt to a new environment. If blockchain users are developers, then such designs neglect user convenience. Ultimately, blockchains must evolve to meet builders’ needs and environments. Currently, the EVM ecosystem is the most active, and parallel EVM addresses its scalability limitations.

Supporting EVM in Sei V2 does not mean abandoning WASM. Sei plans to support both virtual machines—and even interoperability between them—providing a seamless development environment. If successful, Sei V2 could become the most successful integrated blockchain supporting multiple VMs.

Jay, co-founder of Sei Labs, announced at the end of 2023 that with stateful precompiles and chain-level message scheduling, EVM and Cosmwasm contracts will be able to call each other. After audit completion, the upgrade will launch on the public testnet in Q1 2024 and deploy to mainnet in the first half of 2024.

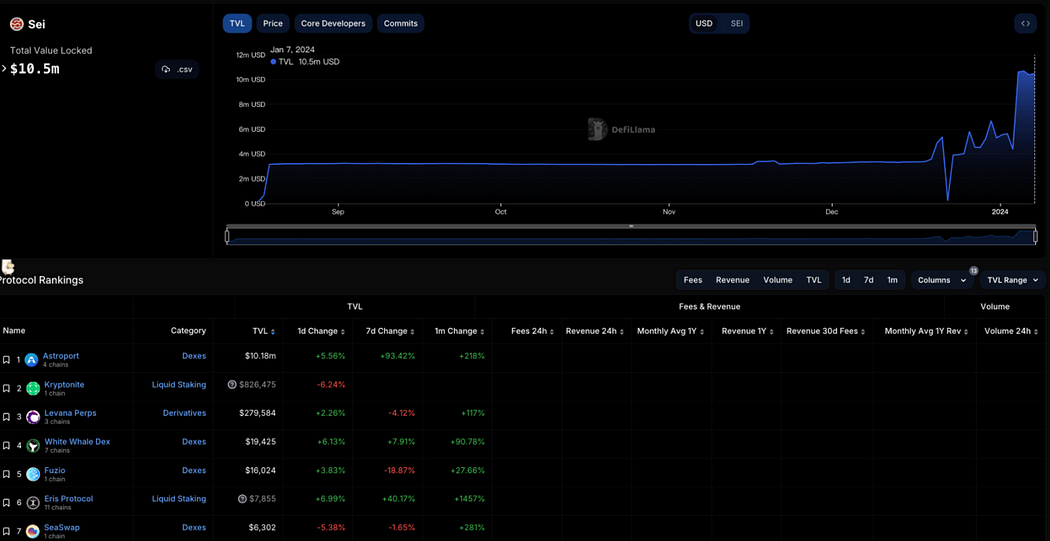

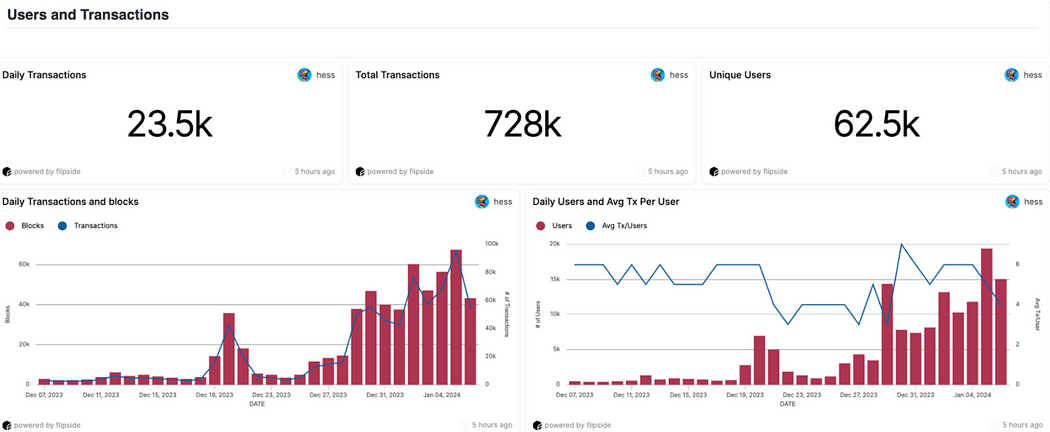

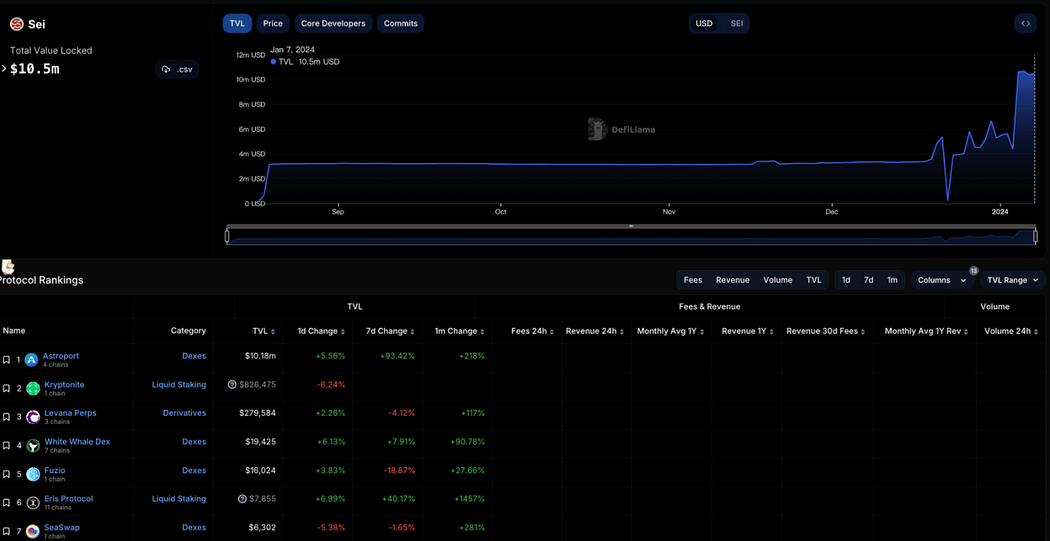

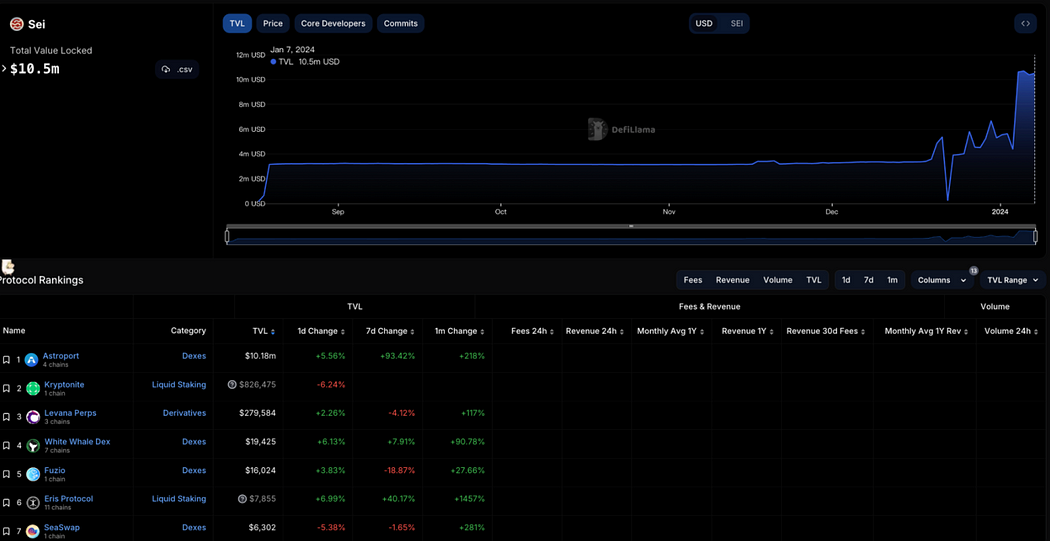

3. On-Chain Ecosystem Development

Over the past 30 days, Sei Mainnet recorded 728,000 total transactions, 62,500 unique users, and an average of 23,500 daily transactions—both transaction count and user base showing upward trends.

Source: Flipside

Over the last 30 days, the most active applications on Sei Mainnet by user activity and transaction volume are Astroport, Tatami, Dagora, and Webump.

Source: Flipside

Astroport (Dex): Astroport aims to become the mainstream next-generation AMM, providing deep liquidity pools and high trading volumes for the Cosmos ecosystem. Better pricing attracts more liquidity, creating a self-reinforcing cycle. Ultimately, Astroport intends to serve as the foundational liquidity layer for Cosmos. It currently operates on four chains: Sei, Neutron, Terra2, and Injective.

Tatami (Gaming): Tatami addresses a key need in Web3—dedicated game publishing. With countless games scattered across various chains, Tatami offers a unified platform where users can play games, collect assets, and complete quests. It combines game development, marketplace integration, and launchpad services, aiming to transform how games are experienced, created, and distributed in Web3.

