Sei: Redefining Web3's Product Form, Network Innovation Mechanisms, and Advantage Analysis

TechFlow Selected TechFlow Selected

Sei: Redefining Web3's Product Form, Network Innovation Mechanisms, and Advantage Analysis

Speed and scalability are among Sei's key features, along with flexibility and adaptability suitable for developers.

Author: Kylo@Foresight Ventures

The emergence of blockchain technology and its ecosystem has created numerous opportunities for innovators, developers, and users. However, scalability, transaction speed, and frontrunning issues have so far hindered Web3 from achieving true mass adoption. Sei was designed to address these very challenges.

This article primarily highlights the advantages of Sei’s architecture by explaining its fundamental mechanisms. The report is divided into several sections: "Introduction to Sei's Mechanisms," "Sei’s Thriving Ecosystem," "Comparison with Other Layer 1s," and "Sei’s Unique Advantages in Trading."

Sei: Mechanism Overview

Sei is a general-purpose Layer 1 network designed to solve common problems faced by existing Layer 1 blockchains. It operates using a Twin-Turbo consensus mechanism and leverages transaction parallelization to achieve fast finality, high throughput, and scalability. This innovative approach makes Sei a versatile and powerful platform that effectively bridges the gap between decentralization and high performance.

Twin-Turbo Consensus

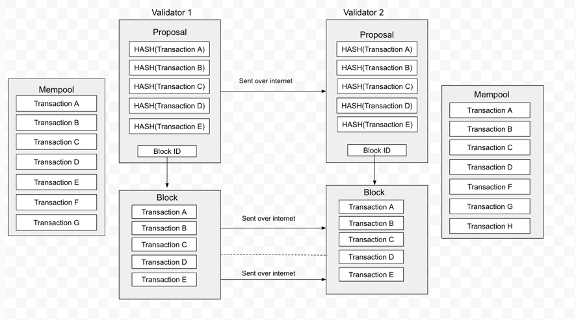

Sei is a high-TPS parallelized Layer 1, similar in some ways to Tendermint used by DyDx at the consensus layer, but with key differences. To better understand Sei’s design, it helps to first review traditional block production. Blocks are generated when validators package transactions from their own mempool and reach network-wide consensus. Each validator maintains its own memory pool (mempool). When a user initiates a transaction, they submit the relevant data to a full node (which may also be a validator), which then broadcasts this information across the network—a process known as gossiping. Upon receiving and validating the transaction, other nodes add it to their respective mempools. The proposer—the node responsible for building the next block—selects and orders transactions from its own mempool, creates a block, and broadcasts it. Other validators then verify the proposed block, and once consensus is reached, they accept the block.

dumb block propagation

From this mechanism, two potential bottlenecks emerge:

-

Since every validator maintains a mempool, many transactions included in a new block may already exist in others’ mempools. Validators could reconstruct the block independently without waiting for the proposer to broadcast full block data.

-

Block confirmation traditionally follows a sequential process: proposal, voting, consensus, and broadcasting. Because these steps happen serially, there’s limited room for acceleration. Parallelizing them could significantly improve performance.

Sei optimizes both aspects at the consensus layer, calling its enhanced mechanism Twin-Turbo Consensus—essentially smarter block propagation and optimistic block execution.

The first turbo addresses two goals:

-

Ensure each validator’s mempool contains as many pending transactions as possible.

-

Enable validators to quickly learn which transactions the proposer has selected for inclusion.

While having perfectly synchronized mempools across all validators would be ideal, it's difficult to achieve in practice. Sei implements a fallback solution: when proposing a block, the proposer fragments the block and sends it network-wide, along with a list of hashes of all included transactions. Validators cross-reference these hashes against their own mempools. If any transactions are missing, they retrieve them from the received block fragments to reconstruct the full block. This reduces the time required for validators to synchronize block data.

intelligent block propagation

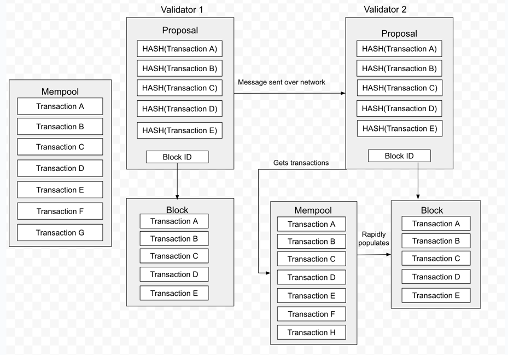

The second turbo employs an optimistic block production model. “Optimistic” here means assuming most block proposals will be valid. Under this assumption, validators can begin processing the proposed block data—writing it into a buffer—concurrently with prevote and precommit phases. If the block is later validated, the buffered data can be directly committed, eliminating the need to wait for prevote/precommit to complete before processing. Through this Twin-Turbo Consensus, Sei significantly reduces transaction latency and enhances overall blockchain performance.

