New Narrative Exploration: The Rise and Outlook of BRCFi

TechFlow Selected TechFlow Selected

New Narrative Exploration: The Rise and Outlook of BRCFi

BRCFi is becoming a highly anticipated narrative in this bull market cycle, with many tokens in this story potentially delivering 100x returns.

Original author: hitesh.eth

Compiled by: Luccy, BlockBeats

Editor's Note:

BRC20 tokens are surging across the board, and Multibridge aims to build an entire DeFi ecosystem around them—propelling BRC20 into the mainstream, known as BRCFi. Crypto researcher hitesh.eth analyzed this emerging concept in a tweet thread and listed several BRCFi projects he is bullish on. The translation of the original content is as follows:

BRCFi is becoming one of the most talked-about narratives in this bull cycle, despite most people likely never having heard the term before.

Many of the tokens within this narrative could deliver 100x returns.

What is BRCFi?

As coined by Multibridge, BRCFi refers to a DeFi ecosystem powered by BRC20 tokens. It’s quite an interesting name.

As stated in Multibridge’s documentation, their goal is to push BRC20 into the mainstream by building a full-fledged DeFi ecosystem around it.

The Summer of BRC20

This past summer, we saw the first wave of BRC20 tokens, marked by a surge of "meme coins." Minting these tokens was extremely simple, causing frenzied investors to mint aggressively and clogging up the Bitcoin network within days.

During the summer of BRC20, tokens like ORDI and SATS were launched. The BRC20 craze lasted for several weeks, then suddenly faded from public attention. Meanwhile, some Ethereum developers found ways to inscribe tokens on Ethereum and other EVM chains.