Dagora (NFTs): Part of the Coin 98 multichain NFT ecosystem, Dagora supports BNB Chain, Polygon, Sei, and others. Features include Marketplace (NFT trading), Launchpad (NFT release platform), and Hot Drops (free mint section). Additionally, C98 token holders can participate in auctions, Launchpad events, and Hot Drops.

Webump (NFTs): Webump supports developer and creator communities on the Sei blockchain and collaborates with Lighthouse to provide open-source smart contracts designed for seamless NFT creation on Sei. Lighthouse is an open protocol and toolkit that enhances the NFT creation process, making it more accessible and efficient for creators and developers.

As a blockchain focused on delivering high-performance DeFi, Sei’s on-chain DeFi TVL—both in aggregate and per project—remains in early stages in terms of metrics and product development.

Source: Defillama

Kryptonite: A decentralized AMM and staking protocol built on Sei, compatible with any bAssets on Cosmos and other blockchains. Kryptonite aims to bring robust native money markets to the Cosmos ecosystem, driving financial innovation and flexibility. Users can stake SEI tokens from the Sei Network to receive liquid staking tokens (bSEI), then use bSEI as collateral—at a 200% collateral ratio—to mint the stablecoin kUSD.

Levana Perps: A perpetual futures trading platform on Sei supporting up to 30x leverage. Levana currently offers leveraged contracts for BTC, ETH, ATOM, and OSMO.

Yaka Finance: An upcoming native DEX on Sei. Interaction is currently available via its website, with potential future airdrops.

Sushiswap and Vortex Protocol: On February 23, 2023, Sushi announced the acquisition of derivatives DEX Vortex and collaboration with Sei to launch a decentralized derivatives exchange on Sei. However, no further updates have been disclosed since, with Vortex’s latest official tweet dated February 2023.

II. Team, Funding & Partnerships

1. Team Background

Sei Network was founded in 2022 by Jeff Feng and Jayendra Jog. Jeff Feng is a co-founder of Sei Labs, graduated from UC Berkeley, and worked at Goldman Sachs’ TMT Investment Banking division from 2017 to 2020. He co-founded Sei Labs with Jay in 2022.

Jayendra Jog is also a co-founder of Sei Labs, a UCLA alumnus, and served as a software engineer at Robinhood from 2018 to 2021.

Phillip Kassab is Head of Growth and Marketing at Sei Network, a graduate of the Stephen M. Ross School of Business at the University of Michigan, formerly marketing lead at Trader Joe and Swim.

Other team members have prior experience at Google, Amazon, Airbnb, and Goldman Sachs.

2. Funding History

In August 2022, Sei Labs, the team behind Sei Network, raised $5 million in seed funding led by Multicoin Capital, with participation from Coinbase Ventures, GSR, and others.

In February 2023, Sei announced an ongoing Series A round at a $400 million valuation, including plans for an airdrop. In April, Sei Network confirmed a $30 million raise at an $800 million valuation, with investors including Jump Capital, Distributed Global, Multicoin Capital, and Bixin Ventures. Funds were allocated to development and APAC market promotion. That same month, the Sei Labs ecosystem fund raised $50 million in a new round, backed by OKX Ventures, Foresight Ventures, and others.

In November 2023, Circle strategically invested in Sei Network, supporting the launch of native USDC on the network.

Source: Rootdata

3. Operations & Partnerships

(1) Testnet Campaigns and Airdrops: During the Atlantic-2 testnet phase, Sei clearly stated it would distribute token incentives to early community members who actively used the chain. Upon the public release of the Pacific-1 mainnet, these rewards became claimable, encouraging user interaction.

(2) Sei Ambassador Program: Launched the Sei Marines ambassador initiative, offering tiered rewards based on contribution levels to stimulate regional promotion.

(3) Sei Launchpad Accelerator Program: Introduced the sei/acc program, investing in and supporting ecosystem projects through resources, mentorship, and incentives. Each selected project receives a dedicated product manager to assist in strategic roadmap planning and coordination with key Sei Foundation team members.

(4) Expansion in Asia-Pacific: In December 2023, Sei sponsored Binance’s event in the Maldives. On December 21, Sei announced a strategic partnership with KudasaiJP to expand its market presence in Japan. In January 2024, South Korean research firm Four Pillars revealed ongoing preparations with Sei to strengthen influence and collaboration in the Korean market.

III. Token Overview

1. Overview

SEI currently has a market cap of $1.674 billion, FDV of $7.947 billion, a total supply of 10 billion, a circulation rate of 23%, and a 24-hour trading volume of $793 million. Primary exchanges include Binance (26.91%), Upbit (25.85%), and Coinbase (8.37%).

