Sei Coin Hits Six-Month High—What's Driving the Surge in Its Ecosystem?

TechFlow Selected TechFlow Selected

Sei Coin Hits Six-Month High—What's Driving the Surge in Its Ecosystem?

Currently, Sei's development is highly dependent on the gaming sector, and the DeFi space is dominated by a single major player, posing challenges to ecosystem diversification and sustainability.

Author: Nancy, PANews

Recently, SEI's token price has been steadily climbing, accompanied by strong ecosystem activity and significant capital inflows, drawing market attention. This momentum is driven by Sei’s accelerated technological upgrades and ecosystem development, combined with faster U.S. localization strategies and narratives around ETF compliance and regulated financial products. However, Sei’s current growth remains heavily reliant on the gaming sector, while its DeFi space is dominated by a single player, posing challenges to long-term diversity and sustainability.

Token Price Nearly Doubles in a Month — Strong Expansion Masks Structural Concentration

Recently, both SEI’s token price and ecosystem have experienced explosive growth.

According to CoinGecko, at the time of writing, SEI’s price had risen to $0.347, up 97% over the past 30 days—reaching a six-month high—with its market cap briefly surpassing $2 billion. Notably, approximately 55.56 million SEI tokens (about 1% of the current circulating supply, valued at ~$18 million) were unlocked today (July 15) at 8:00 PM.

At the same time, multiple key metrics within the Sei ecosystem have shown explosive growth. According to recent official announcements from Sei, since the launch of Sei V2 one year ago, on-chain ecosystem activity has significantly increased, with daily transaction volume growing by 3,600% and TVL rising by 790%.