comparison between “normal” and “intelligent”

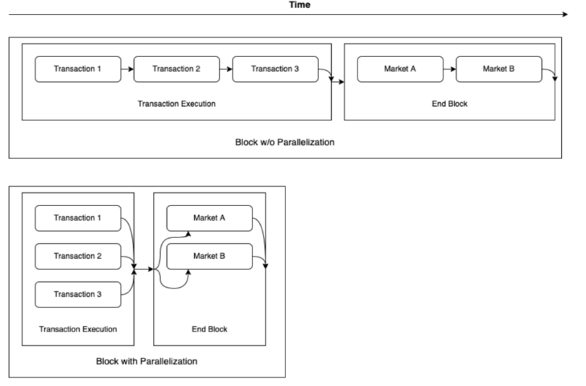

Transaction Parallelization

Transaction parallelization is a technique used by high-performance Layer 1s like Solana and Aptos to increase throughput. For Sei Network, however, parallelization carries additional significance.

Like DyDx’s upcoming V4, Sei embeds an orderbook matching engine directly within validator nodes, requiring each validator to maintain a mempool. When a validator is selected as the block proposer, it must use the built-in matching engine to execute trades and propose the resulting block. In DyDx’s case, the mempool only includes transactions originating from DyDx itself. But since Sei is a general-purpose Layer 1, its mempool contains transactions from various protocols deployed on Sei. Most of these transactions are unrelated. If processed sequentially, different orderbook protocols would compete for block space, hindering overall ecosystem growth.

Thus, Sei’s parallelization design enables applications on Sei to operate independently while increasing system throughput.

A major challenge in transaction parallelization is handling interdependent transactions, which must be executed sequentially. For example, NFT minting requires ensuring a specific NFT hasn’t already been minted, necessitating serial processing. Therefore, distinguishing independent from dependent transactions is critical. While the UTXO model is commonly used for this purpose, Sei employs DAG (Directed Acyclic Graph) technology. A DAG can be visualized as a directional polyline where intersections represent transactions, and connected edges indicate dependencies. Sei constructs a global DAG to track transaction dependencies across the network.

Sei's transaction parallelization

MEV Prevention, Order Bundling, and Oracle Pricing

Sei’s MEV Prevention feature aims to stop block proposers from extracting MEV maliciously during trade matching and block construction. This is achieved via Batch Auctions—a method pioneered by Cowswap to mitigate MEV in AMM trading. Batch Auctions group similar trades over a time window into a single batch, executing them simultaneously at the same price with no ordering preference, thereby eliminating frontrunning.

Order Bundling is a mechanism tailored for market makers. It allows them to update their entire order book state in a single transaction instead of multiple individual ones, enabling rapid, low-cost adjustments to risk exposure across multiple markets.

For oracles, Sei integrates a native oracle system that provides price feeds for assets within its ecosystem. It achieves this by incorporating price reporting into the consensus process. During each block generation, all validators submit their price estimates for supported assets and reach consensus on the final values. As a result, asset prices on Sei are updated with every block.

Current State of Sei’s Ecosystem

To date, Sei’s rapidly growing ecosystem includes around 150 projects spanning multiple areas of Web3, including social, NFTs, gaming, and DeFi.

Sei’s ecosystem

Top projects in the Sei ecosystem include Fable, Dagora, and Fuzio, which are exploring GameFi, NFTs, and DeFi leveraging Sei’s unique architecture. Developers choose Sei for several reasons:

-

Scalability: Sei’s high-performance architecture supports thousands of transactions per second, making it suitable for dApps requiring high throughput and low latency.

-

Low Transaction Fees: Low costs incentivize active participation from both developers and users on Sei.

-

Ecosystem Resources: Sei offers rich development tools, community forums, and backing from well-known investors and established blockchain projects.

-

Interoperability and Composability: Seamless integration with other networks enables combinations of diverse protocols and applications.

-

Security: Sei’s consensus ensures secure transactions, allowing developers to focus on application logic.

-

Community: A growing user base and active community make Sei highly attractive to developers.

-

Grants and Ecosystem Fund: A $120 million ecosystem fund helps accelerate project growth.

Sei provides developers with a fully performant platform to explore new possibilities in dApp design through its unique mechanisms. Additionally, Sei drives liquidity via its “Liquidity Alliance Program” and leverages its large community to give Web3 users exposure to a wide range of projects. On-chain activity is already vibrant: testnet data shows over 100 million transactions and more than 5 million wallet addresses, indicating strong momentum for future ecosystem growth.