Compared to other new public chains, Sei’s market cap is lower than Aptos but higher than Sui, representing approximately 0.5% of Ethereum’s market cap and 3.9% of Solana’s. In terms of DeFi TVL, Sei lags significantly behind Sui and Aptos, with only $12.19 million, indicating it is still in an early stage.

Source: LD Capital

2. Tokenomics

SEI token use cases include:

Network Fees: Pay transaction fees on the Sei blockchain.

DPoS Validator Staking: SEI holders can delegate their tokens to validators or run their own validator node to secure the network.

Governance: SEI holders can participate in protocol governance decisions.

Native Collateral: SEI can serve as collateral for native asset liquidity or within applications built on the Sei blockchain.

Fee Market: Users can tip validators for priority transaction processing, with tips shared among delegators.

Trading Fees: SEI can be used as fee currency on Sei-based exchanges.

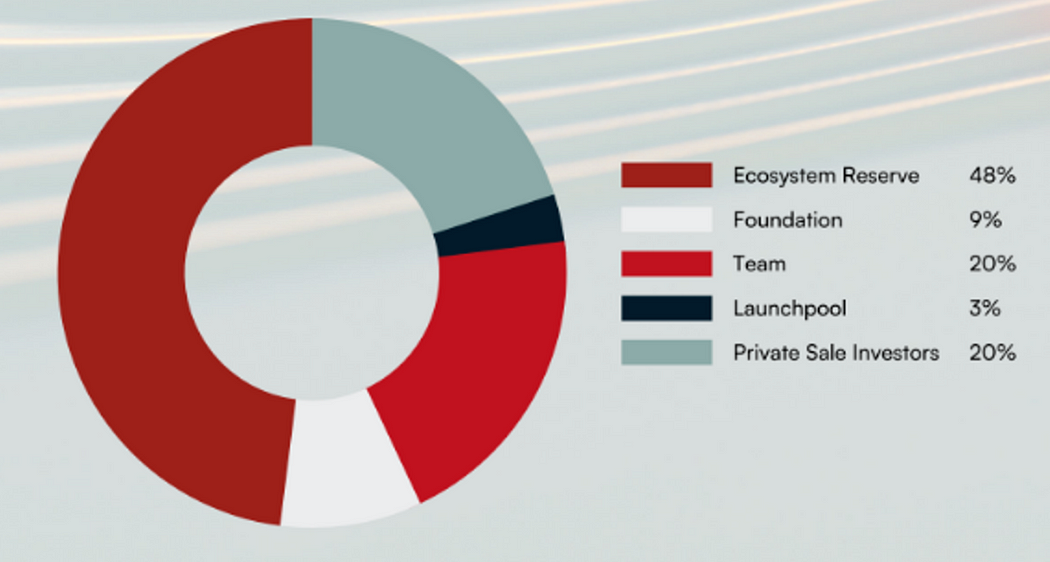

Maximum token supply is capped at 10 billion. 51% is allocated to the community, 48% to ecosystem reserves, 9% to the foundation, 20% to the team, 3% to Launchpool, and 20% to private sales—making the combined team and investor allocation 40%. The 48% ecosystem reserve is divided into three parts:

Staking Rewards

As part of Sei’s decentralized proof-of-stake mechanism, validators protect the blockchain and ensure accuracy. They run full nodes to validate every transaction on the Sei network, propose blocks, vote on validity, and add new blocks to the chain. Users can stake their SEI tokens to validators and earn staking rewards. Validators can set commission rates to compensate themselves and play key roles in protocol governance.

Ecosystem Initiatives

SEI tokens will be distributed via grants and incentives to contributors, builders, validators, and other participants meaningfully contributing to the Sei network.

Sei Airdrops and Incentives:

A portion of the SEI supply is allocated to airdrops, incentivized testnet rewards, and ongoing programs aimed at rapidly distributing SEI to users and the community.