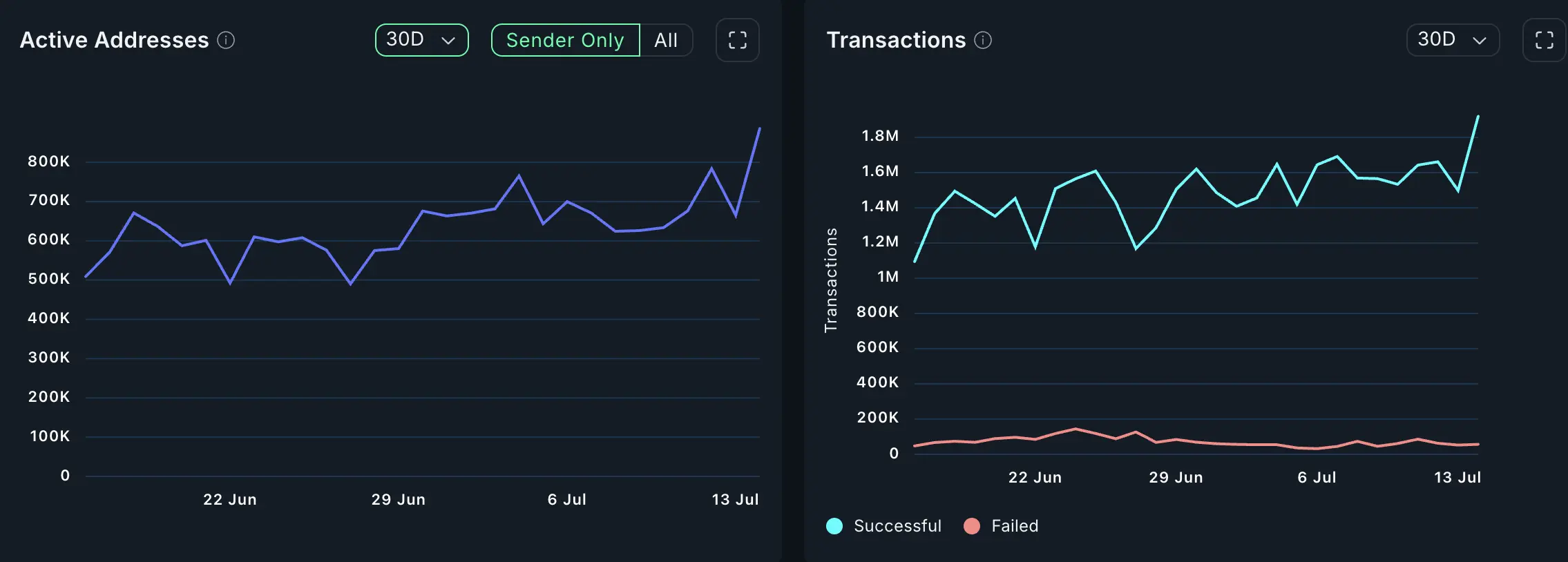

Data from Nansen shows that as of July 15, Sei V2’s daily active addresses surpassed 886,000—an increase of nearly 74.1% over the past 30 days—while daily transactions reached 1.919 million, up approximately 202.05% over the last three months. Despite this surge in user participation, application distribution reveals a heavy concentration: three major gaming apps—Nika Labs, Dragon Slither, and World of Dypians—accounted for over 89% of active addresses, while World of Dypians, Nika Labs, and football game EUFT drove more than 85.9% of all transactions. This indicates that Sei’s ecosystem growth is primarily fueled by a few top-tier gaming projects, lacking diversification. According to DappRadar, Sei ranks as the number one blockchain for Web3 gaming over the past month.

On the capital front, Sei has also demonstrated strong capital attraction. Data from DefiLlama shows that over the past 30 days, Sei’s cross-chain bridges recorded net inflows of $59.84 million—ranking third among all public blockchains, behind only Avalanche and Aptos.

In terms of TVL, DefiLlama data shows that as of July 15, Sei’s total value locked reached $650 million—a 30.72% increase within 30 days. However, TVL remains highly concentrated: Yei Finance alone accounts for $366 million—over half of the total—and only eight projects have TVL exceeding $10 million. This further highlights structural imbalance risks within the Sei ecosystem.

From a revenue perspective, the Sei ecosystem is showing signs of recovery. After dropping to just over $100,000 in March, monthly revenue rebounded and reached $813,000 in June—still well below the peak of $1.27 million recorded in January.

Overall, while Sei is currently in an expansion phase, its ecosystem remains overly dependent on a few leading projects, with applications heavily concentrated in gaming. To achieve sustainable growth, it must broaden its application landscape and improve user retention—by building a richer foundational ecosystem and accelerating deployment across diverse use cases.

Doubling Down on U.S. Localization, Backed by WLFI On-Chain Activity

SEI is widely seen as a “U.S.-themed” token—not only because of its American-rooted founding team, but also due to early backing from top-tier U.S. institutions such as Multicoin Capital, Jump Crypto, Coinbase Ventures, and GSR Ventures. Notably, Jump Crypto—recently reactivated—is believed to have played a key role in driving SEI’s previous price surge.

As U.S. crypto regulations become increasingly open, Sei is accelerating its U.S. localization strategy. In April, the Sei Foundation announced the establishment of the Sei Development Foundation, a U.S.-based nonprofit dedicated to advancing the Sei protocol and boosting its visibility—marking Sei’s formal entry into the U.S. market in both legal and operational terms. Furthermore, Sei’s on-chain interactions with Trump-linked crypto project WLFI have sparked broader market speculation. Between February and April, WLFI repeatedly purchased a total of 5.983 million SEI tokens (~$1 million worth) using USDC and deposited them as collateral into Falcon Finance, custodied by Ceffu. Additionally, last month, Sei Network was selected by Wyoming’s Stablecoin Task Force as a candidate blockchain for WYST—a U.S.-regulated, fiat-backed stablecoin. These developments have strengthened market narratives around Sei’s alignment with U.S. regulatory and financial frameworks.

In stablecoin ecosystem progress, Sei has made significant strides. As of July 2025, its stablecoin TVL hit a record high according to DefiLlama, and though slightly down, remains around $270 million. A few days ago, Sei announced the upcoming launch of native USDC and CCTP V2, aiming to bring the world’s largest compliant stablecoin and frictionless cross-chain transfers to Sei’s high-performance L1. Native USDC offers advantages including regulatory compliance, 1:1 USD redemption, and institutional access, while CCTP V2 enables efficient liquidity movement and cross-chain applications between Sei and other chains. Notably, Circle—one of Sei’s largest institutional investors—held 6.25 million SEI tokens as of the end of 2024, exceeding its holdings in APT and OP.

On the technical front, in early May, Sei Labs’ SIP-3 proposal drew widespread attention. The core idea is to simplify the original architecture into a pure EVM model, improving developer experience, streamlining infrastructure, and fully leveraging Sei’s parallelized EVM performance to support the network’s evolution toward its “Giga” goal—targeting transaction throughput exceeding 100,000 TPS.

Even more notable for market sentiment, European financial institution Valour has launched an ETP product tied to SEI, while Canary Capital has filed an S-1 form with the SEC to launch the first-ever SEI-based ETF in the U.S. This suggests Sei could soon gain validation and expanded liquidity from traditional capital markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News