Shareholder or Speculator? The Necessity of Revenue Sharing in Crypto Projects Seen from GMX

TechFlow Selected TechFlow Selected

Shareholder or Speculator? The Necessity of Revenue Sharing in Crypto Projects Seen from GMX

GMX is a rather successful project: simple user experience, valuable proposals, and its token price as well.

Author: FLORIAN STRAUF

Translation: TechFlow

In the world of digital currencies, revenue sharing has long been a hotly debated topic. This article will delve into the role of revenue sharing within token economics, particularly how it affects token demand and investor interest. By analyzing the case of GMX, we will uncover the effectiveness of revenue sharing as a demand driver and discuss its real impact on attracting investors.

GMX is a notably successful project: simple user experience, valuable proposition, and strong token price performance.

The project's tokenomics include a revenue-sharing mechanism designed to increase long-term holder incentives. Sharing revenue with token holders is a good way to create token demand—better than merely holding tokens for speculation. Investors buy the token, hold it, and receive a share of the project’s revenue.

So in this article, I want to explore further what drives demand—what factors push demand—and what role revenue sharing might actually play.

A Case Study: GMX

What sparked my thinking about revenue sharing was this: on GMX’s website, they tell us that for every dollar invested by users, you get a 3.3% annual return.

To me, a 3.3% return isn’t very attractive. GMX is a high-risk crypto startup. Given that risk level, a 3% return seems low.

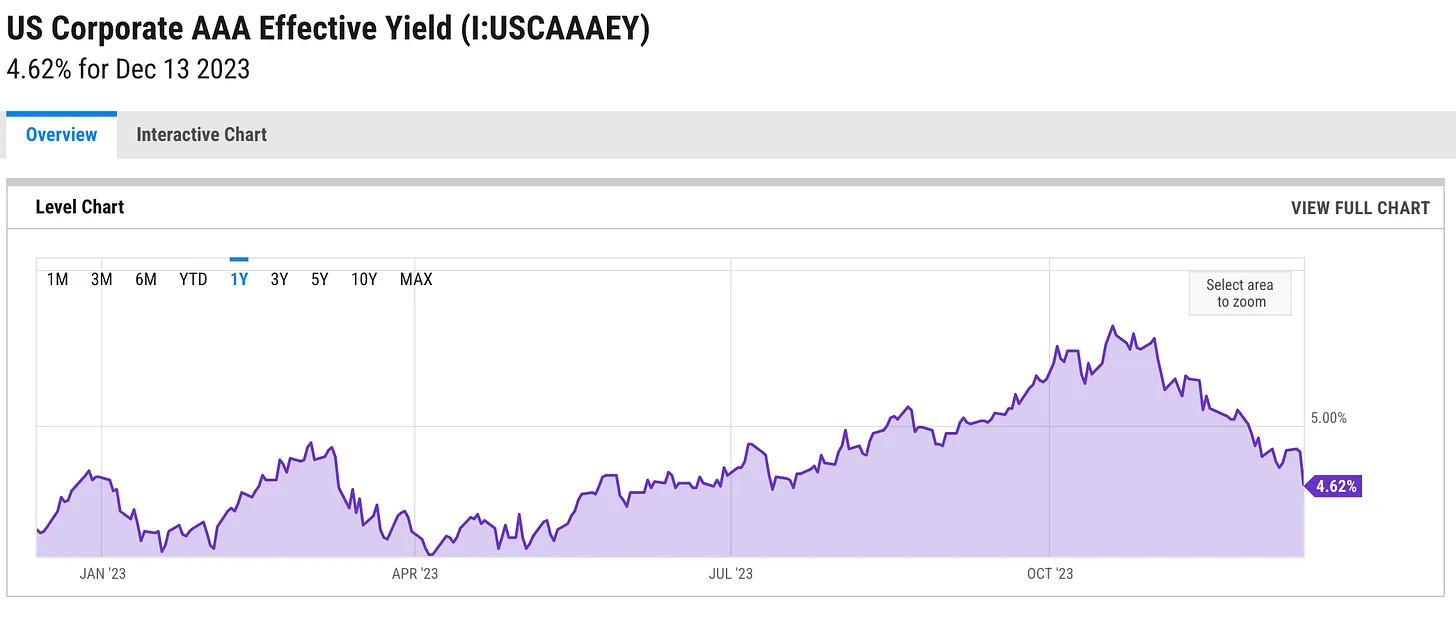

Compare this to top-rated U.S. corporate bonds (long-term average annual return around 4%):

Bond income differs from crypto yield, but I rarely find startups paying dividends. That’s precisely why GMX’s idea of sharing revenue with users becomes more interesting.