Source: Sei Labs

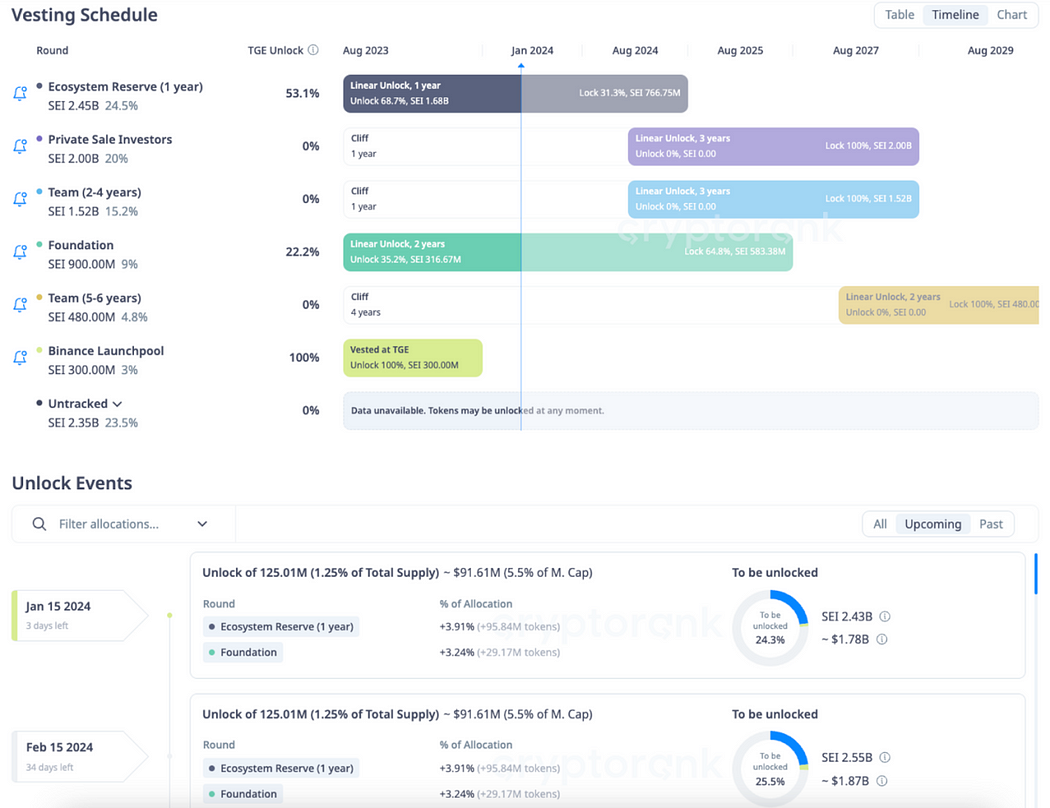

Unlock Schedule

SEI will undergo its first major unlock for private investors and the team on August 15, 2024. Regular monthly unlocks occur on the 15th, primarily releasing tokens from ecosystem and foundation allocations. Monthly unlock volume is 125 million tokens (~$91.61 million).

Source: CryptoRank

3. Recent Trading Activity

Since its listing on August 15, 2023, SEI’s price declined steadily for about three months. From November 22 onward, it began a sharp rise from around $0.14 to a recent peak of $0.88. On January 3, it touched the upper Bollinger Band and pulled back, with daily trading volume slightly declining.

Source: Binance

In derivatives markets, as the price rose recently, both long and short liquidations increased significantly, while open interest decreased. Recently, active buy/sell counts and value differences have been negative, with long-to-short ratio rising.

Source: Binance

IV. Summary

1. Fundamentals: Sei’s core differentiation lies in its underlying architecture based on a central order book, making it highly suitable for DeFi construction. However, from an on-chain ecosystem perspective, its overall applications and TVL remain in early stages, lacking standout DeFi projects. The introduction of parallel EVM in Sei V2 introduces a compelling new narrative. While many other chains and L2s may soon adopt parallel EVM, Sei V2’s timely rollout could offer a first-mover advantage—if it successfully attracts capital, high-quality projects, and users. The V2 upgrade is scheduled for release on the public testnet in Q1 2024 and deployment to mainnet in H1 2024.

2. Team Background and Recent Developments: The core team is young but well-qualified, backed by strong investors. Recent efforts in APAC marketing and operations have intensified.

3. Tokenomics: Maximum supply is capped at 10 billion tokens, with 51% allocated to the community and 40% to team and investors. Market cap-wise, Sei sits below Aptos but above Sui, representing ~0.5% of Ethereum’s market cap and ~3.9% of Solana’s. The first major unlock for private investors and the team occurs on August 15, 2024. Regular monthly unlocks (125 million tokens, ~$91.61 million) continue on the 15th, mainly from ecosystem and foundation reserves.

4. Recent Trading Activity: Price began rising from $0.14 on November 22, reaching a recent high of $0.88. Prices recently pulled back after touching the upper Bollinger Band, with slight declines in daily and derivative trading volumes.

5. The upcoming V2 parallel EVM upgrade, following the quarterly unlock, may positively impact ecosystem growth and price.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News