Interview with CoW Swap Co-Founder: Exploring the Birth of a MEV-Minimized DEX Leading Intent-Based Trading

TechFlow Selected TechFlow Selected

Interview with CoW Swap Co-Founder: Exploring the Birth of a MEV-Minimized DEX Leading Intent-Based Trading

CoW Swap focuses on MEV minimization because MEV maximization approaches carry certain risks.

Host: Stephanie (@stephaniiee_eth)

Guest: Anna (@AnnaMSGeorge)

If you're interested in DeFi and MEV, you've likely heard of intent-based trading, frequent batch auctions, solver models, and order flow auctions (OFAs). CoW Swap stands as a leading example of these innovations, seamlessly integrating them into a DEX product to deliver users the best prices, optimal routing, and full protection against MEV attacks.

In this episode, Stephanie sits down with Anna, co-founder of CoW Swap, to dive deep into the platform’s design. They explore how CoW Swap’s transaction lifecycle—starting from collecting user intents—differs fundamentally from traditional trading models; how user funds are secured when execution is outsourced to professional solvers; how competition among solvers is effectively encouraged, a key component in advancing intent-based trading; and how solvers are continuously incentivized while being prevented from malicious behavior.

They also discuss broader topics such as how new entrants can compete against Uniswap’s first-mover advantage, why CoW Swap adopts an MEV minimization approach rather than MEV maximization, and why MEV mitigation at the dapp level matters.

"The Transaction Lifecycle and Design of CoW Swap"

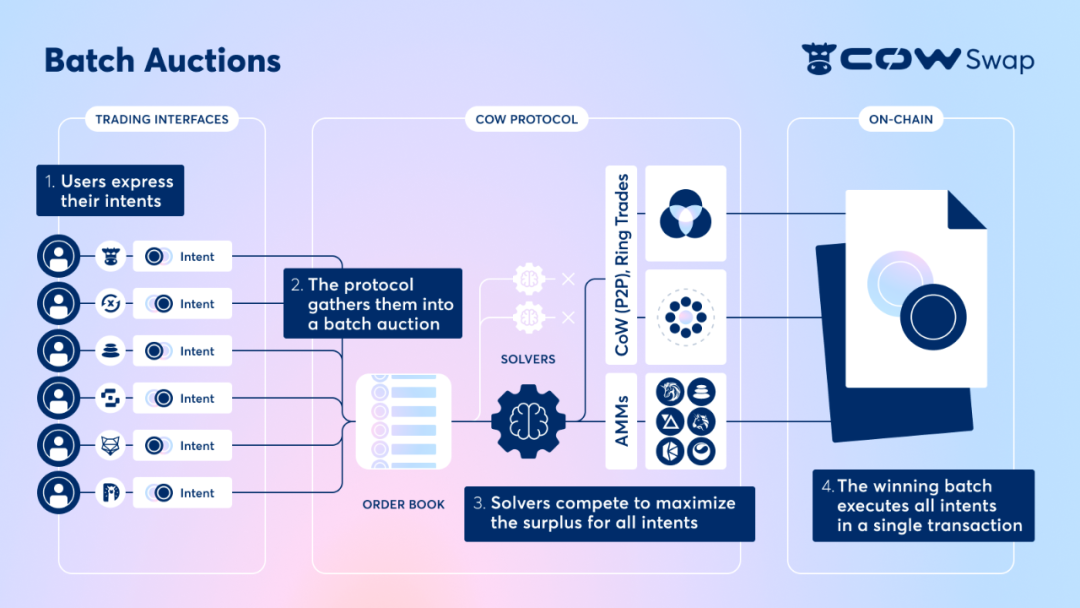

The CoW Swap transaction lifecycle consists of four main steps:

1. Users express their trading intent by signing a message containing details such as the tokens to buy or sell, the amounts, and the validity period for execution.

2. The CoW protocol collects these intents and places them into an off-chain order book for batch auctioning.

3. Third-party solvers access the order book. Skilled in optimization mathematics, they quickly identify the best execution paths—considering all on-chain liquidity, coincidences of wants, and circular trades—and compete with each other. The protocol ranks solvers based on the value they provide to users, and the winning solver executes the entire batch.

4. The winning batch is executed on-chain in a single transaction at a uniform clearing price for all intents in that batch.

How CoW Swap Drives Competition Among Solvers

What elevates intent-based trading at CoW Swap is the introduction of competitive execution layers, moving beyond simple on-chain execution models. To ensure this competition functions effectively and delivers superior trade outcomes, CoW Swap's development has gone through three key phases:

1. Initially, Gnosis ran internal solvers using basic logic—aggregating API endpoints from services like Paraswap, 1inch, and 0x, comparing their quotes, and submitting transactions to whichever offered the best return.

2. During last year’s Devconnect in Amsterdam, a small but highly skilled mathematical team expressed interest in running solvers. They developed their own algorithms and soon outperformed existing API-based solvers.

3. Market makers began joining the ecosystem, integrating their private liquidity with solvers. This gave them a competitive edge due to better pricing and deeper liquidity access.

Today, there are 16 active solvers in CoW Swap’s network, each excelling in different areas.

Design Principles: Incentives and Safeguards

CoW Swap distributes weekly incentives to solvers, divided into two components: one tied to continuity, ensuring solvers remain consistently active rather than only bidding when they expect to win. This maintains robust competition even if some solvers go offline or act maliciously. The second component rewards the margin by which the winning solution outperforms the second-best. This prevents solvers from offering only marginally better routes and instead encourages maximizing user value—the greater the improvement over the runner-up, the higher the reward.

Currently, incentives come from an annual issuance of 2% of CoW tokens. Starting in January, a small fee will be introduced—derived from the value delivered to users. These fees go to solvers, but they must use them to repurchase CoW tokens and return them to the CoW treasury.

While the solver set is theoretically permissionless, practical safeguards exist. Since solvers could potentially exploit users’ slippage tolerance, CoW Swap requires participating solvers to post collateral. While this mechanism doesn’t have to be centralized, it currently involves centralization because the CoW DAO manages a shared staking pool to lower entry barriers. However, in 2024, solvers will be able to create their own staking pools. Smart contracts will automatically verify whether a solver holds the necessary private keys, grants access permissions, and has established sufficient collateral—enabling fully automated entry into the competition.

"MEV Maximization vs. MEV Minimization"

CoW Swap focuses on MEV minimization, as MEV maximization carries significant risks.

First, MEV maximization inherently requires extracting value from users. To redistribute this value, multiple parties must be involved and compensated, meaning users never reclaim 100% of the MEV they generate. At best, they receive small rebates. But CoW Swap believes the MEV value is created by users in the first place—they shouldn't lose any of it.

Second, value redistribution introduces inefficiency, as rebate transactions must be included in blocks, consuming additional block space.

Finally, MEV maximization increases system complexity by requiring mechanisms like PBS (proposer-builder separation). Flashbots initially brought MEV into mainstream discussion and advocated for democratizing MEV extraction—so everyone, not just a few players, could benefit—which was positive. But the downside is that it attracted more participants and professionalized MEV extraction, ultimately worsening the MEV problem today. Of course, we can't know what would've happened without those discussions—but now, MEV has undeniably become a major issue.

CoW Swap believes most MEV opportunities occur at the application layer—where users initiate transactions—and thus should be minimized wherever possible. By collecting user intents and settling each batch of trades within a block at a single uniform clearing price, CoW Swap ensures no value can be extracted or transactions reordered within that batch.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News