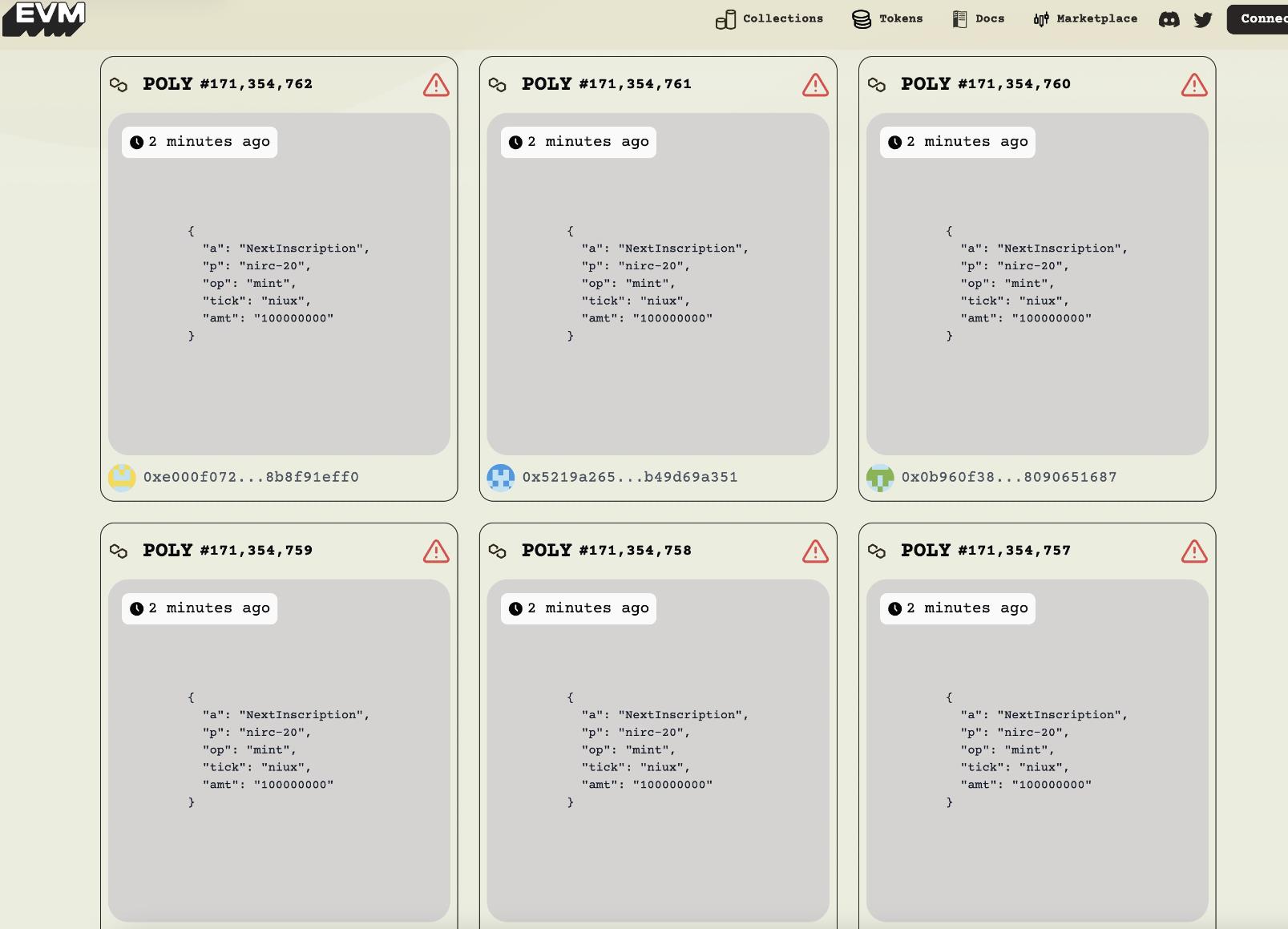

EVM Inscriptions

A young Indian builder, @mrphygital, spotted this massive opportunity and created Evmink—a marketplace for minting and trading EVM inscriptions. Evmink has become the most popular platform for minting and trading inscriptions on Polygon, Avalanche, and BNB Chain.

The Winter of BRC20

When Elon Musk pointed out that most NFTs aren’t truly on-chain, Ordinals regained attention. A new narrative emerged around Ordinals, sparking renewed buying interest and driving capital back into BRC20 tokens.

Some of the earliest BRC20 tokens, especially ORDI, began attracting significant attention. Eventually, ORDI was successfully listed on Binance, and within a month of listing, its market cap grew from $100 million to $1 billion. Other CEXs are now also showing strong interest in listing BRC20 tokens.

The Turning Point

We all know BRC20 tokens cannot survive on meme status alone—they need utility and ecosystem support. While the Bitcoin community has excellent developers, adoption still largely happens on Ethereum. Therefore, BRC20 needs a bridge.

Multibridge

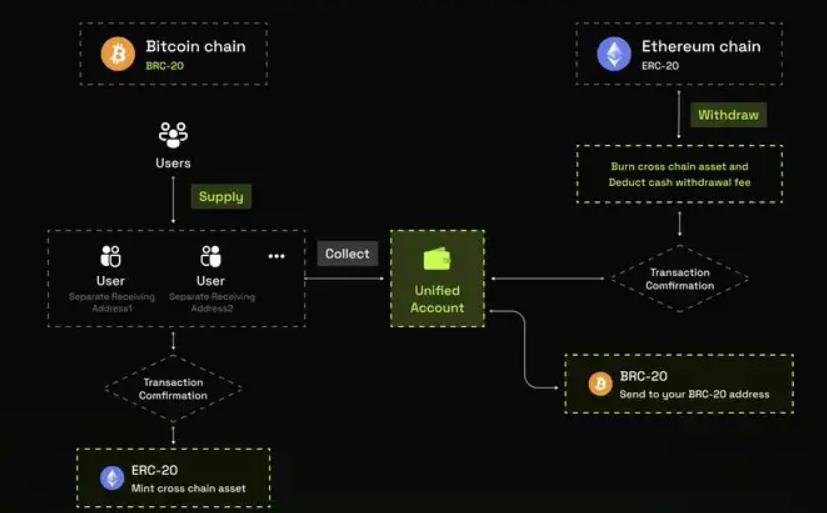

Multibridge built that bridge, enabling cross-chain swaps between BRC20 and ERC20 tokens. It allows you to easily transfer BRC20 assets between the two major chains.

Multibridge has sparked an entire DeFi ecosystem around BRC20. Now we’re seeing projects like Bitstable building a decentralized CDP protocol similar to MakerDAO. They’ve issued DAII, an over-collateralized stablecoin backed by BRC20 tokens.