Here’s my view: no one buys growth stocks for dividends. Few typical growth companies pay dividends—they reinvest profits into expansion, which is exactly why they’re called growth stocks.

Yet in crypto, this appears to be a popular method for driving token demand. Why is that?

Do investors buy tokens because they want to share in project revenues?

When we talk about demand drivers, we usually consider tokenomic features that make people interested in buying a token.

Sharing revenue with token holders turns the token into an income-generating asset. Users hold it and earn some return. In theory, this could convince users to buy and hold the token.

However, going back to GMX—if we consider what returns capital could earn elsewhere, 3.3% annually isn’t much. At best, it’s a small bonus, but the primary motivation must lie elsewhere.

Is it speculation? Hoping the token price will appreciate?

That reason seems far more plausible.

Is speculation the biggest demand driver?

If revenue sharing isn’t your reason for buying a token, then the behavior may be more similar to traditional stock markets.

Let’s draw a comparison.

Think of GMX as a startup or early-stage growth company. They typically don’t pay dividends. Most investors buy their shares speculating on future growth potential.

When you buy such a stock, you hope you’ve spotted something not yet reflected in the price, wait for the market to catch up (i.e., price appreciation), and then sell for a profit.

In the case of GMX, most investors likely believe the product is strong and hope to sell their tokens at a higher price later.

I doubt revenue sharing plays a major role here. There’s nothing wrong with speculation—it’s nothing new. People speculate on growth stocks in exactly the same way.

In my past writings comparing stocks and tokens, I emphasized that people buy growth stocks because they believe dividends may eventually materialize. That potential can form the basis of speculation.

Let’s go back to GMX and dig deeper. Perhaps GMX’s mechanism can help us assess how much interest there really is in revenue sharing.

Staking Data

It’s hard to measure whether people are buying tokens specifically for revenue sharing. We can look at statistics: GMX incentivizes stakers to keep staking by offering enhanced rewards (via multiplier points). I created a dashboard to better understand holder dynamics.

The data clearly shows people are holding tokens long-term—but that doesn’t necessarily mean they’re doing so for revenue sharing. They might simply like the project and treat the revenue share as a bonus.

Given GMX’s high-risk, high-return context, I can’t imagine people buying the token solely for a 3% annual yield.

My fundamental question is: if most people are more interested in 10x returns than modest annual yields, why do projects distribute their revenue to holders? Wouldn’t it be better to reinvest funds into growth or keep them in the treasury until better opportunities arise?

Why do crypto projects go through all this trouble to offer average yield returns? Why not reinvest like other great growth companies and aim for 10x growth instead?

Is the token part of the product?

Personally, I’m interested in truly excellent projects. Well-designed token mechanics matter, but if the product executes well and grows, I’m not sure revenue sharing is the savior solution everyone thinks it is today.

Many protocols use revenue sharing as a marketing tactic to attract users. The team throws investors a bone, making them feel that investor demand drivers have been considered.

Some people will buy tokens because of revenue sharing, and investment strategies can be built around such mechanisms.

I don’t want to completely dismiss revenue sharing—it can be useful. But I also believe projects could implement alternative approaches:

-

Accumulate profits into the treasury and reinvest them via governance to fuel growth. Then, governance itself becomes a demand driver for the token.

-

Focus purely on growth. Why not further reduce fees to attract more trading volume and liquidity, building a moat around the project? This would mirror aggressive growth companies. Governance could still drive demand, as once sufficient scale is achieved, the project could begin paying dividends.

-

Buyback and reinvest, or buyback and burn. This is a more direct mechanism, similar to stocks. The demand driver is owning an asset that becomes increasingly scarce over time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News