DEXs on Sei: High Performance Meets Low Cost

Speed and scalability are among Sei’s defining features, complemented by flexibility and adaptability for developers. Builders are free to create diverse applications on Sei. With high throughput, low fees, and fast finality, Sei offers ideal infrastructure for next-generation Web3 apps.

One of Sei’s standout domains is decentralized exchanges (DEXs). Typically, DEXs suffer under blockchain performance constraints. During traffic spikes, congestion leads to higher fees, longer settlement times, and poor scalability—all degrading user experience and profitability.

Sei offers an effective solution by introducing an on-chain matching engine. Leveraging fast finality, high throughput, and low costs, Sei enables highly efficient on-chain trading. For DEXs, this translates to superior performance and lower costs, potentially making them competitive alternatives to centralized exchanges.

Compared to Serum and DyDx, DEXs on Sei enjoy several advantages. DyDx’s chain is optimized for a single application, leaving little room for other DeFi protocols and limiting composability and shared liquidity. It must rely on cross-chain solutions to connect externally for DeFi functionality. Serum, despite its rich liquidity and composable ecosystem, suffers from instability due to non-trading activities interfering with the core matching engine. In contrast, Sei’s Layer 1 design solves both issues. In short, Sei combines decentralized off-chain order matching with strong DeFi composability, giving it a strong edge in trading performance.

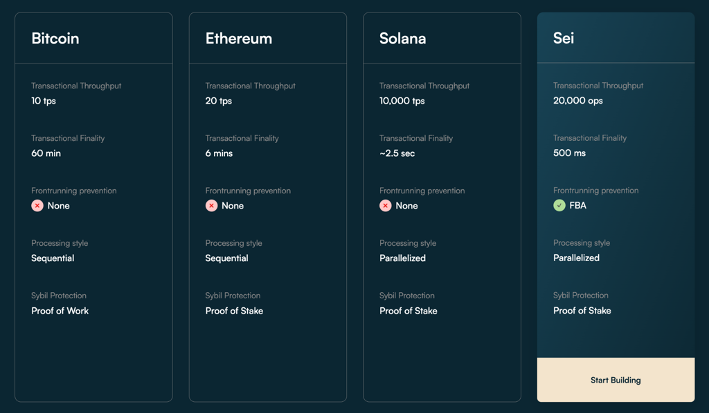

Comparative Analysis: Sei vs. Other Layer 1s

Today’s Layer 1 landscape is diverse, with each platform offering distinct features, strengths, and limitations. To better highlight Sei’s advantages, we compare it with prominent platforms such as Sui, Aptos, Solana, and Ethereum.

Sei

Sei’s key advantage lies in its unique architectural design that addresses widespread issues in other blockchains—scalability, transaction speed, and frontrunning. Using its proprietary Twin-Turbo consensus, Sei achieves high throughput, rapid finality (as fast as 0.5 seconds), and scalable performance. Its transaction parallelization further enhances these capabilities, enabling Sei to handle massive transaction volumes efficiently.

Sui

Although Sui has unique strengths, its scalability faces bottlenecks as transaction volume increases. While Sui emphasizes decentralization, its consensus mechanism lacks the flexibility and validator selection freedom found in Sei.

Solana

Like Sei, Solana uses parallel processing for block production and achieves high speed and low cost via its unique Proof-of-History (PoH) timestamping system. However, its extreme focus on performance comes at the expense of decentralization. Centralization concerns make Solana vulnerable to stability issues under certain conditions.

Ethereum

Ethereum currently hosts the richest dApp ecosystem, leading in both TVL and composability, especially in DeFi. However, it continues to face challenges with high gas fees and scalability. Its current solution—scaling via rollups—requires significant time for applications and TVL to migrate from Layer 1 to Layer 2. In summary, while Sui, Solana, and Ethereum offer unique benefits, Sei stands out due to its novel architecture and robust performance. Sei’s blockchain design optimizes speed, scalability, and security without compromising decentralization, positioning it to potentially surpass even mature platforms like Solana in performance.

Comparative Analysis

The Future of Sei

The potential of blockchain technology is immense. By providing a highly scalable, secure, and user-friendly environment, Sei paves the way for mass adoption. Yet, in the competitive landscape of Layer 1 and Layer 2 platforms, Sei still faces intense competition. While its innovative mechanisms and promising testnet data mark a strong start, sustained growth will depend on nurturing talent within its ecosystem and expanding community outreach.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News