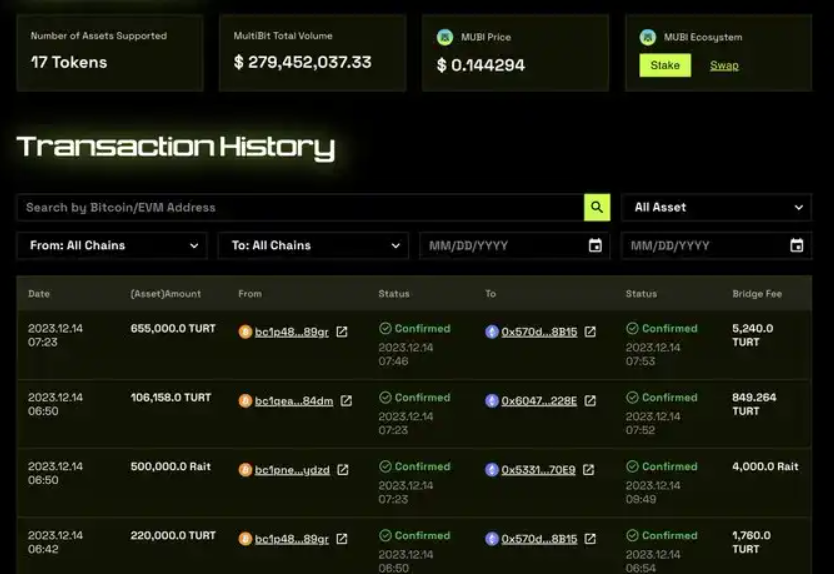

In less than a month, Multibridge has already recorded over $279 million in bridging volume, making it the third most-used third-party bridge in the past 30 days. The price of Multibridge’s native token MUBI has also surged 28x since its IDO.

Bitstable

Bitstable has also gone wild in terms of trading volume and price action. In under two weeks, Bitstable’s total value locked (TVL) surpassed $10 million, and the price of BSSB surged 64x from its IDO price.

Now you're probably wondering two things: What other promising projects exist beyond these two, and where are BRCFi project IDOs happening?

Let me reveal some promising BRCFi projects:

-

Cross-chain bridges: OrdiZK, OrdBridge

-

Money markets: Dova Liquidity Protocol

-

Aggregators: NXHUB

-

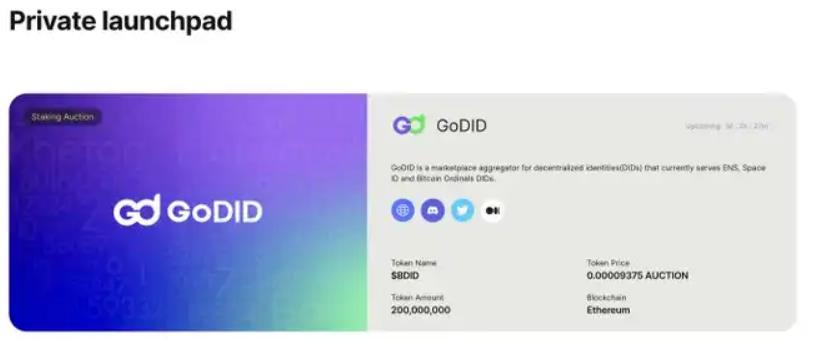

Launchpads: TurtSat, Bounce Brand

BRCFi IDOs

Everyone knows Bounce, right? During the last bull cycle, it was one of the hottest IDO launchpads on Ethereum. Now, they've transitioned into a launchpad specifically for BRCFi tokens.

To participate in future launches, you’ll need to stake AUCTION, DAII, or other required tokens.

Risks Involved

Currently, BRCFi falls into the extremely high-risk category. Most teams building BRCFi projects are anonymous, meaning many of these projects could end in rug pulls. Additionally, most projects haven’t undergone security audits, leaving them vulnerable to hacks.

Disclaimer: The sole purpose of this article is to spread knowledge about the BRCFi narrative. You should conduct your own due diligence on the projects mentioned here. I do not provide any financial advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News